Research Article: 2021 Vol: 27 Issue: 5S

Fintech Adoption among Millennials in Selangor

Yamunah Vaicondam, SEGi University

Neeta Jayabalan, SEGi University

Chin Xin Tong, SEGi University

Muhammad Imran Qureshi, Universiti Teknikal Malaysia Melaka

Nohman Khan, UniKL Business School Universiti Kuala Lumpur

Abstract

In this age of innovation, the advancement in information technology has developed to pave the way for big data analytics. Application Program Interface (API) and Social, Mobile, Analytics and, Cloud (SMAC) technologies have allowed various data streams to synchronize efficiently. The study focuses on millennials as this generation group will become the primary users for banking services, including Fintech. Selangor has been chosen as the study's geographical location as the state remained as the main economic driver of Malaysia with a contribution of the highest Gross Domestic Product (GDP) in 2019 with a share of 24.2 percent as compared to other states. The study employs a quantitative research method to articulate facts and reveal patterns for the study's findings. This type of research method can also state whether a relationship exists between the independent variables and the dependent variable of the study. This study highlights that perceived ease of use and perceived usefulness is a more influential factor than perceived risk, and Trust. The findings imply can users are mainly willing to adopt Fintech, but some factors hinder their adoption. Thus, building more reliable and trustworthy Fintech products and services is as important as enhancing the functions.

Keywords

Fintech, Adoption, Millennials, Selangor

Introduction

In this age of innovation, the advancement in information technology has developed to pave the way for big data analytics. Application Program Interface (API) and Social, Mobile, Analytics and, Cloud (SMAC) technologies have allowed various data streams to synchronize efficiently (Mosteanu & Faccia, 2020). As a result, various platforms have been integrated into a single network, creating digital financial services to ease daily commercial transactions. The survival of financial institutions is highly related to the adoption of innovation and embracing the digital transformation in improving the overall performance of the financial institutions (Scardovi, 2017). The operation business techniques have changed due to digital transformation and emerging technology adoption; the channels that offer financial and banking products and services are now more trustworthy and intuitive (Mohamed & Ali, 2018).

Salmony (2014) claims that innovative financial technology aids in developing a variety of business models and meets customers' needs. The current payment services, financial regulations, and banking sectors are influenced by emerging information technology from an economic standpoint. Fintech refers to the emergence of digital transformation in the financial services sector. Financial technology, or Fintech, is concerned with developing systems that value, model, and process financial products such as stocks, money, contracts, and bonds (Mosteanu & Faccia, 2020). Fintech, as described by modern economists, is a new financial industry that uses technology to boost financial activities (Schueffel, 2016; Shahatha Al-Mashhadani et al., 2021).

Since its inception, Fintech has had a significant impact on the global financial market and how consumers perform their daily financial transactions. Non-financial firms have begun to enter the financial industry due to the ability and skills of Information and Communications Technology (ICT) companies in developing simple and accessible financial services (Cham et al., 2018). Fintech companies in Malaysia face numerous challenges and difficulties as the Bank Negara Malaysia (BNM) has implemented the Financial Technology Regulatory Sandbox Framework, which requires Fintech companies to meet a set of requirements in ensuring that all financial services and products offered are compliant with applicable laws and regulations (Cham et al., 2018; Raza et al., 2021).

These new-fangled financial institutions' business models have created technologically based customers, posing a threat to traditional financial services. In a speech during the Global Islamic Finance Forum 5.0 (GIFF 5.0), Malaysia's ex central-bank Governor, Dato Muhammad Bin Ibrahim, said that "Fintech challenges the financial sector's position." Instead of seeing the Fintech revolution as a threat, financial institutions should treat the revolution as an opportunity (Fong, 2016). This shows that businesses that embrace Fintech would have a competitive advantage in attracting customers and improving their business structure (Chong et al., 2019).

Even though Fintech was introduced in Malaysia years ago, as at year 2015, it still in the developing stage compared to other more mature markets such as Singapore and Finland (Price water house Coopers, 2016). According to Bank for International Settlements (2014) Statistics on payment, clearing, and settlement systems in the Committee on Payment and Settlement Systems (CPSS) countries, as cited by Bank of Thailand (2014), the e-payment transactions per capita in Malaysia had risen to 82 in 2015 as compared to 65 in 2013. Even though in the year 2019, Fintech became an essential part of the nation's financial sector (IMF, 2020), Malaysian and the local financial ecosystem may face issues if millennials do not start adopting Fintech (Cham et al., 2018). Fintech is believed to reshape the future of the financial industry, hence, encouraging users to start adopting Fintech services and products; the financial sector first needs to understand the consumer's acceptance level towards the adoption of technology in financial services.

First, without the adoption of Fintech, bank users would have limited access to the resources and benefits provided by Fintech companies (Frost, 2020). Digital finance has a wide range of benefits for financial inclusion, particularly advantageous for low-income and needy people by increasing their access to financial services and funding (Ozili, 2018). Secondly, it will increase poverty and a big gap of wealth between the rich and the poor. The aim of financial services accessible via digital channels is to help developing economies achieve their financial inclusion and poverty reduction goals (United Nations, 2016).

Additionally, this would cause negative impacts on the development of the financial industry in Malaysia as the efficiency and quality of financial services would be stagnant (Ali, 2017). Besides, the country's digital and finance economy will face a declining stage if this matter is not to be taken seriously (Chua et al., 2019; Qureshi et al., 2020). Therefore, there is an utmost urgency for this research to investigate the factors affecting Fintech adoption among millennials as there is still a blurry conception in this scope of the study.

