Research Article: 2021 Vol: 24 Issue: 1S

Factors Influencing the Good Corporate Governance of the Listed Companies on the Stock Exchange of Thailand

Nopporn Bua-In, King Mongkut’s University of Technology North Bangkok

Keywords

Corporate Governance, Sustainable Development, Corporate Social Responsibility, Risk Management, Internal Control System

Abstract

The purpose of this research was to study the factors influencing the good corporate governance of the listed companies on the stock exchange of Thailand. This research was a mixed-methodology research with 500 respondents including directors, executives, and inspectors who were responsible for the good corporate governance of the listed companies on the stock exchange of Thailand. The second order confirmatory factors were analyzed through IBM SPSS AMOS. Four factors influencing the good corporate governance of the listed companies on the stock exchange of Thailand were found through the qualitative research with in-depth interview. The result of hypothesis test revealed that the four factors positively influenced the good corporate governance of the listed companies at statistical significance level of 0.001. The sustainable development influenced the good corporate governance of the listed companies most, the corporate social responsibility, risk management, and Internal control system, respectively. The results of second order confirmatory factor analysis found that it was in accordance with the empirical data. The Chi-square minimum probability (CMIN/P) was of 0.108, the Chi-square Minimum Discrepancy Per Degree Of freedom (CMIN/DF) was of 1.137, the Goodness of Fit Index (GFI) was of 0.964, and the Root Mean Square Error Of Approximation (RMSEA) was of 0.017.

Introduction

The main causes of corruption are derived from the accumulated problems affecting the good corporate governance under the six theories as follows. 1) The agency problem under the agency theory Klinphanich, Puangyanee, Phoprachak & Jermsittiparsert (2019) stating that the problem arises in case the corporate owners are the only shareholders, and the ownership and all types of income belong to them. However, if some of the shares are sold to the outsiders, the income and benefits are partly deducted. The owners as executives are likely to require some more resources to compensate the loss of proportionate benefits. This is also in according with the study of Solomon (2020) stating that the owner of the business can inspect the organizational management and find some problem solutions especially of conflicts between the mediator and representative to direct the operations through the shareholder’s rights of the takeover and stated that the stock exchange is an important instrument to manage the services and also becomes the issue to be discussed during the shareholder’s meetings. 2) The problem of exploitation under the conflict-of-interest theory Tunpornchai & Hensawang (2018) claiming that the problem arises in case the benefits belong to someone with several roles and duties, and any decision making of them may support a certain benefit in another role or duty and affect the others who lose their benefits (Office of the Civil Service Commission, 2012). 3) The problem of incomplete contract under the contract theory Chatchawanchanchanakij, Arpornpisal & Jermsittiparsert (2019) stating that the contract is never complete because there is business uncertainty. Even though the lawyers have tried to write any flexible contract conditions, the contract is still rectified later. The contract loopholes could be corrected under the good corporate governance to reduce the expenses of representatives (Solomon, 2020). 4) The problem of adverse selection moral hazard under asymmetry information theory Izquierdo & Izquierdo (2007) stating that the problem arises in case the business owner does not receive the entire information of operational management, e.g., the executives often use the organizational data and information for their own benefits, and one of the best ways for the reduction of costs to inspect and follow up the representatives’ management is to set up an inspection mechanism to reduce the conflict of benefits and the problem of motives to look for the benefits (Klinphanich, 2018). Therefore, the corporate committee must be appointed to inspect and follow up the representatives’ operations to protect the shareholders under the principles of good corporate governance (Rattanacharoenchai, Rachapradit & Nettayanun, 2017). 5) The problem of refusing to acknowledge under the stakeholder theory Freeman (1984); Tunpornchai & Hensawang (2018) stating that the first mission of the executives is the management to meet the shareholders’ benefits and the executives are only the employees of business owners.

Therefore, the executives must make money as much as possible to meet the owners’ needs and both businessmen and businesswomen must strictly follow the law as long as it is not violated. If there is no law written for any cases, there is no need to concern about the others who are not the shareholders even though they are affected by the executives’ management (Puangyanee, Yaowapanee, Duangsawang & Jermsittiparsert, 2019). 6) The problem of illegitimacy under the legitimacy theory Chatiwong (2017) stating that the company has the privileges and given by its society to implement the natural resources including human resources in case the company must run the business to meet the society’s expectations. If the company cannot complete the tasks to meet the society’s demands, it may face such a serious problem that it cannot continue the business.

