Research Article: 2021 Vol: 25 Issue: 3S

Forensic Accounting: A Tool for Detecting and Preventing Fraud and its Present Position in Kingdom of Saudi Arabia

Nadeem Fatima, Prince Sattam Bin Abdulaziz University

Keywords

Forensic Accounting, Economic Crime, Cyber Crimes, Fraud, Saudi Arabia

Abstract

Global economic crime and fraud have in the recent past increased in size and scale. Cumulatively, the total value of financial fraud amounts to nearly 5% of a typical county’s revenue, totalling in the trillions. This proliferation of white-collar crime has brought us the urge for forensic accounting. Although this may be thought of as of more recent origin in its present form, it has been with us for quite a long time and probably centuries before Christ. Go back to the times before Christ; forensic accounting has involved the application of various skills such as quantitative methods, accounting, investigation, auditing, and law. Besides having such skills as a professional accountant, he/ she should also use evidence-based techniques which abide by the law. With all this in mind, Forensic accounting is on the race to becoming among the top 20 prestigious courses soon. This paper, therefore, discusses the benefits of forensic accounting as a career and its current state in the kingdom of Saudi Arabia.

Introduction

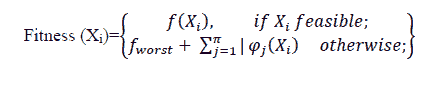

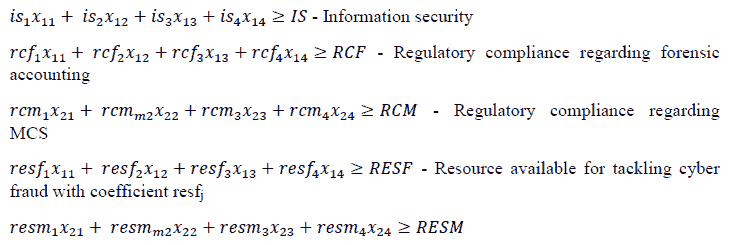

Economic crimes and fraud have recently reached astronomical proportions and spread across every aspect of life. Economic crimes and fraud have existed since the beginning of time when man began to engage in trade and commerce. As clearly put by Mehta (2009), modern economic crimes include tax evasion, currency counterfeiting, smuggling of goods into the borders, credit card corporate fraud, corruption, and intellectual property infringement, and so on. Possibility of fraud is always there in any company or organization. It is a worldwide phenomenon that affects all continents and all sectors of the economy. It is deliberate act by one or more person among management, those charged with governance, employees or third parties, involving the use of deception to obtain unjust or illegal advantage. It may appear in any form like corruption, internal financial fraud, bribery and even embezzlement. Other crimes include embezzlement of government funds, misappropriation of assets, conflicts of interests, kickbacks, bribery, and so on. Economic crimes committed by dishonest personnel pose a significant challenge to society and the economy all over the world. The scale of economic crime has increased dramatically in the globalized and networked economy (Bussman, 2003), with huge amounts of taxpayers' money being siphoned by very few individuals with the interest of their businesses. With the rash of cybercrimes being committed against every business connected to the Internet, the nature of forensic practice is poised to expand into new territory. In spite of the concepts of independence, integrity, fairness and objectivity auditors’ reports are still challenged and most of the times are found vulnerable. A generic algorithm is employed to validate and determine the feasibility of a model. Generic model merits are explained by (Barboza et al., 2015) for solving linear programmed models in the equation

Fworst is function of the worst feasible soln in the selected area of study, qi(Xi) show values on the right of the inequalities

History of Forensic Accounting

Forensic Accounting has taken many great leaps of growth in recent history. Modern forensic accounting has its earliest reference in an accountant's advertising circular in Glasgow, Scotland. Special accountants gave testimony in court and in arbitration proceedings appearing in the year 1824.

One of the first institutions to use the services of forensic accountants was the IRS (Internal Revenue Service). As a result, IRS developed many of the forensic techniques used to detect tax evaders. One of the first income tax evasion cases uncovered by forensic accountants was that of the infamous gangster, Al Capone. During World War II, the Federal Bureau of Investigation (FBI) employed over 500 forensic accountants who were used to examine and monitor financial transactions and in the year 2000.

