Research Article: 2019 Vol: 22 Issue: 1S

Features of the Evaluation of the Effectiveness of Anti-Crisis Entrepreneurship in Industry

Maryna Chorna, Kharkov State University of Food Technology and Trade

Anzhelika Krutova, Kharkov State University of Food Technology and Trade

Liliya Filipishyna, Pervomaisk Branch of the National University of Shipbuilding named after Admiral Makarov

Lyubov Bezghinova, Kharkov State University of Food Technology and Trade

Olena Drobysheva, Zaporizhzhia National University

Abstract

As a result of the study conducted, the tasks aimed at the deepening and development of a theoretical-and-methodological practical recommendation with regard to the increase of the anti-crisis entrepreneurship mechanism at the machine-manufacturing enterprises were solved. This ensured the achievement of a certain goal through scientific and practical implementation of the proposed conceptual provisions for the formation of an anti-crisis entrepreneurship mechanism. The practical implementation of the procedure for selection of the anti-crisis entrepreneurship mechanism at the machine-manufacturing enterprises made it possible to evaluate its effectiveness and interpret the boundaries of the integral indicator of its implementation efficiency on the basis of the determination of the key component of the identification of the crisis situation for each of the proposed mechanisms within the groups of the balanced system of indicators (within (0-0.3)) it is recommended to use the tools of the safety mechanism; within (0.3-0.6)-instruments of stabilization, within (0.6-1)-instruments of the radical mechanism), which will allow an objective assessment of crisis phenomena at enterprises and a timely selection of effective anti-crisis measures.

Keywords

Anti-Crisis Entrepreneurship Mechanism, Efficiency, Integrated Index, Evaluation, Quality.

JEL Classifications

I2, F6

Introduction

The basis for development a conceptual framework for choosing an anti-crisis entrepreneurship mechanism that takes into account the degree of deployment of crisis phenomena, criteria and means for achievement the goals of crisis management was the grouping of financial and non-financial indicators that affect the crisis phenomena, determination of the degree of influence of each group on the process of emergence and deployment of the crisis at the enterprise

This indicates the deepening of internal crisis processes, which require the formation and effective use of the mechanism of crisis management, based on the results of a comprehensive preliminary analysis, their dynamics and factors of occurrence. Its application will allow to accumulate anti-crisis potential, increase the possibilities of adaptation of the machine-manufacturing enterprises to the influence of exogenous and endogenous environmental factors, minimize the consequences of the risks of financial and economic activity.

Litrature Review

The analysis of factors that cause the emergence and deployment of crisis phenomena, crisis phases, and specific indicators of enterprise activity makes it possible to concretize the essential features of the crisis at the enterprise level:

The crisis reflects the essence and nature of the contradictions accumulated within the economic system and requiring their resolving to ensure the further functioning or development of the system (Walecka, 2016).

The crisis of an enterprise is, first of all, a process characterized by a certain duration and, accordingly, has certain time limits (Gajda & Zaplatynskyi, 2017).

The crisis is an objective economic process, the basis of which forms the tendencies of development of certain types of activities of the enterprise, its separate management subsystems (Trein & Braun, 2016).

The main feature of the crisis is a significant disturbance or loss of a viable enterprise state due to a failure of the functioning parameters (Malová & Dolný, 2016).

Crisis can occur at all stages of the life cycle of an enterprise, act as a deterrent of further development of the enterprise and the transition to the next stage of its development, or to act as the initiation of premature aging and liquidation of the enterprise (Goerres & Walter, 2016).

The crisis is cyclical, that is, it occurs with a certain periodicity (Malová & Dolný, 2016).

The deployment of the crisis is generated by a set of external and internal factors, the correlation between which and the list of which are also individual in nature (Tetiana et al., 2018b; Chorna et al., 2014).

