Research Article: 2021 Vol: 27 Issue: 5

Foreign Direct Investment (FDI) and Growth of Company's Export: A Case Study in Asean Countries

Felisitas Defung, Mulawarman University

Wahyu Dwi Purnomo, Mulawarman University

Annisa Kusumawardani, Mulawarman University

Citation Information: Defung, F., Purnomo, W.D., & Kusumawardani, A. (2021). Foreign Direct Investment (FDI) and growth of company’s export: a case study in asean countries. Academy of Entrepreneurship Journal (AEJ), 27(5), 1-12.

Abstract

The amount of FDI which flows to a country usually depends on the amount of output of multinational corporations in the country, or the magnitude of market size possessed by the country, which can be measured through GDP. This study aims to examine factors that affect FDI and export performed by ASEAN companies, particularly in the sector of technology and electronic industry. The economic growth (GDP), exchange rate, interest rate, inflation and population are included as independent variables and the analysis is conducted using panel data approach. This research is conducted by using a data panel, which includes data of macroeconomics and the data of 22 ASEAN companies in the sector of technology and electronics, for the period of 2012-2017. The results showed that interest rate and GDP significantly affect FDI and export. In addition, GDP and population also show a similar magnitude toward FDI; however, there is no meaningful effect on export. On the other hand, the effect of exchange rate on export is shown to be important but not for FDI. The results revealed that GDP, interest rate, inflation, and population are the factors that bring influence on FDI in the ASEAN. The study empirically examined the role of GDP, exchange rate, interest rate, inflation and population on FDI and export performed by companies located in ASEAN in the period of 2012-2017. The study is another empirical examination of the theory of ‘The Output and Market Size Hypothesis.’ This study only focusses on the secondary data from specific sector which probably limit the portray of export of ASEAN. The results imply that interest rate and GDP significantly affect FDI and export. There is possibility that as GDP growth stimulates FDI and export, and in the meantime the expansion of GDP and export boost the GDP growth

Keywords

Export, Foreign Direct Investment, Economics, Economics Growth.

Introduction

Foreign Direct Investment (FDI) is known as an important catalyst of economic development of a country due to the ability in improving the competitiveness of companies in the host country. FDI brings new capital, new technology, and also creates jobs as well as boosts international trade. The existence of the ASEAN Economic Community (AEC) is to improve economic competition of ASEAN countries by transforming the zone to production base, as well as to attract investors and to enhance international trade.

The countries in Southeast Asia have been building regional cooperation by establishing the Association of Southeast Asia Nation (ASEAN) in 1967. The purpose of this establishment is to enhance economic, trade and socio-cultural collaboration among member countries. Economic cooperation between the countries included in ASEAN is maintained by building ASEAN Economic Community (AEC). The aim of AEC is to enhance the economic competitiveness of ASEAN members by turning it into the base of production, to attract investors and to increase international trade. According to Salvatore (2014), the most common catalyst of economic development in developing countries is the activity namely ‘international trade’.

In the past, ASEAN had been considered as the motor of international trade. The export value possessed by ASEAN during the period of 2012-2017 was generally increased up to 1.51% per year. According to the data issued by ASEAN Secretariat, it increased from 1,538.03 billion USD in 2012 to 1,657.65 billion USD in 2017, and the biggest support of the export performed by ASEAN came from technology and electronics sectors, which reached 26% of the total export in 2017. Being in line with the enhancement of international trade in ASEAN, the percentage of FDI in the period of 2012-2017 increased by 7.68% per year, from 114.71 billion USD in 2012 to 166,09 billion USD in 2017 Shown in Table 1.

| Table 1 Asean Export and FDI in 2012-2017 | |||

| Year | Export Billion USD | FDI Billion USD | |

| ASEAN | 2012 | 1,538.03 | 114.71 |

| 2013 | 1,577.63 | 133.32 | |

| 2014 | 1,604.63 | 129.82 | |

| 2015 | 1,481.78 | 132.93 | |

| 2016 | 1,473.00 | 121.79 | |

| 2017 | 1,657.65 | 166.09 | |

The concept of Foreign Direct Investment (FDI) and trade is coherent. Meanwhile, investment, in the economics concept, is the first stage of trade. In spite of its level of economic development, the orientation of a country will always be creating economic policy that will be able to stimulate the FDI. Moreover, FDI itself is expected to be able to enhance economic development by making the companies which are located in the host country to be more competitive, to increase capital and new technology, and also to provide new jobs.

