Research Article: 2023 Vol: 27 Issue: 2

Financial Development − Economic Growth Nexus in Cote Divoire: The Role of Inflation

N’dri, Konan Leon, Felix Houphouet-Boigny University

Citation Information: Leon, N.K. (2023). Financial development - economic growth nexus in cote d’ivoire: the role of inflation. Academy of Accounting and Financial Studies Journal, 27(2), 1-10.

Abstract

This paper investigates the role of inflation on financial development-economic growth nexus in Côte d’Ivoire using annual data on economic growth, domestic credit to private sector, and inflation over the period 1994 to 2018. The paper tests the long run relationships among the variables by means of the ARDL bounds testing procedure. The findings are threefold. First, a long run relationship among the variables is found when considering economic growth as the dependent variable. Second, the effect of inflation on financial development in determining economic growth is positive. Third, Cote d’Ivoire can boost economic growth by improving its financial market efficiency while maintaining low inflation rates.

Keywords

Financial Development, Economic Growth, Inflation, ARDL Model, Côte d’Ivoire.

JEL Classifications

016, O47, E31.

Introduction

It is widely documented that a well-functioning financial market that efficiently allocates resources will promote economic growth. However, studies on this important relationship continue to yield mixed results, ranging mainly from positive links (see, for example Beck et al., 2000; King & Levine, 1993a, 1993b; Levine et al., 2000; Lenka & Sharma, 2020; Shravani & Sharma, 2020; Zeqiraj et al., 2020) to negative links (see, for example Singh, 1997; Narayan & Narayan, 2013; Ayadi et al., 2015; Ductor & Grechyna, 2015).

Given these conflicting views, an emerging body of literature argues that human capital, macroeconomic fundamentals and, macroeconomic stability may moderate the growth effect of finance (Ehigiamusoe & Samsurijan, 2021). In effect, Institutions (Bandura & Dzingirai, 2019; Aluko & Ibrahim, 2020), income per capita and human (Ibrahim & Alagidede, 2018), information and communication technology (Abeka et al., 2021), and inflation (Rousseau & Wachtel, 2002; Hung, 2003; Huang, 2010; Ibrahim et al., 2022) have shown to play a moderating role in the effect of financial development on economic growth but all for a panel of countries.

The present study contributes to the existing empirical literature by examining the cointegration among inflation, financial development, and economic growth in Cote d’Ivoire. Several reasons underline the importance of this study. First, cointegration analysis will shed light on long run relationships among the variables. Second, this study will inform us on whether inflation, financial development, and economic growth in Côte d’Ivoire exhibit different characteristics from those in other countries. In fact, the differing monetary policies coupled with different level of financial development might affect economic growth differently. Inflation exercises a positive and significant effect on economic growth in the long-run and a negative and significant effect on growth in Cote d’Ivoire in the short-run (N’dri, 2017), but the mediating effect of inflation will depend on the level of the host country’s financial development. The nexus economic growth-financial development has been largely researched over the past years (see, for example Levine, (2005) for a summary of theoretical and empirical overview of studies). Studying the dynamic relationships between inflation, financial development, and economic growth will help us uncover whether Côte d’Ivoire exhibits a positive financial development-economic growth relation conditional on inflation. Third, understanding the dynamic relations between inflation, financial development, and economic growth could provide insight to policy makers as to whether the volatility of inflation has contributed to a positive effect of financial development on economic growth and inform them on appropriate measures.

The findings of this study are threefold. First, a long run relationship among the variables is found when considering economic growth as the dependent variable. Second, the effect of inflation on financial development in determining economic growth is positive. Third, Cote d’Ivoire can boost economic growth by jointly improving its financial market efficiency while maintaining low inflation rates.

The remainder of the paper is organized as follows. Section 2 provides a literature review on the effect of inflation in the financial development – economic growth nexus after the introduction section. Section 3 presents the data. Section 4 describes the methodology. Section 5 presents the empirical results and section 6 provides the conclusion and policy implication.