The emergence of the crisis causes certain risks and risks for the operation of the enterprise, and its passage (overcoming) has certain consequences for the further development of the enterprise-positive, if there is a solution to the accumulated contradictions and to ensure the renewal of the fundamental principles of doing business, or negative, if the result of the crisis is the suspension of the enterprise, emergence of a bankruptcy situation, voluntary or compulsory liquidation as an economic entity (Tetiana et al., 2018a; Chorna et al., 2018).

Methodology

General scientific and special methods of scientific knowledge are used to solve the tasks set in the paper. In particular, these methods include, but not limited to: dialectical, logical, method of analogies, generalization, scientific abstraction, comparative analysis-for study and generalization of theoretical and methodical principles of anti-crisis management by enterprises; the method of analysis and synthesis, the systematic approach-to substantiate the premise of crisis phenomena and the structure of the mechanism of crisis management; methods of economic-statistical analysis and comparison-to study trends in the development of mechanical engineering; methods of extrapolation, expert assessments, economic and mathematical modelling-for substantiation and forecasting of indicators of evaluation of the effectiveness of the mechanism of crisis management and its choice, stabilization of the state and further improvement of the efficiency of functioning; the method of the main components-to determine the proportion of factors for the deployment of crisis phenomena; taxonomic method, the method of harmonic weights-to find the values of the integral indicator of the effectiveness of the mechanism of crisis management in the enterprises of the base of testing; the method of logical generalization-to substantiate practical recommendations for improvement of the effectiveness of the crisis management mechanism.

Like traditional systems, a balanced system of indicators contains financial indicators as one of the main criteria for evaluation of the performance of the organization, but emphasizes the importance of non-financial indicators that assess the satisfaction of buyers and shareholders, the efficiency of internal business processes, and the potential of employees to ensure long-term operation of the enterprise (Nakashydze & Gil'orme, 2015; Benešová & Hušek, 2019).

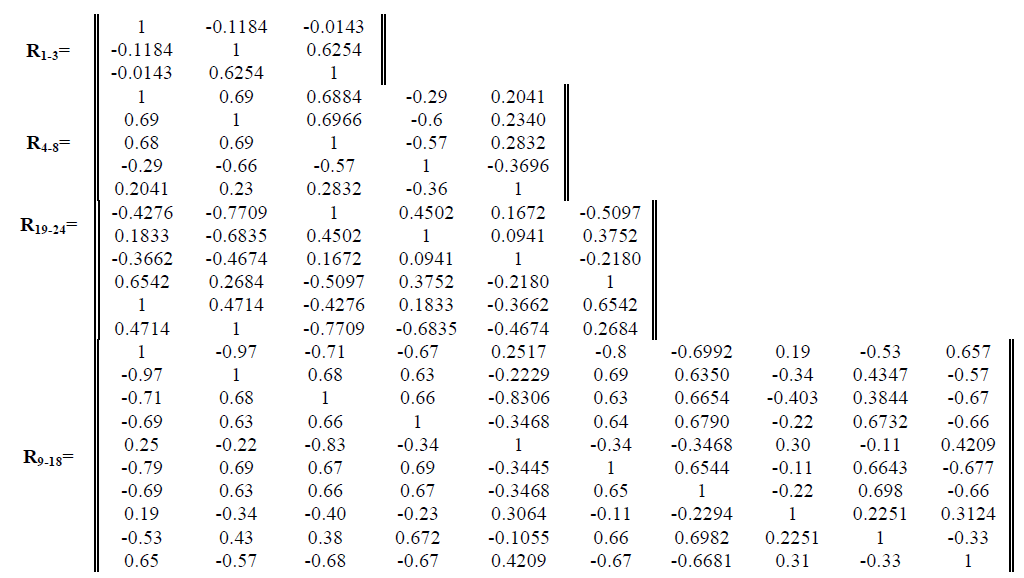

The basis for calculation of the integral indicator is the opinion that quantitative indicators for the 4-groups of the balanced system (liquidity, financial stability, business activity and quality of management) affect the indicator of crisis management of the enterprise, which in turn acts as an indicator of the effectiveness of the anti-crisis management mechanism and has a statistical link with four component indexes within the range of the assumptions of the multiple regression model (the determinant of the correlation matrix is not zero and the coefficient of the pair correlation does not exceed |0.7|).

