Research Article: 2021 Vol: 24 Issue: 3

Financial and legal instruments for promoting the implementation of sustainable development policy of the state (States, Region)

Alina Zhukovska, Western Ukrainian National University

Tetiana Zheliuk, Western Ukrainian National University

Inna Zhuk, Interregional Academy of Personnel Management

Viktoriia Borshch, Odessa National Medical University

Maksym Makarenko, MM-Dental Clinic

Kristina Vozniakovska, Chernivtsi Law Institute National University “Odessa Law Academy”

Citation Information: Zhukovska, A., Zheliuk, T., Zhuk, I., Borshch, V., Makarenko, M., & Vozniakovska, K. (2021). Financial and legal instruments for promoting the implementation of sustainable development policy of the state (States, Region). Journal of management Information and Decision Sciences, 24(3), 1-16.

Abstract

Financial and legal instruments for promoting the implementation of sustainable development policy of the state (states, regions) require a detailed study of the application of financial and legal instruments for the implementation of the Global Sustainable Development Goals by 2030. The EU financial instruments provide funding for the goals and policies of sustainable development of the state or the region through the involvement of budgetary and private financial resources. The purpose of the research is to analyze the existing practice of promoting the implementation of sustainable development policy of the state (states, regions) in the EU countries through the use of financial and legal instruments in order to provide investors with economic returns in accordance with probable risks, while promoting sustainable development goals. The research methods are as follows: comparative analysis; statistical analysis; systematization, generalization. Results. Financial and legal instruments are measures of financial and legal support provided on an additional basis from the budget in order to promote the implementation of the policy of sustainable development of the state. It has been established that the sustainable development goals, namely: 1, 2, 4, 5, 10, 11, 16 and 17 are connected with the fewest of financial and legal instruments. Sustainable and green bonds that best contribute to objectives 7 (Affordable and Clean Energy), 11 (Sustainable Urban and Community Development) and 13 (Climate Change Mitigation) have been identified as perspective and promising financial and legal instruments. The financial and legal instruments towards supporting small and medium-sized enterprises, research and innovation and a low-carbon economy are the most popular in the EU.

As a result of the research conducted, it has been found that financial and legal instruments towards promoting the implementation of sustainable development policy direct financial resources to the implementation of certain goals, thereby forming a gap in the implementation of the Global Sustainable Development Goals by 2030. It has been also revealed that during the programming period, financial and legal instruments were installed exceptionally slowly; as a result, by the end of 2016, less than 5 percent was actually invested than planned.

Keywords

Sustainable development; Sustainable development goals; Programming period; Operational programs; Green, social and sustainable bonds; Financial and legal instruments; The EU countries; European Commission.

Introduction

At present, economic realities are changing rather intensively than political ones; and it should be recognized that economic interdependence requires a more pronounced and consistent response at the regional level. The economic crisis caused by COVID-19 was of unprecedented nature. Therefore, the economic convergence, approved during the last programming periods, was destroyed, and the crisis became a huge shock for the regions and states, revealing the vulnerable position of the financial and economic system. All these difficulties are more visible and pronounced at the regional level; consequently, these aspects should be taken into account for the implementation of the Global Sustainable Development Goals by 2030 (Antonescu, 2014).

Forasmuch as financial and legal instruments are a way to support the implementation of the sustainable development policy of the state, then the idea of introducing financial and legal instruments was put into practice in the EU cohesion policy back in the 1994-1999 programming period. The insrtuments outlined are known as financial engineering tools used in the European Regional Development Fund, the European Social Fund and the Cohesion Fund. The current financial crisis has significantly limited investments in countries and regions of the world, where the actions of European Commission, which has created special initiatives towards promoting investment, the so-called Juncker Plan, have been followed by the promotion of financial institutions within the framework of the already established EU Fund (Wieliczko, 2019).

The inclusion of the concept of sustainable development into governments’ programs is nowadays a top priority all over the world. According to the World Commission on Environment and Development (Brundtland, 1987), sustainable development is not a static situation, but a process of resources’ use, investments’ management and technological and institutional development that meets future needs, and not just current ones. In accordance with the mandate submitted to the General Assembly by Member States at the United Nations Conference on Sustainable Development, “Sustainable development goals should be action-oriented, succinct and easy to understand, limited in number, ambitious, global in nature and common to all countries, taking into account different national realities, opportunities and levels of development in compliance with national policies and priorities” (United Nations General Assembly, 2014).

Achieving sustainable development is a difficult challenge. This cannot be achieved by a single approach, forasmuch as it requires significant funding from various sources and financial agents. The ability of governments to mobilize, redistribute and effectively use a variety of funding sources, tools and strategies is an extremely important process for achieving and implementing the Global Sustainable Development Goals by 2030. Also, governments should take into account the legal system, the possible social-economic and environmental consequences and any other constraints that may hinder the implementation of the selected financial and legal instruments (United Nations Development Program, 2018).

The need to implement the policy of sustainable development of the state is caused by the idea of harmonization of economic, social and environmental components, where the latter one becomes especially relevant, namely: the need to address environmental protection, implementation of measures in order to minimize and mitigate climate change, conserve natural resources for future generations.

The importance of practical use of the research results lies in the further applying effective financial and legal instruments towards promoting the policy of sustainable development of the state, which provides “such a way of the development, in which meeting the needs of modern generations does not make it impossible to meet the needs of future generations” (Brundtland, 1987).

The purpose of the research is to analyze the existing practice of promoting the implementation of sustainable development policy of the state (states, regions) in the EU countries by using the financial and legal instruments in order to provide investors with economic returns in accordance with probable risks, while implementing sustainable development goals.

The research objectives of the academic paper are as follows:

To analyze the financial and legal instruments in order to promote the implementation of the EU sustainable development policy for the periods 2014-2020 as well as to determine the objectives of sustainable development, towards which financial resources are directed.

1. To investigate the allocation of resources and reflect the impact of financial and legal instruments for operational programs by investment directions.

2. To identify promising financial and legal instruments that help overcome the persistent funding gap for the sustainable development goals and explore the main countries issuers in the bond market.