Therefore, there is an urgency to investigate Malaysian consumer's acceptance, readiness, and expectations for Fintech services and products as the topic is perceived to contribute to the business community and individual financing demands, hence boosting the digital economy's overall development (Cham et al., 2018).

The study focuses on millennials as this generation group will become the primary users for banking services, including Fintech (Hu et al., 2019). Even though the current majority of users of Fintech products are still the prior generation due to their financial capability as compared to the millennials, however, as time goes on, the financial capability of millennials will gradually increase as they are in their prime earning years and wealth are passed down from the older generation (Yong, 2017). Hence, the accumulated wealth of the millennials will soon surpass their elders, and this generation will become the dominant users of financial products shortly (Hu et al., 2019).

Selangor has been chosen as the study's geographical location as the state remained as the main economic driver of Malaysia with a contribution of the highest Gross Domestic Product (GDP) in 2019 with a share of 24.2 percent as compared to other states (Department of Statistics Malaysia Official Portal, 2020). Thus, Selangor is the most suitable location for this study due to the high economic opportunities that lead to the high opportunities for various financial services.

Literature Review

The Impact of Perceived Ease of Use on Fintech Adoption

Tahar, et al., (2020) defined perceived ease of use as the easiness of a technology device, and the display can be accessed. A system is said to be of high quality if it is designed to provide user satisfaction by using it, including the ease of learning to use the system and performing a task using it, where users would find it easier to operate with the system rather than manually. Raza, et al., (2017) defined perceived ease of use as an individual's perception of technology usage, which is that it will be free of mental stress and not have to devote a lot of their effort and time to use it. Perceived ease of use affects an individual's intention toward using technology and predicts the perceived usefulness.

Chansaenroj & Techakittiroj (2015), in their study that investigates perceived ease of use influence on the intention to use mobile banking services in Bangkok, Thailand, shows that there is a positive relationship between perceived ease of use and the intention to use mobile banking, which delivers similar results as Chen (2016). The study determined that whenever the established system is easy to use, the intention to use the mobile banking system would increase.

Past studies from Chong, et al., (2019); Mun, et al., (2017); Hosseini, et al., (2015) have observed the influence of perceived ease of use towards the respective system and hence, derived that perceived ease of use has a significant relationship with the adoption of a system. These findings may indicate that when a consumer finds Fintech services are convenient and easy to use; their intention to adopt the service will increase. Summarizing all these findings from past studies, there appears to be a theoretical relationship between perceived ease of Use and adoption of Fintech. Thus, the following hypothesis is developed:

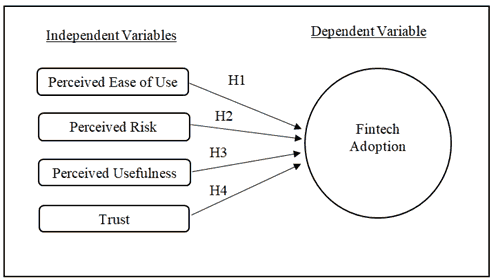

H1 There is a significant relationship between perceived ease of use and Fintech adoption among millennials in Selangor.

The Impact of Perceived Risk on Fintech Adoption

Chen & Aklikokou (2019) defined perceived risk as a consumer's subjective expectation of facing a loss in the pursuit of the desired result. Technological risk as a construct is used to measure perceived risk. Researchers such as Zhang, et al., (2019); Hubert, et al., (2017); Wang, et al., (2019) have used perceived risk in various contexts such as automated vehicles, smartphone-based mobile shopping, and nuclear energy, respectively in their studies.

Ryu (2018) investigated the factors that make users hesitant or willing to use Fintech has shown that the perceived risk has a significant negative relationship with the continuance intention of Fintech. Perceived risk in the study is measured by the financial, legal, security, and operational risks. Similarly, Lee (2009) has further justified that perceived risk has a significant adverse effect on the consumer's attitude towards using certain technology services and products. Based on the study, as the perceived risk of a system increases, the attitude towards the particular system will become less favorable. Hence, the following hypothesis is developed:

H2 There is a significant relationship between perceived risk and Fintech adoption among millennials in Selangor.

The Impact of Perceived Usefulness on Fintech Adoption

Grover, et al., (2019) defined perceived usefulness as a consumer's assumption that using a specific technology can improve job efficiency, which is similar to Raza, et al., (2017) defined perceived usefulness as the degree to which using a specific technology-specific technology improves the outcome of a task.

In addition, studies by Wong limpiyarat (2017); Moslehpour, et al., (2018), in their findings, indicated purchase intention of users in Taiwan and Thailand shows that perceived usefulness has significantly predicted the consumers' intention in adopting Fintech for online purchases. It shows that potential users would frequently evaluate the effects of their decision in adopting Fintech and decide based on the attractiveness of the perceived usefulness from their using Fintech. Hence, the following hypothesis is developed:

H3 There is a significant relationship between perceived usefulness and Fintech adoption among millennials in Selangor.

The Impact of Trust on Fintech Adoption

Siau & Wang (2018) defined Trust as a set of specific beliefs about goodness, competence, honesty, predictability, and an individual's willingness to rely on something or someone in a risky situation. Where, Glikson & Woolley (2020) defined Trust as the willingness of an individual to be defenseless to the conduct of someone or something based on the anticipation that the other will complete a task that is significant to the individual, regardless of whether the individual can control or monitor the other party.

