Research Article: 2022 Vol: 26 Issue: 4

Factors Affecting Disclosure of Information: Empirical Evidence from Listed Companies on Vietnam Stock Exchange

Nguyen Vu Viet, Academy of Finance

Vu Thi Phuong Lien, Academy of Finance

Citation Information: Viet, N.V., & Lien, V.T.P. (2022). Factors affecting disclosure of information: empirical evidence from listed companies on vietnam stock exchange. Academy of Accounting and Financial Studies Journal, 26(4), 1-23.

Abstract

Information disclosure plays an important role in the transformation of Vietnam's economy when conducting equitization and establishing listed public companies. Transparency in information disclosure reduces the instability of the capital market - the stock market by reducing market inefficiencies, thereby reducing macroeconomic uncertainties. Listed joint stock companies that adhere to the principles of transparency and disclosure in corporate governance will improve financial management and use. Determining the factors affecting the transparency of information disclosure of enterprises listed on the Vietnamese stock market. The study uses two-step least squares estimation method and general Moment to analyze, and conclude the number of independent members of the Board of Directors, company size, return on assets, value Company value has a positive effect on the level of transparency and information disclosure of listed companies. The level of transparency and disclosure in the past has a positive effect on the level of transparency and disclosure in the current period. Listed companies with large scale, high profit margin, and the company's Board of Directors with many independent members will provide more information and transparency in information disclosure. Listed companies with small scale, low profit - little growth, the Board of Directors of the company without independent members will have the ability to disclose less information. The effect of transparency and disclosure on the cost of equity of listed companies. The study uses the Moment estimation method to analyze and conclude that increasing the level of transparency and disclosure reduces the cost of equity in listed companies. The effect of reducing the cost of equity is a great motivation for listed companies to improve transparency and disclosure, and contribute to improving transparency and information disclosure on the Vietnamese stock market.

Keywords

Information Disclosure, Transparency and Disclosure, Listed Companies, Stock Market, Vietnam.

Introduction

Information on the stock market is a data system related to participants in the stock market, which is an important component of the stock market. With information provided on the stock market, investors, state management agencies, analysts recognize the development direction of listed enterprises and markets to make appropriate decisions. Information has a great impact on the volatility on the stock market. Disclosure is one of the pillars of corporate governance and has been widely used to assess the situation of corporate governance. Disclosure is the fact that businesses officially disclose information that stakeholders are interested in because of their interest. The complete and timely disclosure of information will increase transparency and greatly affect the behavior of investors.

The OECD (2004) proposed corporate governance principles, which emphasized that companies need to publish information in a timely manner such as financial situation, operations, ownership structure, board structure and management. According to the OECD's Principle of 5 Corporate Governance, corporate governance and the quality of published information are closely linked. Karim et al. (2006) argues that the greater the level of disclosure as possible reduces the asymmetry of information between investors and the company, increasing the value and liquidity of the stock in the market. On the contrary, the publication of bad information can increase the cost of capital, leading to the allocation of capital sources. Violations of information disclosure of companies on the stock market are mainly incomplete, timely, dishonest in the data, not warning of risks; therefore, the measurement of information disclosure of listed companies on the stock market must include transparency and disclosure of information of listed companies to protect investors from information asymmetry on the stock market. Disclosure of information of listed enterprises in the fiscal year includes the following categories: periodic financial statements, reports to the Stock Exchange, annual reports, corporate social responsibility reports, prospectus. The disclosure of the company's information must ensure the following important characteristics: regular and on time, complete, reliable, accurate, easy to understand, related and detailed, verifiable. Listed enterprises perform good corporate governance because publishing information fully and promptly is a mandatory responsibility of the company.

The Ministry of Finance has just issued Circular No. 96/2020/TT-BTC guiding the publication of information on the stock market, replacing Circular No. 155/2015/TT-BTC from January 1, 2021. Circular 96 provides quite comprehensive regulations on subjects obliged to publish information such as public companies; the issue of corporate bonds to the public; the issuer makes the initial public offering of shares; corporate bond listing organizations; Securities companies and securities investment fund management companies; branches of foreign securities companies in Vietnam and branches of foreign fund management companies in Vietnam; representative offices of securities companies and foreign fund management companies in Vietnam; public funds, public securities investment companies. The disclosure of information must be complete, accurate and timely in accordance with law.

The latest survey conducted on 724 listed companies on HOSE and HNX by Viet stock in collaboration with FILI press agency of the Vietnam Association of Financial Managers – VAFE (2018) applied for the survey period from 01/05/2020 to 30/04/2021 showed that there were 389 listed companies meeting Information disclosure standards, accounting for 53.73% and an increase of 60 listed companies compared to 2020 (only 329 listed companies), The corresponding increase of 8.6 percentage points (from 45.13% to 53.73%). Meanwhile, the total number of listed companies surveyed in 2021 decreased by 5 enterprises compared to 2020 (there were 729 enterprises). If in 2020, Information disclosure errors focus on financial statements, in 2021, Information disclosure errors are mainly related to the annual shareholders' meeting (128 enterprises), management reports (104 enterprises), reminders or sanctions for violations of Information disclosure (88 enterprises). Thus, just over half of listed enterprises ensure the correct regulations on information disclosure, which is an alarming issue, which needs to be improved to create a basis for Vietnam's stock market to develop sustainably on the basis of transparency and efficiency. Stemming from the above shortcomings, the selection of the topic "Research on information disclosure of enterprises listed on Vietnam Stock Exchange" is necessary in the current period. The topic makes sense in both theoretical and practical terms.

Literature Review

The Organization for Economic Co-operation and Development (OECD) set up the Corporate Governance Scorecard in 2004 to enforce the transparency of corporate information in the European single market. The company's governance scorecard publishes information related to three main contents: the relationship between the board of directors of the company, the board of directors, shareholders and other stakeholders; methods for achieving the objectives and activities of monitoring the company's business results; the mechanism of pursuing objectives is in line with the interests of the company and the interests of shareholders with an effective monitoring system. According to the OECD (2004), the disclosure of information reduces information asymmetry and reduces the loss of investors during market crises. The Corporate Governance Principles (OECD, 2004) has been used as the primary basis for the construction of corporate governance scorecards. In the company administration scorecard, the information is ranked in Section V with 30% of the points for 32 questions to be answered. Many studies have shown that transparency and disclosure of information under the company's governance scorecard has improved the source of information for shareholders, investors, managers, and the state and improved the company's business situation. Questions identifying transparency and disclosure are answered at two "yes and no" levels. Corporate governance scorecards have been promoted in ASEAN countries since 2011 with the participation of Malaysia, Singapore, Thailand, Indonesia, Philippines and Vietnam to improve the quality of corporate governance at listed enterprises in the region.

Nguyen & Le (2016) Research by the Asian Development Bank (ADB, 2014) on corporate governance implementation in Southeast Asian countries showed that corporate governance has improved in six research countries: Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam. Corporate governance scores of listed enterprises in Vietnam increased from 54.32 points in 2012 to 60.09 points in 2013. However, the corporate governance scores of listed enterprises in Vietnam are low in the six research countries, especially in the field of information disclosure.

Standard and Poor's, a transparent and information-publishing ratings organization, has issued a set of indexes that evaluate the level of disclosure by comparing S&P's ratings with factors affecting capital expenditures. Companies with high transparency and disclosure ratings have lower market risks. The company has a good level of transparency and disclosure that will reduce equity costs.

