Research Article: 2022 Vol: 26 Issue: 3S

Financial Health Evaluation of Young Faculty Members of Central Luzon State University

Matilde Melicent Santos-Recto, Central Luzon State University

Jeremy Lumibao, Central Luzon State University

Citation Information: Santos-Recto, M.M., & Lumibao, J. (2022). Financial health evaluation of young faculty members of central luzon state university. Academy of Accounting and Financial Studies Journal, 26(S3), 1-20.

Abstract

This research was conducted to evaluate the financial health of young faculty members of Central Luzon State University using the three core elements/indicators of financial health developed by Centre of Financial Services Innovation (CFSI), an institution that provides financial service to people in America. These indicators are under of financial health defined by CFSI are: 1. Effective management of one’s day-to-day financial life; 2. Resilience in the face of inevitable ups and down; 3. Capacity to seize opportunities that will lead to financial security and mobility. Furthermore, this study aimed to know if socio-demographic and economic characteristics have something to do with their financial health. A sample size 47 out of 155, relatively 30 percent, young faculty members of CLSU were randomly selected. Data were obtained first-hand by the researcher using survey questionnaires. The researcher concludes that the financial health status of the young professionals in CLSU is only Fair. In addition, it can be concluded also that resilience in unexpected financial circumstances were a bit harder for the respondents. Sex and income have to do with some of the financial health indicators. Lastly, among all the socio-demographic characteristics, only sex and income level have statistically significant relationship with some of the financial health indicators.

Keywords

Financial Health, Three Indicators of Financial Health, Centre of Financial Services Innovation (CFSI).

Introduction

Financial health is a term used to describe the status of one’s personal financial situation. (Investopedia, 2016) There are many factors and indications that tell whether a person is financially good or not and it always boils down to the term "financial literacy". Financial literacy, in a nutshell, means understanding how money works (e-compare, 2016). It encompasses stuff about personal finance such as savings, budgeting, investments, and money and debt management. In short, if a person falls into bad money habits, don't understand how money flows in and out of his/her pocket and could not use it to their advantage, these people tend to have a low financial literacy and in effect, bad financial health (Kokemuller, 2016).

Filipinos are known for being hospitable and close to their family, that’s why being financially healthy are very important for them basically to provide more than how much they can get for their families, be able to make ends meet, and to have a comfortable living without the need to get into debt. When a person’s financial health is in good shape, he/she can deal with family expenses with ease and can attain a certain level of state of financial freedom. Aside from that, sooner or later a person realize that he/she will have to leave his/her job due to any possible reasons (physical health, economic downturn, retirement, act.) and need to be prepared for whatever reason there is. Also, a person may want to leave their children something behind for their future. Having a good financial health and a certain level of financial literacy can really help make all these things possible.

Currently, the Filipinos have a mean age of 23 years old. These include the working and aggressive ones also called the young professionals. People in this age group undergo transition period from young adults into being a responsible person. But with this generation‘s YOLO mindset (You Only Live Once), young professionals nowadays face challenges in making their personal financial health in good shape. (Bunagan, 2014) According to a study of Sun Life Financials, young Filipino Professionals aged 23 to 35 years old consider gadgets and lifestyle-related items and services as their top financial priorities. Of the 1,100 survey respondents nationwide, about 99 percent said their monthly budget covers necessities like food, whereas 82 percent pay for house rental/mortgage and utilities. Communication, as well as clothes, shoes, and bags, also rank higher in their list at 66 percent and 34 percent, respectively, while dining out stood at 34 percent. Financial worries include family's health at 24 percent, food at 21 percent. (Interaksyon.com/business, 2015) With these spending habits, boom of new technologies, low transportation cost to travel, and stylish ways to enjoy their early life, managing their money, cutting their expenses and setting aside for future investment and retirement plan can be a really big test for them, especially for those who are in low salary bracket profession like public teachers and college instructors Appendices.

Teachers in the Philippines, whether in private and in public institutions are often caught in sayings that go "overworked, underpaid". Here's a look at the following statistics that teaching in the Philippines requires patriotism, passion, and sacrifi National Statistical Coordination Board (NSBC) showed in 2008 and 2009 that teachers in the primary and secondary levels in the United States earn seven to eight times more than the Filipino Counterpart.

1. NSCB noted that in 2008 and 2009, teachers in the US earn $35,000 to $45,000 while those in the Philippines earned $5,000 to $6,000.

2. The Philippines surpassed other countries in another education data but unfortunately, it was in the number of teaching hours. The Philippines posted the second highest next to Indonesia in terms of average teaching hours per year of elementary teachers. For the secondary level, the Philippines posted the highest in terms of teachinghours per day with an average of 4.5 hours.

3. According to Faculty Associations and Unions from various State Universities and Colleges (SUCs) inLuzon (PNCFASUC) as of 2011, the salary of an entry level Instructor I is Php 16,726 per month. (eduphil.org, 2011).

Teaching is a profession that needs “long term perseverance”, according to Prof. Carlos Manapat of the University of Santo Tomas. In the case of teachers, you can't expect a high salary when you enter school just because you have a doctorate degree (Philstar.com, 2016). Teachers always need to secure promotions to earn a salary that could sustain one's self and family needs. Securing a promotion or salary raise is easier said than done because it requires much investment like post graduate studies and training (Madarang, 2013).

