Research Article: 2021 Vol: 25 Issue: 1

Financial Return on Equity (Froe): Case of Colombian Industrial Companies

Elías Tovar, CENTRUM Catolica Graduate Business School (CCGBS), Lima, Peru

Pablo Arana, Pontificia Universidad Cato?lica del Peru? (PUCP), Lima, Peru

Abstract

The objective of this article was to propose a new and more simplified decomposition of DuPont's analysis under exclusively financial criteria to aim not only at improving profitability, but also cash generation. For this, I used a methodology with a transversal and non-experimental quantitative approach, using inferential statistical techniques to find the relationship between the variables. The sample corresponded to the financial statements of 35 industrial companies listed on the Colombian Stock Exchange. The proposed model considered the following elements: (a) net profit (NP), (b) equity (E), (c) sales (S), (d) Total Assets (TA), (e) Depreciation and Amortization (D&A ) and and (f) EBITDA. The results indicated that elements such as EBITDA / S, S / TA, TA / E, [(NP + D&A) / EBITDA] are sufficient and adequate to verify the profitability of the various companies studied as well as their cash generation. Finally, in the companies analyzed, the most important indicators in the FROE are the TA / E, [(NP + D&A) / EBITDA] and the S / TA, therefore it is the ones that should be focused on for making financial decisions.

Keywords

DuPont's analysis, FROE, Financial profitability, Cost effectiveness.

Introduction

The research focuses its analysis on propose a new and more simplified decomposition of the DuPont analysis, the latter, according to Jin (2017), serves to forecast future ROE which in turn has effects on financial accounting research and equity analysis professionals, forecasting earnings and capital markets. For this new decomposition, the study proposes to define the elements that such analysis must have in order for it to be appropriate and useful, but also to be based on an exclusively financial perspective in order not only to improve profitability, but also to generate cash. The study, in that sense, will take into account the components of the ROE itself, making it possible to focus on understanding the variables that shape this factor, generating a key tool when making decisions. Due to the aforementioned, the objective of the research is to propose a new and more simplified decomposition of DuPont's analysis under exclusively financial criteria to aim not only to improve profitability, but also cash generation. All of this based on the following research question: What are the elements that a DuPont analysis must have to be appropriate and useful exclusively for financial analysis? And the following hypothesis: H1: EBITDA / S, S / TA, TA / E and (NP + D & A) / EBITDA are the elements that a DuPont analysis must have to be appropriate and exclusively useful for the analysis financial.

DuPont Model as a Financial Analysis Tool

The DuPont analysis represents a strategic benefit and also allows us to know how the company's debt is structured in the future. Jin (2017) indicated that the use of DuPont components to forecast future ROE has immediate implications for financial accounting research and practitioners of equity analysis, earnings forecasting, and capital markets.

Curtis et al. (2015) noted that DuPont's original analysis only decomposed return on assets (ROA) into two elements: asset turnover (ATO) and profit margin (PM). Later on, the ATO was defined as net income (NR) divided by net operating assets (NOA), and the definition of PM was deepened, adding the condition after tax and reaching the same definition of net operating profit after tax (NOPAT), or earnings before interest and taxes (EBIT) multiplied by one minus the applicable tax rate (Amir et al. 2011; Damodaran, 2007).

Thus, other changing aspects have been modeled in DuPont Analysis. Authors such as Weidman et al. (2019) considered (a) PM (net income / sales), (b) ATO (sales / total assets) and (c) FL (total assets / equity), and also included all assets in the analysis. For their part, Mishra et al. (2009) did the same but instead of working with net income, they used gross profit.

As shown, various contributions to the DuPont Analysis have been generated over the years, adding or modifying elements in its process; however, it is not yet clear which composition of DuPont should be used for financial analysis. In this sense, it is worth asking how many factors should be involved? Should the accounting or financial scope be used? What technique should be used to validate its components? (Arana, 2020). For all these reasons, this research proposes to define the elements that a DuPont analysis should have, being appropriate and useful, but also from an exclusively financial perspective.

This study is relevant because instead of trying to understand the behavior of ROE or pose causality, it is proposed to define the elements that best correlate with the ROE of each year to determine which should compose it under a specific scope for the financial field.

