Research Article: 2022 Vol: 26 Issue: 5

Factors Impacting the Special Purpose Acquisition Company Ipo Market in the United States

William Cheng, Troy University, USA

Liyi Zheng, Wenzhou Kean University, China

Anand Krishnamoorthy, Troy University, USA

Citation Information: Cheng, W., Zheng, L., & Krishnamoorthy, A. (2022). Factors impacting the special purpose acquisition company ipo market in the united states. Academy of Accounting and Financial Studies Journal, 26(5), 1-11.

Abstract

During the coronavirus emergency, the implementation of the quarantine policy was not conducive to the operation of traditional initial public offerings (IPOs). Starting from the end of 2019, a technique called “Special Purpose Acquisition Company” (SPAC) became popular within the investment community for handling IPO transactions. This study delves into some of the specifics of the SPAC IPO transaction. Although such transactions do occur in other countries as well, the current study focuses on SPAC IPO transactions in the United States. In order to expand on the existing body of literature with respect to SPAC IPO transactions in the United States, this study has two research objectives. The first objective of this paper is to examine the factors that could potentially impact U.S. based SPAC IPO transactions. In doing so, this study focused on three factors. Those three factors are broad-based market indicators, such as the federal funds rate and the 10-year Treasury rate, policy regulations, and the Covid-19 pandemic. All three factors were equally weighted and so this study did not utilize any weighted average formulas. For the purposes of objective #1, annual SPAC IPO data from 2003-2021 was used. This constituted a total of 17 SPAC IPO transactions. The study’s second objective is to present EV/EBITDA valuation model as a viable model for evaluating SPAC IPO transactions. In this valuation model, EV stands for expected value and EBITDA stands for earnings before interest, taxes, depreciation and amortization. The study’s 2nd objective is driven by prior research studies that have indicated that the EV/EBITDA model is appropriate for valuing SPAC IPO transactions. Research results indicate that broad-based market indicators, policy regulations and the coronavirus pandemic all have an impact on the SPAC IPO market. Based on a single case study, research results also indicate that the EV/EBITDA valuation model can be used to value SPAC IPO transactions although the results are not necessarily conclusive. With respect to the study’s second objective, the researchers acknowledge the need for additional research. However, research results are generally consistent with the study’s postulated hypotheses.

Keywords

SPAC, IPO, M&A, Pandemic, EV/EBITDA Valuation Model, Regression Analysis.

Introduction

The special purpose acquisition company (SPAC) is a kind of shell company with a long history. It initially appeared in the 1990s, but largely lay dormant until the end of 2019. The earliest research, on SPACs, appeared in 2007 and mainly focused on the operational model of SPACs and its history. This was due to the fact that SPACs were not popular enough to attract researchers. Riemer (2007) discussed the relationship between SPACs and the blank check company, which is the SPAC’s predecessor, and delved into the origin of the SPAC.

An SPAC does not have any commercial operations per se. Rather, it is formed strictly to raise capital through an initial public offering (IPO) in an endeavor to acquire or merge with an existing company (Investopedia.com). For private companies that are planning to go public via an IPO, SPACs offer some advantages. The process takes months as opposed to more than a year, in some cases, for conventional IPOs (Investopedia.com).

Undertaking a traditional IPO is a lengthy process involving underwriting, complex negotiations and the like. On the other hand, a company can go public in months if it is acquired by or merges with a SPAC since a SPAC is set up specifically to facilitate such a transaction (Agarwal, 2021). A SPAC is also sometimes referred to as a Blank Check Company (Investopedia.com).

At the end of 2019, the SPAC experienced a resurgence because of the pandemic. In 2020 and 2021, the SPAC IPOs constituted 46% and 52%, respectively of the entire IPO market in the United States (SPAC Analytics, 2021); these figures are representative of the boom of the SPAC IPO market. The model of SPACs and traditional IPOs are different, especially since the SPAC IPO takes less time than the traditional IPO process. For companies that wish to go public through a traditional IPO, they need to hold a roadshow and it could potentially take upwards of a year to conclude the process. During the pandemic, it was difficult for private companies to organize the roadshow because of the policy of quarantining and the unpredictable nature of the pandemic. On the other hand, the SPAC process could significantly expedite the process (Chong et al., 2021).

