Case Reports: 2021 Vol: 25 Issue: 3S

Financial Sustainability Without Comparability in the European Union? The Directive 2011/7/EU

Paula Gomes dos Santos, ISCAL Instituto Politécnico de Lisboa, COMEGI

Carla Martinho, ISCAL Instituto Politécnico de Lisboa,

Research Center (ICPOL - ID&I Unit) of ISCPSI

Abstract

The objective of this work is to analyze if the data of Spain and Portugal, under the reporting mechanisms of the Directive 2011/7/EU, is comparable, allowing to foresee financial problems. One of the great challenges of public governance is taking measures to ensure financial sustainability.

This study highlights the need to obtain comparable, reliable, and timely information in the European Union, urging for a common methodology between the member states.

Financial sustainability is the ability to finance all commitments, ensuring intergenerational equity (CICA, 2009; European Committee [EC], 2011; IFAC, 2013; IPSASB, 2013). According to the EC (2019), solvency problems (ability to meet medium and long-term financial obligations), and liquidity (ability to meet short-term financial obligations), are interrelated and are equally important to ensure the governments' sustainability.

Given the last financial international crisis, several international entities have recommended governments to take actions to ensure financial sustainability, which is one of the major current challenges of public governance (European Parliament [EP], 2009; EC, 2011; International Monetary Fund [IMF], 2014).

It has been pointed out that excessive debt is a risk factor for the governments' financial health and intergenerational equity (Cabaleiro, Buch & Vaamonde, 2013). This reinforces the need to provide comparable, reliable, and timely information, which allows anticipating possible financial problems (Cohen & Karatzimas, 2015; Oulasvirta, 2014; Christiaens, Reyniers & Rollé, 2010).

To develop sustainability policies of short-term public debt, the European Parliament, and the Council of the European Union (EU) have published the Directive 2011/7/EU. Aiming to reduce the late payments culture in Europe (EP, 2009), it set a 30-day deadline for commercial transactions payments. However, it has not established the methodology or the frequency to measure the average payment period (APP). This has already been identified by the EP (2018), pointing that there is no common indicator for the reporting mechanisms concerning the payment behavior of European public authorities and that the absence of such a harmonized measurement limits the up-to-date statistical data, and it does not allow cross-country comparison.

This methodology absence may also be a problem for the research carried out in the context of the public entity’s financial sustainability. For example, Alaminos, Fernández, García, and Fernández (2018) proposed a model for assessing municipal financial distress with a new proxy of financial situation - the ratio of default to municipal commercial debt, based on Spanish Organic Law 2/2012, 27th April, which states that public entities are considered in a good financial situation if the average period for paying debts is less than 30 days.

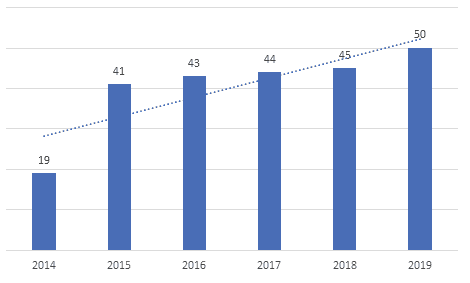

Let us compare the APP of the Spanish Local Entities and the Portuguese Local Governments. Spanish data is reported by Ministerio de Hacienda Y Función Pública (being available monthly, from September 2014 to May 2021), and in Portugal is reported by Direção-Geral das Autarquias Locais (being available quarterly from 2008 to the last quarter of 2019). Given the difference in the periods in which the information is available (highlighting the lack of reports about the last year and a half in Portugal), it was decided to present the APP for December of each year, from 2014 to 2019. In Figure 1, we can see the APP of the Spanish Local Entities.

The objective of this work is to analyze if the data of Spain and Portugal, under the reporting mechanisms of the Directive 2011/7/EU, is comparable, allowing to foresee financial problems. One of the great challenges of public governance is taking measures to ensure financial sustainability.

This study highlights the need to obtain comparable, reliable, and timely information in the European Union, urging for a common methodology between the member states.

Financial sustainability is the ability to finance all commitments, ensuring intergenerational equity (CICA, 2009; European Committee [EC], 2011; IFAC, 2013; IPSASB, 2013). According to the EC (2019), solvency problems (ability to meet medium and long-term financial obligations), and liquidity (ability to meet short-term financial obligations), are interrelated and are equally important to ensure the governments' sustainability..

Given the last financial international crisis, several international entities have recommended governments to take actions to ensure financial sustainability, which is one of the major current challenges of public governance (European Parliament [EP], 2009; EC, 2011; International Monetary Fund [IMF], 2014).

It has been pointed out that excessive debt is a risk factor for the governments' financial health and intergenerational equity (Cabaleiro, Buch & Vaamonde, 2013). This reinforces the need to provide comparable, reliable, and timely information, which allows anticipating possible financial problems (Cohen & Karatzimas, 2015; Oulasvirta, 2014; Christiaens, Reyniers & Rollé, 2010).

