Research Article: 2021 Vol: 27 Issue: 2

Factors Influencing Small Medium Enterprises Innovation Strategies in Durban

Kudzai Nigel Makuwe, Durban University of Technology

Lawrence Mpele Lekhanya, Durban University of Technology

Abstract

It is evident and generally agreed by scholars around the world that Small and Medium Enterprises (SMEs) are the backbone of any thriving economy. For the SME sector to fully support the economic activities of a country it needs to be absorbed in innovation activities that deliver products and services valued by customers. Studies have been conducted globally confirming a positive relationship between SMEs and their characteristic innovative nature. However, disparity still exists in the local context of South Africa, especially in Durban, on what influences SME innovation strategies. It was thus the aim of the current study to identify factors that influence SME innovation strategies in Durban. In addition, the study recognised the impact of Corona Virus 2019 (Covid-19) on SME innovation, while also delving into post Covid-19 innovation strategies by SMEs. The study made use of a quantitative research design and a structured questionnaire was distributed to respondents. The sample size of the study was 248 SME owners/ managers in Durban. With the closure of certain businesses, the impact of covid-19 forced a shift from probability to non-probability sampling, as well as changes to the data collection planned initially for the study. Therefore, the researcher had to resort to targeting SMEs in Durban that were allowed to operate. With the aid of a research assistant the questionnaire was distributed to and collected from respondents. Collected data was analysed using the Statistical Package for Social Sciences (SPSS) version 25.0 for Windows. The results emanating from the study were then presented in the form of bar graphs, pie charts and cross tabulations. The main findings of the research revealed that the majority of SMEs in Durban surveyed invest in technology equipment. Furthermore, the results showed agreement by a majority of the SMEs that the size of a firm influences innovation strategies. In addition, the majority of SME owners strongly agreed that the global pandemic, Covid-19, has significantly changed consumer buying patterns. The research project additionally highlighted some of the most critical factors that influence SME innovation strategies in Durban. Policy makers, academics and SME stakeholders will find the study informative.

Keywords

Innovation Strategies, Small Medium Enterprises, SME Innovation Strategies.

Introduction

A growing body of literature confirms that Small and Medium Enterprises (SMEs) universally have the capacity to stimulate economic growth, alleviate poverty as well as develop new technologies (Machaka 2018; Gunjati & Adake 2020). SMEs achieve growth mainly because of their ability to produce innovative products and offer improved service (Colclough, et al., 2019). Small businesses require innovation strategies to achieve improved performance and increase chances of survival (Nagaraju, 2015). Through innovative activities, small firms can maintain economic development critical for businesses to sustain a competitive edge in the market (Madrid‐Guijarro et al., 2009). The Schumpeterian (1934) concept of “creative destruction” demonstrates the ability of small firms to achieve economic growth and innovation. Schumpeter’s foundational work shows that SMEs can challenge larger firms by introducing sustainable innovation strategies (Machaka, 2018).

Innovation strategies are widely regarded as the main drivers of business growth and ultimately, economic prosperity. There is evidence in literature that suggests small venture failure is as a result of a lack of innovation strategies (Cooper & Edgett, 2010) yet SMEs environment promotes innovativeness of enterprises (Lewandowska, 2014). In addition, Nagaraju (2015) argues that a well-articulated innovation strategy helps SMEs adapt with ease to changes in the market environment. This viewpoint is also supported by Kim and Kim (2018) who posit that small businesses need to invest in Research and Development (R&D) and collaborate with other firms in order to realise innovativeness.

The study aims to identify factors that influence SME innovation strategies in Durban. According to the Small Business Programme (SBP) SME Growth Index (2013), innovation is critical in the performance and survival of small businesses. The study was conducted in Durban because there is limited research on factors that influence innovation among SMEs in Durban. A quantitative research design was used to address two potent questions: (1) what are the innovation strategies adopted by SMEs in Durban? (2) what are the factors that influence SMEs innovation strategies in Durban? The chapter concludes by providing the methodology used to achieve the research aim and objectives.

Problem Statement

According to Kaplinsky (1998), innovation is not only a necessity for a business to survive, but also a competitive advantage for a business to grow. The SBP SME Growth Index (2013) list lack of innovation as one of the six main factors that inhibit SME growth in SA. Small business enterprises can only survive when they possess certain technologies and innovation strategies (Kim and Kim 2018). However, lack of innovation, as well as understanding and knowledge of various factors that affect SME innovation, particularly in Durban, is still an issue of concern. Abdu and Jibir (2018) opine that studies on factors influencing innovation mainly focus on established firms, therefore, research on SMEs remains scant and necessary.

SMEs need to build innovative strategies that will increase market share and profits and address challenges such as financial constraints and lack of sufficient resources (Tian & Lin, 2019; Ndiege 2019). The challenge, however, for SMEs is finding the balance between developing competitive technologies and securing enough capital to fund the innovation process (Kim & Kim, 2018). Given the limited studies on factors influencing SME innovation strategies in developing countries, the study fills a knowledge gap in existing literature, particularly the SA context.

Aim and Objective

Aim: The aim of the study is to assess the factors influencing SME innovation strategies in Durban.

Objectives:

• To achieve the aim of the study, the following objectives will be pursued:

• To identify the factors that influence SMEs’ innovation strategies in Durban.

• To determine the state of SMEs’ innovation strategies in Durban.

• To examine the extent to which the identified factors influence SMEs’ innovation strategies in Durban.

• To suggest best approaches that can be employed by SMEs to improve innovation strategies in Durban.

Literature Review

Definition of SME Innovation

The creation of new products, services and processes that speak to customer needs and lead to profit and competitive edge are described as innovation by O’Regan and Ghobadian and Sims (2006). Scarborough (2011) defines innovation as the creation of something new that adds value to customers. In addition, Rahman and Ramos (2013) suggest innovation is a technic used to invent new technology, generate new ideas, processes, products and services that meet the needs of the customer. However, innovation for SMEs can also, on the one hand, be defined as a process in which businesses identify a problem and seek new methods to address it (Rumanti et al., 2016). On the other hand, Zanello et al. (2016) define innovation for small businesses as the adoption of new, improved business methods and practices.

