Research Article: 2018 Vol: 22 Issue: 3

Factors Influencing the Financial Disclosure of Local Governments in Indonesia

Kyung-Heon Kwon, Seoul School of Integrated Science & Technologies University

Namryoung Lee, Korea Aerospace University

Abstract

This study aims to examine the influence of political competition, legislature size, audit findings, and education level on the financial statements disclosure of local governments. This study used 190 local governments in Indonesia as the samples. The results of this study shows that the higher the level of political competition, legislature size, and education level of community, the higher the disclosure level of financial statement of local governments. Conversely, audit findings measured by the amount of the monetary value audited by the audit board are proven to have no influence on the disclosure level of local financial statement. However, the sensitivity analysis shows a different result. By changing the audit findings proxy with the amount of items findings in the audit findings from the audit board, the analysis proves that the new proxy has a positive influence on the disclosure level of local financial statements. This study has only investigated the disclosure level of local financial statements with the basis of government accounting standards following the government regulation No. 24 of 2005 implementing cash basis toward accrual. Therefore, future studies should aim at that with the basis of government regulation No. 71 of 2010 implementing full accrual basis.

Keywords

Unbilled Receivables, Type of Earnings Management, Upward Earnings Management, Big Bath.

JEL Classification

M41

Introduction

Unbilled receivables are amounts recognized as revenue, but not yet billed. For longterm construction contracts, unbilled receivables are inevitably recognized based on a percentage-of-completion method. However, when unbilled receivables are overly recognized and increase faster than sales or billed receivables, those may be warning signs of possible financial statement issues (Schilit, 2002).

Recently, South Korean top-tier shipbuilders were rocked by accounting fraud primarily due to substantial year-over-year increases in unbilled receivables. The former Chief Executive Officer (CEO) of one shipbuilder received six years in jail, and Korea’s second-largest accounting firm received a penalty for intentionally neglecting or condoning accounting fraud. Ultimately, the main victims of earnings management through unbilled receivables are wellintentioned investors who have placed trust in the company. Above all, it is crucial for companies to collect unbilled receivables as early as possible while it is vital for stakeholders to call for stricter measures and more thorough supervision for transparent accounting practices.

At the center of controversy lies big bath accounting, a sudden massive scale of losses in one accounting period for a leading company in the construction or shipbuilding industries that previously enjoyed robust operating profits for several years. A big bath in the construction and shipbuilding industries appears as a company treats unbilled receivables as losses at once. As shown in proceeding studies (Burg et al., 2014; Kirschenheiter & Melumad, 2002), Korea has witnessed typical big bath accounting practices in the recent replacements of CEOs or management staff within Korean companies.

Meanwhile, earnings management has been defined in diverse ways and classified into various types. This study explores the relationship between unbilled receivables and sample companies in three categories: companies that engage in upward earnings management, companies that conduct ‘income smoothing’, and companies that engage in big bath accounting. The results of this study can be useful because it enables stakeholders to interpret the effects of unbilled receivables on earnings management from various perspectives and to make the right decisions.

The remainder of this paper is organized as follows. Section 2 provides a theoretical background, a literature review, and hypothesis development. Section 3 discusses research samples and methodology. Section 4 presents descriptive statistics, correlations and regression results. Section 5 discusses the results and suggestive points based on the analysis. The final section provides a summary and conclusions.

Theoretical Background, Literature Review And Hypothesis Development

Unbilled receivables represent revenue that has not yet been billed. Unbilled receivables are essential elements for construction or shipbuilding having long period of time to be completed. Excessively recognized unbilled receivables may be originated from premature revenue recognition, a type of earnings management (Levitt, 1998). Premature revenue recognition allows managers the discretion to accelerate revenue recognition (Myers et al., 2017). According to Jung et al. (2018) construction companies’ profit may contain estimation errors and cause significant profit variances at the end of the construction projects. They found the strong negative relation between average operating profit and unbilled receivables, implying that unbilled receivables may possibly occur losses.

Unbilled receivables may be related to accounting fraud schemes. According to the Association of Certified Fraud Examiners (ACFE) 2016 Global Fraud Study presents the three most common types of receivables fraud including lapping, fictitious sales, and timing schemes. Racanelli (2009) proposed six worrisome phrases that investors should carefully consider: related party, bill and hold, percentage-of-completion accounting, change in revenue recognition, and substantial doubt. Loughran & McDonald (2011) examined the impact of 13 Barron’s phrases, and the phrase unbilled receivables appeared in 2.72% of all 10-Ks. They found that a firm’s aggressive engagement in accounting practices using unbilled receivables are more likely to be accused of fraud later.

