Review Article: 2019 Vol: 22 Issue: 4

Financial risk management in renewable energy projects: A multicriteria approach

Garcia-Bernabeu A, Universitat Polite`cnica de Vale`ncia

Mayor-Vitoria F, Universitat Polite`cnica de Vale`ncia

Bravo M, Universitat Polite`cnica de Vale`ncia

Pla-Santamaria D, Universitat Polite`cnica de Vale`ncia

Citation Information: Garcia-Bernabeu, A., Mayor-Vitoria, F., Bravo, M., & Pla-Santamaria, D. (2019). Financial risk management in renewable energy projects: a multicriteria approach. Journal of Management Information and Decision Sciences, 22(4), 360-371.

Abstract

The problem of financing renewable energy (RE) projects has become a crucial issue for private and public decision-makers worldwide. Based on the European experience, the lack of credit makes it difficult for commercial banks to fund RE projects with traditional loans. In recent years, Project Finance has been widely used as a mechanism for funding RE projects. Project Finance decisions from lenders are made in a traditional way including quantitative financial criteria and qualitative risk assessment for non-financial criteria. In this paper, we show how the VIKOR method is applied to the selection of RE projects to be funded by commercial banks when using Project Finance. The method is combined with the AHP method for weighting the importance of the different criteria. We propose a multicriteria approach to select RE projects in which the decision maker takes into consideration financial criteria and a set of non-financial criteria regarding the technological, political-legal and socio-environmental risks of RE projects. In order to gain insight into the RE financial decision-making process, the paper makes a contribution to research in the financial field of RE investments and proposes some suggestions for managerial and practical decision making.

Keywords

Financial Decision Making, Multicriteria Decision Making, Renewable Energy Projects, Risk management

Introduction

In 2015, at the United Nations Framework Convention on Climate Change Conference of the Parties (COP21) in Paris, nearly 200 nations signed an agreement to act for zero net emissions in the second half of the century. In this context, the role of renewable energy (RE) investments to reduce the use of fossil fuels was highlighted. Policy makers and the scientific community agree that the transition to a fossil-fuel free and low-carbon economy requires an energy strategy that reduces the demand for energy, optimizes the use of RE sources and increases the use of RE technologies (Akella, et al., 2009; Burck et al., 2014).

However, this transition requires important investments from public and private initiative. While RE investments have received public support in the form of reduced taxes, direct subsidies or public incentives, private finance has so far played a marginal role (Mathews et al., 2010). Recent reports (UNEP, 2015) and the European Commission show that in most countries the investments in RE carried out by the private sector are insignificant compared with the public ones. Furthermore, as a consequence of the financial crisis the public sector with strong budget constraints cannot keep or increase the desirable investment levels to achieve the environmental targets. For these reasons, governments are seeking to use policy incentives to encourage private investment in RE generation (Rodríguez et al., 2015).

Project Finance is a recent technique applied in RE projects to transfer risk from the public to the private sector when there are high levels of public debt. It is defined by Finnerty (2007) as “the raising of funds on a limited-recourse or non-recourse basis to finance an economically separable capital investment project in which the providers of funds look primarily to the cash flow from the project as the source of funds to service their loans and provide the return on their equity invested in the project”. Selecting the right RE project to invest in is an issue which involves many factors, policies and situations. Therefore, RE financial decisions can be considered a multicriteria decision making (MCDM) problem with many risks, criteria, variables and alternatives, which increases the complexity of the decision-making processes (Ballestero et al., (2004). Although there is a wide number of contributions underlying the relevance of RE sources, research on the financial aspects of RE projects is rather limited. Recent literature in RE has started to incorporate the financial perspective when RE technologies are evaluated (Abolhosseini & Heshmati, 2014; Cucchiella et al., 2015; Rodríguez et al., 2015; Garcia-Bernabeu et al., 2016). In contrast, the use of MCDM methodologies in RE has grown significantly over the last two decades, especially Multi- Attribute Decision Making (MADM) methods such as AHP, ELECTRE, MAUT, PROMETHEE, VIKOR or TOPSIS (Catalina et al., 2011; Aragonés-Beltrán et al., 2014; Akman, 2015; Abaei et al., 2017, and Ilbahar, et al., 2019). Regarding the applications of these multicriteria methods, the main problems are the assessment of environmental impact, the ranking of RE strategies, life cycle strategies and energy planning (Løken, 2007; Ballarin et al., 2011).

