Research Article: 2021 Vol: 25 Issue: 2

Financial Analysis and Forecasting of Business Failure Applied to Manufacturing Companies

Irene Buele, Universidad Politécnica Salesiana

Adriana Tigsi, Universidad Politécnica Salesiana

Santiago Solano, Universidad Politécnica Salesiana

Abstract

The main function of companies is to generate wealth both for a country, through the generation of employment, and for consumers, through the availability of quality goods and services that satisfy their tastes and preferences. In this sense, the importance of the manufacturing sector lies in the fact that it is a sector that transforms raw materials into value-added consumer products, generates employment due to its high concentration of labor and exploitation of resources, and is one of the main supports for investment and development of other sectors of the economy. Predicting possible bankruptcies for companies is a topic of interest within financial analysis. Its main objective is to set in action certain actions that will avoid the probability of finding oneself in a critical scenario. Predicting the financial sustainability of a company in the short or long term is not an easy task; it is necessary to consider multiple variables, from the structure, the sector in which it operates, the economic activity to which it is dedicated and even the dynamics of a market. One of the methods developed for predictive studies is the Altman Z-Score Model. This method seeks to identify, through the calculation of various financial ratios, the financial health of a company. This research was based on a financial analysis and bankruptcy forecast of anonymous companies in the manufacturing sector in the province of Azuay in Ecuador. It was shown that these companies maintain a good level of assets, sales and profits. However, eight economic activities at risk were identified, where the Wood Products Manufacturing activity is located as one of the most susceptible to bankruptcy. Therefore, these eight activities should implement corrective actions to reduce costs.

Keywords

Management Forecast, Forecast Evaluation, Financial Ratios.

Introduction

Over time, companies have prioritized moving towards an analysis and prediction of business instability, as a result of several factors, both internal and external, that cause negative results in the growth of a company in the future. Thus, for Rodriguez (2012), business failure of any organization arises from different factors such as: the lack of good management, limitations by the government and the changing market. For this reason, ensuring that a company remains in stable financial conditions is key in the process of evolution of a company, and therefore, in the development of a country, since maintaining private investment would create new goods and services, and consequently the generation of employment and economic progress of a country by increasing the GDP. However, according to Gutiérrez (2011) each company starts from a unique present and faces a multiple future, that is limited depending on the environment in which it operates and the expectations and realities of its owners (financial situation, location, technology, desired markets, etc.).

It is therefore crucial for a company to predict the factors that will affect its sustainability in the market. For this reason, to evaluate performance, various financial models are catalogued as key instruments in the generation of knowledge of the financial performance of organizations. Through the results we seek to predict the insolvency and bankruptcy of a company, as well as the generation of viable alternatives that guarantee its survival and development. Undoubtedly, performing a financial analysis facilitates the decision-making process about the continuous development of the operational activity, considering the environment or the sector of the organization (Córdoba, 2014). Due to the, although there is no defined rule of insolvency, several financial methods experience the scope of the forecast of financial indicators applied statistically, by virtue of which one of the most recognized methods of predictive analysis is Altman's Z-Score indicator. This method was studied and developed by Edward Altman, whose objective was to improve the viability of the analysis and evaluation of the performance of a business through the application of financial reasons, both technical and analytical (Hernandez, 2014).

Altman's Z-Score Model

Altman (1968) states that the Z-Score model is the distillation in a single measure of a series of duly chosen, weighted and aggregated financial ratios. If the derived Z-score result is higher than a calculated score, the company is classified as financially sound; if it is below the cut-off point, it is typically seen as a potential failure. In addition, according to Garcia (2015), the Altman method is a model for forecasting bankruptcy, but can also be used to detect financial problems in a company. Therefore, the purpose of the indicator is to assign a statistical value by generating a numerical measure called Score. For Cristina Ruza & Curbera (2013), a score is a measure that takes a value that is compared with a certain result obtained over a period. For the analysis through the application of Altman's Z-Score Model, accounting information is required. Miguel Moreno de León (2009) states that the financial statements are those that present the resources generated or profits from operations, the main changes that have occurred in the financial structure of the entity, and their final reflection in cash and temporary investments over a given period. The Altman Z-score method designs a discriminant analysis, combining five financial ratios, to create the Z-score, as identified in Table 1.

