Research Article: 2021 Vol: 25 Issue: 2

Financial Inclusion in India: A Giant Structure on Weak Foundation

Saikat Banerjee, Institute of Management Technology Hyderabad

Soumi Ghosh, Hongkong and Shanghai Banking Corporation

Abstract

Recent developments in the financial inclusion policy of government of India confirm the importance of financial inclusion as a necessary criterion for inclusive growth. The aim of the paper is to analyze the supply side and demand side issues related to financial inclusion in India and find the gaps of the institutional mechanism in supply side and issues in demand side with the help of various theoretical and practical studies carried out in past literature. The paper also examines the comprehensiveness of existing indicators of financial inclusion in India.

Keywords

Financial Inclusion, Policy, India, Institutions, Demand and Supply, Indicators.

Introduction

Since independence, financial inclusion is an important policy matter in India. Recently Government of India has taken several impressive policy initiatives in this domain. To assess the effectiveness of these policy initiatives, several issues of concerns seek immediate attention for intellectual debate in the researchers and practitioners’ community. Are the institutional structures responsible for financial inclusion efficient enough to achieve the desired goal? Are the boundaries of functions of various institutions defined clearly? Are the citizens of India capable enough to participate in these new schemes? Can we measure the success by merely counting the numbers of participation? Should we not also consider the quality of the usages of financial instruments as a broader frame of reference? Ignorance to answer all these questions can lead us towards an unsuccessful future.

Importance of Financial Inclusion

The ‘finance’ can be uniquely considered as a quasi-public good due to its nature of the improvements in value of financial systems and ability to make monetary policy more effective enhancing non-inflationary growth with the increase in financial networks (Kelkar, 2010). Thus, financial inclusion can help in reducing the financial risks of citizens of India to a great extent.

Challenges of Financial Inclusion

The challenges in financial inclusion can be analyzed from both supply side and demand side perspectives. Financial inclusion has two elements such as ‘access to suitable products and services’ (i.e. the ‘supply side’) based on a portfolio of financial products offered by several institutions, and ‘good financial decision-making’ (i.e. the ‘demand side’ of the equation) based on ‘financial literacy’ (i.e. ‘a basic understanding of financial concepts’) and ‘financial capability’ (i.e. ‘the ability and motivation to plan finances, seek out information and advice, and apply these to personal circumstances’) (Mitton, 2008).

Challenges in Supply Side

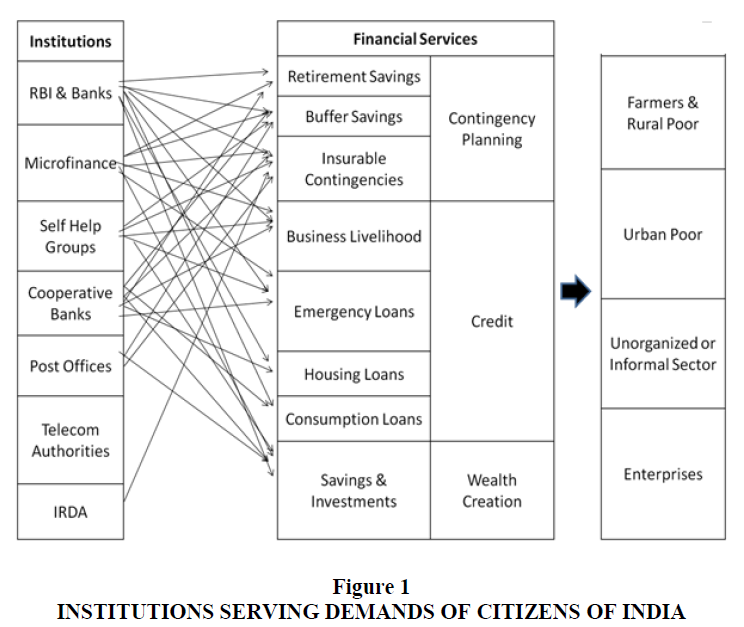

The committee on financial sector reforms, Planning Commission, Government of India (2009) categorized the access to financial services in three ways such as ‘contingency planning’ (retirement savings, buffer savings and insurable contingencies), ‘credit facilities’ (business livelihood, emergency loans, housing loans and consumption loans) and ‘wealth creation’ (savings and investments) (2009). A comparative study of the roles of different institutions with respect to these three dimensions can reveal valuable insights. Major barriers at the supply side can be identified as the operating costs such as salaries to staffs, travelling expenses, commissions, amortization and depreciation, rent on hired buildings and other overheads etc (Sharma, 2009).

Roles of reserve bank of India and banks

Reserve Bank of India is the central bank and regulatory body of banking industry that provides financial services with emphasizes on credit flow to priority sector and Micro Small and Medium Enterprises. There is a large gap between the number of potential and actual clients with the banking system and banking system does not have the capacity to cater the future demand (Srinivasan, 2007). Recent initiatives are also trying to improve the conditions by introducing schemes such as Pradhan Mantri Jan Dhan Yojana (PMJDJ). PMJDJ provides the opportunity to citizens of India to open zero balance bank accounts with debit cards. In addition to providing basic banking accounts, recently government of India announced to facilitate a universal accident insurance scheme named ‘Pradhan Mantri Suraksha Bima Yojana’ connected to all accounts in the banks.

