Research Article: 2018 Vol: 22 Issue: 6

Factors Affecting the Corporate Performance: Panel Data Analysis for Listed Firms in Jordan

Ali Matar, Jadara University, Irbid

Mahmoud Al-Rdaydeh, Ibn Rushd College for Management Sciences, Saudi Arabia

Fadi Al-Shannag, Jadara University, Irbid

Mohammad Odeh, Jadara University, Irbid

Abstract

This paper is dedicated to investigating the impact posed by macroeconomic factors and firm-specific factors towards corporate performance. Such a review have been made using a sample of Jordanian industrial and services firms during the duration between 2007 and 2016. The macroeconomic factors have been demonstrated using Gross Domestic Product (GDP), Inflation rate (INF) and Interest Rate (IR) respectively, whereas firm-specific factors have consisted of firm size, financial leverage, investment, liquidity and sales growth. Therefore, the resulting organisational performance can be evaluated via Return on Asset (ROA) and Market to Book Value (MBV). In reviewing the degree of relationship between the aforementioned factors towards corporate performance, panel data regression has been utilised. The subsequent outcomes have concluded that GDP and INF respectively are impactful towards corporate performance, whereas IR poses less effect. In contrast, only the accounting based measure ROA has been influenced by firm-specific factors. Hence, these findings have solidified the present knowledge regarding factors affecting the organisational performance of listed Jordanian firms. A strong grasp of such information will allow the implementation of strategies towards accomplishing and underpinning the economic growth.

Keywords

Corporate Performance, Panel Data Analysis, Economic Factors, ROA, MBV, Jordan

Introduction

The last 30 years have displayed notable economic reformation in Jordan throughout concentrated efforts to attain global financial liberty and integration. Such changes has been attributed towards financial steps undertaken, such as privatization of state-owned firms, the establishment of trading sector, and trading tendencies emphasizing foreign investments and career opportunities. Furthermore, strategic improvement of the structure and legal factors collectively has allowed more opportunities in business investments and prospects in various fields. Such phenomenon have been reflected in the burgeoning of firm numbers in Amman Stock Exchange; it has recorded a whopping number of 236 firms in 2015 compared to a meagre 66 in 1978. This has subsequently contributed to a 7.1% increase in the average growth rate of the GDP in 2016 (CBJ, 2016; Matar, 2016; Al-Rdaydeh et al., 2017). Therefore, it can be sufficiently deduce that the Jordanian economic progress can be fundamentally credited towards the financial reformation that has taken place. Such advancement has successfully triggered economic liberalisation in developing countries searching for prospective achievements. Nevertheless, the inevitable outcomes of organisational successes and failures alike in challenging and developing throughout time have subsequently emerged as a pertinent issue in financial management and organisational studies. Several studies have empirically undertaken the challenge of studying the determinants of firm performance. Nonetheless, there is still considerable debate among these previous studies regarding factors that affecting financial performance for the firms resulting in various outcomes (Liargovas & Skandalis, 2008; Omondi, 2013). For example, studies conducted by Morck et al. (1988) and McConnell and Servaes (1990) in particular have looked into the nonlinear effect of managerial ownership on firm performance, underlining the impacts of activity sectors in the relationship. Meanwhile, Marius et al. (2014) have substantiated their support for the influential effect of factors that elucidate state economy towards firm performance. A single factor cannot reflect financial performance of firms and therefore the use of several factors allows a better evaluation of the financial profile of firms. So, this paper is also aiming towards supplementing the above works by distinguishing the main factors expounding on Jordanian firm performance. Therefore, this particular work has investigated the macroeconomic factors and firm-specific factors that may pose solid contributory effects towards firm performance. Furthermore, current paper has adopted panel data analysis for a sample of a non-financial sector consisting of service and industrial to allow a look into the determinants of firm performance. Unlike, the majority previous study was conducted in this area focused on manufacturing firms and focused on small to medium?sized firms (Sousa et al., 2008). Moreover, an in-depth understanding of the knowledge may allow policymakers and economic associates alike to ensure strategic execution of actions towards attaining and sustaining growth. In this paper, the content has been organised into five sections accordingly. Section 2 has consisted of literature review regarding the determinants of firm performance, while the subsequent Section 3 has elucidated on the empirical validations obtained. Next, Section 4 is exclusively dedicated to result presentation. Section 5 presented the conclusion, whereas the final section has outlined the policy implications, limitations, and recommendations.

