Research Article: 2021 Vol: 25 Issue: 2S

Financial Sustainability Based on Resource Based View Theory and Knowledge Based View Theory

I Gede Cahyadi Putra, University of Udayana

Ni Luh Putu Wiagustini, University of Udayana

I Wayan Ramantha, University of Udayana

Ida Bagus Panji Sedana, University of Udayana

Abstract

This analysis was reviewed supported the idea of Resource Base Read Theory (RBV) and information primarily based View. Resource Base View Theory (RBV) that states that a corporation that incorporates a competitive advantage may be a company that has a price creation strategy that different corporations don't have and can't imitate. However, the external role is additionally vital in deciding company attitudes and business activities. Neutral theory helps company managers to grasp the surroundings and do effective management among existing relationships within the company environment. Neutral theory acknowledges the external power of the corporate in shaping structure activities and attaches importance to legitimacy. as a result of gaining legitimacy can facilitate corporations to access valuable resources, offer licenses to work and innovate, lower risk. Company resources are all tangible and intangible qualities in hand by the corporate (Barney, 1991). The collaboration of those 2 resources produces a property competitive advantage. accumulated understanding of the existence of workers as a crucial structure asset creates a knowledge-based read of the company. Information primarily based read (KBV) may be a new existence from a corporation resource-based view of the company and provides robust theoretical support for intellectual capital. The role of RBV is to create human capital involvement in order that it permits corporations to adapt to varied issues additional effectively and with efficiency (Chen et al., 2010). This makes human resource development more dominant and structured

Keywords

Financial Sustainability, Resource Base View theory, Knowledge Based View Theory

Introduction

The intense competition in business makes companies do many ways to maintain the sustainability of their companies. Sustainability itself has the meaning of a company's ability to increase its income stably. Sustainability is defined as the ability of an entity to continue business activities indefinitely (Filene, 2011). Strong sustainability will enable the company to achieve above average profitability and increase shareholder wealth (Adams et al., 2010). Financial sustainability is the capacity of an organization to earn income in maintaining its productive processes at a stable level or more to produce results (Leon, 2001).

Financial sustainability is a very important thing for a company to achieve, in order to be able to survive, for that the company must have a competitive advantage over its competitors that can be obtained by innovating. Innovation is one of the main tools for growth and is an important step in gaining a competitive advantage over competitors in today's economic environment. Innovation is widely considered to be one of the most important sources of sustainable competitive advantage, because innovation leads to improving products and processes, making continuous progress that helps companies survive, grow faster, more efficiently, and generate more profit than non-innovators (Atalay et al., 2013). Companies that have a competitive advantage are when the company implements a strategy that is different from its competitors and when competitors cannot imitate that strategy (Barney, 1991; Atalay, et al., 2013) provide evidence that innovation, especially in product and process innovation, is a type of innovation that is considered to be an important instrument for achieving sustainable competitiveness.

The ability to innovate is one of the determining aspects of company performance. Companies that are able to innovate allow these companies to survive and earn profits to maintain their financial sustainability. Innovation is the driver of company growth, directing future success and driving the company to survive in the competitive global economy. (Lee & Tsai 2005; Lin & Chen 2007) state that the higher the level of the company's innovation ability causes the company to have increased performance.

Globalization has driven innovation to be a requirement for business entities to operate in a competitive global market (Gunasekaran et al., 1996). If management is able to explore business opportunities, it will become a strategic position to develop innovations and new products produced by the company. Company competition in the industrial era 4.0 no longer relies on ownership of tangible assets, but on the ability to control information, develop innovation, manage organizations and own resources. Companies are increasingly emphasizing the importance of knowledge assets to improve the performance and sustainability of their companies.

Literature Review

Corporate sustainability is a business approach that creates long-term shareholder value by creating opportunities and managing risks arising from economic, environmental and social developments. Sustainable companies are able to achieve long-term shareholder value with strategy and management; they exploit the market and potential for sustainable products and services. Meanwhile, the company has also succeeded in reducing and avoiding the cost of sustainability and risk.

Sustainability means the company's ability to increase its income stably (Adams et al., 2010). Sustainability is a measure of an organization's ability to fulfil its mission and serve stakeholders from time to time. Therefore it is important for a company to pay attention to the continuity of its business. Strong sustainability will enable the company to achieve above average profitability and increase shareholder wealth (Adams et al., 2010).

Financial sustainability itself is the ability of an organization to mobilize, manage and efficiently use its resources (financial, human resources and mission) reliably to achieve its core goals. Financial sustainability is also defined as the ability of an organization to compare all costs with money or income received from activities carried out (Almilia, 2009). Leon (2001) states that financial sustainability is the capacity of an organization to earn income in maintaining its productive processes at a stable level or more to produce results.

Guntz (2011) states that there are two things to see the sustainability of financial institutions, namely Operating Self-Sufficiency (OSS) and Financial Self-Sufficiency (FSS). OSS is the concept of operational independence that measures the percentage of operating income from operations and financial expenses, including allowance for loan losses and the like. An OSS ratio of greater than 100 percent means that financial institutions can cover all costs through their own operations and are not dependent on contributions or subsidies from donors. Meanwhile, the FSS describes the ability to cover all costs which shows the ability of the institution to operate without subsidies. Financial sustainability at a bank is the bank's ability to compare all costs (financial costs, for example interest expenses on loans, and operating costs, for example employee salaries,

Methods

This study used a qualitative research design based on a hermeneutic approach, namely interpreting a text by reviewing several literatures by comparing and justifying it with theory. The theories used are Resource Based View Theory (RBV) and Knowledge Based View Theory (KBV). Some of the literature analyzed are as follows:

Badrinath & Venkatesh (2018)

Farah, et al., (2019)

Said & Annuar (2019)

Sheikh & Wepukhulu (2019)

Naz, et al., (2019)

Sitnikova, et al., (2019)

Quartey (2019)

Jin, et al., (2017)

Liu (2017)

Agyapong, et al., (2017)

Farida (2017)

Nuryani, et al., (2018)

Nuryakin (2018)

Amin, et al., (2018)

Meflinda, et al., (2018)

Xu, et al., (2019)

Xu & Li (2019)

Zhou & Saunders (2019)

Akintimehin, et al., (2019)

Sun (2019)

Khan & Park (2020)

Hasan, et al., (2020)

Dar & Mishra (2020)

Chen, et al., (2020)

Subramony, et al., (2018)

Kuhzadi, et al., (2019)

Febrian, et al., (2020)

Boys (2020)

Results

Sustainability Based on the Resource Based View Theory (RBV)

The Resources Based View Theory (RBV) was first introduced by (Wernerfelt, 1984) which is a widely accepted theory in the field of strategic management (Newbert, 2007). However, the most influential theory in this regard is in (Barney's, 1991) article entitled "Firm Resources and Sustained Competitive Advance". (Barney, 1991) states that in the RBV perspective, firm resources include all assets, capabilities, organizational processes, company attributes, information, knowledge, and others that are controlled by the company which enables the company to understand and implement strategies to increase efficiency and effectiveness of the company.