Likewise, it is specified that, while many authors such as Godek (2015) have studied the behavior of ROE in certain circumstances such as the link between ROE, dividends and the appreciation of shares; or like Bunea et al (2019) that mixed the decomposition of the ROE elements with financial multiples such as the price / earnings ratio (PER) and price to book value (PBV); in this case, the study focuses on the components of the ROE itself, which will allow it to focus on understanding the variables that shape the ROE and will serve as a powerful tool for decision-making.

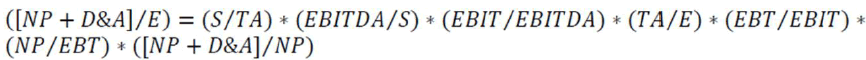

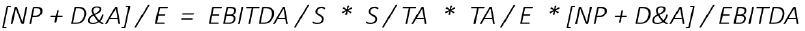

Thus, the model proposed by Arana (2020) considered the following elements:

The proposed model also considers these same effects, but in a different and simplified order, resulting in the FROE in:

Material and Methods

The research has a quantitative approach, since it will use inferential statistical techniques to find the relationship between the variables resulting from the new proposed methodology. In addition, it is cross-sectional, since the study will focus on the analysis of the financial statements of companies listed on the Colombian Stock Exchange during the years 2018 and 2019, and it will be non-experimental because the variables and data will not change. any in the course of the development of this project.

A multiple linear regression will be performed for the main elements of a finance-focused DuPont analysis, or financial return on equity (FROE). The information processed will correspond to the financial statements of 35 industrial companies that are listed on the Colombian Stock Exchange (BVC) since it is those certain companies that have available and complete financial information. The period to be analyzed will be that of the years 2019 and 2018. The research has a quantitative approach, with a non-experimental and cross-sectional design. In addition, the Structural Equations Model (SEM) will be used to find a relationship between the research variables. The population of the present investigation is constituted by 35 industrial companies listed on the Colombian Stock Exchange.

This sample was comprised of the financial statements of 35 industrial companies listed on the Colombian Stock Exchange (BVC). The analyzed period was determined between the years 2018 and 2019, and 35 data records will be considered for the regression.

After obtaining the data, it will be calculated with the ratios in Excel and then the statistical software STATA 16 was used to carry out the SEM model, which was used to determine the relationship between the model variables. This model will help to determine the causality that the present investigation intends to find, in this way, it would be evident that the new calculation shows a relationship with the calculation proposed by Arana (2020).

For statistical validation, three tests were performed thatArana (2020) used in his research, these are:

a. An adjusted R 2 that should be greater than 0.70 (Véliz, 2017) for the robustness of the regression.

b. The variance inflation factor (VIF) to measure multicollinearity and accepted up to 10 (Cea, 2002).

c. An ANOVA test to rule out homoscedasticity through p values greater than 0.05 (Hair et al., 2010).

Analysis and Results

The results are first presented as descriptive statistics in Table 1. In average, the FROE [(NP + D & A) / E] for industrial companies in Colombia corresponds to 11.97%, which is accompanied by its corresponding components. The most relevant is TA / E (leverage) with 3.6679 times, while the least relevant is EBITDA / S with 0.6699 times. Table 2 shows the correlations between the different elements of the multiple linear regression. No correlation exceeds the absolute value of 0.50. These results are consistent with the low level of multicollinearity shown through the VIF results for each variable.