In the year 2002 Sarbanes-Oxley opened up a whole new field of investigation for Forensic Accountants. The Sarbanes-Oxley Act established the Public Companies Accounting Oversight Board (PCAOB) which was charged with developing auditing standards, conducting investigations and ensuring corporate compliance. As a result of the Sarbanes-Oxley Act, there has been continuing emphasis on forensic accounting. The head of a prominent accounting firm entrusted with protecting the assets of victims in bankruptcy and fraud cases was charged with stealing millions in the year 2010. His firm used to specialize in receivership, litigation support and forensic accounting.

Concept of Forensic Accounting

Until today various definitions is given to describe the forensic accounting. The word forensic comes from the Latin word forensis, meaning “in open court” or “public.” When the word forensic comes it usually means it has to do with finding evidence to solve a crime and it could also mean that it has to do with the courts or legal system. Forensic Accounting can be described as the use of auditing and investigative skills to examine financial statements in preparation to be used in a court of law.

The name Forensic Accounting wasn’t even coined until 1946. Advances in forensic technology have broadened the scope of forensic accounting, particularly in fraud prevention, so that one should be aware of the numerous applications available to organization. The forensic accounting process differs from regular financial auditing, searching only for suspicious transactions, and using a strict digital forensic process. The accountants and auditors have to look for different type of fraud throughout the internal control and audit processes. Accounting scandals involving Enron, WorldCom, Satyam, The Internet and other technological advances, and even the threat of terrorists have put Forensic accountants in the public spotlight as never before in their history. In digital environment context, forensic accounting plays an important role in detecting these frauds (financial and non-financial) that are not discovered in accounting and internal auditing process.

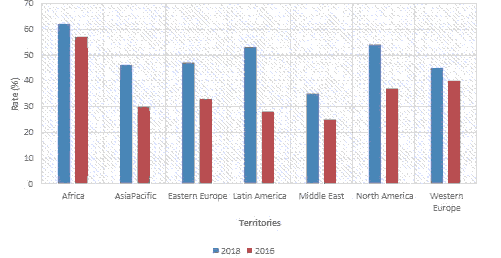

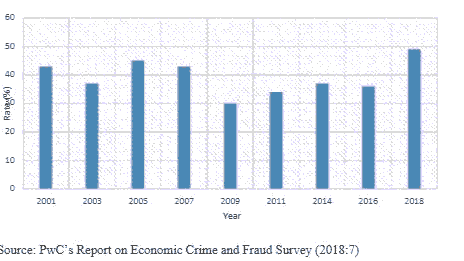

Figures 1 and Figures 2 below illustrate a comprehensive report by PwC across the world for the years 2016 and 2018

It is seen that Forensic accounting and the executive's management frameworks are sets of related parts that perform comparable capacities. The foundational idea of these factors portrays the chance of joining. The measurable bookkeeping and the board control frameworks have been distinguished as autonomous strategies which can help the course of hazard evaluation and the misrepresentation of the executives of these, the danger evaluation is a significant period of the danger the board cycle since it is useful in the risk assessment process to potential risks that may affect an organization.

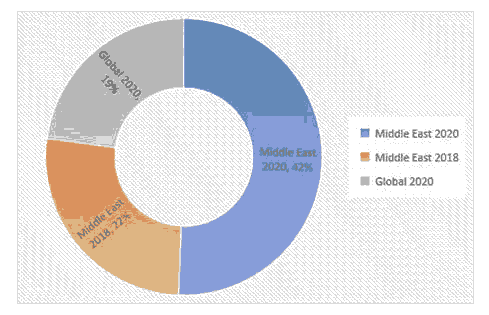

PwC has been surveying trends in global economic crime since 2001 with the findings released bi-annually in the Global Economic Crime Survey. In that time, despite e-orts to combat economic crime, there has been no clear indication that levels in the Middle East or globally has decreased. Economic crime remains as tough to tackle as it’s ever been. In 2020 Economic Crime and Fraud Survey indicates that organisations across the Middle East remain vulnerable to traditional economic crimes that have afflicted the region for centuries. Bribery, procurement fraud and other forms of corruption are still prevalent. At the same time, Middle East organisations, like their global competitors, are the subject of increasingly sophisticated forms of economic crimes including from cyber-threat actors that possess the technology and expertise to infiltrate corporate databases from anywhere in the world. Fraud and economic crime in the Middle East are taking increasingly diverse forms, in line with the global trend. (Pwc report)

Respondents who said their organisation experienced procurement fraud in the past two years Figure 3.