With the rebirth of the SPAC market, more and more research is being done on this area. Owing to this rebirth, the supervision requirements of SPACs are also becoming more comprehensive than before (Newman & Trautman, 2021). Newman & Trautman (2021) discussed the regulation of SPACs and the policy changes instituted by the Securities and Exchange Commission (SEC) with respect to the SPAC market after its resurgence. Additionally, Bai et al. (2020) tested the short-term performance of companies that list on the stock market through conventional IPOs vs. SPACs and concluded that the SPAC performs better than conventional IPOs in the short-term. However, Kolb & Tykvova (2016) concluded that the SPAC does not perform well in the long-term compared with a conventional IPO. Both of these research studies made some comparisons between the SPAC and conventional IPOs. However, there are still some unexplored areas in the research arena on the performance of the SPAC IPO market.

The current study has two research objectives. The first objective is to investigate the factors that impact the SPAC IPO market in the United States. Essentially, the three factors, investigated in this study, are overall market conditions, such as interest rates, policy regulations, and the impact of the pandemic.

Except for the comparison between SPACs and traditional IPOs, the whole process of SPACs also attracts researchers’ attention. Gahng et al. (2021) analyzed the motivation for some companies to go public through a SPAC. They tested the returns for investors on common shares and on warrants. Agarwal (2021) analyzed the overall valuation of the target companies in the SPAC market and found that the valuation is at a high level during 2020 and 2021.

As Agarwal (2021) mentioned, the valuation of the target company is a conundrum for most investors and so it is important for investors to find a commonly used and reliable way to evaluate the company. Fernandez (2007) delved into six main valuation models for enterprises and discussed the different properties of these models. Among these valuation models, Mauboussin (2018) studied the EV/EBITDA model and discussed the pros and cons of this model such as the elimination of the impact of taxation.

The EV/EBITDA valuation model is certainly worthy of additional investigation. Hence, the study’s second objective is to test the EV/EBITDA valuation model with the purpose of ascertaining whether this model could potentially be used to value SPAC IPOs. Since this study has two objectives, it has two corresponding hypotheses. The study’s two empirically testable hypotheses can formally be stated as follows:

H1: Market factors, policy related issues and the impact of the pandemic impact the SPAC IPO market

H2: The EV/EBITDA valuation model is appropriate for valuing SPAC IPOs

Literature Review

Compared with the research on the traditional IPO process, there are fewer academic studies on the special purpose acquisition company (SPAC). In the early years before 2010, most of the researchers focused more on a purely mechanical view of the operating mechanics of SPACs and its origins (Griffin, 2019). Riemer (2007) was one of the earliest researchers to investigate the SPAC market. As stated in the introductory section, he discussed the relationship between SPACs and the blank check company which is the SPAC’s predecessor and investigated the origin of the SPAC.

Presently, owing to the impact of the COVID-19 pandemic, the traditional IPO process may not be as effective as SPACs. Compared to the SPAC, the conventional IPO needs a longer turnaround time to complete, including a roadshow which is challenging at the present time. However, the SPACs could help investors avoid such problems because the very essence of SPACs is an acquisition process. For the target companies, they only need to complete a type of merger and acquisition (M&A) process without going through a traditional IPO process, and the M&A could potentially be completed in six months (Chong et al., 2021).

The SPAC is now experiencing a rebirth in the U.S. market. The number of SPAC IPOs have reached an unprecedented level since 2019; more than half of all of U.S. IPOs were SPAC IPOs in 2021 (Geerken et al., 2021). With this sharp uptick in interest in the SPAC market, the research on this area has also expanded.