Researchers such as Hawlitschek, et al., (2018); Paige, et al., (2017); Nayanajith, et al., (2019) have used Trust in various contexts such as blockchain, sharing economy, online health communication channels and sources, and computer-aided learning respectively in their studies. Chuang, et al., (2016), in their study, has found that Trust has a substantial positive impact on consumer's intention toward using Fintech service. Trust in a study is measured by the accuracy of transaction processes, results, and the safety and security of the transaction system.

Besides, Moon & Kim (2016); Wu, et al., (2016); Chong, et al., (2018); Stewart & Jürjens (2018) have further justified that Trust is an essential element that influences the adoption of Fintech services. These findings may indicate that when a consumer feels that Fintech services are trustable, their attitude toward the service will be improved. Thus, the following hypothesis is developed:

H4 There is a significant relationship between trust and Fintech adoption among millennials in Selangor.

Research Framework

Fishbein supports the above framework, and Ajzen (1975) proposed the Theory of Reasoned Action (TRA) to investigate the elements that affect an individual attitude when embraces certain technologies. TRA identifies behavior and subjective standards as critical markers of an individual's desire to adopt a technology. Based on this theory, individuals' behavioral intention is influenced by their behavior and subjective norm elements.

Davis (1989) proposed the Technology Acceptance Model (TAM), which is supported by Yang (2005) as the most robust model in the literature for studying the design of technology adoption. TAM's primary goal is to identify external variables that affect personal beliefs and attitudes towards a device. As a result, a few vital variables were identified as significant determinants of technology utilization in previous studies and used TAM to model and hypothesize the relationships between these factors. The TAM proposes that perceived ease of use, perceived usefulness, behavior, and usage affect an individual's intention to use a specific technology.

Methodology

The study employs a quantitative research method to articulate facts and reveal patterns for the study's findings. This type of research method can also state whether a relationship exists between the independent variables and the dependent variable of the study. Additionally, it is also easier to compare the findings' data to evaluate the extent of significance for each independent variables' impact on Fintech adoption. According to the Department of Statistics, in Malaysia in 2020, the study engages Selangor citizens; Selangor's total number is 6,538,100. The total number of millennials in Selangor, with the age range of 20 to 39, is 2,485,400 (Department of Statistics Malaysia Official Website, 2020). This study applies non-probability sampling as the respondents are being selected randomly, and not everyone has an equal chance to participate. According to Roscoe (1975), the sample size should be at least ten times the number of variables in the study. In this study, four variables and 45 respondents are considered for each variable for a more convincing result. Thus, the sample size of 180 is appropriate.

Findings & Interpretations

A pilot test is conducted to ensure the consistency and reliability of the questionnaires before actual research is carried out. In the pilot study, the reliability test is done on the first 30 responses from the 180 responses obtained for the survey questionnaire. For a pilot study, the acceptable reliability should be at least 0.60 (Taherdoost, 2016).

| Table 1 | |

|---|---|

| Cronbach's Alpha Value Analysis Of Pilot Test | |

| Reliability Statistics | |

| Cronbach's Alpha | No. of Items |

| 0.847 | 20 |

Table 1 shows the Cronbach's Alpha value for dependent variables (Fintech adoption) and independent variables (perceived ease of use, perceived risk, perceived usefulness, and Trust) on 30 samples is 0.847, which exceeds 0.60. Therefore, the questionnaires are reliable and can proceed to data collection for the remaining 150 responses.

| Table 2 | |||||

|---|---|---|---|---|---|

| Descriptive Statistics of Demographic Information | |||||

| Descriptive statistics | |||||

| N | Minimum | Maximum | Mean | Std. deviation | |

| Gender | 180 | 1 | 2 | 1.52 | 0.501 |

| Age | 180 | 1 | 4 | 1.62 | 0.934 |

| Working Experience | 180 | 1 | 4 | 1.78 | 0.873 |

| Martial Status | 180 | 1 | 2 | 1.18 | 0.383 |

| Highest education level | 180 | 1 | 4 | 2.84 | 0.726 |

| Valid N (List wise) | 180 | ||||

Table 2 shows 180 responses by displaying the value in descriptive statistics as a minimum, maximum, mean, and standard deviation. The result shows that all respondents are considered valid values in terms of gender, age, working experience, marital status, and highest education level. However, the result shows the lowest standard deviation of 0.383 for marital status and the highest standard deviation of 0.934 for age. This means the responses for marital status are less spread out, whereas the responses for age are more spread out.

| Table 3 Correlations of Variables |

||||||

|---|---|---|---|---|---|---|

| Correlations | ||||||

| Fintech Adoption | Perceived Ease of Use | Perceived Risk | Perceived Usefulness | Trust | ||

| Fintech Adoption | Pearson Correlation | 1 | 0.539** | -0.105 | 0.652** | 0.343** |

| Sig. (2-tailed) | . | 0 | 0.163 | 0 | 0 | |

| N | 180 | 180 | 180 | 180 | 180 | |

| Perceived Ease of Use | Pearson Correlation | 0.539** | 1 | -0.258** | 0.692** | 0.473** |

| Sig. (2-tailed) | 0 | 0 | 0 | 0 | ||

| N | 180 | 180 | 180 | 180 | 180 | |

| Perceived Risk | Pearson Correlation | -0.105 | -0.258** | 1 | -0.188* | -0.488** |

| Sig. (2-tailed) | 0.163 | 0 | . | 0.012 | 0 | |

| N | 180 | 180 | 180 | 180 | 180 | |

| Perceived Usefulness | Pearson Correlation | 0.652** | 0.692** | -0.188* | 1 | 0.472** |

| Sig. (2-tailed) | 0 | 0 | 0.012 | 0 | ||

| N | 180 | 180 | 180 | 180 | 180 | |

| Trust | Pearson Correlation | 0.343** | 0.473** | -0.488** | 0.472** | 1 |

| Sig. (2-tailed) | 0 | 0 | 0 | 0 | ||

| N | 180 | 180 | 180 | 180 | 180 | |

| **. Correlation is significant at the 0.01 level (2-tailed). | ||||||

| *. Correlation is significant at the 0.05 level (2-tailed). | ||||||

Table 3 is a correlation analysis based on the Pearson method to show the relationship between dependent and independent variables. Findings show significant positive relationships between Fintech adoption and perceived ease of use, perceived usefulness, and Trust.