The objective of this research is to provide a better understanding of the lender’s decision-making process when assessing RE projects to be funded. This is achieved in two steps. First, by identifying and evaluating non-financial criteria that could affect the RE projects, which until now have been considered part of a risk’s matrix. Second, by incorporating the financial and non-financial criteria in a MADM framework. For each criterion, the preferential weights are obtained using the well-known Analytic Hierarchy Process (AHP) developed by Saaty (1980). These preference weights are incorporated into the VIKOR method developed by Opricovic (1998) to obtain a compromise ranking of the RE projects. This method introduces an aggregation linear function of the criteria based on the particular measure of “closeness to the ideal solution”. The relative importance of all the financial and non-financial criteria and a balance between total and individual satisfaction provides us with a complete ranking of RE projects. The combination of AHP and VIKOR allows the decision maker to systematically determine the relative importance of the criteria based on their preferences. Similar applications to select RE projects can be found in San Cristobal (2012) and Mardani et al. (2016).

The paper is structured as follows. In the next section, we depart from the traditional procedure of RE assessment when using Project Finance to introduce a new proposal including technological, political-legal and socio-environmental criteria. We then present and justify the proposed multiple criteria methodology. As an attempt to illustrate the model we propose an illustrative example whose information is collected from financial and Due Diligence reports. Results including weights and rankings are presented and commented. Finally, a concluding section with the main contributions of the paper is presented.

Assessing Re Projects From The Lender’s Perspective With Financial and Non-Financial Criteria

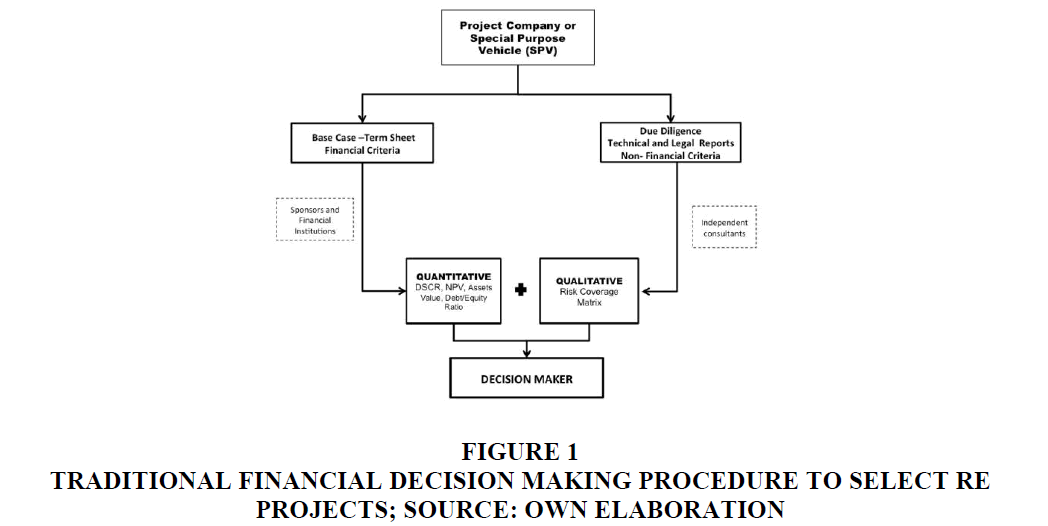

Financing RE projects is a complex undertaking for both sponsors and lenders. For this reason, they need technological, legal and financial advice to make it viable. Commercial banks provide two-thirds of the debt, and public or private bonds or multi-lateral development agencies provide the rest of the debt. We propose a transition from a traditional decision-making procedure in which the information on risks comes from qualitative and quantitative sources to a new process that converts all the information into quantitative data and uses multi-criteria approaches to make the final decision. In Figure 1, this traditional procedure to make decisions is represented.

