Research Article: 2021 Vol: 25 Issue: 2S

Factors Affecting Intention to Use Banking Services: A Case Study of Commercial Banks in Dong Nai Province

Phan Thanh Tam, Lac Hong University (LHU)

Truong Le Hoang, Lac Hong University (LHU)

Keywords

Intention, Use, Commercial, Bank, Service, LHU.

Abstract

The development of banking services is consistent with the inevitable trend in commercial banks’ operations in the region, in the world in general, and of Vietnamese commercial banks in particular. The expansion to serve individual customers and small and medium enterprises help the bank diversify its products, expand the market, and manage risk more effectively, thereby allowing the bank to achieve optimal business performance. Developing banking services diversifies services, meeting the increasing needs of subjects in the society, promoting economic growth and sustainable development. Therefore, the authors surveyed 500 customers related to using banking services from February 2020 to September 2020. The research results showed that five factors affect the intention to use commercial banks’ banking services in Dong Nai province. Finally, the research results are crucial scientific information for bank managers to enhance the banking service.

Introduction

In recent years, banks have focused on exploiting the retail market. So, they have achieved encouraging results, such as promoting the modernization of banking technology. Developing new types of services, multi-utility and socially accepted such as Automatic Transaction Machine (ATM), internet banking, home banking, mobile banking by Beck (2016).

Kamakodi & Ahmed (2018) studied forms of capital mobilization that are increasingly diversified and flexible such as savings with ladder interest rates, bonus savings, flexible interest, and principal savings. Besides, interest savings are based on savings balance combined with insurance, savings in installment deposits, issuance of valuable papers, and sending to one transaction office in many places. Capital mobilization of banks from the population has increased sharply and accounts for 35-40 % of mobilized capital. The number of remittances transferred through banks is expanding in 2020, reaching about 6.5 billion USD), contributing to creating a significant foreign currency source for banks and increasing income from payment fees.

According to Chen (2018), studied the loans have also been expanded: home loans, car purchases, study abroad, proof of finance, loans to officers and employees, overdrafts create conditions to improve people’s lives when accumulation is not enough. Commercial banks have made significant improvements in their financial capacity, technology, governance, organizational structure and distribution channel network, product and service systems. Many retail banking services have been implemented, such as account services, checks, cards, asset management, credit, and mortgage. Besides the achieved results, the retail banking services of Vietnam Commercial banks still have many shortcomings. Banks have not yet built up a plan to develop retail banking services synchronously and effectively by Kazemi (2013).

According to Cheng & Song (2018), banking services’ retail products are not plentiful and have not met customers’ needs. Modern banking services are implemented slowly, card payment services are limited in the scope of use. They have not been widely developed in most public; internet banking services are mainly at the level of thorough inquiry. Payment is not allowed, non-cash payment tools such as personal checks are almost not used, and card payment facilities are limited by Zhang (2019). The banking services serving customers with high income have not been widely deployed, such as asset preservation, financial consulting, investment consulting by Koufaris (2014).

Distribution channels are not diversified and ineffective, with the primary transaction methods at counters. The forms of remote transactions based on information technology platforms are not famous by Chitungo & Munongo (2013). The number of ATMs located mainly in towns, urban areas, and cities, the merchants network is still small, the ATM system’s connection is still in the testing phase, banks have not found it. A familiar voice for unified reference and shared technical infrastructure by Joshua (2009). Therefore, wasting the purchase of machinery and equipment has not created favorable conditions in using the card. Therefore, it limits the ability to access banking services by Sadi (2011). Thus, the author’s research factors affecting intention to use banking services: a case study of commercial banks in Dong Nai province.

