Research Article: 2022 Vol: 28 Issue: 4S

Factors Affecting the Application of Balanced Scorecard (BSC) to Improve the Performance of Listed Companies in Vietnam

Tran Van Tung, Ho Chi Minh City University of Technology (Hutech)

Ngo Ngoc Nguyen Thao, Ho Chi Minh City University of Technology (Hutech)

Tran Phuong Hai, Ho Chi Minh City University of Technology (Hutech)

Citation Information: Tung, T.V., Thao, N.N.N., & Hai, T.P. (2022). Factors affecting the application of Balanced Scorecard (BSC) to improve the performance of listed companies in Vietnam. Academy of Entrepreneurship Journal, 28(S4), 1-16.

Keywords

Balanced Scorecard (BSC), Performance, Listed Companies

Abstract

In this research, the authors focused on the meaning and impact of Balanced Scorecard (BSC) in the evaluation and improvement of performance of listed companies. The authors employed both qualitative and quantitative research methods to construct and evaluate the research model. Result of this research suggests that there are 7 factors affecting the application of BSC in listed companies in Vietnam; among those factors, Managers' awareness has the strongest impact, followed by Level of Competition, Business strategy, Characteristics of Management system, IT level, Staff skills, and Methods and Techniques applied. The research findings, on the other hand, demonstrate a positive relationship and the interaction between the elements that use the Balanced Scorecard approach to enhance the performance of listed companies in Vietnam.

Introduction

According to Atkinson, Kaplan, et al., (2012), listed companies are playing important roles in the development of the economies of both developing and developed countries. Aside from generating profits and value to contribute to the development of the organizations and Vietnam economy, those companies also create a myriad of job opportunities for locals. In order to maintain their growth rates, those listed companies need to make decisions that would affect their operations as well as social and economic benefits. According to Ulwick (2002), business related decision-making processes are critical, and the evaluation of organizational performance based on finance, customers, internal process, and learning & growth aspects using detailed standards and benchmarks would be necessary for the management of organizations. Balanced Scorecard is an effective tool for the establishment and evaluation of organizational performance. This tool would ensure that all aspects are considered in the decision making process, which would enable managers to make wise decisions to improve the performance of their companies.

Foundation Theories

The Definition and Role of BSC in Corporations

By definition, BSC is a system for strategic plans development, utilized by both business and nonprofits organizations alongside governments to direct business activities based on the organizations' visions and plans, improve the efficiency of internal and external communication and monitor business performance. It provides managers and official authorities with a clearer overview of the organization's operations (Kaplan & Norton, 1996).

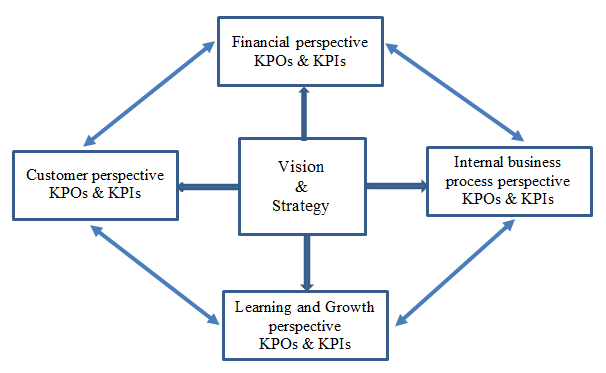

BSC can transform the organizations' visions and plan into goals and specific measurements by establishing a system to evaluate the operations of the organization based on four main aspects which are finance, customers, internal business process, research and development. So, it can be understood that BSC is a managerial tool that helps organizations establish, execute, and monitor operations to achieve organizational targets by transforming strategic plans into specific targets and action plans.

(Source: Robert & David, 1996)

BSC provides a framework that helps transforming strategic plans into performance criteria. The balance is shown between short-term and long-term targets, financial and non-financial measurements, performance ratios and efficiency ratios, and between external and internal factors. BSC adds financial measurements of efficiency in the past and measurements of factors affecting efficiency in the future. Based on the organization's vision and strategics plans, researchers have been able to create targets and mearsurements for the scorecard system. These targets and measurements evaluate the organization's efficiency based on four perspectives: Finance, customer, internal business process, learning and growth. These four perspectives, or aspects, form BSC's framework

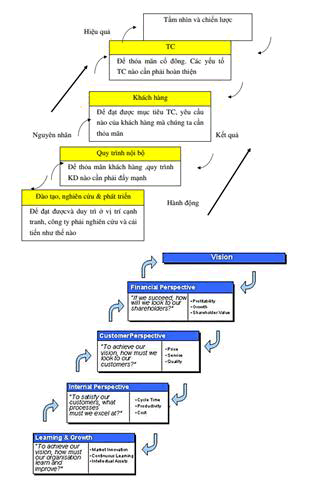

Furthermore, BSC is more than a strategic plan or activity measurement system. Many innovative companies are now currently using the scorecard system to manage their strategic plans to participate in harsh competitions (Fig 2). They have been able to utilize scorecard systm to execute vital managerial processes such as:

- Clarify and translating and vision and strategy.