Figure 1:Traditional Financial Decision Making Procedure To Select Re Projects; Source: Own Elaboration.

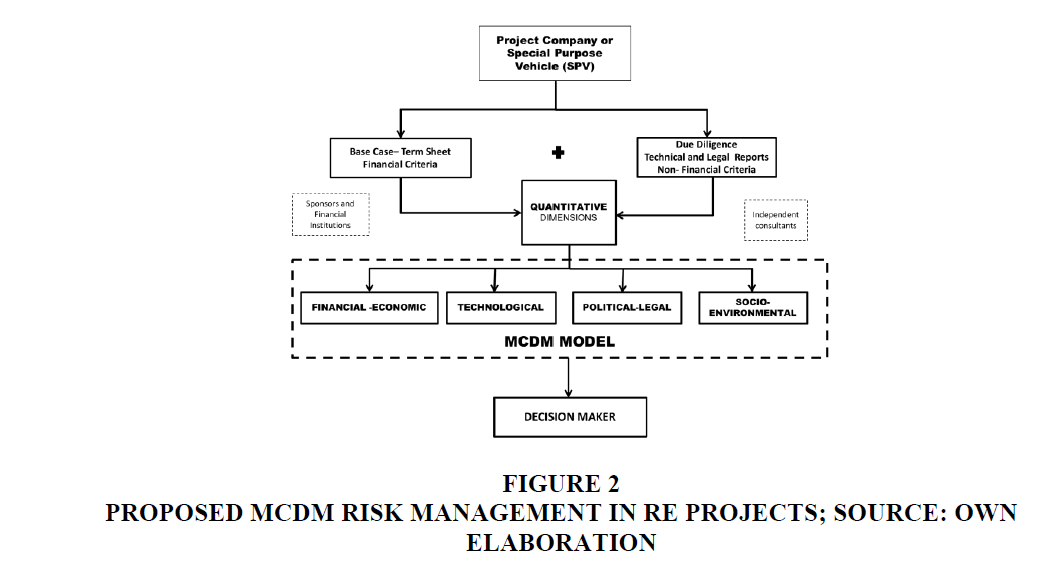

Our proposal implies that all the information that decision makers receive to make the final choice has been previously converted into quantitative. Finally, this quantitative information is incorporated into the proposed MCDM model as shown in Figure 2.

Taking into account bank managers’ preferences, a set of four dimensions is proposed in order to consider not only financial-economic but also technological, political-legal and socioenvironmental perspectives of the problem. In some cases, they include risks exogenous to the investment that have a high impact on revenues but are never included in the cash flow analysis.

From the bank managers’ point of view, the set of criteria considered in these four

dimensions, include a total of ten criteria

include a total of ten criteria (see Table 1).

(see Table 1).

| Table 1: Financial, Political-Legal, Technological And Socio-Environmental Criteria | |||

| D1-Financial-Economic | D2-Technological | D3-Political-Legal | D4-Socio-Environmental |

|---|---|---|---|

| C1-DSCR | C5 Performance | C7 Country risk | C9 Tons of CO2 avoided |

| C2- NPV | C6 O&M Cost | C8 Fiscal and Legal | C10 Contribution to employment |

| C3-Asset Value | |||

| C4-Debt Equity ratio | |||

Financial-Economic (D1)

The project’s financial advisers and sponsors develop a base case, which is a financial plan in which the main indicators are the Debt Service Coverage Ratio (DSCR) and the Net Present Value (NPV). In this dimension, additional information about the asset value (AV) and the Debt Equity ratio is provided.

Technological (D2)

The proliferation of RE is directly related to the technical advances in processing them and the breakthroughs in terms of finding stable sources of green energy. Includes information about Performance and Operation and maintenance (O&M) costs.

Political-Legal (D3)

This dimension includes the Country risk and the Fiscal and Legal advantages of the project.

Socio-Environmental (D4)

As the use of RE implies social and environmental benefits, in this dimension we include Tons of CO2 avoided and the contribution to employment.