The Resource Based View Theory (RBV) states that the company has the resources that can make the company have a competitive advantage and be able to direct the company to have good long-term performance. Valuable and scarce resources can be aimed at creating competitive advantages, so that the resources they have can last a long time and are not easily copied, transferred, or replaced. (Northnagel, 2008) states that RBV has two assumptions, namely resource heterogeneity and resource immobility. Resource heterogeneity reveals whether a company has resources or capabilities that are also owned by other companies that are competitors, so that these resources are not considered as a competitive advantage.

The key to success for companies in today's competitive environment is knowing how to maintain a competitive advantage. Competitive advantage is the ability to get returns on investment consistently above average for the industry (Porter, 1985;Barney (1991) indicates that a company that has a competitive advantage is when the company implements a value creation strategy that is not simultaneously implemented by current or potential competitors and when other companies cannot duplicate the benefits of that strategy. RBV examines the resources and capabilities of companies, which allows them to gain competitive advantage and above average returns (Barney, 1991). According to the RBV theory,

There are three indicators of resources so that the company has a sustained competitive advantage (Barney, 1991), namely: valuable, valuable resources when these resources allow the company to understand or implement strategies that increase efficiency and effectiveness; rare (rare), if the company's resources are not scarce, then many companies will be able to understand and implement the strategy so that the strategy is not a source of competitive advantage, even though these resources are valuable, difficult to imitate (imperfectly imitable). Valuable and scarce company resources can only be a source of sustained competitive advantage if other companies do not have these resources and cannot obtain them or in other words company resources are very difficult to imitate. Thus, it can be said based on the RBV theory that companies with rare and valuable assets will have a competitive advantage, and companies that have assets that are difficult to imitate will have a sustainable competitive advantage.

The RBV model explains that resources have an important role in helping companies to achieve higher organizational performance. There are two types of resources, namely tangible and intangible. Tangible assets are tangible assets such as land, buildings, machinery, equipment. Meanwhile, intangible assets are intangible assets such as brand reputation, trademarks, intellectual property. Then the tangible and intangible resources owned by the company must have heterogeneous and immobile characteristics. Heterogeneous here means capabilities, capabilities and other resources owned by a company that is different from other companies. So it can be said that RBV assumes that the company gains a competitive advantage by using different resources. The second assumption of the RBV is immobile, resources do not move and do not move from company to company. Because these resources are immobile, the company cannot replicate the resources of other companies and implement the same strategy. According to Barney (1991), not all company resources have the potential for sustainable competitive advantage. To have this potential, company resources must have four attributes, namely they must be valuable, rare, imperfectly imitable, and non-substituable. According to (Barney, 1991), not all company resources have the potential for sustainable competitive advantage. To have this potential, company resources must have four attributes, namely they must be valuable, rare, imperfectly imitable, and non-substituable. According to (Barney, 1991), not all company resources have the potential for sustainable competitive advantage. To have this potential, company resources must have four attributes, namely they must be valuable, rare, imperfectly imitable, and non-substitutable.

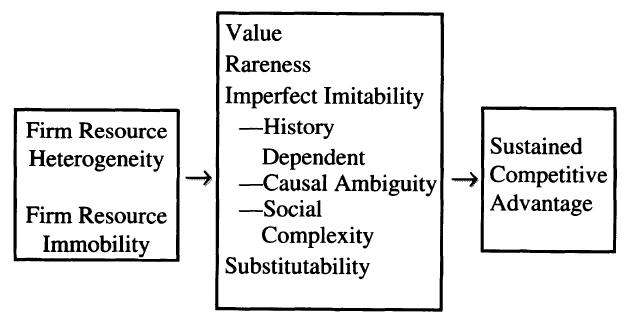

RBV is very appropriate to explain research on intellectual capital, especially in the context of the relationship between Intellectual Capital Performance (ICP) and the market. Companies have unique knowledge, skills, values and solutions (intangible resources) that can be transformed into value in the market. Management of intangible resources can assist companies in achieving competitive advantage, increasing productivity and market value. Barney (1991) states that RBV is a thought that develops in strategic management and a company's competitive advantage, which believes that a company will achieve excellence if it has superior resources. Barney (1991) further explains when explaining the relationship between two resource assumptions in RBV with four potential resource attributes for competitive advantage. (Figure 1)

Figure 1: The Relationship Between Resource Heterogeneity and Immobility, Value, Rareness, Imperfect Imitability, and Substitutability and Sustained Competitive Advantage

Sustainability Based on Knowledge Based View Theory (KBV)

Company resources are all tangible and intangible assets owned by the company (Barney, 1991). The collaboration of these two resources produces a sustainable competitive advantage. Increased understanding of the existence of employees as an important organizational asset creates a knowledge-based view of the company. Knowledge Based View (KBV) is a new existence from a company resource-based view of the company and provides strong theoretical support for intellectual capital. KBV is derived from RBV and suggests that knowledge in its various forms is of resource interest (Grant, 1991). The basic assumptions of company knowledge-based theory are a derivation of the firm's resource-based view theory.

The role of Knowledge Based View is to build human capital involvement so that it allows companies to adapt to various problems more effectively and efficiently (Chen et al., 2010). This makes human resource development more dominant and structured. The company is a combination of human resources and non-human resources. Human resources play an important role in managing company management, namely in the process of planning, organizing, coordinating and evaluating and orchestrating other resources. In KBV's view, companies develop new knowledge that is essential to build competitive advantage from existing unique combinations of knowledge.

Companies compete by developing new knowledge faster than competitors to win the competition in the era of globalization. This involves the role of human resources in the organization to develop knowledge, especially intellectual capital, to produce something unique as a characteristic of the organization that is difficult for competitors to imitate.

The firm's knowledge-based theory outlines the following distinctive characteristics:

1. Knowledge holds the most strategic meaning in the company.

2. Production activities and processes in the company involve the application of knowledge.

3. Individuals within the organization are responsible for creating, holding and sharing knowledge.

The KBV approach forms the basis for building human capital in the routine activities of the company. This is achieved through increasing employee involvement in formulating organizational goals both in the long and long term. The capacity and effectiveness of the company in generating, sharing and imparting knowledge and information determine the value that the company produces as the basis for the company's sustainable competitive advantage in the long term.

