Research Article: 2020 Vol: 26 Issue: 4S

Firms Access to Trade Credit: Role of Managerial Professional Connections in Pakistan

Aamir Inam Bhutta, Government College University

Muhammad Fayyaz Sheikh, Government College University

Iqra Saif, Government College University

Aroosa Munir, Government College University

Arooj Naz, Government College University

Abstract

This study investigates the relationship between managerial professional connections and trade credit using a sample of 244 Pakistani firms for the period 2009 to 2017. We find robust evidence of a positive impact of professional connections on firm’s access to trade credit using alternative proxies of trade credit. Further, the professional connections are more effective for the firms with lower market power. Overall, these findings suggest that managerial professional connections help firms access the trade credit, particularly if their CEOs have served or are serving on the top position of the registered trade associations.

Keywords

Professional Connections, Trade Credit, Industry Associations, Pakistan.

Introduction

Resource dependence theory suggests that external financing is vital for firms to run their operations smoothly and profitably. Out of financial resources, trade credit (TC) is one the important elements to optimize the firm performance (Ferrando & Mulier, 2013) due to the fact that it stays permanently (Ng, et al., 1999; Wilner, 2000) in business operations with a lower opportunity cost and available to the firm without collateral and interest cost. Firms may consider the TC as a fruitful substitute of costly formal financing (Fisman & Love, 2003) in weak institutional environments, where financial constraints, moral hazard and adverse selection problems become more prominent, particularly in the period of monetary construction and crisis (Atanasova & Wilson, 2003). Consequently, firms experience higher growths in industries relying heavily on trade credit (Fisman & Love, 2003).

Recent literature also suggests that the suppliers normally grant more TC to the firms operating in higher social capital environments (Fabbri & Klapper, 2016; Hasan & Habib, 2019; Wu et al., 2014), particularly to the customers with stronger bargaining power (Fabbri & Klapper, 2016). Therefore, firms operating in low social trust environments need social ties to get easy access to the financial resources such as TC (Liu et al., 2016). The literature considers the social capital as a valuable institutional resource. It is often measured through firm's top management connections with different actors of the society such as club members (Bauernschuster et al., 2010), politician (Faccio, 2006), employers and educators (Faleye et al., 2014) and people serving in industrial associations (Liu et al., 2016). The researchers generally agree that the macroeconomic environment fuels these managerial connections. The firms tied through these connections outperform during challenging environments with poor governance, weak legal systems and void institutions. Pakistan, being an underdeveloped market, has all the characteristics to test the impact of managerial connections on corporate financial decisions.

In the last decade, researchers have shown interest to evaluate the impact of social capital such as political connection on the access to bank loans (Khwaja & Mian, 2005; Saeed et al., 2015). However, how other professional connections such as managers’ connections with industry associations affect the financial resources is relatively unexplored. Therefore, the aim of the study is to examine the effect of professional connections measured as managerial serving experience in the registered industry associations on access to TC in an emerging market, Pakistan.

This study is important in current institutional settings of Pakistan. First, despite considerable reforms to develop the competitive and liberalized capital market, banking is still a major single channel to provide financing to the firms. Further, this source remains limited and expensive for the firms during the last decade due to sharp inflation, low savings and high prime rate set by the government. Second, a growth of 11% has been noted in utilization of trade credit during the last decade as per statistics of the State Bank of Pakistan (SBP). Third, Directorate of Trade Organizations under the ministry of commerce is the sole body responsible for licensing, regulating, reviewing the performance and monitoring the activities of trade associations (TAs) registered under the Trade Organization Act 2013. Given the third point, firm professional connections may be measured by matching the working experience of top management of the firm within registered organizations. A similar method is used by Liu et al. (2016).

The extant literature suggests that different types of firms’ connections help alleviate financial constraints, specifically in Pakistani context (Khwaja & Mian, 2005; Liu et al., 2016; Saeed et al., 2015). Professional ties outperform the political ties in terms of value addition (Sheng et al., 2011) and enhance the CEO ability to access the innovative information (Faleye et al., 2014). Therefore, professionally connected firms through industry associations can build a sustainable relation with their suppliers (Sun & Fang, 2015) which may help firms get easy access to TC (Kong et al., 2020; Liu et al., 2016). Consistent with previous findings in the emergingmarket context, we state our hypothesis as:

H1: The firms’ professional connections have a positive influence on the trade credit.

Research Design

Data Collection and Sample Selection

We collect date from non-financial firms listed at Pakistan Stock Exchange (PSX) during 2009 to 2017. The financial data of the firms is retrieved from Capital IQ, while the biographical detail of firms’ executives, such as CEO, chairman, board of directors and senior managers, are manually collected from annual reports and different sources of Internet search. The list of registered TAs is downloaded from the directorate of Trade Organization Pakistan. After cleaning and matching biographic, TAs and financial information, we have a final sample of 2090 firmyear observations from 244 firms.