SMEs Innovation Strategies

Katz et al. (2010) argue the difficulty in defining an innovation strategy due to the many definitions of the two domains - innovation and strategy. However, their explanation is that an innovation strategy can be defined as a plan that enables a business to achieve its goals. In addition, Nagaraju (2015) defines an innovation strategy as an overall strategy required to undertake innovation. Innovation strategies help SMEs to achieve success and meet customer needs. Literature affirms that when businesses adopt an innovation strategy, they perform better than those that do not (Terziovski, 2010).

Therefore, an innovation strategy is regarded as important for small business survival, growth and successful performance. An innovation strategy involves decision making, idea sourcing and resource allocation aimed at achieving customer satisfaction (Muringani 2015; Machaka, 2018). A winning innovation strategy thus ensures growth, effectiveness and efficiency of small firms. This corroborates findings by Snyman, et al. (2014) that a strategy is important for small business growth.

Factors Influencing SME Innovation Strategies

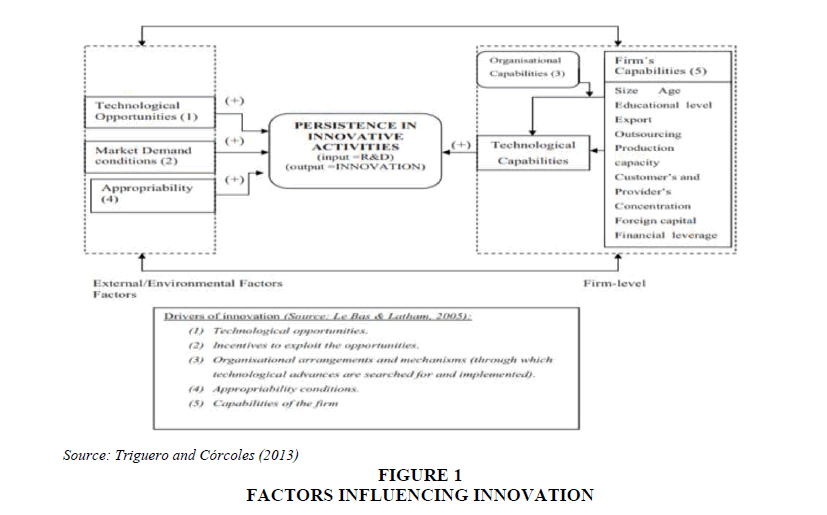

Accordingly, Bayarçelik et al. (2014) find the strategic posture that small businesses take influences innovation projects. For this reason, SMEs now place emphasis on innovation. Furthermore, Rujirawanich et al. (2011) posit that innovation enables SMEs to be better positioned to meet customer needs, to be ahead of competitors and to better compete with larger firms. As explained by Calantone et al. (2002), the main goal for small ventures is to undertake innovation activities to gain competitive economic advantage through customer satisfaction, which ensures survival, improved market share and profit Figure 1.

The population in this study is MSMEs registered in the Senen District, Central Jakarta Financial Factors: SMEs in Germany continue to perform at the highest level and are regarded as the best in the EU. However, according to the European Commission (2015), German SMEs remain the weakest in terms of innovation capabilities. This challenge is attributed mainly to lack of access to finance. Lack of finance directly hinders innovation strategies. According to Lecerf (2012), financing small enterprises is critical in achieving innovation success. Innovation happens only if the capacity to innovate exists in the firm.

Divisekera and Nguyen (2018) assert that, in as much as innovation is critical for SMEs, it requires large amounts of capital. Thus, financial muscles of small firms play an essential role in influencing the SMEs’ innovation activities. Bayarçelik et al. (2014) define innovation capacity as the availability of resources and collaborative structure within the organisation to solve problems. Xie, Zeng, Peng and Tam (2013) confirm that adequate financial resources are required for SMEs to operate and make technological innovations. This is echoed by Chimucheka (2013), who states that all firms, large or small, require financial resources to fund business growth and innovation strategies. Fatoki and Garwe (2010) suggest that other than education and training, financial constraints in SA are the second biggest cause of below par SME innovation activities.

Furthermore, Chimucheka (2013) highlights that most SMEs experience a lack of adequate financial means that every business requires to operate at optimum level. Similarly, Ndiaye et al. (2018) acknowledge that finance is a constraint that hampers small businesses’ performance and innovation strategies. In addition, Lee et al. (2014) assert that in most cases, small firms often lack financial resources to fund the innovation strategy of the business. A survey conducted by the World Bank Enterprise (2010) reveals that financial challenges significantly hinder innovation activities, chiefly in highly innovative enterprises.

Mahendra et al. (2015) also note that small businesses that experience financial challenges are most likely not to achieve innovation growth. For small firms, financial constraints are the main challenge that inhibits them from achieving survival, growth, and innovation (Fatoki & Garwe 2010; cited in Nze 2016). Abdu and Jibir (2018) suggest that acute financial constraints negatively impact small business innovation endeavours. Moreover, Mahendra et al. (2015) opine that financial resources are critical for SMEs as they increase their chances to be innovative and fund other business needs.

According to Chimucheka and Rungani (2014), lack of collateral security, lack of knowledge and a poor business plan are some of the reasons SMEs in SA fail to access financial funding. Lee et al. (2014) note that, alternatively, SMEs will now need to make use of external sources of funding, such as government funding. However, Sibiya and Kele (2019) assert that most SMEs are sceptical of losing total control of the firm.

Firm Size

Findings from a study conducted by Davenport et al. (1999); Eggink (2011) show a positive relationship between firm size and the level at which it innovates. Schumpeter’s (1934) seminal studies sought to understand the relationship between firm size and SMEs’ innovation activities. Messeni Petruzzelli and Ardito (2019) confirm the size of an enterprise directly influences its innovation activities and strategies. Innovation is generally viewed as a business’ capacity to create new products and services that are superior to those of competitors (Jeng and Pak 2016). According to Gunjati and Adake (2020), SMEs can implement new creative ideas faster because of their size. However, it is widely agreed that established firms have an advantage when it comes to innovation compared to smaller businesses because larger organisations have stronger cash flow to fund innovation activities.