| Table 1 Descriptive Statistics | |||||

| N | Minimum | Maximum | Mean | Stand. Dev. | |

| (NP + D&A) / E | 35 | -0.0293 | 0.5683 | 0.1197 | 0.1202 |

| S / TA | 35 | 0.0397 | 6.1904 | 0.9947 | 1.4434 |

| EBITDA / S | 35 | -0.7987 | 5.9571 | 0.67 | 1.2004 |

| TA / E | 35 | -6.3266 | 18.8564 | 3.6679 | 3.3213 |

| (NP + D&A) / EBITDA | 35 | -4.9807 | 20.8283 | 1.3874 | 3.555 |

| Table 2 Correlations | |||||

| PEARSON CORRELATION | S / TA | EBITDA / S | TA / E | (NP + D&A) / EBITDA | (NP + D&A) / E |

| S / TA | 1.0000 | 0.1764 | 0.2268 | 0.1858 | 0.2728 |

| EBITDA / S | 0.1764 | 1.000 | 0.3232 | -0.0519 | 0.2335 |

| TA / E | 0.2268 | 0.3232 | 1.0000 | 0.4584 | 0.2600 |

| (NP + D&A) / EBITDA | 0.1858 | -0.0519 | 0.4584 | 1.0000 | 0.0241 |

| (NP + D&A) / E | 0.2728 | 0.2335 | 0.2600 | 0.0241 | 1.0000 |

| SIGNIFICANCE | S / TA | EBITDA / S | TA / E | (NP + D&A) / EBITDA | (NP + D&A) / E |

| PEARSON CORRELATION | 0.0000 | 0.3060 | 1.2593 | 0.927 | 0.000* |

| EBITDA / S | 0.3060 | 0.0000 | 2.0517 | 0.2885 | 0.0071 |

| TA / E | 1.2593 | 2.0517 | 0.0000 | 2.208 | 2.6869 |

| (NP + D&A) / EBITDA | 0.9270 | 0.2885 | 2.2080 | 0.000 | 0.000* |

| (NP + D&A) / E | 0.0000 | 0.0071 | 2.6869 | 0.000* | 0.000 |

After performing the multiple linear regression, the model offered almost the minimum adjusted R2 required (Véliz, 2017), with 0.66. Table 3 shows the results of the adjustment. Table 4 shows:

| Table 3 Adjustments for the Multiple Linear Regresion | |

| MODEL ADJUSTMENT | RESULTS |

| R | 0.838 |

| R2 | 0.7022 |

| Adjusted R2 | 0.6625 |

| Table 4 Regression Results | |||||

| Variable | Type of Var. | ANOVA | COEFF | SIGNIFICANCE | VIF |

| (NP + D&A) / E | Dependiente | 0.0144 | |||

| S / TA | independiente | 2.0834 | 0.3353 | 0.000* | 1.0011 |

| EBITDA / S | independiente | 1.4489 | 0.0855 | 0.000* | 1.0073 |

| TA / E | independiente | 11.0312 | 0.8131 | 0.000* | 2.9513 |

| (NP + D&A) / EBITDA | independiente | 2.5237 | 0.4276 | 0.0152 | 1.2238 |

1. ANOVA tests for each variable that show that all are heteroscedastic (Hair et al., 2010)

2. The VIF tests that show a very low level of multicollinearity between them (Cea, 2002).

3. The constant and the coefficients, all of which are statistically significant at the 99% level, except for vEBT / EBIT variable, which did not show statistical relevance.

The coefficients reflect the relevance of each element with respect to the formation of the FROE (Hair et al., 2010). The variable with the greatest influence on FROE was TA / E, with a coefficient of 0.8131, followed by [(NP + D & A) / EBITDA] with a coefficient of 0.4276. The rest of the variables obtained coefficients lower than 0.34. The variable with the least influence on the FROE was S / TA. The only item with a negative coefficient was EBITDA / S.

Discussion

It is worth mentioning that this analysis was proposed by comparing it with various investigations, including that of Bauman (2014) who took into account only a DuPont analysis model with a decomposition into components such as asset turnover (ATO) and profit margin ( P.M). Meanwhile, Jin (2017) added four elements to his FROE model to reach a total of seven indicators (ROE, PM, ATO, FLEV, NBC, SG, AT), six of which were statistically significant. Meanwhile, the present FROE model differs from these studies (among others such as those of Weidman et al., 2019; Damodaran, 2007), since elements such as EBITDA / S, S / TA, TA / E were taken into account, and [(NP + D & A) / EBITDA] to move towards a financial-centric approach.

It is worth mentioning that similarities were found with the results of the study by Arana (2020) who indicated that the most relevant element in the FROE is also the TA / E, in his study this gave 1,9287 times, in the present it gave 3.6679. While the least relevant was also the EBITDA / S with 0.1849 times and in the present study with 0.6700.

