Research Article: 2023 Vol: 29 Issue: 6

Factors Related to Financial Stress Among Muslim Students In Malaysia: A Case Study of Sudanese Student

Hamida Mohamed Osman Ahamed Elfaki, International Islamic University

Sherifah Oshioke Musa, Waidsum University

Abdulwahab Deji, Waidsum University

Citation Information: Elfaki Ahamed, O.M.H., Musa, O.S, Deji A (2023). Factors Related to Financial Stress Among Muslim Students in Malaysia: A Case Study of Sudanese Students. Academy of Entrepreneurship Journal, 29(6), 1-15.

Abstract

This study examines factors related to financial stress among Sudanese Students in Malaysia. A lot of Sudanese students study abroad and some of them are in Malaysia. Majority of these students are not on scholarship, they are self-sponsored. Some of these Sudanese students studying in Malaysia are faced with financial stress. They are faced with the inability to meet up with their financial needs and obligations such as difficulty making tuition payment on time, high cost of feeding and other unexpected expenses. These have led the students to be overly stressed and thereby facing depression while studying. The study used survey data and factor analysis approach to investigate and examine the factors related to financial stress among Sudanese Student in Malaysia. Based on a comprehensive framework, eight factors sets of determinant factors were investigated. The joined examination of these eight sets of factors marks the contribution of this study. Our empirical investigation, which is based on principal component analysis technique, represents another contribution of this study. The research questionnaires included open-ended and closed questions, to collect the necessary information, in order to provide insights into a variety of critical factors that determine financial stress among Sudanese students in Malaysia. The data was analysing using SEM. EFA and CFA analysis were carried out. The result shows that there is significant relationship and effect amongst financial stresses, debt, Spending behavior, and insufficient funding among Sudanese students in Malaysia

Keywords

Debt, Spending Behaviour, and Insufficient Funding.

Introduction

Higher education is a priority for many people in today’s modern world. Each year, students spend thousands on better-quality education, requiring them to travel overseas to achieve this. Sudanese students are not left out in this, enrolling in schools in different parts of the world. There are many Sudanese students that are enrolled in colleges and universities in Malaysia for undergraduate and post graduate programs (Sudanese Embassy Malaysia, 2019). Sudanese students come to Malaysia to study because they are fascinated with the quality education at affordable prices of the tuition fees and the amenities that Malaysia has to offer. Malaysia is one of the countries that has developed educational sector and infrastructures which has attracted many students from different parts of the world. The Sudanese students in Malaysia, are international students or individuals who temporary reside in Malaysia to participate in international educational program. According to statistical report (Sudanese Embassy Malaysia, 2019) there are about 3088 Sudanese students studying at various programs and in various institutions all over Malaysia. 18% of these students are doing Diploma programs, while 80% are enrolled in a bachelor’s degree programs, 7% are pursuing master’s degree, while 20% are doing PhD degree. Hence majority of Sudanese students are enrolled for bachelor’s degree. The male population accounts to 88% while the female population is at only 12%. Thus, there are more Sudanese male students than female students studying in Malaysia. These Sudanese students are mostly self-funded or funded by their families. These student’s majority are Muslims, from different family backgrounds, with different experience and skills. All these have effect on how well they can manage themselves while studying (Kadouf, 2016). As Muslims, these students need to spend moderately, fulfil the most needed things (Dharuya) first for existence and living, such as food, shelter, health, and security. We must spend less in excesses (Tasniyah) that is on things we don’t really need to have. We are also expected to spend moderately on our wants (Haija) things we can exist without that are only for comfort. Hence, the spending of a student should follow shariah principle and strike a balance between financial spending and the worship of Allah, this can help reduce or avoid financial stress. Student wellness is a significant topic in university campuses countrywide as higher education and student life managers are becoming increasingly worried with stress among students. Given that stress has been shown to negatively affect student performance (Micheala; Sarah; Hetrick & Alexandra, 2020). Also, research confirms that personal financial problems plays the influential role as a source of stress in the lives of college students (Angelika Anita Schlarb, 2017). Studying abroad is more stressful for both parents and the students due to the increasing cost of the tuition fees, and the inflation rate in Sudan. While they are in Malaysia, the students stress more when faced by unexpected expenses such as hike in food prices and in the cost of retaining a valid student visa. Also, them trying to adapt to the new style of life and new ways of learning and thinking, they face a lot of financial challenges and struggling. This is even tougher for students who have no scholarship but solely on self-funding. Their inability to meet up with their financial needs, hence their financial problems which lead to financial stress. financial stress may lead some of the students to commit some socio-legal problems indebtedness, driving without valid license or drug abuse, (Kadouf, 2016). These problems are faced by many of the Sudanese students studying in Malaysia and majority of these students are not on scholarship, they are self-sponsored. The inability to meet up with their financial needs and obligations such as difficulty making tuition payment on time, high cost of feeding and other unexpected expenses, have led the students to be overly stress and thereby facing depression while studying. In order to address this arising problem, this study aims to examine financial stress, its cause and consequences among the Sudanese student’s community in Malaysia. Hence the purpose of this study is to gain an understanding of financial stress experience by Sudanese students in Malaysia for possible solutions.

