Research Article: 2022 Vol: 26 Issue: 1S

Factors Influencing Internal Accounting and Financial Audit Effectiveness: Evidence from Oman

Haider Alaaldin Alsabti, Universiti Pendidikan Sultan Idris

Azam Abdelhakeem Khalid, Universiti Pendidikan Sultan Idris

Citation Information: Alsabti, H.A., & Khalid, A.A. (2022). Factors influencing internal accounting and financial audit effectiveness: evidence from oman. Academy of Accounting and Financial Studies Journal, 26(S1), 1-11.

Abstract

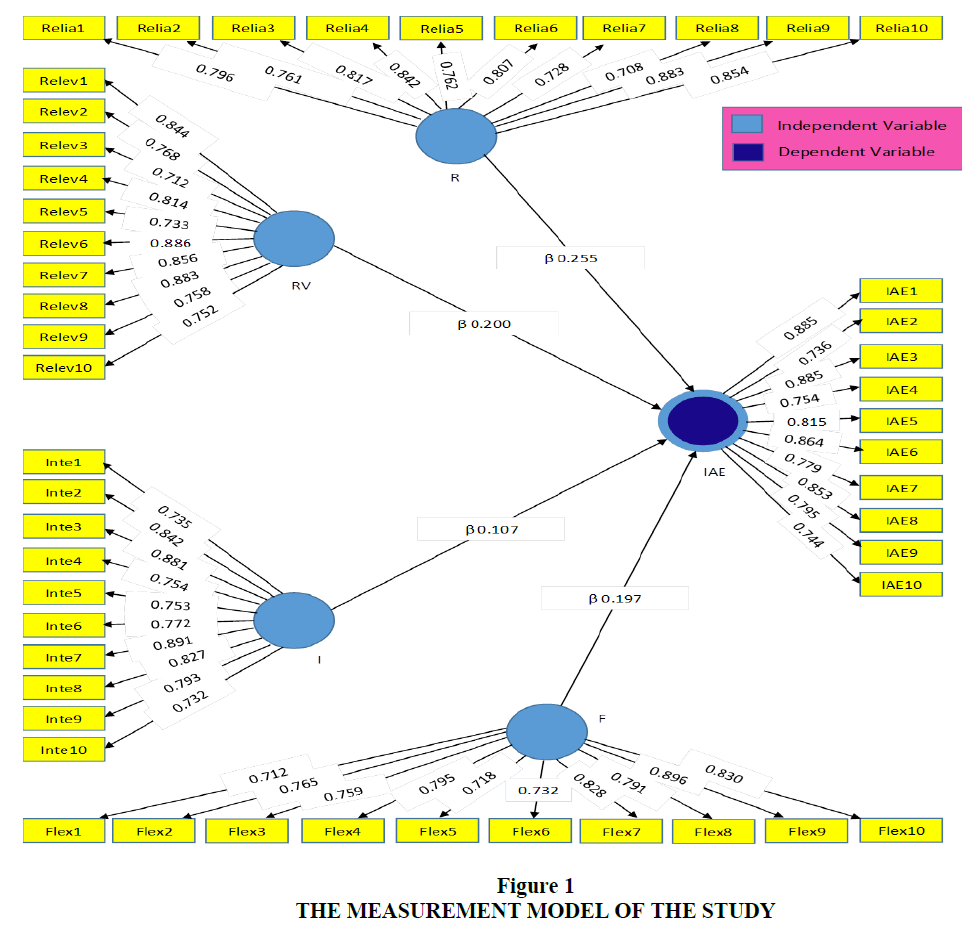

The study aims to investigate the factors influencing internal audit effectiveness (IAE) in the companies listed in Muscat Securities Market (MSM). The selected accounting information system (AIS) factors were reliability, relevance, flexibility and integration. A quantitative approach using structural equation modelling (SEM) was utilised as the main research design. The data was collected from a group of respondents comprising financial\accounts manager, accountant, internal auditor, audit committee member through simple random sampling. The actual survey questionnaire was distributed to 397 respondents, and the data were analysed using SEM to determine the factors influencing IAE in the companies listed in MSM. The study results indicated that AIS factors have a significant influence on IAE. The positive significant relations were reliability (β =0.255, p<0.05), followed by relevance (β= 0.200, p< 0.05), flexibility (β=0.197, p<0.05) and integration (β = 0.107, p<0.05). In conclusion, reliability is the most dominant AIS factor that influence on IAE. The main practical implication of the study is that companies listed in MSM should focus on the improvement of AIS factors to enhance IAE. To the researcher’s knowledge, this study is the first of its kind in Oman that investigate the factors influencing IAE in the companies listed in MSM.