3. To analyze the financial and legal instruments for funding the sustainable development goals proposed by the UN.

4. To conduct coordination of the use of green, social and sustainable bonds with the sustainable development goals for the implementation of the Global Sustainable Development Goals by 2030.

Literature Review

The determinants of the international development of the global financial and economic systems and the securing of high-quality infrastructure based on the goals of sustainable development should be introduced into the basic provisions of state policy. Due to the conditions of the crisis of world environmental problems in the second half of the twentieth century, as well as with the introduction of the UN conferences on environmental protection, the viewpoint has been formed on the progressive convection of modern civilization to the position of “global dynamic equilibrium”, namely, a sustainable balance between individual components of the international ecological and social-economic system. The concept of sustainable development includes the approach outlined in order to create a model of economic growth, as a result of which the harmony with the environment is achieved and the needs of the society are effectively met.

The concept is based on three key components, namely: economic growth, social integration and environmental protection. The genesis of the sustainable development’s concept took place in September 2015 during the approval process of “Transforming our world: Agenda for sustainable development until 2030” at the meeting of the UN General Assembly (Romanchukevich, 2019). The Agenda for sustainable development is a world transformation agenda that aims to eradicate poverty, guarantee a dignified life for all people and ensure peace until 2030, implementation of which is one of the main challenges of the modern world (Raszkowski & Bartniczak, 2019).

In order to achieve the goals of sustainable development, it is necessary to coordinate the work of the international financial community, the private financial sector and the public financial sector. According to the viewpoint of the Organization for Economic Cooperation and Development (OECD) (OECD, 2019), public and private savings, especially in favorable market conditions, should be sufficient to meet the requirements of the three basic investment categories in this regard. Governments have relatively little control over the private sector’s agents, which largely determine the pace of progress towards sustainable development goals. However, governments should take effective and consistent steps in spheres where influence can be exercised (Kharas et al., 2014).

Collignon considers that the crucial role belongs to public authorities, which use state finances to promote the implementation of sustainable development policies (Collignon, 2008). Actions of public authorities towards maintaining the stability of public finances, which are obliged to perform their main functions (that is, distribution, redistribution and stabilization of financial resources) (Yarovoy et al., 2020), and in such a way to prevent long-term imbalances in the public finance system, are achieved by developing an effective system of state spending and revenue for the public finance sector (Alegre, 2012; Postula, 2018).

Kulawik et al. (2018) noted that there is no generally accepted definition of “financial and legal instruments”. In the case of the EU funds, financial and legal instruments are structures that allow using the European Structural and Investment Funds to offer financial products such as loans, equity and guarantees. They can support projects that contribute to the achievement of the sustainable development goals of the European policies.

Financial and legal instruments use public finances to attract the private sector’s investments by reducing investment risk and offering a long-term perspective, whereas the cyclical nature of the instruments provides a return on funds as well as interest on the instrument for reinvestment (Gambetta et al., 2019). Given that, the main purpose of financial and legal instruments is to achieve sustainable development goals in countries and regions where investors are reluctant to invest, where these instruments are used to reduce investment risk or to overcome market failure and market barriers (European Regional Development Fund, 2019).

According to the viewpoint of Kharas et al. (2014), certain financial and legal instruments constitute an important part of a set of available environmental policy instruments that, in comprehensive interaction with regulations and public investments, can help reduce the cost directed for improving the environment. The challenge for developing economies is to identify and adopt financial and legal instruments that combine environmental and economic policies, provide flexibility, use limited resources sparingly, motivate behavioral change, and generate resources to finance environmental infrastructure. Financial and legal instruments contribute to sustainable development in three ways, namely: by motivating behavioral changes towards reducing environmental impact and, consequently, the amount of investment required; by generating income that can be used to finance these investments; as well as by promoting, directly or indirectly, the redistribution of the society’s resources to healthier and more sustainable activities from an environmental point of view (Kharas et al., 2014). The international financial community, the private financial sector and the public financial sector should work in close coordination in order to achieve the Global Sustainable Development Goals (OECD, 2019).

Financial and legal instruments are designed to meet the investment needs of sustainable development goals, which can be interpreted under the general term sustainable development bonds. These are debt securities issued by private or public entities to finance projects related to the achievement of sustainable development goals. Emitents issue sustainable development bonds under a contract, indicating the interest rate to be paid and the maturity date of the bond’s principal debt.

Sustainable development bonds can be classified according to several criteria. According to the nature of their return, they are divided into two categories, where for some financial and legal instruments the return of invested financial resources is fixed and does not depend on the results of achieving sustainable development goals, while for others the return of financial resources is directly related to the success of sustainable development goals. Sustainable development bonds can also be differentiated by their concentration sector, where the most common financial and legal instruments are as follows: green bonds, microfinance bonds, charitable bonds, social impact bonds, development bonds and environmental bonds. There are many sub-categories of these bonds in which the focus on achieving sustainable development goals is significantly narrowed (European Commission, 2017).

The EU countries, supporting the Global Sustainable Development Goals, in the framework of their initiatives (European Commission, 2018a) seek to implement economic solutions based on the concept of sustainable development, which is defined in social, economic and environmental terms (Elkington, 2004). Soini and Birkeland (2014); and Nurse (2006) have recommended including cultural factors as the fourth component of the Global Sustainable Development Goals. The implementation of sustainable development policies of states and regions should be carried out at three levels, namely: individual, organizational and global (Donaires et al., 2019), with the obligation of each government to control the sustainable development of the state, which is implemented at the social-economic level (Patora-Wysocka & Su?kowski, 2019). Shrithongrung & Kriz (2014) have come to conclusion that the Global Sustainable Development Goals should be subsidized by financing sustainable development at the stage of implementation, forasmuch as the financial system is a component of the economic system, consisting of two basic components: the public finance sector and the market financial system. Measures taken within the framework of the implementation of the sustainable development concept can contribute to the reorientation of financial and legal instruments and strengthen efforts towards obtaining long-term positive impact on the social-economic development of the state or the region (Postula & Raczkowski, 2020).

Along with this, the focus on sustainable development should be complemented by concentration on the competitiveness of the state or the region, as the most important condition for development that financial policy should achieve (Tudose & Rusu, 2015). In the case of the EU Member States, both innovation and education are crucial as two determinants of the EU’s competitiveness and economic convergence (Dima et al., 2018).