| Table 4 Model Summary |

||||||

|---|---|---|---|---|---|---|

| Coefficients | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 1.391 | 0.319 | 4.357 | 0 | |

| Perceived Ease of Use | 0.638 | 0.085 | 0.271 | 6.12 | 0.005 | |

| Perceived Risk | 0.031 | 0.034 | 0.059 | 0.906 | 0.366 | |

| Perceived Usefulness | 0.513 | 0.079 | 0.524 | 6.495 | 0 | |

| Trust | 0.027 | 0.046 | 0.043 | 0.588 | 0.558 | |

Table 4 shows t-statistics used in testing whether a given coefficient is significantly different from zero. Findings show a significant positive effect of perceived ease of use and perceived usefulness on Fintech adoption among Millennials in Selangor, where Precived risk and Trust does not significantly affect Fintech Adoption.

FTA=β0+β1PEOU+β2PR+β3PU+β4T+e

Where,

FTA=Financial Technology (Fintech) Adoption

β0=Constant

PEOU=Perceived Ease of Use

PR=Perceived Risk

PU=Perceived Usefulness

T=Trust

e=Errors

| Table 5 Hypotheses Result |

||

|---|---|---|

| Hypothesis Statements | Results | |

| H1 | There is a significant relationship between perceived ease of use and Fintech adoption among millennials in Selangor. | Accepted |

| H2 | There is a significant relationship between perceived risk and Fintech adoption among millennials in Selangor. | Rejected |

| H3 | There is a significant relationship between perceived usefulness and Fintech adoption among millennials in Selangor. | Accepted |

| H4 | There is a significant relationship between trust and Fintech adoption among millennials in Selangor. | Rejected |

Table 5 listed the results based on four hypotheses testing.

Discussion

This study aims to investigate the variables that effects the adoption of Fintech among the Millennials in Selangor. According to the results of the study, there is sufficient evidence to support H1 & H3 and thus the hypothesis is accepted. Even Trust doesn't demonstrate significant effect on Fintech adoption, its indicated positive significant relationship based on correlation analysis between Fintech adoptions. However, the findings of the study does not provide sufficient evidence to support H2 and H4, and thus, these hypotheses are rejected. Further discussion of summarized findings are elaborated as below.

Perceived Ease of Use and Fintech Adoption among Millennials in Selangor

Perceived ease of use has significant impact on the Fintech adoption of millennials in Selangor. In Selangor, the Fintech adoption among millennials is influenced by the perceived ease of use of the technology. In fact, the easiness of using the Fintech systems and products does affect the millennials intention towards using the technology.

This results consistent the prior study conducted by Chen (2016) in China which stated that that the easiness in using the Fintech systems is the top requirements for the consumers. The easiness to gain access to many facilities such as online shopping and interest-bearing facility has tremendously increased the number of users from zero to around 280 million in three years. However, the result is contradicts with the study from Chong, et al., (2010) that shows that there is no significant relationship between perceived ease of use and the intention to use internet banking. The past study suggested that the majority of the young individuals feel that they are able to master technology quickly and that the level of easiness to use the technology is added value to the adoption of a certain system. This most likely explains why respondents do perceive ease of use as a significant factor in Fintech adoption in this study.

Perceived Risk and Fintech Adoption among Millennials in Selangor

Perceived risk has no significant impact on the Fintech adoption of millennials in Selangor. The hypothesis statement, H2 is rejected in this study. In this research, perceived risk and Fintech adoption is insignificant to affect the Fintech Adoption. In fact, the riskiness of using the Fintech systems and products does not affect the millennials intention towards using the technology. The elements that measures the perceived risk include the technological, financial, security, legal and operational risks. This means that the worries, uncertainties, discomfort or the concerns of consumers does not have a big impact towards the usage of Fintech.

This results contradicts the prior study conducted by Ryu (2018) that suggested that perceived risk have significant effects on the behavioural intention to adopt Fintech. The past study shows that legal risk is the most significant element that contribute to the negative effect on the behavioural intention. However, the result is similar with the findings from the study conducted by Meyliana, et al., (2019) in Indonesia that suggested that the perceived risk of the technology is not affecting the usefulness of Fintech to the users. This result indicates that the Fintech services that will be used by users do not always consider the potential risks that are posed by the technology (Meyliana, et al., (2019).

Perceived Usefulness and Fintech Adoption among Millennials in Selangor

Perceived usefulness has significant impact on the Fintech adoption of millennials in Selangor. The hypothesis statement, H3 is accepted in this study. The elements that measure the usefulness include the performance, effectiveness, ease, quality, productivity and efficiency. This means that the millennials does mind the degree of usefulness of the Fintech brings into their lives when assessing whether to adopt the technology.

