Research Article: 2021 Vol: 25 Issue: 2S

Factors Affecting Corporate Income Tax Compliance: A Case Study of FDI Enterprises in Vietnam

Giang Quoc Tuan, Saigon University (SGU)

Nguyen Khac Hung, Saigon University (SGU)

Duong Thi Mai Phuong, Saigon University (SGU)

Huynh Vu Bao Tram, Saigon University (SGU)

Nguyen Anh Hien, Saigon University (SGU)

Keywords

Income, Tax, Compliance, FDI, Enterprises, SGU.

Abstract

In Vietnam, corporate income tax plays a significant role in ensuring State budget revenues and distributing income. The high or low tax rates applied to corporate income tax entities are different, depending on the income regulation point of view and the goal set in each country’s income distribution in each phase. Therefore, this paper aims to determine factors affecting corporate income tax compliance. Besides, the study surveyed 500 FDI enterprises and answered 16 questions, but 485 samples were processed. The data collected from July 2020 to December 2020 in Vietnam. The authors applied a simple random sampling technique, tested Cronbach’s Alpha and Confirmatory Factor Analysis (CFA), and model testing with Structural Equation Model (SEM) analysis. The article’s findings have three factors affecting FDI enterprises’ corporate income tax compliance in Vietnam with a significance level of 0.01. Moreover, this article recommended policies for enhancing the corporate income tax compliance of FDI enterprises.

Introduction

In our country’s market economy, all economic sectors have the right to freedom of business and equality based on the law. Enterprises with a highly skilled workforce and strong financial capacity will have advantages and opportunities to receive high income. In contrast, enterprises with economic power and limited force will receive a low payment, even no pay, by Jatnawati & Sardjono (2017). To limit such shortcomings, the State uses corporate income tax as a tool to regulate the payments of high-income subjects, ensuring the requirement of business entities’ contributions to the State budget, fair, reasonable.

Corporate income tax is an essential source of revenue for the State budget. The scope of corporate income tax application is extensive, including individuals, business groups, individual households, and economic organizations engaged in profitable production and trading of goods and services by Stephen (2018). Our country’s market economy is developing and stabilizing more and more. The economic growth is maintained more and more, the subjects engaged in production, business, and service activities are more and more profitable. Corporate income tax is an essential tool to encourage and promote production and business development in the direction of plans, strategies, and comprehensive development of the State by Sulvariany (2017). The State shall give incentives and incentives to subjects to invest and do business in industries, fields, and regions, and regions where the State has a development strategy priority in each specific period.

The Foreign Direct Investment (FDI) sector increasingly asserts its essential role in Vietnam’s socio-economic development. According to statistics, FDI enterprises currently contribute about 23.5% of total social investment (nearly 20% of GDP), accounting for over 70% of export turnover in 2020. In addition to the recorded contributions and the State has positively supported many aspects, FDI investment activities in Vietnam still have many challenges in recent years. Analyzing the current situation of FDI attraction and the contributions of this economic sector in recent years, the article suggests some policy issues to encourage FDI enterprises to continue investing in economic development - the commune Vietnam Association. Therefore, this paper aims to determine factors affecting corporate income tax compliance of Foreign Direct Investment (FDI) enterprises in Vietnam.

Literature Review

Tax Compliance (TC)

According to Michael & Richard (2012), tax compliance is tax compliance measured by assessing a taxpayer’s willingness to comply with tax laws, accurately declaring income, validating deductions, tax reductions, and payments, tax on time. Taxpayers’ tax compliance means the taxpayer’s full compliance with its obligations, statutory tax, including registration, declaration, reporting and taxpayer by Isabel (2018). Tax compliance is the correct and complete implementation of the provisions of the tax law. Tax compliance is compulsory for many different entities such as tax authorities, taxpayers, and other related organizations and individuals specified in tax laws. In particular, the taxpayer’s tax compliance is always the most concerning issue.

According to Manouchehr & Aida (2019), taxpayers’ tax compliance is reflected in the full, timely, and correct compliance with the tax laws, particularly the compliance with the criteria of timing, accuracy, truthfulness, and completeness. Tax registration, tax declaration, tax payment and other tax obligations of tax payers. Thus, taxpayer’s tax compliance is the taxpayer’s full compliance with tax obligations following the law, including tax registration, tax declaration, tax calculation, and tax payment by Muhammad & Jaffri (2016). Any violation that occurs in one of the above stages leads to different degrees of non-compliance. According to the law, taxpayers’ tax compliance is understood as the taxpayer’s full compliance with tax obligations, including tax registration, tax declaration, tax calculation, tax payment, and compliance with other tax administration requirements as prescribed by law.