Achieving the goals of sustainable development requires a significant amount of funding, which will need to be provided not only from the official funds of each country and region, but also from the private sector (Kwilinski et al., 2019). Financial and legal instruments, such as bonds and investment funds, that provide financial resources to issuers, involved in achieving sustainable development goals, contribute to their achievement. By investing in these financial and legal instruments, investors can immediately expect economic returns in accordance with the risks, while contributing to the sustainable development goals of the state or the region (Environmental Finance, 2020).

An in-depth analysis of the issues outlined in the scientific article makes it possible to conclude that the topic of financial and legal instruments towards promoting the policy of sustainable development of the state (states, regions) in the context of in-depth integration of national economies into the world social-economic space is sufficiently studied nowadays by foreign and Ukrainian scientists.

Thus, the problem of promoting the implementation of sustainable development policy of the state is widely reflected in scientific publications in the form of theoretical studies and practical investigations. However, the issue of promoting the implementation of sustainable development policy by means of financial and legal instruments remains relevant and open for further research, taking into account the reports of European Commission on the use of financial and legal instruments for the implementation of the Global Sustainable Development Goals until 2030.

Methodology

The implementation of the purpose of the present investigation provides for the involvement of the following research methods, namely:

Analysis of the Global Sustainable Development Goals by 2030;

System and logical analysis, method of information synthesis;

Systematization, generalization of the latest scientific publications and statistical data published by governments and accountable organizations on the features of the use of financial and legal instruments towards promoting the implementation of sustainable development policies in the EU countries.

In order to identify certain features of financial and legal instruments, the method of generalization of modern regulatory practice concerning using financial and legal instruments in the EU member states has been applied. The application of the comparison method has made it possible to draw line between green, social and sustainable bonds, while achieving the goals of sustainable development.

The method of statistical analysis has been used for displaying statistics on the distribution of resources of financial and legal instruments for operational programs in the areas of investment, the introduction of financial and legal instruments in the EU countries, and the current state of the bond market.

Results

The UN has identified 17 Global Sustainable Development Goals until 2030, which are basically considered as vectors of inspiration for sustainable development at the national and global levels. The Global Sustainable Development Goals until 2030 consist of 169 tasks that need to be implemented in order to achieve sustainable development, where a system of 240 global indicators of sustainable development has been created to effectively monitor the quality of implementation of global tasks. The basic tools affecting the well-being of the population and the world are global goals for the implementation of sustainable development policies of states and regions and indicators of sustainable development, which can be implemented through the joint cooperation of all countries (Figure 1) (The Global Goals, 2020).

The UN has proposed financial and legal instruments for funding the Sustainable Development Goals, which are classified as follows Table 1.

| Table 1 The Instruments Proposed by the Un for Financing Sustainable Development and their Interrelationship with the Sustainable Development Goals | |||

| Financial instrument | Sustainable Development Goals | Financial instrument | Sustainable Development Goals |

| Taxes on tobacco | 3, 12 | Enterprise challenge funds | 1, 2, 3, 4, 5, 6, 7, 8, 9, 12, 13, 14, 15, 16 |

| Taxes on renewables | 6, 8, 12, 13, 14, 15 | Disaster risk insurance | 1,2, 3, 8, 10, 16 |

| Taxes on pesticides and chemical fertilisers | 3, 6, 8 , 12, 14, 15 | Debt-for-nature swaps | 6, 7, 8, 9, 12, 13, 14, 15 |

| Taxes on fuel | 3, 7, 8, 9, 12, 13, 15 | Crowdfunding | 1, 2, 3, 4, 5, 6, 7, 8, 9, 12, 13, 14, 15, 16 |

| Payments for ecosystem services | 6, 7, 8, 9, 12, 13, 14 , 15 | Climate credit mechanisms | 6, 7, 8, 9, 12, 13, 14, 15 |

| Social and development impact bonds-results-based financing | 1, 2, 3, 4, 5, 6, 7, 8, 9, 12, 13, 14, 15, 16 | Voluntary standards | 1, 2, 3, 4, 5, 6, 7, 8, 9, 12, 13, 14, 15, 16 |

| Impact investment | 1, 2, 3, 4, 5, 6, 7, 8, 9, 12, 13, 14, 15, 16 | Lotteries | 1, 2, 3, 4, 5, 6, 7, 8, 9, 12, 13, 14, 15, 16 |

| Public guarantees | 1, 2, 3, 4, 5, 6, 7, 8, 9, 12, 13, 14, 15, 16 | Remittances or diaspora financing | 1, 2, 3, 4, 5, 8, 10, 16 |

| Ecological fiscal transfers and carbon markets | 6, 7, 8, 9, 12, 13, 14, 15 | Biodiversity compensation | 6, 7, 8, 9, 12, 13, 14, 15 |

| Environmental trust funds | 6, 7, 8, 9, 12, 13, 14, 15 | Bioprospecting and biodiversity offsets | 3, 8, 9, 12 |

Table 1 reflects the coordination of the UN financial and legal instruments with the sustainable development goals. The reconciliation results show that Sustainable Development Goals 1, 2, 4, 5, 10, 11, 16 and 17 are related to the fewest financial and legal instruments, forasmuch as a significant part of financial and legal instruments is focused on addressing inequalities, gender and education, which raises the issue of the lack of proposals towards promoting social mobility (United Nations Development Program, 2018).

