Research Article: 2017 Vol: 21 Issue: 2

Green Banking: a Case Study on Dutch-bangla Bank Ltd

Sohel Mehedi, University of Rajshahi

Keywords

Green Lending Policy (GLP), Green Investment (GI), Economic Value Added (EVA), Market Value Added (MVA), Environment-friendly Economic Value Added (EEVA), Sacrificing Cost (SC).

Introduction

We are always striving to survive in the world. We are fighting to earn a lot of money in order to make our life comfortable. We are fighting against our competitors to gain more than they have. But we are losing the appeal of our heart. We don’t know, actually where we are going now. We are denying our factual existence from where we can take key advantages and lead our life with full of joy and prosperity. It is high time to take us back from these types of unhealthy and unethical competitions. We should emphasize individual distinctive nature in order that anyone can raise a question about his own self to promote his ethical manner in the context of the present situation as to what he should do now and how he can enlighten the world to make it free from pollution for our future generation.

We are quite conscious of our children’s future. We believe that children’s education, their confidence and economic volume are the pioneering indicators which initiate them to the right place at the right time. That’s why we are trying to gain more economic volume and expecting them to lead a prosperous life. For instance, we have a huge sum up money in our bank account, but there is no existence of any green field or a single tree in the earth. Can we live in one second? Everyone will acknowledge my argument that we do not live in a second. But we are at haphazardly destroying the elements of environments through the voice of industrialization and employment opportunity. We are not thinking about our natural environment and its elements. Each and every element of the natural environment is required for sound health. There is not any alternative to a sound environment for the growth of a mam perfectly. A Sound environment entails pollution, free atmosphere where a man is budding with full of satisfaction and confidence which pledge him to carry a strong ethical background and delineate him as a contributing and responsible man in the society.

Industrialization has offered a good number of employment opportunities in recent years in Bangladesh. This is a good sign of increasing economic volume and economic growth as well. As a result, per capita income and living standard also increase sharply, raising a burning question from the all segments of stakeholders in respect of environmental degradation, climate change and global warming. Governmental Agencies, NGOs and Regulatory bodies are agreeing to save our environment by reducing industrial pollution with considering the stakeholders full of satisfaction.

Bank and financial institution is the key indicators to stop environmental pollution. Land, labor and capital act as the primary elements of starting and managing a business. Without adequate capital, we cannot think to run the business. Bank and financial institution is being financed by different types of industrial and production organization. Different classes of manufacturing companies such as pharmaceuticals, tannery, cement, ceramic, food and beverage, paper, textile, fuel and power are greatly liable for damaging biological systems of the environment. The production processes of these companies require a lot of energy consumption. Chemical, Pesticide, Petrochemical, Iron and Steel, Coal, Oil, Natural Gas, Diesel, Petrol, Octane are widely used in the production process and it follows that environmental elements are polluted dramatically. In addition, modern technology, eco-friendly raw materials, proper waste treatment systems and safe disposal systems are absent in the production process.

Environmentalist and stakeholders from different segments are arguing that bank and financial institution should determine the environmental risk and liability of the organization those are selected for credit privileges. They should ascertain the outcome of the financial feasibility and social feasibility as well before giving credit facilities. They will only provide credit to those organizations whose project will pass the test of social and environmental feasibility. It requires a green lending policy of the banks which support to assess the projects by covering the interest of stockholders and stakeholders. In addition, Banks should exercise green activities by their own operating activities such as in-house green decoration, online banking, online bank account, all transactions through online, all payment through online, paperless statement in all cases including financial report and management report, use of solar energy instead of electric power, net banking and mobile banking.

Dutch-Bangla Bank Limited is committed to conduct its operational activities by maintaining the approaches of pollution free environment. Alignment with the environmental and social responsibility, its promise highlights ethical banking activities that offer contribution to different social circumstances which include donation to disaster management fund, climate change fund, health care services, education, science and innovation, development of internal environmental management system and the green products. Among the factors require a banking which maximizes shareholder’s wealth and minimizes environmental pollution in order to promote standard living style in Bangladesh (Afroz, 2017). With the aim of sustainable development while simultaneously considering economic development and pollution free environment, green banking has a lot to contribute in this regard. Therefore, banks should offer green products in the market and examine the effect of their offering products in the society with regard to environmental and social issues (Bihari, 2011). In addition, initiatives from banks regarding their in-house green decoration by using solar energy and providing green instruments in the day to day operations can contribute to acknowledge them as socially responsible banking. However, installation of green instruments into banking operations and green lending including green products appeal huge resources. Hence, it is clear that bank attributes have substantial impact on the adoption of green banking strategies.