Sustainability Based on Contingency Theory

Chapman (1997) states that contingency theory was developed initially as a tool to explain observed differences in organizational structures. Contingency theory explains that there is no unique best way of dealing with organizational structures that apply in all circumstances. In its simplest form, contingency theory explains that what constitutes effective management is situational, depending on the unique characteristics of each situation. The contingency approach assumption is that the environment in which the organization operates determines how best to organize. Further, the basis of contingency theory is that best practice relies on the contingency of situations. Contingency theory tries to identify and measure the conditions under which things are likely to occur. Contingency theory is the relationship between two phenomena, if one phenomenon exists, then a connection can be drawn about other phenomena. Contingency theory is sometimes called an "all dependent" theory because the usual answers to questions posed to contingency theorists are all dependent. Contingency theory is built on the principles developed by the systems approach. Contingency theory sees that organizational theory should be based on an open system concept. Contingency theory is built on the principles developed by the systems approach. Contingency theory sees that organizational theory should be based on an open system concept. Contingency theory is built on the principles developed by the systems approach. Contingency theory sees that organizational theory should be based on an open system concept.

Organizations are faced with different types of contingencies with respect to their internal and external environment, resulting in different levels of uncertainty. Gallardo (2015) asserts that there is no single optimal design that fits all organizations. This implies that leadership strategies that may be effective in some organizations may not be effective when applied to others. The basic concept of contingency theory emphasizes that organizations are open systems, which require managers to make decisions based on contextual and environmental conditions to ascertain the needs of their environment and subsystems, and develop useful skills to advance the organization.

Lawren & Lorsch (1967) determined that the determinants of an effective internal organizational process are dependent (contingent) on the various environments in which the organization operates. Williams (2004) states that technology and the environment are big sources of organizational uncertainty, and that differences in these dimensions will result in organizational differences. Otley (1980) states that the contingency approach can explain why accounting systems can differ from one condition to another. There are three concepts that affect the effectiveness of the accounting system, based on these findings, namely technology, entity structure, and the environment. The contingency approach to management accounting is based on the premise that no universal accounting system is always appropriate to be applied to every entity. but this depends on the conditions or situations that exist in the entity. Some researchers in the field of management accounting conduct tests to see the relationship of contextual variables such as environmental uncertainty, task uncertainty, entity-structure and culture, strategic uncertainty with management accounting system design. This research was conducted at BPRs operating in the province of Bali. The banking industry is one of the first to receive the effects of environmental uncertainty and technological globalization. Based on this, company management must be able to plan and implement the right program to maintain the company's sustainability. Some researchers in the field of management accounting conduct tests to see the relationship of contextual variables such as environmental uncertainty, task uncertainty, entity-structure and culture, strategic uncertainty with management accounting system design. This research was conducted at BPRs operating in the province of Bali. The banking industry is one of the first to receive the effects of environmental uncertainty and technological globalization. Based on this, company management must be able to plan and implement the right program to maintain the company's sustainability. Some researchers in the field of management accounting conduct tests to see the relationship of contextual variables such as environmental uncertainty, task uncertainty, entity-structure and culture, strategic uncertainty with management accounting system design. This research was conducted at BPRs operating in the province of Bali. The banking industry is one of the first to receive the effects of environmental uncertainty and technological globalization. Based on this, company management must be able to plan and implement the right program to maintain the company's sustainability. uncertainty strategy with management accounting system design. This research was conducted at BPRs operating in the province of Bali. The banking industry is one of the first to receive the effects of environmental uncertainty and technological globalization. Based on this, company management must be able to plan and implement the right program to maintain the company's sustainability. uncertainty strategy with management accounting system design. This research was conducted at BPRs operating in the province of Bali. The banking industry is one of the first to receive the effects of environmental uncertainty and technological globalization. Based on this, company management must be able to plan and implement the right program to maintain the company's sustainability.

Research Position Mapping Results

The development of studies on human capital, structural capital, relational capital, social capital, marketing performance, financial strategy performance and financial sustainability is mapped as follows Table 1:

| Table 1 Mapping Of Positions Previous Research Related To Human Capital, Structural Capital, Relational Capital, Social Capital, Marketing Performance, Financial Strategy Performance And Financial Sustainability |

|||||||

|---|---|---|---|---|---|---|---|

| Previous Research | Human capital | Structural capital | Relational capital | Social capital | Marketing performance | Financial strategy performance | Financial Sustainability |

| Badrinath & Venkatesh (2018) | x | x | x | ||||

| Farah, et al, (2019) | x | x | x | x | |||

| Said & Annuar (2019) | x | x | |||||

| Sheikh & Wepukhulu (2019) | x | x | x | x | |||

| Naz, et al., (2019) | x | x | |||||

| Sitnikova, et al., (2019) | x | x | |||||

| Quartey (2019) | x | x | |||||

| Jin, et al., (2017) | x | x | |||||

| Liu (2017) | x | x | x | x | |||

| Agyapong, et al., (2017) | x | x | |||||

| Farida (2017) | x | x | |||||

| Nuryani, et al., (2018) | x | x | x | ||||

| Nuryakin (2018) | x | x | |||||

| Amin, et al., (2018) | x | x | |||||

| Meflinda, et al., (2018) | x | x | |||||

| Xu, et al., (2019) | x | x | x | ||||

| Xu & Li (2019) | x | x | x | x | |||

| Zhou & Saunders (2019) | x | x | |||||

| Akintimehin, et al., (2019) | x | x | |||||

| Sun (2019) | x | x | x | x | |||

| Khan & Park (2020) | x | x | x | ||||

| Hasan, et al., (2020) | x | x | |||||

| Dar & Mishra (2020) | x | x | |||||

| Chen, et al., (2020) | x | x | |||||

| Subramony, et al., (2018) | x | x | x | ||||

| Kuhzadi, et al., (2019) | x | x | |||||

| Febrian, et al., (2020) | x | x | |||||

| Boys (2020) | x | x | x | x | x | x | x |

Discussion

Technological innovation and competition in the era of globalization force organizations to manage organizations well in order to have advantages and be able to increase their current capacities. (Pomeda et al., 2002) suggest that in anticipating these developments, policy makers are looking for methods and tools to obtain new management approaches, which are generally in accordance with the latest developments related to business management. In this regard, (Amidon, 2002) states that the foundations for the new world economic order are based on knowledge, innovation and international cooperation. This is supported by (Seleim et al., 2007), who state that the world has experienced a revolution in information technology, innovation, and telecommunications which has driven the emergence of a knowledge-based economy (Klein 1998).