This research is aimed to achieve the followings; to examine among Sudanese students’ financial stress, debt, Spending behavior, insufficient funding. The study examined if debt, spending behavior and insufficient funding significantly affects financial stress among Sudanese students in Malaysia. This study is intended to fill the gap in the literature by identifying the factors that are associated with increased possibility of financial stress.

This is the first stage in understanding the causes of financial stress among Sudanese students in Malaysia and it will provide valuable information to Sudanese student, their families, advisors and future students. In this research, primary data is used, which is achieved through questionnaires and open-ended questions for Sudanese international students.

Literature Review

This study aims to examine financial stress, its cause, and consequences among the Sudanese student’s community in Malaysia. Stress is an unpleasant feeling that one experiences when one sees that something one value has been lost or is threatened. People feel stress when they believe that they do not have what it takes to face the perceived threat or loss. In this regards the study views the followings.

Financial Stress

This can be defined as emotional stress related to money matters, (Northern, 2010). Many researches on financial stress have focused on stress outcomes. The negatives outcome of financial stress has been documented on many aspects such as depression (Andrews, 2004) (Clark-Lempers, 1990), anxiety, poor academic performance (Harding, 2011). While some other research focusing on cooing behaviour on financially-stress student mainly seeking help (Hayhoe, 2000) other studied the different habit spending among university student taking financial stress as variable on their model (Hayhoe, 2000). Financial stress is personal differ from one to another, unpleasant feeling that one is incapable to meet financial demands, afford the necessities of his /her need, and have enough funds to make ends meet. It is the perception of the financial situation that is implicated in the negative outcomes they describe in their study. The most consistent finding of one research is that financial stress is allied with lowered self-esteem, an increasingly gloomy outlook on life, and reduced mental health, mainly an increase in depression and aggression. There is also a link between financial stress and suicide and alcohol consumption, likely because of the increased level of depression. Financial stress is also linked with decreasing physical health such as an increase in headaches, stomach-aches, and sleeplessness. (Manter, 2004). However, much of literature review indicated that international students face different problems. These challenges and problems, researcher has divided into four categories, as following: firstly, general living adjustment such as adjusting to food, housing environment and financial problems. Secondly, difficulties like lack of skills to survive. Thirdly, socio-cultural difficulties, for instance, face culture shock, recreational Problems. Fourth and lastly, personal psychological adjustment, for example feeling homesickness, loneliness, depression, experience isolation and worthlessness, (Merriam, 1998)

Masoumeh Alavi (2011). However, other study done by (Baki, 2013) classified the challenge faced by the international post- graduate into four categories but slightly different. In his study it showed that the challenges that international student experienced in their first year in college includes problems related to facilities, social environment, academic system and international office programs. Also, recently study by (Kadouf, 2016), on Sudanese students in Malaysia focused on their socio-legal problems. The study adopted mixed methodologies quantitative and qualitative along with comparative methods. This study targeted Sudanese students between the ages of 15 and 25 years born in Malaysia. The discussion in the study generalized the concept, philosophy, and the theories of diaspora. Its finding was different from other studies, built on the empirical data, cybercrime, cyber-bullying, drug abuse, online-shaming, racial tension, cross-marriages, Third Culture Kids (TCK) syndrome, and problems of integration seem to be the major challenges of Sudanese youths in Malaysia. With the stated, different challenges and problems faced by Sudanese students in Malaysia, this research discuses about some of the possible problems associated with financial difficulty in the next section, these are;

Depression

Financial problems can result to depression for many according to an article by (University of Southampton, 2016). The article also mentions that due to financial difficulties which lead to depression and alcoholism’s. Thus, many students turn to alcohol and other substances in order to relive their depression. Depression is the overwhelming feeling of despondency or sadness.

Anxiety

Anxiety is the overwhelming feeling or uneasiness or apprehension. Therefore, due to many university students being concerned about their financial distress causing anxiety symptoms. According to (Lefevor, 2013) nearly 60 percent of university students worry about not being able to pay collage fees and tuitions. Hence due to large amounts of stress and anxiety this can affect the student’s overall health and performance at school or at work.

Lack of Concentration

Financial woes lead to lack of concentration in college students according to (Pather, 2015). Therefore, many students opt to take fewer classes in order to not fail or flop. Other who find that the study load is too overwhelming might decide to transfer to other programs or to other universities. The study finds that 63 percent of first year or second year students will change their majors due to problems with financial stress or difficulties.

Social Difficulties

Socializing at university is a great way to meet new people and networking. According to (HALLIDAY-WYNES, 2014) many students that are financially struggling will be busy working to cover cost instead of socializing. Hence this deprives students of participating in off campus activities or joining clubs. The study states that disintegration socially can deprive students at a positive college experience. Hence limited socially connections results in limits students from social cultural gains.

