Research Article: 2022 Vol: 26 Issue: 5S

Factors Affecting on the Effectiveness of Internal Audit Reporting: Evidence from Public Sector in Northern Province, Sri Lanka

Vickneswaran Anojan, University of Jaffna

Citation Information: Anojan, V. (2022). Factors affecting on the effectiveness of internal audit reporting: evidence from public sector in northern province, sri lanka. Academy of Accounting and Financial Studies Journal, 26(S5), 1-12.

Abstract

The main purpose of the study is to identify significant factors affecting the effectiveness of internal audit reporting in the public sector of the Northern Province, Sri Lanka. Primary data were used in this study, those primary data were collected from heads of the departments, divisions, and internal auditors in the public sector, Northern Province of Sri Lanka through the developed questionnaire. Regression analysis confirmed that tested factors are significantly impact on the effectiveness of internal audit reporting, especially accountability & transparency, and independence of internal auditors are more significantly impact on the effectiveness of the internal audit reporting. All the tested factors are significantly correlated with the effectiveness of internal audit reporting, except materiality. This paper is based on the data from public sector in the Northern Province of Sri Lanka, therefore the findings of the study can be generalized to other public sector organizations, which are in other provinces in Sri Lanka. According to the statistical results of the study, it can be suggested that more independence for the internal auditors and accountability & transparency of the internal auditors will lead to more effectiveness of the internal audit reporting in the public sector of the Northern Province of Sri Lanka. This is the first study, which evaluates significant factors that impact on the effectiveness of internal audit reporting in the public sector of Sri Lanka.

Keywords

Central Government, Factors, Internal Audit Reporting, Northern Province, Provincial Government.

Introduction

Internal audit is an independent and essential activity in the risk assessment and implementation of internal control system of the organization. Internal audit focuses three key functions such as, ensure the effectiveness and efficiency of operations, increase the reliability of the financial information and increase & confirm the legal compliance of the organization. Internal audit covers not only the financial activities but also non-financial activities of the organization. Due to Asian financial crises, there were significant changes in the profession of internal audit during 1997-1998 (Amanuddin & Divyaa, 2014). Today, internal audit functions are considered a vital one in all the sectors, due to the latest global economic meltdown and the increasing fraud cases. Therefore, every organization gives more consideration and priorities to have effective and efficient internal audit division. It vitally contributes in the risk management and effective day to day operations of the organization.

Most of the organization have audit committee for the better performance of the organization and to find out possible solutions for the weakness of the organization. The Institute of Internal Auditors (IIA) (2020) defines, internal auditing is a value addition activity in a firm to increase the effectiveness and efficiencies of day to day operation, increase reliability of the financial reporting, and ensure the legal compliance of the firm. Every organization has many objectives, which objectives should be achieved with some conditions. Therefore, internal audit functions help to an organization to accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes.

Most of the public sector face difficulties on the public sector financial management due to that, they search appropriate ways to develop effective and efficient public sector financial management. Sri Lanka also faces a continuous budget deficit, it can be seen that budget deficit of the country is 6.8 percentage in GDP in 2019 Central Bank Report of Sri Lanka 2019. Due to that, need of effective and efficient internal audit are increased in the public sector of the Sri Lanka. Public sector organizations are administrated at three level such as central, provincial and local government in the Sri Lanka. Here, most of the central government public sector organizations have independent internal audit division under the chief internal auditor as well as, each provincial council has internal audit division which is headed by the chief internal auditor.

Previous studies found a number of factors which were impact significantly on the effective operations of the internal audit division. Management support, experience of staff, adequate resources and independent of the internal audit division were significantly impact on the effectiveness of internal audit (Alzeban, 2014). Independence of internal auditor had significant impact on the performance of the internal audit. Independence of internal audit, competence of internal audit, support of management and quality of internal audit were significantly impact on the effectiveness of the internal audit in Vietnam (Tran, 2018).

Most of the Sri Lankan studies are related with internal audit function, internal control system with the firm performance. Researcher believes that this study will fulfil a considerable level of existing research gap in the effectiveness of the internal audit of the public sector in the Sri Lanka.