Literature Review

Many established works on financial performance can be found, with notable development according to the perspectives of market characteristics and firm-specific resources (Grinstein, 2008; Day, 2011; Alper & Anbar, 2011; Mwangi & Murigu, 2014; Samhan & Al- Khatib, 2015; Menicucci & Paolucci, 2016; Ozgur & Gorus, 2016; Mafumbate et al., 2017; Mehta & Bhavani, 2017; Matar & Eneizan, 2017). Mwangi and Murigu (2014) in particular have investigated the determinants of firm performance by measuring the ROA of insurance firms listed on the Kenyan stock exchange between 2009 and 2012. They have discovered a significant positive impact of equity capital, leverage, and management competence index on ROA, whereas it is negatively affected by firm size and ownership structure. In contrast, Dursan et al. (2013) have published their work that has also reviewed the determinants of firm performance, which have been measured by ROA and Return on Equity (ROE). A statistically significant effect of ratios measuring profitability, debt, and growth opportunities have been discovered from this work by utilising the decision tree analysis methodology. Meanwhile, Alfredo Koltar et al. (2013) have concentrated their efforts on factors elucidating firm performance via measurement of the role of ownership structure, firm size, firm age, and tangible assets. Additionally, the determinants of performance variation have been reviewed by Jeremy and Peter (2008), resulting in the emphasis on the influence of tangibility and intangibility of assets, as well as other variables correlated with activity sectors. These two researchers have utilised a sample consisting of 285 Australian firms, which has been divided into industrial firms and service firms accordingly. A statistically significant effect of resources on firm performance has been observed for the service sector, whereas the sector has also benefited positively and significantly in the context of firm performance.

Furthermore, Issah and Antwi (2017) have looked into the role of macroeconomic factors towards organisational performance in the UK. Their resulting observation has suggested for the implementation of such factors when predicting firm performances. Similarly, Ozgur and Gorus (2016) have also explored the influence of bank-specific and macroeconomic factors on Turkish deposit bank profitability. Their outcomes have indicated that equity over total assets, nonperforming loans to total cash loans, net interest revenues to average total assets, and central bank policy interest rate respectively are significantly influential towards ROA. In contrast, noninterest income over total assets, market share of deposit banks in the banking sector, operational expenses to average total assets, and exchange rate have posed minimal statistical significance. Besides, the empirical outcomes obtained by Mehta and Bhavani (2017) have outlined high capital adequacy ratio and improving asset quality as notable variables capable of influencing bank profitability across all profit measurements. Additionally, a study by Chavali and Rosario (2018) on the capital structure of 23 Indian non-banking finance firms and its impact towards their profitability from 2006 until 2016 has displayed remarkable findings. Long-term debt to total assets, debt equity ratio, and debt to total assets alike have shown positive outcomes towards ROA and ROE. Meanwhile, debt equity and debt to total assets have also substantiated a positive relationship with return on capital employed, whereas they have shown a negative relationship with long-term debt to total assets.

Hence, the works above have spurred the current study in proposing suitable hypotheses that are to be investigated in this research accordingly.

H1: There is a relationship between firm specific factors and return on assets of Jordanian firms.

H2: There is a relationship between macroeconomic factors and return on assets of Jordanian firms.

H3: There is a relationship between firm specific factors and market to book value of Jordanian firms.

H4: There is a relationship between macroeconomic factors and market to book value of Jordanian firms.

Research Methodology

Research Design

In this particular work, the investigation is concentrated on the correlation between bank financing and firm growth in Jordan, focusing on companies listed on the Amman Stock Exchange (ASE). This is due to its position as one of the biggest Middle Eastern stock exchanges. It should be noted that Law No. 12 in 1964 was the first Company Law in Jordan, with the pioneering implementation of the first Commercial Law being upheld in 1966. Jordan’s central role in the Middle Eastern economy can also be attributed to its strategic and important geographical location with the region, as well as its position as an economic channel to markets housing more than one billion customers. However, various issues and obstacles, yielding unfavourable performance in the past few years despite their role as an emerging economy (Alabdullah et al., 2014; Al-Rdaydeh et al., 2018), have negatively impacted the Jordanian nonfinancial sector. Thus, this study has opted for a sample of a non-financial sector consisting of service and industrial division both, specifically of Jordanian firms that have been listed between 2007 and 2016. The data utilised in the study has been sourced from ASE data stream and subsequently analysed using panel data regression to allow a look into the determinants of firm performance. The sample has been inclusive of firms that have observed ground rules of ensuring the availability of their complete data during the specified duration. The omission of financial institutions and firms yielding incomplete data has resulted in a final sample made up of 116 firms. All included firms in the study sample are local firms, their percentage represents 51.7% from the 224 total listed firms in Amman stock exchange in 2016.

