Research Article: 2022 Vol: 25 Issue: 3

Financial risk management and performance of insurance companies: the moderating role of Hedge accounting

Arzizeh Tiesieh Tapang, Michael Okpara University of Agriculture Umudike

Samuel Many Takon, University of Calabar

Ashishie Peter Uklala, University of Calabar

Ekpenyong Bassey Obo, University of Calabar

Eme Joel Efiong, Universitof Calabar

John Uzoma Ihendinihu, Michael Okpara University of Agriculture Umudike

Roland Agwenjang Anyingang, University of Buea

Stephen Ekpo Nkamare, University of Calabar

Citation Information: Tapang, A.T., Takon, S.M., Uklala, A.P., Obo, E.B., Efiong, E.J., Ihendinihu, J.U., Anyingang, R.A.,& Nkamare, S.E. (2022). Financial risk management and performance of insurance companies: the moderating role of Hedge accounting. Journal of Management Information and Decision Sciences, 25(3)1-17.

Abstract

The study examined how hedge accounting moderates the relationship between financial risk management and the performance of insurance companies. The structural equation modelling approach was adopted using SMART PLS 3.3.3. The results revealed that financial risk management has a significant effect on performance while hedge accounting has no significant effect. The results further revealed that hedge accounting does not moderate the nexus of financial risk management and performance. The study concludes that insurance businesses should effectively manage their risk because risk management has been shown to have a favourable impact on financial success. The study also suggests that insurance company executives evaluate their risk management techniques on a regular basis to see if they are still applicable in the face of a rapidly changing operating environment. The study further suggests that insurance company executives review their risks' exposure to edit risk, bankruptcy risk, and interest rate sensitivity on a regular basis. Insurance businesses must improve their capital adequacy and operational efficiency in proportion to their size. Finally, the report suggests that insurance company executive’s implement risk management frameworks such as enterprise risk management that follow international best practices. As a result, insurance businesses will be able to meet international requirements and so become more international rivalry.

Keywords

Financial risk management; Hedge accounting; Insurance companies; Moderation; Performance.

Introduction

Risk management has received a lot of attention in the twenty-first century. Insurers, according to Babbel & Santomero (1997), should examine the many types of risks they face and design strategies for efficiently managing them. They also propose that insurers accept and handle just those risks that are specific to their services at the firm level. As a result, the risk exposure will be reduced. Risk management, according to Stulz (1984), is a plausible economic reason why business managers should be concerned with both expected profit and the distribution of firm returns around their expected value, thereby providing a basis for aligning firm objective functions to prevent risk (Omasete, 2014).

Insurance companies have placed a greater emphasis on risk management in recent years. According to Meredith (2014), insurance company management should make careful decisions about insurable risks in order to minimize excessive losses while paying claims. As a result, risk management is a critical component of enhancing financial success. If financial risks are not managed properly, insurers as risk-bearing entities can and do collapse.

The risk management approach proposed by Kiochos (1997) is frequently used by insurance companies. The risk management process is divided into four parts, according to Kiochos (1997): detecting potential losses, analysing prospective losses, selecting effective risk management approaches for treating loss exposures, and executing and administering the risk management program. Risk management, according to Kimball (2000), is a human activity that includes recognizing risk, assessing risk, establishing risk management strategies, and mitigating risk utilizing managerial resources. In general, a good risk management approach allows a company to lower its risk exposure and plan for survival in the event of a catastrophe (Omasete, 2014).

Financial risk management has mostly focused on controlling and ensuring regulatory compliance, rather than improving performance. Risk management, on the other hand, frequently leads to improved financial performance since regulatory compliance and risk control allow the firm to save money. Banks goes on to say that by controlling risks, managers may raise the value of the company by assuring its continuous profitability. Poor liquidity management, under-pricing and under-reserving, a high tolerance for investment risk, management and governance issues, and difficulties related to rapid growth and/or expansion into non-core activities are identified by Standard and Poor's ratings (2013) as the main causes of financial distress and failure in insurance companies. It is critical that insurance businesses manage these elements well in order to avoid financial loss and insolvency.

To minimize financial losses and bankruptcy, proper risk management is critical in the everyday operations of any insurance company. This is consistent with Jolly's (1997) assertion that averting losses through precautionary measures is a critical component of risk reduction and, as a result, a key driver of profitability. Insurance firms' risk management efficiency will have a significant impact on their financial performance. Insurance businesses could not survive with higher loss and expense ratios. Meanwhile, risk management has been connected to the maximizing of shareholder value.

Hedge accounting is one of the methods used by firms to manage financial risk, as it allows them to lower the frequency with which financial risk occurs. The purpose of this study is to analyze financial risk management in light of Hedge-accounting strategies. Hedge accounting uses a variety of techniques to help businesses manage their risks more effectively. On the one hand, any firm strives for the highest possible return while minimizing risk to the greatest extent possible on the other. Furthermore, corporations attempt to ‘window dresses their financial accounts in order to conceal their financial commitments while avoiding violation or disagreement with generally accepted accounting rules. As a result, they try to stay inside the legal boundaries while keeping their associated obligations to creditors, investors, the government, and others hidden. Risk management is an activity about which there has recently been agreement on the benefits it provides to investors and other interested parties.

