Research Article: 2022 Vol: 28 Issue: 4S

Gender Parity Strategies and the Management of Nigerian Banking Industry's Efficiency: Emphasis on Post-Covid-19 Era

Onuorah, A.C., Delta State University

Odita, O.A., Delta State University

Kifordu, A.A., Delta State University

Citation Information: Onuorah, A.C., Odita, O.A., & Kifordu, A.A. (2022). Gender parity strategies and the management of Nigerian banking industry’s efficiency: Emphasis on post-covid-19 era. Academy of Entrepreneurship Journal, 28(S4), 1-13.

Abstract

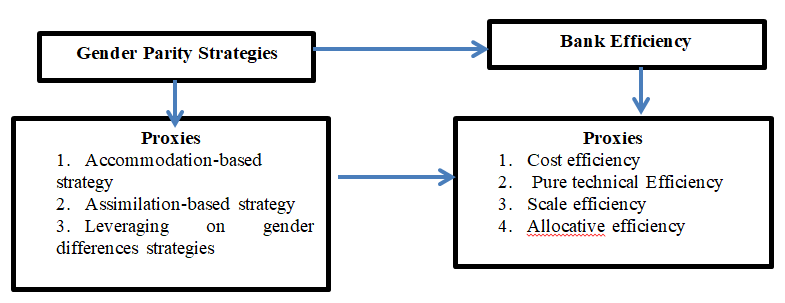

This study specifically modeled the influence of gender parity strategies on bank efficiency in Nigeria with a specific focus on the Covid-19 era. Three gender parity strategies considered include accommodation-based strategy, assimilation-based strategy, and leveraging on gender differences strategies. Meanwhile, bank efficiency was measured by cost, purely technical, scale, and allocative efficiency. Given this, three hypotheses were formulated. The primary data through the instrumentality of well-structured questionnaires were used to elicit information from the research respondents. Although 300 questionnaires were shared across the study areas, 282 were returned and used for analysis. Two statistical parameters (Pearson Product Moment Correlation Coefficient and Coefficients of Determination) were used to test the research hypotheses. Results emanating from the field revealed that accommodation-based strategy and leveraging on gender differences strategies have a high statistically significant influence on bank efficiency. Meanwhile, assimilation-based strategy has a moderate statistically significant influence on bank efficiency. Hence, we conclude that gender parity strategies overall improve bank efficiency, especially in this Covid-19 era. In this light, we recommend that the current accommodation-based strategy adopted by Nigerian banks should be sustained. Lastly, for Nigerian Banks to be more efficient, feminine management traits such as collaboration, listening, and team spirits must be embedded in the workplace.

Keywords

Modeling, Gender Parity Strategies, Bank Efficiency, Post-Covid-19 Era

Introduction

Traditionally, most African men believe that women are weaker vessels and that their major roles are to manage the economy of the home and also to engage in farming activities as the case. As such, they are not allowed to take up any form of formal employment. This further connotes that sensitive financial decisions are made solely by men though women are permitted to make some suggestions only in few instances. This traditional practice tends to form the basis upon which banks design their policies and strategic actions especially wherein there are no efforts to consider the females and females as distinct market segments.

Landry, Bernardi & Bosco (2016) noted that the Patriatrical nature of the Nigerian economy also constituted the reason why men dominate women in the workplace. The evidence of this lost opportunity lies in the high levels of dissatisfaction with the banking industry. Women are least satisfied with financial services out of all consumer industries. However, over the last ten (10) years, the need to recognize the role female employees plays in the workforce. This to a large extent has affected the selection, ratification, appointment, recruitment, promotion, and retention in all human endeavors all over the globe. Gender sensitivity as it were occurs wherein a particular sense is given more attention than another sex.

Before the Corvid-19 pandemic, it remains a known fact that the majority of banks in and outside Nigeria are dominated by men with women accounting for only 17% in the board room. Wimbiz (2014) in a survey on gender representation, Nigerian banks are faced with the gender sensitivity issue in that only 26% of women are in management seats while 16% are in board positions in the Nigerian banking industry in Nigeria. This contradicts the CBN (2018) policy directives on 40% representation of women in management cadre and 30% representation of women in board positions. Meanwhile, on a global scale, only 26.5% of senior leadership positions are held by women.