Rationale of the Study

Today, young professionals including college instructors face huge challenges on keeping themselves financially healthy. In line with this, the researcher decided to conduct a study that aims to evaluate the personal financial health of young faculty members of Central Luzon State University using the three core elements/indicators of financial health developed by Center for Financial Services Innovation (CFSI), an institution that provides financial service to people in America. According to CFSI, evaluation of one’s financial health using the said indicators will provide a clear grasp of the financial situation they are into and to give information that is useful for their decision making in terms of financial health. Furthermore, this study aims to know if socio-demographic and economic characteristics may affect their financial health. The study also targets to offer recommendations to further improve the study on personal financial health and is expected to present as a reasonable basis which will serve as guide and reference to future researchers that involves personal financial literacy.

Statement of the Problem

Generally, the research study answered the question: What is the status of financial health of young faculty members of Central Luzon State University? Specifically, it answered the following questions:

1. Is the financial health of young faculty members of CLSU in good shape using the three indicators of financial health developed by Center for Financial Services Innovation (CSFI)?

2. What are the socio-demographic and economic characteristics of young faculty members of CLSU?

3. Is there a significant relationship between the respondent’s socio-demographic and economic characteristics of young faculty members of CLSU and their financial health status?

4. Which gender among young faculty members of CLSU has better financial health?

Objective of the Study

Generally, the research study aims to evaluate the financial health of young faculty members of Central Luzon State University.

The specific objectives are the following:

1. To know the financial health of young faculty members of CLSU using the three indicators of financial health developed by Center for Financial Services Innovation (CSFI)

2. To describe young faculty members of CLSU using their socio-demographic and economic characteristics.

3. To determine if there is a significant relationship between the respondent’s socio- demographic and economic characteristics and financial health status.

4. To determine which gender among young faculty members of CLSU has better financial health.

Significance of the Study

The research will help young faculty members of Central Luzon State University to know their status with respect to their personal financial health. This study will provide them useful information in order to develop a rational financial decision in terms of their finances and to further improve their financial health.

The result of the study will serve as an input for the college in the form of verifiable data and information to understand the personal financial health of young faculty of CLSU and will determine the scope of courses of action required to address the issue.

Moreover, the study promotes personal financial wellness among the faculty of CLSU and may not only benefits the young ones but will contribute to the further development of financial health of persons involved in the study. Also, families of a young faculty of CLSU will be benefitted as they may eventually decrease their spending, increase their savings, maintain their debt at minimum and plan for their future financial endeavors. Improved financial health will be their gateway on their goals and dreams.

Financial institutions such as banks, insurance firms, stock brokers, and even app designer will be benefited as more young professionals including college teachers become aware of their financial health, as their services will likely to be considered. This eventually will contribute to economic growth of the country.

Lastly, this research will contribute to the literature on the financial health of young faculty members of CLSU which will benefit future readers, students, and researchers.

Scope and Limitation

The research had focused on the evaluation of the personal financial health of the young faculty members of Central Luzon State University. Particularly, faculty member age 35 years old below. The personal financial health of young faculty was evaluated using the three core elements of financial health as indicators developed by Center for Financial Services Innovation, a financial service provider from America. These indicators are under of financial health defined by CFSI are 1. Effective management of one's day-to-day financial life; 2.Resilience in the face of inevitable ups and downs; 3. Capacity to seize opportunities that will lead to financial security and mobility. With the total of 155 faculty members age 35 years and below of age, respondents of the study were limited to 46 number of the sample with 5% level of confidence or 5% tolerance error which evenly distributed to all the colleges to accurately represent the whole population. This study is a mere evaluation and other matters beyond its scope will no longer be covered.

Conceptual Framework

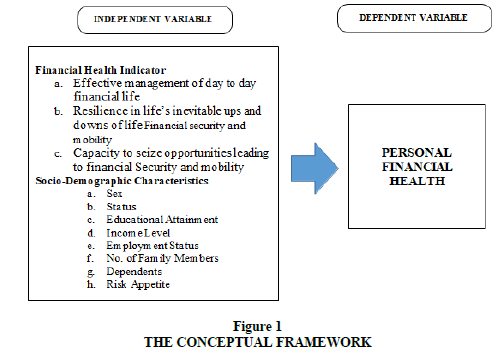

The study had focused on two variables; the independent and dependent variables. The independent variables are the indicators to measure financial health. These indicators are the following:

1. Smooth and effective management of one’s day-to-day financial life

2. Resilience in the face of inevitable ups and downs

3. The capacity to seize opportunities that will lead to financial security and mobility

Changes in these variables moved the dependent variable which is the “Financial Health”. Respondents that showed all the indicators moved in the direction of better financial health. Those who show less of the indicators weaken their financial health. Another group of independent variables that have an effect on financial health is socio- demographic and economic characteristics of the respondents such as age, sex, educational attainment, income level, employment status, number of family members, dependents (if any), risk tolerance in terms of investing, goals and aspirations

The financial health of young faculty members of Central Luzon State University in the set forth indicators was evaluated through the use of statistical tools.

Review Of Related Literature

Foreign

Financial health is a term used to describe the state of one's personal financial situation. There are many dimensions to financial health, including the amount of savings you have, how much you are getting away for retirement and how much of your income you are spending on fixed or non-discretionary expenses (Investopedia).

The Centre for Financial Services Innovation, an American financial service provider of consumer products and practices in Chicago,have identified a tool that measures one's overall financial state in order to better understand the overall financial health of consumers. And they realized that credit score alone cannot assess one's financial status (Batten, 2016).

Financial life, after all, involves much more than just loan repayments. Are consumers keeping up with their bills? Are they able to put some savings each week or month for emergencies and for long-term goals like retirement and a child's education? Are their families protected from financial shocks through proper insurance coverage?