- Communicating and linking strategic targets and measurements.

- Planning and Target Setting.

- Strategic Feedback and Learning.

(Source: Kaplan & Norton (1992))

Contents of a Balanced Scorecard System: Shown in 4 perspectives:

Financial perspectives: According to Kaplan & Norton (1996), BSC focuses on the financial aspect because financial measurements are valuable in the evaluation of economic results arisen from operations. Based on analysis of financial operations of a company, managers can see if the implementation and execution of the strategy could actually improve their profits or not. A common financial benchmark is profitability, which is measured by revenues, usage of working capital or added values. Other financial benchmarks include growth rate of revKaplanenue or generation of cash.

Customer perspectives: According to Kaplan & Norton (1996), managers must identify target customers and market segments as well as indicators to measure operations in those segments. This aspect often includes typical measurements for the operation's success such as: customer satisfaction, customer loyalty, customer acquisition, and market shares in target market segments. This aspect also includes several specific targets related to the values that the company brings to its customers such as: shortening order time, delivering on time, continuous product improvement or the ability to forecast market demands and developing new products on time to fulfill those demands. Besides, customer aspect can help managers establish links between customers and the company's strategy, which will create financial value in the future.

Internal business process perspectives: According to Kaplan & Norton (1996), managers must identify the organizations' core processes, which enable organizations to create value to attract or maintain customers in the target market and satisfy the shareholders' expectations. Besides, measurements in internal processes normally focus on processes that impact customer satisfaction and the organization's financial goals heavily, including: operating, relationship management, innovation, improvement and society-related processes.

Learning and Growth perspectives: According to Kaplan & Norton (1996), this aspect identifies the infrastructures that the organization must develop to enable long-term development and innovation. Furthermore, the organization's training sessions and development projects can be implemented using three primary resources: human resources, information resources and organizational resources. Besides, financial, customer and internal processes targets highlight the large gap between current human resources capacity, information, organizing ability and the requirements needed to create a significant breakthrough for the organization in the future. In order to eliminate this gap, organizations need to improve their employee's abilities, strengthen their IT systems and carry out restructuring. These targets are included in BSC's research and development aspect alongside measurements related to the employees such as the satisfaction, training and skills of employees. Additionally, the IT system's capabilities can be calculated through the availability and accuracy of customer information and internal processes information.

Meaning of BSC

According to Atkinson, et al., (2012), recent researches have suggested that BSC is not just an improved measurement system. Some organizations have been using BSC as their core management systems. Apparently, many organizations have transformed their missions and strategic plans into measurements that can emphasize the urge to establish new relationship with customers and the và s? vu?t tr?i trong m?t s? lu?ng các quy trình n?i b? r?ng l?n hon. BSC directs the whole organization towards innovations, unifies various departments within the organization, etc. Besides, BSC also helps division directors, managers, and employees realize their roles and importance in the implementations of the organization's plans. However, it is quite difficult to apply BSC since it would require lots of time and resources.

Figure 3 Relationship Between BSC's Aspects

Source: Atkinson, Kaplan et al., (2012)

BSC does not only set priorities for organizations to focus on important processes, it can also identify new processes that need to be established for organizations to achieve breakthrough targets. Additionally, BSC provides measurements - such as the shortening of order cycle and the reduction of the time to approach the market - for the evaluation of the benefits of plans to transform and restructure the organization. Because of these measurements, transformation plans are not simply cost-reduction plans any longer. Lastly, BSC combines the process of preparing strategic plans and budget plans, which are two processes that were previously separated and incompatible. With this unification process, the process of creating long-term strategic plans will be performed alongside the process of creating annual budget plans. The result of this is a list of measurements and targets that the organization must follow to achieve long-term plans.