Keywords

Accounting, Finance, Reliability, Relevance, Flexibility, Integration, AIS, Internal audit effectiveness, Oman.

Introduction

Accounting information system adds value to an organization by reducing cost of product and accounting information system helps organization to improve the quality of products and services, reduce waste of materials, improve the decision making and sharing of knowledge by providing competitive advantages to the organization (Bawaneh, 2014). According to Al-Kassawna, (2012), AIS is the administrative element of an institution that handles data collection, organisation, and dissemination of information to diverse consumers for decision-making reasons. According to Amidu et al. (2011), AIS is the method of gathering, structuring, and presenting financial data that has economic value to both external and internal consumers of organisations.

Internal audit scope has been extended to include most of financial transactions' verification, and gradually moved from auditing for management to auditing of management approach (Reeve, 1986). IIA, (2009) defined internal audit effectiveness as the degree to which establish objectives are achieved. Internal auditing could assist organizations in better accomplish their objectives by fetching a systematic and disciplined approach to improve and evaluate the control, risk management, and the governance processes effectiveness (IIA, 2009). The internal auditors have to be characterized with the highest professional objectivity levels of communicating skills including gathering and evaluating information related to the examined activities or processes (IIA, 2009). While management’s increased attention to internal audit recommendations encouraged internal auditors to provide their best efforts, the lack of management attention gives the auditee a bad idea regarding the importance of internal auditing which in turn adversely affect the auditee attributions (Mihret & Yismaw, 2007).

The use of the AIS is one of the important means in the recent era. The growth of organizations, size, services, product variety, and what they provide, also a large number of their financial operations, have directed organizations to pay attention to the AIS (Sambasivan, 2013). AIS is used to deliver financial reports daily and supply important data needed for decision-making and the overall performance of the whole corporation (Sajady et al., 2008). Moreover, they supply adequate control to ensure that the processing and recording of data are accurate (Qasim, 2010). In the context of the required skill, the International Federation of Accountants (IFAC) issued the International Education Standard (IES) Competence Requirements for Audit Professionals, which shows the knowledge content of the training and advancement programs (Arnold & Sutton, 1998; Curtis & Payne, 2008; Janvrin et al., 2009).

In Oman and other Gulf countries, financial reports are the only reliable source of information available to these stakeholders who rely on these reports to form their investment decisions (Alattar & Al-Khater, 2007; Al-Ajmi, 2009). At the same time, expropriation activities and financial reports can be expected to conceal these activities because the ownership structure is very focused, and the internal control mechanisms are very weak (Al?Yahyaee et al., 2010). Therefore, the role of internal auditors in adding credibility to the financial reports in Oman is crucial. Compared to the capital markets of the US and UK, the number of listed companies is very small, for example, 167 companies in 2021.

No evidence has been found related to companies listed in Muscat Securities Market (MSM) that examines the influence of the accounting information system on internal audit effectiveness. The researcher aimed to find to what extent the results in companies listed in MSM is consistent to the global ones. This research is trying to investigate the factors influencing IAE in the companies listed in Muscat Securities Market. The remaining parts are organized as follows. The following section briefly review the relevant literature-related factors and internal audit effectiveness. Followed by research hypothesis, and explains linkages of previous studies. The third section presents the research methodology, while the last section presents findings, results and conclusion.

Literature Review

Factors of Accounting Information System

AIS, mainly employed to execute effective choices and oversee organizational activities, is one of the earliest known and most significant information systems that corporations build (Sajady et al., 2008). In general, accounting information is economic information that belongs to financial or corporate economic activities (Neogy, 2014). AIS is an information system that processes everything with accountancy and utilises this information to achieve an effective, flexible organisation environment continuance change in corporate culture. (Alsharayri, 2011; Mami? Sa?er & Olui?, 2013; Sari et al., 2016) indicated that AIS is a part of the overall information system that aims mainly to generate information for business decisions. AISs aim to provide different stakeholders with various types of information to attain their needs. Hence, AISs endeavour to gain surrounding conditions advantage to enhance the information quality and quantity and provide support techniques to interested users (Alzeban & Gwilliam, 2014; Alzoubi, 2011).