TC1: He/she always declares the exact amounts are subject to income tax enterprise by Siti (2014). TC2: He/she always pays corporate income tax on time by Randmo (2015).

TC2: He/she entirely complies with corporate income tax declaration by Triedman (2014).

Tax Policies and Laws (TPL)

Widjanark (2014) showed that the tax policies and laws built synchronously, clearly; simplicity, transparency, and fewer exceptions create a pro-conducive environment developing business. Besides, TPL reduced compliance costs, reducing risks due to corruption and troublesome for companies, which also helps in good tax compliance over and vice versa. Tax policy is understood as the State’s views and lines related to the use of tax tools in its policy system by Dirkse (2014). That system of opinions and lines is reflected in recognition of the role of tax, the purpose of using the tax tool, the scope of impact, the rate of regulation, the long-term orientation to make the tax tool develop. To fully play its roles according to the State’s socio-economic development strategy and policy by Blumenthal & Christian (2011).

According to Elffers & Hessing (2019) studied that the tax law is a system of mandatory rules of conduct common to organizations and individuals involved in implementing tax policies. Suppose tax policy is the direction to achieve the goal of using tax. In that case, the tax law specifies what organizations and individuals in society must do and cannot do under certain conditions and circumstances to implementing that policy by Troutman and Bryan (2015). Thus, if the State wants tax policies to come to life, it is necessary to institutionalize those policies into tax laws.

TPL1: Stability of regulations and policies law on corporate income tax by Braithwaite (2015).

TPL2: Loopholes in the legal policies on corporate income tax by Balm (2016).

TPL3: The deterrence of measures and sanctions in dealing with corporate income tax fraud by Wenzel (2017).

TPL4: Corporate tax rates are high and unsuitable by Minsey (2017). With the tax as mentioned above policies and laws, the researchers have hypothesis following:

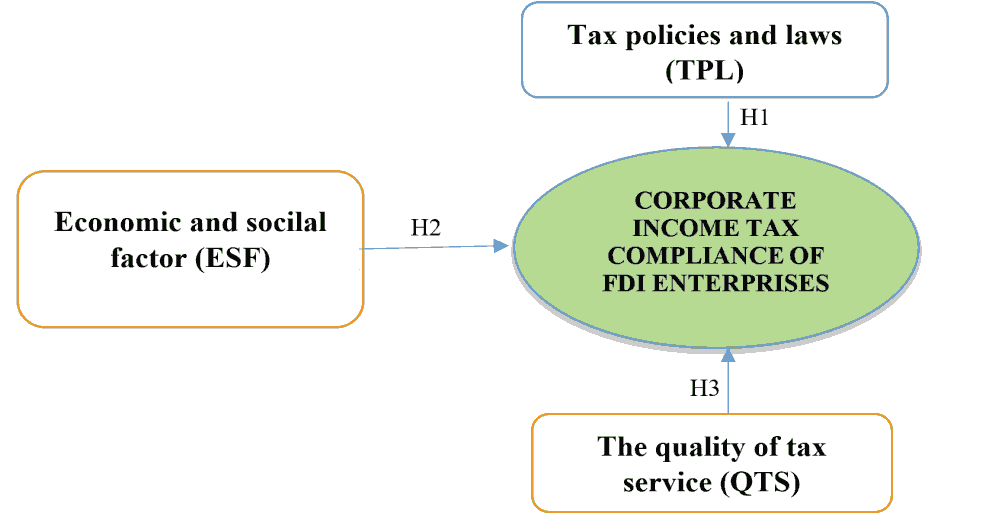

Hypothesis H1 Tax policies and laws positively impact the corporate income tax compliance of FDI enterprises in Vietnam.

