Research Article: 2022 Vol: 25 Issue: 5

Future of e-wallets adoption in Pakistan: a perspective of cashless Pakistan from undergraduates

Fahad Javed Baig, The Islamia University of Bahawalpur

Citation Information: Baig, F.J. (2022). Future of e-wallets adoption in Pakistan: a perspective of cashless Pakistan from undergraduates. Journal of Management Information and Decision Sciences, 25(S7), 1-7.

Abstract

In Pakistan, the cashless revolution is transforming the financial business. Fintech applications like UPaisa, Easypaisa, and Jazz Cash, in addition to internet and phone banking, play a significant role. The purpose of this research is to investigate popular perceptions of a cashless Pakistan and Pakistan's potential to become a cashless economy. We undertake an exploratory study to learn about consumers' cashless technology needs, expectations, views, and worries, and then discuss several possibilities for Pakistan to go entirely cashless, including e-wallets, debit cards, and other digital payment systems. The public's response to a cashless Pakistan has been positive according to the survey results.

Keywords

Cashless revolution; Fintech Applications; Cashless Economy; E-wallets; Public's Response.

Introduction

Currently, 34% of people in Pakistan have access to banking services through their cell phones with broadband capabilities; however, only 21% of Pakistani adults use financial products or services (Zafar et al., 2021). The country is rapidly transitioning toward a digital-first economy and is slated to become the fourth-largest by 2030 (Zafar et al., 2021). Digital wallets are a relatively young technology, with 27.3 million users and an annual growth rate of 87 percent. Easypaisa, UPaisa, Jazz Cash, UBL Omni, and SimSim are some of the biggest digital wallet players, with the bulk of them belonging to the telecom business. In light of the current circumstances, how far away is Pakistan from becoming cashless? By moving to digital transaction systems, Pakistan's people could save $1.5 million just from Karachi (Saeedi, 2018). With the development of digital payment systems, the economy has been revolutionized. It is expected that 90 percent of the population will soon be able to go cashless using digital payment systems. Just ten percent of Karachi's population utilizes those services at present (Saeedi, 2018). It has been claimed by the State Bank of Pakistan that users have shifted from cash payments to electronic payments over the past few years. OLX, Daraz, Zameen.com, and Pakwheels all offer goods and services online that people buy and sell. This proves that people feel internet services are convenient and are attracted to them. These websites also offer e-cash options like Jazz Cash, which are popular with many people (New Desk, 2018).

Literature Review

The scene has now moved to prepare for the latest assessing decisions which include PayPal, a circulated trade structure, flexible cash move commitments like Telenor Easypaisa and Jazz Cash, and digital money MIB exchanges like Bitcoin Pricing system. The shadow esteem system is contained these trade techniques (Awrey & van Zwieten, 2019). Regardless, the shadow portion system is powerless to advanced attacks of various types as a result of the way in which it works. As usage of shadow portion systems extends, you may be cautious with regards to computerized risks, for instance, phishing, ransomware, and discount extortion (Jain & Kailay, 2018). Banking business in Pakistan and how credit just banking has helped it. It reviews the impact of four of the most notable credit just systems, including ATMs, POS machines, contact center banking, and flexible banking, on Return on Equity using data from the second quarter of 2007 to the last quarter of 2014. It has a positive relationship with P-O-S and versatile based trades, yet a negative relationship with call-concentration and ATM trades. Customers' refusal to use call center organizations is attributed to a shortfall of "trust". Customers are moreover stressed that data breaks are presumably going to occur, which can similarly cause a wide collection of cash related damages. It shows a creating awareness of net banking as it decreases regard on the two completions. ATMs hyperlink from ATM servers down bothering clients and reluctant to use these organizations (Kamboh & Leghari, 2016).

A unique report procedure for assessing factors that affect web banking is proposed. It surmises that in the event that clients are given individualized web banking courses of action, they will undoubtedly use them. It also uncovers that individuals like to utilize web banking as an autonomous portion system that can manage different tasks, for instance, covering energy charges, making card portions, and paying school costs. The similitude of the client's lifestyle and work style is a fundamental point in their decision to use web banking. To propel the usage of m-wallets among clients, the maker suggests that associations offer different sorts of coupons, cash back, and unequivocal presents. There are at this point various applications for adaptable wallets to be found (Daneshgadeh & Y?ld?r?m, 2014).