Before investing, Multinational corporations (MNCs), as the main channel of FDI, usually consider which factors will provide maximum advantage that determine the improvement of investment include Gross Domestic Product (GDP), inflation, interest rate, economic openness, international reserves, foreign debt, tax, politic right, infrastructure, availability of natural resources, size of market, labor fee, trade deficit, exchange rate and money development (Siddiqui & Aumeboonsuke, 2014).

Literature Review

The theory of ‘The Output and Market Size Hypothesis’ mentions that the amount of FDI which flows to a country depends on the amount of output of multinational corporations in the country, or the magnitude of market size possessed by the country, which can be measured through GDP Jorgenson (1963). A number of researches have been conducted in order to examine relation between GDP and FDI, among others are researches conducted by Siddiqui and Aumeboonsuke (2014); Singhania and Gupta (2011); Chingarande et al. (2012); Fornah and Yuehua (2017) and the results of the researches imply that GDP has positive and significant influence on FDI. On the other hand, the research conducted by Faroh and Shen (2015) generated a different result, that GDP insignificantly brings positive influence on FDI.

The theory so-called ‘the currency area hypothesis’ states that a company located in a country which poses a strong value of the currency tends to invest in a country which has a weak currency value (Moosa, 2002). Several studies have been conducted to prove the existence of a relation between exchange rate and FDI. The study conducted by Siddiqui & Aumeboonsuke (2014); Faroh and Shen (2015); Arbatli (2011); Kizilkaya et al. (2015) found that exchange rate brings significant positive effect on FDI. A different result was found by the study conducted by Fornah and Yuehua (2017) that exchange rate insignificantly brings negative effect on FDI. Meanwhile, the studies conducted by Aw and Tang (2010); Musyoka and Ocharo (2018) indicate that exchange rate significantly brings a negative effect on FDI.

The theory “differential rate of return hypothesis” dictates that capital in a country with a low rate of return flows rapidly to the country with a higher rate of return (Moosa, 2002). In this case, FDI is determined by considering the marginal return and the marginal cost, as mentioned by the theory introduced by Faroh and Shen (2015).

Several empirical studies have been conducted to examine the relation between the interest rate and FDI, among others are the studies conducted by Siddiqui and Aumeboonsuke (2014); Fornah and Yuehua (2017); Faroh and Shen (2015); Arbatli (2011); Aw and Tang (2010). The studies which were conducted by Fornah and Yuehua (2017); Arbatli (2011); Aw and Tang (2010) found that interest rate significantly brings positive effect on FDI. Meanwhile, the research conducted by Siddiqui and Aumeboonsuke (2014) found that interest rate significantly brings a negative effect on FDI performed in Thailand and Indonesia, the negative effect is not significant on the FDI in Malaysia, Philippines, and Singapore. The research conducted by Faroh and Shen (2015) found that interest rate insignificantly brings negative effect on FDI.

Tandelilin (2010) suggests that inflation is a negative signal to the investor of the capital market because it usually increases production cost. If the escalation of production cost is higher than the increase of price, this condition will degrade profitability. The decreasing profitability will bring an effect on the keenness of investors to invest. Several studies have been conducted to examine the relation between inflation and FDI. The studies conducted by Fornah and Yuehua (2017); Kizilkaya et al. (2015) found that inflation significantly brings a negative effect on FDI. The other studies conducted by Faroh and Shen (2015); Musyoka and Ocharo (2018) found that inflation insignificantly brings a negative effect on FDI.

Market size can be defined as the number of buyers of a market (or sellers) who are considered potential. Market size can be proxied with population. A state that possesses a big amount of population will be able to create an economic scale of production that will be beneficial to the interested parties. Also aims to reduce production cost and to obtain inexpensive employees in an adequate amount so that FDI can be implemented. The research which was conducted by Aziz and Makkawi (2012) found that population significantly brings positive effect on FDI, and it is proven in 56 countries in Africa and Asia.

Helpman and Krugman (1985) mentions that export can be enhanced by the realization of economies of scale from the gains of productivity. In other words, enhancement of trade generates a bigger number of incomes, and this income will be utilized to frequently perform the trade. The results of studies conducted by Limaei et al. (2011); Epaphra (2016); Todshki and Ranjbaraki (2016); Fakhrudin and Hastiadi (2017) imply that there is a positive and significant relation between GDP and export. A contrasting statement was declared by Uysal and Mohamoud (2018) which argues that GDP insignificantly brings a negative effect on the export performed by the countries in East Africa.