Economic and Social Factor (ESF)

According to Wenzel (2017), Economic growth rate, interest rate, inflationary; political situation, foreign delivery; standards, influence, public opinion, and the role of each subject in the social community affect tax compliance. According to the authors, economic factors that affect tax compliance include interest rates, inflation, international integration, tax compliance costs, and financial capacity by Vogel (2014). Dijke (2018) pointed out that if taxpayers are in a social community, intangible social pressures and attitudes influence tax compliance or non-compliance their tax collector. Social norms measure social norms; fairness in a transaction or the benefit received per tax currency; right in tax payable compared to other taxpayers by Hannemann (2016). The justice in the taxation of the tax system.

ESF1: Government policy and efficiency of public spending from taxes by Schwarzen (2017).

ESF2: Inflation, economic growth by Surgoyne & Webley (2019).

ESF3: The level of international integration of the economy by Roberts & Tomney (2017).

ESF4: Social norms and rules (culture about tax) by Kanchez & Juan (2015).

ESF5: Tax compliance costs (money and time invest in corporate income tax compliance) by Mebley (2014). For those as mentioned above economic and social, the researchers have hypothesis following:

Hypothesis H2 Economic and social factors positively impact the corporate income tax compliance of FDI enterprises in Vietnam.

The Quality of Tax Service (QTS)

According to Kirchler (2018), taxpayer’s perception of tax service quality affects taxpayers’ tax compliance. Where perceived tax service quality is measured by including corporate fairness towards the tax system); business satisfaction with tax authorities; corporate tax knowledge by Erard & Feinstein (2018); opportunities for tax non-compliance by Alm & Torgler (2011). The quality of tax services for businesses plays a vital role in tax authorities’ tax administration process. Tax service quality is an essential measure of public administrations’ performance and is one of the main results of their activities.

Besides, Tax service quality is a broad category. It has many different definitions depending on the specific service. Still, the tax service quality’s nature considered what the taxpayer perceives by Allingham & Sandmo (2017). Each taxpayer has different perceptions and personal needs, so their perception of tax service quality is also different.

QTS1: Opportunities for businesses to avoid taxes by Ming & Bee (2014).

QTS2: Service quality of tax authorities by Vogel (2014).

QTS3: His higher encouragement from the tax authority and corporate tax knowledge by Toodbury (2015).

QTS4: System for tax administration, inspection, and examination by Toodbury (2015). The quality of tax service mentioned above capability, the researchers have hypothesis following:

Hypothesis H3 The quality of tax service positively impacts the corporate income tax compliance of FDI enterprises in Vietnam.

A research model for factors affecting the corporate income tax compliance of FDI enterprises in Vietnam following:

Figure 1 : A Research Model for Factors Affecting The Corporate Income Tax Compliance of FDI Enterprises in Vietnam

Methods of Research

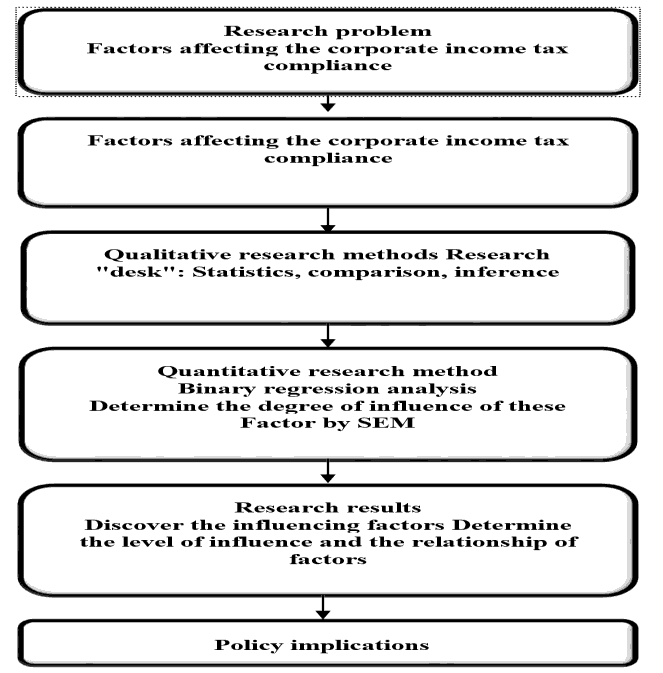

This study presents the research methods and processes used. Research methods are in the paper, including a combination of qualitative and quantitative methods.

Figure 2 : The Research Process for Factors Affecting The Corporate Income Tax Compliance of FDI Enterprises in Vietnam

The article applied a combination of qualitative and quantitative methods.