People are continuously moving towards credit just trades, according to the delayed consequences of the review, but there are several components that compel them to use cash, for instance, security issues, trust issues, a shortfall of advancement redid to client needs, and late reimbursement of cash in case of besieged trades. As shown by the report, Pakistan needs to change people's perceptions to totally advance to a credit just economy (Podile & Rajesh, 2017). Various sorts of wellbeing features for e-wallets to work on their use and lessen the risk of advanced attacks on E-wallets as a strategy for portion have been analyzed in report that moreover proposes the innovative thought of e-checks; since they are currently thoroughly used, it would be less complex and more favorable for them to become electronic. Progressed imprints would get e-checks. These imprints would be taken care of using quick cards that contain coding keys. Starting the card would require the ID number. Another layer of wellbeing could be added by using biometric affirmation (Yahid et al., 2013).

Rathore (2016) stated that PDAs have flooded the market, and people are at present using mobile phones to make different sorts of portions. In addition, he analyzes the challenges that electronic wallet client's face. The use of mechanized wallets benefits customers, banks, and money related foundations. The amount of in fact proficient clients is growing significantly.

Categories and Companies of E-Wallets

Four types of e-wallets exist: open wallets, semi open wallets, closed wallets and semi closed wallets. A customer can access multiple services when using an open wallet, such as purchasing goods and services, transferring funds, and withdrawing cash from ATMs or banks. While using semi open wallets, a specific company must be affiliated with it. Several applications allow the customer to spend money loaded in them. Particularly among e-commerce companies, closed wallets are most popular. Returns or cancellations of products require a minimum amount from the merchant. There is a high demand for semi-closed wallets from merchants, but their limitation is that withdrawals and redemptions are not allowed. The wallet allows you to open an account in your name and purchase goods and services from merchants listed there.

The demonetization issue has been thoroughly analyzed and companies have launched their e-wallets in different ways to gain competitive advantages by analyzing the pros and cons of demonetization and analyzing perceptions of general public. The majority of them fail to survive in the marketplace, but some are very popular among the public.

Easy paisa is the first digital payment method introduced in Pakistan by telecom operator Telenor. It is a mobile app-based payment method through which users can transfer and receive money securely. With the mobile application of Easy Paisa users can recharge mobiles, buy data bundles, and do online shopping or pay utility bills. Launched in 2009 by Telenor Pakistan and Tameer Microfinance Bank, it has reached a great status as the third-largest mobile payment method in the world with 7.4 million users. At the time of writing this article, Easy paisa was the only mobile payment service in Pakistan. Users verify their transactions using a QR code, which the payer scans to send the payment. Easy paisa offers its payment service in partnership with Master Pass, and it is now available as an Android app, making it accessible for users from all networks. Previously, the service was limited to Telenor mobile operator’s customers only.

Jazz Cash is introduced by another telecom operator Jazz. Jazz Cash is also a wallet-based payment system through which users can send and receive payments, recharge mobiles, and buy data bundles or pay utility bills. It is a branchless banking system launched in 2012 formerly known as MobiCash which works like a mobile number-tagged bank account that can be operated on every type of phone not necessarily requiring smart phones with access to your account from any location.

U paisa is introduced by the telecom operator Ufone launched in 2013 a branchless banking service of the company. Through this wallet-based payment system, users can do online transactions easily, pay utility bills, and recharge mobile phones. U paisa also offers debit cards that can be used for drawing cash from local ATM machines. It’s a service made available in over 45,000 locations across Pakistan quickly becoming a sort-after service in the industry. Its services offer users the same services they would get by accessing an online banking service. It’s not limited to a particular mobile network, and users can access it from any location in Pakistan. To open an account with U Paisa, users need to dial *786# from their mobile phone. After that, users have to visit any Ufone franchise and present their original CNIC, as well as their biometric data to verify their identity. After that, they can start using their U paisa account.