Barney & Clark (2007) state that one of the approaches used to have a competitive advantage is a resource-based view theory. Resource Based View Theory (RBV) is a thought that has been developed in strategic management theory and company competitive advantage which believes that a company will achieve excellence if it has superior resources. (Barney, 1991; Grant, 1991) state that RBV explains that companies with valuable and scarce assets have a competitive advantage and allow companies to get superior returns, and companies whose assets are difficult to imitate will have superior sustainable financial performance. RBV considers the company as a pool of resources and capabilities. This view is based on the assumption that differences in the company's resources and capabilities with competitors will provide a competitive advantage. The existence of heterogeneous resources provides its own unique character for each company. Several criteria for companies that can achieve competitive advantage (Barney & Clark, 2007), namely first, resources must add positive value to the company. Second, resources must be unique or rare among existing competitors. Third, resources must be difficult to imitate and resources cannot be replaced with other competing resources. Several criteria for companies that can achieve competitive advantage (Barney & Clark, 2007), namely first, resources must add positive value to the company. Second, resources must be unique or rare among existing competitors. Third, resources must be difficult to imitate and resources cannot be replaced with other competing resources. Several criteria for companies that can achieve competitive advantage (Barney & Clark, 2007), namely first, resources must add positive value to the company. Second, resources must be unique or scarce among existing competitors. Third, resources must be difficult to imitate and resources cannot be replaced with other competing resources.

The capacity and effectiveness of the company in producing and conveying information and knowledge will be able to determine the value and advantages of the company in the long term (Bontis et al., 2000). (Stewart, 2002) states that intellectual capital is seen as knowledge and experience used to create wealth. (Bontis et al., 2000) identified intellectual capital as a set of intangible resources (abilities and competencies) that drive organizations to create company performance and value. Intellectual capital is also known as organizational knowledge, which needs to be regulated to ensure that knowledge is valuable. Intellectual capital is an intangible asset owned by any organization that can improve organizational performance, in order to maintain organizational continuity through the creation of organizational competitiveness or excellence. (Chatzkel, 2002) argues that intellectual capital in a managerial perspective is knowledge, applied experience, organizational technology, relationships, and professional skills that produce a competitive advantage for organizations. Intellectual capital is a strategic asset that has a positive impact on future company performance as measured by net worth or added value (Ahmed Riahi-Belkaoui, 2003). Intellectual capital can provide valuable insights to policy makers regarding future risk control and formulation stage strategies (Edvinsson & Malone, 1997). Argued that intellectual capital in a managerial perspective is knowledge, applied experience, organizational technology, relationships, and professional skills that produce a competitive advantage for the organization. Intellectual capital is a strategic asset that has a positive impact on future company performance as measured by net worth or added value (Ahmed Riahi-Belkaoui, 2003). Intellectual capital can provide valuable insights to policy makers regarding future risk control and formulation stage strategies (Edvinsson & Malone, 1997). argued that intellectual capital in a managerial perspective is knowledge, applied experience, organizational technology, relationships, and professional skills that produce a competitive advantage for the organization. Intellectual capital is a strategic asset that has a positive impact on future company performance as measured by net worth or added value (Ahmed Riahi-Belkaoui, 2003). Intellectual capital can provide valuable insights to policy makers regarding future risk control and formulation stage strategies (Edvinsson & Malone, 1997). Intellectual capital is a strategic asset that has a positive impact on future company performance as measured by net worth or added value (Ahmed Riahi-Belkaoui, 2003). Intellectual capital can provide valuable insights to policy makers regarding future risk control and formulation stage strategies (Edvinsson & Malone, 1997). Intellectual capital is a strategic asset that has a positive impact on future company performance as measured by net worth or added value (Ahmed Riahi-Belkaoui, 2003). Intellectual capital can provide valuable insights to policy makers regarding future risk control and formulation stage strategies (Edvinsson & Malone, 1997).

Several studies examining Intellectual Capital (IC) provide mixed views. (Roos et al., 1997) stated that intellectual capital is a collection of hidden assets owned by an organization, such as brands, trademarks, patents and other assets that are not visible on the financial statements. Furthermore, (Ross et al., 1997) explained that IC is the most important resource for organizations to maintain competitive advantage. (Adriessen, 2004) explains that IC is an intangible resource that exists in an organization, which is an organizational advantage and can create excellence in the future. (Youndt et al., 2004) stated that IC is a collection of knowledge that enables an organization to run a business and win the competition.

Intellectual Capital(IC) in the dynamic knowledge economy is able to become the main mechanism in the company's capacity to stand out from its competitors (Brooking, 1996; Bontis, 2000; Jardon & Martos, 2012; Ferenhof et al., 2015; Jordão, 2015; Andreeva & Garanina, 2016; Verbano & Crema, 2016; Novas et al., 2017). Today's economy is receiving a major stimulus from information and communication technology and is characterized by the intensive use of knowledge in organizational processes and business management. These ideas are in line with the observations of (Jardon & Martos 2012; Cricelli et al., 2013; Jordão et al., 2013), which show that information and knowledge are the two main resources used by companies to generate income. In the future. These resources stimulate the development and maintenance of human capital,

Intellectual capital is the capacity of an organization's intellectual discipline as a result of the internalization synergy or transformation of all work and cognitive competencies (competence to think and solve problems) owned by all members of the organization that occurs through a process of knowledge transformation so as to create company wealth, add value to consumers, and increase welfare for employees and society. (Stewart, 1997) explains that intellectual capital is the intellectual material of knowledge, information, intellectual property and experience that can be used to create wealth.

The components of intellectual capital, which affect organizational performance, still vary widely. Several studies have found elements of intellectual capital that affect organizational performance in different ways. (Kaplan & Norton 2004) state that intellectual capital is human capital, information capital, organization capital, (Schiuma et al., 2008) mention human capital, structural capital, organization capital, social capital, and stakeholder capital. (Edvinsson & Malone, 1997) stated that the components of intellectual capital are Human Capital, Market Capital, Process Capital, Renewal Capital and Financial Capital. (Chatzkel, 2002) states that intellectual capital consists of human capital, structural capital and relational capital or customer capital, as well as the opinion of Maditinos, et al.