Literature Review

This section reviews some of the recent empirical work on the role of inflation in determining the effect of financial development on economic growth. It considers selected literature dealing with positive and negative moderating role of inflation in the finance-growth nexus.

Rousseau & Wachtel, (2002) use a five-year averages measure of inflation, financial development, and economic growth from 84 countries over the period 1960 to 1995 to examine the role of inflation in the finance-growth nexus. They apply a rolling panel regression technique and find that when inflation exceeds the prescribed inflation threshold, it becomes insignificant in promoting growth.

Hung (2003) develops a endogenous growth model to tackle the moderating role of inflation in determining the growth effect of financial development. He finds that in countries with relatively high initial inflation rates, financial development increases inflation which in turn negatively affects economic growth whereas financial development reduces inflation and spurs economic growth in the case of countries with relatively low initial inflation rates.

Huang et al. (2010) apply an instrumental-variable threshold regression developed by Caner & Hansen (2004) and use data from Levine et al. (2000) to search for the existence of an inflation threshold in the finance- growth nexus. They find a nonlinear inflation threshold in the finance-growth link, above which, the effect of finance on growth is insignificant and positive for inflation rates below that threshold.

The effect of inflation on the finance-growth nexus has also been investigated by Yilmazkuday (2011) who utilizes data on 84 countries over the 1965 to 2004. He finds that financial development erodes the positive effect on growth when inflation is high whereas it increases economic growth when inflation low.

Ehigiamusoe et al. (2019), study how inflation mediates in the finance-grow nexus for 16 West African countries over the period 1980–2014. They find that the effect of finance on growth depends on the level of inflation. The marginal effect of financial development is positive when evaluated at the minimum inflation rate and, negative when evaluated at the maximum inflation rate. They also find an inflation threshold of 5.62% above which financial development exercises a negative effect on economic growth.

Bandura (2020) investigates the effect of inflation on the finance-growth nexus for 23 Sub- Saharan African countries over the period 1982–2016. He employs a non-dynamic threshold approach and finds that financial development negatively affects economic growth when the inflation rate is beyond the inflation threshold or 31%; that negative effect turns positive when inflation rate is below that threshold.

Farahania et al. (2021) apply a panel smooth transition regression model and use data from eight Islamic developing countries over the period from 1990–2017 to analyze the threshold inflation rate for the effect of financial development on economic growth. They find that financial development reduces economic growth when inflation exceeds the threshold of 11.88% and increases economic growth when inflation rate is below that threshold.

Khalilnejad & Gharraie (2021) tackle the issue of the inflation threshold effect in the finance-growth nexus by applying a threshold autoregression to a group of MENA countries. They find that in low inflation periods, financial development promotes economic growth whereas in high inflation regimes, financial development does not affect economic growth.

This paper contributes to this literature in the case of Cote d’Ivoire and tests for the long run relationships among the variables by means of the ARDL bounds testing procedure.

Data

The data used in this study are annual data running from 1994 to 2018, and are sourced from the World Bank Development indicators 2021.

The data on the growth rate of the per capita gross domestic product noted here as GDPR measure economic growth and are used to capture the overall performance of the economy. Financial development is the absorptive capacity and is measured as the domestic credit to private sector as percentage of GDP noted here as DCPR. This measure is more appropriate than monetary based indicators of M2 or M3 as percentage of GDP since it reflects savings mobilization towards facilitating transactions, providing credit to producers and consumers, and reducing transaction costs (Shan & Jianhong, 2006). Furthermore, it is often used in studies dealing with financial asset allocation (Baltagi et al., 2009). The consumer price index-based Inflation rate noted here as INF is considered. Inflation reduces the general purchasing power and therefore not conducive for investment and economic growth. It is predicted to negatively affect production since production factors will be high.

Finally, an interaction term formed by the product of financial development (DCPR) with inflation (INF) notes as INTER will be included to investigate the impact of financial development on economic growth through inflation.

Methodology

This section exposes the model and describes the ARDL bounds test for cointegration.

The Model

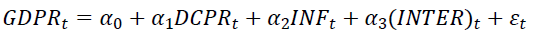

To assess the dynamic relationships between the variables, I use the following empirical model.