Qualitative methods: The researchers interviewed 11 leaders of 11 enterprises in Vietnam. The surveying results had 11 leaders who agreed that all of the factors affecting the corporate income tax compliance of FDI enterprises in Vietnam by Hair, Anderson, Tatham & Black (1998).

Quantitative methods: The researchers surveyed 500 managers related to tax management in 500 FDI enterprises. They observed among more than 50.000 FDI enterprises represented and answered 16 questions, but the sample size of 485 samples processed, 15 samples lack information.

The authors collected the primary sources of data from July 2020 to December 2020 in Vietnam. The researchers were surveying by hard copy distributed. All data collected from the questionnaire are coded, processed by SPSS 20.0 and Amos. The researchers tested scale reliability with Cronbach’s alpha coefficient, and Exploratory Factor Analyses (EFA) were performed.

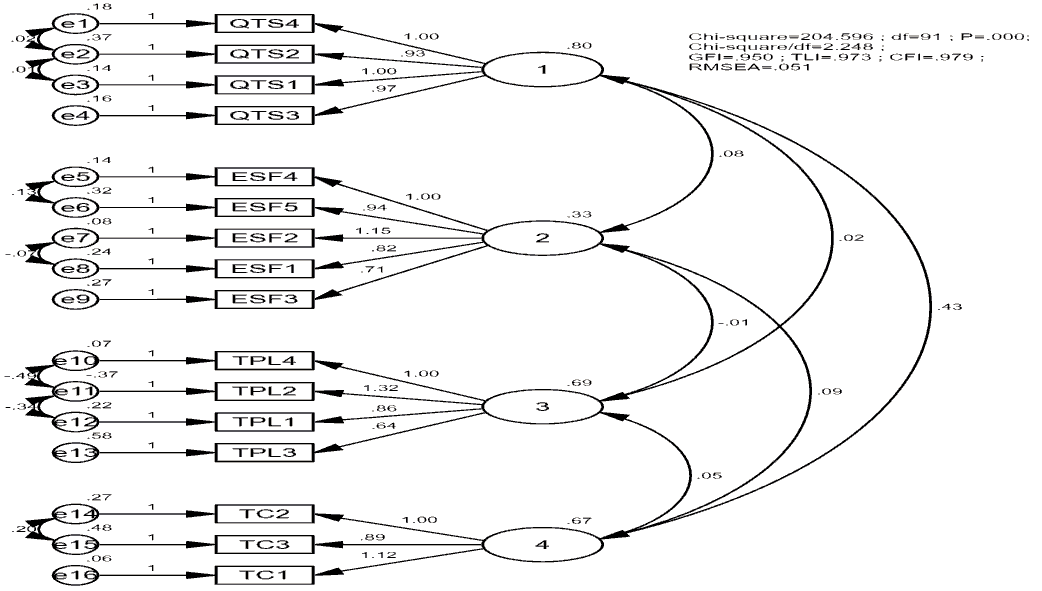

The purpose of Confirmatory Factor Analysis (CFA) helps the author to clarify:

1. Unilaterality,

2. Reliability of scale,

3. Convergence value and

4. Difference value.

A research model considered relevant to the data if Chi-square testing is P-value>5%; CMIN/df ≤ 2.0, some cases CMIN/df maybe ≤ 3.0 or <5.0; GFI, TLI, CFI ≥ 0.9.

However, according to recent researchers’ opinions, GFI is still acceptable when it is more significant than 0.8; RMSEA ≤ 0.08. Apart from the above criteria, the test results must also ensure synthetic reliability>0.6; the Average variance extracted must be greater than 0.5.

Research Results

Testing Cronbach’s alpha for factors affecting the corporate income tax compliance of FDI enterprises in Vietnam following:

| Table 1 Cronbach’s Alpha of The Corporate Income Tax Compliance of FDI Enterprises. (Source: Data Processed by SPSS 20.0) |

||||

|---|---|---|---|---|

| Code | Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted |

| TC1 | 6.5773 | 3.526 | 0.795 | 0.899 |

| TC2 | 6.6784 | 3.219 | 0.886 | 0.822 |

| TC3 | 6.7608 | 3.319 | 0.796 | 0.899 |

Table 1 showed that Cronbach’s alpha of FDI enterprises’ corporate income tax compliance is 0.913>0.6.