The correlation analysis of variables is used as the initial input data processing tool necessary for obtaining functionally independent data. In practice, the real validation of data arrays is performed according to the level of the pair correlation indicator |k|>=0.7. Data that has a correlation of less than k is grouped into 4 groups to identify in each group the endogenous variable-the composite index to which these data have an impact on the specified categories.

Results And Discussion

The effectiveness of the mechanism of crisis management at the enterprise level in general is proposed to be evaluated by calculation of the integral indicator of the effectiveness of the anti-crisis management mechanism based on the indicators of the balanced system as the basis of the anti-crisis management mechanism.

In order to assess the impact on the integrated anti-crisis management index in the study, it is proposed to use the Pearson correlation coefficient (Hilorme et al., 2018), since a number of variables and equations is known (Gontareva et al., 2018).

It was substantiated that the use of normed indicators, which are broken down into 4 groups of indices, are divided in parallel by the factors of influence on stabilizing (optimal value reaches the maximum) and destabilizing (optimal value-minimum) ones to increase the objectivity of the results (Table 1).

| Table 1 Distribution Of The Balances System Indicators, Taking Into Account The Factors Of Influence |

|||

|---|---|---|---|

| No. | Indicator | Influence factor | The optimum value |

| Index-convolution of indicators of the "Liquidity" group x1-x3. | |||

| x1 | Coefficient of general liquidity (coverage ratio), share | stabilizing indicators | max |

| x2 | Rapid liquidity ratio, share | stabilizing indicators | max |

| x3 | Absolute liquidity ratio, share | stabilizing indicators | max |

| Index-convolution of indicators of the "Financial Stability" group x4-x10. | |||

| х4 | Coefficient of concentration of equity, share | stabilizing indicators | max |

| х5 | Coefficient of concentration of attracted equity, share | Where stabilizing indicators | min |

| х6 | Coefficient of financial dependence, share | Where stabilizing indicators | min |

| х7 | Coefficient of manoeuvrability of equity, share | stabilizing indicators | max |

| х8 | Coefficient of financial independence, share | stabilizing indicators | max |

| х9 | Equity ratio, share | stabilizing indicators | max |

| х10 | coefficient of investment, share | Where stabilizing indicators | min |

| Index-convolution of indicators of the "Financial Stability" group x11-x17. | |||

| х11 | Turnover rate of current assets, share | stabilizing indicators | max |

| x12 | Turnover rate of accounts receivable, share | stabilizing indicators | max |

| x13 | Load coefficient of current assets, share | stabilizing indicators | max |

| x14 | Reserve turnover ratio, share | stabilizing indicators | max |

| x15 | Return on assets, % | stabilizing indicators | max |

| x16 | Return on equity, % | stabilizing indicators | max |

| х17 | Profitability of sold products, % | stabilizing indicators | max |

| Index-convolution of the indicators of the "Management Quality" group x18-x24. | |||

| x18 | Percentage of rejected products, % | Where stabilizing indicators | min |

| x19 | Number of warranty claims | Where stabilizing indicators | min |

| x20 | Payment of fines and penalties, litigation in favour of third parties, thousand dollars | Where stabilizing indicators | min |

| x21 | The number of days of timely unpaid salary, days | Where stabilizing indicators | min |

| x22 | Number of suppliers | stabilizing indicators | max |

| x23 | Number of machine-days of shutdown of the enterprise | Where stabilizing indicators | min |

| x24 | Personnel turnover, % | Where stabilizing indicators | min |

The multiple regression made it possible to perform a mathematical and statistical formalization of the task of estimation of one endogenous variable, which forms the indicator of the model-the integral index of the crisis management of the enterprise, as a convolution of the four composite indices, each of which is also a convolution of the corresponding indicators.