Sleep Disorder

When students are starting university, they experience many important changes they need to handle mainly with increased independence, new social situations, change in peer groups, maintenance academic responsibilities and other things. Most of the students have roommates; almost half of these students wake up during night due to the noise of other. These challenges and special circumstances such as financial stress and other problems faced by university students because sleep disorder (Angelika Anita Schlarb, 2017). Another study stated that 27% of the college students at risk are due to less sleep disorder (JF, 2010)

Financial Debt

Study done by Harvard Kennedy School Institute of Political showed that more than 42% Millennials between 18 and 29 years old they or someone in the household has student loan debt while 48% indicated that they had no debt. The report showed that there is no statistical difference founded among age, gender or political party association. Moreover, 75% of the Millennials believe that debt is a major problem for young people in United State (Harvard Kennedy School Institute of Political, 2019). Studies have also shown Financial problems can result to depression for many according to an article by (University of Southampton, 2016). In applicability there is possibility of Sudanese students also experiencing financial debt because studies have shown that 58% have student loan debt, hence this can cause financial depression. This research hypothesis that financial debt can statically significantly cause financial stress among Sudanese students.

Spending Behavior

Many studies showed that financial behavior or spending behavior is learned through social learning starting from childhood of the individual. In a study by Lara Aknin, (2018), it demonstrates experience can lead one to face financial stress. The causes and outcome of spending behavior pertains to the amount that individuals spend on a regular basis. Spending habits can be developed or adapted to over time. For this research states that students in various financial situations can have different spending behaviors. Study on spending behavior of young people in Guangzhou, Hong Kong and Macau stated that entertainment, clothes, and accessories are the mostly spending area for them. However, they would borrow money from friends or work part time to earn more money to spend. The study showed that 20% 0f the youth of the Hong Kong when ran out of pocket money, they tried either borrow money or work part time (MSE, 2004). Appropriateness Sudanese students could experience same habits, as some of these students spend a part of their monthly allowance on entertainment, clothes, and accessories same as their peer. This research hypothesis that spending behavior can statically significantly cause financial stress among Sudanese students.

Insufficient Funding

Insufficient funding refers not having adequate funds for overdraft fees or to transfer to make a payment. Many university students face this issue of not having sufficient funds for the livelihoods of college life. Therefore, this leads too many to turn to loans or credits as a source of funding which can result to debts. In a study conducted, result shows lack of funding for university students makes many turn to illegal methods of gaining funds such as selling drugs and prostitution for money (Masud, 2005) .

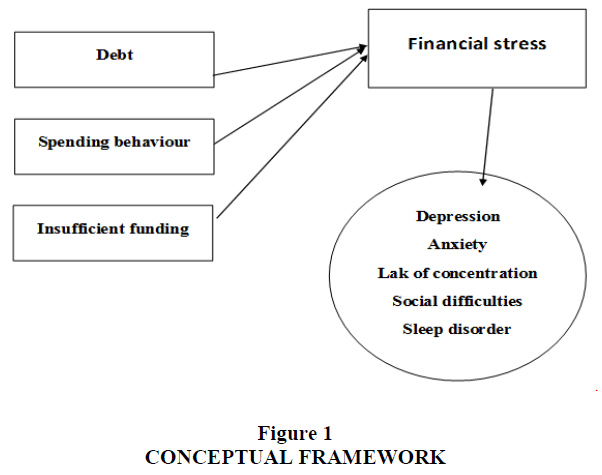

Conceptual Framework

The conceptual framework used in this research will show theories related to the topic of financial stress. Hence the conceptual framework here outlines the ideas pertaining to the cause and effects of financial stress. Figure 1 shows that the reasons or causes that lead to financial stress include: Debt, Spending Behaviors, or Insufficient Funds. These three factors ultimately lead to financial stress. Financial stress is result of economic and monetary proceedings. Hence financial stress results to effects such as: Depression, Anxiety, Lack of Concentration, Sleep disorders. Therefore, this show the health effects that can be caused by financial stress. Moreover, this can explain the issues or matters that Sudanese students experience when going through financial stress or difficulties in Malaysia.

Debt is a situation one someone does not have enough money in his pocket or his account to meet his need and he needs to borrow money from other or companies. Debt not only used by individual but also companies or many corporations as a method of making large purchases that they might not afford under normal situations. Insufficient fund is when someone try to buy whatever he wants using a credit card, that he does not have enough money to cover for his transaction. This kind of transactions usually ends with a big amount of money, which need to be paid before the due date or he would have to pay interest.

The research hypotheses are:

H1: There is significant relationship between financial stresses, debt, Spending behavior, Insufficient funding

H0: There is no significant relationship between financial stresses, financial debt, Spending behavior, Insufficient funding

H2: Financial debt can significantly cause financial stress among Sudanese students.

H0: Financial debt cannot significantly cause financial stress among Sudanese students.

H3: spending behavior can significantly cause financial stress among Sudanese students.

H0: spending behavior cannot significantly cause financial stress among Sudanese students

H4: Insufficient funding can significantly cause financial stress among Sudanese students.

