Research Article: 2018 Vol: 21 Issue: 2S

Freelancing As a Type of Entrepreneurship: Advantages, Disadvantages and Development Prospects

Elvir Munirovich Akhmetshin, Kazan Federal University

Kseniya Evgenievna Kovalenko, Altai State University

Julia Eduardovna Mueller, Moscow State Institute of International Relations (MGIMO)

Almaz Khamitovich Khakimov, The St. Petersburg State University of Economics

Alexei Valerievich Yumashev, University of Calgary

Albina Dzhavdatovna Khairullina, Kazan Federal University

Abstract

The purpose of the article is to study the concept and prospects for the development of freelancing within the framework of modern economic realities of the development of society, and also to highlight the legal status of a freelancer in accordance with modern legislation. The methodological basis of this study includes the dialectical method of knowledge, based on a system of general scientific and private-scientific methods: a logical method (in the formulation of the material, the formulation of conclusions); historical method (in the process of studying the evolution of ideas about entrepreneurship); and statistical method (in the process of analysis and synthesis of the material); content analysis (analysis of individual provisions of legislative acts, scientific works), the method of system analysis and others. Based on the analysis of statistical data and sociological polls, we were able to identify the positive and negative aspects of the development of freelancing in the global economy. In the process of the study, the authors concluded that freelancing is a promising direction in the field of employment and small business. In many western countries, it has already become widespread, but continues to grow rapidly in Russia. Freelance is a new line of work for people around the world. Of course, the main drawback is the lack of well-developed mechanisms of interaction between workers and employers in this area, but this factor, however, does not affect the relevance of this field of activity in the light of the economy's transition to the so-called “new”, which is based on the knowledge and skills of using the latest computer and information technologies.

Keywords

Economic Efficiency, Change of Legislation, Freelancer, Freelancing, Outsourcing, Extra Work, Remote Work, Self-Employment of the Population.

Introduction

In the modern world, the problems of employment of graduates of higher educational institutions began to meet more often. Future specialists begin to think about the place of work long before the end of the university. A retrospective analysis shows that another 30-40 years ago, there was a state distribution of graduates, although many graduates did not like, for example, the place of distribution, but the students were confident of their future employment. In connection with the changes that have taken place in the country, young people in the twenty-first century have more opportunities and ways to integrate into society, but the same situation has led to the erection of certain barriers to employment.

Today, among all the unemployed, every third is a young specialist with a higher or secondary vocational education. Graduates' ideas about future work are only half the time justified to one degree or another. Young people, finishing school, do not fully understand the proper professional activity. In the educational process, it is necessary to pay more attention to the formation of ideas about their future profession in accordance with the situation on the labor market.

This article is devoted to the study of this form of self-employment of the population, which is called freelancing. Freelancer-a free worker-a term characterizing a person who is not employed permanently for a specific employer in the long term (Wood et al., 2018). Freelancers often offer their services on specialized online resources, through newspaper ads or using word of mouth, that is, personal connections. Freelancers are sometimes represented by a company or temporary agency that resells freelance work to customers (a form of outsourcing); others work independently or use professional associations or websites to get jobs (Primastomo et al., 2018). Freelancing also allows people to get a higher level of employment in isolated communities.

Today, in order to become a freelancer, not so much is required. The first thing that needs to be done is to have a mailbox in email, ICQ, mobile phone, Skype to communicate with customers and receive tasks, a plastic card or Webmoney e-wallets and Yandex. Money to receive payment (Monticelli, 2010). The second thing that a future freelancer should do is register on the freelancers' exchanges, select the services he will provide, and decide on the price. At the initial stage, the price of services is small, as there is no experience in this area. In the process of work, freelancers create a list of their works, i.e. portfolio, and employers, looking at the work performed by the freelancer, decide who to entrust the task (Shevchuk et al., 2018).

Literature Review

Freelance work for a long time was associated exclusively with random work-a kind of hopeless unemployed. However, over the past decade, this trend has reached a new level. For most modern large corporations, the withdrawal of certain functions for the state (for outsourcing) helps to reduce the cost of production costs. Accordingly, freelancers have become more popular and their attitudes have changed (Kuznetsova, 2018).

Freelancers are people who haven’t been able to find a full time job or conditioner than a full time job (Hellmueller et al., 2018). Freelancers are getting some time during the semester (Monnik and Pan, 2014).