Data Analysis Technique and Empirical Model

In this particular work, corporate performance as the dependent variable has been measured using the two indicators of ROA and MBV. In contrast, there are eight independent variables, which are inclusive of macroeconomic factors and firm-specific factors alike. Before showing the measurements of these factors, this study presents a brief definition for each variable. The first macroeconomic variable used in this study is Economic growth which is measured by Gross Domestic Product (GDP). GDP is the monetary value of all the finished goods and services produced within a country's borders in a specific time period. The second macroeconomic variable is Inflation, which is a quantitative measure of the rate at which the average price level of a basket of selected goods and services in an economy increases over a period of time. The last macroeconomic variable is Interest rate, which is the amount charged, expressed as a percentage of principal, by a lender to a borrower for the use of assets. Interest rates are typically noted on an annual basis, known as the Annual Percentage Rate (APR).

For the firm-specific variables, the first variable is Leverage, which is defined as the ratio of total liabilities to total assets. It is the residual claim of equity holders. The second variable is Liquidity, which refers to the extent to which liabilities being mature in the next one year can be repaid from quick assets of the firm. The third variable is Size of firm, in an industry there are firms of varying sizes. The costs of production in these firms of different sizes vary. Economists are concerned with the best size of a business unit, that is, a firm in which the average cost of production per unit is the lowest. The fourth variable is firm investment; an investment is an asset or item acquired with the goal of generating income or appreciation. In an economic sense, an investment is the purchase of goods that are not consumed today but are used in the future to create wealth. In finance, an investment is a monetary asset purchased with the idea that the asset will provide income in the future or will later be sold at a higher price for a profit. The last variable is Sales growth, which can be defined as the amount by which the average sales volume of a company's products or services has grown, typically from year to year. Table 1 below has outlined each of the study variables and their respective measurement.

| Table 1 The Study’s Variables And Measurements |

|||

| Variables | Measures | Notation | |

| Dependent Variables | Return on Assets | Net Profit/Total Assets | ROA |

| Market to book value | Market Capitalization/Book Value of Assets | MBV | |

| Independents Variables | Firm-Specific Factors | ||

| Size | Natural Logarithm of Total Assets | SIZE | |

| Financial Leverage | Total Liabilities/Total Assets | LEV | |

| Investment | (Total fixed assets (i,t)-Total fixed assets (i,t-1))/Total fixed assets (i,t-1) | INV | |

| Liquidity | Current Ratio | CR | |

| Sales Growth | Logarithm differences of firm’s sales | SG | |

| Macroeconomic Factors | |||

| Economic Growth | Gross Domestic Product of Jordan | GDP | |

| Inflation | Consumer Price Index (CPI) | INF | |

| Interest Rate | Interest Rate on Loans | IR | |

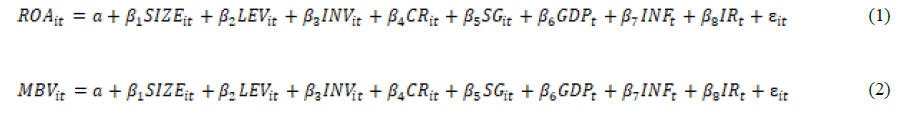

The relationship between these variables has been tested using panel data analysis. The resulting models have included mathematical explanations considered in this work to attain the research objective.

Where, "i" is a subscript for each firm and "t" for each year.