| Table 2 Cronbach’s Alpha of The Tax Policies and Laws (TPL) (Source: Data Processed By SPSS 20.0) |

||||

|---|---|---|---|---|

| Code | Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted |

| TPL1 | 10.3629 | 5.372 | 0.712 | 0.812 |

| TPL2 | 10.266 | 5.179 | 0.702 | 0.815 |

| TPL3 | 10.4062 | 5.242 | 0.656 | 0.835 |

| TPL4 | 10.3897 | 5.222 | 0.729 | 0.804 |

Table 2 showed that Cronbach’s alpha of the tax policies and laws (TPL) at FDI enterprises is 0.856>0.6.

| Table 3 Cronbach’s Alpha of The Economic and Social Factor (ESF). (Source: Data Processed by SPSS 20.0) |

||||

|---|---|---|---|---|

| Code | Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted |

| ESF1 | 9.7423 | 5.865 | 0.602 | 0.868 |

| ESF2 | 9.6144 | 5.316 | 0.744 | 0.834 |

| ESF3 | 9.6887 | 5.967 | 0.59 | 0.87 |

| ESF4 | 9.6433 | 5.193 | 0.841 | 0.811 |

| ESF5 | 9.567 | 5.106 | 0.732 | 0.838 |

Table 3 showed that Cronbach’s alpha of the Economic and Social Factor (ESF) at FDI enterprises is 0.872>0.6.

| Table 4 Cronbach’s Alpha of The Quality of Tax Service (QTS). (Source: Data Processed by SPSS 20.0) |

||||

|---|---|---|---|---|

| Code | Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted |

| QTS1 | 9.301 | 7.471 | 0.876 | 0.909 |

| QTS2 | 9.3464 | 7.537 | 0.795 | 0.936 |

| QTS3 | 9.2639 | 7.641 | 0.861 | 0.914 |

| QTS4 | 9.2454 | 7.421 | 0.872 | 0.91 |

Table 4 showed that Cronbach’s alpha of the Quality of Tax Service (QTS) at FDI enterprises is 0.937>0.6.

3

| Table 5 Testing of The Confirmatory Factor Analysis (CFA). (Source: Data Processed by SPSS 20.0) |

||||||

|---|---|---|---|---|---|---|

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | ||||

| Total | % of variance | Cumulative % | Total | % of variance | Cumulative % | |

| 1 | 4.9 | 30.628 | 30.628 | 4.9 | 30.628 | 30.628 |

| 2 | 3.141 | 19.63 | 50.258 | 3.141 | 19.63 | 50.258 |

| 3 | 2.691 | 16.819 | 67.077 | 2.691 | 16.819 | 67.077 |

| 4 | 1.406 | 8.79 | 75.867 | 1.406 | 8.79 | 75.867 |

| 5 | 0.7 | 4.376 | 80.243 | |||

| 6 | 0.649 | 4.055 | 84.298 | |||

| 7 | 0.513 | 3.206 | 87.505 | |||

| 8 | 0.389 | 2.432 | 89.937 | |||

| 9 | 0.309 | 1.928 | 91.865 | |||

| … | … | … | … | |||

| 16 | 0.118 | 0.737 | 100 | |||

Table 5 showed that the testing of the Confirmatory Factor Analysis (CFA) at FDI enterprises with KMO is 0.804>0.6; Sig is 0.00 (<0.01). Table 5 showed there are four components.

Figure 3 : Testing CFA for Factors Affecting The Corporate Income Tax Compliance of FDI Enterprises in Vietnam

Figure 3 had the Chi-square: 204.596; df: 91; p: 0.000; Chi-square/df: 2.248; GFI: 0.950; TLI: 0.973; CFI: 0.979; RMSEA: 0.051.

| Table 6 Factors Affecting the Corporate Income Tax Compliance of Fdi Enterprises in Vietnam. (Source: Researchers Proposed By Spss 20.0 and amos) |