Roles of microfinance institutions

Due to the reduction in lending to small and poor borrowers in rural areas, microfinance institutions emerge as alternate institutions that recognize the business potential of poor (Kelkar, 2010). Though microcredit is a potential tool to fight poverty, the concept is founded only on a few successful cases through over-advertisement and specialized expertise is required to control any potential opportunistic behaviours (Bebczuk, 2008).

Roles of self-help groups

Based on the common norms, values, geographies, socio-economic backgrounds, culture, people of a self-help group can support each other as a group. Though innovative ideas such as NABARD’s self-help group-bank linkage model and Bangladesh Gramin Bank model are successfully implemented, the fundamental nature of the self-help group as selfsustained mechanism or only carrier of subsidies, is a matter of debate (Dev 2006).

Roles of cooperative banks

Overcoming the challenges of low economics of scale, expensive infrastructure, and low level of trust, cooperative banks serve the poor people at the grassroots level building good relationships. Governmental should investment in the community banking projects considering the overall societal benefits (Jerry, 2008).

Roles of post offices

The 1,39,182 branches of post offices out of total network of 1,54,882 branches (as on 31.03.2014) can offer various financial services such as savings accounts, life insurance, mutual funds, forex services based on the trust in different socio-political backgrounds (Midgley, 2005). Due to the emergence of post offices as competitors to traditional banks in the retail financial markets, the cooperation between banks and post officer is reducing (Midgley, 2005). Post offices can leverage the strategic advantages of their connectivity to the poor people at the remote locations in India (Sarma, 2008).

Roles of telecom authorities

The high usage of internet banking, phone banking and mobile banking makes the role of telecom authorities very vital in nature. According to the press release No.39/2015 of Telecom Regulatory Authority of India, the total number of subscribers of wireless telephone in India is 975.78 Million as on 31st May 2015. Telephones have the potentialities to provide financial services in unbanked locations (Klein & Mayer, 2011). In their study on African countries, Andrianaivo & Kpodar (2011) showed that indicators of financial inclusion such as number of deposits or loans per head is positively related to the ICT penetration indicators such as mobile and fixed telephone penetration rates and the cost of calls.

Role of insurance regulatory and development authority

The objective of Insurance Regulatory and Development Authority is to mitigate the risk by promoting various insurance opportunities to citizens of India.

Challenges in Demand Side

A thorough analysis of financial inclusion policy of India and its implementation can reveal that the main emphasis of the most of the initiatives taken by the regulatory bodies is to improve the supply side and ensure the access of the financial services. The two dimensions such as usage and quality that depend on the improvement of demand side, are ignored in framing and implementing the policy. Financial inclusion policy should encourage not only to adopt the financial services but also to use them frequently. Quality of financial services depends on financial capability and consumer protection (The World Bank, 2012) of demand side. Providing only the access to financial services does not complete the financial inclusion. Supply side issues are of second order importance compared to demand side issues (Bebczuk, 2008). Policy makers of India may consider the learning experience obtained during financial inclusion in other countries to avoid mistakes. For example, in Autazes, a county in the Amazon region, financial inclusion was not successful after the introduction of banking systems since 2002 due to lack of effective inclusive mechanisms like financial education in the presence of low-income population over-indebtedness, reproduction of social exclusion practices and reinforcement of power asymmetries (Diniz et al., 2012). The barriers to financial inclusion from demand side are costs of transportation, time, fees, education etc (Sharma, 2009). For the purpose of understandings, the characteristics of some segments of the population of India can be studied.

Farmers and rural poor

Considering the fact that around 51 per cent of the farmer households are financially excluded, instead of focusing only on credits, institutions can undertake credit plus advisory services (Dev, 2006).

Urban poor

In addition to non-availability of financial services such as savings, credit and payment systems to 40 per cent of urban population, urban poor can not access financial services due to low productivity, lack of literacy, and unavailability of proof of identification due to migration from rural areas in search of works (Kelkar, 2010).

Unorganized or informal sector

The contribution of informal sector in economy is around 93%. Kelkar in his article mentioned that according to National Sample Survey (2007), out of 89 million farm households in our country, more than 40 million households have no access to finance, whether formal or informal (2010). Corporate sector is also contributing through the initiatives such as the ITC e-choupal, Godrej Adhar, Mahindra Shublabh, HLL Shakthi, to improve the conditions of informal sector by bringing them in the financial system (Srinivasan, 2007). Srinivasan also rightly criticised the policies of banks on imposing restriction in number of transactions or hidden costs in small accounts (2007).

Enterprises

Financial inclusion policy should also consider the neglected needs of small enterprises.