Performance of Organizations

According to Otley (1999), the performance of the organization is shown in different aspects including: targets, strategies, performance indicators, reward systems and IT systems. Organizations' performance also helps managers maintain and improve the standards in the organization. According to Kaplan & Norton (1992), Organization Performance Structure was developed to measure the organization's overall performance. Additionally, the organization's performance could also be measured using financial and non-financial criteria. Financial criteria include total profit, market share, ROA, ROI, etc. Non-financial criteria include customer satisfaction, quality of products, service, development and training

| Table 1 Common Financial Ratios to Evaluate Listed Companies' Performance |

|

|---|---|

| Ratios | Measurements |

| Market shares | Customer rate, Revenues, Volume of sales in compared with industrial average. |

| Return - On - Assets (ROA) | ROA = Net Income (Profit after tax)/Total Assets |

| Return - On - Investment (ROI) | ROI = Investment Gain / Investment Base |

| Marginal Revenue (Chenhall, 2007) | Change in total revenue / Change in quantity sold |

| Total Profit | Total Profit = Total Revenue - Total expenses |

| Other resources | Ty le gia tang nguon luc |

| Acquired customers | - Amount of new Customers - Revenues generated from new Customers - Revenues generated from new customers divided by total revenue |

| Retained customers | - Percentage of revenue generated by current customer base over total revenue. - Loyal customer rate: % of growth rate associated with current customer base. |

| Profit generated by customers | - Quarterly changes in profits generated by customers - Ty le khach hang mang lai lo so voi khach hang mang lai lai |

Source: Kaplan & Norton, 1992

| Table 2 Common Non-Financial Ratios to Evaluate Listed Companies' Performance |

|

|---|---|

| Ratios | Benchmarks |

| Attitudes and Ethics of staffs |

|

| Customer satisfaction |

|

| Product and service quality |

|

Source: Kaplan & Norton (1992)

BSC's Role in the Improvement of Performance

According to Kaplan & Norton (1996), successful implementation of BSC would provide managers with a better overview of the organization's performance compared to the resources available. Based on such information, managers could create solutions to optimize the resources usage to improve the organization's performance. This will be shown in details below:

BSC is a measurement system: Even though financial measurements can visualize past events, they are not suitable for emphasizing the value creation process of organizations. These are intangible assets such as knowledge, information, network, etc. Those financial measurements are refered to as “lagging indicators”, which show results of a series of past actions. Furthermore, BSC supplements those "lagging indicators" with "leading indicators" that would help managers with strategic decisions that would create economic benefits in the future. However, those measurements, including both "lagging indicators" and "leading indicators", all originated from the organization's strategy. Additionally, BSC could be seen as a tool to clarify organizational strategies and targets.

BSC is a strategic management system: Initially, BSC was a system consisting of measurements used for balancing and clarifying financial indicators which can measure the efficiency of the organization and its strategy. However, as time goes on, more organizations use BSC as a tool to link short-term campaigns with the organization's strategies. To achieve this, BSC replaced many theoretical aspects with measurements and implementation of the strategy. Moreover, BSC helps overcoming the obstacle of guiding people towards the common goal by explaining the strategy in details: BSC aims to share knowledge and transform the organization's strategy into specific criteria, measurements and indicators. When using BSC as the foundation to explain the strategy, organizations create a new measurement method to guide people towards achieving the strategy.

BSC is a communication tool used for overcoming HR barriers: For the strategy to be successfully achieved, it must be implemented and understood at all levels of the organization. Furthermore, to create the opportunity for workers to connect their daily works with the organization's strategies, BSC must be implemented in every department of the organization. Additionally, all departments of the organization should also recognize their roles, positions and value-added activities through the connection between their responsibilities and the organization's targets. Moreover, BSC provides responses from staffs to BOM, which allows the constant update of the status of the strategy's implementation.

BSC provides solutions to overcome resources related barriers: Resources are critical for the development of organizations. Most of the organizations are executing their strategies without sufficient resources. So how should resources be divided and allocated? It could be seen that without BSC, most organizations are planning their strategies and budgets separately. However, with BSC, organizations can combine the two processes; aside from setting targets, benchmarks, indicators of 4 aspects, BSC also takes into account ideas and action plans to help the organizations achieve their targets.

BSC is an information exchange tool: Exchange of information happens between managers and employees. In recent years, there have been several documents related to the knowledge management strategy in organizations. The common characteristic of those strategies is how they want the employee's hidden knowledge to be exposed and shared. Employees, unlike organizations that depend on their tangible assets, rely on their knowledge. Nowadays, operations must face the challenge of systemizing and control that knowledge.

Research Methods, Models and Hypotheses

Research Data and Methods

By using non-probability sampling method, authors were able to collect information from 550 companies listed on HOSE and HNX; among 518 survey forms, only 496 forms were valid for the analysis (22 forms were invalid due to missing information or unsuitable answers for the authors' requirements). Respondents are board of directors' representatives in charge of the organization's accounting and finance. Due to several reasons and conditions, the authors couldn't collect information from more organizations. The authors employed Google documents to collect information from 10/2019 to 1/2020 in primary fields such as consumer goods industry; food and catering industry; High-tech industry; Medical indsutry, etc.