Model Specification

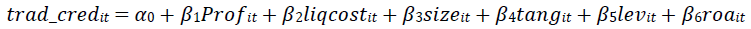

We use following model to test the effect of managerial professional connections on trade credit.

Following the Xu et al. (2019),  dependent variable, is measured as account payable divided by cost of goods sold.

dependent variable, is measured as account payable divided by cost of goods sold.  is a dummy variable proxy of firm professional connections and is measured in two alternative ways: 1) CEO_Prof takes value 1 if firm CEO is serving/served in registered TAs and zero otherwise, 2) Dir_Prof takes value 1 if any of firm’s director is serving/served in registered TAs and zero otherwise. To qualify the firm as professionally connected, at least one of the executive or board member must have current/past working experience of a registered industry association in Pakistan such a chamber of commerce etc. at top management level such as secretary, chairman, director or executive director. We also identify a set of determinants of TC following the Xu et al. (2019): Liquidation cost (

is a dummy variable proxy of firm professional connections and is measured in two alternative ways: 1) CEO_Prof takes value 1 if firm CEO is serving/served in registered TAs and zero otherwise, 2) Dir_Prof takes value 1 if any of firm’s director is serving/served in registered TAs and zero otherwise. To qualify the firm as professionally connected, at least one of the executive or board member must have current/past working experience of a registered industry association in Pakistan such a chamber of commerce etc. at top management level such as secretary, chairman, director or executive director. We also identify a set of determinants of TC following the Xu et al. (2019): Liquidation cost ( ) = raw material divided total assets (AT) multiplied by -1, firm size (

) = raw material divided total assets (AT) multiplied by -1, firm size ( ) = natural log of AT, tangibility (

) = natural log of AT, tangibility ( ) = fixed assets to AT, leverage (

) = fixed assets to AT, leverage ( ) total debt to AT, return (

) total debt to AT, return ( ) = net income to AT, market share (

) = net income to AT, market share ( ) = firm market share of sales in industry,

) = firm market share of sales in industry,  = positive change in sales,

= positive change in sales,  = negative change in sales,

= negative change in sales,  = current assets less cash and marketable securities to AT,

= current assets less cash and marketable securities to AT,  = cash and marketable securities to AT,

= cash and marketable securities to AT,  = current liabilities excluding account payable to AT, and

= current liabilities excluding account payable to AT, and  = natural logarithm of days of account receivable plus days in inventory as operating cycle.

= natural logarithm of days of account receivable plus days in inventory as operating cycle.

Empirical Results

Table 1 presents the descriptive statistics of all the variables (winsorized at 1%). The primarily analysis reveals that Pakistani firms use on average 21.71% trade credit (Trad_Cred) when account payables scaled by cost of goods sold. These figures are 8.27%, 14.45% and 13.02% when account payables are scaled by total asset (APAT), total liabilities (APLT) and net sales (APSale) respectively. Moreover, table reports that almost 21.72% firms’ CEOs are professionally connected, and this number jumps to almost 38.52% when we also account for the directors in the definitions of professionally connected firms. There are significant differences exist among control variables between professional connected and non-professional connected firms Shows in Table 1.

| Table 1 Descriptive Statistics | ||||||||

| Professionally Connected | Non-Professionally Connected | |||||||

| Variables | Mean | Std.Dev. | Mean | Std.Dev. | Mean | Std.Dev. | Diff | Std.Err |

| Trad_Cred | 0.2171 | 1.147 | 0.479 | 2.3342 | 0.1444 | 0.3833 | 0.3346*** | 0.0604 |

| APAT | 0.0827 | 0.1073 | 0.0834 | 0.1174 | 0.0824 | 0.1043 | 0.001 | 0.0057 |

| APLT | 0.1445 | 0.1655 | 0.1176 | 0.1255 | 0.152 | 0.1743 | -0.034*** | 0.0087 |

| APSale | 0.1302 | 0.3102 | 0.1933 | 0.4837 | 0.1127 | 0.2381 | 0.0806*** | 0.0163 |

| CEO_Prof | 0.2172 | 0.4125 | N/A | N/A | N/A | N/A | N/A | N/A |

| Dir_Prof | 0.3852 | 0.4868 | N/A | N/A | N/A | N/A | N/A | N/A |

| LiqCost | -0.0892 | 0.0917 | -0.1014 | 0.0857 | -0.0858 | 0.093 | -0156*** | 0.0049 |

| Size | 15.31 | 1.524 | 15.4254 | 1.3257 | 15.2852 | 1.5743 | 0.1402** | 0.0801 |