Reliability is the most frequent characteristic used by researchers. It refers to the ability of accounting information to be representational and faithful with no deliberate or systematic bias and material error (Bukenya, 2014). Also, to evaluate the events, relevance is used. It refers to the relevancy of accounting information to users’ responsibilities and tasks and its ability to assess previous, current or future events and affect users’ economic decisions (Bukenya, 2014). One of the most common criteria utilised by academics is integration. The degree to which an accounting information system allows combining data from numerous inputs to improve corporate choices is referred to as integration (Heidmann et al., 2008). Finally, Flexibility is also widely used by researchers. It refers to the degree of accounting information system adaptation to various changing conditions.

Measurement of Internal Audit Effectiveness

Internal audit possesses a special role in the public and regulatory agencies’ internal assurance Internal auditors that are effective should have the following qualities: The capacity to harmonise internal audit’s structure with the dynamics of the firm’s activities; a strong link involving managerial talents for preserving proper exposure and audit committee requirements and aspirations; stable service transmission capacity (stability in technique, guidelines, and transmission), such as the ability to keep audit focus and integration of assets with the strategy; great managerial expertise that will guarantee the internal audit teams equipped with proper motivation and capabilities (Alberta, 2005). Aside from the aforementioned factors, the internal audit effectiveness was influenced by the professional credentials of internal auditors, level of training, education, and experience (Al-Twaijry et al., 2003).

Moreover, if it contains the following characteristics, an effective internal audit function could be a valuable resource for enhancing community trust in the financial reporting and corporate governance; organizational independence, a formal authority (presence of authorised audit charter), unfettered access, adequate resources, good management, qualified employees, presence of audit committee, stakeholder encouragement, qualified audit criteria and unrestricted range (Belay, 2007; Smet & Mention, 2011). Nonetheless, internal audit effectiveness is influenced by the following factors: competent and appropriate employees, competence, and connection with the audit committee (Sarens, 2009).

Hypotheses Development

According to FASB, reliability denotes the consistent verification and use of financial information by creditors and investors with the same results. Principally, reliability is the credibility and constancy of the financial statements; otherwise, financial reporting generally is impractical. According to (Hiedmann et al., 2008) who mentioned reliability is important for the success of AIS. Other than that, according to (Ong et al., 2009; Wixom & Todd, 2005), a good AIS is characterised by attaining dependability. Thus, ISI has been seen to provide clear inconsistent possibilities of control and flexibility (Orlikowski, 1991). Subsequently, dependability was employed by (Napitupulu et al., 2016) to select effective and good AIS. From this point on, reliability of AIS was adopted to identify its effect on IAE; therefore, an internal audit should evaluate the accuracy and reliability of information produced from AIS. In addition, it needs to understand how AIS is developed, operates, and how to activate controls. Also, it needs to understand that organizations’ AIS may be vulnerable to attack from inside and outside as most organizations become more practical due to globalization and competition (Romneyet et al., 2013).

Financial information relevancy refers to information ability to help users in decision making about scarce resources allocation and in evaluating the accountability provided by devisers. Information is relevant given that it has the potential to influence users’ economic decisions and if it is provided on time to affect those decisions (Bukenya, 2014). According to (Vasudevan & Chawan, 2014; Harash et al., 2014), AIS quality is influenced by relevance. According to Bukenya, (2014), relevance is one of the true measures of accounting information quality. Based on this, the relevance of AIS was adopted to identify its effect on IAE so that the relevant accounting information can influence the decisions of those using it, such as auditors and management. Moreover, it simplifies comprehensive knowledge, making it easier to make decisions in any difficult circumstance (Sambasivam & Assefa, 2013).