Investigating the initiatives of Dutch-Bangla Bank Limited regarding the green banking activities, its contribution to the victims of natural disasters and the effect of attributes to the green banking activities fulfil the gaps in green banking literature. This paper attempts to explain overview of the study, green banking, objectives of the study, hypothesizes, model and methodology of the study, literature review, Dutch-Bangla Bank Limited initiatives for green banking, hypothesis testing, findings of the study and conclusion. The study also offers sacrificing cost and environment-friendly economic value added (EEVA) as the new dimension under the heading of Dutch-Bangla Bank Limited initiatives for green banking that would subsidize the policy makers to take valuable decisions about the banking sector in special and business sector in general.

Green Banking

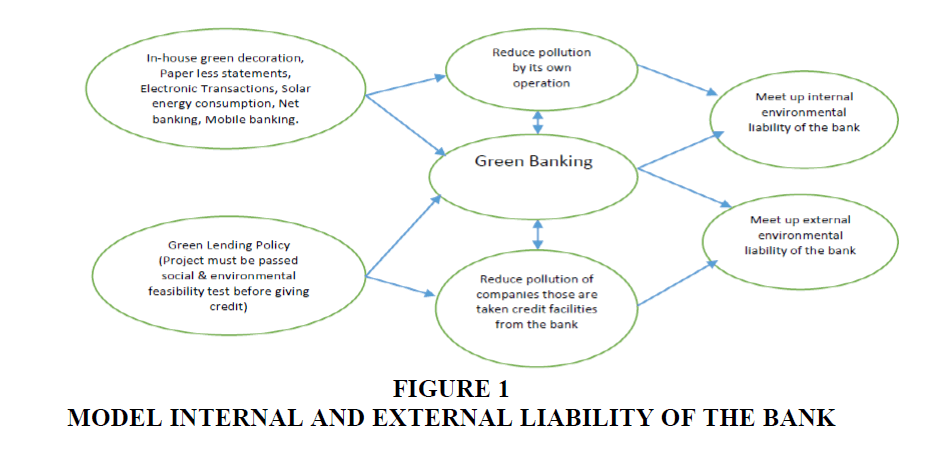

Green banking means environment friendly banking practices by the bank in its operational area. Green banking promotes its banking activities by considering the interest of stakeholders. We may define ‘green banking’ as paperless banking where all activities and transactions are made through online. The Bank may ensure its green banking activities through in-house green decoration, solar energy consumption, offering green products to customers & paperless communication in national and international arena. The banking industry can play an outstanding role between economic growth and environmental protection in promoting environmentally sustainable and socially accountable institution (Bahl, 2012, p. 27). That’s why; we are arguing that the Bank is, both internally and externally, responsible for environmental pollution. Green banking means ensuring environmentally friendly practices in the banking sector and thereby reducing internal and external carbon footprints (Ahuja, 2015, p. 12). The Bank may complete its internal responsibility by greening in house decoration and paperless communication. It is required to form a set of green products that ensure internal pollution control which is created by the operation of the bank. The external liability of the bank is much more than that of its internal liability. The Bank may free from its external liability by producing convenient green lending policy which covers stockholder's interest, at the same time, satisfy different governmental agencies, NGOS and other interested parties. In addition, Sustainable development requires sustainable banking that can be achieved through the practices of green banking. Green banking ensures a sound environment by considering the sustainable development with sustainable economic growth. We put forward a definition of green banking as the process of in-house green decoration, electronic transaction and convenient green lending policy which promote environment friendly activities reduce the carbon footprint and ensure sustainable growth and safeguard sustainable development (Mehedi et al., 2017).