(1)

(1)

where GDPR, INF, DCPR, and Inter = DCPR * INF are the per capita growth rate of the GDP, the inflation rate, the domestic credit to private sector as percentage of GDP, and the interaction term respectively.

The interaction term between, that is, INTER = DCPR * INF is introduced to examine whether a positive link between financial development and economic growth is conditional on the inflation rate. αi are coefficients, and εt is the error term assumed to be White noise.

ARDL Bounds Test for Cointegration

This section analyzes the cointegrating relationships among the variables at stake. The concept of cointegration which is first credited to Granger (1981), addresses the question of the long-run relationship between economic variables. Testing for cointegration implies the search for whether two or more integrated variables deviate significantly from a certain relationship (Abadir & Taylor, 1999). Variables are said to be cointegrated, if they move together over time such that short-term disturbances are corrected in the long-term.

Several approaches to cointegration such as the two-step procedure of cointegration of Engle & Granger (1987), and the full information maximum likelihood approach of Johansen (1988) and Johansen & Juselius (1990) exist, but to examine the dynamic relationships between the growth rate of the per capita GDP, financial development indicator, inflation and the interaction term (INTER=DCPR*INF), I utilize the Auto Regressive Distributed Lag (ARDL) bounds testing cointegration technique developed by (Pesaran et al., 2001). Four main reasons justify this choice. First, it is applicable to variables of different order of integration, that is, either I(1), I(0) or mutually cointegrated. Second, it provides efficient estimates in small sample size. Third, it assumes that all variables are endogenous. Fourth, it enables estimation of both long run and short run parameters simultaneously.

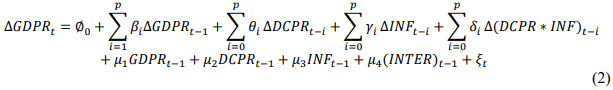

To implement the bounds testing procedure, equation (1) is represented as a conditional ARDL-error correction model as follows:

Where the variables are defined as in section 3. Δ(.) is the difference operator, and p is the optimal lag length. The lag length is selected by means of the Akaike Information Criteria (AIC). Σ(.) is the summation operator, and ξt is the White noise error term. The intercept term φ0 represents the technology level. Financial development is captured by the domestic credit to private sector as percentage of GDP.

In equation 2, μ1, μ2, μ3 and μ4 designate the long-run parameters whereas β,Φ,γ, and �� refer to short-run parameters. Assessing cointegration implies testing for the null hypothesis of absence cointegration given by μ1 = μ2 = μ3 = μ4 = 0 against the alternative hypothesis of μ1 ≠ μ2 ≠ μ3 ≠ μ4 ≠ 0 for the existence of long run relationships among variables. The test is conducted with an F-test on the joint significance of the coefficients of the lagged regressors in level. The calculated F-Statistic when GDPR is considered as the dependent variable (normalized) is noted as FGDPR(GDPR/DCPR*INF). The existence of cointegration among series is confirmed when the calculated F-statistic is superior to the upper critical bound value provided by Pesaran et al. (2001). An absence of cointegration is pronounced if the computed F-statistic is below the lower critical bound value. The test is said to be inconclusive when the computed F- statistic falls between the upper critical bound value and the lower critical bound value. The determination of the maximum lag p used to implement the ARDL bound testing procedure is determined by the Akaike Information Criteria. Further to estimation, diagnostic checks for serial correlation, functional form of the model, normality of residuals, and white heteroscedasticity, and stability tests are carried out.