From the study of guidelines for management related to the good corporate governance in Thailand, (Puangyanee, 2018) it was found that the organizations related to the good corporate governance of the listed companies on the stock exchange of Thailand, such as the Securities and Exchange Commission, Thailand, Thai Institute of Directors, and the Stock Exchange of Thailand manipulated the Handbook of Good Corporate Governance Code for the Listed Companies on the Stock Exchange of Thailand to be the principles for the corporate directors to follow for long-term business profits, shareholders’ trust, and sustainable business value in accordance with the expectations of the business sector, investors, as well as capital market and overall society. The organizations also manipulated a survey based on the survey project of Corporate Governance Report of Thai Listed Companies (CGR) (Freeman, 1984; Tunpornchai & Hensawang, 2018) to survey the development of good corporate governance of the listed companies on the stock exchange of Thailand through the evaluation criteria developed from the good corporate governance of the Organization for Economic Cooperation and Development (OECD) considered CG as internal measures to run an enterprise, related to the relationships between the board of directors, the board and the shareholders of an enterprise (Tran et al., 2021) and present the overall results of evaluation so that the listed companies could use it as a guideline for the development of good corporate governance and the other organizations involved to set a policy and regulations related to the good corporate governance. Therefore, the researcher was interested in the research hypothesis test and the second order confirmatory factor analysis of the factors influencing the good corporate governance of the listed companies on the stock exchange of Thailand in accordance with the empirical data.

From the study, (Puangyanee, Yaowapanee, Duangsawang & Jermsittiparsert, 2019) it was also found that most of the past studies related to the good corporate governance of the listed companies on the stock exchange of Thailand were based on the agency theory and focused on the study of relationship between the structure of good corporate governance committee and the proportion of profit potential of business operations or the financial structure of the listed companies and there was a shortage of the study focusing on new knowledge with the mixed-methodology research to find the factors applied to solve the accumulated problems affecting the good corporate governance under the six theories (Kerdman, 2015). The researcher, therefore, studied the management strategies related to the good corporate governance of the listed companies-the members of Dow Jones Sustainability Indices (DJSI) used to evaluate the efficiency and effectiveness of business operations according to the guidelines for sustainable growth of the leading companies and used as the basis of investment consideration to find the factors influencing the good corporate governance of the listed companies on the stock exchange of Thailand and apply them to reduce the impacts of corruption arisen from the problems under the overall six theories.

Literature Review

The literature review was conducted to study each factor influencing the good corporate governance of the listed companies on the stock exchange of Thailand to determine the research hypotheses to create guidelines for the efficient and effective management of good corporate governance and implementation for protection of corruption in the listed companies. The literature review and research hypotheses could be thoroughly discussed in four points as follows.

The concept of Good Corporate Governance is a key for reducing agency problems and agency cost. The objective for businesses is to create maximum wealth and value for a corporation and its shareholders (Jesover, 2001; Yasser, Entebang & Mansor, 2015). Good Corporate Governance is a mechanism for reducing agency costs to achieve the objective of maximum wealth and value for corporation (Tunpornchai & Hensawang, 2018). Good Corporate Governance has influence on firm performance. It is deemed as company management that relies on corporate governance of companies listed on the Stock Exchange that has effect on firm performance through scoring assessment as an indicator. It has been found that corporate governance has positive influence on firm performance (Puangyanee, 2018).