H0: Insufficient funding cannot significantly cause financial stress among Sudanese students

Research Methodology

The data report in this research is attempting to study financial problems among Sudanese students which lead to their financial stress. The data collection involved the systematic empirical investigation of observable phenomena via statistical or mathematical techniques (Hair et al., 2011). This is to allow high levels of reliability on gathered data; It also provided enough statistical power for data analysis. The quantitative empirical investigation was based on the use of five factors and six hypotheses. The questionnaire was developed based on literature review and pilot study. In a random sampling technique questionnaires were administered to respondents. Variable used in the questionnaire were in a 5-point Likert attitudinal scale. The respondents were requested to indicate their level of agreement with a number of statements relating to their experiences in Malaysia from 1 to 5. The respondents were Sudanese international students, in different universities in Malaysia. The students comprises of undergraduate and post graduate students. Questionnaires were distributed widely through social media and other online platforms used by the Sudanese students in Malaysia. After vetting, the questionnaire from respondents used for analyses was 68 in total. In this regards, total number of respondents is considered was substantial for quantitative analysis (Kate, 2021). The quantitative analysis was two stages of statistical analyses, which started with preliminary data analysis, exploratory factor analysis, followed by confirmatory factor analysis (CFA) using SEM. The Preliminary data analysis involved data coding, screening and descriptive analysis (Zikmund, 2003). All questions in the questionnaire are coded based on their numbering parts and respective subject matter. This was done for ease of data entry, consistency and uniformity of the data for statistical analysis. The questionnaire consists of 42 questions in seven constructs excluding the demographic section. Data screening was carried out on data after the data coding. There were three processes in data screening process. These processes include treatment of missing data, checking for outliers, and assessment of normality. These are carried out to eliminate any problem that may arise during the final data analysis (Pallant, 2013). Using SPSS to check for outliers is performed by boxplot and by five percent trimmed mean. However, there were no extreme cases of outliers. Also considering the difference between the values of 5 percent trimmed mean and the original mean value, the difference was not big and significant. In (Pallant,2013), it viewed that if there are no big difference on the value of 5 percent trimmed mean from the original mean value, the cases should be retained in the data file. In this construct, the value of the original mean value was less than 1. There was not much difference, so the outlier cases were retained.

Results

The population sample size is from thirteen universities in Malaysia, Most of the respondents (29.4 percent) are students of International Islamic University Malaysia. The second-high percent is USCI university 22.1 percent followed by Segi University 14.7 percent. However, Universiti Teknologi Malaysia and University of Malaya have same percentage of 8.8 percent. Only 1.5 percent participates from some universities such as Help University, Multimedia University and University Putra Malaysia. The Cronbach’s alpha is a coefficient of internal consistency. In many studies Cronbach alpha more than 0.5 is considered reliable or valid. After all necessary adjustment in the questionnaire is done, then reliability test was performed to confirm the consistency of the measurement items. The Cronbach alpha of the items had good internal consistency and the data items suitable, which is the value more than 0.848. The demographic profiles of the 68 respondents, shows that 70.6 percent of the respondents are males while 29.4 percent are females. 72.1 of the participants are under the age of 29, however 23.5 percent of them are of the range of 17-20. Moreover, student in this age has less experience in life. Meanwhile, almost third of the respondents are above 28 years old. Also 77.9 percent of the respondents are single, which indicates that 22.1 of the respondents come to Malaysia with their wife’s and children to stay and study. Mostly these students do not stay in campus with their families. The respondent current year of the study when this survey was carried out shows that almost third of the participants are in their third year of the study, while 17.6 percent are in the first year. While 27.9 and 22.1 percent are in their second and fourth year respectively.Result showed that measure of sampling adequacy Kaiser-Meyer Oiken (KMO) is 0.727 exceeding the recommended value of 0.6 (Pallant, 2013). Hence, it is appropriate for factor analysis using principle component analysis (PCA) method. The Bartlett’s Test of spherity also reached statistical significance (0.000), supporting the factorability of the correlation matrix. The next stage is confirmatory analysis.