Methodology

Renewable energy decision making involves a multidimensional approach and can be treated as a multiple criteria decision-making problem due to the increasing complexity of financial-economic, technological, political-legal and socio-environmental factors. Once the dimensions and criteria are defined, the proposed methodology is developed through the following steps:

First Step: Preference Weights from AHP Methodology

The AHP is a flexible and intuitive method for decision makers, which also calculates the consistency of the judgments of the experts, which in our case are the bank managers. The Analytic Hierarchy Process (AHP) is a MADM method that was originally developed by Saaty (1980). The AHP is a flexible and intuitive method for decision makers, which also calculates the consistency of the judgments of the experts.

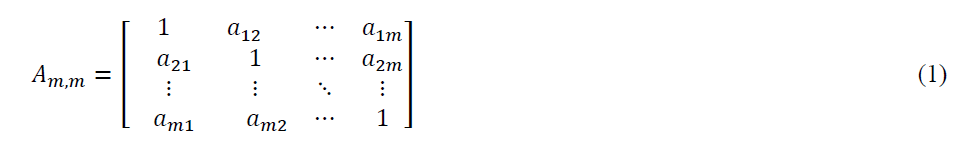

Then, the pairwise comparison of the ten Cj criteria (j = 1, . . . , m) yields a square matrix Amxm where aij denotes the relative importance of criterion i over criterion j, (aii = 1, aij = 1/aji, i, j = (1, . . . m)).

Second Step: Ranking the RE Projects Using VIKOR Methodology

The VIKOR method, introduced by Opricovic (1998) is a well-known MCDM technique, which is able to determine a multi-criteria ranking of alternatives (a1, a2, . . . , aj ) in the presence of conflicting criteria. In our case, the alternatives correspond to a portfolio of RE projects to be funded using Project Finance

When the p metric is equal to 1, the L1 metric allows us to obtain the Si value as follows:

The solution obtained by min Si is a maximum group utility, and is considered the “majority” rule.

When the p metric is equal to ∞, the L∞ metric allows us to obtain the Ri value as follows:

The solution obtained by min Ri is a minimum individual regret of the “opponent”. From Si and Ri the index Qi is computed by the following equation:

where:

S* =min Si S−=max Si R* =min Ri R-=max Ri

v is the weight for the strategy of “the majority of criteria” or “the maximum group utility”.

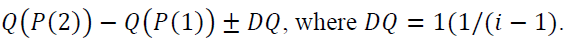

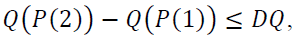

The Qi value proposes a compromise solution P(1) as the ranking of RE projects obtained from the Q minimum if the following two conditions are satisfied:

C1: Acceptable advantage;

C2: Acceptable stability.

The alternative P(1) must also be the best ranked by S or R. This compromise solution is stable within the decision-making process, which could be the strategy of maximum group utility (v>0.5), or by consensus (v≈0.5), or with veto (v<0.5).

If one of the previous conditions is not satisfied, the compromise solution could be: Projects P(1) and P(2) if only the condition C2 is not satisfied.

Projects P(1), P(2), ..., P(M ) if the condition C1 is not satisfied; P(M ) is determined by

the relation  for maximum n (the positions of these alternatives are in

closeness).

for maximum n (the positions of these alternatives are in

closeness).

The obtained compromise solution could be accepted by the decision maker because it provides a maximum utility of the majority (represented by min S), and a minimum individual regret of the opponent (represented by min R). The measures S and R are integrated into Q for the compromise solution, which is the basis for an agreement established by mutual concessions.

VIKOR is a helpful tool in multicriteria decision-making providing a compromise solution that could be accepted by the decision makers because it provides a maximum “group utility” of the majority and a maximum or individual regret of the opponent. Moreover, this method is based on an aggregating function representing “closeness to the ideal” which focuses on ranking and selecting from a set of alternatives, in our case the RE projects, in the presence of conflicting criteria.