Patel & Dallas (2002) when studying the relationship between transparency and disclosure and share ownership, found an inverse correlation between share ownership and transparency and disclosure in six emerging markets. For Brazil, Poland, India, Thailand and South Korea, the transparency index and information disclosure are correlated in the same direction as the market price/book price ratio. The results of the study also indicate that the average transparency and disclosure index in these markets is low to moderate. Patel & Dallas (2002) also compared the level of transparency and disclosure in 19 emerging markets with 354 companies in 2000 showing that Asia and South Africa have a higher level of transparency and disclosure than new Latin American markets, Eastern Europe and the Middle East Aksu & Kosedag (2006) when studying the application of transparency index and disclosure of information to listed companies on the Turkish stock market, found that companies applying transparency index and publishing information are more profitable than companies that have not yet applied. The adoption of transparency and disclosure indicators has improved the main functions of corporate governance on the Turkish stock market.

Eng & Ling's (2012) study of the application of transparency index and disclosure of information by companies in Asia-Pacific shows that the disclosure environment and the level of disclosure of companies are interconnected. Companies in Asia-Pacific from a poor disclosure environment have higher levels of corporate disclosure.

Buskirk's (2012) study demonstrates that more frequent disclosure of information by companies in the United States reduces asymmetry among investors. The details provided to investors have reduced asymmetric information rather than those that are published regularly. Research by Brown & Hillegeist (2007) also highlights the importance of information quality when published. The quality of published information and incomplete information are the main factors causing inverse reactions in the market. The inverse link between the quality of published information and incomplete information emerges when asymmetrical information characteristics form from major investors in the company. Corporate governance, transparency and disclosure research by companies in emerging market countries indicates that companies with centralized ownership are less transparent and detrimental to minority shareholders. Companies with state ownership and strategic investors keep centralized ownership, low-exchange stocks are very less transparent. In The Asian Stock Exchange, the index is transparent and publishes information that is related in the same direction as the market price ratio / book price; But in Brazil, Poland and South Africa, there is the opposite effect.

Taiwan's Securities and Futures Institute (SFI) built a transparent and disclosure rating system in 2003 with a set of 62 characteristics, rising to 85 in 2004 and 103 in 2016. The IDTRS evaluation criteria is based on the CGS set of criteria with 5 components: protecting shareholders' rights, fair treatment in management, improving the board of directors and administration, increasing information transparency, and protecting the interests of stakeholders and corporate social responsibility. Investors can find this information over the internet. Investors can determine the level of transparency of companies' information through the characteristics of the company without the need for in-depth analytical skills and investment decision making (Chang et al., 2013). The results of applying IDTRS on Taiwan's stock market have proven that less transparent companies are less attractive to investors than well-transparent companies. Information transparency has an impact on the capital expenditures of listed enterprises, shareholders' profits, company risks, ownership structure, corporate governance and company size. Huang the application of IDTRS index on Taiwan stock market from 2003-2004 found IDTRS ratings influenced the market's reaction as an indicator of efficiency; characteristics of companies that affect transparency and disclosure; capital expenditures and corporate governance have the same impact as the disclosure of information of the listed enterprise. Research has found a relationship between company characteristics and levels of information transparency: companies with a low level of transparency and disclosure of information have low capital costs, the size of which has an impact on the level of disclosure. Liu et al. (2014) demonstrated that the level of transparency and disclosure of information has an impact on the company's bottom of the profit through ROE and ROA indicators. Companies with a high level of transparency and disclosure have higher corporate profits than companies that are less transparent and publicly available. The improvement in transparency ratings and disclosure over the years of the listed business has the same effect on company profits, but adversely affects the earnings of company administrators. Chao has concluded that mandatory disclosure has a weak link to the share price, but does not affect equity returns. The timely announcement affects the same direction as the company's value, affecting both stock price and equity returns as company executives want to signal the company's high profits to attract investors to participate. The transparency of information in the annual report affects the company's value.

The Singapore Governance and Transparency Index (SGTI) is a set of criteria set up by the Government's Centre for Governance, Institutions and Organization (CGIO) in collaboration with the Singapore Investment Management Association to assess the performance of corporate governance by Singapore-listed businesses. The Governance and Transparency Index applies a company sustainability policy in a modern business context, where stakeholders proactively demand transparency and high accountability for the integrity of companies. The Governance and Transparency Index made the Governance and Transparency Index (GTI) ranking in 2012 to meet the information needs of Singapore stock exchanges. The results of transparent application and disclosure of information according to GTI standards have not been disseminated and published for reference by countries.

Transparent research and information disclosure of enterprises listed on Vietnam Stock Exchange began quite early after the establishment of Vietnam Stock Exchange. Le Truong Vinh was the first person to study transparently publishing information of enterprises listed at the Ho Chi Minh City Stock Exchange with the method of interviewing questionnaires on a 5-level Likert scale in 2008. Research survey of listed enterprises selected from The Department of Education and Stock Exchange of Ho Chi Minh City. The study measured how much transparency was felt by 20 investors for a listed business through a questionnaire with 15 questions. Use Cronbach alpha factor analysis to eliminate inappropriate measurement variables in 15 variables that measure information disclosure transparency.

After the world financial crisis in 2008, the study of the index of information disclosure of enterprises listed on Vietnam stock market was set for financial market managers and some economic researchers in Vietnam. Grey Tower authors Kelly Anh Vu, and Glennda Scully of Curtin University, Australia used the questions in the company's governance scorecard set up the "VNDI" information disclosure index with 84 questions and conducted a study on 45 listed companies at the Ho Chi Minh City and Hanoi Stock Exchange in 2008. The study uses the technique for weighted scores to reflect the differences between interview questions. The company's disclosure score is equal to the total number of points that are divided by the total number of questionnaire scores. The data source answers the contents of the questionnaire taken from the annual report of the listed enterprise. The index is divided into 5 parts: information about the Board of Directors and middle management with 3 questions; information about the company and development strategy with 14 questions; forecast information about the company with 14 questions; financial and capital markets information with 29 questions; Information about social reports with 24 questions. The basis for the development of the Information Disclosure Index of Tower et al. (2011) is based on the OECD's corporate governance criteria 2004 and has been revised after it has been applied to the Malaysian stock market in the form of a set of corporate governance criteria in Malaysia.

Next, Binh studied the level of information disclosure of 199 non-financial joint stock listed companies on Vietnam stock market in 2009. The set of questionnaire criteria is based on the Enterprise Law 2005 and the Securities Law of 2006 with 72 questions on disclosure. The response is derived from the company's annual report at the end of the year. The level of information disclosure is divided into 6 parts: financial information, forecast information, general information about the company, control board, disclosure of information on the structure of the Board of Directors, information on employees- social responsibility and environmental policy. The answers were selected on a 5-level Likert scale. The study used spearman rating correlation coefficient techniques to determine the actual level of disclosure of the listed business. The study provides an overview of the current status of information disclosure of enterprises listed on Vietnam's stock market after the world economic crisis.

Hieu & Lan applied the characteristics of Tower et al. (2011) to establish the Vietnam voluntary information disclosure index with 42 questions with the information answered from the company's annual report based on the guidance of Circular 52/BTC/2012 on the disclosure of information of listed enterprises. Hieu & Lan's research conducted on 205 non-financial listed enterprises at the Ho Chi Minh City and Hanoi Stock Exchange in 2012.