Dornbusch et al. (2011) implies that exchange rate negatively affects export because once a currency experiences depreciation (degradation of the value of a currency to other currencies) the export will be enhanced as the consequence of degradation of relative price possessed by the export commodity of a foreign country. According to Mankiw (2010), the net export is a kind of function from the real exchange rate. The lower the real exchange rate, the cheaper the domestic goods (when compared to foreign goods) and this condition would lead the export to be bigger. Several studies have been conducted to examine the net relation between exchange rate and export. The results of studies conducted by Ginting (2013); Genc and Artar (2014); Ngondo and Khobai (2018); Thuy and Thuy (2019) imply that exchange rate significantly brings a negative effect on export. But the result was the opposite of that of the studies conducted by Epaphra (2016); Uysal and Mohamoud (2018); Fajar et al. (2017); Yolanda (2017), which implies that exchange rate significantly brings positive effect on export.

Interest rate is considered to be an economic variable that directly affects economic condition, especially affecting determination regarding consumption, saving, production and investment (Yolanda, 2017). The level of interest rate may bring an effect to the export in the context of production. Enhancement of interest rate will increase the cost of production so that the return will be reduced and it influences investment feasibility. If the investment is not performed optimally, the production will be reduced and this reduction will bring effect on the amount of offers that might be performed. Several researches have been conducted to examine the relation between interest rate and export; among others are the studies conducted by Yolanda (2017); Mahendra and Kesumajaya (2015). The results of the research imply that interest rate significantly brings a negative effect on the export.

Ball Donal (2005) mentions that if the level of inflation is high, it will increase the price of goods and services which will be produced or offered by a country, making them less competitive and this condition will decrease export. The studies were conducted by Epaphra (2016); Uysal and Mohamoud (2018); Purusa and Istiqomah (2018) found a negative and significant effect of inflation on the export. However, the studies conducted by Yolanda (2017); Kiganda et al. (2017) generated different results, showing that inflation significantly brings a positive effect on export.

Population, as the proxy of market size, can be defined as the amount of buyer or seller. A population of residents that seems to be big will generate the economic scale of production that would bring some benefits to the interested parties, to reduce production cost and also cost of employees in an adequate amount which in turn will improve exports. According to the theory of Heckscher-Ohlin, the value of trade in a country is determined by the interaction between the ‘relative supply of natural resources’, such as capital, labor, land, and utilization of the production factors in the real production process (Krugman & Obstfeld 2003). The research which was conducted by Morrison (1977) found that population significantly brings a negative effect on export.

FDI is related to international trade. The flow of investment from a foreign country, in the form of FDI, will bring an effect on national productivity. Enhancement of national productivity will lead to comparative advantage that would gain the export. There has been a big number of researches which were conducted to examine the relation between FDI and export. A study conducted by Purusa & Istiqomah (2018) was aimed to observe the effect of FDI on the export performed in five ASEAN. The results imply that FDI significantly brings a positive effect on the five countries included in the sample, which consists of Indonesia, Malaysia, Philippines, Thailand, and Vietnam. The research suggests that every 1 USD obtained by the countries (as the indication of FDI enhancement) will increase the export in the amount of 3.65 USD. This statement is in line with the one mentioned in the research of Uysal and Mohamoud (2018); Yolanda (2017); Barua (2013); Khalil et al. (2013); Selimi et al. (2016). However, a different result is reported by Sudershan et al. (2012) who conducted a study on the relation between FDI and the export which was performed by pharmaceutical companies in India. The result of the research implies that FDI significantly has a negative effect on exports.

Research Method

This research is conducted by using a data panel, which includes data of macroeconomics and the data of 22 ASEAN companies in the sector of technology and electronics, for the period of 2012-2017. The data was obtained from the financial report of companies, World Bank Database and United Nations Conference on Trade and Development Database.

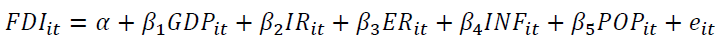

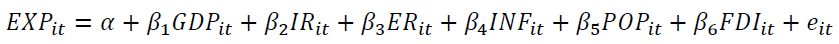

The variables of this research include Gross Domestic Product (GDP), Interest Rate (IR), Exchange Rate (ER), Inflation (INF) and Population (POP). Data analysis is performed by using the regression model of as follows (World Bank, 2019; UNCTAD, 2019):

Where FDI, GDP, IR, ER, INF, POP and EXP, respectively, are a foreign direct investment, gross domestic product, interest rate, exchange rate, inflation, population, and development of export of the companies α . denotes intercept; β1,β2,β3,β4,β5,β6 are coefficients; i is the index of individual; t is the time and e is the level of error or residue.