Results And Discussion

Descriptive Statistics

Table 2 below has displayed the descriptive statistics utilized in this study, consisting of means, minimum and maximum, and standard deviations of variables. The two indicators of ROA and MBV have been highlighted to measure the dependent variable of firm performance. The following Table 3 has shown that the ROA variable has an average of approximately 2.4% with a variation of -18% to 22%, whereas MBV has a lower average of approximately 1.4% and a maximum of 8.6%.

| Table 2 Descriptive Statistics |

||||||||||

| ROA | MBV | SIZE | LEV | INV | CR | SG | GDP | INF | IR | |

| Mean | 2.420 | 1.412 | 7.352 | 0.422 | 0.190 | 2.328 | 0.003 | 0.037 | 0.037 | 0.091 |

| Std. Dev. | 4.959 | 1.155 | 0.635 | 1.317 | 1.639 | 2.740 | 0.451 | 0.022 | 0.041 | 0.004 |

| Minimum | -18.448 | -6.457 | 5.307 | 0.002 | -0.999 | 0.001 | -2.582 | 0.02 | -0.009 | 0.083 |

| Maximum | 22.561 | 8.654 | 9.254 | 31.356 | 27.884 | 29.707 | 9.260 | 0.085 | 0.139 | 0.095 |

| Observation | 1149 | 1148 | 1149 | 1149 | 1149 | 1149 | 1095 | 1160 | 1160 | 1160 |

| Table 3 Correlation Between Variables |

||||||||||

| ROA | MBV | SIZE | LEV | INV | CR | SG | GDP | INF | IR | |

| ROA | 1 | |||||||||

| MBV | 0.104** | 1 | ||||||||

| SIZE | 0.223** | 0.086** | 1 | |||||||

| LEV | -0.045 | -0.023 | -0.099** | 1 | ||||||

| INV | -0.002 | 0.007 | 0.003 | -0.015 | 1 | |||||

| CR | 0.138** | 0.036 | -0.143** | -0.130** | -0.015 | 1 | ||||

| SG | 0.114** | 0.068** | 0.141** | 0.022 | 0.093** | -0.015 | 1 | |||

| GDP | 0.126** | 0.118** | -0.002 | -0.044 | 0.089** | 0.059** | 0.064** | 1 | ||

| INF | 0.070** | 0.038 | 0.005 | -0.051* | 0.014 | 0.075** | 0.079** | 0.387** | 1 | |

| IR | 0.084** | 0.011 | 0.007 | -0.071** | 0.059** | 0.024 | 0.034 | 0.284** | 0.435** | 1 |

| Note: Level of significance at *p<0.10; **p< 0.05. | ||||||||||

In this work, firm-specific factors and macroeconomic factors both have been investigated with correlation with corporate performance. Five out of the eight factors are firmspecific factors, which will be expanded on accordingly. The first factor is firm size (SIZE), which has been measured by taking the natural logarithm of total assets, yielding a mean ratio of approximately 7.35 with a variation of (5.3)-(8.6). Then, the second variable is financial leverage (LEV), which has an average of 42% and variation from 0.2-31.30%. Such percentage is indicative of organisational leverage by some firms at a specific time point, comprising of 31.30% of their total assets. This is also synonymous with their high dependence on external financing availability. Next, the third factor is Investment (INV), which has a mean ratio of 19% and a maximum of 27.88%. Subsequently, Current Ratio (CR) that is representative of a firm’s liquidity level has displayed an average of 19%, whereas the fifth firm-specific factor of Sales Growth (SG) has averaged at 0.3% and with a maximum of 9.26%. In contrast, the remaining three factors are made up of macroeconomic factors, which are GDP, Inflation (INF) and Interest Rate (IR) respectively. GDP has displayed an average of 3.7% and variations from 2-8.5%, whereas INF has resulted in an average of 3.7% with a maximum of 13.9%. Finally, the third factor, IR, has yielded a mean ratio of 9.1% and varied from 8.3-9.5%.

Results And Discussion

In this work, a regression model has been utilised as per the outcomes yielded according to the Hausman test. The results have been substantiated and determined to be robust by the implementation of several diagnostic tests, such as autocorrelation, multicollinearity, heteroscedasticity, and panel unit root tests. These tests have verified and ensured that the regression model is reliable, as well as solving econometric-related issues. Subsequently, the resulting data has been proven to be free from any multicollinearity or stationary issues. However, some problems pertaining to cross-sectional dependence, heteroscedasticity and autocorrelation have been identified, and have been solved by implementing the technique of fixed and random effects robust standard errors.