A way further, noted that over the years, the women activists, United Nations, and federal governments have launched initiatives to address gender disparity both in the workplace and society at large. This is masterminded by the promulgation of laws, policies, reformation or workplace process reformation, appraisal of foreign treaties. These policies and initiatives are well built on egalitarianism, quota, and affirmative actions (Heffernan, 2002). It may as well involve dismantling artificial barriers and discriminatory practices which regard women's career advancements. This mirrors the trends in business overall, where the gender gap in leadership widens as one climbs the corporate ladder.

Pamella & San (2020) asserted that the interplay between the emergence of the Covid-9 pandemic and gender sensitivity heightened the gender sensitivity gap especially in the workplace such that women have in recent times has been in the frontline and hit the hardest. As such, to address this lacuna, different key holders in the sectors must come as a matter of urgency to critically look at the issues (Olagunju, 2014; Odeleye, 2021; Kustina et al., 2019).

The foregoing reveals that though the gender difference between the male and female has reduced over the years, there is still a long way to go when it comes to achieving true gender equality. This is because though women have received serious attention from all quarters but they are yet to take equal possession in the workplace.

A run of empirics revealed that this study is the first of its kind to examine both constructs (gender parity strategy and bank efficiency) during the covid-19 Era. It is in recognition of this perceived gap, the study examined the influence of gender parity strategy on bank efficiency in Nigeria with specific emphasis on the Covid-19 era. Various gender parity strategies considered include accommodation, assimilation, and leveraging on gender differences strategies. Meanwhile, we used to cost, purely technical, scale, and allocative efficiency to measure bank efficiency.

This presupposes that the study would contribute immensely to extant studies in the Nigerian banking industry. Significantly, both bank managers and their employees will stand to gain much from this study. Regulators are not also left out in that it would help them in formulating a more proactive and women-focused strategy.

Literature Reviews

According to the United Nations (2020), Gender Parity Strategy is aimed at creating a more diverse, gender-balanced, and all-inclusive workforce that supports team Spirits and Oneness. It may also involve addressing unconscious biases in recruitment with the sole intention of creating a conducive peaceful environment. On the other hand, the banking industry is said to be efficient if it is cost-efficient, pure technical efficiency, scale efficient, and allocative efficient. According to Nader, Mayssa, Israa & Reda (2019) efficiency enable the banking industry to be more resilient to economic shocks, thereby resulting in growth. Bank efficiency reduces credit restrictions and places the banking industry at a more vantage point in the marketplace.

Workplace Gender Equality Agency (2018) outlined the following as barriers to gender equality in developing economies:

- Structural barriers especially in hiring and promotion systems;

- Workplace culture management;

- Cultural sexism regarding women’s work;

- Lack of role models/mentors;

- Insufficient support for career development;

- Negative attitudes and lack of awareness;

- Access issues;

- Familial obligations; and

- Economic disadvantage

Etymologically, Covid-19 is derived from the Latin word “Corona” meaning ‘crown’. Specifically, Coronaviruses can be defined as a respiratory tract infection that affects both humans and animals (Feigin & Cherry, 2017). According to the World Health Organization (2020), Covid-19is a novel disease that affects the respiratory system of both humans and animals especially those who are aged. In other words, Covid-19 is the worst enemy in human history because it systematically reduced the world population, compelled countries of the world to embark on total (partial)lockdown and the likes.

As espoused by Nwakaego & Bamidele(2017), male dominance in the Nigerian banking industry can be seen from both organizational structures (vertical and horizontal) and cultural perspectives. Specifically, the horizontal dimension of gender disparity is embedded in the principle of naturalization. This principle explains suggests the deliberate location of women in either Public Relations or Human Resources or instead of placing them in core banking positions like CEO positions (Maryla, Aaditya & Dominique, 2020). Meanwhile, vertical gender disparity involves women's over-representation in the lower cadre. This means that majority of men are highly placed as against few voiceless women highly placed women (Ishola, Ityonzughul & Gbamwuan, 2020).

Three known strategies in reducing gender disparity encapsulated in the literature include accommodation, assimilation, and leveraging on gender differences strategies. The accommodation-based-strategies involves active involvement and incorporation of female employees in the policies and programs (mentoring, leave of absence, maternity leaves with pay, part-time (flexible) work arrangements, on-site childcare facilities, paid overtime, an extension of tenure of office, and the likes) of the banking industry (Nhamo, Dube & Chidodzi, 2020; Solomon, 2021; Uzochukwu, 2021; Igweh & Stephen, 2019). However, researches have shown that this strategy is not that effective in the Nigerian banking industry. The possible reason for this is due to the inability of government-owned institutions to fully implement this strategy in the Nigerian banking industry. This in turn has made even statutory labour rights of female staff in the Nigerian banking industry to be ineffective (Olapegba, 2020; Ajayi, Ojo & Mordi, 2015).