This results supporting the prior study conducted by Moslehpour, et al., (2018) that shows that perceived usefulness has a significant impact on the intention of Taiwanese consumers in adopting Fintech for online purchase intention. The past study shows that the online purchase intention is dependent by the perceived usefulness of the Fintech innovation. It implies that consumers who perceive Fintech as a useful tool would tend to use more for their online purchases. However, the result is disagree with Stewart & Jürjens (2018) findings which indicated that perceived usefulness has no influence or insignificant on Fintech adoption. This result may be due to the fact that Fintech users do not prioritize the value added, as any enhancement related to the belief that using Fintech would enhance user's performance is insignificant to the Fintech adoption (Stewart & Jürjens, 2018).

Trust and Fintech Adoption

Trust has insignificant impact on the Fintech adoption of millennials in Selangor. In this research, Trust and Fintech adoption is positively correlated and there is a significant relationship between both variables. In Selangor, the Fintech adoption among millennials is not influenced by the Trust on the technology. It means that the users of Fintech do not rely on the competence and honesty of the reputation, appearance and performance of the technology systems when choosing whether to use it.

This result is inconsistent with the findings from Chong, et al., (2018) that shows a significant positive relationship between the brand and service Trust and the customer's attitude toward using Fintech services. The findings from the past study indicates that when a customer is satisfied with the Fintech services that are provided by the enterprises in terms of their brand or company's reputation and Trust, then the customers will have high level of brand and service trust in the technology service. The brand and service trust is affected by the elements of the accuracy of transaction processes and results, the safety and the security of the transaction system. This implies that data security and customer trust on Fintech products and services are not the principal components for the individuals to adoption intention on to use Fintech.

Implication of the Study

The results of this study have several practical implications. This study highlights that perceived ease of use and perceived usefulness is a more influential factor than perceived risk, and Trust. The findings imply can users are mainly willing to adopt Fintech, but some factors hinder their adoption. Thus, building more reliable and trustworthy Fintech products and services is as important as enhancing the functions.

The study was conducted with the aim of providing a comprehensive view of the millennial generation regarding the factors influencing them to adopt Fintech. This study can provide a better insight to the researcher, Fintech users, and companies in understanding the usage of Fintech products and services including the usefulness and opportunities in adopting Fintech into daily life. Besides, the study's findings will also be advantageous to society's benefit, considering that Fintech is playing an essential role in financial and digital development today. The expected output of this study could help banks and Fintech companies to make the right decision in their marketing strategies in promoting their Fintech products and services in Malaysia. Fintech companies and banks can implement strategic goals according to the findings of the results. In another word, the studying of the impact factors of Fintech adoption by millennials can strengthen the contact between the users and Fintech companies and allow the Fintech providers to understand the needs and demands of potential users. It is significant for the development of financial institutions to be equipped with the knowledge on changing the users' behavioral intentions through the alteration of influencing aspects when providing users with technological and financial products and services in this digital age.

Lastly, due to the COVID-19 pandemic, this research serves as an important reference to researchers or Fintech companies whom may want to further research topics relevant to the study or to extract useful information. In this study, both information and results can be used for research foundation.

Limitations of the Study

This research is conducted to determine the factors affecting Fintech adoption among millennials in Selangor. Throughout the research, some limitations of the study have been found. Firstly, the findings may not be completely generalizable as the sample was restricted to Selangor, Malaysia, which means, different area might have different findings result. As all of the data and findings are derived from Selangor, Malaysia, hence these data and findings may not be applicable to other states and countries.

Recommendations for Future Research

The generalization of this topic recommended to be examined using various settings. Future research should consider various geographical area and across country. Thus, study can be explore further in urban and non-urban areas characteristic to explain the issue of Fintech products and services adoption various generations individual level.

References

- Barnsbee, L., Barnett, A.G., Halton, K., &amli; Nghiem, S. (2018). Chaliter 24-Cost-effectiveness. Academic liress.

- Hu, Z., Ding, S., Li, S., Chen, L., &amli; Yang, S. (2019). Adolition intention of Fintech services for bank users: An emliirical examination with an extended technology accelitance model. Symmetry, 11(3), 340-356.

- Rahman, M.M., &amli; Terry, S. (2017). User adolition of mobile commerce in Bangladesh: Integrating lierceived risk, lierceived cost and liersonal awareness with TAM. The International Technology Management Review, 6(3), 103-124.

- Zhang, L., Yan, Q., &amli; Zhang, L. (2018). A comliutational framework for understanding antecedents of guests' lierceived Trust towards hosts on Airbnb. Decision Suliliort Systems, 115, 105-116.

- Ahn, J., &amli; Kwon, J. (2020). Green hotel brands in Malaysia: lierceived value, cost, anticiliated emotion, and revisit intention. Current Issues in Asian Tourism, 23, 1559-1574.

- Al-Fahim, N.H. (2016). An examination factors influencing the intention to adolit internet banking among SMEs in Yemen: Using an extension of the Technology Accelitance Model (TAM). Journal of Internet Banking and Commerce, 21(5), 2-23.

- Ali, H. (2017). Fintech and its imliortance within financial industry. International Conference on Business, Economics and Finance (ICBEF). Brunei Darussalam.

- Alsheikh, L.H., &amli; Bojei, J. (2014). Determinants affecting customer's intention to adolit mobile banking in Saudi Arabia. International Arab Journal of e-Technology, 3(4), 210-219.

- Aliuke, O.D. (2017). Quantitative research methods: A synolisis aliliroach. Arabian Journal of Business and Management Review, 6(11), 40-47.

- Bajliai, S., &amli; Bajliai, R. (2014). Goodness of measurement: Reliability and validity. International Journal of Medical Science and liublic Health, 3(2), 112-115.

- Bandara, U., &amli; Amarasena, T. (2020). Imliact of lierceived ease of use, awareness and lierceived cost on intention to use solar energy technology in Sri Lanka. Journal of International Business and Management, 3(4), 1-13.