To develop sustainability policies of short-term public debt, the European Parliament, and the Council of the European Union (EU) have published the Directive 2011/7/EU. Aiming to reduce the late payments culture in Europe (EP, 2009), it set a 30-day deadline for commercial transactions payments. However, it has not established the methodology or the frequency to measure the average payment period (APP). This has already been identified by the EP (2018), pointing that there is no common indicator for the reporting mechanisms concerning the payment behavior of European public authorities and that the absence of such a harmonized measurement limits the up-to-date statistical data, and it does not allow cross-country comparison.

This methodology absence may also be a problem for the research carried out in the context of the public entity’s financial sustainability. For example, Alaminos, Fernández, García, and Fernández (2018) proposed a model for assessing municipal financial distress with a new proxy of financial situation - the ratio of default to municipal commercial debt, based on Spanish Organic Law 2/2012, 27th April, which states that public entities are considered in a good financial situation if the average period for paying debts is less than 30 days.

Let us compare the APP of the Spanish Local Entities and the Portuguese Local Governments. Spanish data is reported by Ministerio de Hacienda Y Función Pública (being available monthly, from September 2014 to May 2021), and in Portugal is reported by Direção-Geral das Autarquias Locais (being available quarterly from 2008 to the last quarter of 2019). Given the difference in the periods in which the information is available (highlighting the lack of reports about the last year and a half in Portugal), it was decided to present the APP for December of each year, from 2014 to 2019. In Figure 1, we can see the APP of the Spanish Local Entities.

In Spain, the APPs of the Local Entities are growing, and only in 2014 do they fulfill the 30 days term.

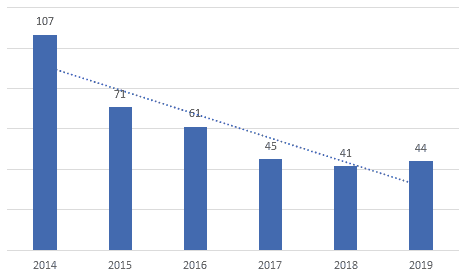

Figure 2 has the APP of the Portuguese Local Governments, which have been decreasing and, despite not fulfilling the 30 days limit, they are approaching and are even better than the Spanish ones since 2018.

But may we compare that information? How is it obtained? In Spain, the APP is based on the average payment period formula established in the Calculation Method of the Average Payment Period Act 2014 (which is presented in Table 1).

| Table 1 Average Payment Formula In Spain |

|

|---|---|

| Average payment (APP) formula | Legend |

| PTR - paid transactions ratio PTA - paid transactions amount PPTR - pending payment transactions ratio PPTA - pending payment transactions amount |

|

The paid transactions and the pending payment transactions number of days were understood as the calendar days since the thirty days after the invoice entry date or from the approval date, as appropriate. Under this methodology, some public administrations reported negative APPs (because thirty days were subtracted from the number of outstanding days). The European Commission sent a letter of formal notice, in February 2017, to the Spanish authorities, for having approved a regulation that systematically granted the public authorities an additional period of thirty days, considering that this methodology was not compatible with the Directive 2011/7/EU. So, the Calculation Method of the Average Payment Period Act 2017 modified Act 2014, to comply with the EC requirement. The formula is the same, but what is understood as the number of days of the paid transactions and the pending payment transactions are the calendar days since the invoice entry date or from the approval date, as appropriate. The new methodology is being used since April 2018. It can be concluded that until that date, the local entities that were considered in a good financial situation may be distorted.

In Portugal, the APP formula has also several problems. It is established in the Pay on Time Program Act 2008 (presented in Table 2).

| Table 2 Average Payment Formula In Portugal |

|

|---|---|

| Average payment (APP) formula | Legend |

|

DF=commercial short-term suppliers’ debt at the end of the quarter A=acquisitions |

Being quarterly (and not monthly, as it is in Spain), it systematically grants the public authorities an additional period of ninety days regarding the payment period (an acquisition in the quarter first day and paid in the last one, is reported as having an APP of 0 days). Also, the accounting basis is not the same throughout the Portuguese Public Sector. Central government reports APP based on cash/budget basis. Public companies, health entities, and local governments report APP obtained from accrual accounting. Moreover, even in these entities, what is considered as ?commercial short-term suppliers? debt? is not the same because in local governments the ?other debts? are not included (although being considered both in public companies and in health entities).

Santos and Martinho (2020) concluded that the Portuguese local governments' APP has been reducing. However, the authors highlight that these may not reflect better payment practices, but only the adoption of ?creative? accounting practices. The number of local governments that fulfill the 30 days term is increasing, but also does it what is presented as ?other debts?, which gets to be 12.3 times higher than ?commercial short-term suppliers? debt? (dos Santos & Martinho, 2021). Baleiras, Dias, and Almeida (2018), and Carvalho, Fernandes, and Cam