A number of empirical studies on Intellectual Capital (IC) on financial performance prove that IC affects financial performance with various measurement proxies. Research by (Chen et al., 2005) examined the relationship between IC and financial performance which resulted in the finding that IC had a significant positive effect on corporate financial performance, both present and future. (Tan et al., 2007) examined the effect of IC on firm performance in public companies in Singapore. The results showed that intellectual capital had a significant effect on company performance as measured by the profitability ratio. This study also provides empirical evidence that in addition to having an effect on the company's financial performance at the present time, Intellectual capital also affects financial performance in the future. This shows that intellectual capital can be used to predict the company's financial performance. Another study that produced consistent results was conducted by (Gan & Saleh, 2008) who examined 89 companies in Malaysia, (Zeghal & Maaloul, 2010) examined companies in the UK, (Murale et al., 2010) examined IT companies in India, (Kamal et al., 2011) on 18 commercial banks in Malaysia, (Zehri et al., 2012) on 25 banks that go public in Tunisia, (Khanqah et al., 2012) on 28 public companies in Tehran, (Guerrini et al., 2014) on 218 companies listed in Italy, (Ozkan et al., 2017) examined 44 banking companies operating in Turkey, showing the results that IC has a positive effect on the company's financial performance. This shows that intellectual capital can be used to predict the company's financial performance. Another study that produced consistent results was conducted by (Gan & Saleh, 2008) who examined 89 companies in Malaysia, Zeghal & Maaloul (2010) examined companies in the UK, (Murale et al., 2010) examined IT companies in India, (Kamal. et al., 2011) on 18 commercial banks in Malaysia, (Zehri et al., 2012) on 25 banks that go public in Tunisia, (Khanqah et al., 2012) on 28 public companies in Tehran, (Guerrini et al., 2014) on 218 companies listed in Italy, (Ozkan et al., 2017) examined 44 banking companies operating in Turkey, showing the results that IC has a positive effect on the company's financial performance. This shows that intellectual capital can be used to predict the company's financial performance. Another study that produced consistent results was conducted by (Gan & Saleh, 2008) who examined 89 companies in Malaysia, (Zeghal & Maaloul, 2010) examined companies in the UK, (Murale et al., 2010) examined IT companies in India, (Kamal et al., 2011) on 18 commercial banks in Malaysia, (Zehri et al., 2012) on 25 publicly traded banks in Tunisia, (Khanqah et al., 2012) on 28 public companies in Tehran, (Guerrini et al., 2014) on 218 companies listed in Italy, (Ozkan et al., 2017) examined 44 banking companies operating in Turkey, showing the results that IC has a positive effect on the company's financial performance.

Different results regarding the effect of IC on performance were found by (Bentoen, 2012) who examined 96 companies in Greece and found that intellectual capital had a significant negative effect on ROA and ROE. The research results of (Firer & Williams, 2003) found that intellectual capital has no effect on the performance of public companies in South Africa. (Puntillo, 2009) found that IC had no effect on firm performance. This research was conducted on 21 banks listed on the Milan Stock Exchange, Italy. (Diez et al., 2010) found that IC had no effect on companies in Spain. (Mehralian et al., 2012) who conducted a study on 19 companies listed on the Iranian Stock Exchange found that there was no effect of IC on company performance in the market.

The studies that have been described show the effect of IC on the financial performance and market performance of companies in several countries in the world. Financial performance that has an increasing and stable trend proves that the company has good financial sustainability. Research by (Naz et al., 2019) which conducted research on savings and loan institutions in Kenya found that human capital, structural capital, and relational capital have a positive and significant effect on financial sustainability. (Sheikh & Wepukhulu 2019) also conducted research in Kenya, namely in the Nairobi region. The results showed that 1) structural capital helps develop the company's organizational activities effectively and efficiently to facilitate the growth of SMEs. 2) Human capital is a very important factor for organizations and 3) relational capital is a component of intellectual capital that has the most dominant influence on financial sustainability. Research conducted by (Simatupang et al., 2019) found evidence that social capital plays a dominant role in the financial sustainability of the sago processing business in Tambat village, Merauke. (Meflinda, 2018) found that social capital has no influence on the performance of SMEs, but has a positive and significant relationship to the financial sustainability of industrial and trade SMEs in Riau. (2019) found evidence that social capital plays a dominant role in the financial sustainability of the sago processing business in Tambat village, Merauke. (Meflinda, 2018) found that social capital has no influence on the performance of SMEs, but has a positive and significant relationship to the financial sustainability of industrial and trade SMEs in (Riau, 2019) found evidence that social capital plays a dominant role in the financial sustainability of the sago processing business in Tambat village, Merauke. (Meflinda, 2018) found that social capital has no influence on the performance of SMEs, but has a positive and significant relationship to the financial sustainability of industrial and trade SMEs in Riau.

According to (Boekestein, 2006) Human capital is the expertise and competence of employees in producing goods and services and their ability to have good relationships with customers. Included in human capital, namely education, experience, skills, creativity and behavior. Human capital is one of the important variables in studying intellectual capital. Human capital is a dimension of intellectual capital based on human knowledge and experience that will affect the value of the company. According to (Mayo, 2011) human capital can be divided into three dimensions, namely ability and potential, motivation and commitment, as well as innovation and learning. (Brennan & Connel, 2000) stated that the most important thing in human capital is what humans do, both individually and collectively. Several previous studies examining the effect of human capital on firm performance have shown inconsistent results. The results of research by (Khan & Park, 2020; Sheikh & Wepukhulu, 2019; Xu et al., 2019; Xu & Li, 2019) found that human capital is an important factor and has a positive effect on company performance. Jardon & Martos (2009); Kamukama et al., (2010); Clarkeet, et al., (2011); Komnenic & Pokrajcic (2012); Mention & Bontis (2013), found that human capital has a positive influence on financial performance. While different results obtained by (Kusumo, 2018; Nuryani et al., 2018) provide results that human capital has no effect on company performance (Wang & Chang 2005; Puntillo, 2009).