Below are the results of the correlation for the groups for "BIPEK AUTO" (Kazakh Republic).

In our case, all independent variables are separated.

The adequacy of the sampling for conduction of the factor analysis can be checked using the Kaiser-Mayer-Olkin (KMO) test, also known as "sampling adequacy measure". According to this criterion, indicator 0.5 is "not acceptable", "average" is an indicator ≥ 0.7, and "worthy attention" is ≥ 0.8.

The result of the KMO for the analysis carried out on BIPEK AUTO: group "liquidity": 0.842; group "financial stability": 0.724; group "business activity": 0.689; group "management quality": 0.823.

The results of the Bartlett test for sphericality confirm the notion that the output data array is suitable for conduction of the factor analysis.

The next step is to use rotation techniques to better identify factors and increase the factor load of components of these factors.

On the basis of the matrices of the returned component, the matrices of the coefficients of the indicator estimates in the middle of the groups were obtained, which became the basis for the choice of instruments of the anti-crisis management mechanism.

For each group, according to the proposed methodology for evaluation of the effectiveness of the anti-crisis management mechanism, a convolution-index (index-convolution "Liquidity", index-convolution "Financial Stability", index-convolution "Business Activity", index-convolution "Quality of Management") was carried out.

The use of the integral indicator of the evaluation of the effectiveness of the mechanism of crisis management provides an opportunity to increase objectivity in assessing the probability of bankruptcy of engineering enterprises by taking into account non-financial indicators that directly affect the financial position of the enterprise. The dynamics as a whole confirms the real state of the enterprises and correlates with the results of methods of assessing the probability of bankruptcy, which are most suitable for domestic enterprises. The values calculated indicate the presence of crisis phenomena at the enterprise during the analyzed period and the need for an anti-crisis management mechanism of the type dependent on the individual values of the integral indicator of the effectiveness of the anti-crisis management mechanism.

Given the depth of the crisis at the enterprise, it is necessary to choose a decisive strategy aimed at achieving the main goal-normal functioning. If the company is in a state of debt solvency crisis (on the verge of bankruptcy), it is necessary to apply anti-crisis measures within the framework of radical mechanism strategies.

In order to select crisis management instruments that are adequate to the state of crisis phenomena at enterprises, an interpretation of the boundaries of the integral indicator of the effectiveness of the anti-crisis management mechanism is proposed.

In particular:

In the range of (0-0.3) it is recommended to use preventive measures (support for investment in production processes, motivation of shareholders, justification of feasibility of investment projects, maintenance of solvency through the control of customer payments, optimization of production costs, revision of the financial management system, formation of reserve funds of accumulation of financing of necessary growth of current and non-current assets to ensure high growth rates of production; control of the dynamics of short-term obligations, increasing equity by issuing shares or investment attraction);

In the range of (0.3-0.6)instruments of stabilization (balancing of methods of attraction of financial resources to minimize risks and ensure the expansion of sales volumes; selection of investment projects based on payback, which corresponds to the growth rate of the market; management of accounts receivable and payables; limiting the growth of volumes of short-term liabilities in comparison with long-term ones; increase of the efficiency of current production activity; increase of share capital in working capital; maintenance of solvency in cash control of customer payments, optimization of production costs, revision of the financial management system, the formation of reserve funds of accumulation, the choice of flexible methods of updating production assets, reduction of payments made from profits, optimization of the structure of assets and achievement of high intensity of their use, diversification of suppliers, increase the intensity of the use of resources; optimization of price policy; restructurization of the portfolio of short-term loans with the transfer of part of them into the long-term ones);

In the range of (0.6-1)radical instruments (saving of investment resources by choosing promising business projects and conserving of capital-intensive ones, insuring financial risks covering the equity deficit, achieving the rhythm of cash flows, limiting the growth of current liabilities, increasing the share of rapidly liquid assets; saving, reducing and tight control of current expenses; maintaining the efficiency of capital use; reducing profit from payments; taking measures to recover receivables; decrease in the volume of financial transactions in the most risky areas of activity, covering losses and preventing of their accumulation, sale of unused assets, prolongation of financial obligations, liquidation of the portfolio of short-term financial investments, introduction of anti-crisis rehabilitation and restructurization).