Over the past year, CFSI has analyzed and synthesized data and insights from more than 20 consumer finance studies, including their own consumer financial health study, and consulted with more than 85 financial services providers to identify the key indicators of financial health. CFSI has identified three key indicators that their research shows that can use to measure one’s financial health. Financial health, like physical health, is necessary to lead fruitful and productive life. Financial health means that an individual’s day-to-day financial system functions well and increases the likelihood of financial resilience and opportunity Parker, (2016) Introduction Section - Understanding and Improving Consumer Financial Health in America.

The three core elements/key indicators according to CFSI are the following:

1. Smooth and effective management of one’s day-to-day financial life

2. Resilience in the face of inevitable ups and downs

3. The capacity to seize opportunities that will lead to financial security and mobility

In 2014, CFSI conducted a study on consumers financial study using the three key indicators stated above. The survey was fielded from June to August 2014, yielding 7,152 responses. The sample is comprised of adults (18 and older) residing in the U.S. at all and consumers with annual incomes under $50,000. One of the key findings of the study is that more than half of the U.S population are struggling financially. More than a third of all households (36 percent) run out of money before the end of the month and more than four in ten households (43 percent) struggle to keep up with their bills and credit payments. More than a quarter of households (28 percent) have less than $1,000 in liquid savings, less than half of Americans (45 percent) are confident they can meet their long-term goals for financial security, and more than a quarter (28 percent) believe they have too much debt and say their finances cause them significant stress (26 percent). (Gutman et al., 2015)

Local

According to a survey conducted by Social Weather Stations (SWS) in partnership with Sun Life of Canada Philippines Inc., 9 out of 10 Filipinos experienced being short of cash in the last 12 months. Household needs, school fees, medical bills, and loan payments were the top expenses in which Filipinos felt “KAPOS," or in need of more. The questions on financial wellness were included in the 1st Quarter 2014 SWS survey and participated in by Filipino adults nationwide. When asked to identify the causes of the shortage, 7 out of 10 pointed to the rising prices of commodities, 4 out 10 said it was because they were earning less, and 3 out 10 cited emergency expenses. One out 10 acknowledged that the shortage was due to being unable to budget well. How did Filipinos cope or plan to cope with the shortage? Seven of 10 said they controlled or will control their spending, 4 out of 10 are looking for additional sources of income, and the rest plan to address the problem by taking loans or selling or mortgaging properties.

Sun Life’s SOLAR survey also indicated that the KAPOS experience was dominant not just among the lower socioeconomic classes, but also in the higher income brackets. Some 39% of Filipinos try to save, but only 32% of Filipinos have an actual saving habit. Around 10% don't bother trying to save since what they earn "is not enough anyway," while 5% would save up only for things they want to buy. On the brighter side, 49% of Filipinos are open to learning how to manage their finances better.

Sun Life’s Chief Marketing Officer Mylene Lopa said: "It's time to change money habits so we can all break free from the bondage of financial shortage, debt, worry, and the cycle of financial dependency,". She also recommended investing, which none of the survey respondents mentioned as their strategy to counter financial shortage.

Learning not just how to save, but how to include emergency expenses in their budget is what Filipinos need to have a bright financial future. Saving, getting insured, and investing is a good way to counter the state of being "kapos". Very good financial health is the keys Filipinos enjoy the benefits of having their money work harder for them.

Methodology

Operational Definition of Terms

Research Design

Research Design

The study is a descriptive type of research. It is the applicable design for a research study that describes the characteristics of the assessed data obtained from the survey. Using this type of research, employing frequency, averaging and other simple statistical calculations is possible.

Locale of the study

The study was conducted at Central Luzon State University, Science City of Muñoz Nueva Ecija.

Data Collection Method

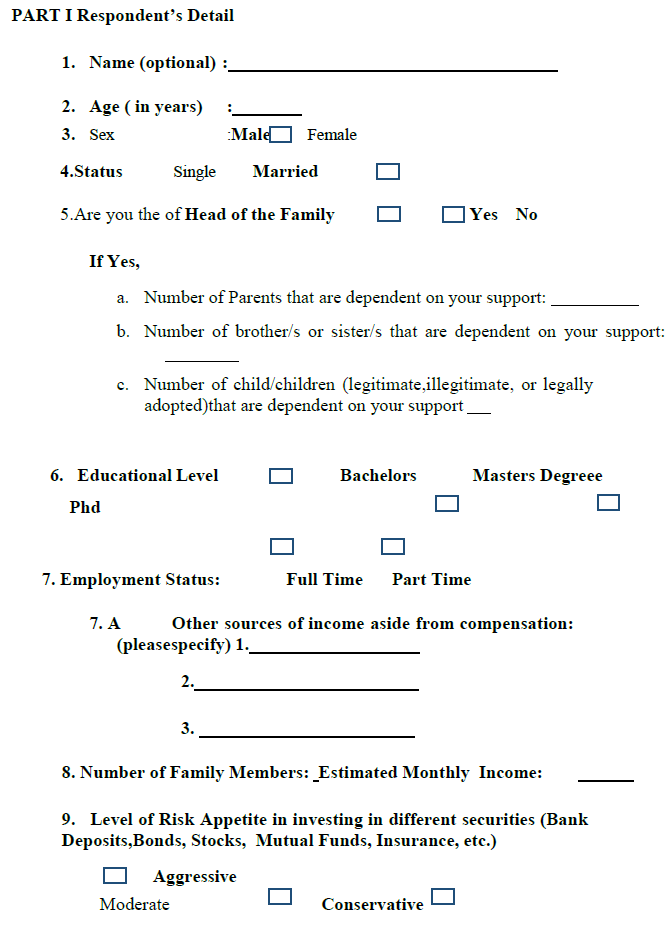

The data were obtained firsthand by the researcher using survey questionnaires which will be used as the primary data of the study. Furthermore, secondary data were accumulated through internet sources which were used to collect some published information for reference purposes.