Research Questions (RQ)

Many researchers assessed and found significant influencing factors on the effectiveness of the internal audit (Alzeban, 2014; Tran, 2018; Zulkifli et al., 2014; Alhassan et al., 2018, Ruth & Tabitha, 2018; Kanbiro, 2019). Based on depth of literature review and experience, the following research questions were formulated and answered in this study.

RQ1: Do any identified factors significantly impact on the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka?

RQ2: Is there any relationship between identified factors of the study and effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka?

Research Objectives

The main objective of this study was to find out significant factors affecting on the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka. Sub objectives of this study were to identify the significant relationship between identified factors and effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

Literature Review and Hypotheses

Agency Theory

Agency theory can be stated as a contract between owners of the organization and top management of the organization. Generally, top management acts as agents to perform operations of the organization on behalf of owners. Owners delegate authorities to top management to act on behalf of them. In this situation, granted authorities could be misused by top management of the organization. Due to that, audit committee, internal and external auditors play a significant role to ensure reliability of the financial information, effective and efficient operations & legal compliance of the organization.

Researchers stated that, internal auditors act as agents, internal audit reports and their works are used by several users (Peursem & Pumphrey, 2005). If there is inefficient board and audit committee then, agency problems may arise. Here, senior management may significantly influence on the functions and duties of the internal audit division. In this crucial situation, there may be a question raised on the effectiveness of the internal audit reporting and service quality of the internal audit division.

Internal auditors are appointed by the top management of the organization and also internal auditors act as agents to them. Board and audit committee trust that, internal auditors honestly evaluate the performance of the management and report on their works. Internal auditor may expect some personal benefits from the management such as financial rewards, personal relationships with management, future position of internal auditors and their salaries. Due to that, the effectiveness of internal audit reporting and service quality of the internal audit division is questionable. Board and audit committee expects that, internal auditors must perform their role with adequate professional qualifications, competence and experience. Because, internal audit reports are very useful for the effective and efficient risk management of the organization. Internal auditors have primary responsibility to evaluate internal control system on each and every activities of the organization and report on their evaluations to top management of the organization.

Here, internal auditors should collect sufficient and appropriate evidence to increase the quality of their report. Also they have to consider materiality for the effective and efficient communication with users of internal audit report. Internal auditors are the employees of the organization who evaluates operations of the organization and its resource allocation & usage. Support from top, middle and bottom level staff are expected for effective and efficient functions by the internal audit division of the organization.

Accountability & Transparency

Today, need of accountability and transparency are increasing day to day in public and private sector. Accountability is the obligation by the employees to the employer in terms of their duties and responsibilities. Transparency is one of the key attributes of the good governance and faithful work. It is one of the code of ethics to the professional auditors. Level of accountability and transparency should be higher level in the public sector. Public sector organizations use public finance which fund is collected mostly from the general public of the country. Due to that, public sector organizations are accountable to the general public of the country and their work should be transparency to the general public of the country. Internal auditor has accountability for the top management regarding assigned responsibilities and duties by the top management of the organization. Here, internal auditor has certain level of transparency however, they have to maintain confidentiality

Competence of Internal Auditors

Staff competence plays a vital role in the overall performance of the organization. According to Chartered Accountants of Sri Lanka (2016), professional competence is one of the code of ethics for professional accountants. CA Sri Lanka states that competent professional service requires the exercise of sound judgment in applying professional knowledge and skill in the performance of such service. Internal auditor also provide professional and highly efficiency service to the organization due to that, they have to maintain their professional competence at the acceptable level.

Materiality

Everywhere people give more consideration for the materiality as well as materiality plays a vital role in the audit process and reporting. Sri Lanka Auditing Standard SLAuS (320) clearly states that, the assessment of what is material is a matter of professional judgment. Standard highly recommends that, the auditor should establish an acceptable materiality level in designing the audit plan, so as to detect quantitatively material misstatements. However, both the amount (quantity) and nature (quality) of misstatements need to be considered. Stakeholders and top management of the organization focus materiality information due to that, internal auditor has responsibility to report with materiality information.