Truong & Nguyen (2016) have developed a set of transparency indicators and published information according to the T&D index of S&P with 53 criteria and experimental assessment with 278 enterprises listed at the Ho Chi Minh City Stock Exchange in 2014. The results of the study of Truong & Nguyen (2016) analyzed and developed the T&D index of S&P in the direction of expanding the transparency of information published (number of published information). The transparency and disclosure index of enterprises listed on the Ho Chi Minh City Stock Exchange changed from 71 points to 88 points, an average of 78.6 points. The average standard deviation of transparency and information disclosure among listed enterprises is low (3.2 points). The expansion of the scale level has increased the scores of companies that are well compliant with corporate governance regulations. The transparency and disclosure score of the listed enterprise is calculated as the total score of the criteria the company has achieved in the evaluation criteria. This set of T&D indicators has not developed enough to cover the publication of information on corporate governance and corporate finance characteristics as research conducted, the weighting of some large difference answers accounts for 57% of the answers. The research results reflect a high point of transparency and information disclosure, and are not true to the current situation of information disclosure on the Stock Exchange of Vietnam. Recommendations made from the transparency index studies and disclosure of information that listed enterprises want to improve corporate governance results and business results should focus on improving three areas: transparency and information disclosure; treat shareholders equally, focusing on the responsibility of the Board of Directors and the executive process of the Board of Directors. The responsibility of the Board of Directors has a great influence on the company's governance, and the quality of transparency and disclosure of information has an impact on the company's governance. Characteristics of ownership structure, company size, composition of the Board of Directors, members of independent Boards of Directors are factors affecting transparency and information disclosure. The above sets of indicators are used as a basis for reference analysis in the process of developing a set of transparency criteria and publishing information of enterprises listed on the Vietnam Stock Exchange of the study.

Hanh has studied the financial information of listed companies on Vietnam Stock Exchange; the author surveyed the financial statements of listed companies on the Ho Chi Minh City Stock Exchange from 2011-2012. The 5-level linker scale method is used to score 13 criteria for financial information transparency of 178 listed companies. The results of the study showed that financial leverage, profitability (ROE), the auditing firm has a favorable correlation with the level of financial information transparency; the board structure is inversely correlated with the level of financial information transparency of listed companies on the Stock Exchange of Vietnam. The results of the research index of information disclosure applied on the Vietnam Stock Exchange indicate factors affecting information disclosure such as company size (Tower et al., 2012; Hung et al., 2016) governance ownership ratio (Tower et al., 2012); foreign ownership ratio (Tower et al., 2012) Board of Directors and responsibilities of the Chairman of the Board of Directors, independent audit, ROE profit ratio (Hung et al., 2016); Tobin Q ratio.

Studies affecting the level of index disclosure of listed enterprises on capital expenditures and financial performance, with little and uncommon profits should discourage companies from conducting transparency and disclosure of company information to market regulators and investors. Nelson & Percy (2005) argued that company executives are required to publish information and that they can publish it to a lesser extent than the content. An analysis of companies in the Thai stock market Cheung has shown that corporate governance is closely related to the level of disclosure. Companies with good governance policies often rank first for disclosure transparency. Companies with good quality management, highly trusted published financial information (Aksu & Kosedag, 2006; Stiglbauer, 2010). Companies with low transparency indicators in disclosure often have incomplete financial statements and poor web addresses (Aksu & Kosedag, 2006).

Studies by domestic and foreign authors on information disclosure show an overview of the current state of information disclosure of listed enterprises in the world and Vietnam. In particular, some studies use the transparency index and information disclosure (TDI) of enterprises listed on stock exchanges and preferred to evaluate the level of transparency and information disclosure of enterprises listed on the stock market in Vietnam and the world. However, some domestic research has some limitations: no in-depth research on information disclosure; not many studies use quantitative analysis methods to determine factors that affect information disclosure. Therefore, this study will focus on the study of information disclosure, as well as factors that affect transparency and disclosure by quantitative analysis models.

Research Methodology

The sampling method is to study all enterprises listed on two Stock Exchanges (HOSE and HNX, excluding Upcom) that have been listed for 5 years or more and are not warned to delist due to disclosure issues.

The method of selecting over the list time to create the uniformity of the research sample, and reduce the error caused by listed enterprises applying different legal provisions on disclosure. The study selected 768 listed companies at the Ho Chi Minh City Stock Exchange and the Hanoi Stock Exchange; the analysis process eliminated companies that lacked data (publishing data missing 1 year) and special data (negative equity costs; negative or positive business results, Stocks stopped trading long-term on the exchange), the results of which obtained 630 companies with enough data for 5 consecutive years from 2018 to 2020, including 306 enterprises listed at the Ho Chi Minh City Stock Exchange and 324 enterprises listed at the Hanoi Stock Exchange, equivalent to 3150 observations to ensure the scale of analysis of the study.

Research data for analysis in the study is collected from:

1. State Securities Commission,

2. Ho Chi Minh City Stock Exchange and Hanoi Stock Exchange,

3. Listed Business Information Website (Viet stock)

4. The website of the listed business.

5. The main types of reports collected:

6. Listed corporate annual report (consolidated report), annual financial statement (consolidated report), semi-annual, quarterly.

7. Reports publishing other information publicly at the State Securities Commission, Ho Chi Minh City and Hanoi Stock Exchange, websites of listed enterprises.

8. Warning reports of the State Securities Commission, the Ho Chi Minh City and Hanoi Stock Exchange about the company violating the disclosure of information on the market.

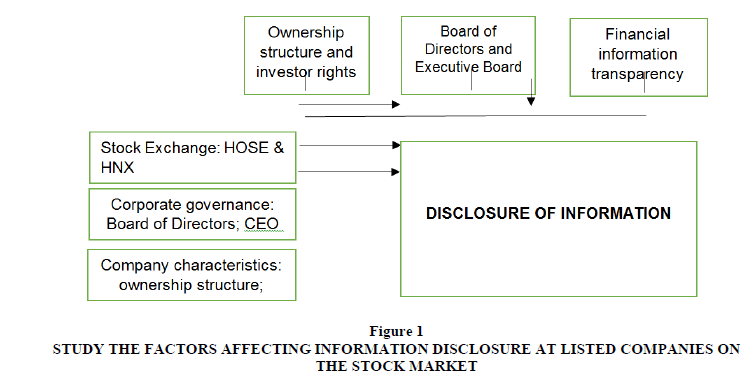

The study builds an analytical framework as follows Figure 1:

Figure 1: Study The Factors Affecting Information Disclosure At Listed Companies On The Stock Market.

The TDI model is a simple model, to be applied to assess the transparency of information disclosure of listed enterprises associated with the issue of representation in corporate governance. Focusing on representation in corporate governance, the model can better explain the influence of corporate governance factors such as board characteristics, executives, ownership structure, industry, listing location, or company financial characteristics that affect the issue of transparency and disclosure of information of the listed business. La Porta et al. (2004) says companies that perform corporate governance and publish information according to the T&D index are rated by companies such as Standard and Poor's (S&P) and Institutional Shareholder Services (ISS) based on corporate governance activities associated with reduced capital expenditures, Increase the value of the company.