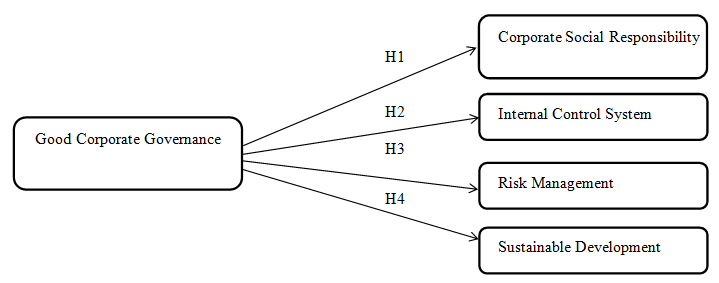

The principles of good corporate governance must be the key benchmark for consideration in the report on good operations and codes of conduct in Thailand to expose the essential information. The principles of good governance are also necessary for business growth and sustainability, reduction of conflict on benefits, and law enforcement for all the stakeholders The good corporate governance also provides the business partners a greater chance of investment for further profits (Kerdman, 2015; Puangyanee, Yaowapanee, Duangsawang & Jermsittiparsert, 2019), and meanwhile the relationship among the people involved also influences the good corporate governance, personal behaviors, and commitment to the organizations. The good corporate governance can be implemented to protect corruption in the corporate management and enhance the corporates’ performance (Elshandidy & Neri, 2015). The relations of variables are as follows:

The concept of sustainable development: The organizations focus on the economic growth, policy and business plans under the principles of good governance, effective risk management, shareholders’ benefits, as well as responsibility for society and environment (Aonthong & Ekchaipaiboon, 2016). The sustainable business development does not only focus on the economic growth, but also the responsibility for environment and society. The Corporate Governance of the Stock Exchange of Thailand supports the listed companies to implement the principles of sustainable development for added value of the shareholders (Securities and Exchange Commission, 2013; Tunpornchai & Hensawang, 2018). Meanwhile the sustainable development also means the integrity of management guidelines for excellence with outstanding operations and management of business and environmental innovation to create the added value for customers and the potential of competition for organizations and all activities must be based on the Sufficiency Economy Philosophy including the measures of anti-corruption and participation in the response to the sustainable development goal according to the United Nations to enhance the sustainable development of the organizations. The sustainable development does not only focus on the economic growth but also cover the Corporate Social Responsibility (CSR) (Muiching et al., 2013; Tran et al., 2021). The stock exchanges in several countries have supported the listed corporates to utilize the sustainable development principle (The Securities and Exchange Commission, Thailand, 2013). The integration is also a guideline for risk management and law enforcement to increase the investors’ trust for sustainable development of the corporates (Doyle et al., 2019).

H1 : The sustainable development positively influences the good corporate governance of the listed companies on the stock exchange of Thailand.

The concept of corporate social responsibility: The Boston College Center for Corporate Citizenship initiated the word “Corporate Citizenship” for “Corporate Social Responsibility: CSR”. The Corporate social responsibility is a combination of the factors of political theory, and the relationship of stakeholders, business ethics, social responsibility, reliability, and management of changes to lead the organizations to proper operations of the management of all stakeholders (Wood et al., 2006). And corporate social responsibility also means the integrity of management guidelines for commitment of stakeholders (except for investors) with the social and environmental responsibility of international standards and the operational reports on economics, society and environment for the stakeholders to create the organizational rightness of good corporate citizenship. The corporate social responsibility is the combination of political theory and stakeholder theory including the business ethics, corporate social responsibility, confidence, and change management to create the guidelines for the good corporate governance of the listed companies on the stock exchange of Thailand (Goss, 2007; Ilacqua, 2008; Ribera, 2010).

H2: The corporate social responsibility positively influences the good corporate governance of the listed companies on the stock exchange of Thailand.

The concept of risk management: The government sector or organizations that always get ready for changes, and stand for the impact of environment, politics, economics, and society Organization for Economic Co-operation and Development (OECD, 2014). The organizations implement the Risk management and adapt themselves to any crisis or difficulties to survive and create the long-term sustainable success (Denyer, 2017). The Risk management is the organizational competency of absorption and adaptation to constant environmental changes to achieve the organizational goals, meet the business growth, response to threats, and opportunities (The International Organization for Standardization (ISO), 2017). The Risk management is a basic conceptual framework of reasons to analyze the operational process to get ready for changes or fast recovery from disasters, and for sustainable development (Abramson, 2015). The study showed that the higher level of corporate legitimacy is related the higher level of preparation for organizational changes as well (Zahller, Arnold & Roberts, 2015). And risk management also means the integrity of management guidelines for awareness of organizational changes including the capacity of understanding the changes so that the organizations will have some good new opportunities with the supporting system of decision making of the changes and risk management to constantly run the business in case of emergency and to get ready for the changes. The business operation under constantly changeable environment may be risky to the organizations, such as legislative changes, economic changes. The Risk management can make the organizations fight against the threats and protect the stakeholders’ benefits supporting the good corporate governance (Thongruang et al., 2015; Puangyanee, Yaowapanee, Duangsawang & Jermsittiparsert, 2019).