System integration refers to the process of building a new system by combining the old and new software systems (Napitupulu, 2015). The integrated system, which integrates and draws data from a public database, is basically connected with accounting organizational processes (Chapman, 2005). Integration can tighten conventional control forms since it limits the probabilities for individual selection, concurrently enhancing the hierarchical vision of those selections (Orlikowski, 1991; Sotto, 1997). (Heidmann et al., 2008) mentioned that integration is important for the success of AIS. On the other side, (Ong et al., 2009) and (Wixom & Todd, 2005) stated that a good AIS could be defined by achieving integration. Finally, (Napitupulu et al., 2016) used integration to identify good and effective AIS. In fact, few studies discussed the direct relationship between AIS and IAE (Moorthy et al., 2011; Mihret & Yismaw, 2007; Tan, 2016). AIS improves internal control and auditing, where auditors need internal control systems and security approval to perform effective auditing (Tan, 2016). Therefore, AIS can be integrated with other organization information systems, and the AIS integration level determines its quality (Mami? Sa?er & Olui?, 2013). The integrated data architecture effectively tracks all events and inspires an active usage of operations and resources by providing a computer-based database system for storing and retrieving data (Tan, 2016).

Flexibility is a factor that increases managers’ discretion in financial reporting; higher flexibility makes it easier for the manager to manipulate accounting signals (FASB, 2010 ; IASB, 2010). According to (Heidmann et al., 2008), flexibility is important for the success of AIS. On the other hand, (Ong et al., 2009) and (Wixom & Todd, 2005 ) claimed that establishing integration defines a good AIS. Finally, to find acceptable and effective AIS, (Napitupulu et al., 2016) employed integration. From this moment forward, flexibility was adopted to identify the effect of flexibility of AIS on IAE (Napitupulu et al., 2016). Furthermore, the flexibility of the accounting system reveals its ability to adapt to future organization needs and growth (Ramazani & Allahyari, 2013). Thus, the auditor should gain practical confirmation that the audited entity financial statements are free from substantial misstatement (Axelsen et al., 2017). Based on the previous review, four hypotheses were developed based on the most factors of the AIS to investigate its impact on the IAE as follows.

H1: Reliability positively influence on internal audit effectiveness in companies listed in MSM.

H2: Relevance positively influence on internal audit effectiveness in companies listed in MSM.

H3: Integration positively influence on internal audit effectiveness in companies listed in MSM.

H4: Flexibility positively influence on internal audit effectiveness in companies listed in MSM.

Methodology

For data collecting, a questionnaire was used. Based on previous studies in the same area, the elements of both constructs have been created. The measuring origins of all products is added. The questionnaires were circulated to the respondents of 167 companies listed in Muscat Securities Market (Financial\Accounts Manager, Accountant, Internal Auditor and Audit Committee member). To enter the final questionnaire, the preliminary questionnaire was subjected to a pilot analysis and the judgments of experts. To remove any uncertainty in the questions and to eliminate any hesitation, the questionnaires were delivered online (google form link send by email) to the respondents. It took about 3 months for the entire process of circulating the questionnaire and gathering the answers. The basic random sampling method was based on sampling. The number of survey questionnaires issued was 468, but the correct answers used in the review process were 397, resulting in a 96.36 percent response rate. The collected data was analysed using SPSS and SmartPLS.

Results and Discussion

Profile of the Respondents

Table 1 indicates the sample distribution by age. The highest indicator is the rank 26-30 at 32.24%. The second age group of the contributors is 20-25 at 28.21%, and 31-35 is 23.43%. The lowest indicators are Over 35 at 16.12%. The table illustrates the educational level of the respondents, showing that 36.78% have a Bachelor’s Certificate and 24.43% have a Master’s Certificate. In addition, 23.43% of the respondents have a diploma degree, and 14.36% have a PHD Certificate. In addition, 1% of the respondents have Professional Certificate (ACCA, CPA, CIMA and etc.). The lowest indicator is Professional Certificate (ACCA, CPA, CIMA and etc.) at 1%. This result indicates that the main requirement for working in the Muscat Securities Marketing sector is a bachelor’s Certificate (Al-Kasswna, 2012).