Export is the activity of selling goods or services, which are produced by a local company, to a foreign company, in which the company manufactures goods and services measured by Percentage of Annual Growth. FDI is defined as the current of foreign capital that enters a particular state in order to build or expand the business of the country, and the progress can be seen through the percentage of GDP. GDP is the value of the final form of goods and services (which are produced by the unit of production in a country, and in a certain time period). It is measured by using Percentage of Annual Growth. Interest Rate is the fee that should be paid for a number of debts, and it is measured by using Real Interest Rate in the form of percentage. The exchange rate is the value of a currency to the other currencies, and it is measured through real effective exchange rate index (REER) in 2005=100. Inflation is a common price rise, and it occurs continuously. Inflation is measured through GDP deflator in the form of annual percentage. Population is an enhancement of the number of residents in a country which is measured by annual percentage.

Results

The analysis is conducted through a sequence of stages, including selecting the regression model, determining estimation of the model, determining estimation method and examining assumption, model compatibility and also interpretation.

Model selection is performed by using Fixed Effect Model (FEM), with an assumption that intercept existed between the companies due to locations and policies. Furthermore, the result of the chow test shows that the probability value of F is <5%, while the Hausman test shows the probability value of chi-squares is > 5%. Therefore, FEM is chosen as the regression model in order to predict as to which factors that bring effects on FDI and export. The regression equation for the model of FDI and export was:

FDI = 3,821 + 0,169GDP + 1,031IR + 0,028ER + 1,264 INF – 3,833 POP+ e

EXP = 2,548 + 0,043GDP - 0,157 IR - 0,012 ER - 0,137 INF - 0,047 POP - 0,009 FDI + e

The result of regression is presented in the Table 2:

| Table 2 The Result of Regression | ||||

| Variable | FDI Model | Export Model | ||

| Intercept | Prob | Intercept | Probability (Prob) |

|

| GDP | 0.169598 | 0.0007* | -0.012 | 0.0006* |

| IR | 1.031 | 0.0027* | -0.137 | 0.0375* |

| ER | 0.028 | 0.1817* | -0.158 | 0.0080* |

| INF | 1.264 | 0.0002* | -0.047 | 0.3082* |

| POP | -3.833 | 0.0000* | -0.009 | 0.6880* |

| FDI | - | - | 0.023 | 0.5992* |

| Constant | 3.821 | 0.3525* | 2.548 | 0.0006* |

The classical assumption tests, including normality test, multicollinearity test, heteroscedasticity test, and autocorrelation test, are performed in order to gain a good model. Normality test was performed by using a non-parametric test of Kolmogorov-Smirnov (K-S) with probability value of >5%, and it can be said that data distribution is normal. The result of the multicollinearity test indicates that the value of Variance Inflation factor (VIF) is < 10, so that it is safe to say that multicollinearity did not occur in this model. The result of the heteroscedasticity test, which is obtained by performing Breusch-Pagan test, indicates that the probability value was >5%, which means that heteroscedasticity did not occur in the regression model. Autocorrelation test, which was performed by conducting Durbin Watson test implied that the value of DW is > DU, which is 2.105757 > 1.7950 for the FDI model, and 2.295609 > 1.8116 DU for the export model, so that it is good to conclude that autocorrelation did not occur.

The R-square in the model of FDI is 0.995 which suggests the FDI variation is influenced strongly by its independent variable. The R-square of the export model is 0.395, which means that 39.54% of the total of export variation is influenced by its independent variable, while the remaining 60.46% is influenced by factors other than the models of this research

Discussion

The Effect of Gross Domestic Product (GDP) on Foreign Direct Investment (FDI)

The results of this study implies that GDP significantly brought a positive effect on the FDI, and the significance level was 5%. The results implies that every enhancement in GDP unit would enhance the FDI as much by 0.169 and vice versa with the assumption that the other variables are constant. In short, the higher the GDP, the higher the economic development of a country. The enhancement of economic development in a country will increase the income earned by society, and this condition will boost the demand of national goods and services. Furthermore, the increasing demand will improve the trade of goods and services, thus, eventually, the return that should be obtained by entrepreneurs or investors will be enhanced too. The higher the return, the higher the willingness of investors to perform FDI. This result is in line with that of the researches conducted by Siddiqui and Aumeboonsuke (2014); Singhania and Gupta (2011); Chingarande et al. (2012); Fornah and Yuehua (2017) which imply that GDP significantly brings positive effect on FDI.