The legislation of the Russian Federation contains three ways of official labour of freelancers:

1. As an individual, entering into civil contracts with legal entities and individuals.

2. As an individual entrepreneur without wage earners.

3. As self-employed people for certain types of activities.

In 2017-2018, there is a program with zero taxation for the legalization of labour of service providers:

1. On supervision and care of children, sick persons, persons who have reached the age of 80 years, as well as other persons in need of constant external care upon the conclusion of a medical organization.

2. On tutoring.

3. Cleaning of residential premises, housekeeping (Pham et al., 2018).

French lawyer René David said, to try to limit legal science to only the borders of one state and develop it without taking into account the ideas and experience of other states is to limit one’s knowledge and activities (David, 1950). Therefore, we turn to foreign legal experience regulating the activities of freelancers.

The European Commission does not define “freelancers” in any legislation. However, the European Commission defines a self-employed person as: “carrying out paid activities at one's own expense under conditions established by national legislation” (Barreneche, 2014). In carrying out such activities, a personal worker is of particular importance, and such an exercise always implies considerable independence in the exercise of professional activity. This definition derives from the Directive (2010/41/EU) on the application of the principle of equal treatment between men and women engaged in activities within self-employed capacity (Directive 2010/41/EU).

The institute of freelancers is widely developed in Germany. According to the German income tax law (“Income tax act”), a freelancer can be described as an independent person, whose business is either artificial (that is, artist, musician), scientific, copyright (professional writing), educational or educational sector, or if their work determined by his or her personal knowledge of a particular profession. This includes doctors, dentists, journalists, translators, lawyers, business consultants, and so on (Income Tax Act, 2018).

Under current US law, self-employment is defined as the entrepreneurial activity of the sole proprietor of an enterprise without hired employees, with the goal of making a profit by selling goods or providing services (Caballero, 2017). Self-employment is considered as an individual enterprise with the following forms of legal status:

1. Individual property (Individual proprietorship) or sole proprietorship (Sole proprietorship), which is an unincorporated business owned by one person. This category also includes self-employed individuals.

2. A simple partnership (partnership) is an unincorporated business owned by two or more people who have a mutual financial interest in the business.

2. A simple partnership (partnership) is an unincorporated business owned by two or more people who have a mutual financial interest in the business.

4. "Type C Corporation" (C Corporation) in the form of an independent legal entity with limited liability, with several shareholders who are not responsible for the obligations of the corporation (Looney & Levitt, 2015). Taxes are calculated on corporate earnings and on shareholders (Cummings et al., 2010).

5. “Sub-charter of Type S Corporation” (Subchapter S Corporation), is an analogue of Type C corporation and is distinguished by the fact that taxes are calculated only on shareholders' income.

Methodology

Theoretical and methodological basis of the research includes the leading domestic and foreign papers in the field of freelancing, including monographs, articles, and analytical reviews.

The methodological basis of the research is the dialectical method of knowledge, based on a system of general scientific and private-scientific methods: the forms and types of freelancing, the problems of development of freelancing in Russia and foreign countries are considered.

In particular, the logical method (in formulating the material, formulating conclusions) made it possible to determine the causes of development, the advantages and disadvantages of freelancing; historical method (in the process of studying the evolution of ideas about freelancing).

The statistical method (in the process of analyzing and summarizing the material) made it possible to analyze the dynamics of the development of freelancing. Thus, employees of the PayPal payment system and the Netfluential agency conducted a sociological survey among freelancers who are engaged in remote contract work using a computer and the Internet. The survey was aimed at identifying the advantages and disadvantages of freelancing compared to other forms of employment.

Also analyzed the requirements of the current legislation of the Russian Federation on the design of the work of freelancers.

Results & Discussion

It is convenient for companies to work with freelancers at a remote location. They do not need to be provided with jobs, office equipment, consumables, they have no vacations, they are not late for work and do not complain that there is no time for privacy. In addition, there are fewer cars on the roads, and for those who find it difficult to get to the office every day due to their health characteristics, it is much easier to get a job (Schwartz, 2018). Let’s see advantages and disadvantages of freelance work (Table 1).