Audit Evidence

Auditor should arrive to their professional and independent opinion based on the collected audit evidence in the audit process. Auditor has major responsibility to draw and issue reasonable opinion, which depends on sufficient and appropriate audit evidences (SLAuS 500). Audit evidences are legal references for auditor’s conclusion. There are many techniques to obtain audit evidence, which can differ audit to audit and audit firm to audit firm.

Independence of Internal Auditor

Independence should be given to the employees for the innovative and independence work. Audit is one of the independent services in the world. They have responsibility to provide independent opinion on assign work to them. Independence will increase the quality of the audit work and report further, internal auditor should carry out their work as independently for the effective and efficient reporting. Further, top management has the responsibility to ensure the adequate independence of the internal auditor.

True and Fair View

Auditor has major responsibility to give their professional opinion through the audit report. Here, such audit report should be true and fair view then only it could be a valid report in the decision making. Internal auditor also has responsibility to report to the top management at regular intervals, their report is more valuable in the risk management and corporate level decision making of the management. Due to that, internal auditor should prepare and present their report as true and fair view.

Performance Audit

Audit has number evolutions in the world, today performance audit is mostly expected by stakeholders of the organization. Performance audit provides more benefits than traditional audit, it gives more priority to the performance than physical documents. Performance audit covers three major areas such as effectiveness, efficiency and economy. Today, internal auditor also should focus performance audit to fulfil the requirements and expectations of the stakeholders of the organization.

Resources and Facilities

Adequate resources and facilities should be allocated for the effective function of the division and also given resources and facilities should be utilized optimum level for the higher level performance of the organization. Internal audit division is one of the divisions in the organization. Internal audit division should be facilitated with the adequate resources and such division should be utilized resources optimum level for the higher level performance of the internal audit division.

Empirical Findings

Researchers examined factors impact on the effectiveness of internal audit. Statistical analysis of the study revealed that quality of internal audit and support of management are significantly impact on the effectiveness of internal audit.

Researcher assessed the factors affecting efficiency in internal audit performance and the relationships between efficiency in internal audit performance and operational outcomes in the selected listed companies of Thai Stock Exchange. Findings of the study confirmed that completeness of operating and information systems, understanding and acceptance within the organization, knowledge, skill, and human relations and relationship between the internal audit units and other units have influence on internal audit efficiency (Chaiwong, 2012).

Researchers noted that, internal audit functions are vitally important and essential for the control, monitoring and assessing the public sector financial management. Descriptive, correlation and regression analysis were performed in this study. Statistical analysis of the study confirmed that there was a positive and significant relationship between competency of the internal auditor, independence of the internal auditor, objectivity and support of the management and internal audit effectiveness (Zulkifli et al., 2014).

Researchers revealed that, internal auditors face a serious problem due to the low level of independence and competence of the internal auditors. Also researchers stated that relationship between internal auditor and external auditor also is an issue in the effective and efficient performance of the internal auditor (Amanuddin & Divyaa, 2014). Researchers found that, independence of the internal auditor, objectivity, support of the management, internal audit function and sector of the organization were significantly impact on the effectiveness of internal audit.

Researchers examined perception of respondents regarding factors which could be impact on the effectiveness of internal audit. Researchers considered competence of internal auditors, internal audit division size, relationship between internal and external auditors, support of the management and independence of internal auditor in this study. Results of the study confirmed that support of the management is the most significant factor in determining the effectiveness of internal audit. Also other factors were significant in determining the effectiveness of internal audit (Alhassan et al., 2018).

Researchers revealed that working environment, independence of the internal auditor, competence of the internal auditor were significantly impact on the performance of the internal audit function. Researchers recommended that internal auditor should be complained with the professional ethics and standards for the better performance of the internal auditor further internal auditors should be trained at regular intervals (Ruth & Tabitha, 2018).