Pay Pak is a domestic payment system introduced in Pakistan by 1 Link under the registration of the State Bank of Pakistan. At the moment, 20 different banking systems of the country have adopted payments through it. It was founded in 2016 to save inter-change costs of International Payment Schemes., operating primarily through Pay Pak cards which can only be used in ATMs and POS services and are yet to launch online transactions.

HBL-Konnect is a simple payment gateway solution that lets users purchase goods and services at their convenience. Once a merchant is registered to receive payment via HBL-Konnect, they can make payments using the platform. Examples of transactions that occur on HBL-Konnect include bills payment, fast food ordering, and much more. Unlike traditional banking services, HBL-Konnect operates a branchless system that works primarily with the mobile number of a client.

M-wallets can be used in a variety of ways depending on the user's preferences and needs. Some of the major applications include prepaid mobile phone recharging, Book airline tickets and movie tickets online, Reservations for hotels, Transferring money to another person and Payment of insurance premiums etc.

A Survey Conducted

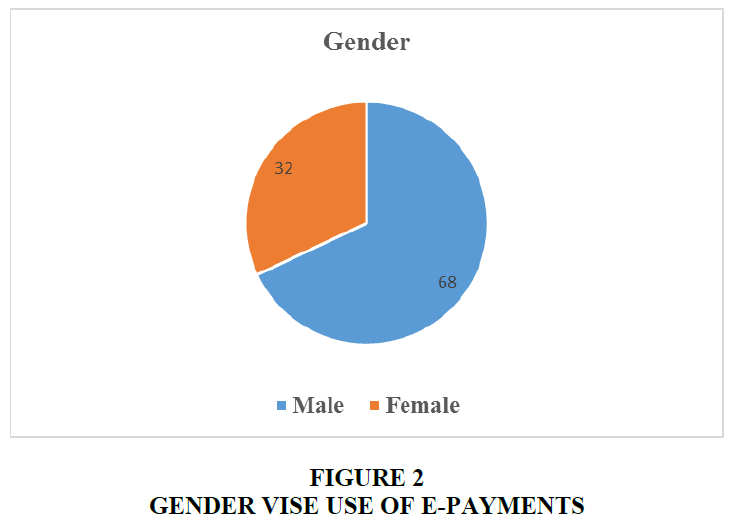

Primary data was collected for this study using a comprehensive survey. Google forms was used to make the questionnaire. There were twenty five questions, out of which four were about the respondent’s profile. There were 121 responses, 69% of those were males and 31% of them were females. Google forms built-in reporting was used to analyze the factors moving towards a cashless Pakistan.

A survey has been mainly focuses on undergraduates. Students from heterogeneous courses and from different universities participated in the survey. From all the questions asked from students, here are a few of the most common ones.

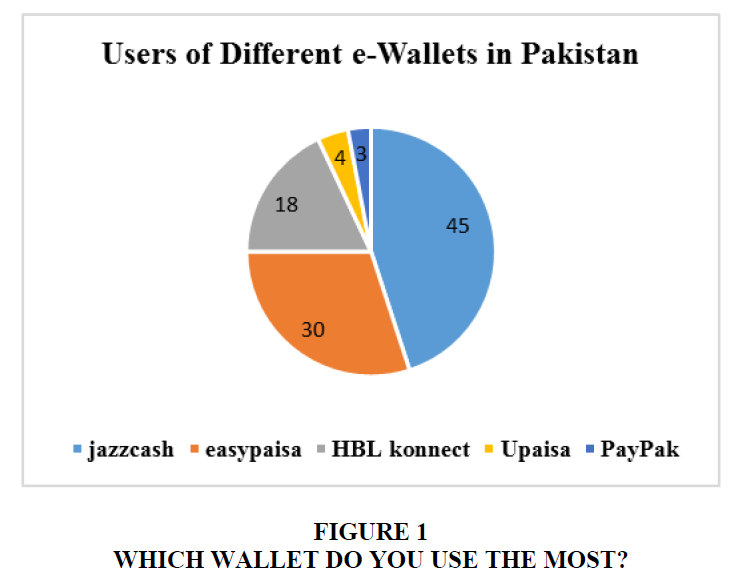

The number of e-payments has increased many folds since demonetization. In recent years, there have been many e-wallets introduced to the market (Figure 1).