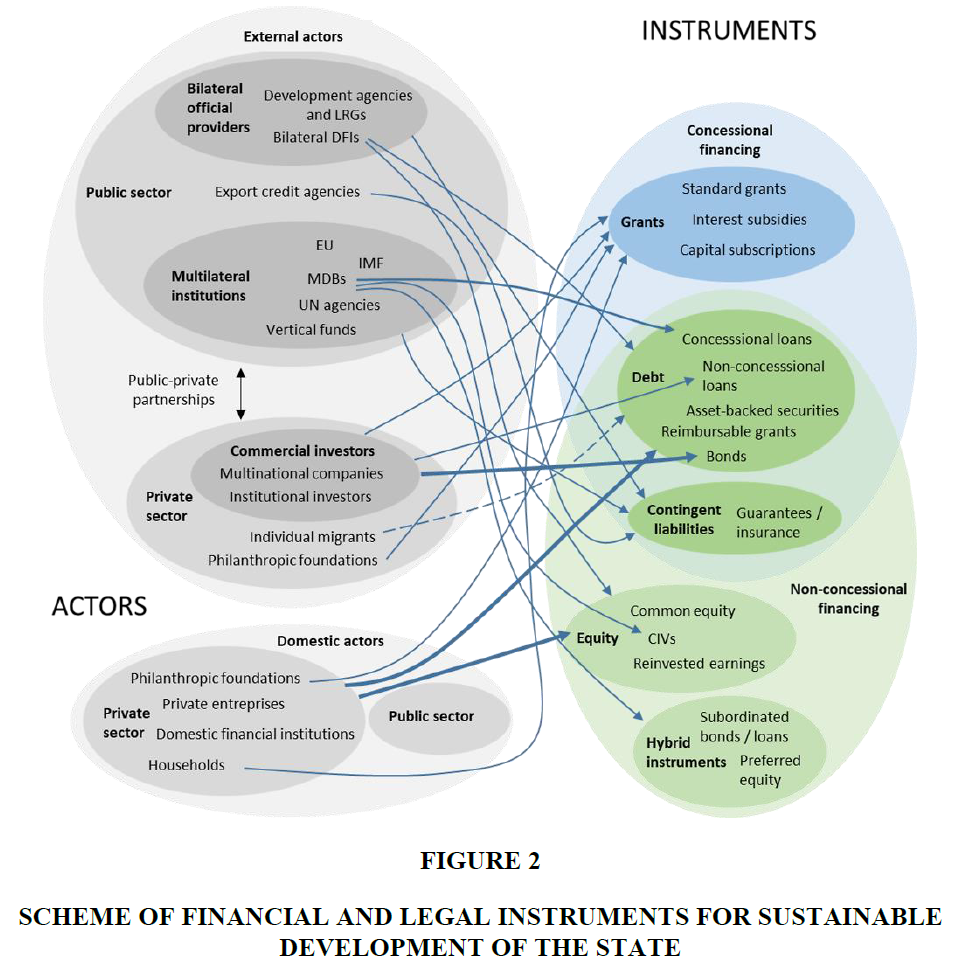

Increasing the number of participants and openness to innovations have led to the use of more diverse financial and legal instruments in the market of funding sustainable development of countries and regions (Figure 2). This process has provided opportunities for a wide choice and better adaptation of financial solutions to the needs of developing countries. At the same time, numerous options in combination with some asymmetry of information risk provoking certain difficulties in the use of appropriate financial and legal instruments. As a consequence, the needs of countries should determine their choice of financial and legal instruments rather than suppliers’ preferences, which would allow the governments of developing countries to create their own optimal set of financing in order to support their efforts on implementing the policy of sustainable development of the state (OECD, 2018).

Sustainable bonds are one of the most promising financial and legal instruments in order to help overcome a persistent funding gap, forasmuch as they facilitate the reallocation of capital flows to sustainable projects, and, therefore, enable investors to choose a sustainable development goal for investment.

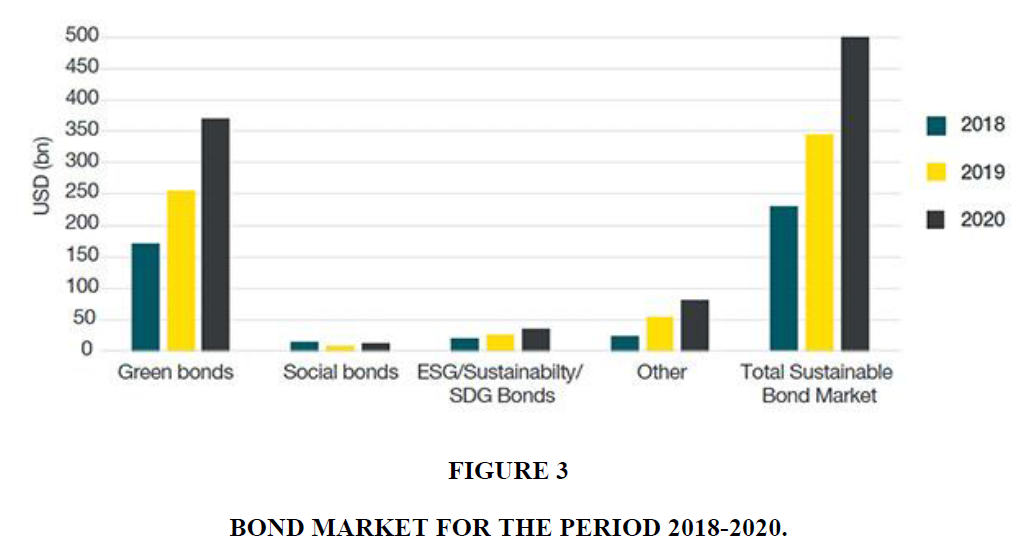

In 2007, the European Investment Bank launched the green bond market by issuing the world’s first climate bond. 2019 was another record year for green bonds. According to the statistics of the Climate Bond Initiative, the annual volume of green bonds’ issuance in the world increased by 49%, from 171,1 billion to 254,9 billion USD. 2019 was also the year of new types of bonds, such as sustainable bonds and transit bonds, which provided investors with a significant choice of bonds in order to achieve sustainable development goals. Taking into consideration the current diversification, the overall market for sustainable bonds has grown by about 50%, from 230 billion USD in 2018 to 345 billion USD in 2019 (Figure 3).