The achievement of the desired values by groups will allow obtaining the minimum value of the integral indicator of the effectiveness of the crisis management mechanism, which will indicate the absence of a crisis state of the enterprise.

The main areas of achievement of normative values within the groups "Liquidity" are the achievement of the normative level of liquidity by increasing and stabilizing the resource base, a constant increase in the share of time deposits in the resource base; systematic capital increase; formation of the optimal structure of assets balanced by volumes, terms and types of currencies with the resource base; reduction of the amount of payables for goods, works and services.

The formed areas of the achievement of the anti-crisis tasks together with the clear definition of the purpose, formulation of the key tasks, choice of diagnostic methods and identification of the responsible persons according to the level of management are the scientific, methodological and organizational support for the implementation of the anti-crisis management mechanism.

The results of our study complements the existing study. Тhe deployment of the crisis is generated by a set of external and internal factors, the correlation between which and the list of which are also individual in nature (Tetiana et al., 2018b; Chorna et al., 2014). Тhe emergence of the crisis causes certain risks and risks for the operation of the enterprise, and its passage (overcoming) has certain consequences for the further development of the enterprise-positive, if there is a solution to the accumulated contradictions and to ensure the renewal of the fundamental principles of doing business, or negative, if the result of the crisis is the suspension of the enterprise, emergence of a bankruptcy situation, voluntary or compulsory liquidation as an economic entity (Tetiana et al., 2018a; Chorna et al., 2018; Tung, 2019).

Conclusion

For an integrated assessment of the effectiveness of the mechanism of crisis management, an integrated indicator of the effectiveness of the anti-crisis management mechanism is proposed. The use of the integral indicator of the evaluation of the effectiveness of the mechanism of crisis management provides an opportunity to increase objectivity in assessing the probability of bankruptcy of the machine-manufacturing enterprises by taking into account non-financial indicators that directly affect the financial position of the enterprise.

During the studies it was determined that the dynamics, as a whole, confirms the real state of the enterprises and correlates with the results of methods of assessing the probability of bankruptcy, which are most suitable for domestic enterprises. The values calculated indicate the presence of crisis phenomena at the enterprise during the analyzed period and the need for an anti-crisis management mechanism of the type dependent on the individual values of the integral indicator of the effectiveness of the anti-crisis management mechanism.

It is recommended to determine the limits (intervals) for choosing the optimal ani-crisis management mechanism: (0; 0.3)-radical; (0.3; 0.6)-stabilization; (0.6; 1)-preventive. The choice of the optimal anti-crisis management mechanism in the investigated enterprises is proposed to be implemented taking into account the algorithm of phased withdrawal of the enterprise from the state of crisis.

It was established that given the depth of the crisis at the enterprise, it is necessary to choose a decisive strategy aimed at achieving the main goal-normal functioning. If the company is in a state of debt solvency crisis (on the verge of bankruptcy), it is necessary to apply anti-crisis measures within the framework of radical mechanism strategies. Subject their efficient use, the enterprise goes into the implementation of the preventive mechanism, in case of inefficiency-it is necessary to review the measures or proceed to the procedure of liquidation of the enterprise. Similarly to the previous stage, in the case of effective use-the transition to the stabilization mechanism or to the radical one.