Factors Impacting SPACs

Chong et al. (2021) designed a comprehensive study of SPACs including the capital structure, market participants, and its management structure. Their research results indicated that numerous firm specific and non-firm specific factors impact SPAC IPOs. Newman & Trautman (2021) focused on the financial reporting and auditing considerations of the SPAC after the boom in the SPAC market in early 2021 because the SEC began paying closer attention to the SPAC market. The researchers discussed the regulatory changes made by the SEC in order to have better supervision over the SPAC market.

There are some studies in the academic literature that focus on the factors that impact the performance of SPAC firms and the factors they choose are usually based on the SPAC itself. Hung et al. (2021) designed a comprehensive study on how management factors including previous financial experience, education, experience heterogeneity, the age & size of the management team, and ownership of patents impact the SPAC firms after acquisition. Jokelainen (2021) chose five SPACs from January 4 to March 31, 2021 and analyzed the factors that impacted the return and the trading price. He does not test the relationship between the announcement of the merger and the stock price, which is later conducted by (Cohen & Qadan, 2021). Cohen & Qadan (2021) concluded that the announcement of the merger could have a significant impact on the share price of SPACs within the ensuing 60- day period.

Agarwal (2021) discussed the reasons as to why the SPACs could be attractive in today’s market. Except for making the comparison between SPACs and conventional IPOs, he also talked about the incentives of founders, investors, and sponsors. Agarwal (2021) also delved into the “valuation conundrum” of SPAC firms. However, his research mainly focuses on integrating the data and the trading price, but he does not explain how the SPAC determines the value of the target company.

Shachmurove & Vulanovic (2017) focused on the SPAC IPO and analyzed the security issue related to the SPAC IPO process. They mention that SPACs do not need to disclose much information to the public. Gahng et al. (2021) focused on the rationale as to why some companies choose SPACs to get listed as a publicly traded company.

International SPACs

In recent years, the research on SPACs outside of the U.S. market has become more prevalent. Shachmurove & Vulanovic (2017) focused on Chinese SPACs. They compared the performance of Chinese SPACs with their U.S. Counterparts and found that Chinese SPACs outperformed U.S. SPACs in the short-term. Riva & Provasi (2019) mainly focused on Italy and analyzed how the SPAC could serve as an effective tool to meet the needs of Italian companies, especially small and mid-sized enterprises. Lai (2021) analyzed the SPAC market in Asia. His study indicated that the research on SPACs is more abundant for some countries, such as China and Korea, as opposed to others.

Short-term vs. Long-term

When analyzing the literature on SPACs, it is difficult to avoid comparisons to the traditional IPO. Datar et al. (2012) conducted the first research study that focused on the financial and operational performance of SPACs in the long-term. They found that companies that chose SPACs had fewer growth opportunities in the long-run. Kolb & Tykvova (2016) tested the long-term abnormal returns of SPACs from 2011 to 2016. Based on an analysis of 127 SPAC acquisitions and 1128 SPAC IPO events, they concluded that companies that go public through SPACs do not perform well in the long-term compared with firms that chose the conventional IPO process. Bai et al. (2020) focused their research on the short-term performance of SPACs. They concluded that short-term performance of SPACs typically outperformed that of traditional IPOs.

Valuation Modes

In his study, Fernandez (2007) discussed four widely used corporate valuation models. He concluded that the EV/EBITDA model is the most appropriate one for evaluating SPAC target companies. This is supplemented by Mauboussin (2018) who stated that the EV/EBITDA is desirable since it eliminates the impact of differences in tax rates and capital structures.

Research Design

As stated in the introductory section of the manuscript, this study has two main objectives: The first objective is aimed at investigating whether the three factors, that are noted below, impact the SPAC IPO market. The three factors investigated in this study are consistent with those advocated by (Chong et al., 2021). The second objective is to ascertain whether the EV/EBITDA valuation model could serve as a feasible and reliable way to evaluate the SPAC target company. This is consistent with studies conducted by (Fernandez, 2007; Mouboussin, 2018). Both of those studies found that the EV/EBITDA model is the most appropriate one for valuing SPAC IPOs.

The Impact of Market Factors

In the first part of this paper, regression analysis is used to analyze the data. The data included, in part I, are the yearly number of SPAC IPO numbers from 2003 to 2021; the natural log of these figures serve as the dependent variable. This is customary in research involving asset values to account for the size of the transaction in question.