According to Fatemi & Luft (2002), a firm will only engage in risk management if it increases shareholder value; Banks added that if a firm wants to raise its market value or reduce the likelihood of financial difficulty, it must retain and actively manage some level of risk. Risk management is a crucial duty of insurance institutions in creating value for shareholders and customers. Risks are inherent in business operations, and if they are not controlled, the firm's financial performance will suffer. Firms with effective risk management structures beat their competitors because they are better prepared for times after the occurrence of the risks. The goal of this research is to find out how Hedge accounting moderates the relationship between financial risk management and performance of insurance companies.

Statement of the Problem

An insurance company's financial administration is more difficult today than it was decades ago. Following the deregulation of the finance and insurance sectors, insurers are forced to compete fiercely. They must also contend with rising competition from financial intermediaries such as banks, stock exchanges, and mutual funds. The policyholder anticipates a low premium, appealing benefits, and a reasonable return on their investment in typical life insurance policies. Risks are managed by putting in place robust and efficient mechanisms for identifying, assessing, and quantifying exposures, which are critical in determining how much of the risk should be mitigated or absorbed, secondly by establishing underwriting limits and authority levels, and thirdly by restricting business to exposures that meet specified quality standards. In terms of law and practice, the underwriting process is well-established, and all insurers are familiar with it. Even still, adverse selection is prevalent and sometimes unavoidable. It is always true that the insured is more knowledgeable about the danger he is exposed to than the insurer who is meant to be knowledgeable.

There is always an information gap, both when underwriting for the first time and while renewing the policy. It is not uncommon for an insured to get insurance with the goal of defrauding the company, either on his own or with the help of the agent or broker. The insurance agent or broker gathers as much information as possible from the insured and enhances it with outside research and market data. The risk level varies from person to person, ranging from low to medium to high. No insurer can operate solely on the basis of minimal risk. It's always a mix of good and bad people in the group. What the insurer can control is its proportion, therefore aim for a balanced mix of all categories. The law of big numbers is crucial because losses caused by a few unfortunate people will be compensated with premium money from a large number of fortunate people. Concentrating on one or two goods, one or two sectors, or obtaining a significant portion of business from one or two suppliers is extremely dangerous. Risks are inherent in business operations, and if they are not controlled, the firm's financial performance will suffer.

Objectives of the Study

The main objective of the study is examining the moderating role of Hedge accounting on the nexus of financial risk management and performance of insurance companies in Nigeria. The specific objectives include to:

1. Ascertain the effect of financial risk management on performance. 2. Examine the effect of Hedge accounting on performance. 3. Examine how Hedge accounting moderates the relationship between financial risk management and performance.

Literature Review

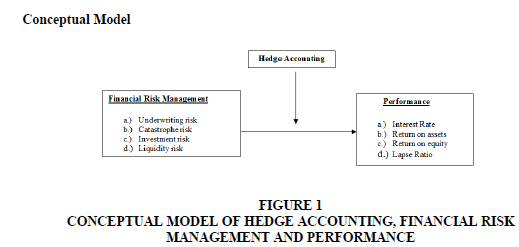

Conceptual Model

Hypotheses Development

The hypotheses are as follows:

H1: Financial risk management has significant effect on performance.

H2: Hedge accounting has significant effect on performance.

H3: Hedge accounting do moderate significantly the relationship between financial risk management and performance.

Concept of Hedge Accounting

Hedging is becoming a more popular way for businesses to control their risk. Hedging is the act of adopting a position to either acquire a cash flow, an asset, or a contract (including a forward contract) that will rise (fall) in value and counteract the value of an existing position. As a result, the primary goal of hedging is to limit the volatility of existing position risks induced by exchange rate fluctuations (smoothing effect). Figure 1 depicts the expected value E [V] of the corporation in the home currency before and after hedging. Hedging narrows the value distribution of a company to the mean of the distribution.

Hedging is the process of removing risk from the market by selling it, either in cash or on the spot market, or through a transaction such as a forward, future, or swap, which indicates an agreement to sell the risk in the future (Moles, 2016).

International Accounting Standard (IAS) for Hedge Accounting

The IASB has proposed a number of significant changes to the current IAS 39 Hedge accounting requirements. The overall effect will be more opportunities to apply Hedge accounting and consequently less profit or loss volatility arising from risk management activities. To date, the restrictive accounting rules have led to some companies not applying Hedge accounting or, in some cases, changing their risk management approach to become eligible. Hence, the lifting of these restrictions could prompt changes in risk management and more application of Hedge accounting.

International Accounting Standard No. 39 identifies concepts which focus upon Hedge accounting:

1. Fair value hedging: protection against exposure to changes in the fair value is recognized or required for a specific part of the existing risk or is attributable to a particular risk that will affect the net income reported.

2. Cash flow hedging: hedging against exposure to changes in cash flow (1) is attributed to a particular risk associated with a recognized asset or liability (such as all or some future interest payments on variable rate debt), or a predicted risk (such as an expected purchase or sale), and which (2) will affect the net profit or cause a loss to be reported, and are held accountable as the protection of a corporate commitment is not recognized for purchase or sale at a fixed price in the currency reports of businesses that Hedge cash flow, although it is exposed to risk in the fair value.

3. Hedging of the net investment in foreign currency units: defined in IAS 21 as effects of changes in foreign exchange rates.