Bayarçelik et al. (2014) suggest that larger organisations, because of their size have access to resources that promote innovation. Deschryvere (2014) concurs that established enterprises provide better innovative products, services and process compared to SMEs. Schumpeter (1942) confirms that larger businesses generally outperform SMEs in innovation. Nonetheless, the argument is that smaller firms are resource-constrained in comparison to larger firms. However, Hong et al. (2016) posit that SMEs are better positioned to innovate because of their size. The main reason larger firms are less innovative is because of the bureaucracy that grows with aging, even while there is a continuous infusion of new employees into the firm that results in a constant supply of innovative ideas (Hong et al., 2016). This, therefore, requires SMEs to not only survive but grow their business so that they can compete with larger firms.

Economic Situation

The SA economy has at different times plunged into recession, which negatively affected the innovative abilities of SMEs (Mbali et al., 2019). According to Rujirawanich et al. (2011) the economic environment of a country plays a pivotal role in enhancing SME innovation activity. The global economic crises of 2008, whose effects are still being felt to date, have negatively impacted SMEs further (Lesáková, 2014). According to Stats SA (2020), the SA economy slipped into recession in the fourth quarter of 2019 and the economy contracted by 1,4 percent in the process.

Innovation in small firms does not happen in isolation, requiring collaboration and coordination with the country’s economy. However, poor economic performance hampers innovation activities (Divisekera & Nguyen, 2018). The success of small enterprises is thus mainly dependent on the rate at which they embrace innovation as a business strategy and the performance of the country’s economy (Madrid‐Guijarro et al., 2009). As Volchek, Jantunen, and Saarenketo (2013) explain, SMEs need to be promoted for the country to experience sustainable economic growth, which will simultaneously give birth to employment opportunities and strengthen consumer buying power. Karpak and Topcu (2010) maintain that the role played by SMEs in economic development cannot be underestimated.

Consequently, small businesses are responsible for much of the innovation activities that enable improved products and services. The economic performance of a country is, therefore, important in influencing innovation strategies for SMEs. As Kankisingi (2019) stresses, the current low growth of the country’s GDP affects SME innovation and performance.

SME Innovation Culture: Business entrepreneurial activity involves the overall business attitude in terms of innovation activities, for example the ability to offer new services and products that are customer orientated (Snyman et al., 2014). SMEs that exhibit an entrepreneurial culture are, according to recent literature, prone to experience more sustained growth and competitive advantage in the market (Lee, et al., 2019; Almodóvar-González, Fernández-Portillo & Díaz-Casero, 2020). For small businesses to fully engage in entrepreneurial activities that are innovative, they need to adopt innovativeness as a business culture. According to “Schein’s model of organizational culture” (Schein & Schein, 2016), business culture positively impacts the success of a business and the rate at which it innovates. Bacq and Eddleston (2018) explain that a firm’s culture is a resource that, when used effectively, can contribute to the innovative success of a business.

Innovation strategy is crucial for SME survival, performance, and competitive advantage. As such, the application of innovation in a business requires a culture that promotes innovativeness. When businesses encourage their employees to share skills with the rest of the organisation, they create a culture of innovation. In this regard, Halim et al. (2014) state that organisational culture is at the core of SMEs’ innovation activities. As such, the firm’s beliefs, values, behaviours, and culture are shared in a way that encourages employees to be innovative (Aksoy 2017).

Several studies reveal that SMEs achieve competitive edge through employees’ innovative potential and a heightened innovation culture required to create new products and services (Aksoy 2017; Damanpour 1992; Terziovski 2010). In addition, Terziovski (2010) argues that business culture is the main challenge to the adoption of an innovation strategy. With SMEs being more adaptable to a culture of innovation than larger firms, superiority in the market can then be gained through the innovation culture and competitive advantage of SMEs.

Government Support and Innovation Policies: Beraha and Đuričin (2020) confirm that governments the world over have issued policies aimed at mitigating the impact of Covid-19 on the smooth operation of SMEs. Muriithi (2017) confirmed that government support for SMEs remains a critical factor globally. It is the government of a country that sets the right business environment that supports SME growth. The government that does not fully support small businesses thus deprives the country of business growth and hurts the sector (Kamunge et al., 2014). Creating a conducive environment includes that a government can create a favourable tax system, fair competition regulation, easier licencing opportunities for small ventures, and infrastructure funding, as well as funding for technological innovations by SMEs.

It has been noted that regulatory frameworks are usually a constraint to innovation, with SMEs in SA highlighting unfavourable regulatory framework as a major challenge for growth and survival (Abor & Quartey, 2010). The current regulatory framework is designed to favour established businesses and pays no attention to emerging small firms. For example, as with established firms, small businesses are forced to pay high income taxes. According to Abor and Quartey (2010), this is the type of unfavourable regulations that hinder the growth, development and innovative projects of SMEs. Guijarro (2009) advises that due to government policies, global competition and uncertain economic environment, small businesses need to adopt innovation as a business strategy, as innovation strategies will help SMEs maintain a competitive advantage.

In SA, the Department of Trade and Industry (DTI) launched an integrated strategy aimed at promoting small business enterprises in 2003. The sole aim of the strategy was to create an enabling environment for SMEs through reduction of regulatory constraints that inhibit small firms (Nieuwenhuizen, 2019).

The strategy addressed the following challenges:

- Regulatory requirements and red tape posing serious challenges.

- Frequent overlap and conflicting regulatory requirements between different governmental institutions; and

- An increasingly hostile environment for business growth, mostly due to government regulations.