Furthermore, the assimilation strategy entails training women to speak like men. It may also go as far as involving them to engage in sponsored masculine sporting activities like football, golf, table tennis, and the like. More so, it may also involve organizing after-work activities wherein women serve as a coach (Afande, 2015).

The last strategy is leveraging on gender differences. This entails embedding feminine management traits such as collaboration, listening, and team spirits into an organization. In this instance, both male and female employees are expected to act in like manner (Nwakaego & Bamidele, 2017)

The above exposition revealed that for the banking industry to be efficient even in the midst of the post-covid-19 era, the three gender parity strategies explained above must be linked directly (see schematic model below) (figure 1).ss

From the empirical viewpoint, Nwakaego & Bamidele (2017) studied the efficacy of work culture on gender parity in the Nigerian banking industry. Various gender parity strategies considered include accommodation, assimilation and leveraging on gender differences strategies. The study covered twenty-two (22) males and female bank employees comprising using a semi-structured in-depth interview. The study revealed that the achievement of gender equality in senior/executive management positions within this sector is strongly predicated on organizational work culture. Furthermore, the responses of the interviewees suggested that men would have to champion this cause by enacting and executing policies, processes, and practices geared towards a change in the work culture of the Nigerian Bank. Again, Anazonwu, Egbunike, handguard (2018) reported that the inclusion of women on the board improves the performance (efficiency) of the baking industry. Hence, the study recommends the adoption of a heterogeneous board composition that leverages the diverse set of skills of board members. In separate studies, Al-Shaer & Zaman (2016); Arayssi, Dah & Jizi (2016); Ben-Amar, Chang & McIlkenny (2017); Cabeza-García, Fernández-Gago & Nieto (2017) discovered that inclusion of women in the board improves the performance (efficiency) of the baking industry. The inference that may be drawn gender parity strategies (accommodation, assimilation and leveraging on gender differences strategies) improves bank efficiency. Based on the above, we hypothesize:

- The accommodation-based strategy has no significant influence on bank efficiency

- The assimilation-based strategy has no significant influence on bank efficiency

- Leveraging on gender differences strategies has no significant influence on bank efficiency

Methodology

This study adopted the interdisciplinary approach to examine the influence of gender sensitivity on the Nigerian banking industry efficiency with a specific focus on the post-Covid-19 Era. A well-structured questionnaire was shared across banks located in Warri, Agbor, and Asaba Metropolis. Considering the nature of this paper, cost, and time, our sample was only confined to 300 questionnaires. This was considered sufficient enough to draw useful inferences. The research questionnaire was grouped into 2 sections. The first section covered the respondents' bio-data while the second section contains all the research questions broken into further questions. Their responses were arranged in 5-Likert scaling ranging from

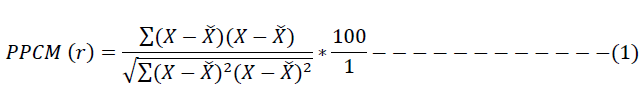

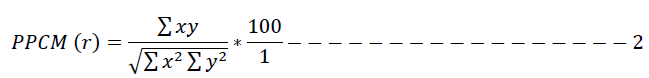

Secondly, we consulted printed materials such as journal articles, books, and internet materials to complement the primary source of data collected. For data analysis purposes, we used the Pearson Product-Moment Correlation Coefficient (PPCM). Mathematically, the formula for calculating PPCM (r) is expressed below:

X= Weighted Answer response options

Y = Frequency of Answer response options

Σ = Summation sign

The above formula though seems simple but is cumbersome. For purposes of simplest, the formula was restructured using the deviation of the average of weighted answer options and an average of frequency responses options. It is therefore presented below:

Results and Discussions

Questionnaire Retrieval Analysis

Although, two hundred and eighty-two (300) questionnaires were shared across the study area only two hundred and eighty-two (282) questionnaires were retrieved and used to analyze this study. This revealed that 94% of the questionnaires distributed were returned while only 6% were lost in transit. For a proper understanding of the numbers of questionnaires that were distributed and the numbers that were returned, table 1 below explicitly presented that:

| Table 1 Questionnaire Retrieval Analysis |

||

|---|---|---|

| Questionnaire Retrieval Analysis | Frequency (F) | Percentage (%) |

| QuestionnairesRetrieved | 282 | 94 |

| Questionnaires Returned Unfilled and numbers lost in transit | 18 | 6 |

| Total Questionnaire Shared | 300 | 100 |

Respondents’ Bio-Data

Table 2 accounted for the bio of the respondents:

| Table 2 Respondents’ Bio-Data |

||||

|---|---|---|---|---|

| S/N | Bio-Data | Category | Frequency (F) | Percentage (%) |

| 1 | Gender | Male | 185 | 65.60 |

| Female | 97 | 34.40 | ||

| Total Respondents | 282 | 100 | ||

| 2 | Age Distributions | 20-30 | 65 | 23.05 |

| 31-40 | 108 | 38.30 | ||

| 41 and Above | 109 | 38.65 | ||

| Total Respondents | 282 | 100 | ||

| 3 | Marital Status | Single | 34 | 12.06 |

| Married | 243 | 86.17 | ||

| Divorced | 5 | 1.77 | ||

| Total Respondents | 282 | 100 | ||

| 4 | Educational Qualifications | OND/NCE | 74 | 26.24 |

| HND/B.Sc. | 95 | 33.69 | ||

| MBA/M.Sc. | 78 | 27.66 | ||

| Others | 35 | 12.41 | ||

| Total Respondents | 282 | 100 | ||

| 5 | Workers Experience | 0-1 Year | 58 | 20.57 |

| 2-5 Years | 66 | 23.40 | ||

| 6-10 Years | 89 | 31.56 | ||

| 11 Years and Above | 69 | 24.47 | ||

| Total Respondents | 282 | 100 | ||

Source: Field Survey, 2021.

Table 2 above reported that 185 (65.60%) of the total respondents were male while the remaining 97 (34.40%) are female. This revealed that the banking industry overall is dominated by male folks. Again, 65 (23.05%) of the respondents are aged 20-30, 108 (38.30%) are aged 31-40 while 109 (38.65%) are aged 41 and above. This suggests that the majority of the bank employees fall within the youthful age. In terms of marital status, 243 (86.17%) are married while the remaining 13.63% are single and divorced. Academically, 74 (26.24%) of the aggregate respondents are OND/NCE holders, 95(33.69%) are HND/B.Sc. holders, 7827.66%) are MBA/M.Sc. holders, while, the remaining 3312.41%) possess other qualifications such as ICAN, ANAN, and the like. Lastly,58(20.57%) have worked for about 0-1year, 66 (23.40%) have worked for 2-5 years, 89(31.56%) have worked for 6-10 years while the remaining 69(24.47%) have worked for 11 years and above.

Responses from the Field

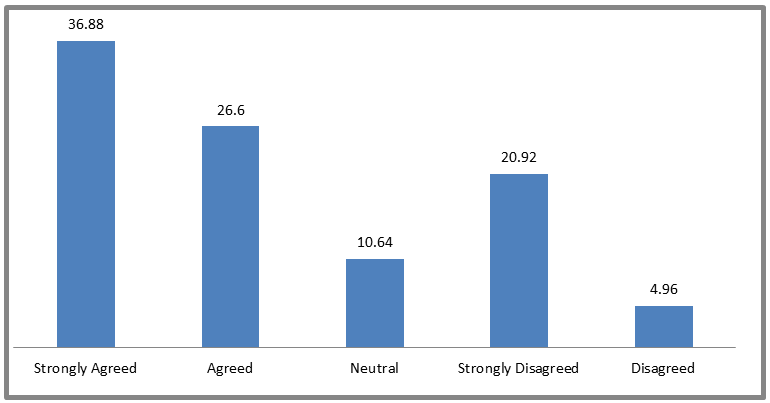

For purposes of clarity, each of the hypothesis formulated were tied to each statement. Specifically, Hypothesis one (H01) was postulated to test if accommodation-based strategy influences bank efficiency significantly or not. The statement which accompanies the first hypothesis read thus:

Accommodation-Based Strategy Increases Bank Efficiency in Nigeria

The response to the above statement is presented in table 3 below:

| Table 3 Responses Base on Hypothesis One |

||

|---|---|---|

| Parameter | Frequency (F) | Percentage (%) |

| Strongly Agreed | 104 | 36.88 |

| Agreed | 75 | 26.60 |

| Neutral | 30 | 10.64 |

| Strongly Disagreed | 59 | 20.92 |

| Disagreed | 14 | 4.96 |

| Total | 282 | 100 |

Source: Field Survey (2021)