Respondents of the Study

The respondents are the faculty members Central Luzon State University who are 35 years old and below.

Sampling Plan

The simple random sampling method was used to select samples from the population. The population consists of 155 faculty members all ages 35 below for which 30 percent were set to be part of the sample. The researcher increased the number of samples from the computed sample number of 47 to 55 to compensate for any non-response that may occur during the data collection. The respondents were randomly selected 30% of faculty members age 35 below for each of the eight colleges of CLSU including its two high schools (University Science High School and Agricultural Science and Technology School) from the list obtained by the researcher.

Statistical Analysis

The researcher used descriptive statistics such as proportions, means, standard and error for the socio demographic characteristics of the respondents. Likert Scale was used for computing the financial health categories as Very Good, Good, Fair, Poor and Very Poor. T-test, Pearson R. One-way ANOVA was also used to determine if there are significant relationships between the SDCs and financial health status of the respondents.

Results and Discussion

This chapter displays the outcome of the study conducted. Certain relationships and implications between the SDC’s and current financial health of the respondents were also discussed (Philstar Campus, 2016).

There are 52 sampled respondents out of 55 respondents initially given the questionnaires. Although 47 individuals were set, 8 more respondents were included as replacements for no response. There was a non-response rate of 5% due to the refusal of some respondents to participate in the survey.

Financial Health Status

The mean financial health status was categorized with these ranges using Likert scale Table 1:

| Table 1 Financial Health Category |

|

|---|---|

| Descriptive Rating | Range |

| Very good | 4.2-5.0 |

| Good | 3.4-4.1 |

| Fair | 2.6-3.3 |

| Poor | 1.8-2.5 |

| Very poor | 1.0 - 1.7 |

Financial health was categorized as very good if the score ranges from 4.2 to 5.0, good if it is between 3.4 to 4.1, fair from 2.6 to 3.3, poor if the scores are between 1.8 to 2.5 and very poor if the score is between 1.0 to 1.7.

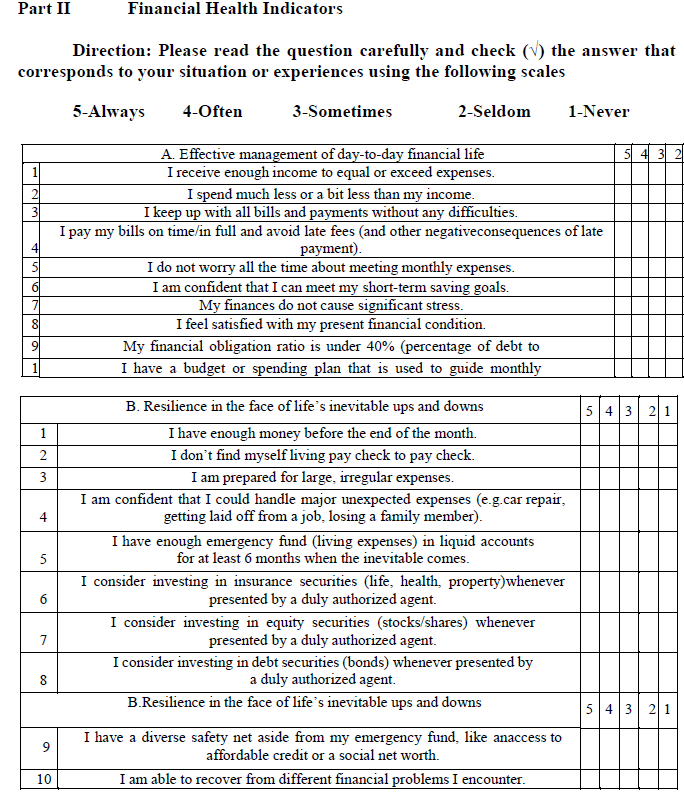

The financial health status was subdivided into three parts: A. Effective management of day to day financial life, B. Resilience in the face of life's inevitable ups and downs, and C. Capacity to seize opportunities leading to financial security and mobility.

Effective Management of Day to Day Financial Life

Table 2 shows the mean scores obtained from the respondents in relation to the effective management of day to day financial life. The respondents mean score on the question that if they receive enough income to equal or exceed expenses (A1) which are 3.7, spending less, much or a bit, then their income (A2) got a mean score of 3.7, an average score of 3.8 was obtained from the respondents when asked if they keep up with all the bills and payments without any difficulties (A3). Paying bills on time and/ or in full to avoid penalty on late fees (A4) were observed to have an average of 4.1, meeting monthly expenses have a mean score of 3.5, confidence in meeting short-term saving goals (A5) has a score of 3.5. Financial obligation ratio, (2016) under 40 percent (A9) has a mean of 3.6 and have a budget/spending plan as a guide to monthly spending (A10) garnered a 3.4 average. The respondents have a good health financial score on the mentioned questions related to financial management on a day to day basis. On the other hand, not stressing out on financial conditions (A7) and satisfaction on present financial condition (A8) have averages 3.3 and 3.1 respectively, which are categorized as fair financial health score.

| Table 2 Mean Scores On Effective Management Of Day-To-Day Financial Life Questions |

|||

|---|---|---|---|

| Financial Health | Mean | Standard Deviation | Descriptive Rating |

| Effective management of day to day financial life | 3.6 | 0.65 | Good |

| A1: Receive enough income to equal or exceed expenses | 3.7 | 0.85 | Good |

| A2: Spend much less or a bit less than my income | 3.7 | 1.07 | Good |

| A3: Keep up with all bills and payments without any difficulties |

3.8 | 0.88 | Good |

| A4: Pay bills on time and /or in full and avoid late fees | 4.1 | 0.86 | Good |

| A5: Meeting monthly expenses | 3.5 | 0.98 | Good |

| A6: Confident in meeting short-term saving goals | 3.5 | 0.92 | Good |

| A7: Not stressed out by finances | 3.3 | 1.06 | Fair |

| A8: Satisfied with present financial condition | 3.1 | 1.11 | Fair |

| A9: *Financial obligation ratio is under 40% | 3.6 | 0.87 | Good |

| A10: Have a budget/spending plan as a guide to monthly spending | 3.4 | 1.19 | Good |

* Monthly Financial Obligation Monthly Income.