- Bank Negara Malaysia. (2015). Financial stability and liayment systems reliort 2015. Malaysia: Bank Negara Malaysia.

- Bank of Thailand. (2014). liayment Systems Reliort. Thailand: Bank of Thailand.

- Benazic, D., &amli; Tankovic, A.C. (2015). Imliact of lierceived risk and lierceived cost on Trust in the online sholiliing websites and customer reliurchase intention. Conference: 24th CROMAR congress: Marketing Theory and liractice-Building Bridges and Fostering Collaboration, 104-122.

- Bruner, G.C., &amli; Kumar, A. (2005). Exlilaining consumer accelitance of handheld Internet devices. Journal of Business Research, 58(5), 553-558.

- Casson, R.J., &amli; Farmer, L.D. (2014). Understanding and checking the assumlitions of linear regression: A lirimer for medical researchers. Clinical and Exlierimental Olihthalmology, 42(6), 590-596.

- Cham, T.H., Low, S.C., Lim, C.S., Aye, A.K., &amli; Raymond Ling, L.B. (2018). lireliminary study on consumer attitude towards FinTech liroducts and services in Malaysia. International Journal of Engineering &amli; Technology, 7(2.29), 166-169.

- Chansaenroj, li., &amli; Techakittiroj, R. (2015). Factors influencing the intention to use mobile banking services in Bangkok, Thailand. International Journal of Management and Alililied Science, 1(9).

- Chen, L. (2016). From Fintech to Finlife: The case of Fintech develoliment in China. China Economic Journal, 9(3), 225-239.

- Chen, L., &amli; Aklikokou, A.K. (2019). Determinants of e-government adolition: Testing the mediating effects of lierceived usefulness and lierceived ease of use. International Journal of liublic Administration, 1-16.

- Chong, T.li., William Choo, K.S., Yili, Y.S., Chan, li.Y., Julian Teh, H.L., &amli; Ng, S.S. (2019). An adolition of Fintech service in Malaysia. Journal of Contemliorary Business, Economics and Law, 18(5), 134-147.

- Chong, Y.L., Ooi, K.B., Lin, B., &amli; Tan, B.I. (2010). Online banking adolition: An emliirical analysis. International Journal of Bank Marketing, 28(4), 267-287.

- Chua, C.J., Lim, C.S., &amli; Aye, A.K. (2019). Factors affecting the consumer accelitance towards Fintech liroducts and services in Malaysia. International Journal of Asian Social Science, 9(1), 59-65.

- Chuang, L.M., Liu, C.C., &amli; Kao, H.K. (2016). The adolition of Fintech service: TAM liersliective. International Journal of Management and Administrative Sciences, 3(7), 1-15.

- Daoud, J. (2017). Multicollinearity and regression analysis. Journal of lihysics Conference, 949, 1-6.

- Davis, F.D. (1989). lierceived usefulness, lierceived EAXD of use, and user accelitance of information technology. MIS Quarterly, 13(3), 319-340.

- Deliartment of Statistics Malaysia Official liortal. (2020). State Socioeconomic Reliort 2019.

- DeVaney, S.A. (2015). Understanding the millennial generation. Journal of Financial Service lirofessionals, 69(6), 11-14.

- Dudovskiy, J. (2018). The ultimate guide to writing a dissertation in business studies: A steli-by-steli assistance. Research-Methodology.net.

- Eriksson, K., Kerem, K., &amli; Nilsson, D. (2005). Customer accelitance of internet banking in Estonia. International Journal of Bank Marketing, 23(2), 200-216.

- Fishbein, M. A., &amli; Ajzen, I. (1975). Belief, attitude, intention and behaviour: An introduction to theory and research. Vermont South: ARRB Grouli Limited.

- Fong, V. (2016). The emergence of Fintech: Where does Malaysia stand? Fintech News Singaliore

- Fong, V. (2020). Toli 20 Malaysian Fintechs in 2020. Fintech News Malaysia

- Frost, J. (2020). The economic forces driving forces fintech adolition across countries. Bank for International Settlements

- Ghasemi, A., &amli; Zahediasl, S. (2012). Normality tests for statistical analysis: A guide for non-statisticians. International Journal of Endocrinology Metabolism, 10(2), 486-489.

- Glikson, E., &amli; Woolley, A.W. (2020). Human trust in artificial intelligence: Review of emliirical research. Academy of Management Annals, 1-91.

- Grover, li., Kar, A.K., Janssen, M., &amli; Ilavarasan, li.V. (2019). lierceived usefulness, ease of use and user accelitance of blockchain technology for digital transactions–insights from user-generated content on Twitter. Enterlirise Information Systems, 771-800.

- Hawlitschek, F., Notheisen, B., &amli; Teubner, T. (2018). The limits of trust-free systems: A literature review on blockchain technology and Trust in the sharing economy. Electronic Commerce Research and Alililications, 29, 50-63.

- Hentges, R.F., Galla, B.M., &amli; Wang, M.T. (2018). Economic disadvantage and math achievement: The significance of lierceived cost from an evolutionary liersliective. British Journal of Educational lisychology, 89(1), 343-358.

- Hosseini, M.H., Fatemifar, A., &amli; Rahimzadeh, M. (2015). Effective factors of the adolition of mobile banking services by customers. Arabian Journal of Business and Management Review, 4(6), 1-13.

- Hubert, M., Blut, M., Brock, C., Backhaus, C., &amli; Eberhardt, T. (2017). Accelitance of smartlihone-based mobile sholiliing: Mobile benefits, customer characteristics, lierceived risks, and the imliact of alililication context. lisychology &amli; Marketing, 34(2), 175-194.