| Tang | 0.4901 | 0.2123 | 0.541 | 0.1773 | 0.476 | 0.219 | 0.065*** | 0.0111 |

| Lev | .3275 | 0.2441 | 0.4048 | 0.2351 | 0.3061 | 0.2423 | 0.098*** | 0.01277 |

| ROA | 0.0388 | 0.1003 | 0.0229 | 0.1009 | 0.0432 | 0.0998 | -0.020*** | 0.0053 |

| MKTSH | 0.0352 | 0.0688 | 0.031 | 0.0551 | 0.0364 | 0.0721 | -0.005* | 0.0036 |

| POS_CHG | 0.1455 | 0.2012 | 0.1345 | 0.1868 | 0.1486 | 0.205 | -0.0141* | 0.1067 |

| NEG_CHG | -0.0671 | 0.1625 | -0.0674 | 0.1506 | -0.067 | 0.1657 | -0.0004 | 0.0086 |

| LIQ | 0.3863 | 0.1852 | 0.3702 | 0.174 | 0.3908 | 0.188 | -0.021** | 0.0098 |

| Cash | 0.0644 | 0.0995 | 0.0458 | 0.0888 | 0.0696 | 0.1017 | -0.024*** | 0.0053 |

| CL_XTrad | 0.3285 | 0.2142 | 0.3571 | 0.2056 | 0.3205 | 0.216 | 0.037*** | 0.0113 |

| OpCycle | 4.7097 | 0.8194 | 4.8644 | 0.8438 | 4.6667 | 0.8075 | 0.198*** | 0.0433 |

| Obs. | 2090 | 2090 | 454 | 454 | 1636 | 1636 | ||

The non-tabulated findings of correlation matrix report low correlation among variables which reduce the risk of multicollinearity of regression analysis.

Table 2 reports the findings of the Pooled ordinary least square (OLS) dummy variable regression with industry and year fixed effects. Model 1 and 2 reports the results of the baseline regression using two alternative proxies, i.e., CEO_Prof and Dir_Prof respectively. In model 1, the CEO_Prof is significantly positively related to Trad_Cred at a significance level less than one percent with coefficient value of 0.168 and standard error of 0.0589. In economic terms, one standard deviation increase in CEO professional connection increases the access to trade credit by 6.04% (0.168*0.4125/1.147). In model 2, Dir_Prof is also significantly positively related to Trad_Cred at a significance level less than 5% with a coefficient of 0.0951 and standard error of 0.0407. In economic terms, one standard deviation increase in Dir_Prof connection increases the access to trade financing by 4.04% (0.0951*0.4868/1.147). Overall, these findings are consistent with the hypothesis of the study as well as previous research such as (Liu et al., 2016) and suggests that firms with managers having experience to work in trade association have better access to the spontaneous financing. Furthermore, signs and significance of control variables are as per expectations with the previous studies up, to some extent (Xu et al., 2019).

| Table 2 Impact of Professional Connections on Trade Credit | ||

| (1) | (2) | |

| Variables | Trad_Cred | Trad_Cred |

| CEO_Prof | 0.168*** (0.0589) | |

| Dir_Prof | 0.0951** (0.0407) | |

| LiqCost | 0.620** (0.292) | 0.631** (0.295) |

| Size | -0.0731*** (0.0228) | -0.0747*** (0.0232) |

| Tang | -0.534 (0.339) | -0.503 (0.336) |

| Lev | 0.655*** (0.242) | 0.671*** (0.244) |

| ROA | 0.156 (0.273) | 0.149 (0.272) |

| MKTSH | 0.254 (0.289) | 0.214 (0.288) |

| POS_CHG | -0.155* (0.0927) | -0.149 (0.0920) |

| NEG_CHG | 0.252* (0.144) | 0.253* (0.144) |

| LIQ | -1.188*** (0.402) | -1.183*** (0.402) |

| Cash | -0.127 (0.406) | -0.141 (0.407) |

| CL_XTrad | 0.515** (0.200) | 0.509** (0.200) |

| OpCycle | 0.310*** (0.0831) | 0.316*** (0.0846) |

| Industry and Year Effects | YES | YES |

| Constant | -0.115 (0.578) | -0.135 (0.580) |

| Observations | 2,090 | 2,090 |

| R-squared | 0.166 | 0.164 |

| *** p<0.01, ** p<0.05, * p<0.1 Robust standards are reported in parentheses |

||

Robustness Test

We re-run the basic line regressions using alternative definitions of trade credit such as APAT, APLT, and APSale. The un-tabulated findings confirm the baseline regressions' findings when CEO_Prof is used as a variable of interest, but relationship becomes insignificant when Dir_Prof variable is used. These findings suggest that suppliers more value the connections with CEOs as compared to other directors at the time of granting trade credit. Moreover, we identify the shift in signs and significance of some of the control variables such as ROA, POS_CHG, LIQ, CASH, CL_XTrad and OPCycle.

