Research Article: 2022 Vol: 26 Issue: 4

Fundamental Analysis from Value Drivers: The Case of Banking, Industrial, Consumer Goods, Healthcare and Tech Firms Listed on the Johannesburg Stock Exchange

Enow Samuel Tabot, IIE Vega School

Citation Information: Tabot, E.S. (2022). Fundamental analysis from value drivers: the case of banking, industrial, consumer goods, healthcare and tech firms listed on the johannesburg stock exchange. Academy of Accounting and Financial Studies Journal, 26(4), 1-11

Abstract

Fundamental trends usually drive the market price of a stock. A healthy and good security is usually reflected in its fundamentals and can be used to provide the direction of trade for investors and investment practitioners. Fundamental drivers can last for years and at times minutes. The purpose of this study was to use fundamental value drivers to provide signals for stocks in the banking, industrial, consumer goods, healthcare and technology firms listed on the Johannesburg stock exchange (JSE). Using a sample of 56 firms from different sectors and a multiple regression analysis, the findings reveals that 50% of the largest 10 firms in the banking sector according to market capitalisation are undervalued. In the industrial sector, 44% of the largest 14 firms where undervalued. Furthermore, only 36% of the 14 largest firms in the consumer goods sector are undervalued while 44% and 45% of the largest 9 and 11 firms in the healthcare and Tech firms respectively listed in the JSE are undervalued. These findings can be used to provide suitable investment strategies for investors and industry practitioners.

Keywords

Fundamental Analysis, Value Drivers, Market Efficiency, Asset Pricing, Johannesburg Stock Exchange, Price Earnings Ratio, Earnings Per Share.

Introduction

Most firms have specific fundamental value drivers that can significantly propel the business to profitability because of the impact it has on the success of the firm (Tiwari & Kumar, 2015). These value drivers are at times generic but can be industry or firm specific. Financial performance measures such as revenues, Earnings per share (EPS), price earnings ratio (P/E ratio), Earnings yield (E/Y), Book-to-market value per share are at times the most important value drivers because they provide strong indicators for the firm and can be used to gain valuable insights into the financial performance of a business (Panigrahi et al., 2014). It is worth noting that financial performance is not limited to profitability, other metrics such as expected future cash flows can be used to access the financial strength of a business. Fundamental analysis using value drivers derived from empirical methodologies has shown to be a useful tool for predicting a stock's future prospects (Segal, 2021). This is because fundamental analysis in the context of value drivers aims to discover the underlying variables that influence a particular security and predicts what buy/sell orders should be placed (Segal, 2021). In so doing, the analysis can be used to evaluate the aspects that affects the value of the security. In applying the concept of fundamentals, the intrinsic value, earnings, book values, price earnings ratios and fair values concepts are important considerations for analysis the prospect of a stock (Doblas et al., 2020). From an investor’s perspective, intrinsic values are the cash flows that can be taken out of the company and be returned to the investor during the holding period of the stocks (Bhattacharyya, 2013).

Intrinsic values are significant and important for cash flow generating assets since they are a function of the magnitude of predicted cash flows (Subramanyam & Venkatachalam, 2001). Earnings events are important to investors for several reasons and have significant impact on the price of a stock where it can result in price volatility (Sharma & Chander, 2009). Public companies are required to publish their earnings reports atleast once a year in other for investors and prospective investors to evaluate the performance of the firm. Although no single metric can tell the whole financial story, positive earnings announcement is very important as it shows how profitable the business has been. Most often, the actual earnings are benchmarked against the expected where earnings above the expected signals a strong firm and vice versa (Schrand & Walther, 2000). The market tends to absorb this information and the stock price jumps in the direction of earnings expectation (Fama, 1970). Fair values are more of a financial reporting concept where it represents the price that will be received if an asset is sold in the market (Chen, 2021) and assumes that the market participants are knowledgeable, independent and willing to enter into a transaction. There are basically three ways of determining the fair value of an asset which are the income approach, market approach and cost approach (Merriman, 2017). The market approach is considered important for the purpose of this study. Fundamental analysts are more interest in securities that have a market price below the intrinsic value and will seek the stock when the price exceeds the intrinsic value (Figurska & Wisniewski, 2016). Therefore, this study applied multiple regression to fundamental analysis to determine stocks that are overvalued and undervalued in the banking and retail industry.

Purpose of Study

The main aim of this study is to use fundamental analysis to generate a value that an investor can weigh against the current price of the security with the goal of outlining the type of position to take that security whether it is under-priced therefore a buy or overpriced which is a sell.

Hypothesis

Considering the purpose of this study, the hypothesis to be investigated are:

H0: All the stocks in the banking, industrial, consumer goods, health care and Tech sectors are undervalued therefore a “Buy” signal.

H1: All the stocks in the banking, industrial, consumer goods, health care and Tech sectors are overvalued and therefore a “Sell” signal.