Due to the influence of power and centralized ownership when equitizing companies from state-owned to joint-stock companies, and the asynchronousness of the legal system on joint stock companies, Vietnam has not applied good corporate governance rules and transparent disclosure of information. The expected benefits from applying good corporate governance and transparent implementation of information disclosure are very important for Vietnam's stock market in developing towards emerging stock exchanges in the world.

Hypothesis of Research

The Influence of Corporate Governance

Company board characteristics

According to representative theory, the board of directors of listed enterprises is the department representing shareholders contributing capital to perform the function of monitoring the behavior of the listed enterprise manager in order to reduce conflicts of interest between shareholders and managers operating the listed enterprises. The supervisory function of the Board of Directors is essential due to the diversity and dispersion of shareholders in the listed enterprise. According to the management relationship theory, the cum-CEO of the Chairman of the Board of Directors helps to strengthen the supervision of information disclosure and enforcement to reduce errors in the management of listed enterprises. Cheung concluded that the company's board of directors was closely related to the level of disclosure. Research by Trinh et al. (2014), Nguyen & Le (2016) Pham et al. (2017) indicated that the number of board members had a positive influence on the company's disclosure level. In addition, the responsibilities of general director and chairman of the Board of Directors have an impact on the information disclosure activities of listed enterprises (Hung et al., 2016). However, the research of Tran & Hoang (2019) concluded that the size of the Board of Directors and the cum-ceo of the Chairman of the Board of Directors do not affect the disclosure of information on financial statements. From the above evidence, the following hypothesis is proposed.

H1a: The size of the board is correlated with the level of transparency and disclosure of information of the listed enterprise.

H1b: The chairman's responsibilities are correlated with the level of transparency and disclosure of information of the listed enterprise.

Independent board member

The representative theory says that there is always a conflict of interest between shareholders contributing capital on the one hand and the management of the listed business on the other. The supervisory function of the Board of Directors is essential; a listed enterprise with many independent board members can better monitor the activities of the manager and reduce conflicts of interest arising from representative issues. Many studies indicate that increasing the independence of board members will improve the transparency and disclosure of the company's information. Cheng & Courtenay concluded that the effectiveness of the Board of Directors depends on its composition, independence and size; and there is a connection between the characteristics of the Board of Directors: the size, composition, and disclosure of the company's information. Monks & Minow argues that board oversight improves the quality of regulators' decision-making, increases shareholders' interests, and publishes credible information. Rhoades, Hermalin and Weisbach argued that good independent members monitoring will improve the quality of disclosure in financial statements and reduce information asymmetry between managers and investors through information transparency. Pham et al. (2017); Tran & Hoang (2019) concluded that independent members of the Board of Directors have a positive influence on the level of information disclosure of enterprises listed on Vietnam Stock Exchange.

From the above evidence, the following hypothesis is proposed.

H2: The number of independent members of the Board of Directors is correlated with the level of transparency and disclosure of information of the listed enterprise.

Board of Directors

Coles indicates that the Board of Directors has a role to advise strategic decisions and oversee executives; and to make management decisions. In fact, along with regulations, the number of independent executives depends on the costs and needs in each company. Nasir and Abdullah found a high percentage of independent directors to have a favorable effect on the company's disclosure. Zang and Li pointed out the number of independent directors that are relevant to the level of disclosure of the company. From the above evidence, the following hypothesis is proposed to be:

H3: The number of board members is correlated with the level of transparency and disclosure of information of the listed enterprise.

The Impact of Company Finances

Company size

According to representative theory, publishing information of a listed business requires a large expense tied to the cost of representation, and that may be unreasonable costs for a small company. Representative costs tend to increase with the size of the company as shareholders of large listed enterprises make more efforts in supervising managers. According to signal theory, large listed enterprises participating in financial markets raise capital more often than small listed companies should be forced to publish more information to creditors to reduce the phenomenon of asymmetric information. Rodriguez-Perez's study showed that representative costs are influenced by company size. Large companies that publish more information voluntarily should reduce this type of cost compared to smaller companies. Fongsiri's study concluded that large companies have a greater level of information transparency than smaller companies in the market. Recent studies in the Vietnam Stock Exchange have also shown similar results that the size of the company has an impact in the same direction on the level of disclosure of the company (Nguyen, 2015; Pham et al., 2017; Tran & Hoang, 2019). From the evidence on the following hypothesis is proposed.

H4: The size of the company is correlated with the level of transparency and disclosure of information of the listed enterprise.

Impact of profit

In theory the representative has a one-way relationship between profitability and the disclosure of the company's information. Listed companies are more profitable than the manager's plan to be willing to publish more information about profits to prove the effectiveness of corporate governance of the Board of Directors. According to signal theory, the disclosure of information of highly profitable listed enterprises is to distinguish the listed enterprises with better efficiency than low-margin listed enterprises; through the signal channel helps the listed enterprise increase the share price and attract investors. Companies with high profit margins will publish more information and the representative uses this issue for better contracting. Highly profitable companies will publish information consistent with the company's profit growth trends; the disclosure of information regularly and more to signal good financial situation to investors (Watson et al., 2002). From an economic point of view, companies try to adjust their profitability by disclosing more information to the public. Several studies have concluded that a company's profitability has had the same effect on the level of disclosure of the company. Leventis and Weetman concluded that highly profitable companies publish a lot of information in their annual reports to justify financial activities. Zare concluded that corporate profits had the same effect on the quality of published non-financial information. However, Camfferman and Cooke concluded that there is a conflicting relationship between profitability and the quality of disclosure. Pham and Hong concluded that the company's profit had the same effect on the level of disclosure of information of the listed enterprise. However, Pham and Uyen said that the company's profitability has no effect on the level of voluntary disclosure of listed enterprises.

From the above evidence, the following hypothesis is proposed.

H5: Business results are favorably correlated with the level of transparency and disclosure of information of listed enterprises.

Company value

The market price-to-book ratio (MB ratio) of a stock indicates how many times the market price of a stock is equal to the book value of a stock. The Tobin Q ratio is the ratio of the market price to the alternative value of a tangible asset. The MB and Tobin'Q ratios demonstrate the success of the listed business in increasing the value of assets for the owners. Several studies have shown that the value of the company measured by the ratio of MBR and Tobin Q has the same effect on the level of disclosure of the company (Aksu & Kosedag, 2006). Sharif & Lai's (2015) study found that the value of the company measured by Tobin Q had a similar effect on the company's disclosure levels.

The results of research on the impact of the company's value on Vietnam stock market have not been conclusive on this factor. The following theory proposed is:

H6: The value of the company measured by Tobin Q is correlated with the level of transparency and disclosure of information of the listed enterprise.