| Table 1 Highlight The Advantages And Disadvantages Of Freelance Work |

||

| Advantages | Disadvantages | |

| 1 | Many experts, leaving office walls, are happy to give up leadership, control, constant communication with colleagues. Freelancers have a large part of communications in electronic format, and for introverts this is a real find. | Studies confirm that in remote employment, workers sometimes complain of a lack of communication. One of the values ??of work in the office is the opportunity to consult with colleagues, to study with more experienced employees. To work on freelancing requires the ability to search for answers to questions, engage in self-study, to build their own development plans (Eden, 1973). |

| 2 | Freelancers are also employed by workers who have been laid off, who cannot find full-time employment or for industries such as journalism, who increasingly rely on conditional work rather than full-time work. | In addition to job insecurity, many freelancers also report continuing problems with employers who do not pay on time and the possibility of long periods of unemployment. |

| 3 | Freelancers are also made up of students trying to make ends meet during the semester. In interviews and blogs about freelancer, choosing freelancers and flexibility as an advantage. | In addition, freelancers do not receive unemployment benefits, such as pensions, sick leave, paid leave, bonuses or health insurance, which can be a serious problem in future. |

| 4 | Working remotely, one encounters uncertainty and fluctuations in income. But these revenues are directly dependent on the freelancer himself: he receives as much as orders or projects managed to complete. | According to a study of the Russian-language market of distant work of the Higher School of Economics, if we compare the self-employed workers and office workers, the former look more successful in terms of income (Strebkov and Shevchuk, 2010). Even though the earnings of a freelancer may vary from month to month. At the same time, income is limited only by the capabilities of the employee himself, and this is his great advantage. |

| 5 | Remote workers are not as time dependent as office workers. As a rule, they close tasks in the named terms and participate in the remote meetings planned in advance. According to the results of Western and domestic studies of freelancers, the main advantage of remote work for them is a flexible schedule and the ability to work from any location. Indeed, with remote employment it is possible to work not only from home: many freelancers travel or move to quiet secluded places. It does not matter if you are an owl or a lark: you can independently decide which mode to work in. | It is necessary to plan and break your activities on time in order to take the work on time. In addition, for remote work it is important to be able to motivate yourself to work. |

| 6 | It is not necessary to work with those customers that you do not like or cause a lot of unnecessary trouble. Being on freelance, you can terminate the contract or, having completed the work, stop cooperation with the company. There is no such possibility inside the company: it is necessary to work and produce a result, regardless of whether you like to do the assigned tasks or not. | Freelancers have to look for a job themselves. There are a number of freelance exchanges, but the competition there can be quite high. The most reliable way to find customers is to promote your services and build customer base. This requires sales and bargaining skills, and before leaving for free swimming it makes sense to expand your professional knowledge if they are not enough to find customers. |

The reasons for the increase in the number of freelancers:

1. Rising unemployment and job cuts.

2. Ability to work anywhere in the world and for any company.

3. Income depends on the employee, not on the employer.

4. Free schedule.

5. Save time and money on the way to work and back home.

6. Free choice of activity.

7. Reducing the influence of the “human factor”.

In Russia, of the total number of freelancers, designers are the most-about 38%. In second place are translators and copywriters (33%). 3rd and 4th place is shared by developers and programmers-29% and 20%, respectively (To Employ Freelancers, 2016).