H2: Majority of the stocks in the banking, industrial, consumer goods, health care and Tech sectors are undervalued.

H3: Fewer stocks in the banking, industrial, consumer goods, health care and Tech sectors are undervalued.

Literature

Theoretical Concept

Asset pricing is the basic foundation of financial theories (Tallman, 1989). These theories are used to determine how much an investor is willing to pay for a stock. Theoretically, rationale investors are willing to pay the present value of future cash flows of a stock, all things remaining constant, investors will pay more for higher expected earnings and less for lower earnings (Ivanovska et al., 2014). As explained by Fama (1970), efficient markets fully reflect prices where these informational efficiencies stem from competition in profits, low transaction cost and readily available information. If there is information suggesting that the value of an asset will be higher in the future, competitive traders will purchase the asset today increasing its price. The competition to incorporate new information for profits means that prices should change quickly as new information develops. The fundamental index of investing proposes that if prices changes are based on new information and cannot be predictable then trying to predict prices should not be expected to improve the outcome (Malkiel, 2003). The concept of market efficiency proposes that prices are random and active managers should not be successful in beating the market and prices should change quickly based on new information (Fama,1970). Although this prediction attempts to describes real markets and prices do at times changes randomly, active managers do on average trail the market after cost (Investment institute company, 2021). Market efficiency and inefficiency is a very important concept in finance and is at the centre of investment valuation. This is because prices represent the best indication of a firm's value in an efficient market, where the valuation process is not justified. On the other hand, if markets are inefficient, implying that the market price does not reflect the firm's value, the valuation procedure to identify the firm's fair value is warranted. Inefficiencies in the market can be used to screen stocks in order to find undervalued securities (Latif et al., 2011). In essence, in an efficient market, a security’s market price can be used as an impartial estimation of the stock's true value. Market efficiency implies that the probabilities of spotting undervalued assets should not be structured, and that random investment techniques will outperform fundamental analysis (Haqqani et al., 2021). However, there are several evidence contradicting the market efficiency concept where active managers have consistently beat the market south Africa (Heymans & Santana, 2018; Fusthane & Kapingura, 2017). When applied to this study, it can be suggested that the South African market is not efficient and fundamental analysis can be used to provide valuable investment advice. It is also worth noting that fundamental analysis emphasis on the use of financial statement in valuing stocks based on revenues, earnings profit margins and other relevant data.

Review of Prior Literature

With regards to the literature on prior studies, not so much have been published on value drivers from fundamental analysis. More specifically, very few studies were found on this topic meaning very little research has been done around the niche area. The table 1 below presents a summary of the review on prior literature.

| Table 1 Summary Of Prior Literature |

|||||

|---|---|---|---|---|---|

| Study (Author & year of study) | Model | Period | Country | Key variables | Findings |

| Akalu (2002) | Ordinary least squares | 1 January 1994 to 31 December 1999 | Netherlands | Free cash flow, net sales, operating cost, interest expense on long term debt, income taxes, fixed cost of investment, replacement cost of investment and working capital investment | Value drivers display similar trends across industries. Operating cost and interest expense significantly affects free cash flow. |

| Eriksson, Forsberg & Gustavsson (2011) | multiple regressions | 2008 - 2011 | United States | Free cash flow, Enterprise value to Earnings before interest, tax and depreciation (EV/EBITDA), price earnings ratio | EV/EBITDA and price earnings ratio are better measures of stock price return. |

| Ali (2014) | Multiple regression | 2001- 2011 | United Kingdom and United states | Price-to-Earnings, Price-to-Net Income, Price-to-EBITDA, Price-to-Sales, and Price-to-Book. | Price to sales and price to book drivers were the most consistent and significant drivers |

| Wafia et al. (2015) | Qualitative review | 2015 | Italy and United Kingdom | Discounted Dividend Model, Discounted Cash Flow Model and Residual Income Model | The Residual Income Model is a better predictor of stock value. |

| Muhammad & Ali (2018) | Common effect model, fixed effect model, and random effect model | 2007 to 2017 | Pakistan | Profitability ratios, liquidity ratios, leverage ratios, and market-based ratios |

Fundamental analysis can be used to predict the direction of trade and a security returns. |

| Daniswara & Daryanto (2019) | Regression analysis | 2014 - 2018 | Indonesia Stock Exchange | Earning Yield, Price Book Value, Return On Asset, and Return On Investment. | Earning Yield , Price Book Value, Return on Asset and Market Return has affecting stock return |

Source: Author.

From the above literature there is still a paucity of research that needs to be conducted on value drivers from fundamental analysis. None of the studies above highlights the main drivers of stock return and a propose buy/sell order from the fundamental analysis. Hence, this study fills in the gap in literature. Also, similar studies can be conducted in other markets using the same methodology.