The pandemic COVID-19 and the subsequent economic shutdown also facilitated significant disruptions in relative demands and corporate resources that often raise the risk of fraud in the coming years (Karpoff, 2020). Investors, banks, credit lending institutions, and the stock exchange market lost a lot of sums of money as a result of fraud (Albrecht, 2015). Whether employees or workers commit fraud against or with the organization, the Association of Certified Fraud Examiners estimated in its Report to the Nation on Occupational Fraud and Abuse that fraud loss in many organizations around the world is around $7 billion (ACFE 2018). Saudi regulators such as the Saudi Organization for Certified Public Accountant (SOCPA), Saudi Capital Market Authority (CMA), Saudi Arabia Monetary Agency (SAMA), and Ministry of Commerce and Investment and similar legislation throughout the world have increased management’s responsibility for fraud risk management. Every corporation is susceptible to fraud, but not all fraud can be prevented, nor is it cost-effective to try (Alturki, 2017). Asian Accounting and Governance Journal Employees of Saudi Arabian Banks Perceive 11 Fraud Prevention Strategies. The study's primary goal is to investigate employees' thoughts on the effectiveness of fraud eradication in Saudi Arabian banks. A hundred and fifty questionnaires were given to Saudi banks employees, with a 53.3 percent response rate. These fraud prevention strategies were classified using Cressey's fraud triangle (pressure, rationalization, and opportunity). Quantitative research was used in the study.

Background Information And Literature Review

The global number of cases and instances of fraud is still on the rise and emerges to be greater, powerful, and even expensive as each day goes by. Therefore, with this in mind, organizations and both small and big companies need to be on the run to reduce if not curb the global rising cases of fraud by anti-fraud programs. An accountant has to detect ad act accordingly to any fraud within the business and its environs. Therefore, it is advisable to have a qualified accountant. Accounting practice and studies have to be changed and be made better to help fight fraud cases (Kirtley, 2021). Dhami & Shimoli (2015) opined that Forensic accounting is very important tool to detect, investigate and prevent the frauds. Further highlighted the importance of forensic accountant and further stated that they need accounting, finance, law, investigative and research skills to identify, interpret, communicate and prevent fraud. Augustine et al., (2014) concluded that forensic accounting does not form a significant part of the educational and professional curricula of colleges and professional bodies responsible for producing and developing accountants in Nigeria and further there does not exist any form of statutory backing for forensic accounting services in Nigeria as does traditional financial audit. In Adamu (2012); Weaver (2007) opined that in order to gather detailed evidence, the investigator must understand the specific type of fraud that has been carried out and how the fraud has been committed. The evidence should be sufficient to ultimately prove the identity of the fraudsters, the mechanics of the fraud scheme and the amount of the financial loss suffered.

All corporations in Saudi Arabia and in the world are subject to fraud risks. The extortion in Saudi banks, specifically, is much extreme and is assessed by a great many exchanges (Hafiz, 2010). Misrepresentation brings adverse outcomes that influence accounts and different parts of monetary establishments, including powerless execution, abatement in money-related and different assets (Omoolorun & Abilogun, 2017). Additionally, these establishments likewise face the disintegration of their standing and intensity (Makridis & Zhou, 2019). Therefore, Saudi banks have embraced numerous endeavours to address extortion which incorporates the execution of misrepresentation avoidance methodologies (Abdulai, 2016). What is not kidding is the way that the utilization of misrepresentation avoidance systems isn't just about as viable as it ought to be. Accordingly, there is a requirement for the extra enemy of extortion measures by associations and legislatures to keep up with financial backer and purchaser trust in strategic policies (Bendor & Gaalen). For sure, most nations in the area were positioned lower than in the earlier year. Ofiafoh Eiya & John I Otalor (2013) found out that forensic audit looks beyond the transactions and audit trail to focus on substances of the transaction. They recommended that the relevant anti-graft agencies should consider engaging the services of forensic accountant to enhance conviction of fraud culprits.