Literature Review

Intention to Use Banking Services (IU)

According to Christen (2015), many researchers try to give general concepts and measure Behavioral Intents; The Reasoned Action (TRA) theory points out two factors: attitudes and subjective standards to predict standard behavior to use of customers. Davis (1993, 1998) introduces the Technology Acceptance Model (TAM) model on the relationship and influence of cognitive factors such as ease of use, usefulness on attitudes, and from that to mind. Intention and behavior in the user are IT adoption, the meaning is considered the direct premise leading to the technology’s action in the TAM model. Research by Zhang, et al. (2012) also affirms that user intent is a crucial concept in consumer behavior research and is also the most important determinant of actual consumer behavior. Besides, many researchers are aware of the usefulness, perceived ease of use of a product/service/bank’s new technology. They are one of the fundamental determinants that impact attitudes and behavior to accept and use banking products and services by Clegg & Abdullah (2018). Many studies are using the technology acceptance model (TAM), a reasoned action (TRA) theory, and combined with other models that proved this idea. Besides, the influence of social factors on the intention to accept and use banking services has been tested in many models by Coelho & Henseler (2019). The influence of social impact shows the community’s effect on performing people’s specific behavior. A consumer’s action is also subject to social factors such as family, the role and social status, and reference group by Doros (2018).

Perceived Usefulness (PU)

According to Dasgupta & Fuloria (2011), it recognizes the usefulness of banking products and services. Perceived usefulness is considered one of the essential determinants of the acceptance and use of products and services that apply modern information technology systems to bring the highest efficiency in customers’ production and business. Therefore, with the empirical evidence from different contexts, the authors proposed the following hypothesis. Based on the concept mentioned above and studies, authors give hypothesis H1 following:

Hypothesis H1 there is a related impact between perceived usefulness factor to the intention to use commercial banks’ banking services in Dong Nai province.

Perceived Ease to Use (EU)

According to Dupas (2009), this factor has been regularly checked against each other in a large number of technology-based product adoption studies. In rural areas, where the literacy level is still relatively low, using a banking service that can be considered traditional such as credit or payment services, needs to be simple to create. Customers are easy to understand to use the service by Foon & Fah (2011). So, with the empirical evidence from different contexts above. Based on the concept as mentioned earlier and studies, authors give hypothesis H2 following:

Hypothesis H2 there is a related impact between perceived ease to use factor to the intention to use commercial banks’ banking services in Dong Nai province.

Trust (TR)

Gusi & Suga (2016) defines trust as an expression of belief in a promise of one party and fulfill the obligation in an exchange relationship; faith brings a sense of security for customers when the partner meets their expectations. The characteristics of banking products and services are those in the monetary and credit sectors by Geetika & Ashwani (2018). In this field, products and services have an intangible nature. Simultaneously, with the development of information technology, banking products and services have been developed based on modern technology to provide customers. Products to improve quality and efficiency for customers to use by Gibson (2019). So, with the empirical evidence from different contexts above. Based on the concept as mentioned above and studies, authors give hypothesis H3 following:

Hypothesis H3 there is a related impact between the trust factor and the intention to use commercial banks’ banking services in Dong Nai province.

Social Norm (SN)

Goldsmith (2015) stated that the social norm is the degree to which an individual is aware of their important people, and other people think that they should use some products. Today, modern banking services are very plentiful: providing transaction accounts and making payment services based on modern technology, international credit payment services, requires customers by Guiltin (2018). Used goods must have access to advanced technology. Learning to use is often more complicated than traditional services, so rural customers are often afraid to access these modern services by Heath (2012). So, with the empirical evidence from different contexts above. Based on the concept mentioned above and studies, authors give hypothesis H4 following:

Hypothesis H4 there is a related impact between social norm factor to the intention to use commercial banks’ banking services in Dong Nai province.

Innovation (IN)

Hoffman (2015) defined innovation as the tendency to buy fancy new and different products. Customers’ innovation is shown through the desire to search for information about the product. Banking services are incredibly diverse, abundant and constantly evolving by Honohan (2017). Traditional banking services with effective public support development information technology and modern technical facilities have formed diversified and contemporary products such as payment services, credit services, investment. Research of Mason, Mark & Houston (2007) also confirmed that innovative factors impact the customers’ intention to use products and services. So with the empirical evidence from different contexts above. Based on the concept mentioned above and studies, authors give hypothesis H5 following:

Hypothesis H5 there is a related impact between innovation factor and the intention to use commercial banks’ banking services in Dong Nai province.