Table 3 above reaffirmed that accommodation-based strategy increases bank efficiency. This is adjudged on the fact that the majority of the respondents asserted that accommodation-based strategy increases bank efficiency in terms of cost, purely technical, scale, and allocative efficiency. For further understanding see figure 2 below:

Accordingly, the responses to the various research questions are presented in table 3 to 5 below:

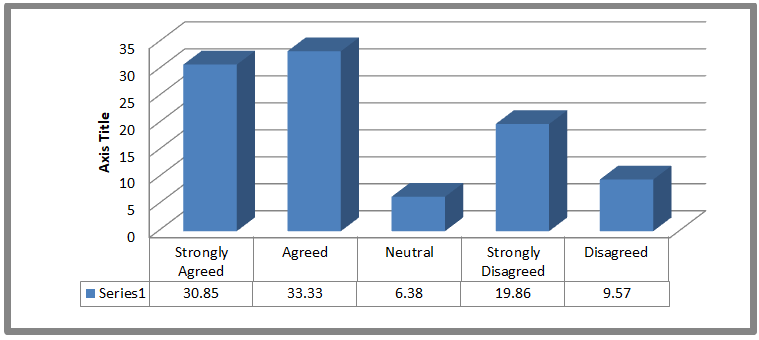

Again, hypothesis two (H02) was postulated to test if assimilation-based strategy influences bank efficiency significantly or not. The statement which accompanies hypothesis two read thus:

Assimilation-Based Strategy Increases Bank Efficiency in Nigeria

The response to the above statement is presented in table 4 below:

| Table 4 Responses Base on Hypothesis Two |

||

|---|---|---|

| Parameter | Frequency (F) | Percentage (%) |

| Strongly Agreed | 87 | 30.85 |

| Agreed | 94 | 33.33 |

| Neutral | 18 | 6.38 |

| Strongly Disagreed | 56 | 19.86 |

| Disagreed | 27 | 9.57 |

| Total | 282 | 100 |

Source: Field Survey (2021)

Table 4 above reaffirmed that accommodation-based strategy increases bank efficiency. This is adjudged on the fact that the majority of the respondents asserted that accommodation-based strategy increases bank efficiency in terms of cost, purely technical, scale, and allocative efficiency. For further understanding see figure 3 below:

Lastly, hypothesis three (H03) was postulated to test if leveraging on gender differences strategies influences bank efficiency significantly or not. The statement which accompanies hypothesis two read thus:

Leveraging on Gender Differences Strategies Increases Bank Efficiency in Nigeria

The response to the above statement is presented in table 5 below:

| Table 5 Responses Base on Hypotheses Three |

||

|---|---|---|

| Parameter | Frequency (F) | Percentage (%) |

| Strongly Agreed | 87 | 30.85 |

| Agreed | 94 | 33.33 |

| Neutral | 18 | 6.38 |

| Strongly Disagreed | 56 | 19.86 |

| Disagreed | 27 | 9.57 |

| Total | 282 | 100 |

Source: Field Survey (2021)

Table 5 above reaffirmed that accommodation-based strategy increases bank efficiency. This is adjudged on the fact that the majority of the respondents asserted that accommodation-based strategy increases bank efficiency in terms of cost, purely technical, scale, and allocative efficiency.

| Table 6 Responses base on Hypothesis Three |

||

|---|---|---|

| Parameter | Frequency (F) | Percentage (%) |

| Strongly Agreed | 100 | 35.46 |

| Agreed | 89 | 31.56 |

| Neutral | 18 | 6.38 |

| Strongly Disagreed | 54 | 19.15 |

| Disagreed | 21 | 7.45 |

| Total | 282 | 100 |

Source: Field Survey (2021)

Table 6 above clearly revealed that assimilation-based strategy increases bank efficiency. This is adjudged on the fact that the majority of the respondents asserted that assimilation-based strategy increases bank efficiency in terms of cost, purely technical, scale, and allocative efficiency.