Research Methodology

Research Design, Procedures, and Measures

By use of a descriptive research design and a questionnaire, this study seeks to investigate the policies and methods used in Saudi Arabian banks to avoid fraud. To ensure that the sample is as representative as possible, the crackdown of employees from each bank is calculated based on demography. Respondents' and perceptions on the efficacy of the fraud combating. As illustrated in the table below, fraud prevention measures are divided into three categories: pressure, rationalization, and opportunity. On a five-point itemized-rating scale of 1 (completely ineffective) to 5 (very effective), with a neutral point, respondents are asked to rank these tactics. Towards the end of the questionnaire, there are a few open-ended questions that require responders to provide ideas. as shows in Table 1.

| Table 1 Sources Of Fraud Prevention Strategies Used In The Questionnaire |

|

|---|---|

| Strategies used to reduce the pressure on employees for committing fraud | Source |

| Employee Counseling and Support | (ACFE, 2008) Bierstaker, et al., (2006) |

| Positive Employee Recognition | (Schaefer, 2006) |

| Continual Education | (Pergola & Sprung, 2005) |

| Pre-Employee Background Check | (Pergola & Sprung, 2005) |

| Personal Lawsuits | (Alkaiat, 2010) |

| Employee Assistance Program | (ACFE, 2008), Bierstaker, et al., (2006) |

| Personal Finance Facility | (Alkaiat, 2010) |

| Negative Society’s Reaction for fraud | (Alkaiat, 2010) |

| Strategies used to reduce the rationalization on employees for committing fraud | Source |

| Reward For Whistle Blowing | (ACFE, 2008) |

| Ethics Officer | (Bierstaker, et al., 2006) |

| Ethical Training | (Bierstaker, et al., 2006) |

| Corporate Code Of Conduct | (KPMG, 2004) |

| Equality Between Employees | (SAMA, 2009) |

| Whistle Blowing | (Bierstaker, et al., 2006) |

| Religion Deterrence and Awareness | (Alkaiat, 2010) |

| Strategies used to reduce the opportunity on employees for committing fraud | Sources |

| External Audit | (ACFE, 2008) |

| Operational Audit | (Bierstaker et al., 2006) |

| Sudden Check | (ACFE, 2010) |

| Security Measures | (Idowu 2009; SAMA, 2009) |

| Fraud Policy | (Bierstaker et al., 2006) |

| Imposing penalty | (Barra, 2010) |

| Enforcing regulations | (Kurdas, 2009) |

| Employee rotation | (ACFE, 2008; Bierstaker et al., 2006) |

| Internal audit | (KPMG, 2004) |

| Fraud auditing | (Bierstaker et al., 2006) |

| Audit committee role | (ACFE, 2008; KPMG, 2004; Bierstaker et al., 2006) |

| Internal control improvement | (Bierstaker et al., 2006; SAMA 2009) |

| Legal punishment | (Alkaiat, 2010) |

| Fraud Hotline | (ACFE, 2008; Bierstaker et al., 2006) |

| Continuous spot check | (Bierstaker et al., 2006) |

Discussion

During the data collecting process, the questionnaires are gathered at two distinct periods. The first group, which was gathered in 2011, with 55 respondents, whereas the second group, which was collected in 2012, involving 25 subjects. The majority of answers from responders on equity and resource allocation issues between both groups are contrasted and compared on a T-test to check for bias in the responses.