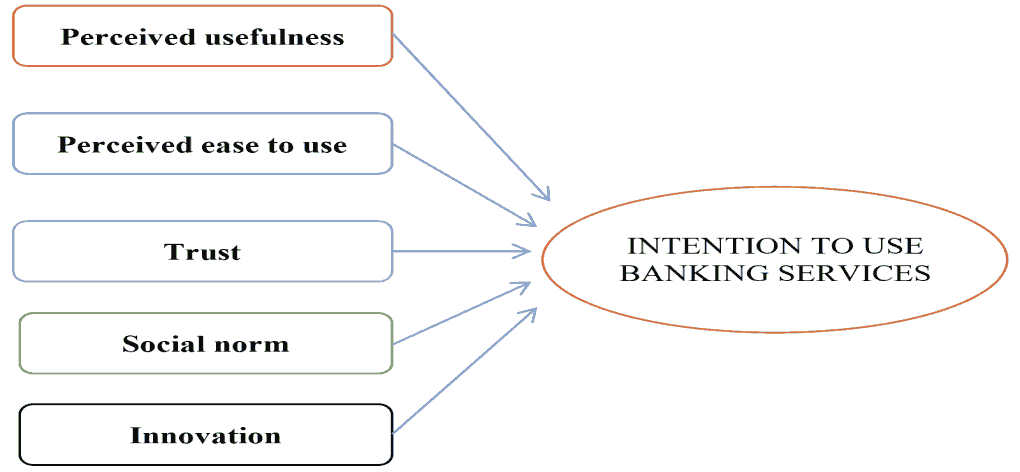

Figure 1: A Research Model for Factor to The Intention to Use Banking Services of Commercial Banks in Dong Nai Province

Methods of Research

The authors applied qualitative and quantitative research methods in this study, based on experts opinions to adjust observed variables.

Qualitative Research

It was conducted to check the fit of the theoretical models and help discover, adjust and complement the observed variables used to measure the concept study to ensure construction scale consistent with academic research. In this study, qualitative research was done through group discussions, opinions of experts and customers. Purpose: (1) The first is to test, refine the independent variables in the author’s model theory, and determine the relationship between them. And the dependent variable. (2) The second is to check the scales’ rationality by Hair, J., Anderson, Tatham, & Black (1998).

Quantitative Research

Primary data was collected reviews intended to accept the banking services through direct interview of customers according to the question on the questionnaires designed before. The information collected includes (1) Information about factors affecting the intention to use banking services. (2) Demographic information, such as age, gender, education, and income of the client; After collecting data of the customer, the author will be using the software SPSS and AMOS to perform data analysis through the steps: (1) Descriptive statistics, (2) Test the reliability of Cronbach’s alpha measuring scale, (3) Analyze Exploratory Factor Analysis (EFA), (4) Analyze the correlation among variables in the model, (4) Analyze Confirmatory Factor Analysis (CFA), (5) Analyze Structure Equation Model (SEM). Besides, quantitative research was conducted through questionnaires with observed variables measured using a 5-point Likert scale includes one strongly disagree and five strongly agree. The authors surveyed 500 consumers who used commercial banks’ services in Dong Nai province. The data collection time is from February 2020 to September 2020. According to the conventional method by Hair, Anderson, Tatham, & Black (1998), samples were selected. The authors collected data processed through SPSS 20.0 software with descriptive statistical tools, scale testing with Cronbach’s Alpha, discovery factor analysis (EFA), and testing Structural Equation Modeling (SEM).