Methodology

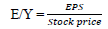

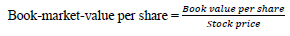

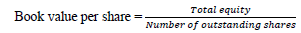

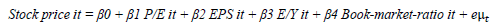

A purposive sampling was used to select 58 firms in the banking, industrial, consumer goods, healthcare and Tech sector. More specifically, 10 firms from the banking sector, 14 from the industrial sector, 14 from the consumer goods sector, 9 from the healthcare and 11 from the tech sector respectively. The selection was based on the market capitalisation from the largest to the smallest. Large market capitalization stocks tend to pay consistent dividends and are less hazardous due to lesser volatility, resulting in adequate analytical coverage (Horton, 2021). The values for all the variables where retrieved on 23/December/ 2021 from yahoo finance providing an up to date market values. In line with the study of this study also used P/E, EPS, E/Y and book-market-ratio to estimate the coefficients of the independent variable in order to estimate the fair value. The values of P/E ratio, EPS where retrieved directly from yahoo finance while the E/Y, book value and book-to-market value per share where calculate based on the following formulas (Daniswara & Daryanto, 2019).

These valuation multiples where applied to determine whether the stock is undervalued or overvalued where a multiple regression analysis was used in the valuation process. The choice of using a multiple regression was because fundamentals such as price-to-book and P/E ratios multiples can be used to value one stock at a time and cannot be applied to stocks with negative EPS or negative book values which make this approach more relevant. The model specification is highlighted below

Firstly, the coefficient for the independent variables where determined which were used to calculate the value factors. The value factors are the weighted average of the coefficients and the values of the independent values. The value factors where then multiples by the stock price to determine the fair values. The results and discussion is presented below Table 2.

Data Results and Analysis

The coefficients of P/E, E/Y and Book-to-market ratio are all positive as expected except in the ba

| Table 2 Fundamental Results For The Banking Sector |

|||||||

|---|---|---|---|---|---|---|---|

| Value Factor | Fair value | Signal | Stock price | EPS | P/E ratio | Book value per share | |

| Standard bank | 100% | 13273.1 | Buy | 13229 | 12.54 | 1062.46 | 135.14 |

| Firstrand | 96% | 5693.0 | Sell | 5918 | 4.77 | 1245.12 | 29.92 |

| ABSA | 115% | 92599.8 | Buy | 80600 | 17.94 | 4528.68 | 186.67 |

| Nedbank | 100% | 979.2 | Buy | 979 | 10.14 | 96.51 | 3026.75 |

| Investec | 109% | 9037.6 | Buy | 8302 | 8.56 | 973.37 | 5.49 |

| Capitec bank | 91% | 179533.8 | Sell | 196716 | 66.93 | 2965.32 | 258.72 |

| Sanlam ltd | 98% | 5616.9 | Sell | 5737 | 4.81 | 1210.97 | 37.46 |

| Discovery limited | 92% | 12611.0 | Sell | 13781 | 4.75 | 2924.48 | 70.67 |

| Rand merchant | 90% | 3960.4 | Sell | 4407 | 1.88 | 2337.4 | 18.97 |

| old mutual | 103% | 1291.8 | Buy | 1250 | 0.79 | 1580.6 | 14.72 |

nking sector where the book-market-ratio is negative Tables 2 to 16. Although, most of the p-values of these variables are not significant at 5% with the exception of the banking sector, the announcement of these positive value drivers such as P/E, EPS and book-market-value per share positively affect stock prices. This finding is in line with the findings of (Eriksson et al., 2011; Daniswara & Daryanto, 2019). A value factor of less than 100% indicates that the stock is backed up by a smaller proportion of the fundamental value meaning the stock is overvalued. On the other hand, a value factor of more than 100% means that the stock is undervalued. Therefore, stock highlighted in green are undervalued hence the “Buy” signal and stocks in yellow are overvalued with a “Sell” signal.

| Table 3 Fundamental Results For The Banking Sector |

|||||

|---|---|---|---|---|---|

| Price | Constant | Earnings yield (E/Y) | Book-to-market value per share | P/E ratio | |