| Table 1 Summary of Frequency Table for Demographic Profile | |||

| Category | Frequency | Percentage (%) | |

| Age | |||

| 20-25 | 112 | 28.21 | |

| 26-30 | 128 | 32.24 | |

| 31-35 | 93 | 23.43 | |

| Over 35 | 64 | 16.12 | |

| Education Level | |||

| Bachelor Certificate | 146 | 36.78 | |

| Diploma degree | 93 | 23.43 | |

| Master’s Certificate | 97 | 24.43 | |

| PHD Certificate | 57 | 14.36 | |

| Professional Certificate (ACCA, CPA, CIMA and etc.) | 4 | 1 | |

| Current position in the organization | |||

| Accountant | 136 | 34.26 | |

| Audit Committee member | 77 | 19.39 | |

| Financial / Account manager | 98 | 24.69 | |

| Internal auditor | 86 | 21.66 | |

| Experience | |||

| 1-5 Years | 138 | 34.76 | |

| 6-10 years | 104 | 26.20 | |

| 11-15 years | 89 | 22.42 | |

| More than 15 years | 66 | 16.62 | |

Moreover, Table 1 reveals the current position in the organization inside Muscat Securities Market. The results show that the Accountant recorded the highest contribution with 136 responses and the Accountant. However, the Audit Committee Member the lowest with 77 response, the Financial / Account manager has 98 responses and the internal auditor has 86 responses. Furthermore, the Accountant has the highest portion (34.26%), Financial / Accounts manager’s portion is 24.69%, the internal auditor’s portion is 21.66%, the Audit Committee member’s portion is 19.39%. These results show the significant tasks of the Accountant and the importance of other departments such as finance and audit departments.

The table presents the experience of respondents and those with 1-5 years comprise 34.76%, and those with more than 15 years comprise the lowest percentage (16.62%). In addition, those with experience between 6-10 years were 26.20% and those between 11-15 years were 22.42%. Table 1 present the distribution of respondents by experience. The number of respondents with 1-5 years’ experience is 138, those with experience between 6-10 years are 104, and those between 11-15 years are 89 and finally, those with more than 15 years’ experience are 66. These results depict the extent of the experience of the respondents and show the interest and experience gained in Muscat Securities Market. Also, these ratios are good and indicate the extent of the importance of the study for the companies listed in Muscat Securities Market.

Reliability Test of All Constructs

The reliability of the sample questionnaire was checked to check the questionnaire's reliability and validity. Table 2 displays the findings of the pilot testing and finding it to be consistent. Different scholars have listed numerous thresholds for the appropriate value of the alpha of Cronbach, but the present study used the value of 0.70 as a construct reliability threshold value (Hiraoka, 2017).

| Table 2 Reliability of Instrument on the Basis of Pilot Test | |||

| Sr. | Dimension | Cronbach's Alpha | No. of items |

| 1 | Reliability | 0.730 | 10 |

| 2 | Relevance | 0.823 | 10 |

| 3 | Integration | 0.761 | 10 |

| 4 | Flexibility | 0.709 | 10 |

| 5 | Internal audit Effectiveness | 0.740 | 10 |

| Total | 0.840 | 50 | |

Internal Consistency Reliability

Internal consistency is measured by composite reliability (CR) (Chin, 1998). Composite reliability (CR) considers indicators that have different loadings, whereas, Cranach’s alpha provides sever underestimation of internal consistency reliability and assumed that all indicators are equally weighted (Chin, 1998). Thus, this study will consider CR instead of CA. Furthermore, researcher has followed the guideline suggested by Nunnally, (1978) stated that an internal consistency is considered satisfactory when the value is ≥ .70, whereas value < 0.60 indicate lack of reliability of measures. Table 3 shows that the CR of each construct for this study ranges from 0.941 to 0.951 and this is above the recommended threshold value of 0.70. Thus, the internal consistency reliability of the constructs is confirmed.

| Table 3 Results of Final Modified Measurement Model | ||

| Model Construct | CR | AVE |

| Reliability | 0.946 | 0.636 |

| Relevance | 0.947 | 0.645 |

| Integration | 0.946 | 0.640 |

| Flexibility | 0.941 | 0.615 |

| Internal Audit Effectiveness | 0.951 | 0.661 |

Fornell and Larcker Criterion

The assessment of measurement model to evaluate the validity and reliability and the systematic evaluation of the criteria follows two steps, namely, the convergent and discriminant validity (Hair et al., 2016). Model estimation delivers empirical measure of the relationships between the indicators and the constructs. The assessment of the reflective measurement model includes composite reliability to evaluate internal consistency and the average variance extracted (AVE) to assess convergent validity. It also includes discriminant validity (Hair, 2016). Table 4 tabulates the square root of the AVE; all off-diagonal elements are smaller than the square root of the AVE (bold on the diagonal). Thus, with the Formal and Larker criteria, the result verified the discriminant validity of the measure.