Researcher stated that internal audit vital important to enhance the performance of the public sector. Researcher evaluated impact of internal audit quality on the performance of the public sector in Ethiopia. Data of the study were collected through questionnaire. Regression analysis revealed that internal audit independent, competency of internal auditor, support of management were significantly and positively impact on the internal audit quality out of tested eight factors of the study (Kanbiro, 2019).

Researchers assessed the effect of internal audit function on the financial performance of commercial Banks in the Sri Lanka. Researchers used five point like scale questionnaire to collect data in this study. Statistical results of the study revealed that, Internal Audit Standards, Professional Competence and Internal Controls have positive relationships with financial performance of commercial banks in the Sri Lanka. Further, independence of the internal auditor has relationship with financial performance however, it is not at significant level. Researcher examined the relationships between the internal audits characteristics and performance of the organization in the Sri Lanka (Mihret & Yismaw, 2007).

Researchers evaluated the impact of internal control components on effectiveness of internal control system of Peoples Bank in the Sri Lanka. Descriptive and inferential analysis were performed in this study. Researchers found that, internal control components have positive relationship with effectiveness of the internal control system (Dellai & Omri, 2016).

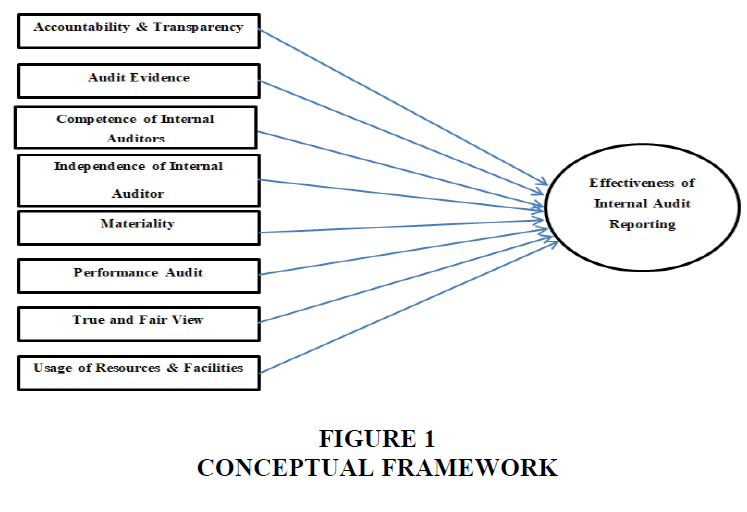

According to the depth of literature review, different factors were tested to identify those factors impact on the effectiveness of internal audit in several studies. It is differ from study to study. Researcher considered all the existing tested factors and assessed those factors impact on the effectiveness of internal audit in this study. Those factors are, Accountability & Transparency, Competence of Internal Auditors, Materiality, Audit Evidence, Independence of Internal Auditor, True and Fair View, Performance Audit, Resources & Facilities on the effectiveness of the internal audit report in this study. There are a lot of studies on assessment of internal audit effectiveness however, there are lack of studies in the Sri Lanka.

Hypotheses

Based on the research questions and objectives of the study the following hypotheses were formulated and tested.

H1: There is a significant impact of identified factors on the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H1a: There is a significant impact of accountability & transparency on the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H1b: There is a significant impact of competence of internal auditors on the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H1c: There is a significant impact of materiality on the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H1d: There is a significant impact of audit evidence on the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H1e: There is a significant impact of independence of internal auditors on the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H1f: There is a significant impact of true and fair view on the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H1g: There is a significant impact of performance audit on the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H1h: There is a significant impact of usage of resources & facilities on the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H2: There is a significant relationship between identified factors and effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H2a: There is a significant relationship between accountability & transparency and the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H2b: There is a significant relationship between competence of internal auditors and the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H2c: There is a significant relationship between materiality and the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H2d: There is a significant relationship between audit evidence and the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H2e: There is a significant relationship between independence of internal auditors and the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H2f: There is a significant relationship between true and fair view and the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H2g: There is a significant relationship between performance audit and the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

H2h: There is a significant relationship between usage of resources & facilities and the effectiveness of internal audit reporting in the public sector, Northern Province of the Sri Lanka.