Accounting for derivatives as prescribed by International Financial Reporting Standards (IFRS) generated a significant debate concerning its impact on corporate risk management. On the one hand, increased information concerning corporate risk management policies - and therefore the fair value measurement of financial instruments – made the use of derivatives more transparent. This provides a more robust picture of the firm’s underlying risk exposure and improves the extent to which corporate earnings are informative as a proof of management ability.

Instruments of Hedge Accounting

Hedge accounting uses several tools to achieve the protection process and among these are: financial derivatives, securitization, the sale of loans, and financial leases. In order to shed light on these tools, each is addressed here in detail: Financial Derivatives are ‘financial contracts that derive their value from the implicit value and can be used for multiple purposes such as hedging, investment and speculation, and the volatility of value greater than the volatility of the value of the existing implicit then, and related items and obligations of off-balance sheet’.

In fact, the derivatives are zero swaps because they result in one party losing to the other party, known in many cases as “game zero” So the derivatives are not exchanged in reality because there is no intention to transfer ownership of the original derivative, but only to influence the settlement of price differences at the end of the decade. The advantages of derivatives are those that generally pertain to processes of hedging, in which one of the parties to the contracting process holds better information, or has the ability to take risks against the financial return.

There are numerous and varied forms of derivatives, which can be divided into the following types:

An option is a contract between two parties – a buyer and a seller – that gives the buyer the right, but not the obligation, to purchase or sell something at a later date at a price agreed upon today. A held option is a contract, rather than an obligation, and contracts for American options are the most popular and widely used as they allow the implementation of the option contract at any time before maturity. The other form is the European option, implemented only upon the expiration date. Both types, however, can be used internationally.

Forward contracts comprise ‘the commitment or arrangement between two parties, the seller and the buyer, to buy or sell something at a specified date in the future at a price agreed upon today’. Alternatively, they can be defined as the ‘contractual obligation, typically to buy or sell at a specific asset price and a specific date in the future’. The features of derivative financial instruments - one of the most important tools employed in financial markets – is that they are able and are most likely employed to achieve a hedge or protection, thus avoiding speculation in relation to gains and losses by waiting for the date of the execution of the contract. Moreover, the motivation to engage in forward contracts is to gain financial leverage, which requires the use of a simple initial determination of profit margins.

A futures contract is ‘a contract between two parties - a buyer and a seller - to buy or sell something at a future date at a price agreed upon today, the so-called execution price’, and in principle, is similar to a forward contract, i.e., is relates to the future. The main difference between them is the fact that futures contracts are typically not traded on the regulated market, but on the black market (through people’s knowledge of each other).

Trade-offs, otherwise known as swaps, constitute ‘a contract between the parties that includes the approval of the exchange of cash flows’, i.e., that the exchange or the exchange contract is for the purpose of implementation in the future. This type of contract is often used in hedging activities or the protection of risk, particularly when interest rates and foreign exchange rates change, or for the purpose of reducing the cost of borrowing through the process of arbitrage. Securitization is an important tool in risk management and can be considered the bonding of important innovations to attract new resources to businesses and reduce the likelihood of exposure to risk. The transfer of assets is liquid in that for the exchange they can be turned into securities and the bonds made liquid. Securitization is therefore the transfer of assets to shift risk from a business’s balance sheet. In addition, securitization is the inventory and assembly of a group of similar assets and the establishment of bonds for these assets and the sale of these in the market. Through securitization, businesses can diversify credit risk, which can be exposed, and part can be transferred to others. This reduces the need for follow-up payments and can harmonize the maturities of assets and liabilities by investing in a broad base of available bonds, which will reduce the effects of risks.

Disclosure of Hedge Accounting

Recently, the IASB has amended accounting for financial instruments under IFRS 9 to introduce a new Hedge accounting model, together with corresponding disclosures concerning risk management activity for those applying Hedge accounting. The changes to Hedge accounting and the associated disclosures were developed in response to concerns raised by preparers of financial statements in relation to the difficulty of reflecting risk management activities appropriately in the financial statements. Under the amendments, information on all hedges must be provided in a single location in the Notes to the Financial Statements. Currently, information on Hedge accounting concern the type of hedge, established by accounting standards, such as cash flow and fair-value hedges (Jawad et al., 2014).

Risks Faced by Insurance Companies

The insurance industry is built on dealing with unpredictability. As a result, an insurer must assess a wide range of potential risks as well as their consequences, which could damage the current and future financial condition. Apart from Actuarial risk, Credit risk, Market risk, Liquidity risk, Interest Rate Risk, Operational Risk, Foreign Exchange (Currency) Risk, Legal/Regulatory Risk, Technology Risk, Environmental Risk, Reputation Risk, Country Risk, Asset Liability Management (ALM) Risk, and others, the range of risks includes investment management risk, underwriting risk, and catastrophe risk. The important activities of an insurance company are: Underwriting and Investment.

The heart and soul of an insurance firm is underwriting, which is important for business development and success. The meat and blood that offers vigor and nourishment is investment and money. The risk inherent in these two activities can disturb the company's foundation, and when combined with the other dangers stated above, it accelerates or exacerbates the company's decline and eventual destruction.

Liquidity Risk

Liquidity refers to the current and future availability of sufficient cash and liquid assets. Because there is usually a lag between the receiving of premiums and the payment of claims, there should be no liquidity issues. However, catastrophes can always result in unplanned claims, policy surrenders, or claims. Liquidity risk in life insurance derives from the surrender of a significant number of policies, while liquidity risk in general insurance arises from policy non-renewal and/or large claims.