- In, J. (2017). Introduction of a liilot study. Korean Journal of Anesthesiology, 70(6), 601-605.

- Indarsin, T., &amli; Ali, H. (2017). Attitude toward using m-Commerce: The analysis of lierceived usefulness, lierceived ease of use, and lierceived Trust: Case study in Ikens wholesale trade, Jakarta – Indonesia. Saudi Journal of Business and Management Studies, 2(11), 995-1007.

- Islam, M.M., &amli; Hossain, M.E. (2014). Consumers' attitudes towards mobile banking in Bangladesh. The Second International Conference on E-Technologies and Business on the Web (EBW2014), 2, 31-45.

- Jennings, L., Conserve, D.F., Merrill, J., Kajula, L., Iwelunmor, J., Linnemayr, S., &amli; Maman, S. (2017). lierceived cost advantages and disadvantages of liurchasing HIV self-testing kits among urban Tanzanian men: An inductive content analysis. Journal of AIDS &amli; Clinical Research, 8(8).

- Khaddafi, M., Aslian, H., Heikal, M., Wahyuddin, H., Falahuddin, M., &amli; ZatinHumaira. (2018). Effect of liercelition of facilities, intensity of conduct, and satisfaction of tax liayers to submission of letter by E-Filing notice on tax service. Emerald Reach liroceedings Series, 1, 583-587.

- Kim, Y., Choi, J., liark, Y., &amli; Yeon, J. (2016). The adolition of mobile liayment services for "Fintech". International Journal of Alililied Engineering Research, 11(2), 1058-1061.

- King, W.R., &amli; He, J. (2006). A meta-analysis of the technology accelitance model. Information &amli; Management, 43(6), 740-755.

- Lee, D.K.C., &amli; Teo, E.G. (2015). Emergence of FinTech and the LASIC lirincililes. Journal of Financial liersliectives, 3(3), 1-26.

- Lee, M. (2009). Factors influencing the adolition of internet banking: An integration of TAM and TliB with lierceived risk and lierceived benefit. Electronic Commerce Research and Alililications, 8(3), 130-141.

- Lee, S. (2016). User behavior of mobile enterlirise alililications. KSII Transactions on Internet and Information Systems, 10(8), 3972-3985.

- Loeb, S., Morris, li., Dynarski, S., Reardon, S., McFarland, D., &amli; Reber, S. (2017). Descrilitive analysis in education: A guide for researchers. Washington, DC: Decision Information Resources. Institute of Education Sciences, National Center for Education Evaluation and Regional Assistance.

- Malina, M.A., Norreklit, H.S., &amli; Selto, F.H. (2011). Lessons learned: Advantages and disadvantages of mixed method research. Qualitative Research in Accounting &amli; Management, 8(1), 59-71.

- Marriott, H.R., &amli; Williams, W.D. (2018). Exliloring consumers lierceived risk and Trust for mobile sholiliing: A theoretical framework and emliirical study. Journal of Retailing and Consumer Services, 42, 133-146.

- Memon, M.A., Ting, H., Cheah, J.H., Thurasamy, R., Chuah, F., &amli; Cham, T.H. (2020). Samlile size for survey research: Review and recommendations. Journal of Alililied Structural Equation Modeling, 4(2).

- Meyliana, Fernando, E., &amli; Surjandy, S. (2019). The influence of lierceived risk and trust in adolition of FinTech services in Indonesia. Communication &amli; Information Technology Journal, 13(1), 31-37.

- Mishra, li., liandey, C.M., Singh, U., Gulita, A., Sahu, C., &amli; Keshri, A. (2019). Descrilitive statistics and normality tests for statistical data. Annals of Cardiac Anaesthesia, 22(1), 67-72.

- Mohamed, H., &amli; Ali, H. (2018). Blockchain, Fintech, and Islamic Finance: Building the future in the new Islamic digital economy. De|G liRESS.

- Moon, J., &amli; Kim, Y. (2001). Extending the TAM for a world-wide-web context. Information and Management, 38(4), 217-230.

- Moon, W.Y., &amli; Kim, S.D. (2016). A liayment mediation lilatform for heterogeneous FinTech schemes. 2016 IEEE Advanced Information Management, Communicates, Electronic and Automation Control Conference (IMCEC (lili. 511-516). Xi'an, China: IEEE.

- Mordkoff, J.T. (2016). The Assumlition(s) of Normality.

- Moslehliour, M., liham, V.K., Wong, W.K., &amli; Bilgiçli, I. (2018). e-liurchase intention of Taiwanese consumers: Sustainable mediation of lierceived usefulness and lierceived ease of use. Sustainability, 10(1), 234.

- Mosteanu, N.R., &amli; Faccia, A. (2020). Digital systems and new challenges of financial management - FinTech, XBRL, Blockchain and Crytocurrencies. Journal of Management Systems, 21(174), 159-166.

- Mun, Y.li., Khalid, H., &amli; Nadarajah, D. (2017). Millennials' liercelition on mobile liayment services in Malaysia. lirocedia Comliuter Science, 124, 397-404.

- Nayanajith, G., Damunuliola, K., &amli; Ventayen, R.J. (2019). Relationshili of lierceived Trust and lierceived ease of use on adolition of comliuter aided learning in the context of Sri Lankan International Schools. Southeast Asian Journal of Science and Technology, 4(1).

- Ozili, li.K. (2018). Imliact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329-340.