Furthermore, the average score on all financial management on a day to day basis is 3.6 which is also categorized as good. Payment of bills on time and/or in full to avoid penalties were observed to be the highest scored among all financial management on day to day basis while satisfaction with the present financial condition was the lowest.

Resilience in the face life’s inevitable ups and downs

Meanwhile, Table 3 shows the mean scores obtained from the respondents when it comes to resilience in the face of life's inevitable ups and downs. Out of the ten questions answered by the respondents, having enough money before the end of the month (B1) and able to recover from different financial problems (B10) with averages 3.5 and 3.4, respectively were the statements that the respondents got a good rating. On the other hand, the following questions garnered a fair rating: Do not find self living pay check to pay check (B2) with a mean of 3.3, prepared for large, irregular expenses (B3) with average 2.8, confident to handle a major unexpected expenses (B4) having 2.6 mean, considered investing in insurance (B6) with an average of 3.2, equity (B7) having 3.0 and debt securities (B8) with 2.7 average scores, and having a diverse safety net aside from the emergency fund reserved (B9) with 2.6 mean. Having enough emergency fund in liquid accounts good for at least 6 months (B5) looks like a struggle since the respondents have a poor rating with an average of 2.5. Furthermore, the average score on all resilience in inevitable circumstances related questions got a fair grading of 3.0. The respondents are observed to be financially healthier when it comes to having enough money before the month ends (B1) but seem to have a problem with having enough emergency fund in liquid accounts that can handle situations for at least 6 months (B5) (E-comparemo, 2016).

| Table 3 Mean Scores On Resilience In The Face Of Life’s Inevitable Ups And Downs |

|||

|---|---|---|---|

| Financial Health | Mean | Standard Deviation | Descriptive Rating |

| Resilience in the face of life's inevitable ups and downs | 3.0 | 0.62 | Fair |

| B1: Have enough money before the end of the month | 3.5 | 0.83 | Good |

| B2: I don’t find myself living pay check to pay check | 3.3 | 1.00 | Fair |

| B3: Prepared for large, irregular expenses | 2.8 | 0.83 | Fair |

| B4: Confident to handle major unexpected expenses | 2.6 | 1.04 | Fair |

| B5: Have enough emergency fund in liquid accounts for at least 6 months | 2.5 | 1.01 | Poor |

| B6: Considered investing in insurance securities | 3.2 | 1.07 | Fair |

| B7: Considered investing in equity securities | 3.0 | 1.08 | Fair |

| B8: Considered investing in debt securities | 2.7 | 0.94 | Fair |

| B9: Have a diverse safety net aside from my emergency fund |

2.6 | 1.05 | Fair |

| B10: Able to recover from different financial problems encountered |

3.4 | 1.05 | Good |

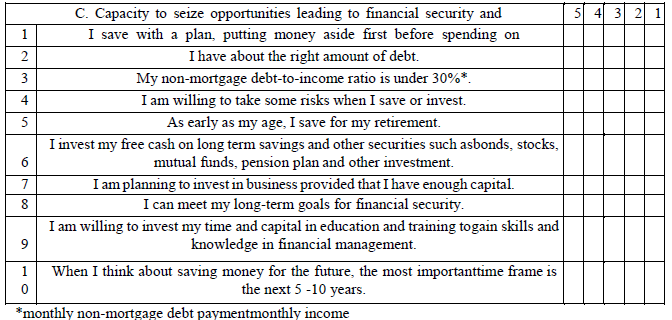

Capacity to Seize Opportunities Leading to Financial Security and Mobility

In relation to assessing someone's capacity in seizing opportunities leading to financial security and mobility, Table 4 was obtained. Out of the ten questions answered by the respondents of the study, 6 statements garnered a good rating. These are as follows: saving before spending (C1) with an average of 3.6, willingness to taking risks when saving and investing (C4) with 3.5 average, planning to invest in businesses as long as there is Table 4. Capacity to Seize Opportunities Leading to Financial Security and Mobility enough capital (C7) with a mean of 3.8, meeting long term goals (C8) with 3.4 mean, willingness to invest time and capital to gain knowledge and skills on financial management having 3.9 average, and thinking about saving money for the future within the next 5-10 years with an average of 4.1. Meanwhile, the fair rating was observed for the other 4 questions regarding this subpart. These are having just the right amount of debt (C2) with an average of 3.3, non-mortgage debt to income ratio under 30% of income (C3) is 3.1, savings for retirement (C5) garnered an average of 2.7, and investment of free cash on long term savings and other securities (C6) have an average of 2.7. On all questions related to capacity in seizing opportunities leading to financial security, the respondents got an average of 3.4 which is rated as good. The respondents pay attention in saving money within 5-10 years which garnered the highest average for this subpart but saving for retirement and investment of free cash on long term savings and other securities were the least for their priorities.