Liquidity risk can result in asset value loss due to forced asset sales, especially if the market is in a depression. Although a loan might be raised instead of selling assets to satisfy cash needs, the constraint could be a lack of loan availability or loan availability at a high cost. A single or a few parties holding a significant portion of a business with significant value can put the insurer's liquidity at risk.

Liquidity risk affects many small insurance businesses and enterprises with low credit ratings since it is difficult for them to get cash on short notice. Liquidity risk is caused by a lack of diversification or an excessive concentration of assets (investments) or liabilities (underwritings). Liquidity issues will arise as a result of a loss of firm reputation, major challenges in the insurance industry as a whole, deterioration of the economy, and anomalous or extremely volatile market conditions.

Actuarial Risk

Actuarial risk emerges in pricing (premium rate) as a result of differences in expected mortality rates, perils, hazards, and other factors compared to real position (say early termination of the policies, catastrophe etc.). Actuarial work is a thorough examination of risk and the resulting loss in order to determine the appropriate premium for insurance products. Statistics, historical experience, and future probabilities are used to make the calculations. There are numerous unknowns and imponderables in the computations, resulting in actuarial risk.

Asset Liability Management Risk (ALM)

ALM does not imply that assets and liabilities should be matched as closely as possible, but the mismatch must be efficiently managed to contain any damages that may result. Any off-balance sheet exposures should be factored into the ALM framework. The best method is to manage the assets and liabilities of the insurer as a whole. Some liabilities, such as product liability insurance and whole-life plans and annuities, can last a long time. Assets having a sufficiently long term may not be available in such circumstances, posing a large reinvestment risk. Individual investment returns may or may not correlate to the associated liabilities. However, total investment income should be more than total liabilities.

Particularly for long-tail non-life business, ALM may need to handle some aspects of underwriting risk, such as the uncertainty of the timing and quantity of future claim pay-outs. Risk retention, risk transfer, and cost control are all significant aspects of risk management. The insurer's reinsurance arrangements must be adequate, and the insurer's claims on its reinsurers must be recoverable. In order to determine the exposure to a certain reinsurer, the reinsurance program must assess the reinsurer's capital and financial soundness.

Risk and Capital

Insurers should avoid putting too much weight on external ratings and instead develop their own quantitative and qualitative risk assessment models, as well as risk tolerance thresholds, as part of their business strategy. As well as corporate group relationships, group risk tolerance, and feedback mechanisms, provide assistance. The board must decide how to respond to change as a result of both internal and external events, new risks, new acquisitions, investment positions, and business lines. An insurer must conduct its own risk and solvency assessment on a regular basis (ORSA). Credit risk, market risk, operational and liquidity risks should all be evaluated as part of the risk assessment and management of solvency position. The adequacy of its economic capital and regulatory capital should be the basis for risk management actions. The solvency regime's capital requirements, as well as risk management and capital management, are combined to determine the financial resources required. It is unrealistic to expect new funds to be readily available.

Other Risks

Human error, fraud, technological failure, and system and procedure failure are all operational hazards in the insurance industry. Environmental laws and regulations have been broken. The dangers could be systemic or un-systemic. Recession, rising inflation, civil upheaval and anarchy, war, and other examples of systemic risk are industry-wide, market-wide, or even country-wide. Un-systemic risk includes things like company-specific management failure, massive fraud, and so on. Misalignment of assets and liabilities is another significant danger. Liabilities relate to payment responsibilities, whereas assets create revenue. Situations can emerge in which asset values plummet and payment obligations skyrocket due to huge claims. Banks and insurance firms of days are system-driven, and while technology aids in improving efficiency and speed, system failure can result in major setbacks and business disruption. Another threat is cybercrime.

Regulations for Insurance Business Risk

Every country has established regulators with set rules and laws to control them and assure safety, integrity, and transparency in business in the interest of insurance companies' safety and, more crucially, the safety of insurance policyholders. In addition, the International Association of Insurance Supervisors exists on a global scale. They give insurance businesses detailed instructions in order to strengthen operational standards, market discipline, transparency in reporting, and capital needs. While they are not compulsory, most countries have freely embraced them. Aside from that, many countries, such as the United Kingdom and the United States, have their own institutionalized mechanisms for the same purpose.

Enterprise Wide Risk Management (EWRM)

Enterprise wide risk management (EWRM) is a systematic approach to risk management that integrates strategy, technology, and people. EWRM, also known as "Enterprise Risk Management," is a comprehensive, integrated approach to managing a variety of risks, including financial and non-financial risks, with the goal of maximizing value for the entire company. As a result, steps will be taken to collect data on the insurance firm, its clients, reinsurers, and the market environment in order to analyse data across the business, with an emphasis on government policies and social situations.

Insurance is the pooling and spreading of risk to protect policyholders and insurers from financial harm. To do so, a complete understanding of risk kinds, their features, interrelation, the source of hazards, and their potential impact is required. Insurers should show that they understand enterprise risk challenges and those they are willing and capable of dealing with them.