H3: The risk management positively influences the good corporate governance of the listed companies on the stock exchange of Thailand.

The concept of sustainable development: The organizations focus on the economic growth, policy and business plans under the principles of good governance, effective risk management, shareholders’ benefits, as well as responsibility for society and environment (Aonthong & Ekchaipaiboon, 2016). The sustainable business development does not only focus on the economic growth, but also the responsibility for environment and society. The Corporate Governance of the Stock Exchange of Thailand supports the listed companies to implement the principles of sustainable development for added value of the shareholders (Securities and Exchange Commission, 2013). And sustainable development also means the integrity of management guidelines for excellence with outstanding operations and management of business and environmental innovation to create the added value for customers and the potential of competition for organizations and all activities must be based on the Sufficiency Economy Philosophy including the measures of anti-corruption and participation in the response to the sustainable development goal according to the United Nations to enhance the sustainable development of the organizations. The sustainable development does not only focus on the economic growth but also cover the corporate social responsibility (CSR) (Muiching et al., 2013; Tran et al., 2021). The stock exchanges in several countries have supported the listed corporates to utilize the sustainable development principle (The Securities and Exchange Commission, Thailand, 2013).

H4 : The sustainable development positively influences the good corporate governance of the listed companies on the stock exchange of Thailand.

From the literature review and the research hypothesis mentioned above, the researcher determined the research objectives and research framework as follows.

The objective of this research was to study the factors influencing the good corporate governance of the listed companies on the stock exchange of Thailand. (Figure 1)

Research Methodology

The population of the qualitative research with the in-depth interview was nine qualified experts. The experts must have over 10 years of working experiences for the listed company under the good corporate governance and hold at least a master’s degree. The population of the quantitative research was the directors, executives, and inspectors who were in charge of the good corporate governance of the 540 listed companies which received a fairly good score evaluated and guaranteed by the Corporate Governance Report of Thai Listed Companies (CGR) (Thai Institute of Directors, 2018). The research criteria of the factor analysis or the structural equation model to assign the sample size of 500 subjects at a very good level (Comrey & Lee, 1992) with simple probability random sampling.

The instrument used in this study was a questionnaire created through the process of the qualitative research with the in-depth interview to provide new knowledge and obtain the questionnaire items of the checklist and Likert scale in accordance with the four strategies of the good corporate governance of the listed companies in the stock exchange of Thailand. The results of analyzing the discrimination showed that the Standard Deviation (S.D.) of each questionnaire item with checklist was of 0.35-2.18 and the Cronbach’s alpha coefficient of the Likert Scale was of 0.98.

The researcher distributed the questionnaire to a total of 500 samples who were directors, executives, and inspectors who were in charge of the good corporate governance of the listed companies. The questionnaire was sent out by the post and online, and the researcher also handed the questionnaire to some respondents. The second confirmatory factor was analyzed through the implementation of IBM SPSS AMOS program to improve factor loading to meet the empirical information according to the criteria introduced by Arbuckle (2012). The researcher adapted the observed variables of the questionnaire with Likert scale. The researcher improve the second confirmatory factor analysis considered through the modification indices (MI) based on the suggestions of Arbuckle (2012) to eliminate each of the observed factors which were not appropriate and reevaluate the new model until it passed all four criteria: (1) the Chi-square probability level with p (CMIN/P)>0.05, (2) the Relative Chi-square (CMIN/DF)<2, (3) the goodness of fit index (GFI)>0.90, and (4) the root mean square error of approximation (RMSEA)<0.08. Therefore, the model perfectly fit the empirical information.

Research Results

The research results showed that the companies with 10,000 million baht up was of 38.00 percent followed by those with 1,000–2,999 million baht was of 21.20 percent, 3,000–10,000 million baht was of 20.60 percent, and less than 1,000 million baht was of 20.20 percent, respectively.