| Table 1 Financial Reasons Used in the Altman Z-Score Model | |

| Name of the Ratio | Factor |

| x1 = Liquidity Ratio (Working Capital/Total Assets) | Liquidity |

| x2 = Profitability Ratio (Retained Earnings/Total Assets) | Profitability |

| x3 = Profitability ratio (Earnings for the year (EBIT)/Total Assets) | Profitability |

| x4 = Solvency ratio (market value of equity/book value of total debt) | Solvency |

| x5 = Efficiency Ratio (Sales/Total Assets) | Efficiency |

Manufacturing sector in Ecuador

The research is applied in the manufacturing sector in Ecuador. Manufacturing companies, according to Treviño (2009), are companies that transform raw materials into finished products. Their primary activity is the production of goods through the transformation and/or extraction of raw materials. According to Rebolledo et al. (2013), the growing participation of the manufacturing sector in the economic activity of a country allows evidence of a higher level of economic development. Therefore, the higher the level of progress of a country's industry, the higher the level of economic development. In Ecuador, in the years 2017 and 2018, the economy of some companies has slowed down, they have accumulated losses that are even higher than their equity, which has a negative impact on the generation of value of the company, on its growth and on the generation of employment in the country (El Telégrafo, 2018). The manufacturing industry for 2018 reflected a variation of -0.38% with respect to 2017, which can be translated into a decrease in Ecuadorian employment. However, not all the results were negative; in this same year, the manufacturing sector contributed 11.47% to the national GDP (Instituto Nacional de Estadística y Censo, 2019). (National Institute of Statistics and Census, 2019).

As mentioned, the dynamics of the environment in which a manufacturing company is developed generates an obligation to analyze the strategies and decisions taken. This is in order to develop an efficient and effective way to generate a competitive advantage by developing a growth and business sustainability. This is achieved thanks to the complex action in the internal decisions, related to the fulfillment of the objectives, which involves the increase and change of certain dimensions in the organization (Penrose, 1962). Therefore, to achieve the growth and the success of the manufacturing sector, it is necessary the administrative effectiveness in the right decision making, as well as the adoption of preventive measures before the risks of the market dynamism. Altman's Z-Score model identifies whether the measures taken are appropriate to continue to operate in the marketplace to safeguard financial sustainability. This analysis is performed using financial variables and indicators. The primary objective of this research is to support and guide entrepreneurs in the manufacturing sector in making corrective decisions. Thus, this research aims to analyze and forecast the financial failure of manufacturing companies in the province of Azuay in Ecuador.

Methodology

The data was obtained through the development of the Altman Z-Score Model, making it possible to verify the financial strength of the companies. The population taken for this study was the 900 thousand companies registered in the Directory of Companies, in use until 2019, in the Superintendence of Companies, Securities and Insurance of Ecuador. These were filtered by type of company, province, and canton, resulting in 118 manufacturing companies, constituted as Joint Stock Companies in the canton of Cuenca. For the determination of the sample, a confidence level of 90% was established, a margin of error of 10%, thus obtaining a total of 53 companies to be analyzed. From the Statements of Financial Position and Comprehensive Income, we worked with variables such as: Working Capital, Total Assets, Retained Earnings, Income for the Year, Market Value of Equity, Book Value of Total Debt and Total Local Net Sales of Goods, which were later used to perform a descriptive analysis. The values required for the calculation of Altman's Z-Score formula were obtained from the Statement of Financial Position and the Statement of Comprehensive Income (Table 2). To develop a better understanding, companies were classified by economic activities.