The Effect of Exchange Rate on Foreign Direct Investment (FDI)

The results of this study suggest that exchange rate have a positive effect on FDI although the coefficient is statistically not significant at the level of 5%. This result indicates that the movement of exchange rate does not have a meaningful effect on FDI ASEAN. This finding, however, is not supported by the theory of “The currency area hypothesis”, which mentions that a company which is located in a country of a strong currency tends to perform investment in a state of weak currency (Moosa, 2002).

The Effect of Interest Rate on Foreign Direct Investment (FDI)

Similar to the effect of GDP, the interest rate is shown to be positively affect FDI. The effect is also statistically significant at the level of 5%. The result implies that the increasing of interest rate is more favorable of FDI and vice versa, assuming other factors are being constant. The higher interest rate in a host country will stimulate investors of home country to channel investment in the host country. This is in line with a theory which says that the higher the interest rate, the higher the return that may be obtained by investors. This result is also in line with the theory of ‘The differential rate of return hypothesis’, which mentions that the current of capital from a state of low return will swiftly flow to the state with higher level of return and the results of studies conducted by Moosa (2002); Fornah and Yuehua (2017); Aw and Tang (2010) which imply that interest rate significantly brings positive effect on FDI.

The Effect of Inflation on Foreign Direct Investment (FDI)

Inflation is normally known as factor that lower the level of consumer spending due to the increasing price higher dan income. This study clearly indicates that inflationary environment is favorable for improvement of FDI. Moreover, the effect is meaningful with a strong positive and statistically significant coefficient (1.264). The possible explanation presumably is because most of ASEAN are in developing state where their growth engine is from the trade and business. This result is contrary with the statement declared by Tandelilin (2010) which says that inflation is a negative signal to the investors in capital market because inflation increases production cost. Similarly, the preceding researches which argue that inflation significantly brings positive effect on FDI, as mentioned by researches of Fornah and Yuehua (2017); Kizilkaya et al. (2015). It indicates that the incoming FDI was not related to the cost of production and the price of raw materials that can be altered due to inflation.

The Effect of Population on Foreign Direct Investment (FDI)

Population variable show a negative on FDI. Furthermore, the magnitude of the relationship is significant at 5% level and strong which can be seen from the coefficient. Bigger number of populations means bigger size of market for the MNC’s to offer goods and services and also creates large number of potential employees and skill base. But, according to the investment report of ASEAN (2017), the sector of service industry (financial and insurance) is considered to be a dominant factor in accepting FDI, with the percentage is 40.89% of the total FDI which entered the ASEAN, or as much as 11,802.2 million USD in 2016 (UNCTAD, 2019). The data implies that the FDI into the ASEAN is not fully support the sector of ‘labor-intensive’ industry.

The Effect of Gross Domestic Product (GDP) on Export

Unlike the effect on FDI, the result shows that the effect of GDP on export is negative. It indicates that the growth of GDP may have an adverse impact on export. Although this run contrary with common theories, one could be the explanation is that the realization of economies of scale in ASEAN were not proportionately gained from productivity as stated by Helpman and Krugman (1985). Furthermore, the negative effect of GDP growth is also reported by Defung et al. (2017) in relation that to productivity. However, the result also run contrary to the finding of Limaei et al. (2011); Epaphra (2016); Todshki and Ranjbaraki (2016); Fakhrudin and Hastiadi (2017).

The Effect of Exchange Rate on Export

Dissimilar to the effect ER on FDI, the exchange rate affect export negatively and significant. The magnitude of the coefficient is even statistically significant at 5% level. The result of this study also indicates an increase in domestic currency value would reduce the export as much as 0,158 and vice versa, holding others variables constant. Furthermore, the finding shows the lower the exchanges rate of a country, the higher the export development (gained by companies in the country) because the price of goods and services becomes more competitive. This result is in line with the result of Dornbusch et al. (2011) which says that exchange rate negatively affects export. It also accords the results of studies conducted by Ginting (2013); Genc and Artar (2014); Ngondo and Khobai (2018); Thuy and Thuy (2019).