| Standard bank | 100% | 7.55915E-05 | 0.0009 | 0.0102 | 1062.46 |

| Firstrand | 100% | 0.000168976 | 0.0008 | 0.0051 | 1245.12 |

| ABSA | 100% | 1.24069E-05 | 0.0002 | 0.0023 | 4528.68 |

| Nedbank | 100% | 0.00102145 | 0.0104 | 3.0917 | 96.51 |

| Investec | 100% | 0.000120453 | 0.0010 | 0.0007 | 973.37 |

| Capitec bank | 100% | 5.08347E-06 | 0.0003 | 0.0013 | 2965.32 |

| Sanlam ltd | 100% | 0.000174307 | 0.0008 | 0.0065 | 1210.97 |

| Discovery limited | 100% | 7.25637E-05 | 0.0003 | 0.0051 | 2924.48 |

| Rand merchant | 100% | 0.000226912 | 0.0004 | 0.0043 | 2337.40 |

| old mutual | 100% | 0.0008 | 0.0006 | 0.0118 | 1580.60 |

| Table 4 Fundamental Results For The Banking Sector |

||||

|---|---|---|---|---|

| P/E ratio | Book-to-market value per share | E/Y | Constant | |

| Coefficients | 0.0002 | -2.53 | 825.97 | 254.37 |

| Standard error | 0.0000 | 0.22 | 71.49 | 141.57 |

| R-square | 0.9942 | |||

| Adjusted R square | 0.8246 | |||

| t-stat | 12.1448 | -11.36 | 11.55 | 1.80 |

| p-value | 0.0000 | 0.0000 | 0.0000 | 0.1225 |

Source: Author.

| Table 5 Fundamental Results For The Industrial Sector |

|||||||

|---|---|---|---|---|---|---|---|

| Value Factor | Fair Value | Signal | Stock price | EPS | P/E ratio | Book value per share | |

| Bidvest Group | 92.7% | 17212.3 | Sell | 18577 | 11.31 | 1648.83 | 84.7 |

| Textainer group | 70.2% | 38378.6 | Sell | 54634 | 76.59 | 724.01 | 25.48 |

| Barloworld limited | 98.8% | 14719.0 | Sell | 14896 | 13.76 | 1077.55 | 108.38 |

| Imperial logistics | 96.8% | 6098.4 | Sell | 6300 | 4.89 | 1292.64 | 40.63 |

| Super group limited | 119.5% | 4073.6 | Buy | 3410 | 2.84 | 1201.83 | 38.17 |

| Kap Industrial | 118.3% | 496.7 | Buy | 420 | 0.38 | 1096.61 | 4.12 |

| Reunert limited | 102.5% | 5284.5 | Buy | 5156 | 4.81 | 1082.33 | 40.52 |

| Afrimat Limited | 77.9% | 4457.4 | Sell | 5725 | 5.34 | 1076 | 16.41 |

| PPC limited | 111.3% | 578.8 | Buy | 520 | 0.55 | 948.62 | 4.46 |

| Raubex group limited | 101.9% | 4055.3 | Buy | 3980 | 2.51 | 1599.04 | 25.84 |

| Wilson Bayly Holmes | 121.4% | 13785.8 | Buy | 11354 | 5.94 | 1919.02 | 105.74 |

| Murray & Roberts | 35.4% | 504.3 | Sell | 1425 | -0.45 | 0 | 12.71 |

| Mix Telematics | 81.1% | 669.4 | Sell | 825 | 0.39 | 1987.18 | 0.22 |

| Mpact Limited | 99.5% | 3312.5 | Sell | 3330 | 3.04 | 1096.48 | 24.04 |

| Table 6 Fundamental Results For The Industrial Sector |

|||||

|---|---|---|---|---|---|

| Price | Constant | Earnings yield (E/Y) | Book-to-market value per share | P/E ratio | |

| Bidvest Group | 100% | 5.38E-05 | 0.001 | 0.005 | 1648.830 |

| Textainer group | 100% | 1.83E-05 | 0.001 | 0.000 | 724.010 |

| Barloworld limited | 100% | 6.71E-05 | 0.001 | 0.007 | 1077.550 |

| Imperial logistics | 100% | 0.000159 | 0.001 | 0.006 | 1292.640 |

| Super group limited | 100% | 0.000293 | 0.001 | 0.011 | 1201.830 |

| Kap Industrial | 100% | 0.002381 | 0.001 | 0.010 | 1096.610 |

| Reunert limited | 100% | 0.000194 | 0.001 | 0.008 | 1082.330 |

| Afrimat Limited | 100% | 0.000175 | 0.001 | 0.003 | 1076.000 |

| PPC limited | 100% | 0.001923 | 0.001 | 0.009 | 948.620 |

| Raubex group limited | 100% | 0.000251 | 0.001 | 0.006 | 1599.040 |

| Wilson Bayly Holmes | 100% | 8.81E-05 | 0.001 | 0.009 | 1919.020 |

| Murray & Roberts | 100% | 0.000702 | 0.000 | 0.009 | 0.000 |

| Mix Telematics | 100% | 0.001212 | 0.000 | 0.000 | 1987.180 |

| Mpact Limited | 100% | 0.0003 | 0.001 | 0.007 | 1096.480 |

| Table 7 Fundamental Results For The Industrial Sector |

||||

|---|---|---|---|---|

| P/E ratio | Book-to-market value per share | E/Y | Constant | |

| Coefficients | 0.0003 | 48.83 | 326.80 | 30.73 |

| Standard error | 0.0001 | 18.12 | 168.62 | 0.30 |

| R-square | 0.9480 | |||

| Adjusted R square | 0.8324 | |||

| t-stat | 2.5864 | 2.69 | 1.94 | 0.30 |

| p-value | 0.0271 | 0.02 | 0.08 | 0.77 |

| Table 8 Fundamental Results For The Consumer Goods Sector |

|||||||

|---|---|---|---|---|---|---|---|

| Value Factor | Fair Value | Signal | Stock price | EPS | P/E ratio | Book value per share | |