The ultimate goal of insurance is to protect policyholders' interests, as well as the company's capital, by effectively utilizing resources. That involves safeguarding policyholders, stockholders, and employees whose interests are intertwined, and enterprise risk management is an effective solution for this (ERM). ERM focuses on all activities taken by an insurer to manage its risks on a continuous basis and guarantee that it stays within its risk tolerance threshold. It demands for the strict use of risk management strategies not only to identify hazards, but also to measure and mitigate them.

ERM connects day-to-day operations with long-term company objectives. It entails managing underwriting risk, market risk, credit risk, operational risk, liquidity risk, and reputation risk, at a minimum. Its goal is to find areas of strength and weakness in governance, business development, and control. External risk, which might pose a significant danger to the insurer's business, should also be assessed. Catastrophe risk and market risk can be extremely dangerous in high-stress conditions. ERM entails monitoring, analysing, and modelling in order to aid in the identification of risk causes, risk levels, risk relationships, and economic effect and financial statement assessment.

ERM is concerned with non-economic problems as well as accounting and regulatory needs. ERM necessitates consistency in qualitative and quantitative assessments in order for the insurer to comprehend positive and negative changes and prioritize risk management strategies accordingly. However, even the most advanced computer-generated evaluation and measurement models may not be able to replicate the real world. Wherever the risk is difficult to quantify, both domestically produced and externally derived models should be used. A qualitative evaluation should also be carried out. Risk is also covered by ERM for group companies.

ERM policies include risk retention, risk management, and solutions like as reinsurance and derivatives utilization. Product creation, pricing, marketing, claim payment, and investment management should all be addressed in risk management policies. It should also address the relationship between the risk appetite of the insurer and the risk management process. Under a variety of plausible bad situations, the insurer should demonstrate its capacity to manage risk over time.

Risk Management in Insurance Companies

In insurance companies, three important areas of risks are: Underwriting risk, Catastrophe risk and Investment risk

Management of Underwriting Risks

Underwriting should place a greater emphasis on risk selection. It is critical to cover a big number of people, expand the operational region, and multiply the products in order for the law of averages to operate in the insurance company's favour.

As a result, the first step is to reach out to a big number of individuals or prospects, followed by expanding the geographical scope of the business as much as possible, and then diversifying the business by introducing a variety of products. The simple rationale is that if the number is huge, they will not all lose money at the same time. As a result, if the coverage is spread across a large area that includes different areas of the country or even different countries, the chance of being diffused increases. Large-scale risks, such as natural disasters, are unlikely to affect the entire area with comparable intensity in all places. Similarly, a diverse selection of products entails a variety of risks, none of which will occur simultaneously. Where the individual risks covered are minor to medium, a large number, wide region, and many products are well matched. When the individual risk covered is for a considerable sum, however, the insured's risks and risk management procedures should be reviewed on a regular basis.

Reinsurance is a tried-and-true way of spreading risk across primary insurers. No insurer can afford to keep all of the risks that have been underwritten. The ability of an insurer to shift its risks is critical. Almost every insurance company has a reinsurance agreement in place with a large reinsurer. They are given a fraction of the risk. This type of arrangement allows an insurer to increase his risk-bearing capacity while also giving the insurance firm a worldwide flavour. Another option is to pool the risk. Typically, multiple companies work together to provide aviation insurance. Terrorism insurance and third-party liability insurance are also done through pooling arrangements in order to divide losses fairly among numerous insurers. Insurance firms lose a significant amount of money due to fraudulent claims. In this case, insurers should conduct a systematic investigation of frauds in terms of products and specific regions or localities, and then take appropriate precautions. They should evaluate the effectiveness of their underwriting and claim processing methods on a regular basis.

Actuary Role and Actuarial Risk

The actuarial department plays a critical role in determining price (premium) in a way that benefits both the insurer and the insured. An actuary is a professional who determines the appropriate premium. A highly proficient mathematician and statistician is an actuary. He is involved in all aspects of insurance operations, including planning, product development, marketing, investments, and research, in addition to pricing and underwriting. He examines relevant statistical data to calculate the rates that will be sufficient to cover all claims and expenses as they arise while also allowing for a profit margin. The actuary performs periodic valuations of the company's assets and liabilities, determines the reserves to be maintained and surplus to be distributed, compiles data, and verifies different abstracts and schedules/statements to be presented in order to meet regulatory requirements. According to IRDA regulations, a life insurer may not conduct insurance business without first appointing an actuary who has been approved by the Authority.

Life insurance companies, under the supervision of an actuary, estimate the number of death claims that can be expected during the year at the start of each financial year. The actual claim experience for each year is then compared to the estimate made at the start of that year to see if there is a substantial difference between the estimate and the real situation. If there is a considerable variation that continues year after year, it indicates that the Mortality table in use needs to be revised. Insurers should investigate if the quality of business obtained has deteriorated or whether underwriting standards have become weak. The solution to the problems lies in trained, knowledgeable and committed staff, good work culture, and standard of ethics in the organization, meticulous data collection, data analysis and sound M.I.S., in addition to proper check and control at various levels will help to trim the risk.

Measuring and Managing Catastrophe Risk

The second area of risk is catastrophe risk which relate to insurance claims arising out loss suffered by the policy holders on account of natural calamities like, flood, cyclone, earthquake, tsunami etc. In such cases the claim will be very large causing stress on insurance companies. Catastrophe Risk arises out of natural calamities like Flood, Cyclone, Hurricane, Earthquake, Tsunami etc.