Hypotheses Testing Estimation and Discussion of Results

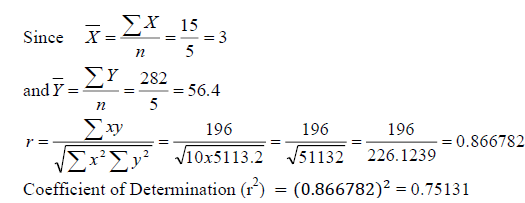

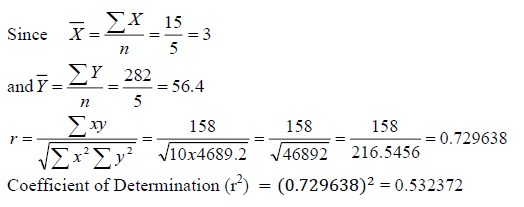

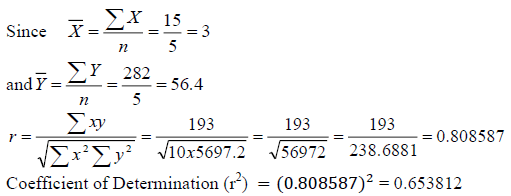

Three hypotheses were postulated earlier to guide the study. Accordingly, the first hypothesis was postulated to test if accommodation-based strategy influences bank efficiency significantly. The second hypothesis postulated that assimilation-based strategy does not influence bank efficiency significantly. Meanwhile, the third hypothesis postulated that leveraging on gender differences strategies does not influence bank efficiency proxies significantly. To test these tentative statements, two statistical parameters were used. These parameters are PPMCC (r) and Coefficients of Determination (r2). First, the PPMCC (r) measures the degree of linearity between the target variables. Meanwhile, the Coefficients of Determination denoted by r2 accounts for the proportion of the dependent variation expressed as y that is explained by the independent variable, x. More so, the r2 gives a clear indication of whether the model is fit for prediction or not. In other words, it speaks of the explanatory power of the model. Premised on this and for ease of comprehension, we presented the three hypotheses formulated earlier in table 7 to 9 below:

| Table 7 Computation of Pearson Product-Moment Correlation Coefficient (r) |

|||||||

|---|---|---|---|---|---|---|---|

| Responses | X | Y | x = X - ? | y = Y - ? | XY | x² | y² |

| Strongly Agreed (SA) | 5 | 104 | 2 | 47.6 | 95.2 | 4 | 2265.76 |

| Agreed (A) | 4 | 75 | 1 | 18.6 | 18.6 | 1 | 345.96 |

| Undecided (U) | 3 | 30 | 0 | -26.4 | 0 | 0 | 696.96 |

| Strongly Disagree (SD) | 2 | 59 | -1 | 2.6 | -2.6 | 1 | 6.76 |

| Disagreed (D) | 1 | 14 | -2 | -42.4 | 84.8 | 4 | 1797.76 |

| Total (?) | 15 | 282 | 196 | 10 | 5113.2 | ||

Source: Researcher’s Compilation, 2021.

Table 7 above reported a PPPCM value of 0.866782suggesting that a very strong positive (linear) linear relationship exists between accommodation-based strategy and bank efficiency. Further, the Coefficient of determination denoted by r2 stood at 75.13% suggesting that the Accommodation-based strategy explained 75.13% variation in bank efficiency. This revealed that the model is highly statistically significant. Based on this, we are at liberty to reject the null hypothesis of no significant relationship and accept the alternate hypothesis of significant relationship instead. This wonderful result implies that if the banking industry must be efficient holistically, there is a need for Nigerian banks to adopt the accommodation-based strategy. This reaffirmed the submissions of Afande (2015).

| Table 8 Computation of Pearson Product-Moment Correlation Coefficient (r) |

|||||||

|---|---|---|---|---|---|---|---|

| Responses | X | Y | x = X - ? | y = Y - ? | XY | x² | y² |

| Strongly Agreed (SA) | 5 | 87 | 2 | 30.6 | 61.2 | 4 | 936.36 |

| Agreed (A) | 4 | 94 | 1 | 37.6 | 37.6 | 1 | 1413.76 |

| Undecided (U) | 3 | 18 | 0 | -38.4 | 0 | 0 | 1474.56 |

| Strongly Disagree (SD) | 2 | 56 | -1 | -0.4 | 0.4 | 1 | 0.16 |

| Disagreed (D) | 1 | 27 | -2 | -29.4 | 58.8 | 4 | 864.36 |

| Total (?) | 15 | 282 | 158 | 10 | 4689.2 | ||

Source: Researcher’s Compilation, 2021.