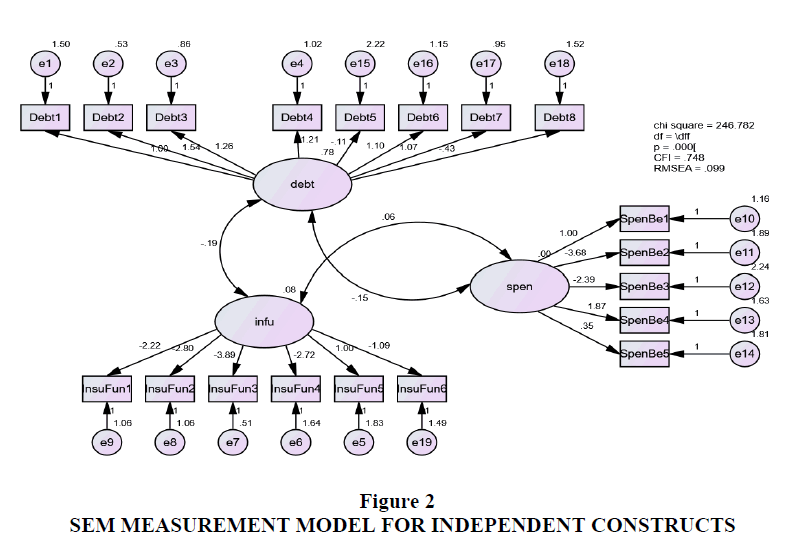

The SEM application involved two stages. The first stage was exploratory factor analysis (EFA) and the second stage was confirmatory factor analysis (CFA). EFA is often used at the early stage of research to gather information about the interrelationships among the set of variables. While CFA is a more complex set of techniques used in later in the research process to test and confirm the research specific hypotheses or theories concerning the structure underlying a set of variables (Pallant, 2013 ). Hence the CFA is carried out after EFA has been done. This model is tested using the confirmatory analysis. Confirmatory factor analysis is conducted to test and confirm specific hypotheses. The measurement model is confirmed by fit statistics, such as root mean error of approximation (RMSEA), degree of freedom (df), chi- square (X2), normed fit index, (NFI) , comparative fit index ( CFI), Tucker-Lewis index (TLI) and incremental fit index (IFI) . In case where a measurement model does not fulfill the validity criteria, other alternatives for fit indicators that can be used are standardized residual covariance and modification index. In other to conduct SEM the independent and dependent constructs should be correlated with each other. The next section discusses of the measurement model of the independent constructs and for the independent constructs and dependent. The measurement carried out on the independent variables was to test the relationship between, financial debt, insufficient fund, and spending behavior. It was deemed sufficient to proceed and asses the measurement model fit. In the loadings, not all the measurement items in the constructs were statistically significant, some of the items had low loadings ranging from 0.3 to 0.4 not meeting the requirement of loading, values of 0.5 (Hairptav et.al 2016). The CFI = 3.208 is higher than the acceptable value of fit which is greater than equal to 0.90. The root means square error of approximately RMSEA =0.099 is above the required threshold of less than 0.05, however recent researches agrees 0.099 is acceptable (Kline, 2010). Df =0.149 incremental fit index (IFI) = 0.762 higher than the acceptable fit and approximately the Lewis index (TLI) = 0.711 (Hair, 2010). See figure 2.

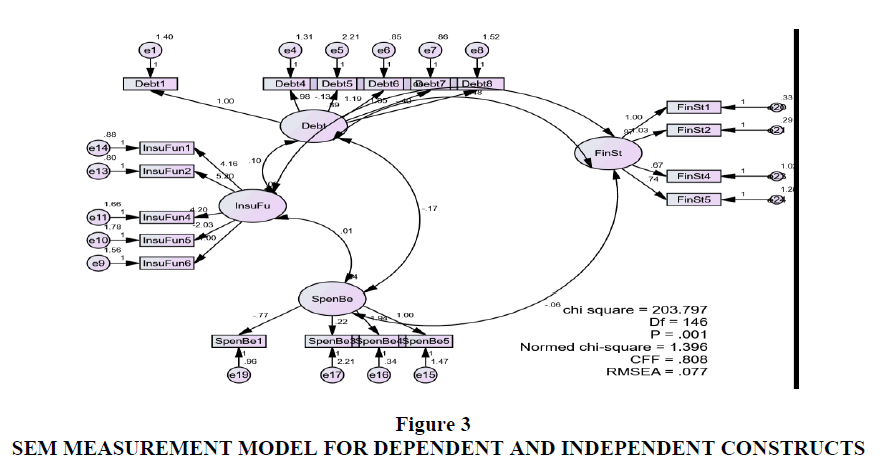

In other to test the research hypotheses H1, measurement was carried out on the dependent and independent variables. This was to test the relationship between, financial stress, financial debt, insufficient fund, and spending behavior. It was deemed enough to proceed and asses the measurement model fit. To confirm with H1 of this research, goodness-of-fit indices and the following, standardized estimates or regression weight, standard error (S.E), critical ratio (C.R) and probability value (p-value) were examined and analyzed, utilized for the model fit Table 1. The significant path between two constructs is confirmed if the C.R value is greater than 1.96 while the p value is statistically significant at 0.05 or 0.001. In this research, the results show that the models have achieved all the fit indices and all the measures support the model fit assumption (Hair 2010). In Chi square = 203.797, df = 146, p = 0.000, TLI = 0.775, CFI 0.808 and RMSEA = 0.077. Table 2 shows the direct relationship between the independent and dependent construct, financial stress, financial debt, insufficient fund, and spending behavior see figure 3.