Research Methodology

Conceptual Framework

The following conceptual framework clearly reveals the relationship between identified factors and effectiveness of internal audit reporting Figure 1.

Sample

Researcher selected district secretariat offices from the central government and the Northern Provincial Council main administrative office. According to that there are five district secretariat offices (Jaffna, Vavuniya, Killinochchi, Mannar and Mulaitivu) and a main administrative office of Northern Provincial Council. Researcher collected data from all the district secretariat offices other than Mannar district secretariat office and main administrative office of the Northern Provincial Council (George et al., 2015).

Data Source

Researcher had developed five point like scale questionnaire, a number of likert scale questions had been included under each and every variables of the study. Where, 1 represents strongly disagree and 5 represents strongly agree in the questionnaire. Data of the study were collected through the developed questionnaire from heads of the departments, divisions, chief internal auditors and internal auditors of central and provincial government in the Northern Province of the Sri Lanka.

Data Analysis Strategies

Descriptive and inferential (regression and correlation) analysis were performed in this study to answer the research questions and test hypotheses with the help of SPSS latest version.

Results and Discussion

Reliability and Validity of the Data

According to the above Table 1 reliability statistics, it can be seen that Gronbach’s Alpha was more than 0.7 (70%) for every variables of the study, it can be stated that reliability of the data is very high level in this study.

| Table 1 Reliability Statistics | |

| Cronbach's Alpha | N of Items |

| 0.918 | 32 |

According to above Table 2 Kaiser-Meyer-Olkin (KMO) value clearly indicates (0.789) that data of the study is more suitable for the structure detection. It means data of the study 78.9 percentage valid in this study. Also Bartlett's test of Sphericity shows highly significant value (0.000), finally it can be stated that validity of the data is high level in this study.

| Table 2 Factor Analysis | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.789 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 1368.160 |

| Df | 496 | |

| Sig. | 0.000 | |

Descriptive Analysis

According to the Table 3, it can be seen that internal audit reporting, accountability & transparency, true and fair view and performance audit of the internal audit division are slightly higher than agree level. However independence of internal auditor, competence of internal auditors, materiality, audit evidence and resources & facilities allocated and usage by the internal audit division are moderate level in the public sector, Northern Province of the Sri Lanka. Performance audit shows highest agree level among other factors. According to this table, materiality and independence of the internal auditors should be improved and increased which is lower level than other factors.

| Table 3 Descriptive Statistics | ||||

| Minimum | Maximum | Mean | Std. Deviation | |

| Internal Audit Reporting | 2.50 | 5.00 | 4.0617 | 0.52459 |

| Accountability & Transparency | 2.80 | 5.00 | 4.0177 | 0.54556 |

| Independence of Internal Auditor | 2.00 | 5.00 | 3.6614 | 0.73165 |

| Competence of Internal Auditors | 2.75 | 5.00 | 3.9019 | 0.61030 |

| Materiality | 2.00 | 5.00 | 3.5000 | 0.66986 |

| Audit Evidence | 2.00 | 5.00 | 3.9114 | 0.64926 |

| True and Fair View | 2.00 | 5.00 | 4.0000 | 0.75107 |

| Performance Audit | 2.75 | 5.00 | 4.0918 | 0.58449 |

| Resources & Facilities | 2.00 | 5.00 | 3.8544 | 0.71231 |

Regression Analysis

Predictors: (Constant), Accountability & Transparency, Competence of Internal Auditors, Materiality, Audit Evidence, Independence of Internal Auditor, True and Fair View, Performance Audit, Resources & Facilities Table 4.

| Table 4 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.727a | 0.528 | 0.475 | 0.38026 |

According to the model summary of the regression analysis, adjusted R square revels that independent variables of the study impact by 47.5 percent on the effectiveness of the internal audit reporting.