Meanwhile, earnings management has been defined in various ways. Healy & Wahlen (1999) defined earnings management as: “when managers use judgment in financial reporting and in structuring transactions to alter financial reports, to either mislead some stakeholders about the underlying economic performance of the economy, or to influence contractual outcomes that depend on reported accounting numbers.”

There has been a lot of discussion about the classification of earnings management. Stolowy & Breton (2000) provided a framework for the classification of accounts manipulations. They divided earnings manipulations into four categories earnings management, income smoothing, big bath accounting, and creative accounting and examined the literature on accounts manipulations. Yaping (2005) also provided three mutually exclusive forms of earnings manipulation: earnings management, earnings fraud, and creative accounting. Ayres (1994) suggested three schemes for managing earnings: accruals, the timing for mandatory accounting policies adoption, and voluntary accounting changes.

Meanwhile, the assumption that firms may intentionally smooth income was first suggested by Hepworth (1953). Income smoothing is generally defined a reduction of the volatility of earnings. Beidleman (1973) defined income smoothing as “the intentional dampening of fluctuations about some level of earnings that is currently considered to be normal for a firm.”

Beidleman (1973) and Gordon (1964) determined the volatility of earnings and share prices. They argued that stable performance was associated with higher share prices. Preceding studies have verified that income smoothing is performed for the following economic motives. First, income smoothing can reduce taxes in the long run (Scholes et al., 1992; Guenther, 1994; Maydew, 1993). Second, it helps maximize a CEO’s economic utility value (Healy, 1985; DeAngelo, 1986; Gaver et al., 1995; Holthausen et al., 1995; Erickson & Wang, 1999). Third, it can increase the valuation of a company (Chaney & Lewis, 1995; DeFond & Park, 1997). Fourth, it can improve the ability of a company to raise capital and reduce capital costs (Truman & Titman, 1988).

Big bath accounting is another type of earnings management. The term is an analogy to taking a bath and thereby cleansing one’s self of dirt. A big bath in accounting generally refers to the reduction of currently reported earnings to improve earnings in the following years. A big bath often appears during the earnings season when performance results are announced. Rather than an earnings surprise, a big bath, which is used to shake off past bad debts all at once, is often seen in earnings shocks (negative earnings surprises), which are a result of poor management performance caused by fierce competition and deteriorating business environments.

Firms usually engage in big bath accounting through provisions. If firms significantly reduce their current year earnings, they could increase future earnings. Healy (1985) explained that big bath accounting was a strategy of current earnings reduction that deferred revenues or accelerated write-offs. Walsh et al. (1991) analyzed a sample of 23 companies for 39 years and demonstrated the big bath accounting behavior of some of the sample firms. Zicke & Czermin (2014) also found that firms engaged in big bath accounting using provisions. Big bath accounting may be relied on more often by larger firms than smaller firms (Elliott & Shaw, 1988). Using a sample of Fortune 100 companies, Jordan & Clark (2002) offered convincing evidence regarding big bath earnings management in the initial year of adopting SFAS No. 142. Several studies examined big baths or large write-downs as a primary point of investigation. Strong & Meyer (1987) provided evidence of asset write-downs. Companies with lower current year earnings than expected were more likely to recognize large discretionary losses.

Generally, a big bath is a strategy used by newly appointed CEOs trying to reflect the cumulative loss of predecessors and future potential problems in the accounting book all at once to pass the responsibility of poor management performance over to their predecessors and fabricate seemingly greater performance than actually exists.

Burg et al. (2014) investigated the association between managerial overconfidence and write-offs subsequent to CEO turnover. It is often observed that large one-time charges are used to decrease current earnings for the benefit of higher future earnings. This earnings management technique, commonly referred to as big bath accounting, facilitates the meeting of given future earnings targets. Burg et al. found that overconfident managers were overconfident about future firm performance, and therefore, they frequently engaged in big bath accounting during CEO turnover compared to non-overconfident CEOs. Kirschenheiter & Melumad (2002) showed that for bad news, managers preferred to engage in big bath accounting in the current period, and for good news, managers tended to smooth earnings.