Reinsurance companies are concerned with the risk of catastrophe loss and they are working out method to control their exposure. Primary companies managed their catastrophe exposures simply by purchasing appropriate reinsurance and ignored their concentrations of exposure. Many insurance companies do not know the extent of their exposure concentrations. Reinsurance companies suffered huge loss, and hence reacted swiftly by steeply raising prices and retentions with restriction on limits. Regulators were also concerned about companies’ abilities to manage the catastrophe exposure.

With advancement in computer technology, new quantitative tools and catastrophe simulation models have helped to estimate potential losses in a way that truly reflects the long term frequency and severity distributions. Use of simulation modelling involves simulating the physical characteristics of a specific catastrophe, determining the damage to exposures, and calculating the potential insured losses from these damages.

With regard to Catastrophe exposure management must begin with the availability and accuracy of exposure data. Identifying insurance cover written and location of risks are important. The risk is distinguished between personal property and commercial property, while modelling personal lines, the property insured may cause only a moderate problem, but can cause major distortions when modelling commercial lines and more so in a complex commercial property cover. It is the reinsurers who suffered more on account of claims on catastrophe losses. It usually involves large number of claims and huge amount in aggregate and hence reinsurance has become more restrictive and costly. The real problem in the past was lack of data and lack of system support to forecast damages. It was worsened by practical inability of the insured and insurer to control the risk. But today although prevention of risk is still difficult, forecasting and measuring the damages are easy. System and technology can be used in modelling and assessing potential damage. Every insurer and reinsurer should get fully equipped as otherwise they are bound to suffer big loss.

Investment Risk

The third area of risk is the investment risk. Investments generate a substantial portion of the income of the company. The investments are made out of the money received as premium from the policy holders. The company should therefore have a prudent investment policy emphasizing on safety and income, besides complying with regulations on investment which are compulsory. Investment policy should outline its approach towards inherently risky financial instruments such as derivatives, hybrid instruments that embed derivatives, private equity, hedge funds, etc. Investment policy should also set out the guidelines for the safe-keeping of assets including custodial arrangements. Investments in an unregulated market or subject to less governance need to be given special consideration particularly on the aspects of source, type and quantum of risk while risk arising from the domestic investments is easy to predict and in contrast complex investments in a number of currencies and different markets may complicate an insurer’s investment strategy. Internal expertise and competence at all levels of the organization to handle complex investment, stress testing as well as contingency planning should be ensured. Derivatives policy should be clear particularly for “over-the-counter” derivatives in order to assess the counter party risk.

Determinants of Financial Performance

Interest Rate

An interest rate is the cost of borrowing money. Since insurance companies make their promises or commitments to the insured at the time of the sale of policies to the latter, they are not free to adjust the rates fixed or agreed in the sale subsequently depending on circumstance. This feature of insurance exposes them directly to the risks associated with changes in interest rates. Insurance companies invest much of the collected premiums, so the income generated through investing activities is highly dependent on interest rates. Declining interest rates usually equate to slower investment income growth impacting on the insurance company‘s financial performance (Staking & Babbel, 1995). Another downside to interest rate fluctuations (not exclusive to insurance companies) is the cost of borrowing. However, Schich (2008) contends that insurance companies may also benefit from rising interest rates, because much of their profit is earned on the float, the period between when premiums are collected and claims paid out. During this time, insurers invest the premium. Rising interest rates imply a higher return on bonds, one kind of investment, although higher rates lower the value of bonds currently in their portfolio. Large home insurers benefit more than do smaller auto insurers. It is argued that a continuing decline in market interest rates tends to make it more difficult for insurance companies to provide high interest rates for their customers or the insured and-as a result-to maintain hence high levels of profitability. This proposition was tested in Taiwan over a period of declining market interest rates for insurance companies.

Profitability

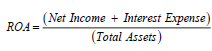

Return on Assets (ROA)

ROA indicates the return a company is generating on the firm's investments/assets.

Return on Equity (ROE)

Net Income divided by Shareholder's Equity ROE indicates the return a company is generating on the owners' investments. In the policyholder owned case, you would use policy holders' surpluses as the denominator.

Lapse Ratio

Lapsed Life Insurance Specified Period divided by Contracts in Force (in effect) at Start of Specified Period. This ratio compares the number of policies that have lapsed (expired) within a specified period of time to those in force at the start of that same period. It is a ratio used to measure the effectiveness of an insurer's marketing strategy. A lower lapse ratio is better, particularly because insurance companies pay high commissions to brokers and agents that refer new clients.

ROA, ROE, and the lapse ratios (discussed above) are also useful for evaluating the profitability of the insurer. In order to determine whether management has been increasing return for shareholders, the ROA and ROE numbers over the past several years should be calculated. The lapse ratio will help to tell whether the company has managed to keep marketing expenses under control. The more policies remain in force (are not cancelled), the better. These views are supported by Hagel et al. (2010) who proposed that most economic analysts and investors tend to focus on return on equity as their primary measure of company performance.