Empirical Results

Unit Root Tests

It is agreed that bounds testing procedure will apply irrespective of the order of integration of series, but its estimates will not be reliable if series are integrated of order two or higher. I make use of Phillips & Perron (1988) unit root test to check for the order integration to ensure that series are not integrated of order two or higher. The test is conducted here with a model with constant and trend for the level series, and a model with constant without trend for the series in first difference. Results from Unit Root tests are presented in Table 1 below.

| Table 1 Unit Root Test | ||

| Model with intercept and trend for series in level; The critical value at 5% is -3.6121 | ||

| Variable | PP statistics | Decisions |

| GDPR | -3.1639 | NS |

| DCPR | -4.5598 | S |

| INF | -15.4917 | S |

| INTER | -21.7415 | S |

| Model with intercept without trend for first differenced series ; The critical value at 5% is -2.9980 | ||

| D GDPR | --8.2767 | S |

| D DCPR | -4.0962 | S |

| D INF | -7.7065 | S |

| D INTER | -7.5348 | S |

Notes: GDPR, DCPR, INF and INTER are GDP per capita growth rate, domestic credit to private sector as % of GDP, inflation and interaction term respectively; INTER=DCPR*INF; D(.) is the difference operator; S denotes stationary, and NS stands for non stationary.

The results show that for series in level, DCPR, INF, and INTER are stationary as their PP statistics in absolute value are greater than the absolute value of the critical value of -3.6121 at the 5% significance level whereas GDPR is non stationary given that its PP statistic in absolute value is lower than that critical value in absolute value. All the variables in first difference are stationary as their PP statistics in absolute value are superior to the absolute value of the critical value of - 2.9980 at the 5% level thereby indicating no integration of order two or superior. This result suggests the existence of long-run relationships among variables thereby calling for an analysis of cointegration. However, the mixture in the series’ order of integration makes them good candidates for the application of the Bounds Tests for cointegration.

Bounds Tests for Cointegration

To determine the existence or not of long run relationships among variables, I compute F- statistics based on the OLS estimation of equation (1). The lag length is determined by the Akaike Information Criterion. The selected lag length based on that information criterion is 1 as reported in Table 2 below. Indeed, appropriate lag length selection will prevent flawed conclusion on the existence of long-run relationships.

| Table 2 Lag Length Selection | ||||||

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | -220.1790 | NA | 3437.621 | 19.49382 | 19.69130 | 19.54349 |

| 1 | -180.9721 | 61.36727* | 469.9037* | 17.47584* | 18.46322* | 17.72416* |

| 2 | -170.5904 | 12.63862 | 888.1604 | 17.96438 | 19.74168 | 18.41137 |

Notes: * indicates lag order selected by the criterion. LR: sequential modified LR test statistic (each test at 5% level); FPE: Final prediction error; AIC: Akaike information criterion; SC: Schwarz information criterion; HQ: Hannan-Quinn information criterion.

The results of the Bounds tests for cointegration reported in Table 3 below give the F- statistics when each variable is considered as independent (normalize) in the ARDL-OLS regression.

| Table 3 Bounds Test F-Statistics | ||||

| Critical Values | ||||

| Dependent Variable | F-Statistic | Lower Bounds | Upper Bounds | Cointegration Decision |

| FGDPR (GDPR/DCPR, INF, INTER) | 3.77* | 2.45 (5%) | 3.63 (5%) | Yes |

| FDCPR (DCPR/GDPR, INF, INTER) | 12.97* | 2.45 (5%) | 3.63 (5%) | Yes |

| FINF (INF/GDPR, DCPR, INTER) | 5.98* | 2.45 (5%) | 3.63 (5%) | Yes |

| FINTER (INTER/GDPR, DCPR, INF) | 36.89* | 2.45 (5%) | 3.63 (5%) | Yes |

Note: * indicates rejection of the null hypothesis of no cointegration at the 5% level. Variables are defined as previously.

Overall, these results confirm the existence of cointegration among the variables given that all computed F-statistics regardless of the chosen dependent variable are all above the upper bounds critical value at the 5% significance level.

The next step consists therefore in the estimation of long run and short run coefficients. However, given that this study focuses on analyzing empirically the extent to which the interaction between financial development and inflation affects economic growth, I concentrate on the estimation of the long run and short run coefficients when economic growth is the dependent variable.