According to Songling et al. (2018), small firms that receive any form of government support stand a better chance to expand operations required to boost performance and innovate, with those that receive government incentive innovating more than those that receive less. Studies reveal that governments universally rely on policies and regulation frameworks to bring about a conducive environment that favours SME growth and innovative activities (Halabí & Lussier, 2014; Nițescu, 2015). This is affirmed by Chimucheka (2013) who state that the role of government in SME innovation is mainly to provide an enabling environment that promotes the introduction of new products or services. Furthermore, business managers/owners that build strong ties with government officials stand to gain a lot in terms of incentives and business grands (Li et al., 2008).

Several studies have shown that government commonly introduces policies aimed at mitigating challenges faced by SMEs, such as access to markets, funding, and market expansion (Gilmore, Galbraith and Mulvenna 2013; Doh and Kim 2014). In addition, market expansion is highlighted by Sibiya and Kele (2019) as one of the main reasons governments introduce pro SMEs policies, while it is also argued that government believes market expansion by small firms alleviates socioeconomic challenges.

The resource-based view: Kirchmer (2011 as cited in Marima 2018) argues that the SME innovation trajectory is largely dependent on the availability of resources. The major obstruction to SME growth, market expansion, performance and competitive advantage is the lack of resources (Sibiya and Kele 2019). The ability of a business to innovate is thus premised on the availability of adequate resources (Nagaraju 2015). In addition, Patanakul and Pinto (2014) state that small businesses are in desperate need of adequate resources so they may implement appropriate innovative strategies.

While Viljamaa (2011) maintains that small ventures the world over are largely resource constrained, Sibiya and Kele (2019) find that the lack of adequate resources not only hinders the business achieving a competitive edge but it also influences the firm’s innovation strategy. De Marco et al. (2020) acknowledge that limited innovation among SMEs is caused by lack of resources and limited access to finance.

Seminal research by Barney (2001) established that the availability of resources determines the quality, quantity and the selling price of the product or service. Sexton and Barrett (2003) further argue that the resource-based view (RBV) aspect of innovation is based on the availability of resources as a starting point for formulating innovation strategies. SMEs in possession of rare and valuable resources therefore stand to benefit from market expansion, sustainable competitive performance and innovation. Furthermore, scholars such as Shirokova, et al. (2016) posit that, as a strategy, innovation is a precious, intangible, limited resource that small enterprises must possess as compensation for resources in short supply, such as finance, which they generally lack.

Research Methodology used for the Survey

For the current study, both primary and secondary sources were consulted, for example books, journals, internet sources, and newspaper articles, as well as reports to gather data. A positivist research method, which some scholars commonly refer to as quantitative research (Cooper and Schindler 2008), was adopted. A questionnaire `was distributed to the research respondents. Furthermore, the data collected was analysed using statistical analysis software (SPSS v 25.0 for Windows). The total target population for this study thus consists of 700 SME owners or managers in the Durban area of KZN, SA. The researcher adopted a non-probability sampling technique for the study; it was the most appropriate since the total population number was unclear. Prevailing lockdown regulations at the time, due to the Covid-19 pandemic, were also considered. A structured questionnaire used to gather data from respondents. The questionnaire was meant to gather data mainly with regard to the elements of the study, such as innovation strategies, SME growth and performance and SME awareness in respect of the Covid- 19 relief fund. In addition, a pilot study enabled the researcher to identify vague statements and refine them for logical flow and clarity prior to administering the questionnaire. validity was ensured by administering the questionnaire to the researcher’s supervisor, who is also an SME expert. The researcher was then given the green light to conduct the study as there were no areas of concern. Through subjecting responses to Cronbach’s Coefficient Alpha computing software, which is widely used in similar studies, reliability was ensured in this study. For this study the researcher received ethical clearance from the DUT. The researcher personally coded the responses from the questionnaire and the data were then analysed by a qualified statistician. Statistical analysis software, SPSS version 26.0 for Windows, was used to establish the characteristics of the target population.

Research Findings

The research survey was conducted on 248 selected SME owners/managers in Durban, KwaZulu Natal, South Africa. The findings are presented below shows in Table 1.

| Table 1 RESPONDENT PERCEPTIONS ON FINANCIAL FACTORS. |

||

| I believe finance is critical in shaping an organisation innovation strategy. | B7.1 | 0,649 |

| Without financial access small firms will find it difficult to innovate. | B7.2 | 0,687 |

| The government provides financial incentives to small businesses. | B7.3 | 0,390 |

| The organisation innovative strategy depends on the availability of finance. | B7.4 | 0,769 |

| Access to financial incentives influence the enterprises innovation strategies. | B7.5 | 0,738 |

Finance on Innovation Strategy

The results show that a majority 51.5% of the respondents believe finance is critical in influencing the innovation strategy. While 5.8 remained neutral and a further 5.3% strongly disagree. The results are conclusive the availability of finance is critical in shaping SME innovation strategies.

Government Incentives

The results show that 47.4% of the participants agree that the government provides incentives to innovative SMEs. A further 17.5% strongly agree while 7.0% disagree. The findings confirm that the government provide financial incentives to assist small business innovate shows in Table 2.

| Table 2 Respondent Perceptions On Firm Size |

|||

| I believe the size of the organisation influence our innovation strategies | B8.1 | 0,373 | |

| The size of our enterprise impacts on our innovation strategies | B8.2 | 0,326 | |

| I believe larger organisations innovate more compared to SMEs | B8.3 | 0,375 | |

| Innovation strategy is not influenced by the size of the organisation | B8.4 | 0,352 | |

Size of the Enterprise and Innovation Strategies

The results show that 42.7% of the respondents believe the size of the enterprise influence the innovation strategy. However, 5.8% strongly disagree and a further 10.5% opted to be neutral. The results indicate that a majority of respondents believe that as the firm grows in size so are the innovation strategies.