Framework of Institutions and Demands

Various institutions are serving different needs of various groups at the demand side. The main focus of them are approximately as per the below figure. Different institutions are offering same products competing with each other to meet the demands and capture the markets Figure 1.

Measurement Issues

The progress of the financial inclusion policy is only measured in the dimensions of supply side improvement and institutional structures. Demand side improvements and effectiveness of financial inclusion on the citizens are not measured at all. For example, Inclusix (CRISIL Financial Inclusion Index), a comprehensive financial inclusion index published for the first time in India in 2013, only considered variables like branch penetration, deposit penetration and credit penetration. The need for a more comprehensive measurement index is required to complete financial inclusion

Conclusion

The comparative analysis of various institutions in supply side reveals various gaps in the institutional mechanisms such as redundant initiatives resulting wastage of resources, over-dependency on banking systems, ambiguous division of roles among institutions, lack of customized financial products satisfying the local needs (Mahadeva, 2008), improper design of community involvement initiatives (Jakab et al., 2001), lack of direct involvement of government, attitude of considering financial inclusion initiatives as a legal obligation instead of business or social cause, lack of coordination among institutions (Bebczuk, 2008) and lack of a central institution as a common platform for all stakeholders. The main emphasis of most of the initiatives is on strengthening the supply side only. But, providing only access to financial services to the citizens of India is not enough. Though some initiatives like financial literacy centres are taken to enrich the cognitive understanding of the people, the demand side initiatives are very less in number and very low in quality in terms of implementation. Demand side issues of the citizens such as farmers, rural poor, urban poor, unorganized or informal sector, and enterprises, need to be resolved to implement financial inclusion effectively. Various barriers such as opportunity cost, transportation cost, and lack of intellectual and financial capital are identified to successful financial inclusion in demand side. The paper also identifies serious issues in the procedure of measuring financial inclusion in India. Demand side improvements and effectiveness of financial inclusion on the citizens are not measured at all. Though there are scopes for improvement at both supply side and demand side, it can be concluded that the existing financial inclusion policy of India is heavily biased towards strengthening the supply side only. The improvement of demand side needs immediate attention for successful implementation of financial inclusion in India. Development of comprehensive measurement index considering both supply side and demand side improvements, can help India to track the progress in achieving the desired goals.

Author Contributions:

All authors contributed equally. All authors have read and agreed to the published version of the manuscript.

Funding:

This research received no external funding. Conflicts of Interest: The authors declare no conflict of interest.

References

- Andrianaivo, M., & Kpodar, K. (2011). ICT, financial inclusion, and growth evidence from African countries. International Monetary Fund.

- Bebczuk, R.N. (2008). Financial Inclusion in Latin America and the Caribbean: Review and Lessons. Document prepared for the Inter-American Development Bank-Poverty and Inequality Unit. Centro de EstudiosDistributivos, Laborales y Sociales. Buenos Aires, CEDLAS.

- Committee on Financial Sector Reforms, Planning Commission, Government of India. (2009). Report on A Hundred Small Steps.

- Dev, S.M. (2006). Financial inclusion: Issues and challenges. Economic and Political Weekly, 4310-4313.

- Diniz, E., Birochi, R., & Pozzebon, M. (2012). Triggers and barriers to financial inclusion: The use of ICTbased branchless banking in an Amazon county. Electronic Commerce Research and Applications, 11(5), 484-494.

- Jakab, M., Preker, A.S., Krishnan, C., Schneider, P., Diop, F., Jütting, J., ...&Supakankunt, S. (2001). Social inclusion and financial protection through community financing: initial results from five household surveys.

- Jerry B. (2008). Community Banking Projects for Low-income Canadians: A Report Examining Four Projects to Promote Financial Inclusion.

- Kelkar V. (2010). Financial Inclusion for Inclusive Growth”, ASCI Journal of Management, Administrative Staff College of India, 2010.

- Klein, M.U., & Mayer, C. (2011). Mobile banking and financial inclusion: The regulatory lessons. World Bank Policy Research Working Paper Series.

- Mahadeva, M. (2008). Financial Growth in India Whither Financial Inclusion?. Margin: The Journal of Applied Economic Research, 2(2), 177-197.

- Midgley, J. (2005). Financial inclusion, universal banking and post offices in Britain. Area, 37(3), 277-285.

- Mitton L. (2008). Financial inclusion in the UK: Review of policy and practice, published by the Joseph Rowntree Foundation.

- Sarma, M. (2008). Index of financial inclusion. Indian Council for Research on International Economics Relations.

- Sharma, P. (2009). Financial Inclusion by Channelizing Existing Resources in India. The India Economy Review, 76-82.

- Srinivasan, N. (2007). Policy issues and role of banking system in financial inclusion. Economic and Political Weekly, 3091-3095.

- The World Bank. (2012). Financial Inclusion Strategies Reference Framework, August Working paper study by Mr. Sadhan Kumar, RBI, 2011.