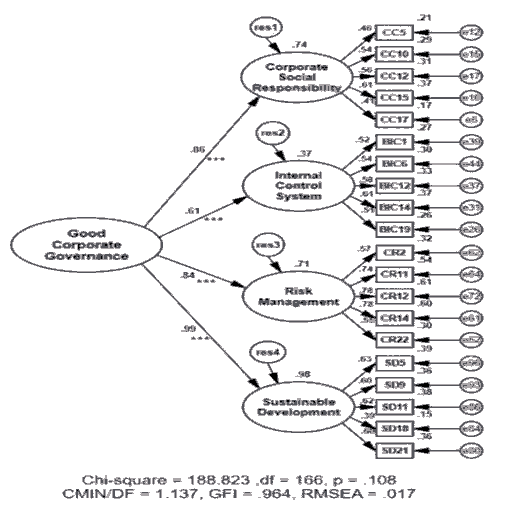

The results of the second order confirmatory factor analysis (SCFA) found that it could not pass the criteria of the goodness of fit with the empirical information. Then, the researcher proceeded to improve the model based on the modification indices suggested by Arbuckle (Arbuckle, 2012) by considering the statistical scores obtained through the implementation of the SPSS under the principle of the theoretical principles in order to eliminate each of the inappropriate observational variables and re-evaluated the new model evaluation until the statistics of new model passed all four statistical criteria. Therefore, it could be concluded that the model considerably fit the empirical information as shown in Table 1 below.

| Table 1 Statistics of the Second Order Confirmatory Factor Analysis (Scfa) of the Good Corporate Governance Factors of Listed Companies on The Stock Exchange of Thailand After the Model Improvement |

|||

|---|---|---|---|

| Statistical index | Criteria | Pre-improvement | Post-improvement |

| Chi–Square | > 0 . 05 | 0 . 000 | 0.108 |

| CMIN /DF | < 2.00 | 3 . 900 | 1.137 |

| GFI | > 0 .90 | 0 . 501 | 0.964 |

| RMSEA | < 0 .08 | 0 . 076 | 0.017 |

Table 1 shows that this empirical data analysis was consistent with the theoretical measurement model, i.e., the good corporate governance of listed companies on the stock exchange of Thailand positively influenced the four latent variables of the strategy at the statistically significant level of 0.001 and this model passed the statistics of the evaluation criteria: (CMIN/P) =0.108 (CMIN/DF) =1.137 (GFI) =0.964, and (RMSEA) =0.017.

The results of the second order confirmatory factor analysis (SCFA) found that there were four factors influencing the good corporate governance of listed companies on the stock exchange of Thailand. The sustainable development had the highest influence on the good corporate governance of the list companies and followed by the corporate social responsibility, the risk management, and the internal control system, respectively. There were 20 questionnaire items consistent with the empirical information as shown in Figure 2.

Figure 1: The Second Order Confirmatory Factor Analysis Influenced the Good Corporate Governance of the Listed Companies in the Standardized Estimate Mode after the Model Improvement

*** Statistically significant level at 0.001

Discussion and Conclusion

These research findings showed that all the components influenced the good corporate governance of the listed companies in the stock exchange of Thailand. This indicates that the research findings can be used as the key benchmark for good corporate governance of the listed companies in the stock exchange of Thailand to reduce the impacts of theoretical problems causing the ineffective implementation of the good corporate governance for the business growth and sustainability, and the reduction of conflict on benefits. The good corporate governance also provides the business partners a greater chance of investment for further profits (Kerdman, 2015; Puangyanee, Yaowapanee, Duangsawang & Jermsittiparsert, 2019). For the sustainable development component, it was found that the listed companies in the stock exchange should share knowledge of the operational systems for the corporates’ Excellency to make the employees realize and apply the knowledge effectively. This is in accordance with the studies of Doyle, et al., (2019); Tunpornchai & Hensawang (2018) stating that the integration is implemented for risk management and the law enforcement to enhance the investors’ trust for sustainable development of the corporates. For the corporate social responsibility component, it was found that the listed companies in the stock exchange should have participation in the activities of the community affected by the corporates’ operations to enhance the awareness for the ecological restoration. This is in accordance with the studies of Goss (2007); Ilacqua (2008); Phelan Ribera (2010) stating that the combination of components of political theories, and stakeholders’ relationship including business ethics, corporates’ responsibility for society, and trust derived from the corporate’s justice becomes the guidelines for good corporate governance to meet the stakeholders’ satisfaction. For the risk management component, it was found that the listed companies in the stock exchange should have a proper system of data storage for the consistent development, and Zahller, Arnold & Roberts, (2015) stating that the business operations under constantly changing circumstances may cause the risks for the corporates, change of law, change of economics, natural change. The corporates implement the strategy for such changes to protect the profits of both corporates and partners. For the sustainable development component, it was found that the listed companies in the stock exchange of Thailand should assign nomination committee to verify the qualifications of the candidates for the seats on the board and this is in accordance with the studies of Muiching, et al., (2013); Tran, et al., (2021) claimed that the sustainable development focuses on the economic growth with policies under the principles of good corporate governance, the anti-corruption, the profit return for the business partners together with the concept of responsibility for society and environment, respectively.