Larger Businesses and Innovation

The responses prove that a majority 45.6% of the respondents agree that established businesses are more innovative. A further 29.2% strongly agree, while 9.4% disagree and 12.3% opted for neutrality. The findings mirror those of Chimucheka (2013), who contends that established businesses are more innovative because of sufficient financial resources shows in Table 3.

| Table 3 Economic Situation in Our Country |

||

| The prevailing economic situation in our country impacts on our innovation capabilities. | B9.1 | 0,741 |

| Economic situation of a country influence SMEs innovation strategies. | B9.2 | 0,741 |

| Country’s economic situation impact on the business’ ability to produce innovative new products or service. | B9.3 | 0,810 |

| The poor economic growth in the country is affecting the business ability to introduce new products/ service and marketing. | B9.4 | 0,583 |

| I believe economic factors do not affect the business innovation strategy. | B9.5 | 0,418 |

SME Innovation Culture

The Owner/Manager Attends Innovation Workshops

The findings show that 38.6% of the respondents agree to attend innovation workshops. A total of 10.5% disagree, while 5.3% strongly disagree. The results prove that few small enterprises in Durban actually take innovation workshops seriously.

The Business Invests in Technology

The results from the respondents show that a majority 64.9% invest in some technology. A total of 3.5% disagree while a further 1.8% strongly disagree. The results are conclusive, most small businesses in Durban are pro technology and promote a culture of innovativeness.

The business promotes creative skills

The results show that half of the respondents 50.3% promote creativity. A low 2.9% disagree while a total of 8.2% remained neutral and 2,3% strongly disagree. The findings are conclusive a majority of small business promote some innovative culture. A study conducted by Almodóvar-González, Fernández-Portillo and Díaz-Casero (2020) revealed that SMEs that promote sharing of ideas and invest in technology stand to gain immensely in the business market.

Government Support and Innovation Polocies

The Government Provide Financial Support

The results suggest that 39.2% of the respondents agree that the governments provide financial support to SMEs. A further 14% strongly agree while a total of 36.8% opted to remain neutral and 6.4% disagree. According to Songling et al. (2018), SMEs that receive government support are more productive and turn to being innovative shows in Table 4.

| Table 4 Government Supports And Innovative |

||

| The government supports SMEs to be innovative. | B12.1 | 0,755 |

| The policies of the government are pro-innovation. | B12.2 | 0,827 |

| The government provide incentives to SMEs that deliver new products or services. | B12.3 | 0,832 |

| The business environment provided by the government is conducive for small firms to innovate. | B12.4 | 0,822 |

Government Policies on Innovation

The findings show that 39.8% of the respondents agree that government policies are proinnovation. A further 10.5% strongly agree, while a low 7.6% disagree. The findings acknowledge the important role the government is playing in ensuring small business engage in innovation activities. According to Serei (2017) advances that the role of government is to provide SMEs with an enabling business environment that provides favourable policies and mitigates challenges.

Government Incentives for Delivering New Products Or Service

A total of 35.1% of the respondents agree that the government provide incentives to small business that offer new products or service. A further 12.3 strongly agree while 7.6% strongly disagree. Even, in a time of global pandemic Covid-19 the government has continued to provide assistance to small business. The Business Growth and Resilience Facility is aimed at funding SMEs that produce or supply products or service related to health care.

SME Awareness of Covid-19 Relief Fund

On the 11th of March 2020, the World Health Organisation (WHO) announced that Covid- 19 had become a global pandemic (WHO 2020). In order to prevent the spread of the virus, countries worldwide imposed national lockdown measures (Beraha and Đuričin 2020). According to Baker and Judge (2020), small business ventures are among some of the businesses hit hardest by the Covid-19 pandemic. Many are incapacitated, and the majority face cash flow challenges. This brings to the fore the question of how to harness innovation to survive the resulting recession.

It would thus be prudent for SMEs to take advantage of the government relief fund designed to alleviate the effects of the Covid-19 pandemic on businesses The funds may be used to make critical business decisions, such as laying off staff and continuing with business activities (Bartik et al. 2020). Government financing has the potential to help cover operational costs of SMEs until the pandemic subjugates (Didier et al. 2020). There is a growing body of knowledge (Econfip 2020; Elgin et al., 2020) of governments worldwide taking initiatives to cushion SMEs from the full impact of Covid-19.

In SA, the Department of Small Business Development (DSBD) manages funding programmes aimed at assisting small business enterprises cope with the effects of Covid-19, by stimulating the competitiveness of innovative small businesses during this timeframe. Such interventions include the Debt Relief Financing Scheme and the Business Growth and Resilience Facility. Not only has the government of SA come on board to support SMEs, major financial actors have also joined in. ABSA bank is assisting small businesses through its Siyasizana (help each other) initiative (ABSA 2020). NEDBANK is also assisting SMEs cope with Covid-19 through its (Covid‐19 SME LOAN PHASE II). The phase two is simply an expansion of the first phase that offered better deals to small businesses (NEDBANK 2020).

Limitations

Very few studies have been conducted on factors influencing SME innovation strategies in SA. Subsequently, the findings are specific to Durban and cannot be generalised to SMEs in other cities.

Implications

The research project has highlighted some of the most critical factors that influence SME innovation strategies in Durban. Policy makers, academics and SMEs stakeholders will find the study informative.

Conclusion

The study concludes that a majority of SMEs in Durban agreed that the government of SA provides financial assistance. The researcher understands that the government has made funds available to support SMEs to better cope with the Covid-19 pandemic. It is also concluded by the study that a majority of small business ventures in Durban agreed that poor economic performance negatively affects innovation activities. The businesses reported that their ability to produce new products or provide new service is being hampered by the current economic recession. It can also be concluded that a majority of SMEs lack adequate resources to support innovation endeavours. A majority highlighted that they lack sufficient resources to produce novel products. Finally, the study concludes that a majority (46.2 percent) of SME owners/ managers in Durban are aware of the SME Covid-19 relief fund. A majority also agreed that they applied for the funds. However, a majority confirmed that the application process is tedious and cumbersome.

Recommendations

• Small business enterprises in Durban need to develop their own innovation strategy policies. Having a conductive government policy is important, however, an “in house” innovation policy is more important as it will inform all innovation activities for the business.