|||||||

|---|---|---|---|---|---|---|---|

| Relationships | Estimate | Standardized Estimate | S.E. | C.R. | P | ||

| TC | <--- | QTS | 0.564 | 0.497 | 0.047 | 12.062 | *** |

| TC | <--- | ESF | 0.202 | 0.129 | 0.065 | 3.095 | 0.002 |

| TC | <--- | TLP | 0.169 | 0.115 | 0.048 | 3.55 | *** |

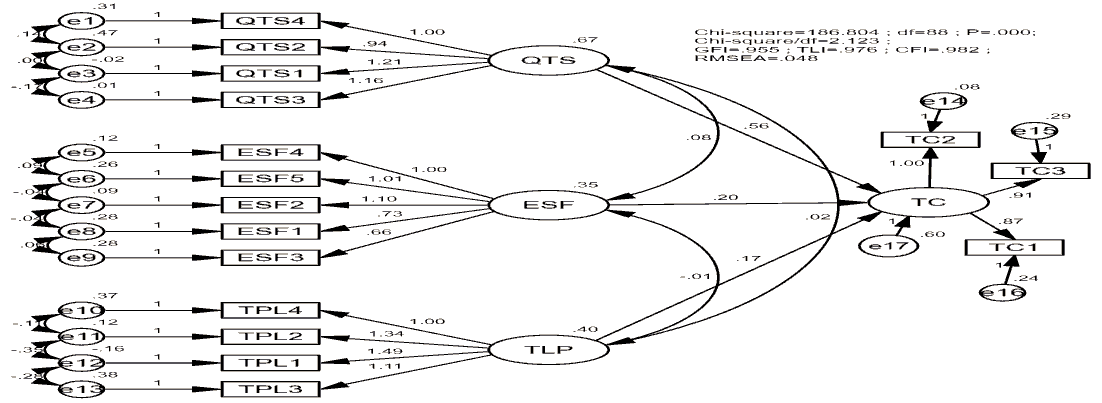

Table 6 showed that column “P”<0.01 with significance level 0.01. This result indicated that three factors affected the corporate income tax compliance of FDI enterprises in Vietnam with a significance level of 0.01.

| Table 6 Factors Affecting the Corporate Income Tax Compliance of Fdi Enterprises in Vietnam. (Source: Researchers Proposed By Spss 20.0 and amos) |

|||||||

|---|---|---|---|---|---|---|---|

| Relationships | Estimate | Standardized Estimate | S.E. | C.R. | P | ||

| TC | <--- | QTS | 0.564 | 0.497 | 0.047 | 12.062 | *** |

| TC | <--- | ESF | 0.202 | 0.129 | 0.065 | 3.095 | 0.002 |

| TC | <--- | TLP | 0.169 | 0.115 | 0.048 | 3.55 | *** |

Table 7 showed that column “Bias”<0.01. This result showed that three factors affected the corporate income tax compliance of FDI enterprises in Vietnam with a significance level of 0.01.

Figure 4 had the Chi-square: 186.804; df: 88; p: 0.000; Chi-square/df: 2.123; GFI: 0.955; TLI: 0.976; CFI: 0.982; RMSEA: 0.048.

Conclusion

Evaluate the tax compliance level of FDI enterprises to have appropriate and effective behavior in practice. Tax administration is the core task of tax administration. This study identifies the factors influencing and impact each factor’s level on FDI enterprises’ tax compliance. Based on the review of the previous studies and the processing of the survey data, it is possible to summarize the study’s main findings:

1. The results show that the three factors with components have a price. Cronbach’s Alpha value is more significant than 0.6, and the total variable correlation is over 0.3. Thus, the research model’s three factors are acceptable to continue to the following research steps.

2. With exploratory factor analysis techniques and affirmative factors, three factors are analyzed above.

3. These main findings help tax authorities better understand the factors affecting FDI enterprises’ tax compliance behavior and each factor’s impact. The tax authorities can refer to take appropriate measures to improve the taxpayer’s tax compliance from these results gradually.

Managerial Implications

Based on the results mentioned above, to enhance the tax compliance behavior of FDI enterprises in Vietnam, the authors had recommendations following:

Managerial implication for the Quality of Tax Service (QTS): The General Department of Taxation continues to reduce and simplify business conditions, to support and remove FDI enterprises’ difficulties. Besides, Vietnam should continue promoting tax administrative procedure reform, shortening the process of handling and applying information technology in tax administration, cut time for managerial procedures, publicity and transparency, and improved tax authorities’ responsibility. Strive to reduce tax payment time to improve the business environment index so that 2021 increases by 7-15 places on the World Bank rankings. Besides, The General Department of Taxation continues completing the abolition and simplification of 50% of business investment conditions; to propose abolishing several conditional business lines according to the list of dependent business lines of the Investment Law to speed up the application of information technology. The General Department of Taxation continues to build a complete, accurate, and centralized taxpayer database throughout the taxation industry. At the same time, Vietnam should promote risk management methods based on applying information technology in tax administration operations, studying and perfecting the information technology system based on professional operations and activities. Administration and management performed on how the systems are interconnected and connected in data exchange; redesign business processes to ensure integration and automation.