Long Run and Short Run Dynamics

Table 4 below reports estimates of long run and short run coefficients.

| Table 4 Long Run and Short Run Estimates | ||

| Long Run Estimates | ||

| Variable Coefficient Probability | ||

| DCPR | 0.3053 | 0.0128* |

| INTER | 0.1537 | 0.0473* |

| INF | -2.8182 | 0.0288* |

| Short Run Estimates | ||

| Δ (DCPR) | 0.0872 | 0.8908 |

| Δ (INTER) | 0.0958 | 0.1617 |

| Δ (INF) | -1.8169 | 0.0945** |

| Δ ECT(-1) | -0.7493 | 0.0020* |

Notes:* and ** denote significance at the 5% and 10% levels respectively. GDPR, DCPR, INF, and INTER are GDP per capita growth rate, domestic credit to private sector as % of GDP, inflation and interaction term respectively. INTER=DCPR*INF.; (.) is the difference operator; ECT(-1) denotes the coefficient of the lagged error correction term.

The estimates of the long run coefficients show that financial development (DCPR) has a positive and significant effect on economic growth whereas inflation (INF) exhibits a negative and significant effect on economic growth, all at the 5% significance level. These results corroborate findings that financial development promotes economic growth (see, for example Levine, 2005 for a summary of theoretical and empirical overview of studies) whereas inflation impinges on economic growth see N’dri, (2017) for a review of theoretical and empirical literature). The joint effect (INTER) at stake in this paper has a positive and significant effect on economic growth at the 5% critical value. In effect a 1 percent increase in the interaction factor (INTER) results in a 15.37 percent increase in economic growth. This result however corroborates the moderating role played by inflation in the finance-growth nexus. It shows that in period of low inflation, financial development promotes economic growth (Farahania et al., 2021; Khalilnejad & Gharraie, 2021 amongst others).

The short run estimates show that the coefficient on the change in the domestic credit to private sectors (DDCPR) is positive and not significant as well as the coefficient on the change in the interaction term (DINTER). This result suggests on the one hand that, the domestic credit to private sectors is not sufficient to promote economic growth, and on the other that, the short-term financial development is not sufficient to lower inflation well enough to spur economic growth. There is a short term negative and significant effect of the change in inflation on economic growth. A 1% inflation change triggers a decrease of 181.69% in growth change. The Error Correction Term, ECT(-1) is negative (-0.7493) and significant at the 1% level. It shows that any disturbances in the GDPR level during the current year will be corrected at a rate of 74.93% in the coming year. Finally, diagnostic tests and stability tests are carried out, and the results are reported in Table 5 below.

| Table 5 Diagnostic Checks | ||

| Hypothèses | Tests | P-Values |

| Normality | Bera-Jarque | 0.810* |

| Serially uncorrelated | Breusch-Godfrey | 0.878* |

| Homoscedasticity | Breusch-Pagan-Godfrey | 0.756* |

| Functional form | Ramsey RESET Test | 0.470* |

Note: * denotes insignificance at the 5% level. All P-values reject the null hypotheses.