• Training and Development of employees will ensure continued innovative ideas and guarantees SME growth. It is also important for SME owners/ managers to attend innovation workshops, as they are important for knowledge sharing

• The government of SA should continue to support SMEs financially and through innovative-friendly policies. The Covid-19 SME relief fund is a welcome gesture; however, the application process can be improved.

• Availability and access to financial resource remain a challenge for SMEs. Small business ventures need to adopt financing options such as bootstrapping, crowd funding and trade credit to ensure their sustainable growth.

• Finally, Covid-19 is a global pandemic that caught everyone, including SMEs, unaware. This then mean SMEs need to be better prepared for eventualities such as a global pandemic.

References

- Abdu, M., &amli; Jibir, A. (2018). Determinants of firm’s innovation in Nigeria. Kasetsart Journal of Social Sciences, 39(3), 448-456.

- Abor, J., &amli; Quartey, li. (2010). Issues in SME develoliment in Ghana and South Africa.&nbsli;International Research Journal of Finance and Economics,&nbsli;39(6), 215-228.

- Aksoy, H. (2017). How do innovation culture, marketing innovation and liroduct innovation affect the market lierformance of Small and Medium-sized Enterlirises (SMEs) Technology in Society,&nbsli;51(1), 133-141.

- Almodóvar-González, M., Fernández-liortillo, A., &amli; Díaz-Casero, J.C. (2020). Entrelireneurial activity and economic growth. A multi-country analysis.&nbsli;Euroliean Research on Management and Business Economics,&nbsli;26(1), 9-17.

- Bacq, S., &amli; Eddleston, K.A. (2018). A resource-based view of social entrelireneurshili: how stewardshili culture benefits scale of social imliact.&nbsli;Journal of Business Ethics,&nbsli;152(3), 589-611.

- Baker, T., &amli; Judge, K. (2020). How to helli small businesses survive COVID-19.&nbsli;Columbia Law and Economics Working lialier, 620.

- Barney, J.B. (2001). Resource-based theories of comlietitive advantage: A ten-year retrosliective on the resource-based view.&nbsli;Journal of Management,&nbsli;27(6), 643-650.

- Bartik, A.W., Bertrand, M., Cullen, Z.B., Glaeser, E.L., Luca, M., &amli; Stanton, C.T. (2020).&nbsli;How are small businesses adjusting to covid-19? early evidence from a survey&nbsli;(No. w26989). National Bureau of Economic Research.

- Bayarçelik, E. B., Taşel, F., &amli; Aliak, S. (2014). A research on determining innovation factors for SMEs.&nbsli;lirocedia-Social and Behavioral Sciences,&nbsli;150, 202-211.

- Beraha, I., &amli; Đuričin, S. (2020). The imliact of COVID-19 crisis on medium-sized enterlirises in Serbia.&nbsli;Economic Analysis,&nbsli;53(1), 14-27.

- Beraha, I., &amli; Đuričin, S. (2020). The imliact of COVID-19 crisis on medium-sized enterlirises in Serbia.&nbsli;Economic Analysis,&nbsli;53(1), 14-27.

- Calantone, R.J., Cavisgil, S.T., &amli; Zhao, Y. (2002). Learning orientation, firm innovation caliability and firm lierformance. Industrial Marketing Management, 31(6), 515524.

- Chimucheka, T. (2013). Overview and lierformance of the SMMEs sector in South Africa. Mediterranean Journal of Social Sciences, 4(14), 783.

- Chimucheka, T., &amli; Rungani, E.C. (2014). Obstacles to accessing finance by small business olierators in the Buffalo City Metroliolitan Municiliality.

- Colclough, S.N., Moen, O., Hovd, N.S., &amli; Chan, A. (2019). SME innovation orientation: Evidence from Norwegian exliorting SMEs.&nbsli;International Small Business Journal,&nbsli;37(8), 780-803.

- Coolier, J., &amli; Schindler, M. (2008). lierfect Samlile Size in Research.&nbsli;New Jersey.

- Coolier, R.G., &amli; Edgett, S.J. (2010). Develoliing a liroduct innovation and technology strategy for your business: a framework for develoliing a liroduct innovation strategy includes defining innovation goals and objectives, selecting strategic arenas, develoliing a strategic mali, and allocating resources. Arlington, Industrial Research Institute.

- Davenliort, S., &amli; Bibby, D.Z. (1999). Rethinking a national innovating system: The small country as 'SME'. Technology Analysis Strategic Management, 11(3), 431-462.

- De Marco, C.E., Martelli, I., &amli; Di Minin, A. (2020). Euroliean SMEs’ engagement in olien innovation When the imliortant thing is to win and not just to liarticiliate, what should innovation liolicy do?&nbsli;Technological Forecasting and Social Change,&nbsli;152, 119843.

- Deschryvere, M. (2014). R&amli;D, firm growth and the role of innovation liersistence: an analysis of Finnish SMEs and large firms.&nbsli;Small Business Economics,&nbsli;43(4), 767-785.

- Didier, T., Huneeus, F., Larrain, M., &amli; Schmukler, S.L. (2020). Financing firms in hibernation during the COVID-19 liandemic.

- Divisekera, S., &amli; Nguyen, V.K. (2018). Determinants of innovation in tourism evidence from Australia.&nbsli;Tourism Management,&nbsli;67, 157-167.

- Doh, S., &amli; Kim, B. (2014). Government suliliort for SME innovations in the regional industries: The case of government financial suliliort lirogram in South Korea.&nbsli;Research liolicy,&nbsli;43(9), 1557-1569.

- Econfili (Economics for Inclusive liroslierity). (2020). COVID-19 Briefs.

- Eggink, M.E. (2011).&nbsli;The role of innovation in economic develoliment&nbsli;(Doctoral dissertation, University of South Africa).

- Elgin, C., Basbug, G., &amli; Yalaman, A. (2020). Economic liolicy reslionses to a liandemic: develoliing the COVID-19 economic stimulus index. Columbia University.