| Table 1 Covariance: (Group Number 1 - Default Model) | |||||||

| Estimate | S.E. | C.R. | P | Label | |||

| Debt | <--> | InsuFu | 0.102 | 0.104 | 0.981 | 0.326 | |

| InsuFu | <--> | FinSt | 0.079 | 0.082 | 0.967 | 0.334 | |

| InsuFu | <--> | SpenBe | 0.014 | 0.023 | 0.617 | 0.537 | |

| Debt | <--> | FinSt | 0.485 | 0.171 | 2.841 | 0.005 | |

| Debt | <--> | SpenBe | -0.167 | 0.114 | -1.472 | 0.141 | |

| FinSt | <--> | SpenBe | -0.055 | 0.087 | -0.635 | 0.525 | |

| Table 2 Correlations: (Group Number 1 - Default Model) | |||

| Estimate | |||

| Debt | <--> | InsuFu | 0.588 |

| InsuFu | <--> | FinSt | 0.435 |

| InsuFu | <--> | SpenBe | 0.132 |

| Debt | <--> | FinSt | 0.522 |

| Debt | <--> | SpenBe | -0.305 |

| FinSt | <--> | SpenBe | -0.096 |

In this confirmatory analysis items with low loadings, insufficient fund 3, debt 2, debt 3, spending behavior 3, and financial stress 3 were removed and the model was re-estimated. In the re-estimation the items the model achieved most of the fit indices. Based on the squared multiple correlation results, the whole result loadings were statistically significant at (>0.50) except for spending behavior Table 1 and Table 3.

| Table 3 Standardized Regression Weights: (Group Number 1 - Default Model) | |||

| Estimate | |||

| Debt1 | <--- | Debt | 0.623 |

| Debt4 | <--- | Debt | 0.628 |

| Debt5 | <--- | Debt | -0.084 |

| Debt6 | <--- | Debt | 0.77 |

| Debt7 | <--- | Debt | 0.731 |

| Debt8 | <--- | Debt | -0.289 |

| InsuFun6 | <--- | InsuFu | 0.146 |

| InsuFun5 | <--- | InsuFu | -0.271 |

| InsuFun4 | <--- | InsuFu | 0.514 |

| InsuFun2 | <--- | InsuFu | 0.731 |

| InsuFun1 | <--- | InsuFu | 0.632 |

| FinSt1 | <--- | FinSt | 0.864 |

| FinSt2 | <--- | FinSt | 0.884 |

| FinSt4 | <--- | FinSt | 0.546 |

| FinSt5 | <--- | FinSt | 0.54 |

| SpenBe5 | <--- | SpenBe | 0.433 |

| SpenBe4 | <--- | SpenBe | 0.89 |

| SpenBe3 | <--- | SpenBe | 0.085 |

| SpenBe1 | <--- | SpenBe | -0.416 |

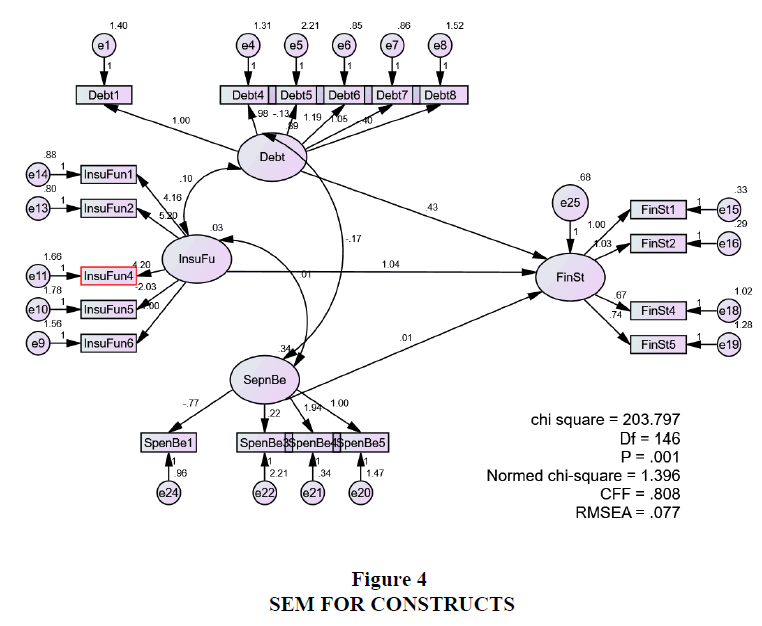

Overall, the constructs measurement model achieved the validity requirements for constructs. The constructs must be correlated with each other. Hence hypotheses H1 are supported. The next section discusses on the structural modelling of the research in order to confirm hypotheses H2, H3, H4, and H5 that is the direct effect of constructs, the results of standardized estimates are observed. Figure 4 shows the SEM for the direct effect of the independent constructs on the dependent constructs.