| Table 2 Z-Score Altman Scoring Formula |

| z = 1,2 * x1 + 1,4 * x2 + 3,3 * x3 + 0,6 * x4 + 1,0 * x5 Variables that express the following: x1 = Working Capital/Total Assets: This variable can be considered as the most important within the analysis of the coefficients selected by the formula, where in the numerator, the working capital that represents the difference between short term assets and short-term liabilities is located; in the denominator, the total assets are located. These, when analyzed as a whole, it is said that the higher the level of working capital, the higher the level of liquidity. x2 = Retained Earnings/Total Assets: Retained earnings can be considered as those that the organization does not distribute to its members in the form of dividends, but that are used internally in future investments that generate benefits to the organization. This is a representative ratio since the measure of this is long term in relation to the profit policy. x3 =Profit of the Year (EBIT)/ Total Assets: This ratio aims to analyze the productivity that presents the assets of a company, undoubtedly the sustainability of a company is measured in the ability to obtain income from their investment in assets. x4 = Market value of equity/ Book value of total debt: This ratio helps us determine the number of times the equity can cover the debt, which in a few words helps determine the credit risk. x5 = Sales/Total Assets: This ratio illustrates the income that is generated with the investment of the company's total assets, as well as the efficiency in which the company invests its assets in order to obtain returns on them. |

The result included 19 different activities within the manufacturing sector such as Food, Publishing, Beverage, Household Appliances, Transportation Equipment, Primary Metals, Computers and Electronic Accessories, Paper, Leather Products, Wood Products, Non-Metallic Mineral Products, Plastic Products, Metallic Products, Manufacturing of Chemicals, Pharmaceuticals, Jewelry, Mining, Telecommunications and Textiles. Applying the predictive model formula, it was determined which activities are in danger of bankruptcy and which are considered financially stable. Altman's Z-Score model uses as a reference several guidelines which identify and discriminate if the company is in financial hardship. Such guidelines are set out in Table 3.

| Table 3 Altman’s Z-Score Model guidelines | |

| Criterion | Observation |

| Z-Score higher than 3,0 | The company is financially healthy. |

| Z-Score between 2,7 y 2,99 | In "alert". This zone is an area where one should be cautious in terms of financial movements so as not to fall into the grey zone. |

| Z-Score between 1,8 y 2,7 | Possibility of the company going bankrupt within the next 2 years of operations, based on the financial figures given. |

| Z-Score lower than 1,8 | Very high probability of financial bankruptcy. |

Results and Discussion

The results of the analysis of the Manufacturing sector are presented: first as a descriptive analysis and then the prediction of business failure with the Altman Z-Score.

Descriptive Analysis of the Manufacturing Sector

Manufacturing companies undoubtedly play an important role in Ecuador's economy. They optimize the quality of life by providing goods and services in optimal conditions. This is why the study of the financial composition of these companies is meaningful. It can be seen that companies in the manufacturing sector presented an average amount of $ 5,213,989.88 in working capital, with which they can operate normally in the market by being able to meet their obligations in the short term. The profit for such activities presents an average amount of $1,140,351.16. The sector’s income in terms of local Net Sales of Goods presents an average amount of $13,731,054.16, which is important for the sustainability of the companies.