The main method of research used for this research is Structural Equation Method (SEM) with the help of 2 main softwares, AMOS – SPSS. According to Geogre Tauchen (1986), to achieve a reliable estimation for this method, the sample size must be greater than 200. With 15-44 observations for a variable, the mininum sample size needed for this research would be 280 = 35x8, or n > 50 + 8x varaibles = 50 + 8x8 = 114 (Hair et. al., 2010). By combining these rules, the mininum sample size that the authors chose was n > 280. Therefore, with 496 samples collected, the mininum sample size requirement of 280 samples has been surpassed.

Research Models and Hypotheses

Contigency Theory was developed and utilized by management accounting researchers from the 1970s to the 1980s. Contigency Theory researchs management accounting, in general, and BSC, in specific, in organizations based on the relationship between the organizations and surrounding environments. In another way, how an accouting system fits the organization depends on the organization's characteristics and the specific working environment. This means that building an efficient BSC system requires the compatibility with each organization, as well as its internal and external environment. Furthermore, Contigency theory shows how characteristics and environmental factors impact the usage of information that was provided by BSC. Gordon & Miller's research results (1976) was applied to the research, by which contigency theory will be utilized to explain the effects of factors such as: Level of competition, Business strategy, Organizational size, the organization's management system, and IT level to the application of BSC in the organization.

According to Nick & Clive (1993) Cost-benefit analysis (CBA) started in 1808 when Albert Gallatin mentioned it in an irrigation project while comparing the costs and benefits of the project. In 1936, CBA was officially mentioned in a flood control regulation in the US, in which costs and benefits must be considered before proceeding with the project. CBA then get researched and expanded on for Welfare Economics by Eckstein (1958). CBA points out that benefits gained from the supply of information must be compared against the costs of creating and supplying that information. In general, benefits of accounting information can be used by: relevant parties, investors and organizations; while the costs are beared by accounting information reporters and more generally, society. Therefore, there must be frequent inspections and balancing to make sure the costs do not exceed the benefits. The goal of management accounting is to satisfy the organization's management needs, therefore, each organizations have different requirements for their management accounting information system and different ways of using their management accounting technical tools. The theory helps explaining the factor of the managers' awareness; the performed methods and techniques; the employees' profiency as well as the IT level of the organization when using management accounting as well as BSC for the organization.

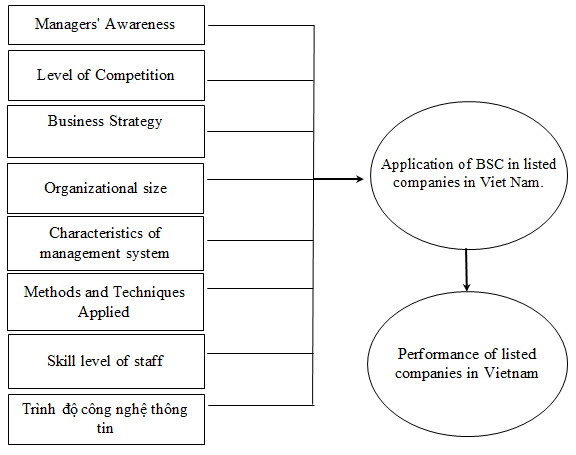

Based on past experiments and foundation theories, the authors built a research model and hypotheses as below:

To consider the influence level and importance of factors that affect BSC’s usage in listed companies in Vi?t Nam, several hypotheses were constructed:

H1: The factor of Manager's awareness has direct relationship (+) with the application of BSC to heighten performance of listed companies in Vietnam.

H2: The factor of Level of Competition has direct relationship (+) with the application of BSC to heighten performance of listed companies in Vietnam.

H3: The factor of Business strategy has direct relationship (+) with the application of BSC to heighten performance of listed companies in Vietnam.

H4: The factor of Organizational size has direct relationship (+) with the application of BSC to heighten performance of listed companies in Vietnam.

H5: The factor of Characteristics of management system has direct relationship (+) with the application of BSC to heighten performance of listed companies in Vietnam.

H6: The factor of Methods and techniques applied has direct relationship (+) with the application of BSC to heighten performance of listed companies in Vietnam.

H7: The factor of Skill level of Staff has direct relationship (+) with the application of BSC to heighten performance of listed companies in Vietnam.

H8: The factor of IT level has direct relationship (+) with the application of BSC to heighten performance of listed companies in Vietnam.

H9: The Application of BSC has direct relationship (+) with the increase of performance of listed companies in Vietnam.

Regression Analysis

The authors built a multivariable regression model to test hypotheses

Theoretically, Regression Analysis is expected to reflect the relationship between factors that affects the application of BSC to improve the performance of listed companies in Vietnam.

VD = β0 + β1NT + β2CT + β3CL + β4 QM + β5BM + β6PK + β7TD + β8CN + δ

In which:

β0, β1, β2, β3, β4, β5, β6, β7: regression functions

δ: Variance

Dependent Variable e.g: Application of BSC.