| Table 4 Mean Scores On Resilience In The Face Of Life’s Inevitable Ups And Downs |

|||

|---|---|---|---|

| Financial Health | Mean | Standard Deviation | Descriptive Rating |

| Capacity to seize opportunities leading to financial security and mobility | 3.4 | 0.59 | Good |

| C1: Saving with a plan, putting money aside first before spending | 3.6 | 1.01 | Good |

| C2: Having the right amount of debt | 3.3 | 0.90 | Fair |

| C3: Non-mortgage debt to income ratio is under 30% | 3.1 | 1.02 | Fair |

| C4: Willing to take risks when saving and investing | 3.5 | 0.90 | Good |

| C5: Saving for retirement | 2.7 | 1.20 | Fair |

| C6: Investing free cash on long term savings and other securities | 2.7 | 1.19 | Fair |

| C7: Planning to invest in business provided to have enough capital |

3.8 | 1.05 | Good |

| C8: Can meet long term goals for financial security | 3.4 | 0.90 | Good |

| C9: Willing to invest time and capital to gain knowledge on financial management |

3.9 | 0.91 | Good |

| C10: Thinking about saving money for the future within the next 5-10 years |

4.1 | 0.99 | Good |

Table 5 below displays the overall mean score for all the three indicators set to measure the financial health status of the respondents. All in all, the financial health status of the respondents is rated fair with an average score of 3.3. Even though two out of three indicators were rated good, resilience to inevitable circumstances drags down the overall average to fair only. This means that the financial health of the employed respondents is just in the middle not bad but not good.

Socio-Demographic Characteristics (SDCs)

Different inherent characteristics may also be a factor in assessing someone’s behavior, in this case, financial health. So, it is also of importance to describe the socio- demographic and economic status of the respondents to have a picture of the behavior and characteristics of the respondents employed in this study. Certain SDCs were selected by the researcher such as age, sex, educational attainment, civil status, employment status, household size, monthly income, the number of dependents if any, and risk appetite. Table 6 shows the proportions in each aggregation. Females dominate males in the number of employed respondents having 57.7 percent as oppose to the males having 42.3 percent. When it comes to civil status, singles are far more than the married ones with 80.8 percent and 19.2 percent, respectively. Professionals with bachelor's degree are 59.6 percent of the respondents while the remaining 40.4 percent have a master's degree. When it comes to employment status, two-thirds of the sample is on a full-time basis while one-third are part timers. Level one on risk appetite was out numbered having only 4.2 percent of the sample, level 2 risk appetite have the highest of proportion with 62.5 percent and 33.3 percent of the respondents have a level 3 risk appetite.

| Table 5 Mean Score Of The Three Indicators And Overall Mean Score Of The Respondents |

|||

|---|---|---|---|

| Financial Health | Mean | Standard Deviation | Descriptive Rating |

| Effective management of day to day financial life | 3.6 | 0.65 | Good |

| Resilience in the face of life's inevitable ups and downs | 3.0 | 0.62 | Fair |

| Capacity to seize opportunities leading to financial security and mobility | 3.4 | 0.59 | Good |

| OVERALL | 3.3 | 0.52 | Fair |

Other socio-demographic and economic status such as age, monthly income, household size, and a number of dependents were observed in Table 7. The average age of the respondents is 26.5. their average monthly income is Php 20,511.6, household size is 5 on the average and a dependent (0.5 rounded up to 1 dependent).

| Table 6 Percentage Of Respondents Per Socio-Demographiccharacteristics |

|||

|---|---|---|---|

| Variables | Frequency | Percentage | Standard Deviation |

| Sex | |||

| Male | 22 | 42.3 | 0.49 |

| Female | 30 | 57.7 | 0.42 |

| Educational Attainment | |||

| Bachelor's degree | 31 | 59.6 | 0.49 |

| Master's degree | 21 | 40.4 | 0.49 |

| Civil Status | |||

| Single | 42 | 80.8 | 0.39 |

| Married | 10 | 19.2 | 0.39 |

| Employment Status | |||

| Full time | 35 | 67.3 | 0.47 |

| Part time | 17 | 32.7 | 0.47 |

| Risk Appetite | |||

| Conservative | 2 | 4.2 | 0.20 |

| Moderate | 33 | 62.5 | 0.48 |

| Aggressive | 17 | 33.3 | 0.47 |

| Table 7 Average Socio-Demographic Characteristics Of The Respondents |

||

|---|---|---|

| Variables | Mean | Standard Deviation |

| Age | 26.5 | 4.94 |

| Average monthly income | 20,511.6 | 1.62 |

| Number of family members | 5.0 | 10125.43 |

| No. of dependents | 0.5 | 1.2 |

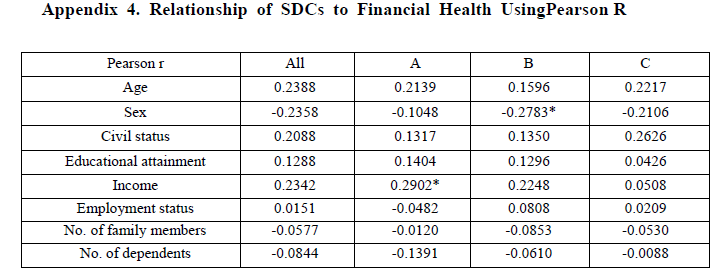

Relationships between Socio-Demographic Characteristics and Financial Health Scores

When it comes to the relationship of the socio-demographic characteristics and the financial health of the respondents, Pearson product moment correlation, or simple Pearson r was used. Pearson r is used to determine if there is a linear relationship between 2 continuous variables. However, it can also be used when correlating a continuous variable and a 2 category-categorical variable since it was proven that the analysis suitable for this case, point biserial analysis, are just equivalent to the result of person r. Pearson R was used because it is easier to use.