Since SPAC IPOs pre-pandemic were few and far between, monthly data were not available for much of this time frame. Hence, annual SPAC data, obtained from SPAC analytics, were utilized to test the impact of overall market factors. The sample size, during the period of interest, constituted 17 SPAC IPOs.

In order to analyze the relationship between the SPAC IPO market and overall market conditions, the federal fund rate, and the 10-year U.S. treasury rate are chosen as the independent variables. These choices are appropriate since the federal fund rate is one of the most important indices of the market, and the 10-year treasury rate is the established benchmark for many other rates such as the mortgage rate. This information is widely available and can be obtained from the website of the U.S. Treasury department (treasury.gov), among other sources. As stated in the preceding paragraph, the researchers used annual data since the SPAC IPO, during many months, is zero. This was especially true prior to 2019. In addition to the key independent variables, the 1-year and 5-year treasury rates are used as control variables in the regression model that is utilized to evaluate the impact of market factors.

The Impact of Regulatory Policies

In order to evaluate the impact of regulatory policies, on SPAC IPOs, the researchers needed to delve into the regulation of SPAC transactions. Since it is difficult to find or create an index to represent regulation, and the policies do not contain any measurable variable, the data for this portion was obtained from the U.S. Securities and Exchange Commission (SEC) and analyzed qualitatively.

The impact of the Pandemic

In order to test the impact of the pandemic on the SPAC IPO market, the monthly number of new infections were collected from Jan. 2020 to Oct. 2021. This information was obtained from the U.S. Centers for Disease Control and Prevention (cdc.gov). The number of new infections together with the monthly number of SPAC IPOs constitutes the dataset for analyzing the impact of the pandemic. The monthly number of SPAC IPOs cannot be found in one database because most of the available data sources only contain annual data. Hence, SPAC data, to assess the impact of the pandemic, came from multiple sources including SPAC analytics, Bloomberg, and SPAC track. To analyze the impact of the pandemic, a regression model was used and the natural log of the monthly SPAC IPO number is used as the dependent variable.

The EV/EBITDA Valuation Model

In order to evaluate the manuscript’s second objective, all calculations are based on the formula ![]() where equation terms are defined as follows:

where equation terms are defined as follows:

EV (enterprise value) = market value of the company + value of debt – total cashflow

EBITDA = earnings before interest, taxes, depreciation and amortization

The EV/EBITDA valuation model includes shareholder return and creditor return in the EBITDA portion and contains equity market value and debt market value in the EV part. Another potential valuation model is the P/E model. However, the P/E ratio only contains the shareholders return in “E” and equity market value in “P”, while excluding the portion pertaining to creditors. Hence, the EV/EBITDA model considers different levels of leverage thereby taking into account the fact that two companies with the same level of profitability can use different means of financing.

In this study, the EV/EBITDA valuation model is tested through a case analysis based on New Frontier’s acquisition of United Family Healthcare (UFH) in November 2019. All data, to test the null hypothesis with respect to the study’s second objective, came from the SEC, company filings, and financial statements.

Research Results

This section, of the manuscript, discusses the results of executing the methodology outlined in the preceding section. In doing so, this section has the same four subsections as the “RESEARCH DESIGN” section.

The Impact of Market Factors

It is commonplace to use the natural log value in studies involving IPOs to account for the size of the IPO transaction. Hence, the natural log of the dependent variable is used which resulted in the dependent variable being ln (SPAC IPO). Furthermore, in order to ensure stationarity, a Dickey-Fuller Unit Root test was performed on the dependent variable as well as both independent variables, the federal funds rate and the 10-year Treasury rate. First order difference tests were performed as needed.