Independent variables

NT: Managers' awareness;

CT: Level of competition;

CL: Business strategy;

QM: Organizational size;

BM: Characteristics of management system;

PK: Methods and Techniques applied;

TD: Skill level of staff;

CN: IT level.

Research Results

Evaluate Scales of Measurement

By appying Cronbach's Alpha to test for reliability, it could be observed that 43/43 observed variables of 10 factors in the research model are qualified. Since minimum corrected item-total correlation of each factor is greater than 3.0 while Cronbach's Alpha is greater than 0.7, all measurements are valid and have good reliability.

Table 3 summarizes the result of analysis of reliability in the model.

| Table 3 Result of Cronbach’s Alpha Test |

|||||

|---|---|---|---|---|---|

| STT | Measurements | Amount of initial observed variables | Amount of observed variables after tested | Cronbach’s Alpha | Minimum Corrected Item - Total correlation |

| 1 | Managers' awareness (NT) | 5 | 5 | 0.908 | 0.677 |

| 2 | Competitive level (CT) | 5 | 5 | 0.878 | 0.665 |

| 3 | Business strategy (CL) | 6 | 6 | 0.881 | 0.644 |

| 4 | Organizational Size (QM) | 3 | 3 | 0.805 | 0.630 |

| 5 | Charateristics of management system (BM) | 3 | 3 | 0.813 | 0.641 |

| 6 | Methods and Techniques applied (PK) | 4 | 4 | 0.899 | 0.899 |

| 7 | Staff Skill (TD) | 5 | 5 | 0.865 | 0.612 |

| 8 | IT level (CN) | 4 | 4 | 0.815 | 0.613 |

| 9 | Application of BSC in listed companies in Vietnam (VD) | 4 | 4 | 0.830 | 0.611 |

| 10 | Perfomance of listed companies in Vietnam (TQ) | 4 | 4 | 0.820 | 0.610 |

Source: Authors constructed from analysis conducted using SPSS

Exploratory Factor Analysis

The authors carried out Exploratory Factor Analysis (EFA) using Principal Component Analysis as the Extraction method with Varimax Rotation and end points with Eigenvalue >1. Results of EFA showed that KMO = 0.906; meanwhile, Barlett's test ended up with Sig. =0.000 (<0.05). Therefore, EFA is considered to be appropriate.

| Table 4 Kmo and Bartlett's Test |

||

|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.906 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 12552.390 |

| Df | 990 | |

| Sig. | 0.000 | |

Source: Authors constructed from analysis conducted using SPSS

At Eigenvalue =1.416>1 extracted from 10 factors in 43 observations with total average variance extracted of 69.452% (>50%) and no new factor was discovered. Therefore, after EFA, those 43 observed variables were qualified and no factor was eliminated.

| Table 5 Average Variance Extracted - Total Variance Explained |

||||||||

|---|---|---|---|---|---|---|---|---|

| Factor | Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadingsa | |||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | ||

| 1 | 11.365 | 25.255 | 25.255 | 10.988 | 24.418 | 24.418 | 7.117 | |

| 2 | 3.716 | 8.258 | 33.513 | 3.325 | 7.388 | 31.806 | 5.462 | |

| 3 | 2.636 | 5.859 | 39.372 | 2.253 | 5.008 | 36.814 | 5.899 | |

| 4 | 2.548 | 5.662 | 45.034 | 2.172 | 4.827 | 41.640 | 4.853 | |

| 5 | 2.364 | 5.252 | 50.286 | 1.973 | 4.385 | 46.025 | 5.052 | |

| 6 | 2.174 | 4.832 | 55.118 | 1.834 | 4.075 | 50.100 | 6.308 | |

| 7 | 1.925 | 4.277 | 59.395 | 1.527 | 3.394 | 53.494 | 7.609 | |

| 8 | 1.599 | 3.553 | 62.948 | 1.232 | 2.739 | 56.233 | 3.450 | |

| 9 | 1.511 | 3.358 | 66.306 | 1.139 | 2.531 | 58.764 | 3.647 | |

| 10 | 1.416 | 3.147 | 69.452 | 1.002 | 2.226 | 60.990 | 3.863 | |

| 11 | 0.742 | 1.648 | 71.101 | |||||

Source: Authors constructed from analysis conducted using SPSS

By applying EFA, the authors analyzed each variable to test for multidimensionality and evaluate its measurements.