The listed companies in the stock exchange should determine the corporates’ strategies based on the qualitative research with the in-depth interviews of the experts to reduce the impacts of the theoretical problems related to the good corporate governance. The corporates’ strategies include: 1) the corporates should develop the environmental and business innovation management to get the excellency of business operations and sustainable development regarding the UN’s concept, 2) the corporates should declare the economic, social and environmental reports for the righteousness among the stakeholders of organizations, 3) the corporates must analyze the business opportunities, levels of risk and should provide the supporting system of the decision-making with the modern technologies, 4) the corporates must enhance convince the investors through the organizational structure with clear authority and responsibilities and the law enforcement for all in the corporates, and 5) the corporates must study the organizational change management to enhance the employees’ competencies to analyze business opportunity under the corporates’ appropriate strategies to meet all the business situations.

Acknowledgement

Dr.Nopporn Bua-In is an Assistant Professor at King Mongkut’s of Technology North Bangkok, Thailand. His email address is nopporn.b@fba.kmutnb.ac.th

References

- Abramson, D.M. (2015). The resilience activation framework: A conceptual model of how access to social resources promotes adaptation and rapid recovery in post-disaster settings. The Journal of Behavioral Health Services & Research, 42(1), 42-57.

- Aonthong, P., & Ekchaipaiboon, S. (2016). Checklist: Conquer sustainable business. Social Responsibility Development Center, The Stock Exchange of Thailand Press.

- Arbuckle, J.L. (2012). IBM SPSS Amos 21 User’s Guide. U.S.A.: IBM Corporation.

- Chatiwong, T. (2017). Accounting theory research: From the past to the future. Journal of Business Administration, 6(2), 203-211.

- Chatchawanchanchanakij, P., Arpornpisal, C., & Jermsittiparsert, K. (2019). The role of corporate governance in creating a capable supply chain: A case of Indonesian tin industry. International Journal of Supply Chain Management, 8(3), 854-864.

- Comrey, A.L., & Howard, L.B. (1992). A First Course in Factor Analysis (2nd edition). NJ.: Lawrence Erlbaum Associates.

- Denyer, D. (2017). Organizational resilience: A summary of academic evidence, business insights. London: BSI and Cranfield University.

- Doyle, E., McGovern, D., McCarthy, S., & Perez-Alaniz, M. (2019). Compliance-innovation: A quality-based route to sustainability. Journal of Cleaner Production, 210, 266-275.

- Elshandidy, T., & Neri, L. (2015). Corporate governance, risk disclosure practices, and market liquidity: Comparative evidence from the UK and Italy. Corporate Governance: An International Review, 23(4), 331-356.

- Freeman, R.E. (1984). Strategic Management: Stakeholders Approach. Boston: Pitman.

- Goss, A. (2007). Essays on corporate social responsibility and financial performance. Doctor of philosophy thesis, York University.

- Ilacqua, C. (2008). Corporate social responsibility’s impact on stock price: A quantitative study of the U.S. Biotechnology industry. Doctor of business administration thesis, University of Phoenix.

- Jesover, F. (2001). corporate governance in the Russian federation: The relevance of the OECD Principles on shareholder rights and equitable treatment. Corporate Governance: An International Review, 9, 79-88

- Kerdman, S. (2015). The relationship between corporate governance and return on securities and enterprise value of listed companies on the stock exchange of Thailand. Doctoral dissertation, Kasetsart University.