| Anheuser-Busch | 78.70% | 74464.7 | Sell | 94600 | 39.14 | 2427.43 | 39.72 |

| British american Tobacco | 105.50% | 60892.2 | Buy | 57700 | 56.33 | 1030.52 | 27.44 |

| Compagnie fin Richmont | 82.00% | 18712.9 | Sell | 22832 | 7.46 | 3092.83 | 31.61 |

| Distell group | 79.80% | 13192.1 | Sell | 16530 | 8.78 | 1862.61 | 61.54 |

| Tiger brands | 85.10% | 15040.5 | Sell | 17676 | 11.3 | 1576.02 | 87.48 |

| AVI limited | 83.90% | 6253.2 | Sell | 7451 | 4.97 | 1488.74 | 13.33 |

| RCL Foods limited | 85.50% | 1162.2 | Sell | 1360 | 1.12 | 1217.55 | 11.15 |

| Astral foods limted | 89.40% | 15213.3 | Sell | 17026 | 12.17 | 1406 | 107.15 |

| Oceana Group limited | 117.80% | 6526 | Buy | 5540 | 6.33 | 877.45 | 51.22 |

| Metair Investment limited | 135.60% | 3575.1 | Buy | 2636 | 3.72 | 708.03 | 21.89 |

| Libstar Holdings limited | 127.20% | 825.2 | Buy | 649 | 0.08 | 8036.15 | 9 |

| Sea Harvest group | 116.60% | 1544.4 | Buy | 1325 | 1.66 | 800.12 | 9.99 |

| RFG holding | 76.00% | 895.1 | Sell | 1177 | 0.82 | 1433.62 | 10.52 |

| Quantum foods holdings | 81.70% | 436.9 | Sell | 535 | 0.53 | 1009.43 | 10.29 |

| Table 9 Fundamental Results For The Consumer Goods Sector |

|||||

|---|---|---|---|---|---|

| Price | Constant | Earnings yield (E/Y) | Book-to-market value per share | P/E ratio | |

| Anheuser-Busch | 100% | 1.06E-05 | 0.000 | 0.000 | 2427.430 |

| British american Tobacco | 100% | 1.73E-05 | 0.001 | 0.000 | 1030.520 |

| Compagnie fin Richmont | 100% | 4.38E-05 | 0.000 | 0.001 | 3092.830 |

| Distell group | 100% | 6.05E-05 | 0.001 | 0.004 | 1862.610 |

| Tiger brands | 100% | 5.66E-05 | 0.001 | 0.005 | 1576.020 |

| AVI limited | 100% | 0.000134 | 0.001 | 0.002 | 1488.740 |

| RCL Foods limited | 100% | 0.000735 | 0.001 | 0.008 | 1217.550 |

| Astral foods limted | 100% | 5.87E-05 | 0.001 | 0.006 | 1406.000 |

| Oceana Group limited | 100% | 0.000181 | 0.001 | 0.009 | 877.450 |

| Metair Investment limited | 100% | 0.000379 | 0.001 | 0.008 | 708.030 |

| Libstar Holdings limited | 100% | 0.001541 | 0.000 | 0.014 | 8036.150 |

| Sea Harvest group | 100% | 0.000755 | 0.001 | 0.008 | 800.120 |

| RFG holding | 100% | 0.00085 | 0.001 | 0.009 | 1433.620 |

| Quantum foods holdings | 100% | 0.001869 | 0.001 | 0.019 | 1009.430 |

| Table 10 Fundamental Results For The Consumer Goods Sector |

||||

|---|---|---|---|---|

| P/E ratio | Book-to-market value per share | E/Y | Constant | |

| Coefficients | 0.000171 | 2.89 | 902.30 | -163.17 |

| Standard error | 0.000032 | 31.74 | 145.46 | 275.33 |

| R-square | 0.960501 | |||

| Adjusted R square | 0.848651 | |||

| t-stat | 5.346260 | 0.09 | 6.20 | -0.59 |

| p-value | 0.000325 | 0.93 | 0.00 | 0.57 |

| Table 11 Fundamental Results For The Health Care Sector |

|||||||

|---|---|---|---|---|---|---|---|

| Value Factor | Fair value | Signal | stock price | EPS | P/E ratio | Book value per share | |