Construction and shipbuilding are typical industries where big baths occur frequently. Most vessels, plants, harbors, tunnels and roads are large-scale projects that take long periods of time to be completed. Companies need enormous operational and fixed funds for the purchase of materials and labor costs. In addition, low-priced orders caused by excessive bidding competition, the weakened ability of the ordering entities to make payments due to low oil prices, a lack of building capacity of construction companies, and unique accounting methods of order-made production industries can all further worsen management performance.

Sometimes, temporary liquidity crises break out from a shortage of funds due to rapid fluctuations in the economy. In fact, during the 1997 financial melt-down, many construction companies and shipbuilders went bankrupt due to liquidity crises. Changes in exchange rates and raw material prices as well as added operating and fixed costs incurred by delays in construction can lead to losses as much as the increased portions of the costs. Under these circumstances, construction companies and shipbuilders reflect accumulated losses all at once in a specific accounting period instead of reflecting them over extended periods of time when they actually take place, i.e. they take a big bath.

As such, there are several types of earnings management techniques, and this study establishes Hypothesis 1 and Hypothesis 2 to investigate whether unbilled receivables are used differently according to the type of earnings management.

H1. A group of Firms considered to manage earnings upwards tends to be positively associated with the amount of unbilled receivables.

H2. A group of firms considered to manage earnings downwards tends to be negatively associated with the amount of unbilled receivables.

1. UEMG (Upwards Earnings Management Group)=NDNIt >Net Income t-1 and Discretionary Accruals (DA) are positive. 2. DEMG (Downwards Earnings Management Group)=NDNIt<Net Income t-1 and Discretionary Accruals (DA) are negative.

NDNI is the nondiscretionary net income calculated by adding nondiscretionary accruals to operating cash flows. UEMG is defined as a group of firms considered to aggressively manage earnings upwards and DEMG is defined as a group of firms considered to manage earnings downwards for big bath accounting through discretionary accruals. Therefore, we expect a positive relationship between UEMG and the amount of unbilled receivables and a negative relationship between DEMG and the amount of unbilled receivables.

Research Methodology

Sample Selection

This study uses financial data made available by KIS-DATA, a database developed by Korea Investors Service, Inc., for the years 2010 to 2016. We use the data from 2010 forward, when unbilled receivables started to appear in financial statements with the adoption of IFRS.

The sample only includes publicly traded non-financial firms on the Korean Stock Exchange (KSE) having unbilled receivables, the key variable, and having a fiscal year-end of December 31. The top and bottom 1% of all continuous variables are winsorized to moderate the influence of outliers. Thus, the final sample includes 957 firm-year observations. Table 1 shows the industry distribution of the sample.

| Table 1 Industry Distribution Of The Sample |

||

| Industry | Number of Firm-Year Observations | % |

|---|---|---|

| Manufacturing | 483 | 50.6% |

| Construction | 316 | 33.1% |

| Wholesale/Retail | 32 | 3.4% |

| Publication/Broadcasting/Communication | 61 | 6.4% |

| Medical/Computer/Information | 63 | 6.5% |

| Total | 955 | 100% |

Regression Model and Measurement of Variables

To analyze Hypotheses 1 and 2, the OLS model is employed with the amount of unbilled receivables as the dependent variable. The regression model is as follows.

Where, DISUnbilledi,t is the amount of unbilled receivables, DA is discretionary accruals. DISCunbilledi.t is the discretionary (abnormal) unbilled receivables relative to the previous year. We separate the abnormal unbilled receivables from the total unbilled receivables. We run the following regression model by year and industry and take the residual for the analysis.

Where, Unbilledi,t is the amount of unbilled receivables, and Xj is the other factors affecting unbilled receivables, including leverage, size, ROA, assets growth and the natural log of sales.

EMG, the earnings management group dummy variable, is based on the signs of both nondiscretionary earnings and discretionary accruals. We employ two EMGs: (1) UEMG (Upwards Earnings Management Group), if nondiscretionary net income of current year>net income of previous year and discretionary accruals are positive; (2) DEMG (Downwards Earnings Management Group), if nondiscretionary net income of current year<net income of previous year and discretionary accruals are negative. UEMG is defined as a group of firms considered to aggressively manage earnings upwards and DEMG is defined as a group of firms considered to manage earnings downwards for big bath accounting through discretionary accruals. Therefore, we expect a positive relationship between UEMG and the amount of unbilled receivables and a negative relationship between DEMG and the amount of unbilled receivables.