In Table 4, the outcomes of regression testing for H1 and H2 have been displayed, which are specifically pertaining to the analysed impact of firm-specific and macroeconomic factors on ROA. The model has deemed a significant F-Statistic suitability as acceptable, whereby the independent variable is capable of explaining 26% of variation in the regression model. Furthermore, the outcome for R squared has displayed consistency when compared to the findings presented in previous works, positioning the set of factors as the determinants of firm performance. Therefore, the variables investigated in this particular study are regarded as integral components of these factors.

| Table 4 The Panel Analysis Of Model (1) |

|||

| Independent Variables | Dependent variable: ROA-Regression with robust standard errors | ||

| Beta | Std. Err. | VIF | |

| SIZE | 3.2720*** | 0.9150 | 1.06 |

| LEV | 0.1531** | 0.0666 | 1.04 |

| INV | 0.0360 | 0.0616 | 1.02 |

| CR | 0.1851* | 0.1115 | 1.05 |

| SG | 0.8884* | 0.4605 | 1.04 |

| GDP | 29.4032*** | 9.1347 | 2.00 |

| INF | -8.0581* | 4.1419 | 2.42 |

| IR | 88.6003** | 39.1169 | 1.41 |

| Constant | -31.0828 | 7.6396 | |

| R squared | 0.26 | ||

| F-Statistic | 0.00 | ||

| Number of observation | 1095 | ||

| Note: Level of significance at *p<0.10; **p<0.05; p***<0.01. | |||

Table 5 below has displayed the regression test results for H3 and H4, which are specifically tailored to analyse the impact of firm-specific and macroeconomic factors on MBV. The model has deemed a significant F-Statistic suitability as acceptable, whereby the independent variables are capable of explaining only 14% of variation on the regression model. Nevertheless, empirical evidence has substantiated the lesser importance of firm-specific factors when compared to macroeconomic factors to explain firm performance in ROA and MBV both.

GDP, inflation, and annual interest rate are the three macroeconomic factors incorporated in this study, and the aforementioned lesser importance may be attributed to issues affecting performance specifically for the past few years (Alabdullah et al., 2014). Inflation, in particular, has been correlated negatively to firm performance, whereas GDP contrasted by influencing firm performance positively. Therefore, most of the theoretical prediction is consistent with the findings obtained: inflation impedes firm performance. Meanwhile, GDP poses a positive influence towards both indicators of firm performance, specifically ROA and MBV. GDP is commonly known as a pertinent indicator for any economic element due to it being a definitive representation of the entire economic landscape. Therefore a GDP that poses a good and stable position is helpful in attaining excellent firm performance. However, the unpredicted outcome obtained between interest rate and ROA has served as evidence of the positive correlation between interest rate to ROA, despite the variable being separate from MBV. This particular result may be due to the utilisation of annual interest rate and is indicative of its stability and its advantage in attaining a good performance.

In the context of firm-specific factors, firm size has been found to be positively correlated to ROA with a 99% confidence level, despite it is not significantly related to MBV. Such outcome allows the conclusion that firm size can improve with firm profitability, indicating bigger profits can be reaped by bigger firms. In contrast, it cannot be correlated with MBV, which is a notable observation as firm size is typically of higher correlation with the fundamental and core values compared to their market value. Therefore, such finding may indicate that sizable firms are capable of taking advantage of their size to negotiate their input values and subsequently reducing their average cost. This will yield improved profitability for the firm. Additionally, this may also suggest that these firms will be better prepared towards implementing new macroeconomic environments that positively influence their profitability. However, this particular outcome is a direct contrast with the Schumpeterian view of the highly intricate relationship between size and profits.

The second firm-specific factor financial leverage (LEV) has displayed empirical evidence that positively linked the variable to the fundamental firm value ROA, but without any correlation to the market value of firm MBV. Despite the positive influence of profitability, the market value of firm is not indicative of the level of corporate leverage. The measurement of liquidity via Current Ratio (CR) has been found to be pertinent with firm profitability ROA, but without any correlation to market value MBV. Therefore, it can be deduced that firm profitability is contingent upon the debt maturity or firm liquidity. In contrast, short-term asset deflated by short-term debt is typically used to measure solvability and has been found to be irrelevant towards firm performance. Additionally, the importance of firm investment towards firm performance has also been emphasised in this work, with the findings indicating that this particular variable poses no impact towards both ROA and MBV. Finally, the third and final firm-specific factor Sales Growth (SG) has yielded findings as per researcher expectation, whereby it is found to be positively linked to firm profitability and market value. Therefore, a firm that is capable of improving its sales can achieve higher profits, allowing bigger funds for further firm expansion. This will inevitably become a reflection of their potential and reputation in the landscape.