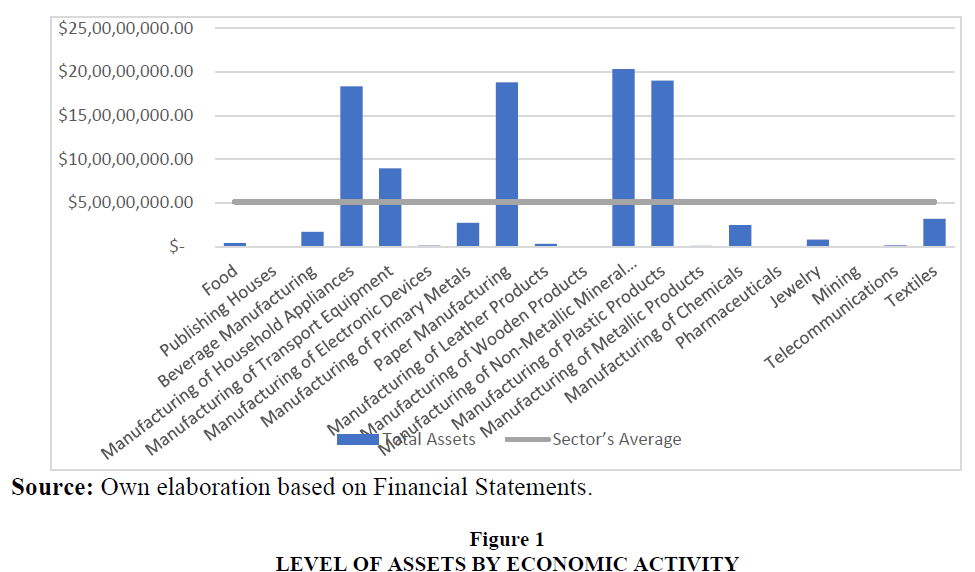

The correct management of these numbers allows companies to continue contributing to the growth of the region and the country. These results are positive considering that Ecuador is a country that generates raw materials for export, but not so much for the creation of finished products. The largest companies in Ecuador are dedicated to the commercialization and provision of financial services (Ekosnegocios, 2019). Figure 1 shows the total assets of the different activities of the Manufacturing Sector and the average assets of the sector, which amounts to $51,304,227.55. The assets correspond to the rights, resources and goods owned by the company. The economic activities that are located above the average level of assets are Manufacturing of different products such as Household Appliances, Transportation Equipment, Paper, Non-Metallic Mineral Products as the activity that presents the highest amount of assets, and Manufacturing of Plastic Products. The economic activity of Publishing Houses presents the lowest amount of assets, around $13,082.71, which represents a difference of $51,291,144.84 with regard to the average assets of the sector. The companies that stand out for their large amount of assets are Cartones Nacionales S.A. Cartopel and Continental Tire Andina S.A., which have assets of $187,049,738.00 and Ch$163,400,657.35 respectively; they exceed the average of the sector individually.