Structural capitalis the infrastructure that supports the human capital component of intellectual capital such as information technology systems, company image, organizational concepts and documentation (Brinker, 1997). Structural capital is a manifestation, empowerment that supports human capital infrastructure, including organizational capacity, the system used to transmit and store intellectual data (Chatzkel, 2002). Structural capital includes all non-human resources, knowledge within the organization which includes databases, organizational charts, manual processes, routine strategies and anything that is higher than material value (Kaplan & Norton, 2004). Structural capital that is strong and has an elemental linkage to one another is able to shape organizational values and culture so that it supports employees to be more creative through knowledge, skills and experience. Research on the effect of structural capital on company performance was conducted by (Xu et al., 2019; Xu & Li, 2019; Sheikh & Wepukhulu, 2019) found that there is a positive relationship between structural capital and firm performance. Research conducted by (Bontis et al., 2000; Wang & Chang, 2005; Cabrita & Bontis, 2008; Ting & Hooi 2009; Kamukama et al., 2010; Clark et al., 2011; Kusumo, 2018) found that structural capital has a positive impact on company business performance. Meanwhile, different results obtained by (Puntillo, 2009; Komnenic & Pokrajcic 2012), Mention and Bontis (2013), Hejazi et al. (2016) found that structural capital has no effect on company performance. Research on the effect of structural capital on company performance was conducted by (Xu et al., 2019; Xu & Li 2019; Sheikh & Wepukhulu, 2019) found that there is a positive relationship between structural capital and firm performance. Research conducted by Bontis, et al., (2000); Wang & Chang, (2005); Cabrita & Bontis (2008); Ting & Hooi (2009); Kamukama, et al., (2010); Clark, et al., (2011); Kusumo (2018) found that structural capital has a positive impact on company business performance. Meanwhile, different results obtained by (Puntillo, 2009; Komnenic & Pokrajcic, 2012; Mention & Bontis, 2013; Hejazi et al., 2016) found that structural capital has no effect on company performance. Research on the effect of structural capital on company performance was conducted by (Xu et al., 2019; Xu & Li 2019; Sheikh & Wepukhulu, 2019) found that there is a positive relationship between structural capital and firm performance. Research conducted by (Bontis et al., 2000; Wang & Chang 2005; Cabrita & Bontis, 2008; Ting & Hooi, 2009; Kamukama et al., 2010; Clark et al., 2011; Kusumo, 2018) found that structural capital has a positive impact on company business performance. Meanwhile, different results obtained by (Puntillo, 2009; Komnenic & Pokrajcic, 2012; Mention & Bontis, 2013; Hejazi et al., 2016) found that structural capital has no effect on company performance. (Sheikh & Wepukhulu, 2019) found that there is a positive relationship between structural capital and company performance. Research conducted by (Bontis et al., 2000; Wang & Chang 2005; Cabrita & Bontis, 2008; Ting & Hooi, 2009; Kamukama et al., 2010; Clark et al., 2011; Kusumo, 2018) found that structural capital has a positive impact on company business performance. Meanwhile, different results obtained by (Puntillo, 2009; Komnenic & Pokrajcic, 2012; Mention & Bontis, 2013; Hejazi et al., 2016) found that structural capital has no effect on company performance. (Sheikh & Wepukhulu, 2019) found that there is a positive relationship between structural capital and company performance. Research conducted by Bontis et al., (2000); Wang & Chang (2005); Cabrita & Bontis (2008); Ting & Hooi (2009); Kamukama, et al., (2010); Clark, et al., (2011); Kusumo (2018) found that structural capital has a positive impact on company business performance. Meanwhile, different results obtained by (Puntillo, 2009; Komnenic & Pokrajcic, 2012; Mention & Bontis, 2013; Hejazi et al., 2016) found that structural capital has no effect on company performance. Kusumo (2018) found that structural capital has a positive impact on company business performance. Meanwhile, different results obtained by (Puntillo, 2009; Komnenic & Pokrajcic, 2012; Mention & Bontis, 2013; Hejazi et al., 2016) found that structural capital has no effect on company performance. (Kusumo, 2018) found that structural capital has a positive impact on company business performance. Meanwhile, different results obtained by (Puntillo, 2009; Komnenic & Pokrajcic, 2012; Mention & Bontis, 2013; Hejazi et al., 2016) found that structural capital has no effect on company performance.

Relational capitalis all the relationships that exist in the organization, especially regarding relationships that are focused on customers, suppliers, shareholders and administration. Relational capital consists of market channels, customer and supplier relationships, understanding of government and the impact of industry associations (Chatzkel, 2002). Relational capital refers to the value of the organization to maintain relationships with the main agent and other partners and the value to maintain good relations with other parties socially around the company. Relational relationships are built to maintain relationships both inside and outside the organization to develop and support organizational activities in achieving goals. Research by (Bramhandkar et al., 2007; Cabrita & Bontis 2008; Sharabati et al., 2010; Kamukama et al., 2012), found that relational capital has a positive influence on company performance. Meanwhile, different research results obtained by (Jardon & Martos, 2009; Ting & Hoo, 2009; Mention & Bontis, 2013; Kusumo, 2018; Xu & Li, 2019) found that relational capital has no effect on company performance.

Social capital is a force capable of building a civil community that can enhance participatory development. Social capital is a collection of resources needed by individuals or groups so that they have a more durable institutional network to recognize and respect each other. In general, social capital refers to trust, concern for others, and a willingness to live by the norms prevailing in a community and to be sanctioned if they do not comply. Social capital is a person's or group's sympathy for another person or group that can generate potential benefits, benefits and preferential treatment to a person or group of people outside those expected in a relationship. Social capital is also very close to another social term known as social virtue. Social virtue will have a very strong influence if it is attached to a feeling of mutual attachment to a reciprocal relationship in a social relationship.

According to (Chegini et al., 2012), social capital is an asset for companies in value creation that can influence success at work, motivate novelty, create intellectual capital and strengthen relationships with suppliers, regional production networks, and organizational learning. The increase in social capital of the poor combined with financial capital and physical capital is able to positively affect their welfare. Several studies have found different results regarding the effect of social capital on corporate financial performance. Research conducted by (Dar & Mishra 2020; Chen et al., 2020) found that social capital has a significant impact on increasing company performance. (Liu, 2017; Agyapong et al., 2017) show that social capital can improve organizational performance.

Marketing performance is a measure of the success of the overall marketing process activity in a company. Good marketing performance is expressed in three main quantities, namely sales value, sales growth and market share which ultimately leads to company profits (Ferdinand, 2014; Zhou et al., 2019) prove that marketing agility has a positive effect on company financial performance and innovation ability is a mediating variable between marketing agility and financial performance. Research by (Sheikh & Wepukhulu, 2019) shows that customer satisfaction has a positive effect on financial sustainability and there is a long-term relationship between customer capital and financial sustainability. While different results were obtained by Dave, et al., (2013).

Conclusion

This research is based on the theory of Resource Base View theory (RBV) which states that a company that has a competitive advantage is a company that has a value creation strategy that other companies do not have and cannot imitate. However, the external role is also very important in determining company attitudes and business activities. Stakeholder theory helps company managers to understand the environment and carry out effective management among existing relationships in the corporate environment. Stakeholder theory recognizes the external power of the company in shaping organizational activities and attaches importance to legitimacy. Because gaining legitimacy will help companies to access valuable resources, give licenses to operate and innovate, lower risk,

Company resources are all tangible and intangible assets owned by the company (Barney, 1991). The collaboration of these two resources produces a sustainable competitive advantage. Increased understanding of the existence of employees as an important organizational asset creates a knowledge-based view of the company. Knowledge Based View (KBV) is a new existence from a company resource-based view of the company and provides strong theoretical support for intellectual capital. The role of RBV is to build human capital involvement so that it allows companies to adapt to various problems more effectively and efficiently (Chen et al., 2010). This makes human resource development more dominant and structured.

Very tight business competition in Industry 4.0 requires companies to work hard to be able to maintain the financial sustainability of their companies. Financial sustainability is the company's ability to obtain, maintain, and develop its productive level in producing results. In achieving financial sustainability, companies must have a competitive advantage that will make a company different from other companies.