Conclusion

Based on the findings obtained in this study, two primary outcomes have been elicited. Firstly, macroeconomic factors have been found to pose higher relevance when describing firm performance. Secondly, the fundamental and core firm values are typically more turbulent compared to their market value. Profitability (ROA) has been found to be pertinent in appraising the fundamental value of firms, while market to book value (MBV) is a clear indication of their market value or market perception. Similar to other developing countries, the Jordanian capital market is comparatively turbulent and may result in a fallacious evaluation of firm performance.

Furthermore, firm size has been deemed of higher importance with the fundamental firm value as compared to market value. This is suggestive of investors of the capital market to be less concerned with the firm size during evaluations. Similar outcomes have been obtained with leverage, which has been found to be positively correlated with fundamental firm value, but without a link to market firm value MBV. Liquidity (CR) has also yielded the same outcomes, whereby it has been found to be correlated with firm profitability ROA, but without a link to market firm value MBV. It may be deduced that firm profitability is gauged according to debt maturity or firm liquidity. Finally, solvability, as measured by short-term asset deflated by shortterm debt, has been found to be irrelevant towards firm performance.

Policy Implications, Limitations, And Recommendations

The findings achieved from this study will prove to be useful for policymakers and associates in the economic industry and services towards grasping the knowledge and understanding regarding the influence of macroeconomic and firm-specific factors towards Jordanian firm performance. This will be highly convenient in allowing the incorporation of strategies and techniques towards attaining and underpinning the country’s economic growth. This study is also important for different parties like, investors, service firm’s managers, and academic researchers. Firm’s managers should improve the ROA and MBV to get at the optimal levels, in order to maximize their firm's performance. This can be done through holding a policy of optimal use of their assets. In addition, they should make attention to macroeconomic variables of GDP and inflation. Inflation, in particular, has been correlated negatively to firm performance, whereas GDP contrasted by influencing firm performance positively. Therefore, most of the theoretical prediction is consistent with the findings obtained: inflation impedes firm performance. Meanwhile, GDP poses a positive influence towards both indicators of firm performance, specifically ROA and MBV. GDP is commonly known as a pertinent indicator for any economic element due to it being a definitive representation of the entire economic landscape. The firm-specific factor Sales Growth (SG) has yielded findings as per researcher expectation, whereby it is found to be positively linking to firm profitability and market value. Therefore, a firm that is capable of improving its sales can achieve higher profits, allowing bigger funds for further firm expansion. This will inevitably become a reflection of their potential and reputation in the landscape in Jordan.

Applying limited numbers of selected performance indicators, this due present the main limitation of this study to the unavailability of data, which prevent us to use comprehensive set of performance indicators. Finally, we suggest for further studies to investigate additional factors may be affecting the firm performance such as, trade openness, FDI, and money supply. Moreover, it’s suggested to enroll new financial performance indicators such as, market share, value added productivity, cash flow, and non-financial indicators like the balance scorecard.

References

- Alabdullah, T.T.Y., Yahya, S., & Ramayah, T. (2014). Corporate governance mechanisms and Jordanian companies' financial performance. Asian Social Science, 10(22), 247-262.

- Alfredo, D.M., Josip, K., Giovanna, C., & Lucio, C. (2013). Dispersion of family ownership and the performance of small-to-medium size private family firms. Journal of Family Business Strategy, 4(3), 166-175.

- Alper, D., & Anbar, A. (2011). Bank specific and macroeconomic determinants of commercial bank profitability: Empirical evidence from Turkey. Business and Economics Research Journal, 2(2), 139-152.

- Al-Rdaydeh, M., Almansour, A.Y., & Al-Omari, M.A. (2018). Moderating effect of competitive strategies on the relation between financial leverage and firm performance: Evidence from Jordan. Business and Economic Horizons, 14(3), 626-641.

- Al-Rdaydeh, M., Matar, A., & Alghzwai, O. (2017). Analyzing the effect of credit and liquidity risks on profitability of conventional and Islamic Jordanian Banks.International Journal of Academic Research in Business and Social Sciences,7(12), 1145-1155.