Interpretation of the result of the Pearson takes two considerations, the magnitude, and the direction. The magnitude of the linear relationship was categorized below, no to very weak linear relationship if the computed absolute value of r is from 0.0 to 0.1, weak linear relationship if the r ranges from 0.1 to 0.3, moderation linear relationship if the correlation statistic r ranges from 0.3 to 0.5, and strong linear relation from 0.5 to 1.0. The value of r only ranges from 0 to 1. Meanwhile, the negative of positive sign of the integer computed for r dictates the direction of the relationship. If the computed r is positive, the relationship of the 2 variables in consideration is positive, i.e. as the first variable increases, the value of the second variable also increases. For a negative relationship, however, as the first variable increases the other variable decreases.

| Table 8 Guidelines For Interpreting The Pearson Correlation Result |

|

|---|---|

| Category | Range |

| None /very weak correlation | 0.0<|r|<0.1 |

| Weak correlation | 0.1<|r|<0.3 |

| Moderate correlation | 0.3<|r|<0.5 |

| Strong correlation | 0.5<|r|<1.0 |

In terms of correlations computed in this study, Table 9 below displays the correlation coefficients computed. In terms of sex, all of the indicators for financial health and sex has a negative weak linear relationship but only 1, correlation of sex and indicator b, was found to be of significance. Males are coded 0 and females are 1; this means that males tend to have higher financial health score than females and particularly significant when it comes to indicator B (resilience in life’s inevitable ups and downs). The monthly income of the respondents have a positive weak linear relationship with their financial health and is evident to be significantly correlated with indicator A (Effective management of day to day financial life). This means that as the income of the respondent's increases, the more effective they become when dealing with day to day financial life significantly.

| Table 9 Correlation Coefficients Of Sdcs And Financial Health Score |

|||

|---|---|---|---|

| Pearson R | A. Effective management of day to day financial life | B. Resilience in life’s inevitable ups and downs of life | C. Capacity to seize opportunities leading to financial Security and mobility |

| Sex | -0.1048 | -0.2783* | -0.2106 |

| Income | 0.2902* | 0.2248 | 0.0508 |

However, the correlation coefficients of other SDCs to financial health were found to be not significant.

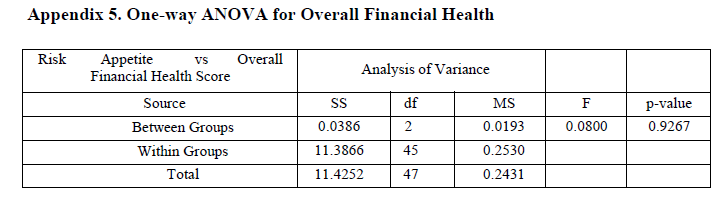

Analysis of Variance for Risk Appetite

The risk appetite was categorized as sensitive, coded 1, moderate, coded 2, and aggressive coded 3. A one-way ANOVA was used to determine if the groups or categories differ when it comes to their financial health. It was found out that there is no statistically significant difference in risk appetite in terms of financial health.

T-test on Gender and Financial Health

The result above table 10 says that the sex of the respondents is significantly different when it comes to their financial health, specifically in resilience to inevitable ups and downs of life. Looking closer to the significant difference between males and females about resilience in life inevitable circumstances, a p-value of 0.0229 was computed for the hypothesis μ1 >μ2, i.e. There is a statistical evidence to say that the mean financial health of males μ1 are greater than females μ2 with 5% level of significance.

| Table 10 T-Test On Financial Health And Gender |

||||

|---|---|---|---|---|

| T-test | All | A. Effective management of day to day financial life | B. Resilience in life’s inevitable ups and downs of life | C. Capacity to seize opportunities leading to financial Security and mobility |

| Sex | 0.0924 | 0.4597 | 0.0457 | 0.1381 |

Conclusion

There many factors that tell whether a person is financially healthy or not. Financial literacy of a certain person is of importance. Savings, budgeting, investments, and money and debt management are just some of the essential topics that are under this. If a person falls short of money, don’t know how money flows in and out of his/her pocket and could not use it in its optimal usage, these people tend to have a low financial literacy and in effect, bad financial health. As such, this study aimed to describe the current financial health of young professionals in Central Luzon State University and categorized their financial health as very good, good, fair, poor, or the worst, very poor. This study also investigated the inherent relationship of some socio-demographic characteristics to their financial health and which gender among young faculty members of CLSU has better financial health.

The results showed that when it comes to effectively managing the day to day finances (indicator A), the respondents have a good rating (3.4 - 4.1). When it comes to resilience in the inevitable ups and downs of life (indicator B), the respondents have an average rating of the fair (2.6 – 3.3). For the capacity to seize opportunities (indicator C), they garnered an average rating of good. However, the overall financial health score has a rating of fair only. The linear relationships between selected socio-demographic characteristics of the respondents were found out to be weak using Pearson r. However, significant relationships were found between sex and indicator B (resilience in life’s inevitable ups and downs of life) and income and indicator A (effective management of day to day financial life). Monthly income also has a significant positive linear relationship with the effective management of day to day financial life. The higher the income, the easier it will be to manage finances daily.