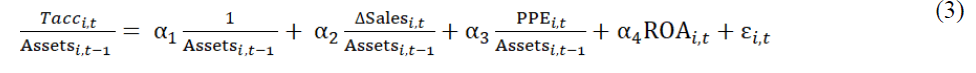

For discretionary accruals, the OLS regression model below is performed, and the residual is determined, following the modified Jones model developed by Dechow et al. (1995). The estimated residual is the proxy for the discretionary accruals.

Where, Tacc is the total accruals calculated by subtracting operating cash flows from net income using the measure of total accruals developed by (Hribar & Collins, 2002), thereafter divided by the beginning of year assets. PPE is property, plant, and equipment. ΔSales is the change in sales relative to the previous year, and ROA is return on assets. We estimate Eq. (2) for each industry and in each year.

X is the other factors affecting unbilled receivables–leverage, size, ROA, sales growth and the liquidity ratio. Leverage is the total liabilities divided by total assets. For companies having higher debts ratios, managers tend to have incentives to manage earnings for the reduction of the costs of their debt (Smith & Stulz, 1985; Graham & Rodgers, 2000). Size, which is measured as the natural log of total assets, is used to control for size effects. Return on assets, which is measured as net income divided by total assets, is included to control for firm profitability. Sales growth, which is measured as the change in sales relative to the previous year and liquidity ratio is also included. The liquidity ratio is measured as total assets divided by total liabilities. Finally, industry dummy variables, defined by the one-digit Korea Standard Industry Code, and year dummy variables are included as control variables.

Results And Discussion

Descriptive Statistics and Correlations

Table 2 shows the descriptive statistics for the main variables. The mean (median) for DISUnbilled are -0.1011 (-0.0726). The means (medians) for UEMG and DEMG are 0.4868 (0) and 0.2371 (0), respectively. This means that 48.7% of the sample firms are classified into a group of firms that manage earnings upwards and 23.7% of the samples firms may engage in big bath accounting. The mean (median) values for the control variables LEV, SIZE, ROA, GROW and liqR are 0.8668 (0.5282), 19.5913 (19.2168), 0.0159 (0.0175), 0.4665 (0.0135) and 1.9041 (1.3790), respectively.

| Table 2 Descriptive Statistics |

|||||

| Variables | Mean | Std. Dev. | Median | Q1 | Q3 |

|---|---|---|---|---|---|

| DISUnbilled | -0.1011 | 0.3422 | -0.0726 | -0.2359 | 0.0840 |

| UEMG | 0.4868 | 0.5000 | 0 | 0 | 1 |

| DEMG | 0.2371 | 0.4254 | 0 | 0 | 0 |

| LEV | 0.8668 | 1.8674 | 0.5282 | 0.3016 | 0.7096 |

| SIZE | 19.5913 | 1.6434 | 19.2168 | 18.3718 | 20.6546 |

| ROA | 0.0159 | 0.1624 | 0.0175 | -0.0178 | 0.0567 |

| GROW | 0.4665 | 2.3193 | 0.0135 | -0.1400 | 0.1894 |

| liqR | 1.9041 | 1.8856 | 1.3790 | 0.9362 | 2.0942 |

Key:

DISUnbilled : discretionary (abnormal) unbilled receivables.

UEMG : coded 1 if NDNIt > Net Income t-1 & DA are positive, and 0 otherwise.

DEMG : coded 1 if NDNIt < Net Income t-1 & DA are negative, and 0 otherwise.

LEV : total liabilities divided by total assets.

SIZE : the natural logarithm of total assets.

ROA : net income divided by total assets.

GROW : sales growth.

liqR : total assets divided by total liabilities.