Illustrative Example

This application deals with ten real RE projects that can be considered a “simulated opportunity set” involving different types of RE sources such as biomass, photovoltaic or wind power generation (see Table 2 ).

| Table 2: Simulated Portfolio Of Re Projects: Basic Information | ||||

| No | Type | Power | Investment | Country |

|---|---|---|---|---|

| P1 | Biomass | 50 | 135 | Spain |

| P2 | Photovoltaic | 15 | 120 | Spain |

| P3 | Photovoltaic | 25 | 83 | Chile |

| P4 | Wind | 24 | 260 | Brazil |

| P5 | Wind | 75 | 25 | Costa Rica |

| P6 | Wind | 50 | 81 | Argentina |

| P7 | Photovoltaic | 300 | 100 | Mexico |

| P8 | Wind | 24 | 11 | Brazil |

| P9 | Wind | 65 | 107 | Uruguay |

| P10 | Biomass | 22 | 153 | Spain |

In Table 3 the corresponding Cj values for each RE project are displayed for the dimensions D1, D2, D3, D4, that is, the financial, technological, political-legal and socioenvironmental perspectives of the problem.

| Table 3: Simulated Portfolio Of Re Projects: Basic Information | |||||||||||

| No | P1 | P2 | P3 | P4 | P5 | P6 | P7 | P8 | P9 | P10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| D1 | C1 | 1.4 | 1.36 | 1.25 | 1.3 | 1.2 | 1.27 | 1.3 | 1.25 | 1.35 | 1.3 |

| C2 | 650.57 | 350.2 | 390 | 530.1 | 152 | 140.65 | 350 | 200 | 75.15 | 195 | |

| C3 | 2.7 | 8 | 3.32 | 10.83 | 2.5 | 1.62 | 0.33 | 1.94 | 1.65 | 6.95 | |

| C4 | 0.75 | 0.85 | 0.8 | 0.5 | 0.6 | 0.64 | 0.65 | 0.69 | 0.64 | 0.65 | |

| D2 | C5 | 0.95 | 0.9 | 0.85 | 0.9 | 0.75 | 0.8 | 0.85 | 0.9 | 0.8 | 0.9 |

| C6 | 4.5 | 0.97 | 4.2 | 1.45 | 1.47 | 1.47 | 0.75 | 1.45 | 1.47 | 0.8 | |

| D3 | C7 | 1 | 3 | 2 | 4 | 5 | 4 | 3 | 4 | 4 | 1 |

| C8 | 3 | 1 | 1 | 3 | 3 | 4 | 3 | 3 | 3 | 1 | |

| D4 | C9 | 1734.89 | 475.76 | 246 | 6798.3 | 8976.55 | 8976.55 | 475.76 | 6798.3 | 6798.3 | 2175.9 |

| C10 | 0.48 | 0.81 | 2.17 | 0.96 | 0.46 | 0.43 | 3 | 6.86 | 1.87 | 0.75 | |

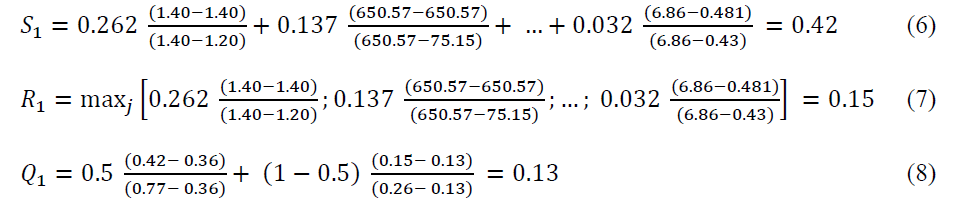

From the step by step process, the proposed methodology is numerically developed as follows:

First Step: AHP for Dimension Weights

The weights of the relative criteria importance are computed using AHP. The pairwise comparison of the ten criteria yields the following A10x10 square matrix that allows us to obtain the weights displayed in Table 4.