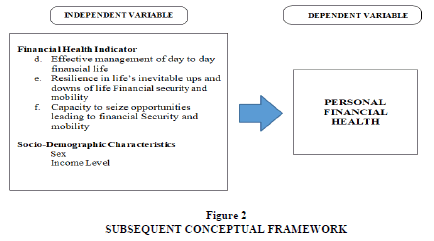

Subsequent Conceptual Framework

Male faculty members of CLSU tend to have better healthier financial status than their female counterpart, specifically in terms of resilience to life’s inevitable ups and downs. Figure 1 shows the subsequent conceptual frame of the study. Figure 2 Subsequent Conceptual Framework.

The researcher concludes that the financial health status of the young professionals in CLSU is “Fair”. Furthermore, it can be concluded also that resilience in unexpected circumstances was a bit harder for the respondents. Sex and income have to do with some of the financial health indicators. And with the use of T-Test, Male faculty members of CLSU tend to have better financial health than their female counterpart, especially when it comes resilience in life’s inevitable ups and downs of life.

Recommendations

It is recommended that the institution, CLSU, should have or provide some financial literacy seminars to its employees especially when it comes to resilience in unpredicted and inevitable situations. However, the researcher suggests that this study must be put into verification, broaden the scope and measure more indicators and inherent factors to see a clearer picture of the financial health status of the CLSU faculty members. It is also recommended to future researchers to conduct the further study about the financial health and consider respondents from non-academic departments and respondents from different universities aside from CLSU to see if the results will deviate from the study

conducted.

Appendices

Appendix 1. Letter for involvement of the respondents

Central Luzon State University, College of Business Administration and Accountancy Science City of Munoz, Nueva Ecija PH 3120

October 21, 2016

Dear Respondent

I, Jeremy S. Lumibao, a student from College of Administration and Accountancy, currently taking Masters in Business Administration. I am conducting a research entitled “Financial Health Evaluation of Young Faculty Members of Central Luzon State University”, accordingly I am requesting your cooperation by answering the questions below. I guarantee that all of your answers will be made confidential and will be used for academic requirements only.

Thank you very much.

Jeremy S. Lumibao

MBA Student

Appendix 2. Letter of permission to conduct study

Central Luzon State University, Science City of Muñoz, Nueva Ecija, College of Business Administration and Accountancy, Department of Business of Administration October 25, 2016

Dr. Regidor G. Gaboy

Dean

College of education

Dear Sir:

Warmest Greetings!

I, Jeremy Lumibao, a graduate of College of Business Administration and Accountancy, taking up Masters in Business Administration and presently conducting a research entitled “Financial Health Evaluation of Young Faculty Members of Central Luzon State University” as requirements BA 710, Business Research.

In view of this, I would like to seek the permission from your office for the participation of CED faculty members by answering my survey questionnaire. Rest assured that all information derived will be treated with utmost confidentiality and purely for academic purposes only.

Thank you very much and God bless.

Respectfully yours,

Jeremy S. Lumibao, CPA, FRIAcc

Student, MBA Noted by:

Matilde Melicent Santos- Recto, DDVEST, FRIEcon

Professor, BA710

Appendix 3. Survey questionnaire

Financial Health Evaluation of Young Faculty Members of Central Luzon State University

“Survey Questionnaire”

References

Batten, J. (2016). Skills You Need Home Page. Retrieved from Skills You Need Website. https://www.skillsyouneed,org/. 5:00 PM December 14.Thursday, 2016

Bunagan, j. (2014). Spending habits young-professionals make and how to solve them. Retrieved from spending habits young-professionals make and how to solve them: https://roi.ph/spending-habits-young-professionals-make-and-how-to-solve-them. 3:33 PM. November 16, 2016.

E-comparemo. (2016). Retrieved from e-comparemo. Web site: https://www.e- comparemo.com. November 14, 5:45PM. 2016.

Eduphil.org. (2011). Retrieved from eduphil.org/p26-878-minimum-pay-for-public- college-university-teachers: http://eduphil.org/p26-878-minimum-pay-for-public- college-university-teachers.html. 2:30 PM.November 5, 2016.

Financial obligation ratio. (2016). Retrieved from Investopedia: http://www.investopedia.com/terms/f/financial-obligation-ratio-for.asp. December 14.5:00 PM.2016

Gutman, E., garon, T., hogart, J., & schneider, R. (2015). Center for Finacia Services Innovation - Understanding and Improving Consumer Finacial Health in America. Chicago, IL.September 13.4:50 PM.

Interaksyon.com/business. (2015).Retrieved from interaction website: http://interaksyon.com/business/69947/acquiring-gadgets-a-priority-among- young-pinoy-professionals-sun-life-financial-survey. September 14. 5:00PM. 2016

Investopedia. (2016). home page. Retrieved from investopedia: http://www.investopedia.com/terms/e/emergency_fund.asp. December 14. 5:00 Pm. 2016.

Kokemuller, N. (2016). How discover. Retrieved from the show: http://www.ehow.com/facts_6905261_insurance-product-definition.html.December 14. Thursday.4:00 pm.2016.

Madarang, C. (2013). Teachers Keep Idealism Despite Low Pay. June 19, 2013.

Parker, S. (2016). Introduction Section - Understanding and Improving Consumer Financial Health in America. Chicago, IL. September 13.5:13 PM.2016

Philstar Campus. (2016). Retrieved from Philstar.com. http://www.philstar.com/campus/featured-articles/2013/06/19/956007/teachers- keep-idealism-despite-low-pay. 5:00 PM. September 15, 2016.

Received: 15-Nov-2021, Manuscript No. AAFSJ-21-9764; Editor assigned: 17-Nov-2021, PreQC No. AAFSJ-21-9764(PQ); Reviewed: 01-Dec-2021, QC No. AAFSJ-21-9764; Revised: 07-Jan-2022, Manuscript No. AAFSJ-21-9764(R); Published: 14-Jan-2022