The Pearson correlation results are reported in Table 3. Significant positive correlations are also seen between unbilled receivables and two of the control variables (ROA and liqR) (p<0.01). Significant positive correlations are also seen between unbilled receivables and three of the control variables (LEV, SIZE and GROW) (p<0.01). To test for multi-collinearity, the Variance Inflation Factors (VIFs) are computed- VIFs for all variables less than 10, Mean VIF 3.31. No multi-collinearity problems are evident.

| Table 3 Correlations |

||||||||

| Variables | Unbilled | UEMG | DEMG | LEV | SIZE | ROA | GROW | liqR |

|---|---|---|---|---|---|---|---|---|

| Unbilled | 1.0000 | |||||||

| 1.0000 | ||||||||

| UEMG | 0.0229 | 1.0000 | ||||||

| 0.4796 | 1.0000 | |||||||

| DEMG | -0.0415 | -0.5430 | 1.0000 | |||||

| 0.2001 | 0.0000 | 1.0000 | ||||||

| LEV | -0.3865 | -0.0122 | 0.0313 | 1.0000 | ||||

| 0.0000 | 0.7064 | 0.3328 | 1.0000 | |||||

| SIZE | -0.3726 | 0.0548 | -0.0906 | 0.2934 | 1.0000 | |||

| 0.0000 | 0.0899 | 0.0050 | 0.0000 | 1.0000 | ||||

| ROA | 0.3039 | -0.1034 | 0.1589 | 0.0973 | 0.0295 | 1.0000 | ||

| 0.0000 | 0.0014 | 0.0000 | 0.0026 | 0.3622 | 1.0000 | |||

| GROW | -0.3247 | -0.0221 | 0.0589 | 0.9215 | 0.2292 | 0.2371 | 1.0000 | |

| 0.0000 | 0.4951 | 0.0686 | 0.0000 | 0.0000 | 0.0000 | 1.0000 | ||

| liqR | 0.1976 | -0.1016 | 0.0645 | -0.1532 | -0.3320 | 0.1549 | -0.1010 | 1.0000 |

| 0.0000 | 0.0016 | 0.0460 | 0.0000 | 0.0000 | 0.5086 | 0.0018 | 1.0000 | |

Note: See Table 2 for variable definitions.

Regression Result and Discussion

| Table 4 Regression Results: Unbilled Receivables-Earnings Management Group |

||||||

| Panel A. OLS Regression Results | ||||||

|---|---|---|---|---|---|---|

| Variables | Expected sign | Dependent Variable: Unbilled Receivables | ||||

| Model 1 | Model 2 | |||||

| Constant | ? | 1.1645*** (9.08) | 1.2427*** (9.68) | |||

| UEMG | + | 0.0697*** (2.65) | - | |||

| DEMG | - | - | -0.0890*** (-4.53) | |||

| LEV | +/- | -0.0195 (-1.46) | -0.0198 (-1.49) | |||

| SIZE | +/- | -0.0634*** (-10.32) | -0.0657 *** (-10.72) | |||

| ROA | +/- | 0.8024*** (13.03) | 0.8205*** (13.37) | |||

| GROW | - | -0.0363*** (-3.34) | -0.0350*** (-3.24) | |||

| liqR | +/- | 0.0016 (0.30) | 0.0010 (0.19) | |||

| Industry dummies | Included | |||||

| Year dummies | Included | |||||

| F value | 33.83*** | 35.15*** | ||||

| Adjusted | 0.3546 | 0.3637 | ||||

| N | 957 | 957 | ||||

| Panel B. Fixed Effect Regression Results | ||||||

| Variables | Expected sign | Dependent Variable: Unbilled Receivables | ||||

| Model 1 | Model 2 | |||||

| Constant | ? | 3.7065*** (5.67) | 3.5887*** (5.55) | |||

| UEMG | + | 0.0524* (1.85) | - | |||

| DEMG | - | - | -0.0949*** (-4.17) | |||

| LEV | +/- | -0.0424*** (-3.09) | -0.0445*** (-2.28) | |||

| SIZE | +/- | -0.1900*** (-5.79) | -0.1820*** (-5.59) | |||

| ROA | +/- | 0.8586*** (13.12) | 0.8656*** (13.33) | |||

| GROW | - | -0.0208* (-1.85) | -0.0176 (-1.58) | |||

| liqR | +/- | -0.0034 (-0.38) | -0.0021 (-0.24) | |||

| Industry dummies | Included | |||||

| Year dummies | Included | |||||

| F value | 28.16*** | 29.73*** | ||||

| Adjusted | 0.2894 | 0.3002 | ||||

| N | 957 | 957 | ||||

Note: See Table 2 for variable definitions.

t-values are shown in parentheses. *p<0.10; ***p<0.01.