- Klinphanich, W. (2018). Impact of business nature on corporate governance report through a degree of independence of board of directors: A case study of listed companies in the stock exchange of Thailand. PSAKU International Journal of Interdisciplinary Research, 7(1), 210-218.

- Klinphanich, W., Puangyanee, S., Phoprachak, D., & Jermsittiparsert, K. (2019). Influence of representative factors on tax planning through corporate governance of listed companies in the stock exchange of Thailand. International Journal of Innovation, Creativity and Change, 7(1), 300-316.

- Izquierdo, S., & Izquierdo, L. (2007). The impact of quality uncertainty without asymmetric information on market efficiency. Journal of Business Research, 60(8), 858-867.

- MuiChing, C., & John, W., & David, W. (2014). Corporate governance quality and CSR disclosures. Journal of Business Ethics, 125(1), 59-73.

- Office of the Civil Service Commission. (2012). Guidebook of the development and promotion of the practice based on the ethics of the civil servants. Bangkok: Office of the Civil Service Commission.

- Organisation for Economic Co-operation and Development (OECD). (2014). Guild Line for Resilience System Analysis. Paris: Organization for Economic Co-operation and Development (OECD).

- Puangyanee, S. (2018). The influence of board independence on ability to operate and capital structure through corporate governance disclosure of companies listed on the stock exchange of Thailand. PSAKU International Journal of Interdisciplinary Research, 7(1), 182-190.

- Puangyanee, S., Yaowapanee, P., Duangsawang, K., & Jermsittiparsert, K. (2019). The influence of the shareholding structure on economic performance through good corporate governance oflisted companies in the stock exchange of Thailand. International Journal of Innovation, Creativity and Change, 7(8), 116-133.

- Phelan-Ribera, K. (2010). Corporate social responsibility practice and financial performance over time for the selected U.S. corporations. Doctor of Philosophy Thesis, Texas A&M University.

- Rattanacharoenchai, C., Rachapradit, P., & Nettayanun, S. (2017). The impact of corporate governance and sustainability report and their impact on firm value: Evidence from stock exchange of Thailand. Journal of Accounting Profession, 13(37), 53-72.

- Solomon, J. (2020). Corporate governance and accountability. John Wiley & Sons.

- Thai Institute of Directors. (2018). A list of companies achieving the annual CG scores of “good”, “very good”, “excellent” level of recognition. Bangkok: Thai Institute of Directors.

- The International Organization for Standardization (ISO). (2017). Security and Resilience: https://www.iso.org/standard/50053.html

- The Securities and Exchange Commission, Thailand. (2013). Capital market and sustainable development. Bangkok: The Securities and Echange Commission.

- Thongruang, T., Esichakul. R., Parkatt, G., & Somboonsavatdee, A. (2015). The causal model of the factors that affecting the constant business management of the manufacturing industries listed in the Stock Exchange of Thailand. BU Academic Review, 14(2), 202-219.

- Tran, Q.T., Nguyen, N.K.D., & Le, X.T. (2021). The effects of corporate governance on segment reporting disclosure: A case study in Vietnam. The Journal of Asian Finance, Economics and Business, 8(4), 763-767.

- Tunpornchai, W., & Hensawang, S. (2018). Effects of corporate social responsibility and corporate governance on firm value: Empirical evidence of the listed companies on the stock exchange of Thailand in the SET100. PSAKU International Journal of Interdisciplinary Research, 7(1), 161-170.

- Wood, D.J., Logsdon, J.M., Lewellyn, P.G., & Davenport, K.S. (2006). Global business citizenship: A transformative framework for ethics and sustainable capitalism. ME Sharpe.

- Yasser, Q., Entebang, H., & Mansor, S. (2015). Corporate governance and firm performance in Pakistan: The case of Karachi stock exchange (KSE-30). Journal of Economics and International Finance, 3(8), 482-491.

- Zahller, K.A., Arnold, V., & Roberts, R.W. (2015). Using CSR disclosure quality to develop social resilience to exogenous shocks: A test for investor perception. Behavioral Research in Accounting, 27(2) 155–177.