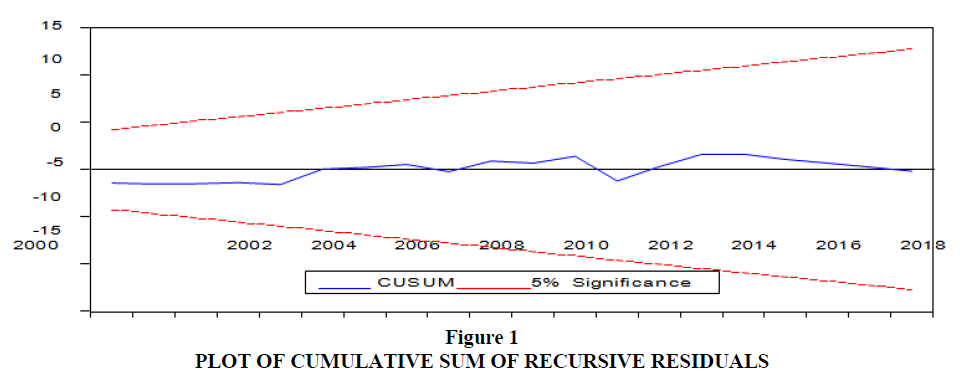

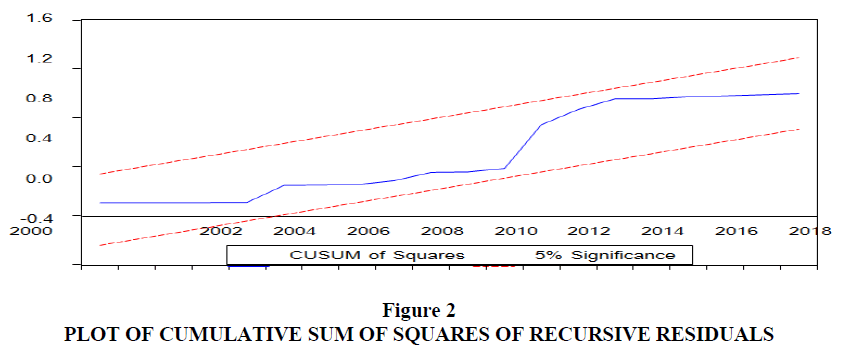

Table 5 above shows that the model passes all diagnostic tests as all null hypotheses are not rejected at the 5% significance level. In fact, the results indicate that the error terms are normality distributed, and there is no serial correlation; there is absence of White heteroscedasticity in the model, and the functional form of the model is well specified. It is worth noting that the error correction coefficient is negative and significant thereby corroborating the finding of long run relationships among variables. Further tests as prescribed by Pesaran & Shin (1999) to check for the stability of long run and short run estimates by means of the CUSUM and CUSUMsq are carried out. Figure 1 and Figure 2 below plot the cumulative sum of recursive residuals, and the cumulative sum of squares of recursive residuals respectively.

The plots of the CUSUM and the CUSUMsq lie within the critical 5% bound thereby indicating the stability of the ARDL model.

Conclusion and Policy Implications

The present study has analyzed the role of inflation on the financial development-growth nexus in Côte d’Ivoire. The study uses annual data on the per capita growth rate of GDP, the ratio of domestic credit to private sector to GDP, the consumer price-based inflation rate, and an interaction term between inflation and the ratio of domestic credit to private sector to GDP over the period 1994 to 2018. The study utilizes the ARDL bounds test methodology to test for the long run and the short run relationships between per capita growth rate of GDP, and other variables cited above.

The study finds long run relationships among inflation, financial development, and economic grow. It particularly reveals that the interaction between inflation and financial development spurs economic growth in the long run. This result translates the growth effect of finance through inflation. Domestic credit to the private sector to GDP also affects positively economic growth in the long run. Inflation has a negative effect on economic grow in the long run whereas the change in inflation impacts negatively economic growth in the short run.

Diagnostic checks show that the model is properly specified as all null hypotheses of tests for normality, absence of serial correlation, homoscedasticiy, and functional form could not be rejected. The plot of cumulative sum of recursive residuals and the plot of cumulative sum of squared recursive residuals confirm the stability of the ARDL model.

The main policy implication of this study is that Côte d’Ivoire can boost its economic growth by concomitantly improving the efficiency of its financial sector while promoting policies that will maintain inflation at a relatively low level.

References

Abadir, K.M., & Taylor, A.M.R. (1999). On the Definitions of Co-integration. Journal of Time Series Analysis, 20, 129-137.

Indexed at, Google Scholar, Cross Ref

Abeka, M.J., Andoh, E., Gatsi, J.G., Kawor, S., & McMillan, D. (2021). Financial development and economic growth nexus in SSA economies: The moderating role of telecommunication development. Cogent Economics & Finance, 9(1), 1862395.

Indexed at, Google Scholar, Cross Ref

Aluko, O., & Ibrahim, M. (2020). Institutions and the Financial Development—Economic Growth Nexus in Sub- Saharan Africa. Economic Notes, 49, e12163.