Managerial implication for the Economic and Social Factor (ESF): The General Department of Taxation continues to implement the linkage between tax agencies and relevant state agencies. Administrative procedures between state agencies related to enterprises have not been linked effectively. The tax department’s data, the tax department, and the investment planning department are still not consistent. Hence, businesses have to make many declarations, providing information to many different state agencies while using mutual inheritance. The tax authority has not timely grasped the money that the business pays at the treasury, but the company must bring documents to prove. Many companies have paid taxes, but the tax authorities still report tax debt, affecting their interests and reputation. The General Department of Taxation continues renovating and strengthens the capacity of inspection, inspection, and compliance supervision for taxpayers based on applying modern and integrated information technology, focusing on improving inspection skills. Check-in some transfer pricing areas, e-commerce; promptly and thoroughly urge tax debts to the state budget, strictly handle cases of tax law violations, and reduce tax arrears.

Managerial implication for the Tax Policies and Laws (TPL): The General Department of Taxation continues building simpler, easier-to-understand forms and needs to remove unnecessary items. In particular, it is necessary to limit the change of templates too quickly. If there is a change in law, but the old forms are still usable, it is not required to issue a new reform. It is necessary to update many cases and form information attached on the tax agency’s website for each item to solve the problem. Besides, Vietnam appoints a qualified tax officer to be on the phone to guide the required procedures, business, regularly organize seminars to update new tax regulations and answer questions and complaints about businesses. Besides, online tax declaration is also a measure to minimize errors and misunderstandings about the form. It is necessary to have a template available with unified guidance for the business to avoid cases where the tax office does not agree. Besides, The General Department of Taxation continues strengthening propaganda and support to taxpayers (taxpayers) to meet each taxpayer group’s needs. Support services for taxpayers to carry out tax administrative procedures are mainly done by electronic form, route, focusing on the entire taxation industry.

This article had some limitations, and future research needs improving.

1. The model needs to test on a sample of other FDI enterprises in Vietnam.

2. Reinforced by adding control variables such as tax compliance costs, the quality of human resources.

3. The following article should compare the longitudinal databases available over time due to eventual changes in the variables and improved samples in other countries.

References

- Allingham, M.T., & Sandmo, A.J. (2017). Income tax evasion: A theoretical analysis. Journal of Public Economics, 2(1), 5-13.

- Alm, J., & Torgler, B. (2011). Do ethics matter? Tax compliance and morality. Journal of Business Ethics, 10(1), 635-651.

- Balm, J.F. (2016). Tax structure and tax compliance. Review of Economics and Statistics, 4(6), 53-60.

- Blumenthal, M.F., & Christian, C. (2011). Taxpayer response to an increased probability of audit: Evidence from a controlled experiment in Minnesota. Journal of Public Economics, 7(9), 45-53.

- Braithwaite, V.H. (2015). Understanding small business taxpayers-issues of deterrence, tax morale, fairness, and work practice. International Small Business Journal, 23(5), 53-68.

- Data. National Tax Journal, 2(1), 49-56.

- Dijke, M.K. (2018). When do severe sanctions enhance compliance? The role of procedural fairness. Journal of Economic Psychology, 3(2), 12-23.

- Dirkse, R.J. (2014). The exploration of service quality and its measurement for taxpayer satisfaction level. Southern African Business Review, 8(2), 83-97.

- Elffers, H.D., & Hessing, D.J. (2019). Decision frames, opportunity tax compliance, and tax evasion: An experimental approach. Journal of Economic Behavior and Organization, 14(3), 53-61.

- Erard, T., & Feinstein, R. (2018). Tax compliance. Journal of economic literature, 3(2), 81-96.

- Evidence from the United States and Hong Kong. Journal of International Accounting, Auditing, and Taxation, 9(2), 8-17.

- Hair, J., Anderson, R., Tatham, R., & Black, W. (1998). Multivariate data analysis with readings. US: Prentice-Hall: Upper Saddle River, NJ, USA.