Results

The authors tested the scale reliability for the intention to use commercial banks’ banking services in Dong Nai province, including five components.

| Table 1 Testing of Cronbach’s Alpha for Factor to The Intention to Use Banking Services of Commercial Banks in Dong Nai Province. (Source: Data Processed By SPSS 20.0) |

||

|---|---|---|

| No. | Items | Cronbach’s alpha |

| 1. Perceived usefulness (PU) | 0.945 | |

| Pu1 | Using banking services increases productivity and business efficiency | 0.912 |

| Pu2 | Using banking services saves more time | 0.938 |

| Pu3 | Using banking services for fast and convenient currency and credit transactions | 0.945 |

| Pu4 | Using banking services following business needs | 0.916 |

| 2. Perceived ease to use (EU) | 0.861 | |

| Eu1 | Easy to learn and use banking services | 0.814 |

| Eu2 | Conducting transactions with banking services is clear and easy to understand | 0.819 |

| Eu3 | Banking services can be mastered easily | 0.847 |

| Eu4 | Feeling flexible and easy to apply banking services | 0.811 |

| 3. Trust (TR) | 0.902 | |

| Tr1 | When using banking services, I believe in personal information kept secret | 0.87 |

| Tr2 | When using banking services, I believe my transaction is guaranteed | 0.83 |

| Tr3 | When using banking, I believe my privacy will not be disclosed | 0.879 |

| 4. Social norm (SN) | 0.951 | |

| Sn1 | People who matter to me think that I should use new and modern banking | 0.929 |

| Sn2 | People who are familiar with me think that I should use new and modern banking | 0.944 |

| Sn3 | The people who influence my behavior think I should use new and modern banking | 0.945 |

| Sn4 | Most of the people around me think I should use new and modern banking | 0.926 |

| 5. Innovation (IN) | 0.947 | |

| In1 | I often look for information about banking services | 0.924 |

| In2 | I like to go places where I get a lot of information about new banking services | 0.945 |

| In3 | I like magazines that introduce and advertise new banking services | 0.936 |

| In4 | I took the first chance to learn about the new bank service | 0.918 |

Table 1 showed that all of (1) perceived usefulness (PU), (2) perceived ease to use (EU); (3) trust (TR); (4) social norm (SN), (5) innovation (IN). All of Cronbach’s alpha is higher than 6.0. This result is excellent and satisfactory.

| Table 2 Testing of Cronbach’s Alpha for Intention to Use Banking Services (IU).(Source: Data processed by SPSS 20.0) |

||

|---|---|---|

| No. | Items | Cronbach’s alpha |

| Intention to use banking services (IU) | 0.862 | |

| Iu1 | I intend to use more of the new services the bank offers over the next three months | 0.845 |

| Iu2 | I intend to use banking service regularly in the future | 0.786 |

| Iu3 | I plan to use more of the banking services offered soon | 0.861 |

| Iu4 | I intend to increase the research and use of new and modern banking services in the future | 0.797 |

Table 2 showed that Cronbach’s Alpha values using banking services (IU) meet this technique’s requirements. Specifically, Cronbach’s Alpha values of intent to use banking services (IU) is more than 0.6.

|

Table 3 |

||||||||

|---|---|---|---|---|---|---|---|---|

| Model | NPAR | CMIN | DF | P | CMIN/DF | GFI | TLI | CFI |

| Default model | 75 | 501.137 | 201 | 0 | 2.493 | 0.918 | 0.963 | 0.97 |

| Saturated model | 406 | 0 | 0 | 1 | 1 | |||

| Independence model | 23 | 10367.82 | 253 | 0 | 40.98 | 0.31 | 0 | 0 |

Table 3 showed that the assessment of the scale of factor to the intention to use banking services of commercial banks in Dong Nai province includes the following elements: CMIN/DF : 2.493 (<5.0), GFI : 0.918 (>0.850), TLI : 0.963 (>0.900) and CFI : 0.970 (> 0.9).

| Table 4 Testing Coefficients for Factor Affecting The Intention to Use Banking Services of Commercial Banks in Dong Nai Province. (Source: Data Processed By SPSS 20.0 and AMOS) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Relationships | Unstandardized Estimate |

Standardized Estimate |

S.E. | C.R. | P | Hypothesis | ||

| IU | <--- | PU | 0.06 | 0.119 | 0.021 | 2.879 | 0.004 | Accepted |

| IU | <--- | EU | 0.072 | 0.118 | 0.026 | 2.782 | 0.005 | Accepted |

| IU | <--- | TR | 0.217 | 0.368 | 0.036 | 6.124 | *** | Accepted |

| IU | <--- | IN | 0.097 | 0.208 | 0.025 | 3.875 | *** | Accepted |

| IU | <--- | SN | 0.061 | 0.123 | 0.021 | 2.976 | 0.003 | Accepted |

Table 4 showed that the column “P”<0.01 with significance level 0.01. These results indicated five factors to the intention to use commercial banks’ banking services in Dong Nai province with a significance level of 0.01. These results are science evident for managerial implications to enhance the intention to use commercial banks’ banking services in Dong Nai province.