The reliability (CR) and validity (AVE) of the constructs is confirmed. A high value of CR and AVE indicate there is internal consistency all measures are reliably representing their constructs (Hair 2010). The variables specified to measure an underlying construct were statistically significant. Most of the factors fulfilled the requirement for convergent validity 0.50 and above not exceeded 1.00. the variance of the error terms was found to be in the range of requirement for statistical significance. The measurement error represents other variations for an observed variable and the variance of a measurement error is estimated. Overall, the constructs measurement model achieved the validity requirements. H2, H3, and H4, are supported see Table 4.

| Table 4 Hypothesis Statement and Result Analysis | ||

| Hypothesis | Statement | Analysis |

| H1 | There is significant relationship between financial stresses, debt, Spending behavior, Insufficient funding | Supported |

| H2 | Financial debt can significantly cause financial stress among Sudanese students. | Supported |

| H3 | spending behavior can significantly cause financial stress among Sudanese students | Supported |

| H4 | Insufficient can significantly cause financial stress among Sudanese students. | Supported |

Summary of Research Findings & Discussions

This research is carried out to know the factors of financial stress and its effect among Sudanese students in Malaysia, which was carried out based on four research objectives, research questions and four hypotheses. Investigation of the four research objectives was aimed to test the hypotheses on factors that related to financial stress among Sudanese students in Malaysia. The quantitative research, few statistical analyses was done utilizing SPSS and Amos software in order to achieve the research objectives. Next sub-sections discuss the research findings.

Objective 1:

To examine if there was statistically significant relationship between financial stress, insufficient funding, debt and spending behavior among Sudanese students in Malaysia. Research analytical result shows there was a significant relationship. That all the constructs or variable significantly affect one another among the Sudanese students in Malaysia.

Objective 2:

To examine if debt significantly affect financial stress among Sudanese Student in Malaysia. That is to find out if debt was also the cause of financial stress. Hence the hypothesis for this objective was to test if debt was of any significance effect on financial stress among the Sudanese students. There was significance, H2 supported

Objective 3:

To examine if spending behavior causes financial stress among Sudanese students in Malaysia. In objective four, the study aims to find out if spending behavior was significant in the cause of financial stress among the students. Though spending behavior was significant, but it did not have a strong significance. However, H0 is rejected and hypotheses H3 is supported.

Objective 4:

In objective four, the study aims to find out if insufficient funding was also significant in the cause of financial stress among the students. The result shows there was significance level, hence null hypotheses H0 is rejected and hypotheses H4 is supported. This also prove the measurement items are also related and valid to measure debt as it affect financial stress among Sudanese Student in Malaysia.

Conclusion

The study used survey and SEM analysis approach to investigate, and examine the factors related to financial stress among Sudanese Student in Malaysia based on a comprehensive framework. Eight factors sets of determinant factors were investigated The joined examination of these eight sets of factors marks the contribution to this study. Our empirical investigation, which is based on principal component analysis technique, represents another contribution of this study. The research questionnaires included open-ended and closed questions to collect the necessary information, in order of provide insights into a variety of critical factors that determine financial stress among Sudanese students in Malaysia. Research analytical result shows there is significant relationship between financial stress, insufficient funding, debt and spending behavior. That all the constructs significantly affect one another among the Sudanese students in Malaysia. The results support all research hypotheses. The study limitations are, the study did not differently analyze data between on campus and off campus Sudanese students, whose cost of living and spending habits might be different from one another. Other factors, which may affect financial stress apart from the mentioned ones were not considered. Although our results are robust, future work could incorporate larger sample size, other nationalities, and other factors that could cause financial distress. In recommendation, sufficient funding for students by their sponsors will prevent financial stress and make them do better in their academics. Inclusively, universities and colleges, especially private ones should not overly pressurize the students in fulfilling their financial responsibility. Also, the communities where these institutions are, can support by not exploiting the students when they patronize their businesses, like accommodation and groceries. Universities should consider providing more scholarships, discounts, bursaries, grants, work study opportunities, and other school provisions such as accommodation and campus transportation especially for their international students. The students are expected to avoid debt, curtail their spending habits, consider not embarking on what they cannot financially afford or have financially planned on, to avoid financial stress.

References

Aknin, L. B., Wiwad, D., & Hanniball, K. B. (2018). Buying well-being: Spending behavior and happiness. Social and Personality Psychology Compass, 12(5), e12386.

Indexed at, Google Scholar, Cross Ref

Alavi, M., & Mansor, S. M. S. (2011). Categories of problems among international students in Universiti Teknologi Malaysia. Procedia-Social and Behavioral Sciences, 30, 1581-1587.

Indexed at, Google Scholar, Cross Ref

Al-Zubaidi, K. O., & Rechards, C. (2010). Arab postgraduate students in Malaysia: Identifying and overcoming the cultural and language barriers. Arab World English Journal, 1(1).

Indexed at, Google Scholar, Cross Ref

Andrews, B., & Wilding, J. M. (2004). The relation of depression and anxiety to life-stress and achievement in students. British journal of psychology, 95(4), 509-521.

Indexed at, Google Scholar, Cross Ref

Bourque, E., & Dudek, G. (2004, September). Procedural texture matching and transformation. In Computer Graphics Forum (Vol. 23, No. 3, pp. 461-468). Oxford, UK and Boston, USA: Blackwell Publishing, Inc.