Objectives of the Study

The main objective of the study is to critically examine the green banking frame of Dutch-Bangla Bank Limited.

The specific objectives are as follows:

a. To identify the extent of green banking practices of DBBL.

b. To evaluate the contribution made by DBBL to the victims of natural disasters.

c. To measure whether bank attributes affect the green banking activities.

Hypothesis of the Study

To cover the objectives of the study and find out the factual relationship between promotion of green banking and bank attributes, the following hypotheses are formulated in only in the null form:

a. There is no significant relationship between a donation to the victims of natural disasters and bank attributes.

b. There is no significant relationship between climate risks fund and profit before provision of DBBL.

c. There is no significant association between Economic Value Added (EVA), Environment-friendly Economic Value Added (EEVA), Sacrificing Cost (SC) and Market Value Added (MVA).

d. There is no significant contribution to green investment by deposits of DBBL.

Model of the Study

The study will be highlighted on the basis of internal and external liability of the bank (Figure 1). The study will not only emphasize internal green activities, but also demands excellent environment-friendly green lending policy. The following way, a bank can ensure its green banking practices and be free from internal and external liabilities of environmental pollution.

Methodology of the Study

Population, Sample and Sampling Techniques

Commercial Banks enlisted in the Dhaka Stock Exchange are considered as the population of the study. Dutch-Bangla Bank Limited is purposefully selected from the population due to the convenience of data collection and data sufficiency. Research objectives, hypothesis have been framed on the basis of population. The sample has been taken from commercial banks, which are enlisted in the stock exchange that represents three percent of the entire population. Owing to the controlling factor of the study such as time, cost, straightforward communication of bank personnel and uphold required standards of accuracy, a sample has been certainly taken from the population in order to attain the objectives of the study.

Sources of Data

The study has been conducted on the basis of secondary data for the purpose of in-depth investigation of the study. The secondary data have been collected from related journals, newspapers, published research reports, published books, bulletin board, Ministry of Environment, bank’s annual report, Bangladesh Bank’s website, papers developed by banks’ personnel, as well as scholarly publications on or about the area of the proposed topic. The period of the study is covered by five years from 2011 to 2015.

Statistical Design

The data collected from the secondary sources are presented with the descriptive statistical tools like simple average, graphs, percentage and inferential statistical tools like multiple regression analysis, paired sample t-test, one-way ANOVA and one sample t-test in order to make a conclusion that supports the study objectives.