Conclusion and Managerial Implications

Conclusion

In the current context of Vietnam’s economy, the critical role of commercial banks has been affirmed. It is to contribute to the realization of socio-economic development goals, banking services are increasingly plentiful and diversified with traditional and modern services associated with high technology. To promote customers to accept and use banking services actively, organizations providing banking services need to understand customers. Besides, the official study had a sample of 500 clients, but 485 samples are processed. The paper used SPSS 20.0 and Amos software to perform Cronbach’s analysis, an EFA analysis to select the scales in the proposed research model to ensure high reliability, meet research standards, and put it into testing. The results showed that the research model factors affecting the intent to use commercial banks’ banking services in Dong Nai province. Based on SEM analysis results, the authors offer some managerial implications to improve the intention to use banking services of commercial banks in Dong Nai province following.

Managerial Implications

First of all, commercial banks should develop risk prevention standards for the bank’s services to ensure safety when customers use their services. Ensure safety for customer information. Besides, commercial banks should continue applying information technology in service development and expansion, quality improvement, and risk prevention and management in the operations of commercial banks is an inevitable development trend in the coming time. Commercial banks should build products that suit your needs and create benefits for your users.

Secondly, commercial banks should plan a development strategy that requires increasing the application of modern information technology in banking management. Besides, the development of products and services based on information technology to implement cash management and liquidity, safety, security, and information system integration to meet the needs of ensuring safety and security for customers. Commercial banks should create confidence for customers using the service. Commercial banks should simple in implementation, short and easy-to-remember process so that customers are not afraid to use.

Thirdly, commercial banks should build a strict risk management process fully and effectively. Besides, banks continue implementing regulations on risk management following national and international standards, creating and fostering a contingent of highly specialized staff and staff with knowledge and skills in professional information technology to meet the needs of administration and operation to master modern technology systems.

Fourthly, the commercial banks should take high responsibility in fulfilling the customer’s request and promptly handle it if there is any risk to the customer. Currently, the modern banking system has also recognized the importance of protecting customers from services provided to customers to develop the Vietnamese commercial banking system. As the development of retail banking services, especially those associated with high technology, customer protection is an urgent requirement.

Finally, when introducing the bank’s services, the salesman is also the one who guides the use of the service to customers. Enthusiastic salespeople guide to use the service will make it easier for customers to use the new product. This recommendation can help customers trust the choice of the bank’s services. Thereby, it is possible to convince customers that the banking services can better meet their needs and be easy to use and benefit customers’ business operations. Commercial banks need to develop non-cash payment activities suitable to the rural area’s purchase, sale, exchange, and transaction needs. Diversify other financial services such as financial leasing and financial consulting to create a favorable environment for business households in this area to explore and have new business opportunities.

References

- Beck, T.A. (2016). Access to & use of banking services across countries. J financ econ, 85(1), 234-266.

- Chen, C.H. (2018). Toward an underst&ing of the behavioral intention to use mobile banking. Comput Hum Behav, 21(6), 873-891.

- Cheng, D.G., & Song, Y.F. (2018). Customer acceptance of Internet banking: Integrating trust & quality with UTAUT Model. International Journal of Service Operations & Logistics, 2(3), 12-21.

- Chitungo, S.K.., & Munongo, S. (2013). Extending the technology acceptance model to mobile banking adoption in rural zimbabwe. Journal of Business Administration & Education, 3(1), 51-79.

- Christen, R.K. (2015). Maximizing the outreach of microenterprise finance: an analysis of successful rural finance programs. J Consum Psychol, 4(2), 32-45.