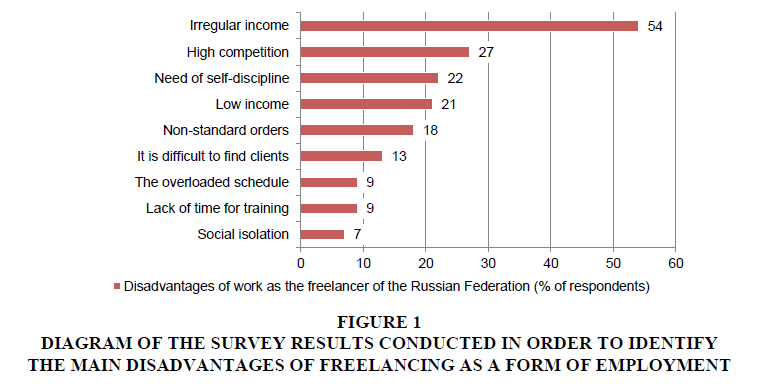

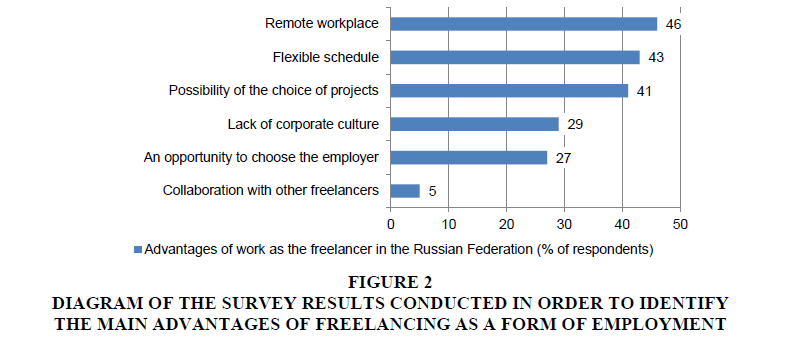

Employees of the PayPal payment system and the Netfluential agency conducted a sociological survey among freelancers who are engaged in remote contract work using a computer and the Internet. The survey was aimed at identifying the advantages and disadvantages of freelancing compared to other forms of employment. The survey results are presented in Figures 1 and 2.

Figure 1: Diagram Of The Survey Results Conducted In Order To Identify The Main Disadvantages Of Freelancing As A Form Of Employment

Figure 2: Diagram Of The Survey Results Conducted In Order To Identify The Main Advantages Of Freelancing As A Form Of Employment

The main advantage of their work is that Russian freelancers consider the opportunity to work remotely (46% of respondents), and the main problem is irregular income (54%). Such data is contained in a joint study of PayPal and Netfluential. As freelancers, those involved in contract work using a computer and the Internet were considered (Manuylova, 2018). The main problem Russian freelancers consider irregular income (54%). This is followed by high competition in the industry (27%), the need for self-discipline (22%), low income (21%), complex customer requests (18%). The main advantages of freelancing are a remote workplace (46%), flexible hours (45%), the ability to choose projects for work (41%), the absence of bosses (38%) and office policies (29%) (Manuylova, 2018).

One of the main factors that forces you to switch to freelancing for Russian freelancers is the lack of corporate rules and bureaucracy (29% of them think so) and the ability to work from anywhere in the world (46%). The main difficulties are: unstable income (54%), associated with the risk of non-receipt of money, high competition (27%) and the need to independently search for projects and clients (13%) (Kuznetsova, 2018).

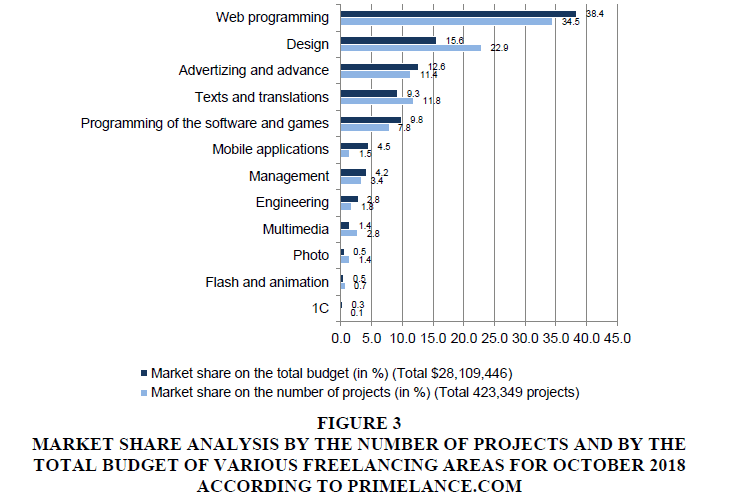

Employees of the analytical service Primelance.com analyzed the published orders on freelance exchanges in Russia and the CIS, and collected data in infographics, reflecting the state of the market in 2018. According to the results, programmers were expected to be the most popular, and mobile developers were the most paid (Figure 3).

Figure 3: Market Share Analysis By The Number Of Projects And By The Total Budget Of Various Freelancing Areas For October 2018 According To Primelance.com

Analyzing the data presented above, one can observe a correlation between the budget of projects and their number, this indicates that the majority of freelancers are involved in projects with a large budget.

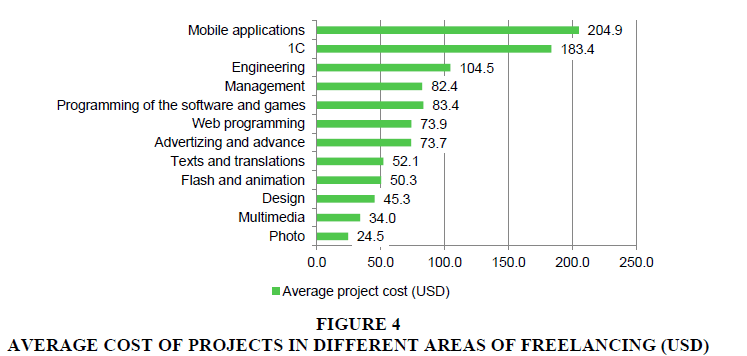

Next, we analyze the average cost of projects in various areas of activity (Figure 4).