As for the variable with the greatest influence on the FROE in the Arana study (2020), it was EBITDA / S, with a coefficient of 0.886, followed by EBT / EBIT with a coefficient of 0.290 and its only negative element was the constant; However, in the present investigation it was found that the most relevant indicators are the TA / E and the [(NP + D & A) / EBITDA].

Conclusions

Based on the foregoing, the investigation concludes that the objective of proposing a new and more simplified decomposition of DuPont's analysis under exclusively financial criteria was fulfilled.

Thus, it was indicated that elements such as EBITDA / S, S / TA, TA / E and [(NP + D & A) / EBITDA] they are sufficient and adequate to verify the profitability of the various ompanies studied as well as their cash generation.

In the companies analyzed, the most important indicator is the FROE, mainly influencing two elements of its composition: TA / E (leverage) and S / TA (asset rotation) on which they should focus for making financial decisions.

The element, meanwhile, that was least relevant was EBITDA / S, however, it is not advisable to rule it out since this is an approximate measure (agent) of the ability to generate cash flow from commercial operations, so it usually be very observed in the financial industry in practice. At the same time, the net profit (NP) of the companies is appreciated, which are quite positive in most cases.

Recommendations

For future researchs, it is recommended to continue with the study of the elements mentioned here for exclusively financial purposes. At the same time, it is recommended to take into account a greater number of years, that is, a more diverse and representative sample in order to reaffirm the functionality and success of the proposal presented here.

References

- Amir, E., Kama, I., & Livnat, J. (2011). Conditional versus unconditional persistence of RNOA components: Implications for valuation. Review of Accounting Studies, 16(2), 302-327.

- Arana, P. (2020). Financial return on equity (FORE): A new extended DuPont approach. Academy of Accouting and Financial Studies Journal, 24(2), 2020.

- Bauman, M.P. (2014). Forecasting operating profitability with DuPont analysis: Further evidence. Review of Accounting and Finance, 13(2), 191-205.

- Bunea, O.I., Corbos, R.A., & Popescu, R.I. (2019). Influence of some financial indicators on return on equity ratio in the Romanian energy sector - A competitive approach using a DuPont-based analysis. Energy, 116251.

- Cea, M.A. (2002). Multivariate analysis: Theory and practice in social research. Madrid, Spain: Editorial Síntesis. ISBN: 978-8-4773-8943-9

- Curtis, A., Lewis-Western, M., & Toynbee, S. (2015). Historical cost measurement and the use of DuPont analysis by market participants. Review of Accounting Studies, 20(3), 1210-1245.

- Damodaran, A. (2007). Return on Capital (ROC), Return on Invested Capital (ROIC) and Return on Equity (ROE): Measurement and Implications. https://www.fep.up.pt/disciplinas/mbf922/Damodaran%20-% 20return% 20measures.pdf

- Godek, P. (2015). A simple model of market valuation and trend reversion for US equities: 100 Years of bubbles, non-bubbles, and inverse-bubbles. Finance Research Letters, 13, 29-35.

- Hair, J., Black, W., Babib, B., & Anderson, R. (2010). Multivariate data analysis (7th ed.). Mexico City, Mexico: Pearson Education. ISBN: 978-0-1381-3263-7

- Jin, Y. (2017). DuPont Analysis, Earnings Persistence, and Return on Equity: Evidence from Mandatory IFRS Adoption in Canada. Accounting Perspectives, 16(3), 205–235.

- Mishra, A.K., Moss, C.B., & Erickson, K.W. (2009). Regional differences in agricultural profitability, government payments, and farmland values: Implications of DuPont expansion. Agricultural Finance Review, 69(1), 49-66.

- Véliz, C. (2017). Multivariate analysis: multivariate statistical methods for research. Mexico, DF, Mexico: Cengage Learning. ISBN: 978-6-0732-0142-1

- Weidman, SM, McFarland, DJ, Meric, G., & Meric, I. (2019). Determinants of return-on-equity in USA, German and Japanese manufacturing firms. Managerial Finance, 45(3), 445-451.