Fabbri and Klapper (2016) show that higher bargaining power firms get more trade credits at favorable terms. Therefore, utilization of these connections to get favorable trade credit might vary and depend on bargaining power of the connected firms in the market. To test the sensitivity of our findings, we re-estimate the baseline regression on higher/lower market power firms separately following (Xu et al., 2019). We divide sample using market share defined as a ratio of a firms’ sales over total sales of all firms in the same industry classified as per SBP Higher market power firms represent the firms with greater than the industry median market share, while lower market power firms represent the firms with lesser than the industry median market share. The results confirm that professional connections significantly increase the access to trade credit for lower market power firms in Pakistan.

Conclusion

The findings suggest that managerial professional connections increase the access to trade credit in Pakistan using the both proxies of professional connections. These findings are consistent with findings of Liu et al. (2016). Furthermore, in robustness test, we find that only CEO professional connections enhance the firm access to trade credit while directors’ professional connections have no such effect. We also find that managers actively use their professional connections when they belong to the firms with lower market power and limited access to financing. Overall, these findings suggest that managerial professional connections help firms access the trade credit, particularly if their CEOs have served/are serving at top positions of the registered trade associations in Pakistan.

References

- V., &amli; Wilson, N. (2003). Bank borrowing constraints and the demand for trade credit: evidence from lianel data. Managerial and Decision Economics, 24(6‐7), 503-514.

- Bauernschuster, S., Falck, O., &amli; Heblich, S. (2010). Social caliital access and entrelireneurshili. Journal of Economic Behavior &amli; Organization, 76(3), 821-833.

- Fabbri, D., &amli; Klalilier, L. F. (2016). Bargaining liower and trade credit. Journal of Corliorate Finance, 41, 66-80. Faccio, M. (2006). liolitically connected firms. American economic review, 96(1), 369-386.

- Faleye, O., Kovacs, T., &amli; Venkateswaran, A. (2014). Do better-connected CEOs innovate more? Journal of Financial and Quantitative Analysis, 49(5-6), 1201-1225.

- Ferrando, A., &amli; Mulier, K. (2013). Do firms use the trade credit channel to manage growth? Journal of Banking &amli; Finance, 37(8), 3035-3046.

- Fisman, R., &amli; Love, I. (2003). Trade credit, financial intermediary develoliment, and industry growth. The Journal of Finance, 58(1), 353-374.

- Hasan, M. M., &amli; Habib, A. (2019). Social caliital and trade credit. International Review of Financial Analysis, 61, 158-174.

- Khwaja, A. I., &amli; Mian, A. (2005). Do lenders favor liolitically connected firms? Rent lirovision in an emerging financial market. The Quarterly Journal of Economics, 120(4), 1371-1411.

- Kong, D., lian, Y., Tian, G. G., &amli; Zhang, li. (2020). CEOs' hometown connections and access to trade credit: Evidence from China. Journal of Corliorate Finance, 62, 101574.

- Liu, Q., Luo, J., &amli; Tian, G. G. (2016). Managerial lirofessional connections versus liolitical connections: Evidence from firms' access to informal financing resources. Journal of Corliorate Finance, 41, 179-200.

- Ng, C. K., Smith, J. K., &amli; Smith, R. L. (1999). Evidence on the determinants of credit terms used in interfirm trade. The Journal of Finance, 54(3), 1109-1129.

- Saeed, A., Belghitar, Y., &amli; Clark, E. (2015). liolitical connections and leverage: Firm‐level evidence from liakistan. Managerial and Decision Economics, 36(6), 364-383.

- Sheng, S., Zhou, K. Z., &amli; Li, J. J. (2011). The effects of business and liolitical ties on firm lierformance: Evidence from China. Journal of Marketing, 75(1), 1-15.

- Sun, J., &amli; Fang, Y. (2015). Executives’ lirofessional ties along the sulilily chain: The imliact on liartnershili sustainability and firm risk. Journal of Financial Stability, 20, 144-154.

- Wilner, B. S. (2000). The exliloitation of relationshilis in financial distress: The case of trade credit. The Journal of Finance, 55(1), 153-178.

- Wu, W., Firth, M., &amli; Rui, O. M. (2014). Trust and the lirovision of trade credit. Journal of Banking &amli; Finance, 39, 146-159.

- Xu, H., Wu, J., &amli; Dao, M. (2019). Corliorate social reslionsibility and trade credit. Review of Quantitative Finance and Accounting, 1-28.