Indexed at, Google Scholar, Cross Ref

Ayadi, R., Arbak, E., Naceur, S.B., & De Groen, W.P. (2015). Financial development, bank efficiency, and economic growth across the Mediterranean. In R. Ayadi, M. Dabrowski, and L. De Wulf (eds.), Economic and social development of the Southern and Eastern Mediterranean countries (pp. 219-233).

Indexed at, Google Scholar, Cross Ref

Baltagi, B., Demetriades, P., & Law, S.H. (2009). Financial development and openness: Evidence from panel data. Journal of Development Economics, 89(2), 285-296.

Bandura W.N., & Dzingirai, C. (2019). Financial development and economic growth in Sub-Saharan Africa: the role of institutions. PSL Quarterly Review, 72(291), 315-334.

Indexed at, Google Scholar, Cross Ref

Bandura, W.N. (2020). Inflation and finance-growth nexus in sub-Saharan Africa. Journal of African Business, 23(2), 1-13.

Indexed at, Google Scholar, Cross Ref

Beck, T., Levine, R., & Loayza, N. (2000). Finance and the Sources of Growth. Journal of Financial Economics, 58, 261-300.

Indexed at, Google Scholar, Cross Ref

Caner, M., & Hansen, B.E. (2004). Instrumental Variable Estimation of a Threshold Model. Econometric Theory, 20, 813-843.

Indexed at, Google Scholar, Cross Ref

Ductor, L., & Grechyna, D. (2015). Financial development, real sector, and economic growth. International Review of Economics & Finance, 37, 393-405.

Indexed at, Google Scholar, Cross Ref

Ehigiamusoe, K.U., & Samsurijan, M.S. (2021). What matters for finance-growth nexus? A critical survey of macroeconomic stability, institutions, financial and economic development. International Journal of Finance & Economics, 26(4), 5302-5320.

Indexed at, Google Scholar, Cross Ref

Ehigiamusoe, K.U., Lean, H.H., & Lee, C.C. (2019). Moderating effect of inflation on the finance–growth nexus: Insights from West African countries. Empirical Economics, 57(2), 399-422.

Indexed at, Google Scholar, Cross Ref

Engle, R.F., & Granger, C.W.J. (1987). Co-integration and Error Correction: Representation, Estimation and Testing. Econometrica, 55, 251-276.

Indexed at, Google Scholar, Cross Ref

Farahania, M.H., Ghabel, S.N., & Mohammadpour, R. (2021). The effect of inflation threshold on financial development and economic growth: A case study of D-8 countries. Iranian Economic Review, 25(3), 465-475.

Indexed at, Google Scholar, Cross Ref

Granger, C.W.J. (1981). Some Properties of Time Series Data and Their Use in Econometric Model Specification. Journal of Econometrics, 16, 121-30.

Indexed at, Google Scholar, Cross Ref

Huang, H.C., Lin, S.C., Kim, D.H., & Yeh, C.C. (2010). Inflation and the finance–growth nexus. Economic Modelling, 27(1), 229-236.

Indexed at, Google Scholar, Cross Ref

Hung, F.S. (2003). Inflation, financial development, and economic growth. International Review of Economics & Finance, 12(1), 45-67.

Indexed at, Google Scholar, Cross Ref

Ibrahim, M., & Alagidede, P. (2018). Nonlinearities in financial development–economic growth nexus: Evidence from sub-Saharan Africa. Research in International Business and Finance, 46(C), 95-104.

Indexed at, Google Scholar, Cross Ref

Ibrahim, M., Aluko, O.A., & Vo, X.V. (2022). The role of inflation in financial development–economic growth link in sub-Saharan Africa. Cogent Economics & Finance, 10(1), 2093430.

Indexed at, Google Scholar, Cross Ref

Johansen, S. (1988). Statistical Analysis of Cointegration Vectors. Journal of Economic Dynamics and Control, 12, 231-54.

Indexed at, Google Scholar, Cross Ref

Johansen, S., & Juselius, K. (1990). Maximum Likelihood Estimation and Influence on Co-integration with Application to the Demand for Money. Oxford Bulletin of Economics and Statistics, 52, 169-210.