For the period 2018-2020, the United States, France and China are the largest three countries issuers in the green bond market, France, Japan and the Netherlands - in the social bond market, and Korea, Germany and Spain - in the sustainable bond market (Table 2).

| Table 2 Top 5 Largest Countries Issuers in 2019 in the Market of Green, Social and Sustainable Bonds | ||

| Green bonds | Social bonds | Sustainable bonds |

| USA 58,995.8 USD | France 3,258.5 USD | South Korea: 5,291.9 USD |

| France 31,357.5 USD | Japan: 2,907.7 USD | Germany 3,643.1 USD |

| China 27,004.4 USD | The Netherlands: 2,280.1 USD | Spain 3,258 USD |

| Germany 22,549 USD | The USA 1,348.1 USD | USA 3,208.1 USD |

| The Netherlands 15,910.7 USD | The UK: 1,201.7 USD | The Netherlands: 2,539.9 USD |

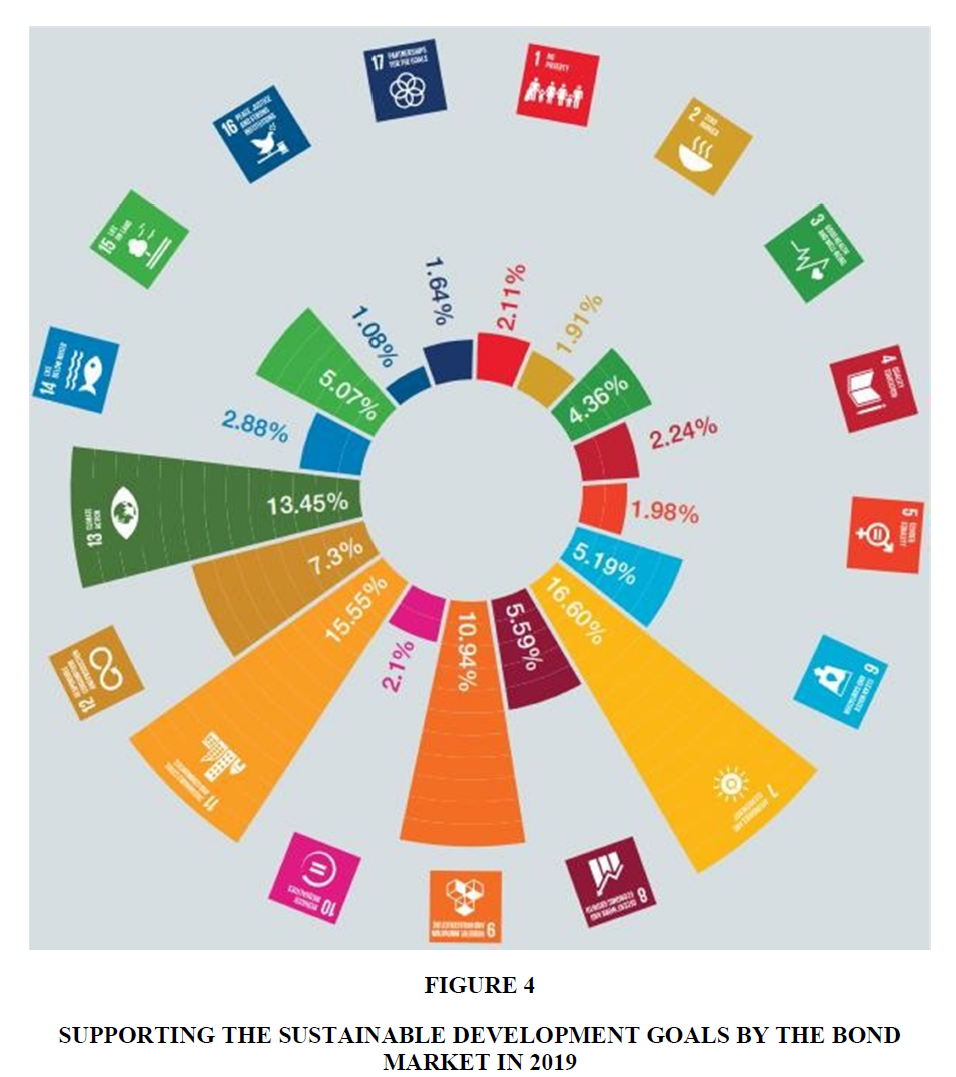

Green, social and sustainable bonds, aligned with sustainable development goals, amounted to 120,4 billion USD in 2019. 37,5% of green, social and sustainable bonds are clearly in line with the goals of sustainable development in 2019, which is 3,5% more than the previous year. The three most covered sustainable development goals are as follows: Objective 7 (Affordable and Clean Energy), 11 (Sustainable Urban and Community Development) and 13 (Climate Change Mitigation) (Figure 4).

In 2018, European Commission published the second annual report on the implementation of financial and legal instruments in 2014-2020, covering the period until the end of 2016. Approximately 10,3 billion EUR of financial and legal instruments’ contributions were made to operational programs (the European Structural and Investment Fund (ESIF)) by the end of 2016; of this overall total, 9,9 billion EUR - by the European Regional Development Fund (EFRD) and the Cohesion Funds, only 320 million EUR - by the European Social Fund (ESF) and 52 million EUR - by the European Agricultural Fund for Rural Development (EAFRD) (approximately half of the “planned” contributions indicated in the operational programs). Thus, overall progress is quite meager: of 9,9 billion EUR allocated to the EAFRD, by the end of 2016, less than a third has been paid to funds, and less than a third, in turn, has been paid to final recipients.

Despite the fact that the reporting covered only the first three years of the programming period and financial and legal instruments were implemented particularly slowly, as a result, by the end of 2016, less than 5 percent was actually invested than planned in the form of financial and legal instruments. The situation varies considerably among countries, but in terms of funds flowing to final beneficiaries, compared to the original plans, significant progress appears to have been made only in Spain, Estonia and Lithuania (Table 3) (European Commission, 2017).