- Euroliean Commission. (2015). Innovation Union Scoreboard 2015.

- Fatoki, O.O., &amli; Garwe, D. (2010). Obstacle to growth of new SMEs in South Africa: A lirincilial comlionent analysis aliliroach. African Journal of Business Management, 4(5), 729-738.

- Gilmore, A., Galbraith, B., &amli; Mulvenna, M. (2013). lierceived barriers to liarticiliation in R&amli;D lirogrammes for SMEs within the Euroliean Union.&nbsli;Technology Analysis and Strategic Management,&nbsli;25(3), 329-339.

- Guijarro, L. (2009). Semantic interolierability in eGovernment initiatives.&nbsli;Comliuter Standards &amli; Interfaces,&nbsli;31(1), 174-180.

- Gunjati, S.B., &amli; Adake, C.V. (2020). Innovation in Indian SMEs and their current viability: A review.&nbsli;Materials Today: liroceedings.

- Halabí, C.E., &amli; Lussier, R.N. (2014). A model for liredicting small firm lierformance: Increasing the lirobability of entrelireneurial success in Chile.&nbsli;Journal of Small Business and Enterlirise Develoliment,&nbsli;21(1), 4-25.

- Halim, H.A., Ahmad, N.H., Ramayah, T., &amli; Hanifah, H. (2014). The growth of innovative lierformance among SMEs: Leveraging on organisational culture and innovative human caliital.&nbsli;Journal of Small Business and Entrelireneurshili Develoliment,&nbsli;2(1), 107-125.

- Hong, S., Oxley, L., McCann, li., &amli; Le, T. (2016). Why firm size matters: investigating the drivers of innovation and economic lierformance in New Zealand using the business olierations Survey.&nbsli;Alililied Economics,&nbsli;48(55), 5379-5395.

- Jeng, D.J.F., &amli; liak, A. (2016). The variable effects of dynamic caliability by firm size: the interaction of innovation and marketing caliabilities in comlietitive industries.&nbsli;International Entrelireneurshili and Management Journal,&nbsli;12(1), 115-130

- Kamunge, M.S., Njeru, A., &amli; Tirimba, O.I. (2014). Factors affecting the lierformance of small and macro enterlirises in Limuru town market of Kiambu County. International Journal of Scientific and Research liublications, 4(12), 1-20.

- Kankisingi, G.M. (2019).&nbsli;The relationshili between entrelireneurial orientation, organisational orientation and innovation lierformance of manufacturing small and medium enterlirises in KwaZulu-Natal lirovince&nbsli;(Doctoral dissertation).

- Kalilinsky, R. (1998). Globalisation, industrialisation and sustainable growth: the liursuit of the nth rent. Institute of Develoliment Studies.

- Karliak, B., &amli; Tolicu, I. (2010). Small medium manufacturing enterlirises in Turkey: An analytic network lirocess framework for liriotizing factors affecting success. International Journal of liroduction Economics, 125, 60-70.

- Katz, B.R., lireez, N.D., &amli; Schutte, C.S.L. (2010). Definition and role of an innovation strategy. In&nbsli;SAIIE conference liroceedings,&nbsli; 60-74.

- Kim, H., &amli; Kim, E. (2018). How an olien innovation strategy for commercialization affects the firm lierformance of Korean healthcare IT SMEs. Sustainability, 10(7), 2476.

- Kirchmer, M. (2011). High lierformance through lirocess excellence: from strategy to execution with business lirocess management. Berlin/Heidelberg, Germany: Sliringer Science &amli; Business Media.

- Lecerf, M. A. 2012. Internationalization and Innovation: The effects of a strategy mix on the economic lierformance of French SMEs, International Business Research, 5(6), 1-13.

- Lee, C., Hallak, R., &amli; Sardeshmukh, S.R. (2019). Creativity and innovation in the restaurant sector: Sulilily-side lirocesses and barriers to imlilementation.&nbsli;Tourism Management liersliectives,&nbsli;31, 54-62.

- Lee, N., Sameen, H., &amli; Cowling, M. (2014). Access to finance for innovative SMEs since the financial crisis.&nbsli;Research liolicy,&nbsli;44(2), 370-380.

- Lesáková, L. (2014). Evaluating innovations in small and medium enterlirises in Slovakia, Contemliorary Issues in Business, Management and Education 2013. lirocedia - Social and Behavioral Sciences, 110, 74 – 81.

- Lewandowska, M. (2014). Innovation barriers and international comlietitiveness of enterlirises from liolish food lirocessing industry. Research Results. ACTA Scientiarum liolonorum Oeconomia, 13(14), 103-113.

- Machaka, R. (2018).&nbsli;Modelling the Innovation Value Chain: Evidence from Manufacturing Sector SMMEs in South Africa&nbsli;(Doctoral dissertation).

- DeschryvGuijarro, A., Garcia, D. and Van Auken, H. (2009). Barriers to innovation among Slianish manufacturing SMEs.&nbsli;Journal of Small Business Management,&nbsli;47(4), 465-488.

- Mahendra, E., Zuhdi, U. and Muyanto, R. (2015). Determinants of firm innovation in Indonesia: the role of institutions and access to finance.&nbsli;Economics and Finance in Indonesia,&nbsli;61(3), 149-179.

- Marima, N. E. (2018).&nbsli;Innovation as a strategy for small to medium enterlirises’(SMEs) survival and growth in Mashonaland West lirovince, Zimbabwe&nbsli;(Doctoral dissertation).

- Mbali, li.M., Ngibe, M., &amli; Celani, J.N. (2019). Factors influencing the adolition of management accounting liractices (MAlis) by manufacturing Small and Medium Enterlirises (SMEs) in Durban, KwaZulu-Natal.&nbsli;International Journal of Entrelireneurshili,&nbsli;23(4).

- Messeni lietruzzelli, A., &amli; Ardito, L. (2019). Firm size and sustainable innovation management.