| Aspen Pharmacare | 112% | 24683.7 | Buy | 22016 | 10.53 | 2131.17 | 144.18 |

| Mediclinic international | 80% | 5142.6 | Sell | 6449 | 3.34 | 1962 | 4.02 |

| Life healthcare group | 102% | 2379.4 | Buy | 2323 | 1.2 | 1951.79 | 13.18 |

| Netcare Limited | 136% | 2044.7 | Buy | 1501 | 0.54 | 2847.15 | 7.91 |

| Investec | 41% | 3432.6 | Sell | 8302 | 8.56 | 973.37 | 5.49 |

| Adcock Ingram Holdings | 75% | 3767.9 | Sell | 5000 | 3.96 | 1260.79 | 28.95 |

| Afrocentric investment corp | 94% | 475.4 | Sell | 505 | 0.51 | 988.26 | 5.68 |

| Ascendis health limited | 97% | 74 | Sell | 76 | -2.27 | 0 | 1.07 |

| Advance health limted | 102% | 45.7 | Buy | 45 | -0.05 | 0 | 0.36 |

| Table 12 Fundamental Results For The Health Care Sector |

|||||

|---|---|---|---|---|---|

| Price | Constant | Earnings yield (E/Y) | Book-to-market value per share | P/E ratio | |

| Aspen Pharmacare | 100% | 4.54215E-05 | 0.0005 | 0.007 | 2131 |

| Mediclinic international | 100% | 0.000155063 | 0.0005 | 0.001 | 1962 |

| Life healthcare group | 100% | 0.000430478 | 0.0005 | 0.006 | 1952 |

| Netcare Limited | 100% | 0.000666223 | 0.0004 | 0.005 | 2847 |

| Investec | 100% | 0.000120453 | 0.0010 | 0.001 | 973 |

| Adcock Ingram Holdings | 100% | 0.0002 | 0.0008 | 0.006 | 1261 |

| Afrocentric investment corp | 100% | 0.001980198 | 0.0010 | 0.011 | 988 |

| Ascendis health limited | 100% | 0.013157895 | -0.0299 | 0.014 | 0 |

| Advance health limted | 100% | 0.022222222 | -0.0011 | 0.008 | 0 |

| Table 13 Fundamental Results For The Health Care Sector |

||||

|---|---|---|---|---|

| P/E ratio | Book-to-market value per share | E/Y | Constant | |

| Coefficients | 0.0004 | 44.07 | 1.35 | 29.92 |

| Standard error | 0.0001 | 33.88 | 16.93 | 20.46 |

| R-square | 0.9337 | |||

| Adjusted R square | 0.6939 | |||

| t-stat | 3.4981 | 1.30 | 0.08 | 1.46 |

| p-value | 0.0173 | 0.25 | 0.94 | 0.20 |

| Tables 14 Fundamental Results For The Tech Sector |

|||||||

|---|---|---|---|---|---|---|---|

| Value Factor | Fair Value | Signal | Stock price | EPS | P/E ratio | Book value per share | |

| Prosus N.V | 26% | 31697.73342 | Sell | 122346 | 199.04 | 624.02 | 26.71 |

| Naspers limited | 25% | 59163.53942 | Sell | 236005 | 558.08 | 427.9 | 97.85 |

| Bytes Technolgy group | 110% | 595.7918408 | Buy | 543 | 9.3 | 58.53 | 0.06 |

| Karoooo ltd | 102% | 53450.14299 | Buy | 52399 | 14.61 | 3619.57 | 56.16 |

| Datatect ltd | 121% | 4677.883873 | Buy | 3871 | 0.92 | 4268.19 | 3.18 |

| Capital appreciation limited | 121% | 205.8568835 | Buy | 170 | 0.13 | 1287.88 | 1.11 |

| Alviva holdings limited | 74% | 1223.639731 | Sell | 1650 | 2.59 | 636.93 | 21.7 |

| AYO Tech Solutions | 124% | 494.8696322 | Buy | 400 | -0.6 | 0 | 12.99 |

| EOH holdings | 8% | 46.27371295 | Sell | 605 | -1.66 | 0 | 0.85 |

| Adapt IT holding | 83% | 580.5719073 | Sell | 700 | 0.5 | 1391.65 | 5.84 |

| Mustek limited | 83% | 1102.362584 | Sell | 1336 | 4.24 | 312.37 | 20.56 |

| Tables 15 Fundamental Results For The Tech Sector |

|||||

|---|---|---|---|---|---|

| Price | Constant | Earnings yield (E/Y) | Book-to-market value per share | P/E ratio | |

| Prosus N.V | 100% | 8.17E-06 | 1.63E-03 | 2.18E-04 | 624.02 |

| Naspers limited | 100% | 4.24E-06 | 2.36E-03 | 4.15E-04 | 427.90 |

| Bytes Technolgy group | 100% | 1.84E-03 | 1.71E-02 | 1.10E-04 | 58.53 |

| Karoooo ltd | 100% | 1.91E-05 | 2.79E-04 | 1.07E-03 | 3619.57 |

| Datatect ltd | 100% | 2.58E-04 | 2.38E-04 | 8.21E-04 | 4268.19 |

| Capital appreciation limited | 100% | 5.88E-03 | 7.65E-04 | 6.53E-03 | 1287.88 |