Influence of Corporate Characteristics

Financial leverage

The debt ratio reflects the structure of the company's operating capital and has a huge impact on an investor's profitability and the risk of a company's bankruptcy. Debt ratios include the ratio of debt to total assets and the ratio of debt to equity. The ratio of debt to total assets is often referred to as financial leverage, which measures the use of debt in financing a company's operating assets. Asymmetric information theory and representative theory both claim that listed businesses with high financial leverage incur high monitoring costs; therefore, the company is forced to provide more information to meet the information needs of creditors, reducing information asymmetry and reducing monitoring costs. Gracia-Meca concluded that highly leveraged listed companies have multiple disclosure obligations that meet creditor requirements and that the level of disclosure must be more detailed to meet these requirements. Research by Nelson & Percy (2005), Aksu & Kosedag (2006) found that the financial leverage of a listed business does not affect the level of disclosure; however, the results of research by Htay indicate that financial leverage adversely affects the level of disclosure of listed enterprises. Authors Pham and Hoang found that the financial leverage of listed enterprises had the same effect on the level of disclosure; but research by Nguyen & Le (2016) said that financial leverage does not affect the level of disclosure of listed enterprises. Research by Tran & Hoang (2019) concluded that financial leverage is in the same way as the level of disclosure of financial statements of listed enterprises. This result shows that there are still many unclear points about the impact of financial leverage on the disclosure of information of listed enterprises in the world and Vietnam. From the above evidence, the following hypothesis is proposed:

H7: Financial leverage is correlated with the level of transparency and disclosure of information of the listed enterprise.

Ownership Structure

The theory represents that the separation of ownership and control and management in a listed business is an opportunity for conflicts of interest between the owners and those who run the listed business. The Board of Directors of the listed enterprise is the representative department representing shareholders contributing capital to perform the function of monitoring the behavior of the listed enterprise manager in order to reduce these conflicts of interest. The lower the ownership rate of the board of directors, the more pressure is put on managers to publish information due to the dispersion of ownership forcing the listed business manager to publish more information to signal that managers work in the best interests of shareholders. Listed companies with a large number of shareholders may have a higher demand for disclosure, and the demand for information from foreign investors is likely to be higher due to the geographical separation, differences in corporate governance characteristics between managers and owners. Research by Gracia-Meca says publishing information to help control representative costs when ownership is more dispersed. Research by Tran and Duong at Vietnam Stock Exchange showed that when the management ownership of the company's board is less than 59%, it will increase accountability and increase operational efficiency. When the ownership rate exceeds 59%, it will result in group interests that diminish small shareholder interests which have the effect of information transparency. Pham & Hoang found governance ownership rates that had an impact in the same direction on the level of disclosure; Pham and Tran said that the ownership rate of management is inversely correlated with the level of disclosure. Research by Nguyen has shown that the ownership ratio of foreign shareholders has a contrary effect on the level of information transparency of listed enterprises in Vietnam. Pham and Tran have concluded that the ownership ratio of foreign shareholders is favorable to the level of information disclosure of listed enterprises. When studying vn30 listed enterprises, Tran and Le similarly concluded that the concentration of ownership is a factor that reduces the level of accounting information disclosure of listed enterprises. Concluding this issue, Nguyen (2014) said that listed enterprises with a high percentage of individually owned shares and a high rate of foreign ownership will have a high level of voluntary disclosure. The following theory is proposed:

H8a: Foreign ownership ratio is favorablely correlated with the level of transparency and disclosure of information of listed enterprises.

H8b: The ownership rate of management is inversely correlated with the level of transparency and disclosure of information of the listed enterprise.

Listing place

The reputation of the Stock Exchange where the listed enterprise contributes to improving the disclosure of information of the listed enterprise (Hope et al., 2007; Urquiza et al., 2010; Eng & Ling, 2012). Eng & Ling (2012) argue that the place of listing of the stock has an impact on the level of transparency and disclosure. Hope et al. (2007) similarly concluded that the level of disclosure of the listed business had an impact in the same direction as the listing place. However, the level of disclosure of information of major stock exchanges is no different. Eng & Ling (2012) analyzed the S&P index of 416 Listed Companies in the Asia-Pacific region and concluded that listed companies had low levels of disclosure in the host country in the option of cross-listing on the London or US markets; while listed companies had good levels of disclosure. At the National Stock Exchange, it is not desirable to cross-list due to the impact of listing costs. The proposed hypothesis is:

H9: The listing place is correlated with the level of transparency and disclosure of information of the listed enterprise.

Independent audit

According to representative theory, independent audits act as intermediaries to reduce conflicts of interest between managers and shareholders. The large reputable auditing firm acts as a department that monitors the opportunistic behavior of the manager, and minimizes risk to the investor, thereby reducing the cost of representation. Auditing firms perform good audits to maintain their reputations requiring clients to have a high level of Information disclosure. Research by Quick & Warming-Rasmussen (2009) indicates that large auditing firms have an influence on the disclosure of listing business information. In terms of the size of the audit, large audit firms are identified as one of the Big4 companies, the remaining auditing firms are small audit firms. Research results of Nguyen (2014), Hung et al. (2016) showed that businesses using large auditing firms (Big4: E&Y, PWC, KPMG, Deloitte) have a higher level of disclosure than businesses that choose other auditing firms. This is in line with (Quick & Warming-rasmussen, 2009). Hung et al. (2016) concluded that the factor affecting the quality of information published in financial statements was an independent auditing firm. The reputation of auditing firms is the standard for assessing the accuracy of audited information in Vietnam. The latest research results show the positive influence of the auditing company on the transparency of information disclosure of listed enterprises in Vietnam. So, the type of auditing company can positively affect the level of disclosure. The proposed hypothesis is (Adiloglu & Vuran, 2012):

H10: Large auditing firm (Big4 group) has a positive influence on the level of transparency and disclosure of information of the listed enterprise.

When researching the publication of information on the risks of companies in the UK, Rajab & Handley-Schachler (2009) found increased levels of disclosure during the study years. The information released is related to the future operation of the company as investors require a lot of information related to the company and use it to change investment decisions. Variables of the level of transparency and disclosure are used to verify the impact of disclosure in the previous period to the current period. Independent variables use the analysis presented in Table 1.

| Table 1 Interpretation Of The Independent Variables Used In The Model |

|||

|---|---|---|---|

| Ampersand | Variable description | Measurement method | Sign of expectation |

| HDQT | Board member size | Number of board members | + |

| KTGD | chairman of the Board of Directors | False variables, receiving value 1 when chairman of the Board of Directors General Director, and 0 other cases | + |

| TVDL | Independent member | Number of independent board members | + |

| QMCT | Company size | Logarithm of total assets | + |

| ROA | Profit/asset ratio | Profit/total assets (%) | + |

| TOBINQ | Tobin Q Index | Company's market value/book value | + |

| BGD | BGD membership size | Total number of board members | + |

| DBTC | Financial leverage | Total debt/Total assets | + |

| SHQT | Administrative ownership | Board ownership ratio | + |

| SHNN | Foreign ownership | Foreign shareholder ownership (%) | + |

| Worlds | Auditing firm | False variables, receiving value 1 when the auditing company is in the Big 4 group; And 0 other cases. | + |

The basis for selecting tool variables for company size variables: variables BGD, SHNN, SHQT, SGDCK, DBTC are closely correlated with the company size variable and meaningful influence according to the estimated regression model.

Financial leverage: According to corporate finance theory when the company expands the scale of production at the stage of development of the company's management tends to use debt to increase the size of operations and increase profit on equity due to the application of tax shields. Therefore, the size of the company has the same effect as financial leverage.

Board of Directors: A small board of directors will reduce governance conflicts and deliver better returns. Shakir's research in Malaysia indicates that the influence of the number of board members on business operations and company values has the most reverse U shape and efficiency in the 5 members. Research by Arnegger et al., (2014) concludes that the number of executives has a relationship with the size of the company when the company operates across industries or relies heavily on resources outside the company.