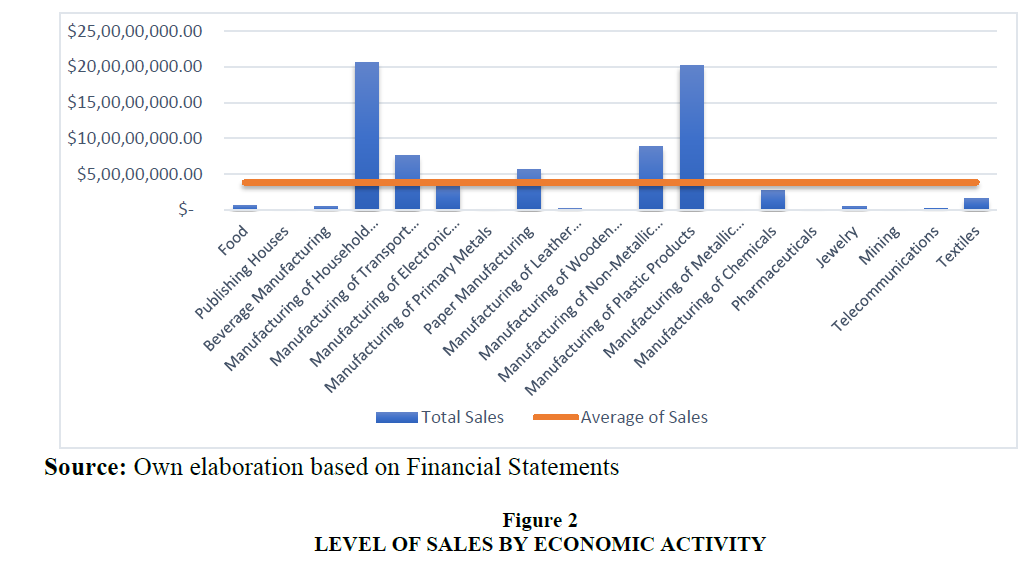

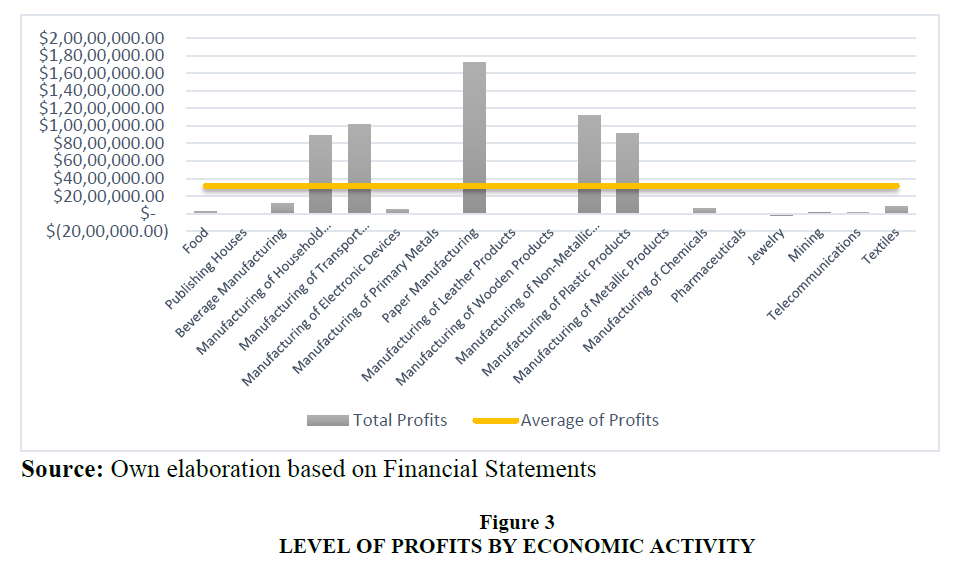

A company's sales enable the cycle of the economy to work, thus allowing the circulation and flow of money in an industry. Within the results obtained, in Figure 2, it is possible to evidence an average of sales of the sector of $38,302,414.25. 5 of the 19 activities are found to exceed the average. Activities of Manufacture of Electrical Appliances and Manufacture of Plastic Products stand out. This group of companies include Induglob S. A, dedicated to the manufacture of household appliances, Cartones Nacionales S.A. Cartopel, which is dedicated to the manufacture of paper, and Continental Tire Andina S. A, a company dedicated to the manufacture of tires. However, there are 14 of the 19 activities that evidence sales below the average of the sector. The level of utility is one of the most appropriate indicators to assess the performance of companies. Figure 3 shows that the average amount of profits in the Manufacturing sector is $3,153,780.25. The activity that stands out for its profits is the Manufacture of Paper, where the company Cartones Nacionales S.A. Cartopel stands out, with an amount in profits of $17,198,848.80. However, it can be seen that there are 14 economic activities found below the average profits of the sector in 2018.

Prediction of Business Failure with Z-Score Altman

Table 4 shows the results of the application of the Z-Score Altman prediction method. Financially healthy companies are considered those that are above 3.0; under this statement, the economic activities that present this result are publishing companies. They stand out for their excellent ratio of sales to assets, since they cover almost 4 times the level of total assets; however, they present a low level of liquidity; 0.22. The Beverage manufacturing activity stands out in second position, showing a liquidity indicator of 0.31 for the year analyzed. In monetary terms it represents $5,247,715.53. This amount enables the companies to continue operating in the market. Regarding the profit for the year on total assets, it presents a value of 0.07, which means that for each dollar invested, the company benefits from 0.07. As for the solvency ratio, it is possible to cover foreign resources in 5.53 times, due to the fact that for that year a greater number of own resources was held, adding up to $14,225,819.37.