Indexed at, Google Scholar, Cross Ref

Clark-Lempers, D. S., Lempers, J. D., & Netusil, A. J. (1990). Family financial stress, parental support, and young adolescents' academic achievement and depressive symptoms. The Journal of Early Adolescence, 10(1), 21-36.

Indexed at, Google Scholar, Cross Ref

Gaultney, J. F. (2010). The prevalence of sleep disorders in college students: impact on academic performance. Journal of American College Health, 59(2), 91-97.

Indexed at, Google Scholar, Cross Ref

Hair, J. B. (2010). Multivaraiative Data Analysis 7th Edition. Pearson, New York.

Halliday-Wynes, S., & Nguyen, N. (2014). Does financial stress impact on young people in tertiary study?. National Centre for Vocational Education Research.

Harding, J. (2011). Financial circumstances, financial difficulties and academic achievement among first-year undergraduates. Journal of Further and Higher Education, 35(4), 483-499.

Indexed at, Google Scholar, Cross Ref

Harvard Kennedy School Institute of Political. (2019). Harvard Kennedy School Institute of Political. Retrieved from Harvard IOP ©2019 The President and Fellows of Harvard College: https://iop.harvard.edu/student-debt-viewed-major-problem-financial-considerations-important-factor-most-millennials-when

Hayhoe, C. R., Leach, L. J., Turner, P. R., Bruin, M. J., & Lawrence, F. C. (2000). Differences in spending habits and credit use of college students. Journal of Consumer Affairs, 34(1), 113-133.

Indexed at, Google Scholar, Cross Ref

Jones, P. J., Park, S. Y., & Lefevor, G. T. (2018). Contemporary college student anxiety: The role of academic distress, financial stress, and support. Journal of College Counseling, 21(3), 252-264.

Indexed at, Google Scholar, Cross Ref

Kadouf, H. A., & Kulliyyah, A. I. CONTEXTUALIZING SOCIO-LEGAL PROBLEMS OF SUDANESE YOUTH IN MALAYSIA: A CASE STUDY.

Kline, R. B. (2023). Principles and practice of structural equation modeling. Guilford publications.

Letkiewicz, J., Lim, H., Heckman, S., Bartholomae, S., Fox, J. J., & Montalto, C. P. (2014). The path to graduation: Factors predicting on-time graduation rates. Journal of College Student Retention: Research, Theory & Practice, 16(3), 351-371.

Indexed at, Google Scholar, Cross Ref

LM., C. (2008). Pilot Studies. Medsurg Nurs.

Manter, c. G. (2004). The Consequences of Financial Stress for Individuals, Families, and Society. ResearchGate.

Masud, J., Husniyah, A. R., Laily, P., & Britt, S. (2004). Financial Behaviour and Problems Among University Students: Needs for Financial Education. Journal of personal Financial, Vol. 3, Issues 1.

Merriam, S. B. (1998). Qualitative Research and Case Study Applications in Education. Revised and Expanded from" Case Study Research in Education.". Jossey-Bass Publishers, 350 Sansome St, San Francisco, CA 94104.

MSE. (2004). Young People Should Cultivate Attitude Of Rational Spending. Retrieved from mce.edb.hkedcity.net/upload/news/Rewrite-125-eng-m.doc

Nadome, A. (2014). SPENDING HABITS AMONG MALAYSIAN UNIVERSITY STUDENTS. Academia.

Northern, J. J., O'Brien, W. H., & Goetz, P. W. (2010). The development, evaluation, and validation of a financial stress scale for undergraduate students. Journal of College Student Development, 51(1), 79-92.

Indexed at, Google Scholar, Cross Ref

Pallant, J. (2020). SPSS survival manual: A step by step guide to data analysis using IBM SPSS. McGraw-hill education (UK).

Pather, S. (2015). Financial stress distracts university students from academic success. Cape Peninsula University of Technology.

Ross, S. E., Niebling, B. C., & Heckert, T. M. (1999). Sources of stress among college students. College student journal, 33(2), 312-312.

Schlarb, A. A., Friedrich, A., & Claßen, M. (2017). Sleep problems in university students–an intervention. Neuropsychiatric disease and treatment, 1989-2001.

Indexed at, Google Scholar, Cross Ref

Talebloo, B., & Baki, R. B. (2013). Challenges faced by international postgraduate students during their first year of studies. International Journal of Humanities and Social Science, 3(13), 138-145.

University of Southampton. (2016, August 9). Financial worries linked to mental health issues among university students. Retrieved from University of Southampton: https://www.southampton.ac.uk/news/2016/08/debt-mental-health.page

Zikmund, W. (2003). Business Reasearch Methods.

Received: 25-Aug-2023, Manuscript No. AEJ-23-14015; Editor assigned: 28-Aug-2023, PreQC No. AEJ-23-14015(PQ); Reviewed: 11-Sep-2023, QC No. AEJ-23-14015; Revised: 16-Sep-2023, Manuscript No. AEJ-23-14015(R); Published: 23-Sep-2023