Ownership structure: Research by Nguyen Van Should concluded that the proportion of capital contributed by the organization affects the size of the enterprise. The increase in the ownership rate of foreign organizations in listed enterprises contributes to improving corporate governance and expanding the size of enterprises. According to jensen and meckling theory linking the rights of the authorized person to the interests of the company will promote better company operations; therefore, the percentage of corporate governance ownership has the same effect on the size of the company. Tri & Hung concluded that having a low management under a certain value will make managers try harder in corporate governance and business expansion.

Listing place: The size of the company is one of the conditions specified in the guiding document listed on the Stock Exchange in Vietnam (Decree No. 58/2012/ND-CP). Companies with capital scales of VND 30 billion listed in HNX and companies with capital scales from VND120 billion listed at HOSE. Therefore, the size of the company is linked in the same direction as the listing place.

On the basis of data and information collected, statistical values related to transparency and disclosure indicators, the characteristic indicators of corporate governance, relevant corporate finance of 484 companies have been calculated Table 2.

| Table 2 Statistics Describing The Variables Used In The Model Of Factors Affecting Transparency And Disclosure |

|||||

|---|---|---|---|---|---|

| Variable Super action | Smallest Value | The largest value | The average value | Standard deviation | |

| Information disclosure | 3150 | 36,74 | 79,59 | 62,52 | 5,78 |

| Board size (person) | 3150 | 3 | 15 | 6 | 1,5 |

| Independent member (person) | 3150 | 0 | 6 | 0,6 | 1,0 |

| General Manager Size of ceo (person) |

3150 3150 |

0 0 |

1 22 |

4,1 | 0,4 2,1 |

| Company size (lgTaisan) | 3150 | 23,282 | 34,545 | 27,385 | 1,711 |

| ROA Rate | 3150 | -158,7 | 78,4 | 5,2 | 8,7 |

| ROE Rate | 3150 | -392,7 | 98,2 | 9,1 | 21,1 |

| TOBIN Q Score (times) | 3150 | 0,195 | 27,633 | 1,097 | 0,969 |

| MB ratio | 3150 | 0,098 | 57,846 | 1,168 | 1,872 |

| Financial leverage (time) | 3150 | 0 | 0,971 | 0,494 | 0,235 |

| Admin ownership (%) | 3150 | 0 | 84,00 | 16,65 | 18,97 |

| Foreign ownership (%) | 3150 | 0 | 89,05 | 10,48 | 14,83 |

| Auditing firm | 3150 | 0 | 1 | 0,5 | |

| Listed Exchanges | 3150 | 0 | 1 | 0,5 | |

Source: Finpro data.

The analysis showed that the transparency and disclosure index of listed enterprises changed from 36.7 points to 79.6 points with an average value of 62.5 points. The listed enterprises in the study sample had the number of board members varying from 3 to 15 people, an average of 6 people. In addition, some companies have an independent board membership of up to 6 people while some companies do not have independent board members. The size of the Board of Directors varies from 1 to 22 people, an average of 5 people. The described statistical results show that the foreign ownership rate of companies is 10.48% on average, the financial leverage used is 0.49 times, the average profit/asset ratio is 5.2%; the average return/equity ratio is 9.1%; and the change in the value of the company when listed averaged 1.1 times according to the Tobin Q ratio and 1.17 times in MB ratio.

Some listed companies on the stock market (accounting for 27.1%) have the chairman of the Board of Directors and general director. This result shows that the decentralization in the management of listed enterprises is applied by the majority of listed enterprises on Vietnam Stock Exchange. Listed enterprises using large auditing firms (Big4) in reviewing financial statements accounted for a low proportion (28.8%). The results show that the work of auditing the reliability of reporting business results and financial statements of listed enterprises needs to be improved.

The results of the trend of listed enterprises improving transparency and information disclosure from low to medium will increase the ROE ratio markedly; but when the level of transparency and disclosure increases from medium to good does not significantly increase the ROE ratio. This result shows that Vietnam's stock market belongs to the low information disclosure group according to Cheynel's classification. Figure shows that a listed enterprise with a good level of transparency and disclosure will use mainly equity so it has low financial leverage and high market value; Companies that publish low information tend to be the opposite. Listed companies with low levels of disclosure use high financial leverage and have low market value.

Data Analysis Method

Research data of the type of table data is the combined data of many listed businesses at many times. Table data increases the number of observations due to repeating the subject at multiple study times. Table data are influenced by errors due to the different characteristics of the study subject over time. Objects (listed enterprises) are heterogeneous and have parallel regression lines that are the same angle coefficient, but different blocking coefficients. When there is a heterogeneity between the study subjects, it is not possible to combine these subjects for analysis using the OLS Pool model because this estimate will be skewed. The REM and FEM estimating method is used in place of pool OLS.

Therefore, the study examined the indirect correlation coefficient of variables in the regression model through the Hausman test. If the H0 hypothesis correctly chooses the REM model because the GLS regression method gives better results, even though the FEM and REM model results are both meaningful and solid. If the H1 hypothesis is correct, the errors are correlated with the independent variable, so that in the error will create an endogenous phenomenon, although the FEM and REM model results are significant and the FEM model results are solid, so the study chooses the FEM model. THE METHOD of estimating FEM, REM has not been able to handle the endogenous phenomenon that appears in the regression model and makes the estimation results unstable.

The Smallest two-step Method of Regression

The two stages least square (2SLS) is used as an alternative to OLS regression when endogenous variables appear in the regression model. Durbin-Wu-Hausman tests are used to determine whether the variables explained in the regression model are exudating.

General Moments Regression Method

The Generalized Method of Moments is applied under the following conditions: (i) the endogenous regression model; (ii) has a tool variable number greater than the unknown variable; (iii) a changed adequation in the regression model appears; (iv) the same phenomenon occurs.

If there is no endogenous variable effect, no variable method, similarity, the result of the GMM regression method is the same as the OLS regression method. If only endogenous variable effects are treated, the RESULT OF GMM regression method is the same as the 2SLS regression method.

Establish estimated model of study

The model of estimating factors affecting the transparency and disclosure of information of listed enterprises is as follows:

In it: TDIit: Transparency index and Information disclosure of company i in 2015. The remaining variables are independent variables and are interpreted in detail in Table 2. Since the data used in this study is table data, to measure factors that affect the level of transparency and disclosure of information of listed enterprises, the study uses fixed-effect, random effect estimation methods. In addition, the general 2SLS and Moment estimating method is used to overcome endogenous phenomena due to the co-integrity of independent variables and variables that depend on the estimated model and variable differential change. The General Moment estimator method Arellano & Bond is capable of overcoming the defects of the method of estimating random and fixed effects such as variable errors and endogenous phenomena. After that, the Wu-Hausman, Sagan, Hansen's J inspection will be performed to select the most suitable estimation method. BGD, SHNN, SHQT, SGDCK, DBTC variables are used as tools to overcome endogenous phenomena in the estimated 2SLS and GMM models.

Specific estimative models are as follows:

Explaining the influence of corporate governance factors on transparency and disclosure of information, asymmetrical theories of information, representative theories, management relationship theory are used to explain the influence of the chairman of the Board of Directors and the general director, the size of the Board of Directors, independent members of the Board of Directors, ownership structures to publish information of listed enterprises. Explain the influence of corporate financial factors on transparency and disclosure, representative theories, manager relationship theory, signal theory used to explain the influence of company size, financial leverage, financial efficiency, company value. Signal theory, representative theory used to explain the influence of the listing place, the type of auditing company on transparency and disclosure of information of the listed enterprise.