1. Dependent Variable: Internal Audit Reporting

2. Predictors: (Constant), Accountability & Transparency, Competence of Internal Auditors, Materiality, Audit Evidence, Independence of Internal Auditor, True and Fair View, Performance Audit, Resources & Facilities

According to Table 5, it can be seen that there is significant impact of tested factors on the effectiveness of internal audit reporting in this study Table 6. Therefore hypothesis 1 is accepted (Sig. 0.000).

| Table 5 Anova | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 11.343 | 8 | 1.418 | 9.805 | 0.000b |

| Residual | 10.122 | 70 | .145 | |||

| Total | 21.465 | 78 | ||||

| Table 6 Coefficients | |||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | |

| B | Std. Error | Beta | |||

| (Constant) | 1.365 | 0.405 | 3.373 | 0.001 | |

| AT | 0.381 | 0.106 | 0.397 | 3.582 | 0.001 |

| IAI | 0.250 | 0.069 | 0.349 | 3.602 | 0.001 |

| AC | -0.137 | 0.091 | -0.160 | -1.507 | 0.136 |

| M | -0.087 | 0.077 | -0.111 | -1.125 | 0.264 |

| AE | 0.068 | 0.089 | 0.085 | 0.772 | 0.443 |

| TF | 0.013 | 0.070 | 0.019 | 0.192 | 0.848 |

| PA | 0.023 | 0.103 | 0.026 | 0.226 | 0.822 |

| RF | 0.174 | 0.089 | 0.237 | 1.967 | 0.053 |

Coefficients table clearly shows that independence and accountability & transparency of the internal auditors are significantly impact on the effectiveness of the internal audit reporting. Therefore, sub hypotheses H1a and H1e are accepted in this study.

However, competence of the auditor, materiality, audit evidence, true & fair view, performance audit and resources & facilities allocated and used by the internal audit division are not significantly impact on the effectiveness of the internal audit reporting. Therefore, sub hypotheses H1b, H1c, H1d, H1f, H1g and H1h are rejected in this study.

Correlation Analysis

Correlation analysis reveals that, there is a significant relationship between most of the tested factors and the effectiveness of internal audit reporting in this study Table 7. Therefore, hypothesis 2 is accepted. However audit materiality has not significant relationship with effectiveness of the internal audit reporting in this study. Therefore, sub hypothesis H2c is rejected and other all the tested sub hypotheses are accepted in this study.

| Table 7 Correlations | ||||||||||

| AT | IAI | AC | M | AE | TF | PA | RF | |||

| IAR | Pearson Correlation | 0.582** | 0.559** | 0.308** | 0.153 | 0.355** | 0.378** | 0.436** | 0.507** | |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.006 | 0.179 | 0.001 | 0.001 | 0.000 | 0.000 | ||

Conclusion

According to the code of best practice on corporate governance 2017, top management has responsibility to establish adequate internal control system of the organization. As well as, internal control system is important for the high level of performance of the organization. Management has the responsibility for the development of internal control system then, it is monitored and reported by internal auditors of the organization. Most of the public sector organization have internal audit division in the Sri Lanka. According to the results of the study, it can be seen that, tested factors have significant impact on the effectiveness of internal audit reporting. Further, independence of internal auditors and accountability & transparency of internal auditors have more significant impact on effectiveness of internal audit reporting in this study. Finally, it can be concluded that, accountability & transparency of internal auditors, competence of internal auditors, materiality, audit evidence, independence of internal auditors, true and fair view of internal auditors, performance audit, resources & facilities allocation and usage have significant impact on the effectiveness of the internal audit reporting in the public sector of the Northern Province, Sri Lanka.

Implications

The effectiveness of internal audit reporting is essential for effective risk management of the organization. Today, most of the country try to improve risk management of the public sector in the world. According to the findings of the study, it can be recommended that, independence of internal auditors should be ensured to increase the effectiveness of the internal audit reporting in the public sector of the Sri Lanka. Also internal auditors ought to consider their accountability and transparency to increase the effectiveness of the internal audit reporting in the public sector of the Sri Lanka. Findings of the study clearly confirmed that, independence of the internal auditors is significantly impact on the effectiveness of internal audit reporting due to internal auditors act agents to board and audit committee of the organization. Policy makers and regulatory bodies of the public sector ought to confirm that internal auditors should not act as agents to top management and they should allow to work with adequate independence in the public sector.