Panel A of Table 4 represents the OLS regression results for the association between earnings management and unbilled receivables. The results support Hypotheses 1 & 2. Model 1 depicts the association between unbilled receivables and upward Earnings Management Group (UEMG). The results show that unbilled receivables are significantly positively associated with UEMG (p<0.01) and strongly support the expectation for the firm’s upward earnings management using unbilled receivables. Model 2 analyzes the association between unbilled receivables and Upward Earnings Management Group (UEMG), a group of firms considered as big bath accounting firms. The results show that unbilled receivables are significantly negatively associated with big bath group (p<0.01) and strongly support the anticipation that firms may strategically engage in big bath accounting by managing earnings downwards via discretionary accruals. The results support premature revenue recognition theory (Myers et al., 2017) and are consistent with the findings by previous studies (Levitt, 1998; Racanelli, 2009; Loughran & McDonald, 2011) that aggressive engagement in accounting practices can be performed using unbilled receivables under percentage-of-completion accounting method. In particular, the results from the analysis for hypothesis 2 are consistent with big bath accounting and support the evidence of existing studies (Healy, 1985; Strong & Meyer, 1987; Zicke & Czermin, 2014; Burg et al., 2014) suggesting that firms are likely to reduce current earnings using provisions in an attempt to increase future profits.

The results for the control variables are inconsistent, but two control variables, SIZE and GROW, are significantly negatively associated with unbilled receivables in all models. The control variable, ROA is significantly positively associated with unbilled receivables in all models.

Panel B of Table 4 represents the fixed effect regression results. For the main explanatory variables, these results remained consistent with the OLS results.

Conclusions

In Korea, top-tier construction and shipbuilding companies have recently engaged earnings management using unbilled receivables. At the time of the CEO's replacement, a big bath was created that caused massive losses, resulting in accounting fraud. Prior research proved the correlation between aggressive accounting practices using unbilled receivables and accounting fraud. Therefore, this study explores the relationship between unbilled receivables and the type of earnings management.

For the analysis, this study employed two types of earnings management group: (1) upward earnings management group that make upward earnings management and (2) downward earnings management group that engage in big bath accounting and explored their relationships with unbilled receivables.

The results of the analysis on the relationship between unbilled receivables and earnings management demonstrated that the companies considered to manage earnings upward had a significant positive (+) relationship with unbilled receivables while the companies considered to have engaged in big bath accounting had a significant negative (-) relationship with unbilled receivables. That is, the results of the analysis imply that unbilled receivables may be actively used in upward earnings management or big bath accounting.

There have been not many unbilled receivables related studies. To address the lack of empirical studies on unbilled receivables to date, this paper analyzes the effect of unbilled receivables on the type of earnings management. The findings of this paper support that firms perform various types of earnings manipulation as needed, particularly using ‘unbilled receivable account’ which is specific for certain industries such as construction and shipbuilding and may be related to accounting fraud schemes. The study used data from 2010 forward, when unbilled receivables started to appear in financial statements, therefore, may have limitations such as data size. Despite the limitations, there have not been many empirical studies on unbilled receivables, and it is meaningful to make information available to academia and industry by presenting various analysis results on the association between unbilled receivables and the type of earnings management.

References

- Ayres, F.L. (1994). Perceptions of earnings quality: What managers need to know. Management Accounting, 75(9), 27-29.

- Beidleman, C.R. (1973). Income smoothing: The role of management. The Accounting Review, 48(4), 653-667.

- Burg, V., Pierk, J., & Scheinert, T. (2014). Big bath accounting and CEO overconfidence. Working Paper. Humboldt University of Berlin.

- Burgstahler, D., & Dichev, I. (1997). Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics, 24, 99–126.

- Chaney, P.K., & Lewis, C.M. (1995). Earnings management and firm valuation under asymmetric information. Journal of Corporate Finance 1, 319-345.

- DeAngelo, L.E. (1986). Accounting numbers as market valuation substitutes: A study of management buyouts of public stockholders. The Accounting Review 61, 400-420.

- Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting earnings management. Accounting Review, 70, 193-225.

- DeFond, M., & Park, C. (1997). Smoothing income in anticipation of future earnings. Journal of Accounting and Economics, 23, 115-139.

- Elliott, J., & Shaw, W. (1988). Write offs as accounting procedures to manage perceptions. Journal of Accounting Research, 26(Supplement), 91-119.

- Erickson, M., & Wang, S. (1999). Earnings management by acquiring firms in stock for stock mergers. Journal of Accounting and Economics, 27(2), 149-176.