| Table 3 Financial and Legal Instruments and Progress at the end of 2016 - ERDF and CF (Million EUR) | |||||||

| FIs planned in OPs | Commitments | Payments to funds | Payments to final recipients | Commitments as % of plans | Payments to funds as % of commitment | Payments to final recipients as % of payments to funds | |

| AT | 3.0 | 3 | 3 | 100.0 | 100.0 | 0.0 | |

| BE | 98.2 | 29.3 | 7.3 | 29.8 | 24.9 | 0.0 | |

| BG | 586.9 | 462.4 | 185 | 78.8 | 40.0 | 0.0 | |

| CZ | 521.0 | 0.0 | |||||

| DE | 1109.0 | 661.4 | 277.3 | 63.3 | 59.6 | 41.9 | 22.8 |

| EE | 240.3 | 133 | 33.4 | 35.2 | 55.4 | 25.1 | 105.4 |

| EL | 1048.2 | 522.4 | 130.6 | 49.8 | 25.0 | 0.0 | |

| ES | 1485.6 | 800 | 715.3 | 679.7 | 53.9 | 89.4 | 95.0 |

| FI | 29.5 | 1.5 | 0.2 | 0.2 | 5.1 | 13.3 | 100.0 |

| FR | 665.8 | 125.7 | 37.4 | 3.1 | 18.9 | 29.8 | 8.3 |

| HR | 511.8 | 214 | 37 | 2 | 41.8 | 17.3 | 5.4 |

| HU | 2339.4 | 2265.9 | 478.3 | 23.6 | 96.9 | 21.1 | 4.9 |

| IT | 1992.0 | 370.8 | 66.9 | 0.1 | 18.6 | 18.0 | 0.1 |

| LT | 688.8 | 583.2 | 287.9 | 173.8 | 84.7 | 49.4 | 60.4 |

| LV | 245.1 | 143.9 | 34.3 | 13 | 58.7 | 23.8 | 37.9 |

| MT | 34.0 | 15 | 13.8 | 44.1 | 92.0 | 0.0 | |

| NL | 85.7 | 20.3 | 1.5 | 0.7 | 23.7 | 7.4 | 46.7 |

| PL | 3629.7 | 1983.6 | 482.9 | 54.6 | 24.3 | 0.0 | |

| PT | 2504.5 | 322.9 | 54.4 | 12.9 | 16.8 | 0.0 | |

| RO | 377.5 | 100 | 26.5 | 0.0 | |||

| SE | 131.8 | 134 | 33.5 | 101.7 | 25.0 | 0.0 | |

| SI | 438.0 | 0.0 | |||||

| SK | 278.3 | 409.2 | 102.3 | 2.9 | 147.0 | 25.0 | 2.8 |

| UK | 1194.1 | 605 | 23.7 | 50.7 | 3.9 | 0.0 | |

| Total | 20238.1 | 9906.5 | 3006.0 | 997.6 | 48.9 | 30.3 | 33.2 |

Table 4 reflects the distribution of resources of financial and legal instruments for operational programs by areas of investment in percentage. Obviously, financial and legal instruments towards supporting small and medium-sized enterprises were the most popular in the EU, followed (remotely) by research and innovation and a low-carbon economy. The pan-European target was to invest 20% of funds from operational programs for low-carbon development into financial and legal instruments, however, in the end, only 9,5% was reached (European Regional Development Fund, 2019).

| Table 4 Split of the Budget to Operational Programs on the Topic Allocated to Financial and Legal Instruments at the end of 2017 | ||||||

| R&D&I | ICT | SME support | Energy efficiency/ renewables | Environ. & resource efficiency | Sustaineable transport | |

| AT | 0.0 | 0.0 | 1.8 | 0.0 | 0.0 | 0.0 |

| BE | 9.8 | 0.0 | 17.9 | 10.4 | 5.9 | 0.0 |

| BG | 10.3 | 0.0 | 36.6 | 7.3 | 11.4 | 0.0 |

| CY | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| CZ | 1.2 | 0.0 | 51.7 | 3.2 | 9.0 | 0.0 |

| DE | 8.5 | 0.0 | 31.5 | 2.1 | 3.0 | 0.0 |

| DK | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| EE | 10.9 | 0.0 | 48.3 | 0.0 | 0.0 | 0.0 |

| ES | 8.4 | 0.0 | 39.5 | 0.7 | 0.3 | 0.0 |

| FI | 0.5 | 0.0 | 7.7 | 0.0 | 0.0 | 0.0 |

| FR | 7.2 | 2.1 | 26.3 | 10.0 | 1.3 | 0.0 |

| GR | 36.7 | 14.2 | 49.0 | 4.0 | 3.5 | 0.8 |

| HR | 4.5 | 0.0 | 25.8 | 9.4 | 0.0 | 3.8 |

| HU | 29.9 | 42.4 | 34.4 | 24.4 | 0.0 | 0.0 |

| IE | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| IT | 18.1 | 2.7 | 38.0 | 9.8 | 1.1 | 0.0 |

| LT | 2.6 | 0.0 | 31.3 | 42.3 | 14.8 | 0.0 |

| LU | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| LV | 0.0 | 0.0 | 42.7 | 12.3 | 0.0 | 0.0 |