| Alviva holdings limited | 100% | 6.06E-04 | 1.57E-03 | 1.32E-02 | 636.93 |

| AYO Tech Solutions | 100% | 2.50E-03 | -1.50E-03 | 3.25E-02 | 0.00 |

| EOH holdings | 100% | 1.65E-03 | -2.74E-03 | 1.40E-03 | 0.00 |

| Adapt IT holding | 100% | 1.43E-03 | 7.14E-04 | 8.34E-03 | 1391.65 |

| Mustek limited | 100% | 7.49E-04 | 3.17E-03 | 1.54E-02 | 312.37 |

| Tables 16 Fundamental Results For The Tech Sector |

||||

|---|---|---|---|---|

| P/E ratio | Book-to-market value per share | E/Y | Constant | |

| Coefficients | 0.0003 | 32.44 | 51.70 | 104.52 |

| Standard error | 0.0001 | 17.13 | 32.68 | 101.48 |

| R-square | 0.7960 | |||

| Adjusted R-square | 0.5657 | |||

| t-stat | 2.7292 | 1.89 | 1.58 | 1.03 |

| p-value | 0.0294 | 0.10 | 0.16 | 0.34 |

Source: Author

Conclusion

These recommendations are based on the fact that the stocks are justified or not by the fundamental value drivers. It is also worth noting that the R2 and Adjusted R2 indicates that more than 50% of stock price volatility can be explained by the P/E ratio, E/Y and book-to-market ratio. In some cases, the variables accounted for more than 80% of the stock price. With regards to specific sectors the following can be concluded;

1. Banking sector – 50% of the largest 10 banks listed on the JSE are undervalued while 50% are overvalued

2. Industrial sector – Approximately 43% of the largest 14 firms in the industrial sector listed on the JSE are undervalued while 57% are overvalued.

3. Consumer goods sector – Approximately 36% of the largest 14 firms in the consumer goods sector listed on the JSE are undervalued while 64% are overvalued.

4. Healthcare sector – Approximately 44% of the largest 9 firms in the healthcare sector listed on the JSE are undervalued while 56% are overvalued.

5. Tech sector – Approximately 45% of the largest 11 firms in the Tech sector listed on the JSE are undervalued while 55% are overvalued.

From the above analysis, investing in selected firms in the banking and Tech sectors listed in the JSE will provide the optimal returns for investors. This is evident in the 50% and 45% of undervalued stocks in the market. From the above analysis, hypothesis 3 (H3) is accepted and H0, H1 and H2, are all rejected.

Significance of Study

This study empirically applied the concept of fundamental analysis in the different sectors on the JSE to provide insights on which stocks are good investment opportunities in the South African market and also makes inferences on the different sectors highlighted in section 1.1. The study uniquely combines multiple regression and value factor to determine the fair values which is the first study in the South African market as per the authors knowledge. Industry practitioners in other geographical regions can apply the same methodology in other markets.

Limitation of the Study

The main limitation of this study is that it assumes that P/E ratio, E/Y, book-to-market ratio are the only determinants of stock price movements. However, there are other factors that should be considered when investing in equity securities such as governance of the firm, management capabilities and the amount and nature of tangible and intangible assets.

References

Akalu, M.M. (2002). Measuring and Ranking Value Drivers, Tinbergen Institute Discussion Paper, No. 02-043/2, Tinbergen Institute, Amsterdam.

Indexed at, Google Scholar, Cross Ref

Ali, K.E.S. (2014). Fundamental Analysis and Relative Valuation Multiples: A Determination of Value Drivers and Development of a Value Model for the US and UK Markets. Unpublished doctoral dissertation, University of Portsmouth.

Bhattacharyya, S. (2013). Intrinsic Value of Share: A Conceptual Discussion. Business Studies, 1-8.

Chen, S. (2021). Fair Value. Retrieve on December 27, 2021 from https://www.investopedia.com/terms/f/fairvalue.asp.

Daniswara, H.P., & Daryanto, W.M. (2019). Earnings per share (eps), price book value (PBV), return on asset (ROA), return on equity (ROE), and indeks harga saham gabungan (IHSG) effect on stock return. South East Asia Journal of Contemporary Business, Economics and Law, 20(1), 11-27.

Doblas, M.P., Lagaras, M.C.P., & Enriquez, J.A. (2020). Price to Earnings and Price to Book Ratios as Determinants of Stock Return: The Case of Financial Institutions Listed in Bahrain Bourse. Journal of Applied Economic Sciences, 3(69), 532-539.