| Table 4 Results of the Altman Z-Score Model | ||||||

| ACTIVITY | Working Capital/To tal Assets | Retained Earnings/Tot al Assets | EBIT/Tot al Assets | Total Assets/Total Liabilities | Sales/Total Assets | MZS A |

| Food | 0,22 | 0,01 | 0,06 | 1,04 | 1,53 | 2,62 |

| Publishing Houses | 0,03 | 1,93 | 0,20 | 0 | 3,99 | 7,38 |

| Beverage manufacturing | 0,31 | 0,00 | 0,07 | 5,53 | 0,28 | 4,19 |

| Manufacturing of Household appliances |

0,28 | 0,02 | 0,05 | 0,60 | 1,12 | 2,01 |

| Manufacturing of Transport Equipment |

0,38 | 0,30 | 0,11 | 0,62 | 0,85 | 2,48 |

| Manufacturing of Electronic Devices |

0,00 | 0,29 | 0,00 | 0,26 | 0,68 | 1,26 |

| Manufacturing of Primary Metals |

0,32 | - | 0,02 | 0,70 | 1,27 | 2,14 |

| Paper manufacturing | 0,20 | 0,12 | 0,09 | 0,83 | 0,30 | 1,50 |

| Manufacturing of Leather Products |

0,16 | 0,01 | 0,01 | 0,34 | 0,76 | 1,20 |

| Manufacturing of wooden products |

0,00 | 0 | 0 | 0,02 | 0 | 0,01 |

| Manufacturing of Non- Metallic mineral products |

0,29 | 0,05 | 0,05 | 2,64 | 0,43 | 2,62 |

| Manufacturing of Plastic products |

0,30 | 0,03 | 0,05 | 1,27 | 1,06 | 2,38 |

| Manufacturing of Metallic products |

0,16 | 0,12 | 0,01 | 0,26 | 0,44 | 0,99 |

| Manufacturing of Chemicals |

0,42 | 0,01 | 0,03 | 2,89 | 1,07 | 3,41 |

| Pharmaceuticals | 0,00 | 0,04 | 0,03 | - | 1,45 | 1,60 |

| Jewelry | 0,18 | 0,06 | - | 0,56 | 0,56 | 1,19 |

| Mining | 0,00 | 0,25 | - | 0,79 | 1,52 | 2,35 |

| Telecommunications | 0,45 | 0,46 | 0,11 | 1,46 | 1,23 | 3,65 |

| Textiles | 0,29 | 0,06 | 0,03 | 1,00 | 0,50 | 1,61 |

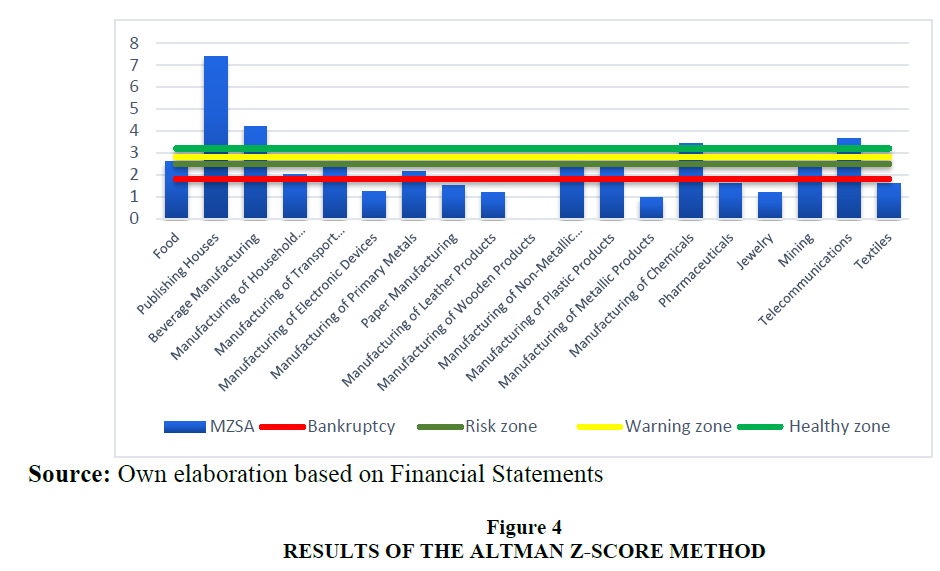

Finally, the efficiency ratio of 0.28, represents sales over total assets. Within the analysis and about the guidelines externalized by the method, the economic activities that are located between 1.8 and 2.7, have a chance of bankruptcy within the following 2 years of operations. In this range the activities that can be found are manufacturing of household appliances, food, transport equipment, primary metals, non-metallic mineral products, plastic products, and mining. Finally, a company is considered to have a high probability of financial failure when it is below 1.8. The activities that belong to this group are manufacturing of electronic devices, paper, leather, wood, metallic products, pharmaceuticals, jewelry, and textiles. Figure 4 shows the results of the of the Altman Z-Score model application to manufacturing companies in the province of Azuay.

These results reveal a possible business failure of eight activities, such as manufacturing of electronic devices, paper, leather, wood, metallic products, pharmaceuticals, and jewelry. These activities are below the average presented by the formula of the Altman Z-Score model. Within the analysis, it is also possible to evidence that there are 7 activities in the Gray Zone that have the possibility of going out of business within the next 2 years of operations. In this situation can be mentioned food, manufacturing of household appliances, transport equipment, primary metals, non-metallic mineral products, plastic products, and mining. It is also worth mentioning that in the Alert Zone, which is comprised of a range of 2.7 to 2.99, there are no activities at risk. Finally, the economic activities that are positioned above 3.0 show a stable financial health. The activities under this parameter are publishing, beverage manufacturing, manufacturing of chemicals and telecommunications.