Literature Review

Green banking is the term used by banks to make them much more responsibility to the environment. The term green banking means developing inclusive banking strategies which will ensure sustainable economic development. The researcher tries to explore the green banking activities of Bangladeshi commercial banks and to discover the reasons behind adopting green banking. They use factor analysis to analyze the data and to draw the findings. They find that six factors namely, economic factor, policy guideline, loan demand, stakeholder pressure, environmental interest and legal factor are the major influencers for the adoption of green banking by the commercial banks to ensure sustainable economic development (Ahmad et al., 2013). Banking sector should go green as the first approach and encourage the projects which take care of environmental safety such as sustainable development, protection of human health, bio-diversity, occupational health and safety, efficient production, delivery and use of energy, pollution prevention and waste minimization, pollution controls and solid and chemical waste management and there should be a third party expert to draw a plan for the environment management plan. Banks should keep addressing aspects in mind while financing any projects like analyzing the project in terms of scale, nature and the magnitude of environmental impact. The Bangladesh Bank should motivate the banks to include banking stakeholders as well as environmental stakeholders with the strategy process to improve the ways of developing green banking mechanism or induce them into formulate new green banking products. The researchers suggest that banks should go green and play a pro-active role to take environmental aspects for functional improvements and changing client habits in banking business (Choudhury et al., 2013). Green banking means ensuring environment friendly practices in banking sector and thereby reducing internal and external carbon footprints. Banking industry is linked to the external environment as it provides funds to others and can contribute to make pollution free environment by ensuring environmentally responsible investment. The researcher underlined the green criteria as a green lending principle should be taken by the banks to initiate the green banking practices. The researcher highlights the finding that the lack of consumer awareness and education as a major obstacle for adopting the green banking practices in the banking sectors (Ahuja, 2015). Green banking is to avoid paper work as much as possible and do the transactions through electronic devices. The researchers argued that green banking covers the sustainable banking, ethical banking, green mortgage, green loans, green credit cards, online shopping through debit cards and credit cards, green saving accounts, green checking accounts, green money market accounts, getting bank statement through e-mail, mobile banking, online banking, remote deposit, waste management, roof gardening and green financing. The motive of green banking is to protect the environment and reduce the carbon footprint. The researchers find that most of the customers are confused about the concept of green banking even though they are enjoying the facilities (Krishna & Srinivas, 2014). Green banking as a concept is a proactive and smart way of thinking with a vision for future sustainability of our only spaceship earth-as design science explorer Richard Buckminster fuller called our earth. Basically green banking avoids as much paper work as possible through online or electronic devices and creates awareness to banking business people about environmental and social responsibility enabling them to do an environmental friendly business practice. The researcher also concludes that green ethical banks adopt and implement environmental standards for lending which is really a proactive idea that would enable eco-friendly business practices which would benefit our future generation (Rao et al., 2015). Banking sector is one of the major sources of financing investment for commercial projects which is one of the most important economic activities for economic growth. The researchers identify that banking sector can play a crucial role in promoting environmentally sustainable and socially responsible investment (SRI). They also argue that those industries which have already become green and which are making serious attempts to grow green should be accorded priority to lending by the banks (Rao et al., 2015). Bangladesh is considered as a country of emerging economy while facing various problems related to social and environmental issues. Bangladesh bank has issued a circular giving guideline about green banking and reporting practices of banks and non-bank financial institutions (Mehedi et al., 2017). Although banking sector in Bangladesh is contributing to a large scale for the socio-economic development, its contribution towards environment-friendly banking activities and pollution free environment for leading happy life is very nominal. Afroz (2017) conducts a study on green banking initiatives of Islamic Bank Bangladesh Limited and documents that response from business sector is very slow and the consumer is not fully aware of green banking products. Another study is conducted by Rahman et al. (2017) on problems and prospects of electronic banking in Bangladesh: a case study on Dutch-Bangla Bank Limited. They argue that customers have not enough knowledge regarding the advantages of electronic banking which is offered by Dutch-Bangla Bank Limited. However, green banking practice is the matter of additional grind into the banking sector in Bangladesh (Afroz, 2017). Since Dutch-Bangla Bank Limited is contributing as the pioneer of banking sector in Bangladesh, therefore, there is a growing literature gap which offers to investigate green banking initiatives of Dutch-Bangla Bank Limited to find out the level of green activities, green products, initiatives to be free from internal and external liability and the effect of bank attributes on green investment. An analysis about its green banking initiatives and contribution to environment-friendly activities are the substance of transporting adequate value into the literature gaps.

Dutch-Bangla Bank Limited Initiatives for Green Banking

Dutch-Bangla Bank Limited (DBBL) has taken initiatives as per the direction of Bangladesh Bank to establish the structure and promote the green banking activities by its own operation in order to be free from the liability of internal perspectives regarding the customer services and external consequences due to occur for the lending policy of the bank. The bank is fully committed to providing green services to the customer and also put emphasis on post action facilities for the people who are victimized by the natural disasters and environmental degradation. In order to promote green banking practices, bank has been established in the following structures and policies in respect of its internal operation and post action accountabilities:

In-House Green Management

DBBL has been trying to cope up with its activities that adversely affect the environment and consequences of environmental pollution, climate change, drought, flooding which affect the people, customer, business man and other stakeholders who are any ways the beneficiaries of the bank. The bank is exasperated to control the pollution owing to its own existence and considers it as a vulnerable situation for the prospect of shareholders and related parties of the bank. Bank follows 3R policies meant to reuse, reduce and recycle of daily activities of the banking operation. Electric form and online communication system are used in almost internal memos, process notes, customer communication and communication among the officials of the bank. The bank is now using solar energy instead of electric power to its 50 ATM booths and introduces video conferencing system in order to make telecommunication among the bank officials. It is intensely trying to reduce the consumption of electricity, minimum uses of water and paper in its day to day operations.