Conclusion

According to the study's findings, all of the tactics are quite effective. The Friedman test found that the tactics under opportunity were the most effective. However, extensive assessments of the practices were contrasted across several parameters, revealing a variety of perceptions. Female employees rated positive employee recognition, ethical training, and enforcing penalties as extremely significant. Employees without a college diploma, on the other hand, ranked positive recognition of workers and morality most crucial. Experts in accounting thought religion training was very important, whereas those without accounting expertise thought personal lawsuits were very important. Younger employees were also enthusiastic about fraud auditing. Shari'ah advisors and accountants also thought that implementing regulations, applying penalties, and disciplinary action was more important than auditing. Religious training was viewed as extremely vital by those working in significant departments. In general, Saudi bank employees thought that the banking sector's fraud prevention techniques significantly reduced bank employees' misbehavior, with opportunity measures being the most successful whereas pressure measures being the least successful. In terms of monitoring and implementation, detailed studies of each item with their plan demonstrated that certain areas needed maintenance while others needed improvement. The anti-fraud policy under “Opportunity” received the lowest score, necessitating a judgment on whether to keep or improve this component. In terms of pressure, employee recognition needs to be improved by banks. Nearly half had suffered at least one fraud – with an average of six per company. The most common types were customer fraud, cybercrime, and asset misappropriation.

Nonetheless, there are significant limitations to this research. First, the participants stepped forward to participate in the study, and thus sample randomization was compromised. Second, the time it took to study was a lot. The analyst had to devote a lot of time and put more effort into following up with the respondents to ensure that they returned their surveys with responses. Due to Saudi Arabia's business and social culture, as well as the security and information sensitivity that banks had, there were also constraints in terms of data collecting. Finally, the findings may only apply to internal auditors' perceptions. Although the internal auditor's viewpoint could improve the bank's strategy because they are from the internal control business environment and function, the participation of a big number of the audit staff would increase the perception score improve the results.

References

- Albrecht, W.S., Albrecht, C.O., Albrecht, C.C., & Zimbelman, M.F. (2015). Fraud examination. Cengage Learning.

- Abdulai, S.A.A.K.A. (2016). Auditor’s responsibilities/roles and the expectation of public sector workers: An analysis of volta river authority/northern electricity distribution company (vra/nedco) staff (doctoral dissertation).

- Adamu, G.Z. (2012). The relevance of forensic accounting education in financial accounting.

- Alhassan, A. F.M (2017). Forensic accounting and financial fraud: Evidence from Saudi Arabia. El-Bahith Review, 17, 41-47.

- Association of Certified Fraud Examiners (ACFE) (2014). Fraud examiners manual. Texas: ACFE.

- Augustine, E.A., & Uagbale-Ekatah, R.E. (2014). The growing relevance of forensic accounting as a tool for combating fraud and corruption: Nigeria experience. Research Journal of Finance and Accounting, 5(2), 71-77.

- Barbozaa, O.A., Junior, F.N., Bortolottia, S.L.V., & De Souza, R.A. (2015). Mixed integer linear programming and genetic algorithm applied to storage and transportation problems in an oil industry. Systems & Management, 10, 561-574.

- Bendor, J., Taylor, S., & Van Gaalen, R. (1985). Bureaucratic expertise versus legislative authority: A model of deception and monitoring in budgeting. American Political Science Review, 79(4), 1041-1060.

- Dhami, S. (2015). Forensic accounting: Signaling practicing accountants to improve skill set and forming regulatory body for forensic accountants in India. Global Journal for Research Analysis International, 4(5).

- Eiya, O., & Otalor, J.I. (2013). Forensic accounting as a tool for fighting financial crime in Nigeria. Research Journal of Finance and Accounting, 4(6), 18-25.

- Hafiz, T. (2018). How Saudi Arabia is fighting back against financial fraud. Arab News, 15 October.

- Karpoff, J.M. (2020). The future of financial fraud. Journal of Corporate Finance.

- Kirtley, O. (2021). The accountancy profession: Fighting fraud and corruption.

- Omoolorun, A.J. (2017). Fraud free financial report: A conceptual review. International Journal of Academic Research in Accounting, Finance and Management Sciences, 7(4), 83-94.

- Omoolorun, A.J., & Abilogun, T.O. (2017). Fraud-free financial report: A conceptual review. International Journal of Academic Research in Accounting, Finance, and Management Sciences, 7(4), 83?94.

- Price Water House Cooper. (2017). Economic Crime Update.

- Romanosky, S. (2016). Examining the costs and causes of cyber incidents. Journal of Cybersecurity, 2(2), 121-135.

- Zhou, Y., & Makridis, C. (2019). Financial misconduct and changes in employee satisfaction.