| Table 4 Discriminant Validity Using Fornell and Larker’s Criterion | |||||

| Variable | F | I | IAE | RV | R |

| F | 0.836 | ||||

| I | 0.820 | 0.845 | |||

| IAE | 0.781 | 0.813 | 0.822 | ||

| RV | 0.779 | 0.835 | 0.810 | 0.873 | |

| R | 0.696 | 0.795 | 0.729 | 0.826 | 0.850 |

Goodness of Fit of the model GOF

Hair et al., (2016) defined GOF as the global fit measure and the geometric mean of AVE and the average of R2 of the endogenous variables. The purpose of GOF is to account for reliance on the study model at both levels conceptually and empirically, namely, measurement. Table 5 shows that GOF value is 0.659 greater than 0.36. The criteria of GOF to determine whether GOF values are no fit, small, medium, or large to be consider as globally valid by the PLS model have been given by (Henseler et al., 2014). The result indicated that the model’s goodness of fit measure was higher than the adequate validity of the global PLS model. Structural model focus on the overall performance of the model (Henseler et al., 2014). The calculation formula of GOF is as follows: Gof=√(AVE*R2).

| Table 5 Goodness of Fit of the Model (GOF) | ||

| R Square | AVE | |

| Reliability (R) | 0.636 | |

| Relevance (Rv) | 0.645 | |

| Integration (I) | 0.640 | |

| Flexibility (F) | 0.615 | |

| (IAE) | 0.682 | 0.661 |

| The Average | 0.637 | |

| GOF | 0.659 | |

Path Coefficient of Hypothesis Testing

The current study proposed to examine the impact of the relationship of the four independent variables (reliability, relevance, integration and flexibility) on the dependent variable internal audit effectiveness. For this purpose, four hypotheses were developed, and they were tested through the SmartPLS. The results of the effects are shown in table 6 and figure 1.

| Table 6 Path Coefficient Assessment | |||||

| Hypothesis | Path coefficient | Std. Error |

T- value | P-value | Decision |

| H1: Reliability positively impact on internal audit effectiveness in Companies listed in MSM | 0.255 | 0.064 | 3.985*** | 0.000 | Fail to reject |

| H2: Relevance positively impact on internal audit effectiveness in Companies listed in MSM. | 0.200 | 0.070 | 2.835* | 0.005 | Fail to reject |

| H3: Integration positively impact on internal audit effectiveness in Companies listed in MSM. | 0.107 | 0.053 | 2.002* | 0.046 | Fail to reject |

| H4: Flexibility positively impact on internal audit effectiveness in Companies listed in MSM | 0.197 | 0.055 | 3.568*** | 0.000 | Fail to reject |

The results showed that all the hypotheses are fail to reject because the P-Value summit is less than 0.05.

Conclusion

Investigate the factors influencing IAE in the companies listed in MSM was identified in the study. For a population of 167 companies used, a Descriptive study Design was used. Primary data is used as information sources. The primary data was obtained from 167 companies listed in MSM through a questionnaire. By obtaining the level of education of the respondents, years of experience in the company, their views on factors influencing IAE in the companies listed in MSM in Oman and the efficacy of the four factors of AIS (Reliability, Relevance, Integration and Flexibility).

However, the results of the study showed that companies that successfully incorporated AIS factors had comparatively improved IAE. An important positive association between AIS and IAE in the companies listed in MSM in Oman has been established from the regression study, and the lack of AIS results in negative IAE.

The limitation of study is a location or place limitation which involves (covering) 167 Omani companies listed in MSM. The time constraint of this study involved around one year because this study used a survey for data collection.