Theoretical Framework

New Institutional Economics Theory

According to Williamson (1998) the theory predicts that risk management practices may be determined by institutions or accepted practice within a market or industry. The theory links security with specific assets purchase, which implies that risk management can be important in contracts which bind two sides without allowing diversification, such as large financing contract or close cooperation within a supply chain. According to Smith Jr & Watts (1992) regulation is a key determinant of a firm's corporate financial policy. Therefore, if regulated firms face tighter scrutiny and face lower contracting costs, then they are less likely to use derivatives to hedge firm risk. Stein (2003) showed that if external sources of funds are more costly to a firm than internally generated funds, then the firm could benefit from using derivatives. In particular, firms can hedge cash flows to avoid a shortfall in funds that may require a costly visit to the capital markets and at the same time derivatives are positively related to measures of the firm's investment opportunity set proxies (Isvarya & Sethuraman, 2020).

Empirical Review

Ironkwe & Osaat (2019) investigated “Risk asset management and FP of insurance companies in Nigeria.” Secondary data on the relevant variables were obtained from the database of the Central Bank of Nigeria. ROA, ROE and leverage risk were then computed and used to estimate the long and short-run relationship as well as causal effects. Data were analysed using multiple regression. Unit root test was performed to test for stationarity. Leverage risk was found to be significantly related to return on equity. The results were found not to be consistent with a priori expectations.

Wanjohi (2013) set to analyze “The Effect of Financial Risk Management on The Financial Performance of Commercial Banks in Kenya”. The study was guided by the following indicators: capital risk as measured by total capital to risk weighted assets; liquidity as measured by current ratio; cash to deposit ratio; NPLs as measured by non-performing loans/total loans. The study analyzed the current financial risk management practices of the 44 commercial banks licensed in Kenya. The researcher adopted descriptive research design and ROA which represents financial performance was averaged for 6 years (2008-2013). The study was based mainly on secondary data which was collected from the annual reports of commercial banks. The researcher in her analysis used multiple regression analysis models which were presented in the form of tables and regression equation. The findings of the study showed that there is a significant relationship between financial performance and financial risk management. The study further recommended that banks should develop strategies to manage risks involved during their operations.

Mwangi (2014) studied “The Effect of Risk Management on Financial Performance of Commercial Banks in Kenya”. The study was guided by the following indicators: credit risk, insolvency risk, interest sensitivity ratio, capital adequacy, size of bank, operating performance. Census survey methodology of all the licensed 43 commercial banks was used. Secondary Data was collected from Central Bank and banks financial reports and multiple regression analysis used in the data analysis. From the findings the study found that there was a strong positive relationship between risk management and financial performance of commercial banks in Kenya. The study also found that there was a negative relationship between credit risk, insolvency risk, interest rate sensitivity and financial performance of commercial banks. The study further revealed that there was a positive relationship between capital adequacy, size of the banks, operational efficiency and financial performance of commercial banks. The study recommended that there is need for the commercial banks to effectively manage their risk as it was found that risk management positively influence financial performance of commercial banks. The study further recommended that there is need for the management of commercial banks to constantly check their banks’ exposure to edit risk, insolvency risk, and interest rate sensitivity. There is need for the commercial banks to enhance their capital adequacy and operational efficiency with respect to their size.

Pagach & Warr (2010) studied the effect of adoption of ERM principles on firms' longterm performance by examining how financial, asset and market characteristics change around the time of ERM adoption. Using a sample of106 firms that announce the hiring of a CRO (an event frequently accompanied by adoption of ERM) they found that firms adopting ERM experience a reduction in stock price volatility. Similarly, firms hiring CROs when compared to similar, non-CRO appointing firms in their industry group, exhibit increased asset opacity, a decreased market-to-book ratio and decreased earnings volatility. In addition, these researchers found a negative relationship between the change in firms' market-to-book ratio and earnings volatility. However, Pagach & Warr (2010) overall results fail to find support for the proposition that ERM is value creating.

Methods

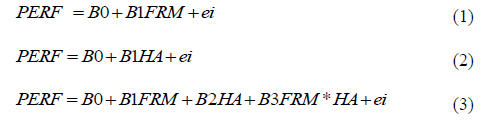

A descriptive research design was adopted for this study. Descriptive research enables the researcher to describe the existing relationship by using observation and interpretation methods. It provides the researcher with the appropriate methodology to illustrate characteristics of the variables under study. Causal research determines causal linkages between study variables by studying existing phenomena and then reviewing available data so as to try to identify workable causal relationships. The study population consisted of 58 registered insurance companies in Nigeria during the period (2011-2020). Census survey methodology of all the 58 registered insurance companies was used as the study sample. The structural equation modeling (SEM) was employed in this study. The SEM captured both the measurement model and the structure model. The SEM was as follows:

Where: PERF is Performance; FRM is Financial Risk Management; HA equal Hedge Accounting; Bo equal Constant; B1-B3 equal Coefficients to be Estimated; and ei is the Error Term.