The results of the regression analysis, to test for the impact of market factors, are depicted in Table 1. As stated earlier to normalize for IPO size, the natural log of the SPAC IPO number is used. Although the R-squared is low and shows an insignificant relationship among the variables, the p-value and t-statistic indicate that the federal fund rate and the 10-year treasury rate have a significant impact on the SPAC IPO market at conventional levels of significance. The SPAC IPO market is positively related to the federal funds rate and has a negative relationship with the 10-year Treasury rate.

| Table 1 Regression Analysis For Broad-Based Market Factors |

||||||||

|---|---|---|---|---|---|---|---|---|

| SPAC IPOs | Coef. | St.Err | t-value | p-value | Sig. | |||

| Fed fund rate | 1.190 | 0.481 | 2.47 | 0.029 | ** | |||

| 10-year Treasury rate | -1.766 | 0.584 | -3.02 | 0.011 | ** | |||

| 1-year Treasury rate | -0.658 | 0.403 | -1.63 | 0.128 | ||||

| 5-year Treasury rate | 1.262 | 0.411 | 3.07 | 0.010 | ** | |||

| Discount rate | -0.427 | 0.348 | -1.23 | 0.243 | ||||

| Mean dependent var | 0.220 | SD dependent var | 1.093 | |||||

| R-squared | 0.564 | Number of obs | 17.000 | |||||

| F-test | 3.100 | Prob > F | 0.050 | |||||

| Akaike crit. (AIC) | 46.854 | Bayesian crit. (BIC) | 51.020 | |||||

| *** p<0.01, ** p<0.05, * p<0.1 | ||||||||

Robustness tests were also performed. The results of the robustness tests are noted in Table 2. As can be seen, the results for both independent variables are consistent with those depicted in Table 1.

| Table 2 The Robustness Test Results |

||||||||

|---|---|---|---|---|---|---|---|---|

| SPAC IPOs | Coef. | St.Err | t-value | p-value | Sig. | |||

| Fed fund rate | 1.156 | 0.517 | 2.24 | 0.047 | ** | |||

| 10-year Treasury rate | -1.733 | 0.621 | -2.79 | 0.018 | ** | |||

| 1-year Treasury rate | -0.652 | 0.420 | -1.55 | 0.149 | ||||

| 5-year Treasury rate | 1.265 | 0.428 | 2.95 | 0.013 | ** | |||

| Discount rate | -0.406 | 0.370 | -1.10 | 0.296 | ||||

| _cons | 0.061 | 0.234 | 0.26 | 0.799 | ||||

| Mean dependent var | 0.220 | SD dependent var | 1.093 | |||||

| R-squared | 0.548 | Number of obs | 17.000 | |||||

| F-test | 2.663 | Prob > F | 0.082 | |||||

| Akaike crit. (AIC) | 48.750 | Bayesian crit. (BIC) | 53.749 | |||||

| *** p<0.01, ** p<0.05, * p<0.1 | ||||||||

Research results indicate that there is a significant, negative relationship between the 10-year Treasury rate and the SPAC IPO market. When Treasury yields fall, investors may seek out alternative investments where they could potentially earn a higher return. A portion of those investment dollars could potentially flow into the SPAC IPO market thereby accounting for the negative relationship between Treasury rates and the SPAC IPO market.

Research results also indicate a positive, significant relationship between the federal funds rate and the SPAC IPO market. When the federal funds rate increases, it typically increases interest rates throughout the U.S. economy thereby causing the dollar to appreciate in value. If investors overseas have reason to believe that they could potentially earn higher returns on U.S. investments, they may allocate a greater portion of their investment dollars in the U.S., a portion of which could flow into the SPAC IPO market thereby resulting in the positive relationship. This effect would be especially pronounced if a portion of the transaction is financed with debt.

The Impact of Regulatory Policies

On April 12, 2021, the SEC issued a series of guidance on SPAC IPOs, the most important of which was the need for future SPAC warrants granted to early investors to be documented on its balance sheet in the form of debt rather than equity as originally assumed. Based on the new guidance, all SPACs, either lining up to go public or having already completed listing and mergers, needed to readjust their statements based on the new accounting rules.