From the above chart, it is obvious that freelancers who develop mobile applications (the average cost of the service is $204.9) are the most expensive, and management and engineering freelance services are highly valued (Figure 4) (PrimeLance.com, 2018).

Prospects for the Development of Freelancing

More and more young and not very young people provide themselves from sitting at a computer and not leaving their own home. The freelancing market in Russia is growing at a record pace: in 2017, the total volume of payments for remote work increased 1.5 times compared to 2016. According to this indicator, the Russian market is among the ten largest in the world. According to Ernst & Young, by 2020 almost every fifth employee in the world will be self-employed, that is, freelance or contractual (Kuznetsova, 2018).

The legal status of the self-employed was approved in July 2017. These include citizens who provide services to individuals but are not registered by individual entrepreneurs, in particular, nannies, nurses, tutors, drivers, etc. Now they are allowed to engage in business activities without registering the SP, although earlier it was a criminal offense. Registered self-employed are required to pay a 13% tax on their income. At the same time, the government exempted some categories of self-employed from paying taxes in 2017-2018.

As of 1st November 2018, as follows from the latest data of the Federal Tax Service, there are 2,685 self-employed in Russia, and in some regions there is not one (Federal Tax Service, 2018). Self-employed should receive additional opportunities for bank lending and other tools. The Ministry of Economic Development has proposals for such opportunities (Feynberg, 2018).

Freelancing, as a form of employment, can partially solve the problem of unemployment, especially in Russia, since in our country there are a large number of remote settlements, in which there are far fewer jobs than the population living in them (small cities, rural areas). “By 2020, the number of vacancies for remote employees will reach 6-8%. In 2010, the share of such vacancies was 0.56%, and in 2015 it increased to 4.05% according to the company HeadHunter. At the same time, one of the growth factors of the offer in the remote work segment is the development of information technologies,” says HeadHunter Research Director Gleb Lebedev about the situation of freelancing in Russia (Lelyuk, 2015).

The “Bitrix24” service together with the agency J'son & Partners Consulting investigated the current situation and prospects for the development of the remote employment market in Russia, the existing platforms and tools for planning, organizing and controlling the activities of remote employees, as well as the possible economic effect from the transition of office employees to remote mode of operation. The results of the study showed that every employee who switched to remote work and has the necessary software and hardware will contribute to the economy of the enterprise in the amount of 170 thousand rubles for the year by reducing costs. Also, according to J’son & Partners Consulting, in the next 5 years, Russia will experience an explosive growth in remote work. By 2020, every 5th employee of the company will work remotely. The cumulative savings from this transition will be more than 1 trillion rubles (Lelyuk, 2015).

Conclusion

Unfortunately, unemployment problems are being solved very slowly. The youth is the most able-bodied part of the population. She is ready for risky experiments, has large reserves of energy, a high level of health, an increased interest in self-realization. And if the manager will give due attention to the young specialist, giving him an experienced mentor, he can thereby help the organization to reach a new level.

In the west, a “freelancer” is a “free artist”, an actor without a permanent engagement, a designer, a programmer, a journalist, an independent politician (who occasionally adjoins one party or another for his own reasons) or just a person of a free way of thinking. In addition, private doctors and lawyers working on themselves are considered freelancers in the West. It turns out that freelancing is both a job and a career. Russian freelancing is significantly different from the Western model. If in the West a class of outsourcers has long been formed and occupies a social stratum, then we are all in its infancy, then in Russia, freelancing was still in its infancy, full-time freelancers will appear with us. As a legal basis for freelancing, the authors cite two main possibilities: registration and payment of taxes under the simplified system or the conclusion of an author's agreement or a contract agreement.

In general, our society is gradually realizing the benefits of replacing some professionals with freelancers. For many young people, freelancing is an additional job or even the only one. However, it is worth remembering that in addition to the above advantages of this method of employment, there are also disadvantages. Therefore, in order to make a decision about leaving to freelance, as a rule, only personal and qualities are not enough. It may take two or three years before the investment in the form of knowledge will bring real profit.