- Clegg, B., & Abdullah, S.R. (2018). Internet banking acceptance in the context of developing countries: An extension of the technology acceptance model. Inf Syst,, 2(3), 19-32.

- Coelho, P.H. & Henseler, J.M. (2019). Creating customer loyalty through service customization. Eur J Mark, 46(3/4), 331-356.

- Doros, T. (2018). Integrating trust in electronic commerce with the technology acceptance model: model development & validation. Eur J Mark, 2(2), 13-26.

- Dasgupta, S.P., & Fuloria, S. (2011). Factors affecting behavioral intentions towards mobile banking usage: empirical evidence from India. Romanian Journal of Marketing, 6(1), 6-28.

- Davis, F.D. (1993). User acceptance of information technology: System characteristics, user perceptions & behavioral impacts. Int J Man Mach, 38(3), 475-487.

- Davis, F.D. (1989). Perceived usefulness, perceived ease of use, & user acceptance of information technology. MIS Quarterly, 13(3), 319-340.

- Dupas, P.M. (2009). Savings constraints & microenterprise development: evidence from a field experiment in Kenya. International Journal of Marketing, 4(3), 16-24.

- Foon, Y.S. & Fah, B.C.Y. (2011). Internet banking adoption in kuala lumpur: an application of utaut model. Int J Bus Manag, 6(4), 161-167.

- Gusi, L., & Suga W. (2016). Measuring the performance of rural finance institutions. International Journal of Bank Marketing, 2(5), 28-41.

- Geetika, T.M. & Ashwani, U.T. (2018). Internet banking in India: issues & prospects. The International Journal of Bank Management, 7(2), 47-61.

- Gibson, L.R. (2019). Chinese American internet banking acceptance: implications multicultural marketing. The International Journal of Bank Management, 7(2), 17-26.

- Goldsmith, J.K. (1995). The generality/specificity issue in consumer innovativeness research. Technovation journal, 15(10), 601-612.

- Guiltin, J.P. (2018). The use of product portfolio analysis in bank marketing planning in Shanmugam & Burke (Eds), Management Issues for Financial Institutions, 50(2), 4-12.

- Hair, J., Anderson, R., Tatham, R., & Black, W. (1998). Multivariate data analysis with readings. US: Prentice-Hall: Upper Saddle River, NJ, USA.

- Heath, Y.R. (2012). Extending the theory of planned behavior predicting the use of public transport. J Appl Soc Psychol, 32(10), 2154-2189.

- Hoffman, K.D. (2015). Factors influencing the behavioral intention to adopt internet banking: an empirical study in India. International Refereed Research Journal, 4(1), 7-21.

- Honohan, P.T. (2007). A meta-analysis of the technology acceptance model: Investigating subjective norm & moderation effects. Information & Management, 44(1), 90-103.

- Subin, I., Mason, C.H., & Mark, B.H. (2007). Does innate consumer innovativeness relate to new product/service adoption behavior? The intervening role of social learning Via vicarious innovativeness. J Acad Mark Sci, 35(1), 63-75.

- Joshua, A.J. (2009). Adoption of technology-enabled banking self-services: antecedents & consequences, J Acad Mark Sci, 1(9), 10-16.

- Kamakodi, N.K. & Ahmed, M.B. (2018). Customer expectations & service level in E-banking Era: An empirical study. Journal of Bank Management, 7(4), 50-70.

- Kazemi, A.M. (2013). Factors affecting isfahanian mobile banking adoption based on the decomposed theory of planned behavior. Int j acad, 3(7), 230-245.

- Koufaris, M.W. (2014). The Development of initial trust in an online company by new customers. Inf Manag, 41(3), 377-397.

- Sadi, M.F. (2011). Factors influencing the adoption of m-commerce: an exploratory analysis. Journal of Business Administration & Education, 4(5), 92-102.

- Zhang, L.Q. (2019). A meta-analysis of mobile commerce adoption and the moderating effect of culture. Comput Hum Behav, 28(5), 1902-1911.