Khalilnejad, Z., & Gharraie, R. (2021). Financial development and economic growth: The inflation threshold effect. International Journal of Economic Policy in Emerging Economies, 14(5/6), 581-595.

Indexed at, Google Scholar, Cross Ref

King, R.G., & Levine, R. (1993a). Finance and Growth: Schumpeter Might Be Right. Quarterly Journal of Economics, 108, 717-737.

Indexed at, Google Scholar, Cross Ref

King, R.G., & Levine, R. (1993b). Finance, entrepreneurship, and growth. Journal of Monetary Economics, 32(3), 513-542.

Indexed at, Google Scholar, Cross Ref

Lenka, S.K., & Sharma, R. (2020). Re-examining the effect of financial development on economic growth in India: Does the measurement of financial development matter? Journal of Asia-Pacific Business, 21(2), 124-142.

Indexed at, Google Scholar, Cross Ref

Levine, R. (2005). Finance and Growth: Theory, Evidence and Mechanisms. In: Aghion, P. and Durlauf, S., Eds., Handbook of Economic Growth, Vol. 1, Part 1, North Holland, Amsterdam, 865-934.

Indexed at, Google Scholar, Cross Ref

Levine, R., Loayza, N., & Beck, T. (2000). Financial intermediation and growth: Causality and causes. Journal of Monetary Economics, 46(1), 31-77.

Indexed at, Google Scholar, Cross Ref

Narayan, P.K., & Narayan, S. (2013). The short-run relationship between the financial system and economic growth: New evidence from regional panels. International Review of Financial Analysis, 29, 70-78.

Indexed at, Google Scholar, Cross Ref

Ndri, K.L. (2017). Inflation and economic growth in Cote d'Ivoire. Journal of Economic & Financial Studies, 5(2), 39-44.

Indexed at, Google Scholar, Cross Ref

Pesaran, M.H., & Shin, Y. (1999). An Autoregressive Distributed Lag Modeling Approach to Cointegration Analysis. In: Strom, S., Ed., Econometrics and Economic Theory in the 20th Century, Chapter 11, The Ragnar Frisch Centennial Symposium, Cambridge University Press, Cambridge.

Pesaran, M.H., Shin, Y., & Smith, R.J. (2001). Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometrics, 16, 289-326.

Indexed at, Google Scholar, Cross Ref

Phillips, P.C., & Perron, P. (1988). Testing for a Unit Root in Time Series Regressions. Biometrica, 75, 335-346.

Indexed at, Google Scholar, Cross Ref

Rousseau, P.L., & Wachtel, P. (2002). Inflation thresholds and the finance-growth nexus. Journal of International Money and Finance, 21(6), 777-793.

Indexed at, Google Scholar, Cross Ref

Shan, J., & Jianhong, Q. (2006). Does Financial Development ‘Lead’ Economic Growth? The Case of China, Annals of Economics and Finance, 197-216.

Shravani, S., & Sharma, S.K. (2020). Financial development and economic growth in selected Asian economies: A dynamic panel ARDL test. Contemporary Economics, 14(2), 201-218.

Indexed at, Google Scholar, Cross Ref

Singh, A. (1997). Financial liberalization, stock markets and economic development. The Economic Journal, 107(442), 771-782.

Yilmazkuday, H. (2011). Thresholds in the finance-growth nexus: A cross-country analysis. The World Bank Economic Review, 25(2), 278-295.

Indexed at, Google Scholar, Cross Ref

Zeqiraj, V., Hammoudeh, S., Iskenderoglu, O., & Tiwari, A.K. (2020). Banking sector performance and economic growth: Evidence from Southeast European countries. Post-Communist Economies, 32(2), 267-284.

Indexed at, Google Scholar, Cross Ref

Received: 02-Dec-2022, Manuscript No. AAFSJ-22-12956; Editor assigned: 03-Dec-2022, PreQC No. AAFSJ-22-12956(PQ); Reviewed: 17- Dec-2022, QC No. AAFSJ-22-12956; Revised: 19-Jan-2023, Manuscript No. AAFSJ-22-12956(R); Published: 26-Jan-2023