Table 8 above reported a PPPCM (r) value of 0.7296 suggesting that a strong positive (linear) linear relationship exists between Assimilation-based strategy and bank efficiency. However, the Coefficient of determination value of 53.24% suggests that the assimilation-based strategy explained 53.24% variation in bank efficiency. This result implies fair goodness of fit. This revealed that the model is statistically significant. The justification for this is that training woman to speak like men as well as involving them to engage in sponsored masculine sporting activities like football, golf, table tennis, and the like increases bank efficiency (Afande, 2015). The result further suggests the need for banks in Nigeria to intensify their assimilation-based strategy if they must be efficient.

| Table 9 Computation Of Pearson Product-Moment Correlation Coefficient (r) |

|||||||

|---|---|---|---|---|---|---|---|

| Responses | X | Y | x = X - ? | y = Y - ? | XY | x² | y² |

| Strongly Agreed (SA) | 5 | 100 | 2 | 43.6 | 87.2 | 4 | 1900.96 |

| Agreed (A) | 4 | 89 | 1 | 32.6 | 32.6 | 1 | 1062.76 |

| Undecided (U) | 3 | 18 | 0 | -38.4 | 0 | 0 | 1474.56 |

| Strongly Disagree (SD) | 2 | 54 | -1 | -2.4 | 2.4 | 1 | 5.76 |

| Disagreed (D) | 1 | 21 | -2 | -35.4 | 70.8 | 4 | 1253.16 |

| Total (?) | 15 | 282 | 193 | 10 | 5697.2 | ||

Source: Researcher’s Compilation, 2021.

Table 9 above reported a PPPCM (r) valueof0.808587suggesting that a strong positive (linear) linear relationship exists between leveraging on gender differences strategies and bank efficiency. However, the Coefficient of determination value of 65.38% suggests that the assimilation-based strategy explained 53.24% variation in bank efficiency. This result implies that the model is statistically significant. This entails embedding feminine management traits such as collaboration, listening, and team spirits into an organization to increase bank efficiency (Nwakaego & Bamidele, 2017).

| Table 10 Summary of Test Of Hypotheses |

|||

|---|---|---|---|

| Hypothesis | PPPCM (r) Value | Coefficient of Determination (R2) | Decision |

| One | 0.866782 | 75.13% | Reject H01 |

| Two | 0.729638 | 53.24% | Reject H02 |

| Three | 0.808587 | 65.38% | Reject H03 |

Source: Researcher’s Compilation (2021)

Conclusion and Recommendations

This paper sought to examine the influence of gender parity strategies on bank efficiency in Nigeria with a specific focus on the Covid-19 pandemic. For purpose of clarity, gender parity strategies were measured by accommodation-based strategy, assimilation-based strategy, and leveraging on gender differences strategies. Meanwhile, bank efficiency was measured by cost, purely technical, scale, and allocative efficiency. Specifically, three hypotheses were formulated. Corollary to the major findings discussed in the earlier section, we conclude that gender parity strategies overall improve bank efficiency, especially in this Covid-19 era. In this light, we recommend that:

- The current accommodation-based strategy adopted by Nigerian banks should be sustained.

- Female employees should be engaged in sponsored masculine sporting activities like football, golf, table tennis, and the like. This is because it exerted a high statistical significant influence on bank efficiency.

- For Nigerian Banks to be more efficient, feminine management traits such as collaboration, listening, and team spirits must be embedded in the workplace.

References

Afande, F.O. (2015). Factors affecting Women's Career Advancement in the Banking Industry in Kenya (A Case of Kenya commercial bank branches in Nairobi County, Kenya). Journal of Marketing and Consumer Research, 9, 69-95.

Ajayi, F., Ojo, S., &Mordi, C. (2015). Work-family balance and coping strategies among women: Evidence from commercial banks in Nigeria. European Journal of Business and Management, 7(2), 152-161.

Allison, P.D. (1994). Using panel data to estimate the effects of events. Sociological Methods & Research, 23(2), 174–199.

Al-Shaer, H., & Zaman, M. (2016).Board gender diversity and sustainability reporting quality. Journal of Contemporary Accounting & Economics,12(3), 210-222.

Anazonwu, H.O., Egbunike, F.C., & Gunardi, A. (2018). Corporate board diversity and sustainability reporting: a study of selected listed manufacturing firms in Nigeria. Indonesian Journal of Sustainability Accounting and Management, 2(1), 65–78.

Arayssi, M., Dah, M., & Jizi, M. (2016).Women on boards, sustainability reporting and firm performance. Sustainability Accounting, Management and Policy Journal, 7(3), 376–401.

Ben-Amar, W., Chang, M., &McIlkenny, P. (2017). Board gender diversity and corporate response to sustainability initiatives: Evidence from the carbon disclosure project. Journal of Business Ethics, 142(2), 369–383.