Eriksson, P., Forsberg, T., & Gustavsson, N. (2011). Fundamental Stock Analysis. A study of the fundamental analysis for practical use at the Swedish Stock Exchange. Unpublished bachelor’s dissertation, University of Jonkoping.

Fama, E.F. (1970). Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance, 25(2), 383-417.

Indexed at, Google Scholar, Cross Ref

Figurska, M., & Wisniewski, R. (2016). Fundamental Analysis – Possibility of Application on the Real Estate Market. Real Estate Management and Valuation, 24(4), 35-46.

Indexed at, Google Scholar, Cross Ref

Fusthane, O., & Kapingura, F.M. (2017). Weak Form Market Efficiency of the Johannesburg Stock Exchange: Pre, During and Post the 2008 Global Financial Crisis. Journal of Economics and Behavioral Studies, 9(5), 29-42.

Indexed at, Google Scholar, Cross Ref

Haqqani, K., Aleem, M., Ul Islam, S., Rafiq, I., & Ziauddin. (2021). Market Inefficiencies and Corporate Investments: Insights from Extended Literature Review. International Journal of Elementary Education, 20(1), 3106-3117.

Heymans, A., & Santana, L. (2018). How efficient is the Johannesburg Stock Exchange really? South African Journal of Economic and Management Sciences, 21(1), 1-14.

Indexed at, Google Scholar, Cross Ref

Horton, M. (2021). What Are Common Advantages of Investing in Large Cap Stocks? Retrieve on December 23, 2021.

Investment Institute Company. (2021). Trends in the Expenses and Fees of Funds, 2020. ICI Research Perspective, 27(3), 1-32.

Ivanovska, N., Ivanovski, Z., & Narasanov, Z. (2014). Fundamental Analysis and Discounted Free Cash Flow Valuation of Stocks at Macedonian Stock Exchange. UTMS Journal of Economics, 5(1), 11–24.

Latif, M., Arshad, S., Fatima, M., & Farooq, S. (2011). Market Efficiency, Market Anomalies, Causes, Evidences, and Some Behavioral Aspects of Market Anomalies. Research Journal of Finance and Accounting, 2(9), 1-15.

Malkiel, B. (2003). The Efficient Market Hypothesis and Its Critics. Journal of Economic Perspectives, 17(1), 59–82.

Indexed at, Google Scholar, Cross Ref

Merriman, K.K. (2017). Valuation of human capital. Lowell, MA: Palgrave macmillan.

Muhammad, S. (2018). The Relationship Between Fundamental Analysis and Stock Returns Based on the Panel Data Analysis; Evidence from Karachi Stock exchange (KSE). Research Journal of Finance and Accounting, 9(3), 84-96.

Panigrahi, S.K., Zainuddin, Y., & Azizan, A. (2014). Comparing Traditional and Economic Performance Measures for Creating Shareholder’s Value: a Perspective from Malaysia. International Journal of Academic Research in Accounting, Finance and Management Sciences, 4(4), 280–289.

Indexed at, Google Scholar, Cross Ref

Schrand, C.M., & Walther, B.R. (2000). Strategic Benchmarks in Earnings Announcements: The Selective Disclosure of Prior-Period Earnings Components. The Accounting Review, 75(2), 151-177.

Indexed at, Google Scholar, Cross Ref

Segal, T. (2021). Fundamental Analysis. Retrieved on December 27, 2021 from https://www.investopedia.com/terms/f/fundamentalanalysis.asp.

Sharma, K., & Chander, R. (2009). Earnings Announcements and Stock Price Behavior on Indian Stock Markets. Asia-Pacific Business Review, 5(3), 118- 127.

Indexed at, Google Scholar, Cross Ref

Subramanyam, K.R., & Venkatachalam, M. (2001). Earnings, Cash Flows and Ex post Intrinsic Value of Equity. The Accounting Review, 82(2), 1-38.

Indexed at, Google Scholar, Cross Ref

Tallman, E.W. (1989). Financial Asset Pricing Theory: A Review of Recent Developments. Economic Review, 26-41.

Tiwari, R., & Kumar, B. (2015). Drivers of Firm’s Value: Panel Data Evidence from Indian Manufacturing Industry. Asian Journal of Finance & Accounting, 7(2), 1-23.

Wafia, A.S., Hassana, H., & Mabrouka, A. (2015). Fundamental Analysis Models in Financial Markets – Review Study. Procedia Economics and Finance, 30, 939-947.

Indexed at, Google Scholar, Cross Ref

Received: 03-Feb-2022, Manuscript No. AAFSJ-22-11137; Editor assigned: 05-Feb-2022, PreQC No. AAFSJ-22-11137(PQ); Reviewed: 16-Fab-2022, QC No. AAFSJ-22-11137; Revised: 11-Apr-2022, Manuscript No. AAFSJ-22-11137(R); Published: 18-Apr-2022.