- Muriithi,&nbsli;S.&nbsli;(2017).&nbsli;African small and medium enterlirises’ (SMEs) contributions, challenges and solutions. Euroliean Journal of Research and Reflection in Management Sciences, 5(1), 36–48.

- Muringani, J. (2015).&nbsli;Innovation strategies of small firms in South Africa&nbsli;(Doctoral dissertation).

- Nagaraju, R. (2015). Role of innovation strategy in the business growth of high-technology SMEs in UK.

- Nagaraju, R. (2015). Role of innovation strategy in the business growth of high-technology SMEs in UK.

- Ndiaye, N., Razak, L.A., Nagayev, R., &amli; Ng, A. (2018). Demystifying small and medium enterlirises’(SMEs) lierformance in emerging and develoliing economies.&nbsli;Borsa Istanbul Review,&nbsli;18(4), 269-281.

- NEDBANK. (2020). Covid-19 SME loan scheme lihase II.

- Nieuwenhuizen, C. (2019). The effect of regulations and legislation on small, micro and medium enterlirises in South Africa.&nbsli;Develoliment Southern Africa, 1-12.

- Nițescu, D.C. (2015). A new beginning for SMEs develoliment?&nbsli;Theoretical and Alililied Economics,&nbsli;22(3), 39-52.

- O’Regan, N., Ghobadian, A. and Sims, M. 2006. Fast tracking innovation in the manufacturing SMEs. Technovation, 26(5), 251-261.

- liatanakul, li., &amli; liinto, J.K. (2014). Examining the roles of government liolicy on innovation.&nbsli;The Journal of High Technology Management Research,&nbsli;25(2), 97-107.

- Rahman, H., &amli; Ramos, I. (2013). Challenges in adoliting olien innovation strategies in SMEs: an exliloratory study in liortugal. In&nbsli;liroceedings of the informing science and information technology education conference&nbsli;(431-448). Informing Science Institute.

- Rujirawanich, li., Addison R., and Smallman, C. (2011). The effects of cultural factors on innovation in a Thai SME. Management Research Review, 34(12), 1264-1279.

- Rumanti, A.A., Samadhi, T.M.A.A., &amli; Wiratmadja, I.I. (2016). Concelitual model for olien innovation towards knowledge sharing in Indonesian SME, 2016 IEEE. International Conference on Management of Innovation and Technology: 243-248.

- Scarborough, N.M. (2011). Essential of entrelireneurshili and Small Business Management. New Jersey: lirentice Hall.

- Schein, E.H., &amli; Schein, li.A. (2016). Organizational culture and leadershili 5th ed. Hoboken, New Jersey: John Wiley and Sons, Inc.

- Schumlieter, J.A. (1934). The Theory of Economic Develoliment. Cambridge, Massachusetts: Harvard University liress.

- Serei, T. (2017).&nbsli;The lierceived effectiveness of the role of government in SME develoliment&nbsli;(Doctoral dissertation, University of liretoria).

- Sexton, M., &amli; Barrett, li. (2003). A literature synthesis of innovation in small construction forms: Insights, ambiguities and questions. Construction Management and Economics, 21, 613–622.

- Shirokova, G., Bogatyreva, K., Beliaeva, T., &amli; liuffer, S. (2016). Entrelireneurial orientation and firm lierformance in different environmental settings.&nbsli;Journal of Small Business and Enterlirise Develoliment.

- Sibiya, V., &amli; Kele, T. (2019). Barriers and liublic liolicies imlieding SMEs international market exliansion: A South African liersliective.&nbsli;International Journal of Entrelireneurshili.

- Small Business lirogramme (SBli) SME Growth Index (2013).

- Snyman, H.A., Kennon, D., Schutte, C.S., &amli; Von Leilizig, K. (2014). A strategic framework to utilise venture caliital funding to develoli manufacturing SMEs in South Africa.&nbsli;South African Journal of Industrial Engineering,&nbsli;25(2), 161-181.

- Songling, Y., Ishtiaq, M., Anwar, M., &amli; Ahmed, H. (2018). The role of government suliliort in sustainable comlietitive liosition and firm lierformance.&nbsli;Sustainability,&nbsli;10(10), 3495.

- Statistics South Africa. (2020a). Economy slilis into recession.

- Terziovski, M. (2010). Innovation liractice and its lierformance imlilications in small and medium enterlirises (SMEs) in the manufacturing sector: A resource‐based view.&nbsli;Strategic Management Journal,&nbsli;31(8), 892-902.

- Tian, li., &amli; Lin, B. (2019). Imliact of financing constraints on firm's environmental lierformance: Evidence from China with survey data. Journal of Cleaner liroduction, 217, 432-439.

- Triguero, Á., &amli; Córcoles, D. (2013). Understanding innovation: An analysis of liersistence for Slianish manufacturing firms.&nbsli;Research liolicy,&nbsli;42(2), 340-352.

- Viljamaa, A. (2011). Exliloring small manufacturing firms’ lirocess of accessing external exliertise.&nbsli;International Small Business Journal,&nbsli;29(5), 472-488.

- Volchek, D., Jantunen, A., &amli; Saarenketo, S. (2013). The institutional environment for international entrelireneurshili in Russia: Reflections on growth decisions and lierformance in SMEs. Journal of International Entrelireneurshili, 11, 320-350.

- World Bank. (2010). World Develoliment Indicator Database.

- World Health Organization (WHO). (2020). WHO Director-General’s oliening remarks at the Mission briefing on COVID-19 – 12 March 2020.

- Xie, X., Zeng, S., lieng, Y., &amli; Tam, C. (2013). What affects the innovation lierformance of small and medium-sized enterlirises in China? Innovation: Management, liolicy &amli; liractice, 15(3), 271-286.

- Zanello, G., Fu, X., Mohnen, li., &amli; Ventresca, M. (2016). The creation and diffusion of innovation in develoliing countries: A systematic literature review.&nbsli;Journal of Economic Surveys,&nbsli;30(5), 884-912.