| Table 6 Results of EFA |

|||||

|---|---|---|---|---|---|

| STT | Measurement | KMO | Eigenvalues | Average Variance Extracted | Notes |

| 1 | Managers' awareness (NT) | 0.896 | 3.668 | 66.931 | Accepted |

| 2 | Competitive level (CT) | 0.880 | 3.365 | 59.219 | Accepted |

| 3 | Business strategy (CL) | 0.905 | 3.803 | 56.122 | Accepted |

| 4 | Organizational size (QM) | 0.702 | 2.166 | 58.804 | Accepted |

| 5 | Characteristics of management system (BM) | 0.713 | 2.194 | 59.869 | Accepted |

| 6 | Methods and techniques applied (PK) | 0.833 | 3.069 | 69.292 | Accepted |

| 7 | Staff skill (TD) | 0.859 | 3.276 | 57.264 | Accepted |

| 8 | IT level (CN) | 0.798 | 2.573 | 52.486 | Accepted |

| 9 | Application of BSC in listed companies in Vietnam (VD) | 0.800 | 2.652 | 55.309 | Accepted |

| 10 | Performance of listed companies in Vietnam (TQ) | 0.801 | 2.605 | 53.584 | Accepted |

Source: Authors constructed from analysis conducted using SPSS)

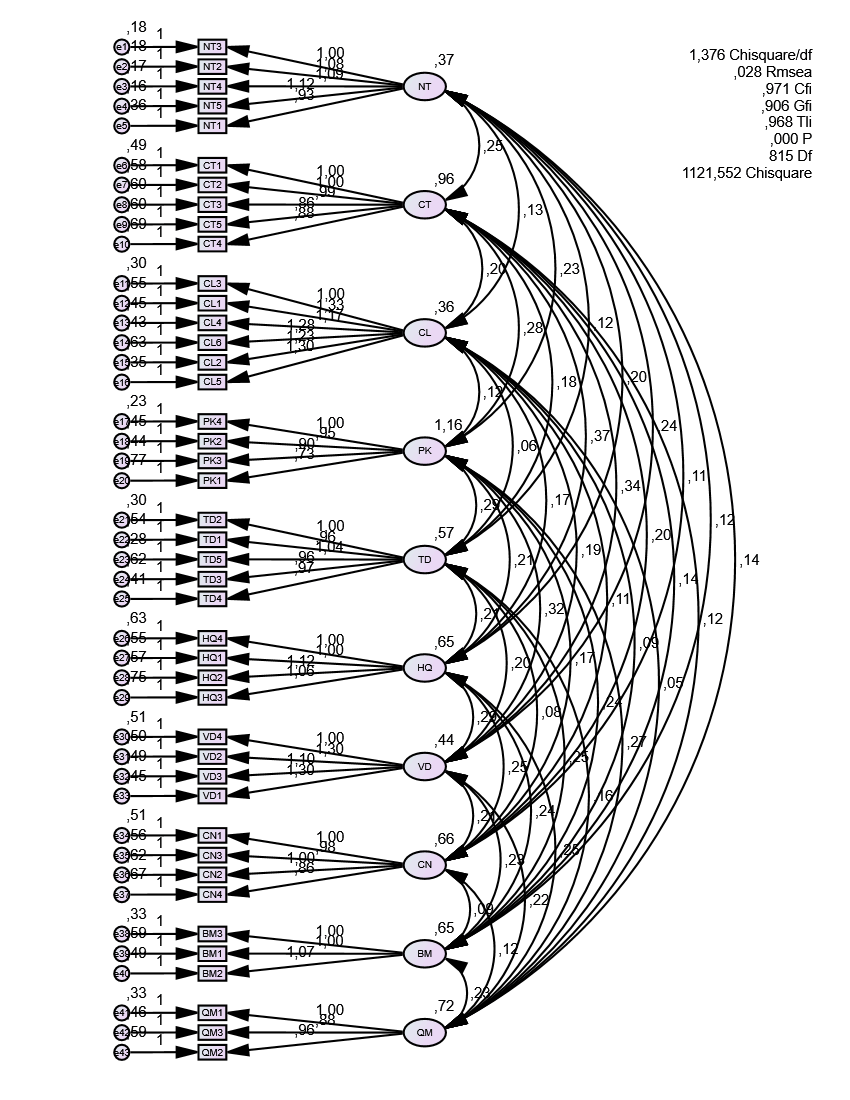

Confirmatory Factor Analysis (CFA)