Financial sustainability is the capacity of an organization to earn income in maintaining its productive processes at a stable level or more to produce a result (Leon, 2001). Financial sustainability is a very important thing for a company to achieve, in order to be able to survive, for that the company must have a competitive advantage over its competitors that can be obtained by innovating.

References

- Adams, M., Thornton, B., & Sepehri, M. (2010). The impact of the pursuit os sustainability on the financial performance of the firm. Journal of Sustainability and Green Business, 1-14.

- Agyapong, F.O., Agyapong, A., & Poku, K. (2017). Nexus between social capital and performance of micro and small firms in an emerging economy: The mediating role of innovation. Cogent Business & Management, 4(1), 1309784.

- Akintimehin, O.O., Eniola, A.A., Alabi, O.J., Eluyela, D.F., Okere, W., & Ozordi, E. (2019). Social capital and its effect on business performance in the Nigeria informal sector. Heliyon, 5(7). 2024.

- Almilia, S.L. (2009). Factors affecting the financial sustainability ratio at national non-foreign exchange national commercial banks 1995-2005. Journal of Accounting and Finance,11(1), 42-52.

- Atalay, M., Anafarta, N., & Sarvan, F. (2013). The relationship between innovation and firm performance: An empirical evidence from the Turkish automotive supplier industry. Badrinath, M.N., & Venkatesh, R.

- 2018). The role of Psychological empowerment and its moderating effect between market strategy and organizational performance: A conceptual framework. International Journal of Pure and Applied Mathematics, 120 (5), 1337-1350.

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, 99-120.

- Barney, J.B., & Clark, D.N. (2007). Resource-based theory creating and sustaining competitive advantages. Oxford: Oxford University Press.

- Bentoen, S. (2012). The influence of intellectual capital on financial performance, growth, and market value. Article presented at the pelita harapan university Surabaya national conference. Surabaya.

- Bontis, N. (1998). Intellectual capital: An exploratory study that develops measures and models. Management Decision, 36(2), 63-76.

- Bontis, N. (2000). Assessing knowledge assets: A review of the models used to measure intellectual capital. International Journal of Management Reviews, 3(1), 41-58.

- Bontis, N., William C.C.K., & Stanley, R. (2000). Intellectual capital and business performance in malaysia industries. Journal of Intellectual Capital, 1(1), 85-100.

- Bramhandkar, A., Erickson, S., & Applebee, I. (2007). Intellectual capital and organizational performance: An empirical study of the pharmaceutical industry. In ECKM2007-Proceedings of the 8th European Conference on Knowledge Management: ECKM (147). Academic Conferences Limited.

- Brennan, N., & Connell, B. (2000). Intellectual capital: Current issues and policy implications. Journal of Intellectual capital.

- Brinker, B. (1998). Intellectual capital: Tomorrow asset, today's challenge.

- Cabrita, M.D.R., & Bontis, N. (2008). Intellectual capital and business performance in the portuguese banking industry. International Journal Technology Management, 43, 1-3.

- Hao-Shu, C., Ho-Chia, C., & Ho, C.Y. (2012). A study of marketing performance evaluation system for notebook distributors. International Journal of Business and Management, 7(13).

- Chang, W.S., & Hsieh, J.J. (2011). Exploring a human capital driven intellectual capital framework: Evidence from information technology industry in Taiwan. European Journal of Social Sciences, 21(3), 392-404.

- Chapman, R.S. (1997). Language development in children and adolescents with Down syndrome. Mental Retardation and Developmental Disabilities Research Reviews, 3(4), 307-312.

- Chatzkel, J. (2002). A conversation with Göran Roos. Journal of Intellectual Capital, 3(2), 96-117.

- Chatzkel, J. (2006). The 1st world conference on intellectual capital for communities in the knowledge economy nations, regions and cities. Journal of Intellectual Capital, 7(2). 272-282.

- Chegini, M.G., Alipour, H., & Zamani, A. (2012). The relationship between social capital and inter-organizational entrepreneurship in Rasht industrial city, Iran. Journal of Basic Applied Scientific Research, 2(1/2/3), 389 - 401.

- Chen, Cheng, M.C.S.J., & Hwang, Y. (2005). An empirical investigation of relationship between intellectual capital and firms' market value and financial performance. Journal of Intellectual Capital, 6(2), 159-176.

- Clarke, M., Dyna S., & Rosalind H.W. (2011). Intellectual capital and firm performance in Australia. Journal of Intellectual Capital, 12(4), 505-530. Dar, I.A., & Mishra, M. (2020). Dimensional impact of social capital on financial performance of SMEs. The Journal of Entrepreneurship, 29(1), 38-52.

- Dave, P., Wadhwa, V., Aggarwal, S., & Seetharaman, A. (2013). The impact and development on the financial sustainability of Information Technology (IT) companies listed on the s&p 500 index. Journal of Sustainable Development, 6(11), 122-138.

- Diez, J.M.M.L., Ochoa, M.B.P., & Santidrian, A. (2010). Intellectual capital and value creation in Spanish firm. Journal of Intellectual Capital, 11(3), 348-367.

- DiMaggio, P., & Powell, W., (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147-160.

- Edvinsson, L., & Malone, M.S. (1997). Intellectual capital: Realizing your company's true value by finding its hidden roots. New York: HarperCollins Publishers Inc.

- Ferdinand, A. (2014). Management research methods: Research guidelines for writing thesis, thesis and management science dissertation, (Fifth Edition). Semarang, Diponegoro University Publishing Agency.

- Filene. (2011). Credit union financial sustainability: A colloquium at Harvard University. Report No. 231. Filene Research Institute. Havard University.

- Firer, S., & Mitchell, S.W. (2003). Intellectual capital and traditional measures of corporate performance. Journal of Intellectual Capital, 4(3), 348-360.

- Gallardo-Echenique, E.E., de Oliveira, J.M., Marqués-Molias, L., Esteve-Mon, F., Wang, Y., & Baker, R. (2015). Digital competence in the knowledge society. MERLOT Journal of Online Learning and Teaching, 11(1).

- Grant, R.M. (1991). The resource-based theory of competitive advantage: Implications for strategy formulation. California Management Review, 33(3)114-135.

- Gunasekaran, A., Okko, P., Martikainen, T., & Yli-Olli, P. (1996). Improving productivity and quality in small and medium enterprises: Cases and analysis. International Small Business Journal, 15(1), 59-72.

- Jardon, C.M.F., & Martos, M.S. (2012). Intellectual capital as a competitive advantage in emerging clusters in Latin America. Journal of Intellectual Capital, 13(4), 462-481.