Cabeza-García, L., Fernández-Gago, R., & Nieto, M. (2017). Do Board Gender Diversity and Director Typology Impact CSR Reporting?European Management Review.

Feigin & Cherry (2017).Textbook of Pediatric Infectious Diseases, (8th Edition).

Garcia-Torea, N., Fernandez-Feijoo, B., & de la Cuesta, M. (2016). Board of director’s effectiveness and the stakeholder perspective of corporate governance: Do effective boards promote the interests of shareholders and stakeholders?BRQ Business Research Quarterly, 19(4), 246–260.

Igweh, F., & Stephen, A. (2019). Effect of entrepreneurial roles on performance of SMEs: the Nigeria human resource perspective. International Journal of Business, Economics & Management, 3(1), 22-29.

Ishola, J.A., Ityonzughul, T.T., & Gbamwuan, A. (2020).Coronavirus pandemic and the Nigeria’s entertainment industry.International Journal of Development and Economic Sustainability, 8(4), 60-73.

Kustina, K.T., Dewi, G.A.A.O., Prena, G.D., Suryasa, W. (2019). Branchless banking, third-party funds, and profitability evidence reference to banking sector in Indonesia.Journal of Advanced Research in Dynamical and Control Systems, 11(2), 290-299.

Landry, E.E., Bernardi, R.A., &Bosco, S.M. (2016). Recognition for sustained corporate social responsibility: Female directors make a difference.Corporate Social Responsibility and Environmental Management, 23(1), 27–36.

Maryla, M., Aaditya, M., & Dominique, D.D. (2020). The potential impact of COVID-19 on GDP and Trade: A preliminary Assessment. Policy Research Working Paper, 1-24.

Nader, A., Mayssa, F., Israa, W., & Reda, S. (2019). Banking efficiency: Concepts, drivers, measures, literature and conceptual model.

Nhamo, G., Dube, K., & Chidodzi, D. (2020).Implications of Covid-19 on gaming, leisure, and entertainment industry.Available at Accessed on 13th March 2021.

Nwakaego B.E., & Bamidele A.W. (2017). Work culture as a driver for gender equality in the Nigerian banking sector. Available at https://www.researchgate.net/publication/323869731.Accessed on 13th January 2021.

ODELEYE, O.T. (2021). Brand equity and marketing performance: Perspectives from the brewing industry in Nigeria. International Journal of Business, Economics & Management, 4(1), 103-115.

Olagunju, F. (2014). Meet Bizwatch"s Top 10 Women in Banking. Retrieved: January 24th, 2021

Olapegba, P.O. (2020). A Preliminary Assessment of Novel Coronavirus (COVID-19) Knowledge and Perception in Nigeria. Retrieved from Accessed on 13th March 2021.

Sanad, S.., & S, A. (2021). The impact of participative decision-making on organizational commitment: A study among employees of mobile telecom companies in Yemen. Journal of Advanced Research in Economics and Administrative Sciences, 2(3), 75-88.

Solomon, E.A. (2021). Organizational value systems and firms’ competitive advantage in the Nigerian banking industry. International Research Journal of Management, IT and Social Sciences, 8(4), 303-312.

United Nations (2021).Concept of gender parity strategy.Available at https://reform.un.org/content/gender-parity-strategy.Accessed on 13th February 2021.

Uzochukwu, O. (2021). Direct selling strategies and customers loyalty in the Nigerian deposit money banks. International Journal of Business, Economics & Management, 4(1), 116-129.

Wei, S.-Y., & Lin, L.-W. (2021). The influence of Taiwan electronic production company’s proprietary data products on the interaction of company effectiveness. Journal of Advanced Research in Economics and Administrative Sciences, 2(3), 40-74.

Wimbiz. (2014). Due diligence analysis for financial institutions in Nigeria, 2012-August, 2014.Retrieved May 10, 2015,

Workplace Gender Equality Agency (2013).Gender Strategy Toolkit: A direction for achieving gender equality in your organization. Government of Australia. Used with permission.

Received: 03-Jan-2022, Manuscript No. AEJ-21-9970; Editor assigned: 05- Jan -2022, PreQC No. AEJ-21-9970 (PQ); Reviewed: 19- Jan-2022, QC No. AEJ-21-9970; Revised: 26-Jan-2022, Manuscript No. AEJ-21-9970 (R); Published: 09-Feb-2022