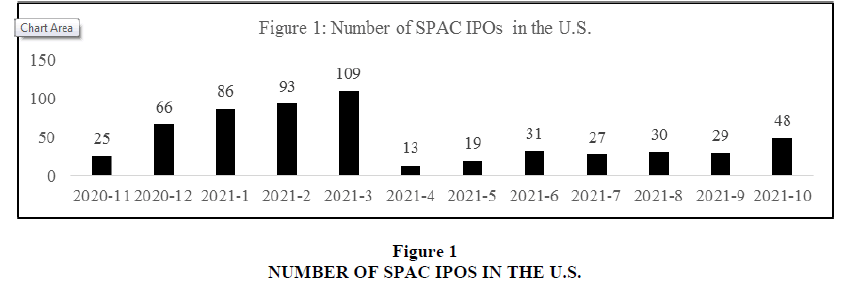

Figure 1 depicts the impact of this policy change. As can be seen from the figure, the number of SPAC IPOs, in the United States, kept steadily increasing until March 2021, but then sharply declined to only 13 in April of that year. There has been a modest uptick in the ensuing months, but has not reached pre-policy change numbers. In other words, research results indicate that an increase in regulatory hurdles resulted in a decrease in the number of SPAC IPOs. This makes intuitive sense since added scrutiny and/or increased compliance requirements would tend to discourage potential SPAC IPOs from moving forward.

The Impact of the Pandemic

The empirical results pertaining to the impact of the Covid-19 pandemic on the SPAC IPO market are depicted in Table 3. As Table 3 illustrates, there is a significant, positive relationship between the number of new infections and the number of SPAC IPOs. Said differently, research results indicate a sharp uptick in SPAC IPOs as Covid-19 cases rise. This makes intuitive since SPAC IPOs are less complicated and quicker than traditional IPOs; furthermore, they can potentially be accomplished while maintaining social distancing guidelines. These are desirable qualities while in the midst of a global health crisis.

| Table 3 Regression Results Pertaining To The Impact Of Covid-19 |

||||||||

|---|---|---|---|---|---|---|---|---|

| SPAC IPOs | Coef. | St.Err | t-value | p-value | Sig. | |||

| New Infections | 2.132 | 0.330 | 6.45 | 0.000 | *** | |||

| Mean dependent var | 2.916 | SD dependent var | 1.296 | |||||

| R-squared | 0.350 | Number of obs | 22.000 | |||||

| F-test | 10.762 | Prob > F | 0.004 | |||||

| Akaike crit. (AIC) | 67.343 | Bayesian crit. (BIC) | 69.525 | |||||

| *** p<0.01, ** p<0.05, * p<0.1 | ||||||||

Generally speaking, research results are consistent with the study’s postulated hypothesis with respect to Objective #1. Results of this study have provided evidence to indicate that broad-based market indicators, regulatory issues, and the global pandemic all have at least some impact on the SPAC IPO market in the United States. Although there isn’t much literature on regulatory factors and the impact of the Covid-19 pandemic, the results with respect to market factors are consistent with the findings of (Chong et al., 2021).

The EV/EBITDA Valuation Model

As stated in the “Data and Methodology” section, the EV/EBITDA model for valuing SPAC IPOs, is tested through a case analysis pertaining to New Frontier’s acquisition of United Family Healthcare (UFH) in November 2019. Before performing any calculations, there is an important statement in the company’s Form S-4 which needs to be taken into account. As it so happens, some of the financial measures including the adjusted EBITDA were not calculated in accordance with the International Financial Reporting Standards as issued by the International Accounting Standards Board.

To get the enterprise value (EV), details regarding agreements, investments, and unredeemed shares are needed. Those items are needed to measure the stock value of the company which pertains to the company’s market capitalization. For this specific case, the transaction included two types of agreements a forward purchase agreement and a subscription agreement along with a reinvestment and unredeemed shares commitment. The researchers then referred to the financial statements in 2019 to get data on debt as well as the amount of debt financing utilized in the SPAC transaction. The EBITDA figure, on the other hand, was obtained directly from company filings.