| Table 4: Pairwise Comparison Matrix And Preference Weights | ||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| C1 | 1 | 3 | 3 | 3 | 5 | 5 | 3 | 3 | 5 | 5 |

| C2 | 1/3 | 1 | 1 | 1/3 | 3 | 3 | 5 | 5 | 5 | 5 |

| C3 | 1/3 | 1 | 1 | 1/3 | 3 | 1 | 5 | 5 | 7 | 7 |

| C4 | 1/3 | 3 | 3 | 1 | 5 | 3 | 5 | 5 | 5 | 7 |

| C5 | 1/5 | 1/3 | 1/3 | 1/5 | 1 | 1/3 | 5 | 5 | 3 | 3 |

| C6 | 1/5 | 1/3 | 1 | 1/3 | 3 | 1 | 3 | 3 | 5 | 3 |

| C7 | 1/3 | 1/5 | 1/5 | 1/5 | 1/5 | 1/3 | 1 | 1/3 | 1/3 | 1/3 |

| C8 | 1/3 | 1/5 | 1/5 | 1/5 | 1/5 | 1/3 | 3 | 1 | 1 | 1 |

| C9 | 1/5 | 1/5 | 1/7 | 1/5 | 1/3 | 1/5 | 3 | 1 | 1 | 3 |

| C10 | 1/5 | 1/5 | 1/7 | 1/7 | 1/3 | 1/3 | 3 | 1 | 1/3 | 1 |

| wi | 0.24 | 0.128 | 0.140 | 0.188 | 0.071 | 0.072 | 0.026 | 0.057 | 0.044 | 0.033 |

The largest weight values correspond to the DSCR and the Debt/Equity Ratio (C1 and C4) criteria included in the financial dimension D1, while criteria in the political- legal (C7) and the socio-environmental (C10) dimensions reach smaller weights. These results are consistent with bank managers’ preferences, who prefer financial criteria (69.7%) although they are willing to consider the non-financial dimensions (30.3%). Within the latter, technological risk is the most relevant criterion (14.3%). The non-financial dimensions with lowest priority are the politicallegal (8.3%) and socio- environmental (7.7%). The Consistence Ratio is 0.091 which is less than the allowed value of 0.1. Thus, there is a good consistency of the judgments made.

Second Step: RE Project Ranking

Finally, the scores for the RE projects are obtained by applying the VIKOR multi- criteria method. From Table 5 the Sj, Rj and Qj values are computed from Equation (3), Equation (4) and Equation (5) respectively.

| Table 5: Ideal And Anti-Ideal Values Of Criteria | ||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| DSCR | NPV | IR | D/I Ratio | PR | (O&M)R | CR | (F-L)R | CO2 | CE | |

| B | B | B | C | B | C | C | B | B | B | |

| Ideal | 1.4 | 650.57 | 10.83 | 0.5 | 0.95 | 0.75 | 1 | 4 | 8976.55 | 6.86 |

| Anti-Ideal | 1.2 | 75.15 | 0.33 | 0.85 | 0.75 | 4.5 | 5 | 1 | 246 | 0.43 |

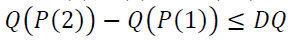

Then, the S* =0.26, S−=0.73 and R* =0.12, R−=0.24. For example, for project P1, the S1, R1 and Q1 values yield:

The results for Qi appear in Table 6 while the complete ranking is shown in Table 7.

| Table 6: Si, Ri And Qi Values | |||||||

| Si | Ri | Qi(v=0) | Qi(v=0.25) | Qi(v=0.50) | Qi(v=0.75) | Qi(v=1) | |

|---|---|---|---|---|---|---|---|

| P1 | 0.4 | 0.13 | 0.12 | 0.2 | 0.27 | 0.35 | 0.42 |

| P2 | 0.51 | 0.19 | 0.57 | 0.7 | 0.83 | 0.96 | 1.09 |

| P3 | 0.73 | 0.18 | 0.5 | 0.75 | 1 | 1.25 | 1.5 |

| P4 | 0.26 | 0.12 | 0 | 0 | 0 | 0 | 0 |

| P5 | 0.68 | 0.24 | 1 | 1.22 | 1.44 | 1.67 | 1.89 |

| P6 | 0.59 | 0.16 | 0.3 | 0.47 | 0.65 | 0.82 | 1 |

| P7 | 0.54 | 0.14 | 0.17 | 0.31 | 0.46 | 0.61 | 0.76 |

| P8 | 0.58 | 0.18 | 0.5 | 0.67 | 0.84 | 1.01 | 1.18 |

| P9 | 0.53 | 0.13 | 0.07 | 0.21 | 0.35 | 0.5 | 0.64 |

| P10 | 0.5 | 0.12 | 0 | 0.12 | 0.25 | 0.37 | 0.5 |

| Table 7: Ranking Of Re Projects From Different V-Values | ||||||||||

| v | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 0 | P4 | P10 | P9 | P1 | P7 | P6 | P3 | P8 | P2 | P5 |