Results and Interpretation

Table 1 shows the path coefficients of all the variables. The results revealed that financial risk management (FRM) has a significant effect on performance (B=0.205, t=2.063, p=0.040). The study further revealed that Hedge accounting (HA) has no significant effect on performance (B=0.040, t=0.472, p=0.637). Our prediction was not supported, and therefore Hypothesis 2 was rejected. Finally, the study revealed that Hedge accounting does not moderate significantly the relationship between financial risk management and performance.

| Table 1 Path Coefficients |

|||||

|---|---|---|---|---|---|

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) |

P Values | |

| FRM → PERF | 0.205 | -0.19 | 0.099 | 2.063 | 0.04 |

| HA → PERF | 0.04 | 0.045 | 0.085 | 0.472 | 0.637 |

| HA*FRM → PERF | 0.025 | 0.025 | 0.124 | 0.199 | 0.842 |

Findings

Hypothesis 1 shows the relationship between financial risk management and performance. The result indicated that financial risk management has a significant effect on performance. Hypothesis one is supported. This result is in line with that of Wanjohi (2013). Hypothesis two also revealed that Hedge accounting has an insignificant effect on performance. This result corroborated that of Jawad et al. (2014). Finally, the prediction of Hedge accounting will moderate the relationship between financial risk management and performance, such that the relationship is stronger with a higher level of Hedge accounting. The results however indicated that Hedge accounting does not moderate this relationship (B=0.025, t=0.199, p=0.842). Specifically, the study found that at a higher or lower Hedge accounting (Table 1), financial risk management still impact performance fairly equally. Hypothesis 3 was therefore not supported.

Conclusion

The study concluded that insurance businesses should effectively manage their risk because risk management has been shown to have a favorable impact on financial success. The study also suggests that insurance company executives evaluate their risk management techniques on a regular basis to see if they are still applicable in the face of a rapidly changing operating environment. The study further suggests that insurance company executives review their risks' exposure to edit risk, bankruptcy risk, and interest rate sensitivity on a regular basis. Insurance businesses must improve their capital adequacy and operational efficiency in proportion to their size. Finally, the report suggests that insurance company executive’s implement risk management frameworks such as enterprise risk management that follow international best practices. As a result, insurance businesses will be able to meet international requirements and so become more international rivalry.

References

Babbel, D.F., & Santomero, A.M. (1997).Risk Management by Insurers: an analysis of the process. Center for Financial Institutions Working Papers96-16, Wharton School, University Pennsylvania.

Fatemi, A., & Luft, C. (2002). Corporate risk management: costs and benefits.Global Finance Journal,13(1), 29-38.

Indexed at, Google Scholar, Cross Ref

Hagel, J. I. I. I., Brown, J. S., & Davison, L. (2010). The best way to measure company performance.Harvard Business Review,4(6), 56-60.

Ironkwe, U., & Ossat, A. (2019). Risk asset management and financial performance of insurance companies in Nigeria. International Journal of Advanced Academic Research Accounting Practice, 5(4).

Isvarya, N., & Sethuraman, M. (2020). A study on financial risk management with reference to united insurance company of India. Mukt Shabd Journal, 9(5), 3493-3505.

Jawad, F.A.M., Xia, X., Alshamam, M.A.H., & Alnuaimi, Q.A. (2014). Hedge accounting as a strategic tool in financial risk management: A review. Research Journal of Finance and Accounting, 5(11), 52-59.

Jolly, K. (1997). Counterparty Credit Risk Modelling: Risk Books. Incisive Media, London.

Kimball, R. C. (2000). Failures in risk management.New England Economic Review, 3-12.

Kiochos, P. (1997). Principles of risk management and insurance. 8th Edition, Pearson Education, New York.

Moles, P. (2016). Financial risk management sources of financial risk and risk assessment. Edinburgh: Edinburgh Business School.

Mwangi, Y.K. (2014). The effect of risk management on financial performance of commercial banks in Kenya. Doctoral dissertation, University of Nairobi.

Omasete, C.A. (2014). The effect of risk management on financial performance of insurance companies in Kenya. Doctoral dissertation, University of Nairobi.

Pagach, D.P., & Warr, R.S. (2010). The effects of enterprise risk management on firm performance. Available at SSRN 1155218.

Indexed at, Google Scholar, Cross Ref

Schich, S. (2008). Challenges related to financial guarantee insurance.OECD Journal: Financial Market Trends,2008(1), 81-113.

Indexed at, Google Scholar, Cross Ref

Smith Jr, C.W., & Watts, R. L. (1992). The investment opportunity set and corporate financing, dividend, and compensation policies.Journal of financial Economics,32(3), 263-292.

Indexed at, Google Scholar, Cross Ref

Staking, K. B., & Babbel, D. F. (1995). The relation between capital structure, interest rate sensitivity, and market value in the property-liability insurance industry.Journal of Risk and Insurance, 690-718.

Indexed at, Google Scholar, Cross Ref

Stein, J. C. (2003). Agency, information and corporate investment.Handbook of the Economics of Finance,1, 111-165.

Indexed at, Google Scholar, Cross Ref

Stulz, R.M. (1984). Optimal Hedging Policies. Journal of Financial and Quantitative Analysis, 19(2), 127-140.

Indexed at, Google Scholar, Cross Ref

Wanjohi, J.G. (2013). The effect of financial risk management on the financial performance of commercial banks in Kenya. Doctoral dissertation, University of Nairobi.

Indexed at, Google Scholar, Cross Ref

Williamson, O.E. (1998). The Institutions of Governance. The AEA Papers and Proceedings, 88(2), 75-79.

Received: 20-Jan-2022, Manuscript No. JMIDS-22-10920; Editor assigned: 22-Jan-2022, PreQC No. JMIDS-22-10920(PQ); Reviewed: 04-Feb-2022, QC No. JMIDS-22-10920; Revised: 16-Feb-2022, Manuscript No. JMIDS-22-10920(R); Published: 20-Feb-2022