As stated earlier, the acquisition, in question, happened in Nov. 2019. The company's filings provided the EBITDA data for 2018, along with forecasts for 2019 and 2020. The researchers used the estimate for 2019 for the purposes of this analysis. Specific numbers, along with all calculations are noted below:

$190m (Forward Purchase Agreements) + $711.5m (Subscription Agreements) + $167.6m (re-investments) + $90m (unredeemed shares) + $26.7m (debt) + $300(loan) -$180m (cashflow) = $1,305.8 Million.

As can be noted from the above computations, the EV/EBITDA valuation model yielded a value of approximately $1.3 Billion. Official records report the actual value of the transaction at $1.4 Billion. Hence, the EV/EBITA model slightly undervalued the transaction. An undervaluation, albeit a slight one, is consistent with the findings of (Fernandez, 2007).

As stated in the introductory section, the study’s second objective is to evaluate the EV/EBITDA valuation model as a potential model to value SPAC IPOs. A case study involving New Frontier’s acquisition of United Family Healthcare in November 2019 was used to test the null hypothesis that the EV/EBITDA model is appropriate for valuing SPAC IPOs. There is a discrepancy, albeit a modest one, between the model calculations and the official figures. The EV/EBITDA calculations underestimated the actual amounts based on official figures. It is worthy of mention that these results are based on a single case study. Although these results have provided some insight, into the usefulness of this model to value SPAC IPOs, conclusive statements cannot be drawn based on a single case study. Hence, at this time, the researchers cannot conclusively state that the EV/EBITDA valuation model is superior to other valuation models, for valuing SPAC IPO transactions.

Limitations

All research projects have limitations and this study is no exception. With respect to broad-based market factors that could potentially impact the SPAC IPO market in the United States, this study considered the federal funds rate and the 10-year Treasury rate. However, these two factors are not exhaustive, and there could potentially be other market indicators that impact the SPAC IPO market that were not considered in this study. Furthermore, this study only evaluated the impact of regulatory policies, on the SPAC IPO market, qualitatively. Research results, with respect to the impact of regulatory policies on the SPAC IPO market, might be more reliable if quantitative tools had been used. However, the researchers did not have access to an index, database, or other such sources that might have enabled them to measure the impact of regulatory policies, on the SPAC IPO market in the U.S., quantitatively.

With respect to the study’s second objective, the researchers evaluated the validity of the EV/EBITDA valuation model to value the size of SPAC IPO transactions. Applying this model to a single case illustrated that the model came relatively close to the actual figures, but slightly underestimated the magnitude of the transaction. However, it is not possible to draw firm conclusions based on a single data point. Additional research is needed before being able to conclusively state that the EV/EBITDA model is superior to other valuation models for valuing SPAC IPO transactions.

Conclusion

This study had two objectives. The first objective was to examine the impact of three factors on the SPAC IPO market in the United States. Those three factors are broad-based market indicators, the impact of regulatory issues, and the impact of the Covid-19 pandemic. The first and third factors were evaluated using quantitative tools; the second factor was evaluated qualitatively. Research results, with respect to objective #1, are consistent with the study’s postulated hypothesis. All three factors have an impact on the SPAC IPO market in the United States.

The study’s second objective was to evaluate the EV/EBITDA model with respect to valuing SPAC IPOs. The hypothesis, with respect to this objective, was tested using a case study. Research results indicate that the model came close to the actual transaction value thereby providing some support for the null hypothesis with respect to objective #2. However, the researchers acknowledge that additional research is needed on this topical area in order to conclusively state that the EV/EBITDA valuation model is superior to competing models with respect to valuing SPAC IPO transactions.

There are several avenues for future research projects based on the current study. In evaluating broad-based market factors, the researchers considered the federal funds rate and the 10-year Treasury rate. Future studies could consider the impact of other market factors that could potentially impact the SPAC IPO market in the U.S. Furthermore, the researchers were unable to find a means for quantifying the impact of policy regulations. Hence, another potential research idea is to investigate quantitative indices to represent official policies and investigate the impact of policy related issues on the SPAC IPO market quantitatively.