- Hannemann, H.R. (2016). Tax rates, tax administration, and income tax evasion in Switzerland. Public Choice, 8(8), 16-27.

- Isabel, M.T. (2018). The effect of online service quality factors on internet usage: The web delivery system of the taxation department. International Journal of Quality & Reliability Management, 28(7), 76-87.

- Jatnawati, T., & Sardjono, S. (2017). Analysis of effect of knowledge and service quality, accessibility of information, awareness, and behavior of taxpayers and impact on satisfaction and compliance with taxpayers of land and buildings in the city batam island riau province. International Journal of Business and Management Invention, 6(8), 13-23.

- Kanchez, I.H., & Juan, A.T. (2015). Economic and noneconomic factors in tax compliance. Journal of Business Ethics, 10(4), 35-51.

- Kirchler, E.L. (2018). Preconditions of voluntary tax compliance: knowledge and evaluation of taxation, norms, fairness, and motivation to cooperate. National Tax Journal, 3(8), 35-43.

- Manouchehr, L., & Aida, R. (2019). An investigation of the effect of improving taxpayer service satisfaction VAT department in Tehran. International Journal of Basic Sciences & Applied Research, 3(2), 19-28.

- Mebley, P.R. (2014). Small business owner’s attitudes on tax compliance in the UK. Journal of Economic Psychology, 22(2), 19-32.

- Michael, K.J. & Richard, R.B. (2012). Performance-only measurement of service quality: A replication and extension. Journal of business research, 55(1), 7-13.

- Ming, L., & Bee, W.Y. (2014). Tax noncompliance among SMCs in Malaysia: Tax audit evidence. Journal of Applied Accounting Research, 15(2), 25-34.

- Minsey, K.J. (2017). Understanding taxpaying behavior: A conceptual framework with implications for research. Law & Society Review, 2(4), 63-76.

- Muhammad, S.T. & Jaffri, S.K. (2016). Determinants of trust on zakat institutions and its dimensions on intention to pay Zakat: A pilot study. Journal of Advanced Research in Business and Management Studies, 3(1), 4-16. Public Economics, 1(4), 23-32.

- Randmo, A.S. (2015). The theory of tax evasion: A retrospective view. National Tax Journal, 5(4), 64-73.

- Roberts, R.T., & Tomney, J.K. (2017). The social norms of tax compliance: Evidence from Australia, Singapore, and the United States. Journal of Business Ethics, 4(1), 9-18.

- Schwarzen, B.H. (2017). Misperception of chance and loss repair: On the dynamics of tax compliance. Journal of Economic Psychology, 2(8), 67-79.

- Siti, N.S. (2014). Reengineering tax service quality using a second-order confirmatory factor analysis for self-employed taxpayers. International Journal of Trade, Economics, and Finance, 15(5), 42-49.

- Stephen, A.O. (2018). Factors affect tax compliance among Small and Medium Enterprises (SMEs) in North Central Nigeria. International Journal of Business and Management, 7(12), 8-17.

- Sulvariany, T.M. (2017). The effect of service quality and taxpayer satisfaction on compliance payment tax motor vehicles at office one roof system in Kendra. The International Journal of Engineering and Science, 6(11), 25-34.

- Surgoyne, C.M., & Webley, P.R. (2019). Tax communication and social influence: evidence from a British sample. Journal of Community & Applied Social Psychology, 9(3), 37-46.

- Tax compliance. Journal of Economic Psychology, 2(6), 91-108.

- Toodbury, D.T. (2015). The effect of tax laws and tax administration on tax compliance. National Tax Journal, 3(8), 1-13.

- Triedman, J.G. (2014). Tax evasion, inflation, and stabilization. Journal of Development Economics, 4(1), 10-23.

- Troutman, C.T., & Bryan, D.M. (2015). An expanded model of taxpayer compliance: Empirical.

- Vogel, J.S. (2014). Taxation and public opinion in Sweden: An interpretation of recent survey.

- Wenzel, M.D. (2017). The multiplicity of taxpayer identities and their implications for tax ethics. Law & Policy, 9(1), 31-45.

- Widjanark, R.B. (2014). Measurement model of service quality, regional tax regulations, taxpayer satisfaction level, behavior and compliance using confirmatory factor analysis. World Applied Sciences Journal, 29(1), 56-61.