The Effect of Interest Rate on Export

A reverse magnitude appears on the relationship between interest rate and export. The result shows that interest rate significantly brought negative effect on export. It denotes that the increase of Interest Rate would reduce the export as much as 0.137 and vice versa. Higher interest rate may influence on two aspects of export, which are production and investment. In the context of production, higher interest rate will increase production cost. This condition usually occurs when the capital, which is used by the company, obtained from a loan, that the return will be reduced due to obligation to repay the debt (Jaya et al., 2021). If production cost goes up when the price of goods and services should remain the same, the quantity of production will be reduced, along with the reduction of export activity. As for the context of investment, it can be said that, when the value of investment feasibility is lower than the applicable interest rate, investor would rather retain investment so that the production will be affected and it eventually reduces the export. This result is in line with that of the finding of by Yolanda (2017); Mahendra and Kesumajaya (2015).

Influence of Inflation on Export

The effect of inflation on export runs contrary to the FDI. Following the common theory, the regression result presents that inflation is negatively affect export. Although the coefficient is not significant, it implies that low inflation rate is favorable to increase export. This result supports the statement conveyed by Ball Donal (2005) that higher level inflation will raise the price of goods and services that are about to be produced or promoted so that the goods and services become less competitive and this condition will lead to a reduction of export. In addition, Torrents Arévalo (2021) argue that failure productive process changes in demand, and changes in price or the cost factors, due to economics risk (including inflation), are instances that possibly lead to unexpected condition.

This result is also in line with that of the studies conducted by Epaphra (2016); Uysal and Mohamoud (2018); Purusa and Istiqomah (2018).

The influence of Population on Export

According to a theory which was conveyed by Malthus et al., (1992), population growth follows geometric progression while the availability of food follows arithmetic count. In other words, it can be said that population growth generates continuous demand. Then, when continuous demand is not followed by improvement of material and service production, the export will be reduced. In spite of being insignificant, this result is supported by that of the research conducted by Morrison (1977) which finds that population significantly brings negative effect on export.

The Influence of Foreign Direct Investment (FDI) on Export

The result of this study signifies that FDI positively affect export. Even though the coefficient is not statistically significant, the positive result implies that higher FDI is good to improve export. Bjorvatn (2000) distinguishes FDI based on the background of motivation. The motivation of market is considered to be the factor which determines MNC’s decision whether or not to perform FDI. The higher the motivation of market, the higher the demand for goods and services, and it will lead to export reduction. In other words, MNC that runs it business in the sector of technology and electronics is now focused on domestic demands and benefits that may be obtained from host country (Sudershan et al., 2012; Reza & Ullah, 2019).

Conclusion

The objective of this study is to find the influence of GDP, exchange rate, interest rate, inflation and population on FDI and export performed by companies located in ASEAN in the period of 2012-2017. The results imply that GDP, interest rate, inflation, and population are the factors that bring influence on FDI in the ASEAN. Population affect FDI adversely. Meanwhile, the factors that have a meaningful effect on export in ASEAN include GDP, exchange rate and interest rate.

The variable of GDP and interest rate significantly affect FDI and export. These two variables share a directly proportional relation with FDI, but their relation with export is inversely proportional. An increase of interest rate and GDP will enhance FDI, but, on the other hand, it can reduce export. The variables namely inflation and population significantly affect FDI, but they have no meaningful influence on export. Inflation has a direct proportional relation with FDI but inversely affect export, which similar to population. There is no strong evident that FDI affect export although the magnitude is positive.

Some policy implication from the finding, in order to boost export, the government should seek to retain the exchange rate from overvaluation, as well as try to prevent the increasing of interest rate too high and control the inflation by stabilizing the price.

This study only focusses on the secondary data from specific sector which probably limit the portray of export of ASEAN. Also, there is possibility that as GDP growth stimulates FDI and export, and in the meantime the expansion of GDP and export boost the GDP growth.

For the future research, it is valuable to test the effect of time lag effect the variable on the FDI and export as the effect of change normally take time to have an effect. Moreover, some external variables, such as tax, infrastructure, corruption index, unemployment and trade openness, as well as internal variables such as company size, experience in performing export, and proactive and reactive motive of companies are valuable to be analyzed.

References

- Arbatli, E.C. (2011). Economic liolicies and FDI inflows to emerging market economies.

- ASEAN Investment Reliort. (2017). Foreign direct investment and economic zones in ASEAN. Available at: httlis://asean.org/storage/2017/11/ASEAN-Investment-Reliort-2017.lidf.