As a result of the study, it was determined that boys are more inclined towards e-payments (Figure 2).

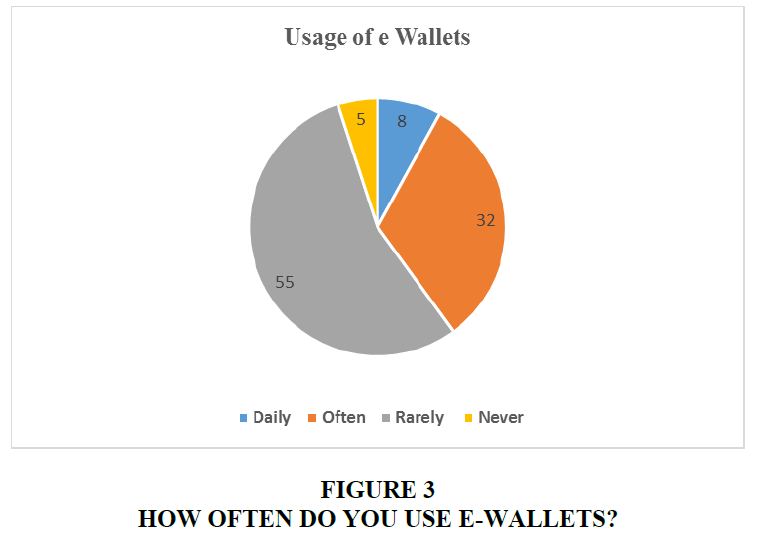

E-wallet usage is most common among students. Considering the analysis is done between 14 and 24 years of age, students are not required to purchase a wide range of products. Thus, they have a limited purchasing power (Figure 3).

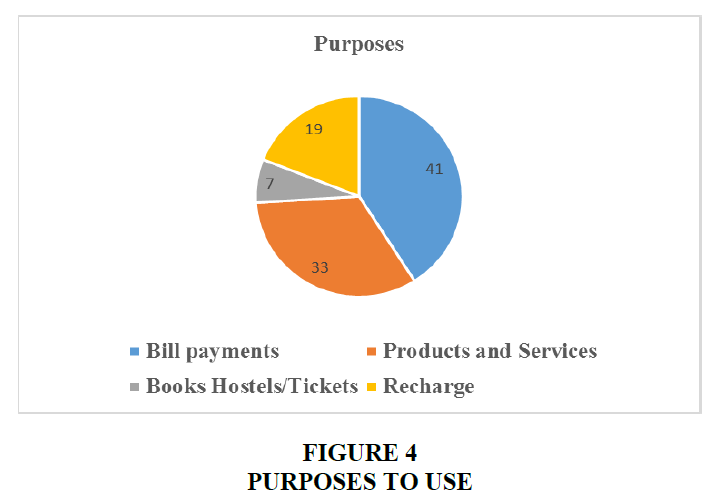

Most students use e-payment options to pay their electricity and water bills. However, many users use it to buy products (Figure 4).