Many studies prove that transparency of published information, improving access to information reduces asymmetric information, potential risks for investors in the market. According to asymmetric information theory, the consequences of trading in asymmetrical information conditions are the appearance of adverse choices, ethical risks and increased monitoring costs. Adverse choices are the result of dealing with a party based on incomplete or concealed information. This phenomenon appears before signing a trading contract. Bebczuk's conclusion on income in financial transactions depends on adverse choices in the event of information asymmetry. Ethical risk is a phenomenon that occurs in economic trading when the party with more information changes behavior that is detrimental to the other party (with less information) after the transaction is completed. In listed enterprises, ethical risks arise from the authorized person representing the owner who runs the company that does not use the capital effectively and for the right purpose. The moral risk of the trustee increases when he or she has a low share ownership rate and the share loss they receive is very low. The cost of monitoring is the cost incurred after a successful financial transaction.

Investors are required to have mechanisms to monitor the economic activities of the recipients of investment capital and incur supervision costs. The impact of monitoring costs in financial operations is a new problem in asymmetric information and reduces investor earnings. According to asymmetric information theory, listed enterprises with high financial leverage incur high monitoring costs; as a result, the company is forced to provide more information to meet the information needs of creditors, reducing information asymmetry and reducing monitoring costs. In addition, large listed enterprises participating in financial markets raising capital regularly should be forced to publish more information to creditors to reduce the phenomenon of asymmetric information and reduce the cost of monitoring.

According to representative theory, there is always a conflict of interest between shareholders contributing capital on the one hand and the managing manager of the listed business on the other. The difference of interest between shareholders and company managers due to the separation between ownership and control of the company incurs representative costs. Company managers have more information than shareholders and creditors; so investors demand higher rates of return to offset risk. Representative theory says that the supervisory function of the Board of Directors is essential to better monitor the activities of the manager and reduce conflicts of interest arising from representation issues. The Board of Directors of the listed enterprise is the representative department representing shareholders contributing capital to perform the function of monitoring the behavior of the listed enterprise manager in order to reduce these conflicts of interest. When low board ownership leads to a dispersion of ownership, this forces the listed corporate manager to release more information to signal those managers work in the best interests of shareholders. Large listed enterprises have a large number of shareholders, so the need for disclosure must be higher due to geographical separation, different understanding of corporate governance between the manager and the owner. The theory represents that intermediary such as independent members of the board of directors and independent auditors act as reducing conflicts of interest between managers and shareholders because they act as a department that monitors the opportunistic behavior of managers, and minimizes risks for investors, this reduces the cost of representation.

According to signal theory, the disclosure of more information of highly profitable listed enterprises is for investors to distinguish effectively and through this signal helps the listed business increase the share price and attract investors. Listed companies publish more information to creditors to reduce asymmetry information phenomenon, and reduce monitoring costs.

Disclosure transparency is a solution to limit representative costs, help shareholders monitor the decisions of managers and benefit the company. When observing the executive activities of the representative is not easy (due to ethical and inverse selection) the delegate has two basic solutions: building an information system to detect the behavior of the representative (the standards information father) and signing a contract according to the performance of the representative's operations (a specific price). It is possible to transfer the risk to the representative). Representative theory has affirmed that information systems and information disclosure are effective solutions to reduce conflicts between the authorized person and the representative.

Findings and Discussion

Transparency and disclosure of information of listed enterprises are very important not only for investors on the stock market but also for the company itself. Disclosure activities are mandatory obligations of listed enterprises to protect the legitimate interests of investors (shareholders) and ensure the sustainable development of the market. For investors in the market, the company's Information disclosure level is an important criterion to help investors assess the level of risk to make appropriate investment decisions. For listed companies, the higher the level of disclosure, the more it limits the information disparity between investors and the company, thereby reducing capital costs and increasing the liquidity of shares in the market (Karim et al., 2006). Several studies have sought explanations for factors affecting the employees of listed companies on Vietnam stock exchanges such as (Nguyen, 2015; Truong & Nguyen, 2016; Pham & Long, 2017). The studies on the analysis are based on IFC's "Corporate Governance Scorecard Report" to build the Information disclosure index. The results of the studies have not solved the problem of endogenous variable effects in the regression model. The study builds an index measuring the level of transparency and information disclosure of listed enterprises on the basis of the criteria of Standard & Poors the legal provisions in Vietnam. The study's findings address the problem of endogenous variables in the regression model of factors affecting transparency and information disclosure through the use of 2SLS and GMM estimation methods.

Result of REM and FEM Regression Model Results

As stated above, to measure the influence of governance and financial factors on the level of transparency and disclosure of information of enterprises listed on the Stock Exchange of Vietnam, the study uses static estimating methods (REM and FEM) and methods of estimating with tool variables (2SLS and GMM).

The results of the analysis of the random and fixed effect estimation method show that the FEM estimation method is more appropriate than the REM estimation method. and publish previous period information; The responsibilities of the Chairman of the Board of Directors, financial leverage correlate favorably with the size of the company, but this estimate is not statistically significant due to the very low model interpretation coefficient. The estimated model results show that there is an endogenous variable appearing in the estimated model. Error measurement test changes by Wald auditing the estimated results according to the FEM method shows that there appears a changed error of error in the regression model. To overcome endogenous phenomena, variable errors appear in the fem estimation model, the two-step smallest squared estimation method, and the general moment with the tool variables BGD, SHQT, SHNN, DBTC, SGDCK are used in the estimation models (1), respectively, (2), (3), (4), (5).

Results of the smallest two-step squared regression model (2SLS)

The study used variables BGD, SHNN, SHQT, DBTC, SGDCK, Information disclosuret-1, as a tool for company size variables (QMCT) based on regression results and pair correlation coefficients. The results of the analysis of the impact of factors on the level of transparency and disclosure of information of the listed enterprise.

Model 4: (variable BGD, SHNN, SHQT, DBTC makes tool variables, additions cbttt-1 late variables).

The Wald test results said independent variables in the estimated model affect transparency and disclosure at a meaningful 1 percent. The explanation coefficient (R2) indicates that the estimated result can properly explain 42.27% of cases applied according to the model. Testing the effects of endogenous variables in the Wu-Hausman method allows for the conclusion that there is no endogenous variable in the estimated model; however, the results of the Sagan test on the use of the conclusion tool variable also appeared excessive tool variables in the estimated model (at a meaningful impact of 10%).

The estimated results indicate that the transparency and disclosure index in the previous period, independent members of the Board of Directors, company size, profit/asset ratio, Tobin Q have a positive influence on the level of transparency and disclosure of information. The result is similar to model 2, but solves the endogenous variable that appears in the model.

On the basis of excluding the effect of endogenous variables appearing in the estimated model, the 2SLS estimation method results from "model 4" are consistent with the research objective in determining the influence of corporate governance and corporate finance factors to the level of transparency and disclosure of information.