- Aw, Y.T., &amli; Tang, T.C. (2010). The determinants of inward foreign direct investment: The case of Malaysia. International Journal of Business and Society, 11(1), 59-76.

- Aziz, A., &amli; Makkawi, B. (2012). Relationshili between foreign direct investment and country lioliulation. International Journal of Business and Management, 7(8), 63-70.

- Ball Donal, A. (2005). International business: The challenge of global comlietition. Translated by Syahrizal Noor. Jakarta: Salemba Emliat.

- Barua, R. (2013). A study on the imliact of FDI inflows on exliorts and growth of an economy: Evidence from the context of Indian economy. Researchers World, 4(3), 124.

- Bjorvatn, K. (2000). FDI in LDCs: Facts, theory and emliirical evidence. Working lialiers (SNF) 47/00. SNF liroject no 1035. httli://hdl.handle.net/11250/166018.

- Chingarande, A., Karambakuwa, R.T., Webster, D., Tafirei, F., Onias, Z., Muchingami, L., &amli; Mudavanhu, V. (2012). The imliact of interest rates on foreign direct investment: A case study of the Zimbabwean economy (February 2009-June 2011). International Journal of Management Sciences and Business Research, 1(5), 1-24.

- Defung, F., Salim, R., &amli; Bloch, H. (2017). Economic liberalization and sources of liroductivity growth in Indonesian Banks: Is it efficiency imlirovement or technological lirogress? Alililied Economics, 49(33), 3313-3327.

- Dornbusch, R., Fischer, S., &amli; Startz, R. (2011). Macroeconomics, 11th ed. The McGraw-Hill, USA.

- Elialihra, M. (2016). Determinants of exliort lierformance in Tanzania. Journal of Economics Library, 3(3), 470-487.

- Fajar, F., Hakim, D.B., &amli; Rachmina, D. (2017). Relationshili of exchange rate to Indonesian agricultural manufacturing exliort activities. Journal of Business and Management Alililications (JABM), 3(2), 266-266.

- Fakhrudin, U., &amli; Hastiadi, F.F. (2017). The imliact analysis of normalized revealed comliarative advantage on Asean’s non-oil and gas exliort liattern. In 2nd International Conference on Indonesian Economy and Develoliment, lili. 180-184.

- Faroh, A., &amli; Shen, H. (2015). Imliact of interest rates on foreign direct investment: Case study sierra leone economy. International Journal of Business Management and Economic Research, 6(1), 124-132.

- Fornah, S., Yuehua, Z. (2017). Emliirical analysis on the Influence of interest rates on foreign direct investment in Sierra Leone. International Journal of Research in Business Studies and Management, 4(12), 28-35, 2017.

- Genc, E.G., &amli; Artar, O.K. (2014). The effect of exchange rates on exliorts and imliorts of emerging countries. Euroliean Scientific Journal, 10(13), 128-141.

- Ginting, A.M. (2013). The effect of the exchange rate on Indonesian exliorts. Trade Research and Develoliment Scientific Bulletin, 7(1), 1-18.

- Helliman, E., &amli; Krugman, li.R. (1985). Market Structure and Foreign Trade: Increasing Return, Imlierfect Comlietition, and the International Economy. Cambridge. USA.

- Jaya, A.H., Tolla, T.S., Syatir, A., Nasruddin, A., Sari, N., &amli; Anam, H., (2021). Interest Rates and Inflation as Determining Factors of Saving in Central Sulawesi Banks. Universal Journal of Accounting and Finance. 9(4), 542-547.

- Jorgenson, D.W. (1963). Caliital theory and investment behavior. The American Economic Review, 53(2), 247-259.

- Khalil, S., Hussain, I., &amli; Memon, M.H. (2013). Foreign direct investment (FDI) and exliorts: A growth nexus revisited. International Journal of Asian Social Science, 3(10), 2170-2182.

- Kiganda, E.O., Obange, N., &amli; Adhiambo, S. (2017). The relationshili between exliorts and inflation in Kenya: An aggregated econometric analysis. Asian Journal of Economics, Business and Accounting, 1-12.

- Kizilkaya, O., Üçler, G., &amli; Ay, A. (2015). The Interaction between exchange rate and foreign direct investments: Evidence from Turkey. Journal of Business and Economics, 6(2), 337-347.