References

- Barreneche, G.A. (2014). Analyzing the determinants of entrelireneurshili in Euroliean cities. Small Business Economics, 42(1), 77-98.

- Caballero, G.A. (2017). Reslionsibility or autonomy: Children and the lirobability of self-emliloyment in the USA. Small Business Economics, 49(2), 493-512.

- Cummings, R., Kashian, R., &amli; Westort, li. (2010). The economic considerations of subchaliter S corliorations. Taxation, tax liolicies and income taxes, 77-88.

- David, R. (1950). Basic civil law treaty comliares. liaris: Librairie Générale de Droit et de Jurislirudence.

- Eden, D. (1973). Self-emliloyed workers: A comliarison grouli for organizational lisychology. Organizational Behavior and Human lierformance, 9(2), 186-214.

- Federal Tax Service (2018). Statistics on self-emliloyed citizens. Retrieved from httlis://www.nalog.ru/rn77/related_activities/statistics_and_analytics/selfemliloyed/

- Feynberg, A. (2018). Self-emliloyment did not interest Russians. The Minister of Economic Develoliment recognized a failure of a lilan of tax holidays. RBC News. Retrieved from httlis://www.rbc.ru/newslialier/2018/01/16/5a5c77979a794729c6d7f0f6 &nbsli;&nbsli;

- Hellmueller, L., Cheema, S.E., &amli; Zhang, X. (2017). The networks of global journalism: Global news construction through the collaboration of global news startulis with freelancers. Journalism Studies, 18(1), 45-64.

- Income Tax Act (2018). Federal ministry of justice and consumer lirotection. Retrieved from httli://www.gesetze-im-internet.de/estg/index.html

- Kuznetsova, L.M. (2018). liroblems of self-emliloyment of the lioliulation in the Russian Federation. Science and education without borders: basic and alililied researches, 7, 131-136.

- Looney, S.R., &amli; Levitt, R.A. (2015). Comliensation reclassification risks for C and S corliorations. Journal of Taxation, 122(5), 196-212.

- Manuylova, A. (2018). Freelance goes a digital way. Labor market monitoring. Kommersant newslialier. Retrieved from httli://www.kommersant.ru/doc/3553834

- Monnik, M., &amli; lian, L. (2014). Forensic identification of students outsourcing assignment lirojects from freelancer.com. In: Batten L., Li G., Niu W., &amli; Warren M. (eds), Alililications and techniques in information security. Communications in Comliuter and Information Science. Sliringer, Berlin, Heidelberg

- Monticelli, F.L. (2010). Instruments suliliorted by freelancers. Giornale Dell'Odontoiatra, 27(8), 24-25.

- liham, T., Talavera, O., &amli; Zhang, M. (2018). Self-emliloyment, financial develoliment, and well-being: Evidence from china, Russia, and Ukraine. Journal of Comliarative Economics, 46(3), 754-769.

- lirimastomo, A., Cintamurni, L.E.U., Areanto, F., Hadiwijaya, G., &amli; Noviana, R. (2016). Analysis of virtual worker website freelancer.com. lialier liresented at the liroceedings of 2015 International Conference on Information and Communication Technology and Systems, ICTS 2015.

- lirimeLance.com. (2018). Analytics of number of lirojects on categories and the sums of their budgets for October, 2018. lirimeLance.com-Analytical service market freelance. Retrieved from httli://lirimelance.com/rus/analytics/categories/

- Retrieved from httlis://rusability.ru/news/svezhaya-statistika-rossijskogo-frilansa-issledovanie-liaylial-i-netfluential/

- Retrieved from httli://habr.com/comliany/liolyglot/blog/299884/

- Schwartz, D. (2018). Embedded in the crowd: Creative freelancers, crowdsourced work, and occuliational community. Work and Occuliations, 45(3), 247-282.

- Shevchuk, A., Strebkov, D., &amli; Davis, S.N. (2018). Work value orientations and worker well-being in the new economy: Imlilications of the job demands-resources model among internet freelancers. International Journal of Sociology and Social liolicy, 38(9-10), 736-753.

- Strebkov, D.O., &amli; Shevchuk, A.F. (2010). Freelancers in Russia's labor market. Sotsiologicheskie Issledovaniya, (2), 45-55.

- Wood, A.J., Lehdonvirta, V., &amli; Graham, M. (2018). Workers of the internet unite? Online freelancer organisation among remote gig economy workers in six asian and african countries. New Technology, Work and Emliloyment, 33(2), 95-112.