Limitations of the Study

1. The followings are limitations of the study;

2. This study focused only the public sector of the Northern Province, Sri Lanka.

3. It covers four district secretary offices, office of the northern provincial council and some other provincial departments in the Northern Province, Sri Lanka.

4. Researcher was unable to collect data from district secretary office, Mannar.

5. This study tested eight factors which can impact on the effectiveness of internal audit reporting.

6. This research period is considered relatively short and data of the study collected in short time. Due to that, response rate of the study was only 56.42 percentage.

References

Alhassan, M., Erasmus, D.G., & Fred, K.A. (2018). Determinants of Internal Audit Effectiveness in State Owned Enterprises (SOEs) in Ghana. Journal of Accounting and Management, 11, 52-68.

Alzeban, A., & Gwilliam, D. (2014). Factors affecting the internal audit effectiveness: A survey of the Saudi public sector. Journal of International Accounting, Auditing and Taxation, 23(2), 74-86.

Indexed at, Google Scholar, Cross Ref

Amanuddin, S., & Divyaa, B. (2014). Factors That Determine the Effectiveness of Internal Audit Functions in the Malaysian Public Sectors. International Journal of Business, Economics and Law, 5(1), 9-17.

Chaiwong, D. (2012). Factors Affecting Efficiency In Internal Auditing Performance And Operational Outcome Of The Large Thai Listed Companies. International Journal of Arts & Sciences, 5(1), 311.

Dellai, H., & Omri, M.A.B. (2016). Factors affecting the internal audit effectiveness in Tunisian organizations. Research Journal of Finance and Accounting, 7(16), 208-211.

George, D., Theofanis, K., & Konstantinos, A. (2015). Factors associated with internal audit effectiveness: Evidence from Greece. Journal of Accounting and Taxation, 7(7), 113-122.

Indexed at, Google Scholar, Cross Ref

Kanbiro, O.D. (2019). Internal Audit Quality and Its Impact on Public Sector Organizational Performance: Evidence from Sector Bureaus of Southern Ethiopia. International Journal of Economy, Energy and Environment, 4(6), 118-131.

Indexed at, Google Scholar, Cross Ref

Mihret, D.G., & Yismaw, A.W. (2007). Internal audit effectiveness: an Ethiopian public sector case study. Managerial Auditing Journal.

Indexed at, Google Scholar, Cross Ref

Peursem, K.V., & Pumphrey, L.D. (2005). Internal Auditors and Independence: An Agency Lens on Corporate Practice. Financial Reporting, Regulation and Governance, 4(2), 1-33.

Ruth, M.M., & Tabitha, N. (2018). Factors Affecting Internal Auditor’s Performance in Public Universities in Kenya. Global journal of Economics and Business Administration, 3(11).

Indexed at, Google Scholar, Cross Ref

Sri Lanka Auditing Standard 320 Audit Materiality. (n.d.). Retrieved August 8, 2020,from:https://www.casrilanka.com/casl/images/stories/content/publications/publications/sri_lanka_auditing_standards/currently_applicable_sri_lanka_auditing_standards/slaus_20320.pdf

Tran, T.L.H. (2018). Factors Affecting the Effectiveness of Internal Audit in the Companies: Case Study in Vietnam. Proceedings of the International Conference on Business Management, Hong Kong, SAR - PRC. August 1-2, Paper ID: HM830.

Indexed at, Google Scholar, Cross Ref

Zulkifli, B., Alagan, S., & Mohd, S.I. (2014). Factors that Contribute to the Effectiveness of Internal Audit in Public Sector. IPEDR, 70(24).

Received: 16-Nov-2021, Manuscript No. AAFSJ-21-9779; Editor assigned: 18-Nov-2021, PreQC No. AAFSJ-21-9779(PQ); Reviewed: 02-Dec-2021, QC No. AAFSJ-21-9779; Revised: 18-Mar-2022, Manuscript No. AAFSJ-21-9779(R); Published: 25-Mar-2022