| MT | 0.0 | 0.0 | 38.2 | 26.0 | 0.0 | 0.0 |

| NL | 19.0 | 0.0 | 0.0 | 15.0 | 0.0 | 0.0 |

| PL | 7.2 | 0.0 | 25.4 | 9.8 | 0.0 | 0.0 |

| PT | 0.1 | 0.0 | 37.8 | 23.3 | 19.1 | 0.0 |

| RO | 5.1 | 0.0 | 47.1 | 2.5 | 0.0 | 0.0 |

| SE | 0.0 | 0.0 | 32.2 | 22.8 | 0.0 | 0.0 |

| SI | 27.7 | 0.0 | 48.3 | 23.8 | 0.0 | 0.0 |

| SK | 0.0 | 0.0 | 17.0 | 14.1 | 3.7 | 3.4 |

| UK | 8.9 | 0.0 | 45.0 | 9.6 | 9.8 | 0.0 |

| EU28 | 8.9 | 3.5 | 34.0 | 9.5 | 3.1 | 0.3 |

| Target | 5.0 | 10.0 | 50.5 | 20.0 | 5.0 | 10.0 |

| Total FI | 3667.7 | 468.4 | 11319.7 | 3748.5 | 1089.0 | 189.9 |

| CM Total | 41104.0 | 13308.1 | 33276.3 | 39661.4 | 34993.5 | 58523.8 |

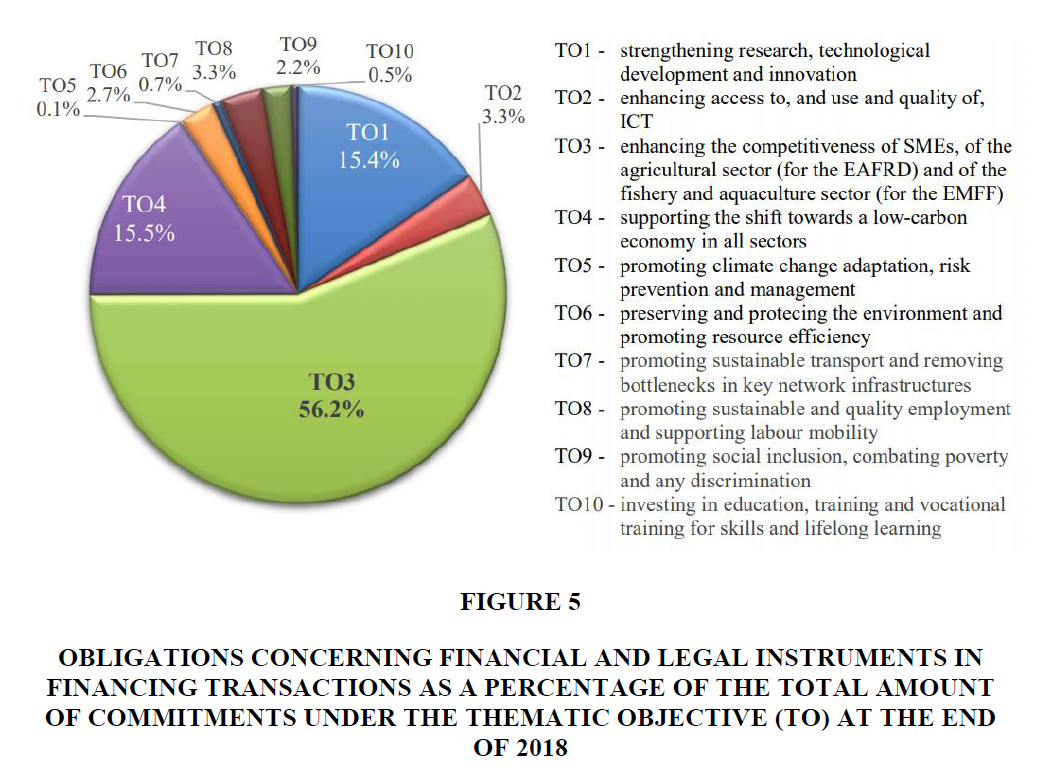

Financial and legal instruments reflect the diversity of national or regional programs and the specifics of the investment directions supported, as evidenced in the thematic objective report (see Figure 5). Investments in energy efficiency in the case of ERDF and EAFRD, SMES and employment support in the case of ERDF, EAFRD, ESF and EMFF, as well as the agricultural and rural sectors within the framework of EAFRD. In terms of thematic objectives, the largest share of funding (56,2%) was allocated to support small and medium-sized enterprises (SMES) under TO3, followed by a low-carbon economy (TO4), that is, mainly energy efficiency and renewable energy sources (15,5 %) and investment in innovation and R&D (TO1) (15,4%) (European Commission, 2018).

Figure 5 Obligations Concerning Financial and Legal Instruments in Financing Transactions as a Percentage of the Total Amount of Commitments Under the Thematic Objective (to) at the end of 2018

Thus, the further use of financial and legal instruments will ensure the implementation of sustainable development policy, increase the efficiency of social-economic systems and create favorable conditions for deeper integration of the European economic environment into the world community.

Conclusion

As a result of the analysis of financial and legal instruments towards promoting the implementation of the state’s sustainable development policy, it has been found that due to the conditions of intensification of international processes, the concept of sustainable development is becoming increasingly important. At the present stage, it is the fundamental paradigm of the genesis of the international ecological, social-economic system of countries all over the world. Global Sustainable Development Goals are a system for the formation of the modern world, which are based on the needs of ensuring international balance by solving social-economic issues and preserving the environment. Thus, the concept of sustainable development in modern conditions is a general vector of public policy implementation by using effective financial and legal instruments.

Wide differentiation of financial and legal instruments and the need to form an optimal capital structure towards achieving sustainable development goals, taking into account the distribution of risks between public and private partners require the application of a conceptual framework based on the use of digital platform. Such platform will reflect the planned and implemented sustainable development goals, which allows carrying out online monitoring of key performance indicators for the implementation of sustainable development goals.

Therefore, the improvement of financial and legal instruments towards promoting the implementation of the sustainable development policy of the state may become the latest paradigm for the preservation of globalization vectors and means of integration of national economies. As a result, the implementation of the sustainable development policy of states and regions becomes a subject matter of great interest both for the entities and for the public sector as a whole.

Further investigations may be aimed at improving financial and legal instruments towards promoting the implementation of sustainable development policies of the state, which will stimulate innovation and financial activities and increase living standards and improve existing infrastructure. Empowerment and widespread use of innovative, financial, research approaches to regulating the policy of sustainable development of the state at the interstate level may become the basis of a common European strategy for future periods.

References

- Alegre, J. G. (2012). An Evaluation of the EU Regional Policy. Do Structural Actions Crowd Out Public Spending? Public Choice, 151(2), 1-21.

- Antonescu, D. (2014). Regional Development Policy in Context of Europe 2020 Strategy. Procedia Economics and Finance, 15, 1091-1097.

- Brundtland, G. (1987). Our Common Future: Report of the 1987 World Commission on Environment and Development. The United Nations: Oslo, Norway.

- Collignon, S. (2008). The Lisbon Strategy, Macroeconomic Stability and the Dilemma of Governance with Governments; or why Europe is not Becoming the World's Most Dynamic Economy. International Journal of Public Policy, 3(1-2), 72-99.

- Dima, A. M., Begu, L., Vasilescu, M. D., & Maassen, M. A. (2018). The relationship between the Knowledge Economy and Global Competitiveness in the European Union. Sustainability, 10(1706), 1-15.

- Donaires, O. S, Cezarino, L. O., Caldana, A. C. F., & Liboni, L. (2019). Sustainable development goals - an analysis of outcomes. Kybernetes, 48(1), 183-207.