There are also avenues for future research projects based on the study’s second objective. The EV/EBITDA model was evaluated using a single case study. Future research projects could potentially “widen the net” with respect to the validity of this model for valuing SPAC IPOs. Future studies could also compare this model to other valuation models in an attempt to shed light on the most desirable model that the investment community can utilize to evaluate the potential value of a SPAC IPO transaction.

This study has given both practitioners and academicians some “food for thought” regarding potential issues to consider when evaluating SPAC IPO transactions with the understanding that additional research is needed on this topical area. Hence, that is the primary contribution of this research project to the academic literature.

References

Agarwal, R. (2021). An Insight into SPACs and their Valuation Conundrum.Available at SSRN 3882261.

Indexed at, Google Scholar, Cross Ref

Bai, J., Ma, A., & Zheng, M. (2020). Reaching for Yield in the Going-Public Market: Evidence from SPACs.Available at SSRN.

Chong, E., Zhong, E., Li, F., Li, Q., Agrawal, S., & Zhang, T. (2021). Comprehensive Study of Special-Purpose Acquisition Company (SPAC): An Investment Perspective.Available at SSRN 3862186.

Indexed at, Google Scholar, Cross Ref

Cohen, G., & Qadan, M. (2021). The Information Conveyed in a SPAC′ s Offering.Entropy,23(9), 1215.

Indexed at, Google Scholar, Cross Ref

Datar, V., Emm, E., & Ince, U. (2012). Going public through the back door: A comparative analysis of SPACs and IPOs.Banking & Finance Review,4(1).

Fernandez, P. (2002). Company valuation methods. The most common errors in valuations.IESE Business School,449, 1-27.

Gahng, M., Ritter, J. R., & Zhang, D. (2021). SPACs.Available at SSRN 3775847.

Geerken, V., Vega, L. G., Coronado, M., & Cassinello, N. (2021). Special-Purpose Acquisition Companies: Same Spacs but Different Types: The Good, the Bad, the Ugly and the Others.Available at SSRN 3897143.

Indexed at, Google Scholar, Cross Ref

Griffin, J. (2019). Emerging Trends in the Special Purpose Acquisition Company Market: Implications of Front-End IPO Underpricing.

Hung, H., Liu, J., Yao, X., Zhang, H., Zhumabayev, M., & Zhang, T. (2021). Factor Analysis of SPACs: Impact on SPACs Performance by Management Factors.Available at SSRN 3866680.

Indexed at, Google Scholar, Cross Ref

Jokelainen, E. (2021). Performance of selected five special purpose acquisition companies in the stock market in the period 4.1.-31.3. 2021.

Kolb, J., & Tykvova, T. (2016). Going public via special purpose acquisition companies: Frogs do not turn into princes.Journal of Corporate Finance,40, 80-96.

Indexed at, Google Scholar, Cross Ref

Lai, K. (2021). Asian SPACs must tread carefully.International Financial Law Review.

Mauboussin, M. J. (2018). What Does an EV/EBITDA Multiple Mean?Bluemont Investment Research.

Newman, N., & Trautman, L.J. (2021). Special Purpose Acquisition Companies (SPACs) and the SEC.Available at SSRN 3905372.

Indexed at, Google Scholar, Cross Ref

Riemer, D. S. (2007). Special purpose acquisition companies: SPAC and SPAN, or blank check redux.Wash. UL Rev.,85, 931.

Riva, P., & Provasi, R. (2019). Evidence of the Italian special purpose acquisition company.Corporate Ownership & Control,16(4), a6.

Indexed at, Google Scholar, Cross Ref

Shachmurove, Y., & Vulanovic, M. (2017). US SPACs with a focus on China.Journal of Multinational Financial Management,39, 1-18.

Received: 23-Jun-2022, Manuscript No. AAFSJ-22-12237; Editor assigned: 25-Jun-2022, PreQC No. AAFSJ-22-12237(PQ); Reviewed: 11-Jul-2022, QC No. AAFSJ-22-12237; Revised: 03-Aug-2022, Manuscript No. AAFSJ-22-12237(R); Published: 10-Aug-2022