- Central Bank of Jordan, Annual report. Retrieved from http://www.cbj.gov.jo/

- Chavali, K., & Rosario, S. (2018). Relationship between capital structure and profitability: A study of non-banking finance companies in India. Academy of Accounting and Financial Studies Journal, 22(1), 1-8.

- Day, G.S. (2011). Closing the marketing capability gap. Journal of Marketing, 75, 4183-4195.

- Dursun, D., Cemil, K., & Ali, U. (2013). Measuring firm performance using financial ratios: A decision tree approach. Expert Systems with Applications, 40(10), 3970-3983.

- Grinstein, A. (2008). The effect of market orientation and its components on innovation consequences: A meta-analysis. Journal of the Academy of Marketing Science, 36(2), 166-173.

- Guendouz, A.A., & Ouassaf, S. (2018). Determinants of Saudi Takaful insurance companies’ profitability.Academy of Accounting and Financial Studies Journal,22(5), 1-24.

- Issah, M., & Antwi, S. (2017). Role of macroeconomic variables on firms’ performance: Evidence from the UK.Cogent Economics & Finance,5(1).

- Jeremy, G., & Peter, G. (2008). Firm factors, industry structure and performance variation: New empirical evidence to a classic debate. Journal of Business Research, 61(2), 109-117.

- Liargovas, P., & Skandalis, K. (2008). Factor affecting firms financial performance: The Case of Greece. Working Papers 0012, University of Peloponnese, Department of Economics.

- Mafumbate, J., Ndlovu, N., Mafuka, A., & Gavhure, P. (2017). The influence of firm specific determinants on financial performance in the power industry. Journal of Economics and Behavior Studies, 9(5), 18-28.

- Makhlouf, M.H., Laili, N.H., Ramli, N.A., Al-Sufy, F., & Basah, M.Y. (2018). Board of directors, firm performance and the moderating role of family control in Jordan.Academy of Accounting and Financial Studies Journal,22(5), 1-15.

- Marius, P., Delia, G., & Cecilia, A. (2014). Economic determinants of Romanian firms’ financial performance. Procedia-Social and Behavioral Sciences, 124, 272-281.

- Matar, A., & Eneizan B. (2018). Determinants of financial performance in the industrial firms: Evidence from Jordan. Asian Journal of Agricultural Extension, Economics & Sociology, 22(1), 1-10.

- Matar, A. (2016). Does portfolio’s beta in financial market affected by diversification? Evidence from Amman stock exchange.International Journal of Business and Management,11(11), 101-114.

- McConnell, J.J., & Servaes, H. (1990). Additional evidence on equity ownership and corporate value. Journal of Financial Economics, 27(2), 595-612.

- Mehta A., & Bhavani G. (2017). What determines banks’ profitability? Evidence from emerging markets: The case of the UAE banking sector. Accounting and Finance Research, 6(1), 77-88.

- Menicucci, E., & Paolucci, G. (2016). Factors affecting bank profitability in Europe: An empirical investigation. African Journal of Business Management, 10(17), 410-420.

- Morck, R., Shleifer, A., & Vishny, R.W. (1988). Management ownership and market valuation: An empirical analysis. Journal of Financial Economics, 20, 293-315.

- Mwangi, M., & Murigu, J.W. (2014). The determinants of financial performance in general insurance companies in Kenya. European Scientific Journal, 11(1), 288-297.

- Omondi, M. (2013). Factors affecting the financial performance of listed companies at the Nairobi Securities Exchange in Kenya. Research Journal of Finance and Accounting, 4(15), 99-104.

- Ozgur, O., & Gorus, M.S. (2016). Determinants of deposit bank profitability: Evidence from Turkey. Journal of Applied Economics and Business Research, 6(3), 218-231.

- Samhan, H.M., & Al-Khatib, A.Y. (2015). Determinants of financial performance of Jordan Islamic bank. Research Journal of Finance and Accounting, 6(8), 37-47.

- Sousa, C.M.P., Francisco, J., Lopez, M., & Coelho, F. (2008). The determinants of export performance: A review of the research in the literature between 1998-2005. International Journal of Management Reviews, 10(4).

- Zraiq, M.A.A., & Fadzil, F.H.B. (2018). The impact of ownership structure on firm performance: Evidence from Jordan.International Journal of Accounting, Finance and Risk Management,3(1).