- Gaver, J.J., Gaver, K.M., & Austin, J.R. (1995). Additional evidence on the association between income management and earnings-based bonus plans. Journal of Accounting and Economics, 19, 3-28.

- Gordon, M. (1964). Postulates, principles and research in accounting. The Accounting Review, 39(2), 251-263.

- Graham, J.R., & Rogers, D.A. (2002). Do firms hedge in response to tax incentives? Journal of Finance, 57, 815-839.

- Guenther, F.H. (1994). Earnings management in response to corporate tax rate changes: Evidence from the 1986 Tax Reform Act. The Accounting Review, 69(1), 230-243.

- Healy, P.M. (1985). The effect of bonus schemes on accounting decisions. Journal of Accounting and Economics, 7, 85-107.

- Healy, P.M., & Wahlen, J.M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(4), 365-363.

- Hepworth, S.R. (1953). Periodic income smoothing. The Accounting Review, 28(1), 32-39.

- Holthausen, R., Larcher, L.F., & Sloan, R.G. (1995). Annual bonus schemes and the manipulation of earnings. Journal of Accounting and Economics, 19, 29-74.

- Hribar, P., & Collins, D. (2002). Errors in estimating accruals: Implications for empirical research. Journal of Accounting Research, 40(1), 105-134.

- Jordan, C.E., & Clark, S.J. (2002). Big Bath Management: The case of goodwill impairment under SFAS No.142. Journal of Applied Business Research, 20, 2-63.

- Jung, M., You, S., Chi, S., Yu, I., & Hwang, B. (2018). The relationship between unbilled accounts receivable and financial performance of construction contractors. Sustainability, 10, 2679.

- Kirschenheiter, M., & Melumad, N.D. (2002). Can “big bath” and earnings smoothing co-exist as equilibrium financial reporting strategies? Journal of Accounting Research, 40(3), 761-796.

- Levitt, A. (1988). The numbers game. U.S. Securities and Exchange Commission. Retrieved from http://www.sec.gov/news/speech/speecharchive/1998/spch220.txt

- Loughran, T., & McDonald, B. (2011). Barron's red flags: Do they actually work? Journal of Behavioral Finance 12(2), 90-97.

- Maydew, E. (1993). Tax-induced earnings management by firms with net operating losses. Journal of Accounting Research, 35, 83-96.

- Myers, L.A., Schmardebeck, R., Seidel, T.A., & Stuart, M.D. (2017). Increased managerial discretion in revenue recognition and the value relevance of earnings. Working Paper. Retrieved from http://dx.doi.org/10.2139/ssrn.2559438

- Racanelli, V. (2009). Watch their language. Barron’s. Retrieved from https://www.barrons.com/articles/SB125150839847868595

- Schilit, H. (2002). Financial shenanigans-How to detect accounting gimmicks & fraud, in financial reports, (2nd Edition). McGraw-Hill.

- Scholes, M.S., & Wolfson, M.A. (1992). Taxes and business strategy. A planning approach. Englewood Cliffs, NJ, Prentice-Hall.

- Shuto, A. (2007). Executive compensation and earnings management: Empirical evidence from Japan. Journal of International Accounting, Auditing and Taxation, 16, 1-26.

- Smith, C., & Stulz, R. (1985). The determinants of hedging policies. Journal of Finance and Quantitative Analysis 20, 391-405.

- Stolowy, H., & Breton, G. (2000). A framework for the classification of accounts manipulations, HEC Accounting & Management Control, Working Paper. Retrieved from http://dx.doi.org/10.2139/ssrn.263290

- Strong, J., & Meyer, J. (1987). Assets write downs: Managerial incentives and security returns. Journal of Finance 42, 643-661.

- Suda, K., & Shuto, A. (2006). Earnings management to meet earnings benchmarks: Evidence from Japan. In M. Neelan (Ed.), Focus on Finance and Accounting Research. Nova Science Pub Inc.

- Walsh, P., Craig, R., & Clarke, F. (1991). Big bath accounting using extraordinary items adjustments: Australian empirical evidence. Journal of Business Finance & Accounting, 18(2), 173-189.

- Yaping, N. (2005). The theoretical framework of earnings management/La structure théorique du management des revenues. Canadian Social Science, 1(3), 32-38.

- Zicke, J., & Czermin, S. (2014). The discretionary use of provisions-Evidence from Germany. Working Paper.