SWOT Analysis

The results found allow to know the Strengths, Opportunities, Weaknesses and Threats of the manufacturing companies. Among the Strengths, it is observed that the Total Equity / Total Liabilities indicator is 1.1, a value that indicates that manufacturing companies have sufficient Equity to cover their debts. Which also indicates that the decision-making power is still held by the owners of the companies and not by the suppliers. Regarding Opportunities, manufacturing companies have the possibility of exporting their products, as of 2019 these companies only exported approximately 7% of their sales (INEC, 2019). As a weakness for the manufacturing sector, it is observed that this adds a Z-Score of 2.35 which reflects that these companies present a possibility of bankruptcy within the following 2 years of operations. Which is negative in global terms. Among these weaknesses, the low level between EBIT and Total Assets is also evident, it is barely 0.05, which reflects an inefficient use of the asset. Within the Threats, they must currently face the restrictions caused by the global pandemic COVID 19, which between March and May 2020 left losses for Ecuador of USD 6 421 million (Secretaría Técnica Planifica Ecuador, 2021).

Conclusions

Throughout this study, it was possible to evidence that, independently from a company to be small or large, it will always be subject to tolerate situations of financial imbalance due to insolvency and lack of liquidity, attached to this, poor implementation of financial policies, financial errors, production, administrative and commercial management. From the analyzed data, it can be concluded that the manufacturing sector presents an Altman Z-Score of 2.35, which represents that they have the possibility of wanting in the next 2 years. 32% of the companies belong to the group of healthy companies that should continue deciding for a correct administrative management. These are located above 3.0. On the other hand, 4% of the analyzed companies are in the warning zone, an area where it is necessary to be cautious in the financial management to prevent falling in the gray zone. They are located between 2.7 and 2.99. A 26% corresponds to the companies that are in the gray zone, in an average of 1.8 to 2.7. These companies have the possibility of going bankrupt within 2 years. Finally, a 38 % corresponds to the companies that have a very high possibility of bankruptcy, and which are below 1.8. Regarding the analyzed companies that are placed in the financial bankruptcy zone, it is seen that they do not have a good working capital.