- Jordão, R.V.D., Novas, J.C., Souza, A.A., & Neves, J.T.R. (2013). Intellectual capital control: A model applied to the management of knowledge assets. Iberoamerican Journal of Strategy, 12(2), 195-227.

- Jordão, R.V.D. (2015). Knowledge and information management practices in small and medium-sized enterprises organized in cooperative networks: A multi-case comparative study in the Brazilian industry. Information Science Perspectives, 20(3) 178-199.

- Jordão, R.V.D., & Vander, R.D.A. (2017). Performance measurement, intellectual capital and financial sustainability. Journal of Intellectual Capital, 18(3), 643-666.

- Kamukama, N., Ahiauzu, A., & Ntayi J.M. (2010). Intellectual capital and performance: Testing interaction effects. Journal of Intellectual Capital, 11(4), 554-574.

- Kaplan & Norton. (2004). Strategy map: Converting intangible asset into tangible outcomes. Harvard: Harvard Business School Press. Khan, M.Z.A., & Park, J.H. (2020). Retraction: The effect of human capital on performance of East African commercial banks. Banks and Bank Systems, 15(2), 56.

- Komnenic, B., & Pokrajcic, D. (2012). Intellectual capital and corporate performance of MNCs in Serbia. Journal of Intellectual Capital, 13(1), 106-119.

- Kusumo, M., & Endro. (2018). Relational relationship between intellectual capital and organizational performance (study on regional government work units of the fak fak regency government of west Papua province. PDIM dissertation postgraduate faculty of economics ub. Malang

- Lawrence, P.R., & Lorsch, J.W. (1967). Differentiation and integration in complex organizations. Administrative science quarterly, 1-47.

- Lin, C.Y., & Chen, M.Y. (2007). Does innovation lead to performance? An empirical study of SME in Taiwan. Management Research News, 32(2), 132.

- Lee-Chang, J., & You-Yen, Y. (2016). Effects of corporate technological innovation activities on technological and management performance- focusing on government supported convergence consulting. Indian Journal of Science and Technology, 9(41).

- Leon, P. (2001). Four pillars of financial sustainability. International Publications Program. The Nature Conservancy.

- Liu, C.H. (2017). The relationships among intellectual capital, social capital, and performance-The moderating role of business ties and environmental uncertainty. Tourism Management, 61. 553-561.

- Maditinos, D.D., Chatzoudes, C., Tsairidis, & Theriou, G. (2011). The impact of intellectual capital on firms' market value and financial performance. Journal of Intellectual Capital, 12(1)132-151.

- Mayo, A. (2000). The role of employee development in the growth of intellectual capital. Personal Review, 29(4), 521-533.

- Mayo, A. (2001). The human value of the enterprise - valuing people as assets - monitoring, measuring, managing. London: N. Brealey Publishing.

- Mehralian, G., Rasekh, H.R., Akhavan, P., & Sadeh, M.R. (2012). The impact of intellectual capital efficiency on market value: An empirical study from Iranian pharmaceutical companies. Iranian Journal of Pharmaceutical Research, 6(1), 195-207.

- Anne-Laure, M., & Bontis, N. (2013). Intellectual capital and performance within the banking sector of Luxembourg and Belgium. Journal of Intellectual Capital, 14, 286-309.

- Najibullah, S. (2005). An empirical investigation of the relationship between intellectual capital and firms' market value and financial performance in context of commercial banks of Bangladesh. Unpublished Paper. Independent University.

- Naz F., Salim S., Rehman R.U., Ahmad, M.I., & Ali, R. (2019). Determinants of financial stability of microfinance institutions in Pakistan. Upravlenets - The Manager, 10(4), 51–64.

- Newbert, S., & Majluf, N. (1984). Corporate financing and investment decisions when firm: A assessment and suggestions for future research. Strategic Management Journal, 86(2), 121-147.

- Northnagel, K. (2008). Empirical research within resources based theory: A meta-analysis of the central propositions. Germany: Gabler.

- Otley, D.T. (1980). The contingency theory of management accounting: Achievement and prognosis. In Readings in accounting for management control (83-106). Springer, Boston, MA.

- Michael, E.P. (1985). Competitive advantage creating and sustaining superior performance. United States of America: The Free Press.

- Puntillo, P. (2009). Intellectual capital and business performance: Evident from italian banking industry. Journal of Corporate Finance, 5(12), 96-115.

- Sharabati, A.A.A., Shawqi, N.J., & Nick, B. (2010). Intellectual capital and business performance in the pharmaceutical sector of Jordan. Management Decision. 48(1), 105-131

- Sheikh, H.I., & Wepukhulu, J.M. (2019). Effect of intellectual capital efficiency on financial sustainability of Savings and Credit Cooperative Societies in Nairobi County, Kenya. International Academic Journal of Economics and Finance, 3(4), 16-31.

- Simatupang, D.O., Dawapa, M., Fachrizal, R., & Untari, U. (2019). Social and economic capital on sustainability of sago processing business. International Journal of Civil Engineering and Technology, 10(3).

- Stewart, T.A. (1997). Intellectual capital: The new wealth of organizations. London: Nicholas brealey publishing.

- Stewart, T. (2002). Intellectual capital: A new property of organizations. Jakarta: PT. Elex Media Komputindo.

- Tan, H.P., Plowman, D., & Hancock. P. (2007). Intellectual capital and financial returns of companies. Journal of Intellectual Capital, 8(1), 76-95.

- Ting, I.W.K., & Hooi H.L. (2009). Intellectual capital performance of financial institutions in Malaysia. Journal of Intellectual Capital, 10(4), 588-599.

- Wang, W.Y., & Chang, C. (2005). Intellectual capital and performance in causal models: Evidence from the information technology industry in Taiwan. Journal of Intellectual Capital, 6(2), 222-236.

- Wernerfelt, B. (1984). A Resources-based view of the firm. Strategic Management Journal, 65(2), 171-156.

- Xu, J., & Li, J. (2019). The impact of intellectual capital on SMEs' performance in China: Empirical evidence from non-high-tech vs. high-tech SMEs. Journal of Intellectual Capital.

- Xu, J., Haris, M., & Yao, H. (2019). Should listed banks be concerned with intellectual capital in emerging Asian markets? A comparison between China and Pakistan. Sustainability, 11 (23), 6582.

- Zeghal, D., & Maaloul, A. (2010). Analysis of value added as an indicator of intellectual capital and its consequences on company performance. Journal of Intellectual Capital, 11(1), 39-60.

- Zhou, J., Mavondo, F.T., & Saunders, S.G. (2019). The relationship between marketing agility and financial performance under different levels of market turbulence. Industrial Marketing Management, 83, 31-41.