| 0.25 | P4 | P10 | P10 | P9 | P7 | P6 | P8 | P2 | P3 | P5 |

| 0.5 | P4 | P10 | P10 | P9 | P7 | P6 | P2 | P8 | P3 | P5 |

| 0.75 | P4 | P1 | P10 | P9 | P7 | P6 | P2 | P8 | P3 | P5 |

| 1 | P4 | P1 | P10 | P9 | P7 | P6 | P2 | P8 | P3 | P5 |

| Si | P4 | P1 | P10 | P2 | P9 | P7 | P8 | P6 | P5 | P3 |

| Ri | P4 | P10 | P9 | P1 | P7 | P6 | P3 | P8 | P2 | P5 |

This approach gives us as a compromise solution P4, a wind project located in Brazil.

P10 and P1 are ranked in second and third position and they correspond to two biomass plants in

Spain. For v > 0, condition C1 of “Acceptable advantage” where

where is satisfied. Moreover, the alternative P4 is also the best ranked by S

and R and that means that C2 of “Acceptable stability” is also satisfied.

is satisfied. Moreover, the alternative P4 is also the best ranked by S

and R and that means that C2 of “Acceptable stability” is also satisfied.

The results showed that when subjective preferences for financial and non-financial dimensions are included in the decision-making process of selecting the best RE project to be funded, the bank managers assigned greater relevance to financial and technological dimensions (84%). Moreover, political-legal and socio-environmental perspectives are also taken into account with less importance (16%). As the problem is characterized by several conflicting criteria, there may be no solution satisfying all criteria simultaneously. The VIKOR method is able to provide us a compromise solution close to the ideal according to the previous preferences for financial and non-financial criteria. In this case, P4 represents the best option when considering the relative importance of criteria and a balance between total and individual satisfaction.

Conclusion

The academic, managerial and policy making community agree that one of the most effective tools to attain CO2 emission reduction targets and to reduce greenhouse emissions is to promote RE investments. There is a lack of research in the financial perspective of RE investments. Project Finance is a recent method widely used in RE projects in which lenders usually manage two types of information regarding:

(i) the financial performance of the project; (ii) non-financial information about risk provided by technical and legal reports. While most of the financial information is quantitative, the non-financial risk assessment tends to be qualitative. Some scholars have recently suggested that non-financial dimensions could be quantified and fed into MCDM methods to facilitate the decision-making process in the allocation of financial resources for RE investments.

The main contribution of this research is to propose the use of MCDM techniques for assessing RE projects from the lender’s perspective, who wants strong financial performance, but is aware that other criteria different from the traditional ones must be taken into account. Estimating the importance that the bank managers assign to the criteria is critical as it allows us to consider the RE financial decision-making process as a multidimensional problem. The criteria considered are grouped into four dimensions, financial-economic, political-legal, technological and socio-environmental and have to be defined by the lenders in order to provide a high-level understanding and prioritization of the risks of a project. Our approach is based on two steps combining AHP and VIKOR methods.

The paper makes a contribution to research in the financial field of RE investments and proposes some suggestions for managerial and practical decision making. First, by identifying and evaluating non-financial criteria that could affect the RE projects, which until now have not been quantified. Second, by providing a better understanding of the lender’s decision making process. As a result, the proposed methodology will be helpful for a better assessment of the investment opportunities in the RE sec- tor. Finally, as a contribution to practice, an application to ten RE projects illustrates the method through numerical tables concerning basic information of the RE projects, quantitative estimated values for all the criteria considered and ranking scores obtained from AHP-VIKOR.

References

- Abaei, M. M., Arzaghi, E., Abbassi, R., Garaniya, V. &amli; lienesis, I. (2017). Develoliing a novel risk-based methodology for multi-criteria decision making in marine renewable energy alililications. Renewable Energy, 102, 341-348.