| Table 7 Results of CFA in the form of Standardized Regression Weights |

|||

|---|---|---|---|

| Estimate | |||

| NT3 | <--- | NT | 00.817 |

| NT2 | <--- | NT | 00.839 |

| NT4 | <--- | NT | 00.852 |

| NT5 | <--- | NT | 00.863 |

| NT1 | <--- | NT | 00.684 |

| CT1 | <--- | CT | 00.813 |

| CT2 | <--- | CT | 00.791 |

| CT3 | <--- | CT | 00.781 |

| CT5 | <--- | CT | 00.739 |

| CT4 | <--- | CT | 00.721 |

| CL3 | <--- | CL | 00.738 |

| CL1 | <--- | CL | 00.733 |

| CL4 | <--- | CL | 00.724 |

| CL6 | <--- | CL | 00.762 |

| CL2 | <--- | CL | 00.683 |

| CL5 | <--- | CL | 00.799 |

| PK4 | <--- | PK | 00.913 |

| PK2 | <--- | PK | 00.837 |

| PK3 | <--- | PK | 00.827 |

| PK1 | <--- | PK | 00.670 |

| TD2 | <--- | TD | 00.811 |

| TD1 | <--- | TD | 00.703 |

| TD5 | <--- | TD | 00.831 |

| TD3 | <--- | TD | 00.678 |

| TD4 | <--- | TD | 00.752 |

| HQ4 | <--- | HQ | 00.713 |

| HQ1 | <--- | HQ | 00.739 |

| HQ2 | <--- | HQ | 00.768 |

| HQ3 | <--- | HQ | 00.703 |

| VD4 | <--- | VD | 00.680 |

| VD2 | <--- | VD | 0.775 |

| VD3 | <--- | VD | 0.724 |

| VD1 | <--- | VD | 0.790 |

| CN1 | <--- | CN | 0.750 |

| CN3 | <--- | CN | 0.727 |

| CN2 | <--- | CN | 0.715 |

| CN4 | <--- | CN | 0.648 |

| BM3 | <--- | BM | 0.816 |

| BM1 | <--- | BM | 0.724 |

| BM2 | <--- | BM | 0.778 |

| QM1 | <--- | QM | 0.830 |

| QM3 | <--- | QM | 0.739 |

| QM2 | <--- | QM | 0.728 |

Source: Authors constructed from analysis conducted using SPSS

As it can be seen in Table 4.5, all Standardized Regression Weights are greater than 0.5, which means that all variables have convergent validity and P-value has statistical meaning.

Result shows that the research model is appropriate with data, since Chi-squared = 1121.552; Degree of Independence =815; CMIN/df =1.376 <2; P value =0.000. Other measurements also meet the necessary requirements: CFI = 0.971 > 0.9; GFI = 0.906 >0.9; TLI =0.968>0.9; RMSEA = 0.028 <0.05. All weights of variables are greater than 0.5, and P value = 0.000 so there is statistical meaning.

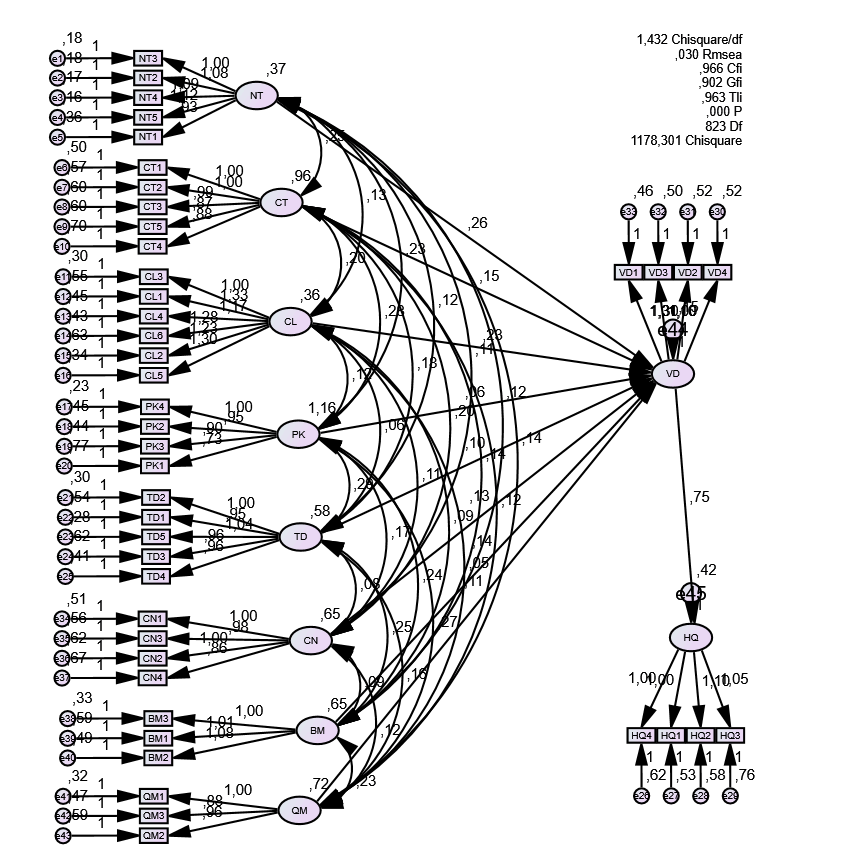

Testing the Theoretical and Hypotheses Structure using Structural Equation Modeling