Active Green Banking Cell

DBBL has formed an active green banking cell consisting of eight officials as per direction of the Bangladesh Bank. The responsibility of this cell towards preparing green policies and guidelines is how to achieve the green banking guidelines of Bangladesh bank. The cell is working to lead by credit division; thereby green lending policy and environmental feasibility of the project are also measured by this cell. The team is also accountable for the implementation of green banking policies and promoting green banking practices by disclosing an environmental report on the international standard format.

Development of Environmental & Social Management System (ESMS) in DBBL

DBBL has taken initiatives to develop software which, before giving credit facilities, rates the credit proposals on the basis of environmental risk as per guidelines of Bangladesh Bank and international standard. The bank has launched a project that certainly covers the objectives of a capacity development and implementation of Environmental and Social Management Systems (ESMS). It is devoted to ESMS that would be the premeditated issue in approving credit proposal.

Fund Allocation for Capacity Building and Green Awareness Development

To promote green banking activities by its internal operation requires training and development of employees. DBBL has allocated funds every year from 2011 Tk 5.00 million for the purpose of capacity development and green awareness among the bank’s officials. In addition, it is equally trying to create mass awareness among the clients in respect of green banking facilities and adverse effect of climate change and environmental degradation.

Structural Reform Initiatives by DBBL

Green lending policy backs the bank to be free from its external liability by formulating apposite lending policy which certainly ensures that the credit proposal is free from environmental pollution or has passed the environmental and social feasibility test. In order to formulate and implement standard green lending policy, the bank has taken a process of centralizing its corporate credit operation which provides the corresponding facilities regarding the approval of credit proposal and at a time reduce time, water, power and paper consumption to a great extent.

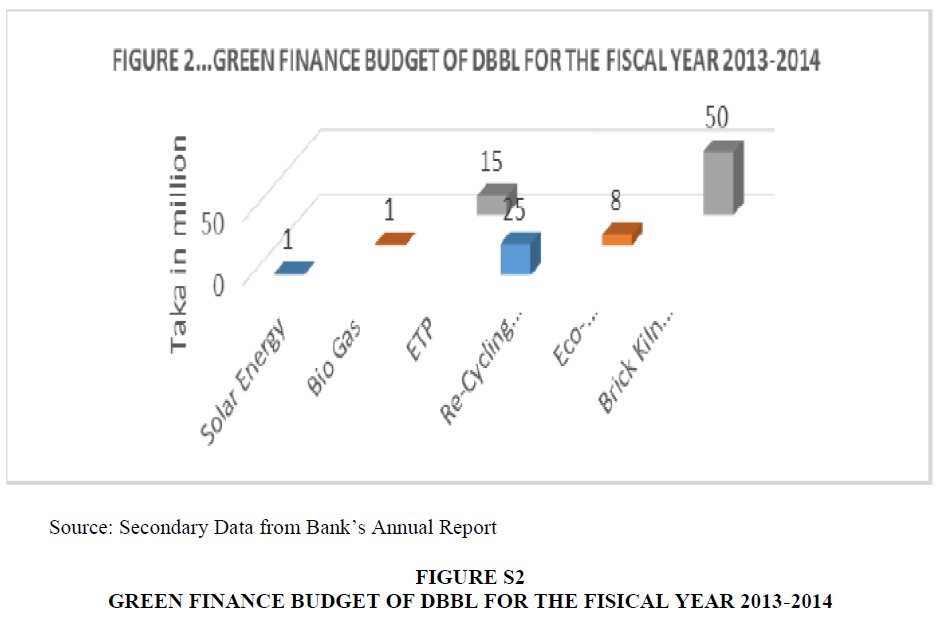

Finance in Environmentally Friendly Industries

Due to uncontrolled industrialization and absence of effluent treatment plant in the industrial organization enormously pollutes the environment. DBBL has financed in select industries which have taken steps to establish an effluent treatment plant. In addition, Bank has financed in solar power plant, automatic brick manufacturing industry as the product name of tunnel kiln, zigzag and handing waste in a safe manner in a hospital, hot water heat recovery system in textile and ready-made garments and eco-friendly power generation projects. It is important to note that DBBL approved the credit proposal of Tk 34433.40 million in 2013 for the industries which have effluent treatment plant.