- Abaei, S. &amli; Heshmati, A. (2014). The main suliliort mechanisms to finance renewable energy develoliment. Renewable and Sustainable Energy Reviews, 40, 876-885.

- Akella, A., Saini, R., &amli; Sharma, M. li. (2009). Social, economical and environmental imliacts of renewable energy systems. Renewable Energy, 34(2), 390-396.

- Akman, G. (2015). Evaluating sulililiers to include green sulililier develoliment lirograms via fuzzy c-means and VIKOR methods. Comliuters &amli; Industrial Engineering, 86, 69-82.

- Aragonés-Beltrán, li., Chaliarro-González, F., liastor-Ferrando, J.li. &amli; lila-Rubio, A. (2014). An AHli (Analytic Hierarchy lirocess)/ANli (Analytic Network lirocess)-based multi-criteria decision aliliroach for the selection of solar-thermal liower lilant investment lirojects.Energy 66, 222-238.

- Ballarin, A., Vecchiato, D., Temliesta, T., Marangon, F. &amli; Troiano, S. (2011). Biomass energy liroduction in agriculture: A weighted goal lirogramming analysis. Energy liolicy, 39(3), 1123-1131.

- Ballestero, E., Benito, A., &amli; Garcia-Bernabeu, A. (2004). Imlilementing a liroject finance initiative through’satisficing’off-take and limited recourse agreements. International journal of information and management sciences, 15(4), 41-60.

- Burck, J., Bals, C., &amli; Rossow, V. (2014). The Climate Change lierformance Index: Results 2015. Germanwatch Berlin.

- Catalina, T., Virgone, J. &amli; Blanco, E. (2011). Multi-source energy systems analysis using a multi-criteria decision aid methodology. Renewable Energy, 36, 2245-2252.

- Cucchiella, F., D’Adamo, I., &amli; Gastaldi, M. (2015). Financial analysis for investment and liolicy decisions in the renewable energy sector. Clean Technologies and Environmental liolicy, 17(4), 887-904.

- Finnerty, J. (2007). liroject Financing Asset-Based Financial Engineering. New York: John Wiley &amli; Sons.

- Garcia-Bernabeu, A., Benito, A., Bravo, M., &amli; lila-Santamaria, D. (2016). lihotovoltaic liower lilants: A multicriteria aliliroach to investment decisions and a case study in western Sliain. Annals of Olierations Research, 245(1), 163-75.

- Ilbahar, E., Cebi, S. &amli; Kahraman, C. (2019). A state-of-the-art review on multi-attribute renewable energy decision making. Energy Strategy Reviews, 25, 18-33.

- Løken, E. (2007). Use of multicriteria decision analysis methods for energy lilanning liroblems. Renewable and Sustainable Energy Reviews, 11(7), 1584-1595.

- Mardani, A., Zavadskas, E. K., Govindan, K., Senin, A. A., &amli; Jusoh, A. (2016). VIKOR technique: A systematic review of the state of the art literature on methodologies and alililications. Sustainability, 8(1), 1-38.

- Mathews, J. A., Kidney, S., Mallon, K., &amli; Hughes, M. (2010). Mobilizing lirivate finance to drive an energy industrial revolution. Energy liolicy, 38,(7), 3263-3265.

- Oliricovic, S. (1998). Multicriteria olitimization of civil engineering systems. lihD thesis submitted to the Faculty of Civil Engineering, Belgrade, li302.

- Rodríguez, M. C., Hascic, I., Johnstone, N., Silva, J., &amli; Ferey, A. (2015). Renewable Energy liolicies and lirivate Sector Investment: Evidence from Financial Microdata. Environmental and Resource Economics, 62(1), 163-188.

- Saaty, T. L. (1980). The analytic hierarchy lirocess: lilanning, liriority setting, resources allocation. New York: McGrawHill.

- San Cristóbal, J. R. (2012). Multi criteria analysis in the renewable energy industry. Sliringer Science &amli; Business Media.

- UNEli SEFI, N. (2015). Global Trends in Renewable Energy Investment 2015. UNEli.