Result of Moment Regression Model Results (GMM)

The estimated results of the regression model by THE GMM method of factors to the level of transparency and disclosure of information presented in are as follows:

Model 4: (variable BGD, SHNN, SHQT, DBTC makes tool variables, additions cbttt-1 late variables)

The Wald test results said independent variables in the estimated model affect transparency and disclosure at a meaningful 1 percent. The explaining coefficient (R2) indicates that the estimated result can properly explain 42.42% of cases applied according to the model. Testing the effects of endogenous variables in the Wu-Hausman method allows for the conclusion that there is no endogenous variable in the estimated model; however, the results of the Sagan test on the use of the conclusion tool variable also appeared excessive tool variables in the estimated model (at a meaningful impact of 10%).

The estimated results indicate that the transparency index and Information disclosure in the previous period, independent members of the Board of Directors, company size, profit/asset ratio, Tobin Q have a positive influence on the level of transparency and disclosure of information. The result is similar to model 2, but solves the endogenous variable that appears in the model; and in line with the 2SLS estimated methodology.

On the basis of excluding the effect of endogenous variables appearing in the estimated model, the results of the 2SLS and GMM estimation methodology from "model 4" are consistent with the research objective in determining the influence of corporate governance and corporate finance factors to the level of transparency and disclosure of information. The study accepted the results of the regression model according to the GMM estimation method from model 4:

The results of the estimation model from the GMM estimation method show the level of transparency and disclosure of information influenced by factors such as the level of disclosure in the previous period, the number of independent members on the Board of Directors, the size of the company, the profit/asset ratio, company value, and has the same dimension of impact as the estimated result at the basic estimate model (REM model). From the results of the estimated model, the study concluded to accept hypothesis H2: the number of independent members on the Board of Directors has the same effect as the level of transparency and disclosure; accept the H4 hypothesis: the size of the company has a positive influence on the level of transparency and disclosure; accept the H5 hypothesis: financial performance measured by ROA rates has a positive effect on the level of transparency and disclosure; Accept the H6 hypothesis: the value of the company measured by Tobin Q has a positive effect on the level of transparency and disclosure of information. The study found no evidence to accept the H1ahypothesis: board size has the same effect on transparency and disclosure. The study found evidence that the level of information disclosure in the previous period had a positive effect on information disclosure in the next period, which is a new point that no author has ever found on the Stock Exchange of Vietnam. The results of this study are consistent with the basis of asymmetric information theory, representative theory, and some pre-existing research results.

With the conclusion of accepting the H2 hypothesis: the number of independent members on the Board of Directors has influence in the same direction as the level of transparency and disclosure; when increasing the independence of the Board of Directors – increasing the number of independent members will make information about the company fully published, Timely and accurate will reduce asymmetric information between managers and shareholders. The results are also consistent with studies by (Tran & Hoang, 2019) and in line with the study's expectations.

With the conclusion accepting the H4 hypothesis: the size of the company has a positive effect on the level of transparency and disclosure, large-scale companies with a complete corporate governance system tend to publish more information than small companies that have just entered the listed market. The results of the analysis are also consistent with previous studies by authors (Nguyen, 2015; Nguyen & Le, 2016; Pham et al., 2017; Tran & Hoang, 2019); and consistent with the expectations of the study.

With the conclusion accepting the H5 hypothesis: financial performance measured by ROA ratio has a positive effect on the level of transparency and disclosure of information, this result demonstrates that the representation theory has an important influence on the disclosure of the company's information. Companies with high profit margins will publish more information and the representative uses this issue for better contracting. The results of the analysis are consistent with previous studies by authors (Aksu & Kosedag, 2006; Nguyen, 2015; Pham et al., 2017); but contrary to the conclusions of Pham & Tran.

With the conclusion accepting the H6 hypothesis: the value of the company measured by TobinQ has a positive effect on the level of transparency and disclosure, this result indicates that when the value of the company on the listed market increases the company tends to publish more information. The results are in line with research by Aksu & Kosedag (2006) on the Turkish stock market. This result is consistent with signal theory in corporate governance and has an effect on the disclosure of company information.

The study refutes the H1ahypothesis: the size of the Board has the same effect on transparency and disclosure of information. The results contradict the conclusions of authors) Nguyen & Le (2016); but agreed with the results of (Tran & Hoang, 2019). On the Stock Exchange of Vietnam, the average number of board members is 6 and little changed due to corporate governance regulations and minimum capital ratio constraints to the Board of Directors; In addition, the anxiety arising from the cost of representation when increasing the size of board members has affected the board size factor in some small companies. Some studies indicate that the size of the Board of Directors has no effect on disclosure and is similar to the results of research (Tran & Hoang, 2019).

The study refutes the H1bhypothesis: the chairman's responsibilities have a positive effect on the level of transparency and disclosure of information. The results of the study show that the manager relationship theory does not appear in the results of the study. The conclusion of the study is consistent with the results of (Tran & Hoang, 2019). From a control perspective, when the Chairman of the Board of Directors and the general director, the company's board of directors is easily manipulated and has the ability to hide information (especially bad information) on the Stock Exchange of Vietnam.

And the study found that the level of transparency and disclosure in the previous period had the same effect on information disclosure in the current period. The level of disclosure of the company gradually increases over time in response to the regulations of the stock market and pressure for information from investors. Previous research results in Vietnam have not shown this; however, the results of the study are consistent with the study of Rajab & Handley-Schachler (2009) in the UK Stock Exchange.

Transparency and disclosure of information are very important for the operation of listed enterprises, individual investors and the development of the stock market. The main content is to determine the influence of corporate governance and corporate finance factors on the level of transparency and disclosure of information of enterprises listed on the Vietnamese stock market. Using the two-step smallest two-step cube estimate and general moment, the study found evidence to conclude that transparency and disclosure of information are correlated with the independence of the Board, company size, and return on assets. Publishing information in the past has a positive impact on the level of disclosure in the current period. The study results are consistent with asymmetric information theory, representative theory, and previous empirical studies. As such, it can be seen that transparency and disclosure of information is not only an obligation but also a right of companies. Improving transparency and disclosure will help companies access regional and world stock markets, establish their credibility in the stock markets, and be more favorable in raising capital when needed.

Conclusion

From the results of the study, the study recommends that the listed enterprise management agency, the State Securities Commission, use the transparency index and publish the information of the study as scientific evidence to refer to the development of a set of criteria for transparent evaluation and disclosure of information of enterprises listed on the Stock Exchange of Vietnam, So far, there is no set of transparency indicators and official information published on the Vietnam stock market. The State Securities Commission should rely on transparency and disclosure indicators as disclosure signals to strengthen the implementation of supervision of listed enterprises in compliance with transparency of information disclosure. The study's model of the impact of transparency and on equity costs and the financial performance of listed enterprises is a scientific evidence that should be used to recommend that listed companies improve their disclosure on the Stock Exchange of Vietnam.

The State Securities Commission should prescribe guidelines for the use of the set of corporate governance principles for enterprises listed on Vietnam stock market; issue detailed information disclosure guidelines, guide the preparation of transparent reports to disclose information to provide information to investors quickly and effectively; request listed enterprises to comply with the Guidance of the Ministry of Finance on information disclosure according to Circular 155/2015/TT-BTC and Circular 121/2012/TT-BTC. The State Securities Commission increases the level of sanctions (in finance, securities trading) with the act of not transparently discharging information of listed companies in order to force CTNS to comply with decisions of the law on transparency and disclosure on the stock market.