They do not have profits; their sales decreased in relation to previous year, and they do not cumulate their retained earnings among other aspects that cause their failure. To avoid these failures, companies should be monitored in advance to evaluate the efficiency of their market operations. Consequently, it can be concluded that Altman's Z-Score model is a good predictive mechanism, becoming a useful tool for financiers, due to the fact that the results it produces can be identified in advance, making the application of corrective measures effective. This process must be applied continuously, that is, after the fiscal closing of the companies' operations, to ensure that the results achieved are reliable and with a high probability of accuracy.

References

- Belalcazar G.R., & Trujillo, O.A. (2016). Es el modelo Z-Score de Altman un buen predictor de la situación financiera? 30.

- Censo, I.N. (2019). Instituto Nacional de Estadística y Censo. Retrieved from https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKE wjRveCcrMjpAhVOMt8KHXirDQgQFjAAegQIBBAB&url=https%3A%2F%2Fwww.ekosnegocios.com %2Farticulo%2Findustria-manufacturera-el-sector-de-mayor-aporte-al-pib&usg=AOvVaw2o-OE-bi

- Córdoba, M. (2014). Análisis Financiero. N/A: Ecoe Ediciones.

- Cortez, F.G., Fonseca, C.A., Morales, G.J., Solano, S.J., & Tames, R.K. (2014). Modelo de Z Altman y diagrama de Solidez aplicado al mercado costarricense. TEC, 143.

- Edward, I.A. (1968). RATIOS FINANCIEROS, ANÁLISIS DISCRIMINANTE Y LA PREDICCIÓN DE QUIEBRA CORPORATIVA. RATIOS FINANCIEROS, ANÁLISIS DISCRIMINANTE Y LA PREDICCIÓN DE QUIEBRA CORPORATIVA, 589.

- Ekosnegocios. (2019). Ekosnegocios. Retrieved from Ranking Empresarial: https://www.ekosnegocios.com/rankingempresarial

- El Telégrafo. (2018). El Telégrafo. Retrieved from Ecuador enfrenta la desaceleración de su economía: https://www.eltelegrafo.com.ec/noticias/economia/4/ecuador-desaceleracion-economia

- Gutiérrez, C.J. (2011). Modelos financieros con Excel: Herramientas para mejorar la toma de decisiones empresariales (2a. ed.). Ecoe Ediciones.

- Hernandez R.M. (2014). Modelo financiero para la detección de quiebras con el uso de análisis. InterSedes, 17. INEC. (2019). Instituto Ecuatoriano de Estadíticas y Censos. Retrieved from Ecuador en Cifras: https://public.tableau.com/profile/instituto.nacional.de.estad.stica.y.censos.inec.#!/vizhome/Visualizadorde EstadisticasEmpresariales/Dportada

- Moreno De León, M. (2009). Estados financieros. Retrieved from https://bibliotecas.ups.edu.ec:2708: Retrieved from https://bibliotecas.ups.edu.ec:2708.

- Penrose, E. (1962). Teoría del Crecimiento de la empresa. Madrid: Ediciones Aguilar.

- Ruza, C., & Curbera, P. (2013). El riesgo de crédito en perspectiva. España: UNED - Universidad Nacional de Educación a Distancia.

- Secretaría Técnica Planifica Ecuador. (2021). Retrieved from https://www.planificacion.gob.ec/entre-marzo-ymayo-de-2020-el-covid-19-dejo-perdidas-para-ecuador-por-usd-6-421.

- Treviño Jiménez , D. (2009). La contabilidad en los diferentes tipos de empresas. Madrid: El Cid Editor.

- García, I.V. (2017). Modelo financiero para la detección de quiebras con el uso de análisis discriminante múltiple. Universisas Autónoma del Estado de Hidalgo, 145.