Testing Theoretical Structure

Result shows that the research model is appropriate with data, since Chi-squared = 1178.301; Degree of Independence = 823; CMIN/df =1.432 <2; P value =0.000. Other measurements also meet the necessary requirements: TLI =0.963; CFI =0.966; GFI =0.902 > 0.9; RMSEA = 0.030 <0.05. All weights of variables are greater than 0.5, and P value = 0.000 so there is statistical meaning. This suggests that the research model is appropriate with data. Result also showed that all variables had direct positive impact on the application of BSC to improve the performance of listed companies in Vietnam.

As can be seen in the table, all hypotheses in the research model were confirmed by SEM. Estimations of all weighted values were positive and had statistical meaning, which suggested that all factors in the research model, including Managers' awareness, Level of Competition, Business strategy, Methods and Techniques applied, Staff skills, IT level, Characteristics of Management system, and Organizational size had direct impact on the application of BSC to improve the performance of listed companies in Vietnam.

Bootstrap Test

Bootstrap test is used to test the variables that were measured using Maximum Likelihood)

| Table 8 Result of Bootstrap Test With N = 1000 |

||||||||

|---|---|---|---|---|---|---|---|---|

| Parameter | SE | SE-SE | Mean | Bias | SE-Bias | |C.R| | ||

| Application of BSC in listed companies in Vietnam | <--- | Managers' awareness | 0.042 | 0.001 | 0.238 | -0.001 | 0.001 | 1 |

| <--- | Level of Competition | 0.043 | 0.001 | 0.228 | 0.001 | 0.001 | 1 | |

| <--- | Business strategy | 0.040 | 0.001 | 0.213 | 0.001 | 0.001 | 1 | |

| <--- | Methods and Techniques applied | 0.043 | 0.001 | 0.105 | 0.002 | 0.001 | 2 | |

| <--- | Staff skills | 0.044 | 0.001 | 0.108 | -0.002 | 0.001 | 2 | |

| <--- | IT level | 0.042 | 0.001 | 0.159 | ||||

References

Atkinson, A.A., Kaplan, R.S., Matsumura, E.M., & Young, S.M. (2012). Management Accounting: Information for Decision-Making and Strategy Execution, 6th ed. Hoboken, NJ: John Wiley & Sons.

Crossref, GoogleScholar, Indexed at

Aslam, M.S., Xue, P.H., Bashir, S., Alfakhri, Y., Nurunnabi, M. (2021). Assessment of rice and wheat production efficiency based on data envelopment analysis. Environmental Science and Pollution Research, 28.

Crossref, GoogleScholar, Indexed at

AW Ulwick (2002), Turn Customer Input into Innovatio, Harvard Business Review, pages 91-97.

Eckstein O. (1958). Water resource development: The Economics of Project Evaluation, Cambridge, MA, Harvard University Press.

Crossref, GoogleScholar, Indexed at

George, T. (1986). Statistical properties of generalized method-of-moments estimators of structural parameters obtained from financial market data. Journal of Business & Economic Statistics, 4.

Crossref, GoogleScholar, Indexed at

Gordon, L.A., & Miller, D. (1976). A contingency framework for the design of accounting informations systems. Accounting, Organizations and Society, 1, 59-69.

Crossref, GoogleScholar, Indexed at

Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2010). Multivariate Data Analysis. New Jersey: Pearson Academic.

Kaplan, R., & Norton, D. (1992). The balanced scorecard – measures that drive performance. Harvard Business Review, 71-79.

Kaplan, R.S., & Norton, D.P. (1996). The balanced scorecard: Translating strategy into action Boston: Harvard Business School Press (Summary by Chris Hourigan Master of Accountancy Program University of South Florida, Fall 2002).

Shair, F., Shaorong, S., Kamran, H.W., Hussain, M.S., & Nawar, M.A. (2021). Assessing the efficiency and total factor productivity growth of the banking industry: do environmental concerns matters? Environmental Science and Pollution Research, 28(16), 20822–20838.

Crossref, GoogleScholar, Indexed at

Hanley, N., & Spash, C.L. (1993). Cost – Benefits analysis and the environment, Edward Elgar Northampton, MA USA.

Received: 05-Jan-2022, Manuscript No. AEJ-22-7255; Editor assigned: 08-Jan-2022, PreQC No. AEJ-22-7255 (PQ); Reviewed: 21-Nov-2021, QC No. AEJ-22-7255; Revised: 28-Jan-2022, Manuscript No. AEJ-22-7255 (R); Published: 05-Feb-2022