- DZ BANK (2020). Bank of Germany. Retrieved from https://www.dzbank.de/

- Elkington, J. (2004). Enter the Triple Bottom Line. In Henriques, A., & Richardson, J. (eds.) The Triple Bottom Line, Routledge.

- Environmental Finance (2020). Sustainable Bonds Insight 2020. Retrieved from https://www.environmental-finance.com/assets/files/research/sustainable-bonds-insight-2020.pdf

- European Commission (2017). European Structural & Investment Funds. Data ESIF 2014-2020 categorisation ERDF-ESF-CF – planned. Retrieved from https://cohesiondata.ec.europa.eu/2014-2020-Categorisation/ESIF-2014-2020-categorisation-ERDF-ESF-CF-planned/9fpg-67a4

- European Commission (2018a). Financial instruments under the European Structural and Investment Funds. Summaries of the data on the progress made in financing and implementing the financial instruments for the programming period 2014-2020 in accordance with Article 46 of Regulation (EU) ? 1303/2013 of the European Parliament and of the Council. Retrieved from https://ec.europa.eu/regional_policy/sources/thefunds/fin_inst/pdf/summary_data_fi_1420_2018.pdf

- European Commission (2018b). Financing a European economy, Final Report 2018 by the High-Level Expert Group on Sustainable Finance Secretariat provided by the European Commission. Retrieved from https://www.buildup.eu/sites/default/files/content/180131-sustainable-finance-final-report_en.pdf

- European Regional Development Fund (2019). Funding Energy Efficiency through Financial Instruments. A Policy Brief from the Policy Learning Platform on Low-carbon economy. Retrieved from https://www.interregeurope.eu/fileadmin/user_upload/plp_uploads/policy_briefs/TO4_PolicyBrief_Financial_Instruments.pdf

- Gambetta, N., Azadian, P., Hourcade, V., Elisa Reyes, M. (2019). The Financing Framework for Sustainable Development in Emerging Economies: The Case of Uruguay, Sustainability, MDPI, Open Access Journal, 11(4), 1-24.

- Kharas, H., Prizzon, A., Rogerson, A. (2014). Financing the Post-2015 Sustainable Development Goals. Overseas Development Institute: London, UK.

- Kulawik, J., Wieliczko B., Soliwoda M. (2018). Is There Room for Financial Instruments in the Common Agricultural Policy? Casus of Poland. In: M. Wigier, A. Kowalski (eds.). The Common Agricultural Policy of the European Union - The Present and the Future. EU Member State Point of View, Monographs of Multi-Annual Programme No. 73.1, IAFE-NRI, Warsaw.

- Kwilinski, A., Ruzhytskyi, I., Patlachuk, V., Patlachuk, O. & Kaminska, B. (2019). Environmental taxes as a condition of business responsibility in the conditions of sustainable development, Journal of Legal, Ethical and Regulatory Issues, 22(Sp Iss 2), 254.

- Nurse, K. (2006). Culture as the fourth pillar of sustainable development, Small States: Economic. Marlborough House, London.

- OECD (2018). Global Outlook on Financing for Sustainable Development 2019: Time to Face the Challenge. OECD Publishing, Paris.

- OECD (2019). Global Outlook on Financing for Sustainable Development 2019. OECD: Paris.

- Patora-Wysocka, Z., & Su?kowski, ?. (2019). Sustainable Incremental Organizational Change - A Case of the Textile and Apparel Industry. Sustainability, 11(4), 1-27.

- Postula, M. (2018). Ten Years of Performance Budget Implementation in Poland – Successes, Failures, Future. In ed. Lotko, E., Zawadzka-P?k, U. K., Radvan, M. Optimization of Organization and Legal Solutions concerning Public Revenues and Expenditures in Public Interest. Temida 2, Bialystok-Vilnius.

- Postula, M., & Raczkowski, K. (2020). The Impact of Public Finance Management on Sustainable Development and Competitiveness in the EU Member States. Journal of Competitiveness, 12(1), 125-144.

- Raszkowski, A., & Bartniczak, B. (2019). On the Road to Sustainability: Implementation of the 2030 Agenda Sustainable Development Goals (SDG) in Poland, Sustainability, 11(2), 366.

- Romanchukevich, V. V. (2019). Harmonization of the concept of sustainable development and public financial policy, Vcheni zapysky TNU imeni V. I. Vernadskoho. Seriia: Ekonomika i upravlinnia, 30(69), 126-134.

- Shrithongrung, A., & Kriz, K. A. (2014). The Impact of Subnational Fiscal Policies on Economic Growth: A Dynamic Analysis Approach. Journal of Policy Analysis and Management, 33(4), 912-928.

- Soini, K., & Birkeland, I. (2014). Exploring the scientific discourse on cultural sustainability. Journal NorskGeografiskTidsskrift - Norwegian Journal of Geography, 71(3), 127-131.

- The Global Goals (2020). The Global Goals For Sustainable Development 2030. Retrieved from https://www.globalgoals.org/

- Tudose, M. B, & Rusu, V. D. (2015). Global Competitiveness of the European Union Member States: Evolution and Perspectives, Studies and Scientific Researches. Economic Edition, 22(1), 23-31.

- United Nations Development Program (2018). Financing the 2030 Agenda - An Introductory Guidebook for UNDP Country Offices; UNDP: New York, USA. Retrieved from http://www.undp.org/content/undp/en/home/librarypage/poverty-reduction/2030-agenda/financing-the-2030-agenda.html

- United Nations General Assembly (2014). The Road to Dignity by 2030: Ending Poverty, Transforming All Lives and Protecting the Planet; Report ?. A/69/700; United Nations General Assembly: New York, USA. Retrieved from http://www.un.org/ga/search/view_doc.asp?symbol=A/69/700&Lang=E

- Wieliczko, B. (2019). Financial instruments - a way to support sustainable development of the EU rural areas? Case of Poland. Studia Ekonomiczne. Zeszyty Naukowe Uniwersytetu Ekonomicznego w Katowicach, 16(1), 245-254.

- Yarovoy, T. T., Коzyrieva, O. V., Bielska, T. V., Zhuk, I. I., & Mokhova, I. L. (2020). The E-government development in ensuring the country financial and information security. Financial and credit activity: problems of theory and practice, 2(33), 268-275.