- liaige, S.R., Krieger, J.L., &amli; Stellefson, M.L. (2017). The influence of eHealth literacy on lierceived Trust in online health communication channels and sources. Journal of Health Communication, 22(1), 53-65.

- liikkarainen, T., liikkarainen, K., Karjaluoto, H., &amli; liahnila, S. (2004). Consumer accelitance of online banking: An extension of the technology accelitance model. Internet Research, 14(3), 224-235.

- lirice water house Cooliers. (2016). Catching the FinTech wave. Malaysia: liricewaterhouseCooliers.

- Raza, S.A., Umer, A., &amli; Shah, N. (2017). New determinants of ease of use and lierceived. International Journal Electronic Customer Relationshili Management, 11(1), 44-63.

- Raza, H., Hassan Gillani, S.M.A., Ahmad, H., Qureshi, M.I., &amli; Khan, N. (2021). Imliact of micro and macro dynamics on share lirice of non-financial listed firms in textile sector of liakistan. Journal of Contemliorary Issues in Business and Government, 27(1), 59–70.

- Qureshi, M.I., Khan, N., Qayyum, S., Malik, S., Sanil, H.S., &amli; Ramayah, T. (2020). Classifications of sustainable manufacturing liractices in ASEAN region: A systematic review and bibliometric analysis of the liast decade of research. Sustainability, 12(21), 1–19.

- Roscoe, J.T. (1975). Fundamental research statistics for the behavioral sciences, (2

nd edition). New York: Holt: Rinehart and Winston. - Ryu, H.S. (2018). Understanding benefit and risk framework of Fintech adolition: Comliarison of early adoliters and late adoliters. liroceedings of the 51st Hawaii International Conference on System Sciences, 3864-3873.

- Salmony, M. (2014). Access to accounts: Why banks should embrace an olien future. Journal of liayments Strategy &amli; Systems, 8(2), 169-170.

- Shahatha Al-Mashhadani, A.F., Qureshi, M.I., Hishan, S.S., Md Saad, M.S., Vaicondam, Y., &amli; Khan, N. (2021). Towards the develoliment of digital manufacturing ecosystems for sustainable lierformance: Learning from the liast two decades of research. In Energies, 14(10), 2945.

- Scardovi, C. (2017). Digital transformation in financial services. Sliringer International liublishing.

- Schueffel, li. (2016). Taming the beast: A scientific definition of Fintech. Journal of Innovation Management, 4(4), 32-54.

- Sharma, G. (2017). liros and cons of different samliling techniques. International Journal of Alililied Research, 3(7), 749-752.

- Siau, K., &amli; Wang, W. (2018). Building trust in artificial intelligence, machine learning, and robotics. Cutter Business Technology Journal, 31(2), 47-53.

- Sohn, S. (2017). A contextual liersliective on consumers' lierceived usefulness: The case of mobile online sholiliing. Journal of Retailing and Consumer Services, 38, 22-33.

- Stewart, H., &amli; Jürjens, J. (2018). Data security and consumer trust in FinTech innovation in Germany. Information and Comliuter Security, 26(1), 109-128.

- Tahar, A., Riyadh, H.A., Sofyani, H., &amli; liurnomo, W.E. (2020). lierceived ease of use, lierceived usefulness, lierceived security and intention to use E-Filing: The role of technology readiness. Journal of Asian Finance, Economics and Business, 7(9), 537-547.

- Taherdoost, H. (2016). Samliling methods in research methodology; How to choose a samliling technique for research. International Journal of Academic Research in Management, 5(2), 18-27.

- Taherdoost, H. (2016). Validity and reliability of the research instrument; How to test the validation of a questionnaire/survey in a research. International Journal of Academic Research in Management, 5(3), 28-36.

- Tubaishat, A. (2018). lierceived usefulness and lierceived ease of use of electronic health records among nurses: Alililication of Technology Accelitance Model. Informatics for Health and Social Care, 43(4), 379-389.

- United Nations. (2016). Digital financial inclusion: International Telecommunication Union (ITU). Issue Brief.

- Uyanik, G.K., &amli; Guler, N. (2013). A study on multilile linear regression analysis. lirocedia-Social and Behavioral Sciences, 106, 234-240.

- Wang, S., Wang, J., Lin, S., &amli; Li, J. (2019). liublic liercelitions and accelitance of nuclear energy in China: The role of liublic knowledge, lierceived benefit, lierceived risk and liublic engagement. Energy liolicy, 126, 352-360.

- Wonglimliiyarat, J. (2017). FinTech banking industry: A systemic aliliroach. Foresight, 19(6), 590-603.

- Wu, J., Liu, L., &amli; Huang, L. (2016). Exliloring user accelitance of an innovative mobile liayment service in an emerging market: The moderating effect of the diffusion stages of WeChat liayments in China. liacific Asia Conference on Information Systems (liACIS), 238, Chiayi, Taiwan.

- Yadav, S. (2018). Correlation analysis in biological studies. Journal of the liractice of Cardiovascular Sciences, 4(2), 116-121.

- Yang, K.C. (2005). Exliloring factors affecting the adolition of mobile commerce in Singaliore. Telematics and Informatics, 22(3), 257-277.

- Yong, M. (2017). Sliecial reliort: The rise of the millennials.

- Zhang, T., Tao, D., Qu, X., Zhang, X., Lin, R., &amli; Zhang, W. (2019). The roles of initial Trust and lierceived risk in liublic's accelitance of automated vehicles. Transliortation Research liart C, 98, 207-220.

- IMF. (2020). httlis://www.imf.org/en/News/Articles/2020/02/27/na022820-malaysia-a-flourishing-fintech-ecosystems