This study contributes to Omani companies represents management and founders. The empirical contribution is the impact factors of AIS which are: (Reliability, Relevance, Integration, and Flexibility) influencing IAE. This study provides insights on the possibility of applying AIS factors to increase the efficiency of IAE in companies listed in MSM in Oman.

The present study verifies and indicate that handling the research problem using structural equation relationships is beneficial to all companies to avoid the wrong information that affects significantly their decision making. This can be done by using the AIS and increase the experience of the accountants and auditors through continuous training. Companies should use the information technology and modern computerized systems to increase the efficiency and effectiveness of the audit process by reducing time and effort audit process.

The study recommended that the companies effectively implement and maintain AIS due to the nature of the company’s riskiness and its impact on the country's economic growth. The companies must have Centralized data management to improves the accuracy of data and information management and the applied AIS encourages the spirit of creativity and innovation among all employees. Besides this, an independent audit department that is well trained and staffed should be set in the companies to facilitate effective implementation of AIS.

Future studies could compare the analysis of developed countries and developing countries to understand the nature and extent of accounting information system factors and their relationship to internal audit effectiveness. It is essential to understand the extent of AIS factors in other countries.

References

Alberta, A. G. (2005). Examination of internal audit departments. Internal Audit Report. Retrieve on, 12(09), 2012.

Alzoubi, A. (2011). The effectiveness of the accounting information system under the enterprise resources planning (ERP). Research Journal of Finance and Accounting, 2(11), 10-19.

Arnold, V., & Sutton, S. G. (1998). The theory of technology dominance: Understanding the impact of intelligent decision aids on decision maker’s judgments. Advances in accounting behavioral research, 1(3), 175-194.

Belay, Z. (2007). Effective implementation of Internal Audit function to promote good governance in the public sector. In Ethiopian Civil Service College Research, Publication Consultancy Coordination Office, conference paper, Addis Ababa.

Chin, W.W. (1998). The partial least squares approach to structural equation modeling. In G. A. Marcoulides (Ed.), Modern methods for business research, Mahwah, NJ: Lawrence Erlbaum. 295-358.

FASB. (2010). The conceptual framework for financial reporting. Malaysia Financial Reporting Standards, (8), 1-42.

Hair, Jr, J. F., Hult, G. T. M., Ringle, C., & Sarstedt, M. (2016). A primer on partial least squares structural equation modeling (PLS-SEM). Sage Publications.

Henseler, J., Dijkstra, T. K., Sarstedt, M., Ringle, C. M., Diamantopoulos, A., Straub, D. W., ... & Calantone, R. J. (2014). Common beliefs and reality about PLS: Comments on Rönkkö and Evermann (2013). Organizational research methods, 17(2), 182-209.

IIA, T. (2009). The role of internal auditing in enterprise-wide risk management, IIA Position Paper, Institute of Internal Auditors, 1-8.

Napitupulu, I. H., Mahyuni, S. R. I., & Sibarani, J. L. (2016). The impact of internal control effectiveness to the quality of management accounting information system: The survey on State-Owned Enterprises (SOEs). Journal of Theoretical and Applied Information Technology, 88(2), 358.

Reeve, J. T. (1986). Internal Auditing. In Cashin, J. A., Neuwirth, P. D., & Levy, J. F. (Eds.) Cashin’s Handbook for Auditors. Englewood Cliffs, NJ: Prentice Hall.

Romney, M., Steinbart, P., Mula, J., McNamara, R., & Tonkin, T. (2012). Accounting Information Systems Australasian Edition. Pearson Higher Education AU.

Sambasivam, Y., & Assefa, K. B. (2013). Evaluating the design of accounting information system and its implementation in Ethiopian manufacturing industries. Research Journal of Sciences & IT Management, 2(7), 16-29.

Sari, N., SE, M., & Purwanegara, H. (2016). The Effect of Quality Accounting Information System in Indonesian Government (BUMD at Bandung Area). Decision-Making, 7(2), 301–302.

Tan, Ö. F. (2016). Impact of Accounting Information Systems on Internal Auditors in Turkey. Marmara Üniversitesi Öneri Dergisi @Bullet Cilt, 12(46), 1300–1845.

Wixom, B. H., & Todd, P. A. (2005). A theoretical integration of user satisfaction and technology acceptance. Information Systems Research, 16(1), 85-102.