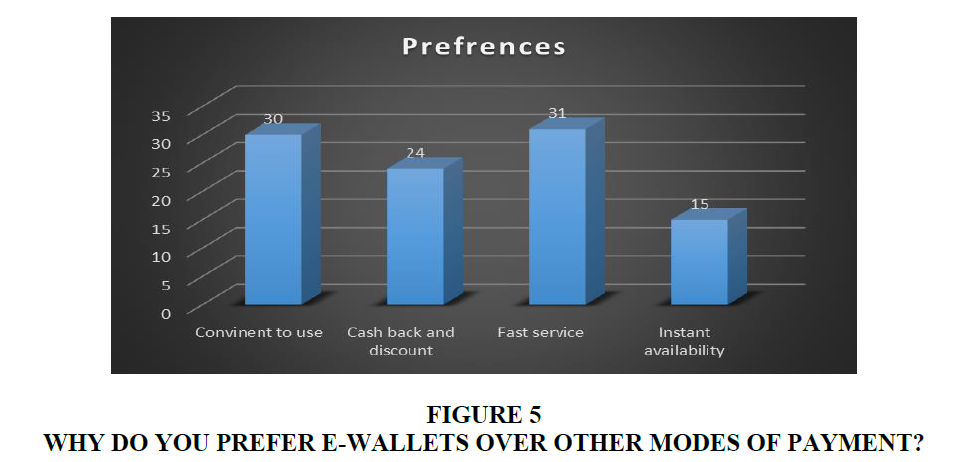

Young people are turning to mobile wallets for many reasons. Almost all users find it convenient. Furthermore, these wallets offer attractive cash back and discount offers. Customers also appreciate its easy accessibility and fast service (Figure 5).

Conclusion

According to the results of the survey, although most people are in favor of a cashless Pakistan, they have not taken advantage of the current cashless technologies. People are still compelled to use cash because there is a certain stigma associated with cashless technologies. There are several issues that people face with cashless technologies including the difficulty of use, security concerns, lack of awareness and late reimbursement for transactions that do not go smoothly, as well as the lack of trust with which they share their financial information. In Pakistan, people are positive about cashless methods and would like the country to become cashless.

Future Scope

Numerous security aspects have not yet been explored. A major hindrance in the success of digital payments is the inability of information technology to make the transaction secure and complete. Furthermore, it is important that a transaction be consistent. It is better to execute either the entire transaction or not execute it at all to prevent reconciliation issues. The use of mobile wallets may be introduced in transportation services in buses due to the large amount of cash transactions that take place every day.

References

Awrey, D., & van Zwieten, K. (2019). Mapping the Shadow Payment System. University of Oxford Legal Studies Research Paper Series. SWIFT Institute Working Paper No. 2019-001.

Indexed at, Google Scholar, Crossref

Daneshgadeh, S., & Yildirim, S.Ö. (2014). Empirical investigation of internet banking usage: The case of Turkey. Procedia Technology, 16, 322-331.

Indexed at, Google Scholar, Crossref

Jain, R., & Kailay, T. (2018). A Dream of Cashless Society: A Myth or Reality!(Study of customers regarding the awareness and preference for plastic money). International Journal of Scientific and Research Publications, 8(10), 13-24.

Kamboh, K. M., & Leghari, M. E. J. (2016). Impact of cashless banking on profitability: A case study of banking industry of Pakistan. Paradigms: A Research Journal of Commerce Economics and Social Sciences, 10(2), 82.

Indexed at, Google Scholar, Crossref

News Desk (2018). Pakistan on its way to becoming a cashless economy. Global Village Space.

Podile, V., & Rajesh, P. (2017). Public perception on cashless transactions in India. Asian Journal of Research in Banking and Finance, 7(7), 63-77.

Indexed at, Google Scholar, Crossref

Rathore, H.S. (2016). Adoption of digital wallet by consumers. BVIMSR’s Journal of Management Research, 8(1), 69.

Saeedi, S.T. (2018). Cashless payments estimated to save Rs182 billion a year for Karachi: Visa. The News International.

Yahid, B., Shahbahrami, A., & Nobakht, M.B. (2013). Providing security for e-wallet using e-cheque. In 7th International Conference on e-Commerce in Developing Countries: with focus on e-Security (pp. 1-14). IEEE.

Indexed at, Google Scholar, Crossref

Zafar, S., Riaz, S., & Mahmood, W. (2021). Conducing the Cashless Revolution in Pakistan Using Enterprise Integration. International Journal of Education and Management Engineering, 11(4), 12-25.

Indexed at, Google Scholar, Crossref

Received: 04-Apr-2022, Manuscript No. JMIDS-22-11681; Editor assigned: 06-Apr-2022, PreQC No. JMIDS-22-11681(PQ); Reviewed: 20-Apr-2022, QC No. JMIDS-22-11681; Revised: 24-Apr-2022, Manuscript No. JMIDS-22-11681(R); Published: 02-May-2022