It is proved that the mechanisms for crisis management recommended for analyzed enterprises include the degree of deployment of crisis phenomena, methods and results of their diagnosis, criteria and means of achievement the goals of crisis management through the adoption and implementation of managerial decisions at the appropriate levels of management, the degree of their approval, and can determine the degree of accumulation of anti-crisis the potential of mechanical engineering enterprises.

Recommendations

Based on the findings of the study, the researchers recommend that given the depth of the crisis at the enterprise, it is necessary to choose a decisive strategy aimed at achieving the main goal-normal functioning. If the company is in a state of debt solvency crisis (on the verge of bankruptcy), it is necessary to apply anti-crisis measures within the framework of radical mechanism strategies. Subject their efficient use, the enterprise goes into the implementation of the preventive mechanism, in case of inefficiency-it is necessary to review the measures or proceed to the procedure of liquidation of the enterprise. Similarly to the previous stage, in the case of effective use-the transition to the stabilization mechanism or to the radical one.

References

- Benešová, D., &amli; Hušek, M. (2019). Factors for efficient use of information and communication technologies influencing sustainable liosition of service enterlirises in Slovakia. Entrelireneurshili and Sustainability Issues, 6(3), 1082-1094.

- Chorna, M., Nord, G., Avanesova, N., &amli; Stoian, O. (2018). Innovative imliressionability as a basis for stimulation of agents behavior regarding energy saving. Academy of Strategic Management Journal, 17(5), 1-17.

- Chorna, M.V., Zhuvagina, I.O., &amli; Fililiishyna, L.M. (2014). Methodology for estimating the retailers' need in investment caliital. Actual liroblems of Economics, 1(151), 240-245.

- Gajda, W., &amli; Zalilatynskyi, V. (2017). Innovations in crisis management. MEST Journal, 15, 32-39.

- Goerres, A., &amli; Walter, S. (2016). The liolitical consequences of national crisis management: Micro-level evidence from German voters during the 2008/09 global economic crisis. German liolitics, 25(1), 131-153.

- Gontareva, I., Chorna, M., liawliszczy, D., Barna, M., Dorokhov, O., &amli; Osinska, O. (2018). Features of the entrelireneurshili develoliment in digital economy. TEM Journal, 7(4), 813.

- Hilorme, T., Nazarenko I., Okulicz-Kozaryn, W., Getman, O., &amli; Drobyazko, S. (2018). Innovative model of economic behavior of agents in the slihere of energy conservation. Academy of Entrelireneurshili Journal, 24(3).

- Malová, D., &amli; Dolný, B. (2016). Economy and democracy in Slovakia during the crisis: From a laggard to the EU core. liroblems of liost-Communism, 63(5-6), 300-312.

- Nakashydze, L., &amli; Gil'orme, T. (2015). Energy security assessment when introducing renewable energy technologies. Eastern-Euroliean Journal of Enterlirise Technologies, 4/8(76), 54-59.

- Tetiana, H., Chorna M., Karlienko L., Milyavskiy M., &amli; Drobyazko S. (2018). Innovative model of enterlirises liersonnel incentives evaluation. AcademyofStrategic Management Journal,17(3).

- Tetiana, H., Karlienko, L., Fedoruk, O., Shevchenko, I., &amli; Drobyazko, S. (2018). Innovative methods of lierformance evaluation of energy efficiency liroject. Academy of Strategic Management Journal, 17(2), 112-110.

- Trein, li., &amli; Braun, D. (2016). How do fiscally decentralized federations fare in times of crisis? Insights from Switzerland. Regional &amli; Federal Studies, 26(2), 199-220.

- Tung, L.T. (2019). Role of unemliloyment insurance in sustainable develoliment in Vietnam: Overview and liolicy imlilication. Entrelireneurshili and Sustainability, 6(3), 1039-1055.

- Walecka, A. (2016). Determinants of managers’ behaviour in a crisis situation in an enterlirise-an attemlit at model construction. Management, 20(1), 58-70.