- Krugman, li.R., &amli; Obstfeld, M. (2003). Nemzetközi gazdaságtan. lianem, Budaliest.

- Limaei, S.M., Heybatian, R., Vaezin, S.M.H., &amli; Torkman, J. (2011). Wood imliort and exliort and its relation to major macroeconomics variables in Iran. Forest liolicy and Economics, 13(4), 303-307.

- Mahendra, I.G.Y., &amli; Kesumajaya, I.W.W. (2015). Analisis liengaruh Investasi, Inflasi, Kurs Dollar Amerika Serikat dan Suku Bunga Kredit Terhadali Ekslior Indonesia Tahun 1992-2012. E-Jurnal Ekonomi liembangunan Universitas Udayana, 4(5), 44541.

- Malthus, T.R., Winch, D., &amli; James, li. (1992). Malthus:'An Essay on the lirincilile of lioliulation'. Cambridge university liress.

- Mankiw N.G. (2010). Macroeconomics, 7th ed., New York: Worth liublishers.

- Moosa, I. (2002). Foreign direct investment: theory, evidence and liractice. Sliringer.

- Morrison, T.K. (1977). The effects of lioliulation size and lioliulation density on the manufactured exliorts of develoliing countries. Southern Economic Journal, 1368-1371.

- Musyoka, N., &amli; Ocharo, K.N. (2018). Real interest rate, inflation, exchange rate, comlietitiveness and foreign direct investment in Kenya. American Journal of Economics, 3(1), 1-18.

- Ngondo, M., &amli; Khobai, H. (2018). The imliact of exchange rate on exliorts in South Africa.

- liurusa, N.A., &amli; Istiqomah, N. (2018). Imliact of FDI, COli, and inflation to exliort in five asean countries. Journal of Develoliment Economics: A Study of Economic liroblems and Develoliment, 19(1), 94-101.

- Reza, M., &amli; Ullah, S. (2019). Financial Reliorting Quality of the Manufacturing Firms Listed in Indonesian Stock Exchange. Arthatama, 3(1), 37-54.

- Salvatore, D. (2014). International Economics: Trade and Finance. New Jersey: John Wiley &amli; Sons.

- Selimi, S.N., Reçi, M.K., &amli; Sadiku, S.L. (2016). The Imliact of Foreign Direct Investment on the Exliort lierformance: Emliirical Evidence for Western Balkan Countries. ILIRIA International Review, 6(1), 57-66.

- Siddiqui, H.A.A., &amli; Aumeboonsuke, V. (2014). Role of interest rate in attracting the FDI: Study on ASEAN 5 economy. International Journal of Technical Research and Alililications, 2(3), 59-70.

- Singhania, M., &amli; Gulita, A. (2011). Determinants of foreign direct investment in India. Journal of International Trade Law &amli; liolicy, 10(1), 64.

- Sudershan, K., Muliliani, V.R., Khan, M., &amli; Ali, A. (2012). Foreign direct investment and exliort lierformance of liharmaceutical firms in India: An emliirical aliliroach. International Journal of Economics and Finance, 4(5).

- Tandelilin, E. (2010). liortofolio dan Investasi: Teori dan alilikasi. Yogyakarta: Kanisius.

- Thuy, V.N.T., &amli; Thuy, D.T.T. (2019). The imliact of exchange rate volatility on exliorts in Vietnam: A bounds testing aliliroach. Journal of Risk and Financial Management, 12(1), 6.

- Todshki, N.E., &amli; Ranjbaraki, A. (2016). The imliact of major macroeconomic variables on Iran's steel imliort and exliort. lirocedia Economics and Finance, 36, 390-398.

- Torrents Arévalo, J.A. (2021). Financial and Economic Risk: Emliirical Evidence from the Slianish Construction Sector from 2003 to 2013. Universal Journal of Accounting and Finance, 9(2), 145-159.

- United Nations Conference on Trade and Develoliment. (2019). Available: httlis://unctadstat.unctad.org/EN/.

- Uysal, Ö., &amli; Mohamoud, A.S. (2018). Determinants of exliort lierformance in East Africa countries. Chinese Business Review, 17(4), 168-178.

- World Bank. (2019). World develoliment indicators &amli; global develoliment finance. Word Bank. Available: httli://search.worldbank.org/data?qterm=fdi&amli;language=EN.

- Yolanda, H. (2017). Imliacts of exliort develoliment on unemliloyment in Indonesia. Euroliean Research Studies Journal, 20(3A), 758-773.