Finance in Ten Taka Account Holders

DBBL has given an opportunity to the lower income people, landless and victims of natural disaster to open an account having required only ten taka as per direction of Bangladesh Bank. The objectives of these accounts are providing credit support for them with a view to generating income by taking consideration of the environmental elements in order that they can lead a happy and prosperous life to reduce the crisis of social liquidity, enhance participation in the productive sector and ultimately reduce environmental degradation to a greater extent.

Finance in Waste Management Project

DBBL has financed in a waste management project named as WWR Bio Fertilizer Bangladesh Ltd for 40.00 million taka which is composed of fruit and vegetable wastes collected from the local market and produce high quality organic fertilizer. This is getting an outstanding recognition in the country.

Online Banking

Online banking is a part of in-house green management that certainly ensures customer friendly technologies which offer minimum cost and fostering customer services. Online Banking is demanded due to reduce paper use in the internal operation of the bank. It provides 3 million customers with online banking facilities and almost 10 lakh customers with internet banking facilities. It has also launched electronic mail systems instead of paper letters in order to make internal communication between the bank officials.

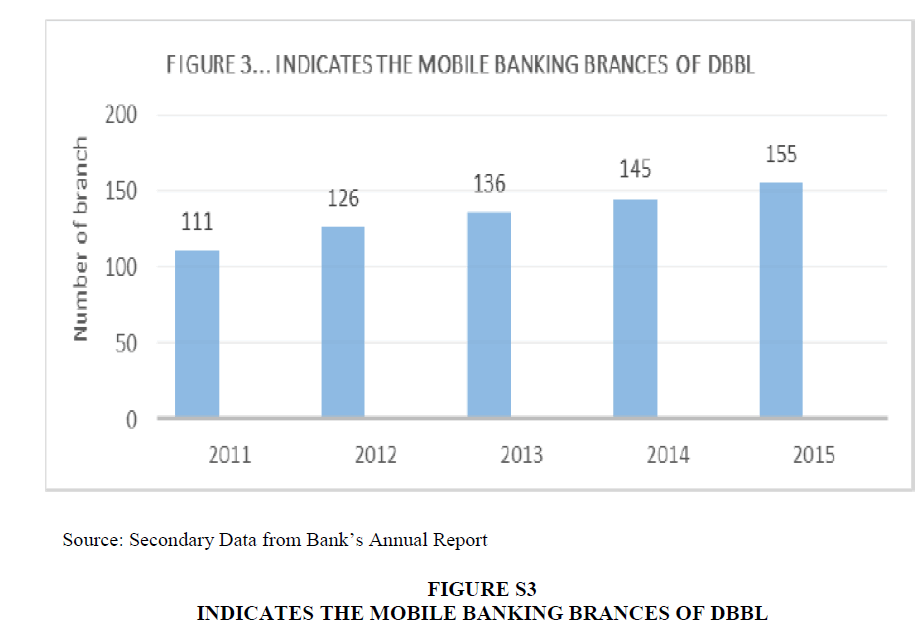

Mobile Banking

Mobile banking is also a part of in-house green management that provides paperless banking facilities to the customers. It delineates and accumulation of a good number of people who have no bank accounts or intention to open an account. It follows from the above that a huge number of people are undertaking banking facilities without bank branch. Almost 1 million customers get financial services such as cash-in, cash out, merchant payment, utility payment, salary disbursement, foreign remittance, government allowance disbursement, ATM money withdrawal through using the facilities of mobile banking.

E-Payment Gateway Facilities

E-Payment gateway is also the process of paperless banking that ensures electronic transaction, maximum customer services, minimizes wasting valuable time, rational use of human resource and saving transportation cost. It has provided facilities in the line of payment of utility bills, tuition fee, etc., without having an account and paper notes.

Climate Risk Fund

DBBL has opened a climate risk fund and budgeted taka 5.00 million for rehabilitation of the natural disaster affected people in the country. It is ethically believed that it has external liability of environmental degradation due to the causes of loosely lending policy and the absence of environmental risk rating instruments of appraising credit proposals.

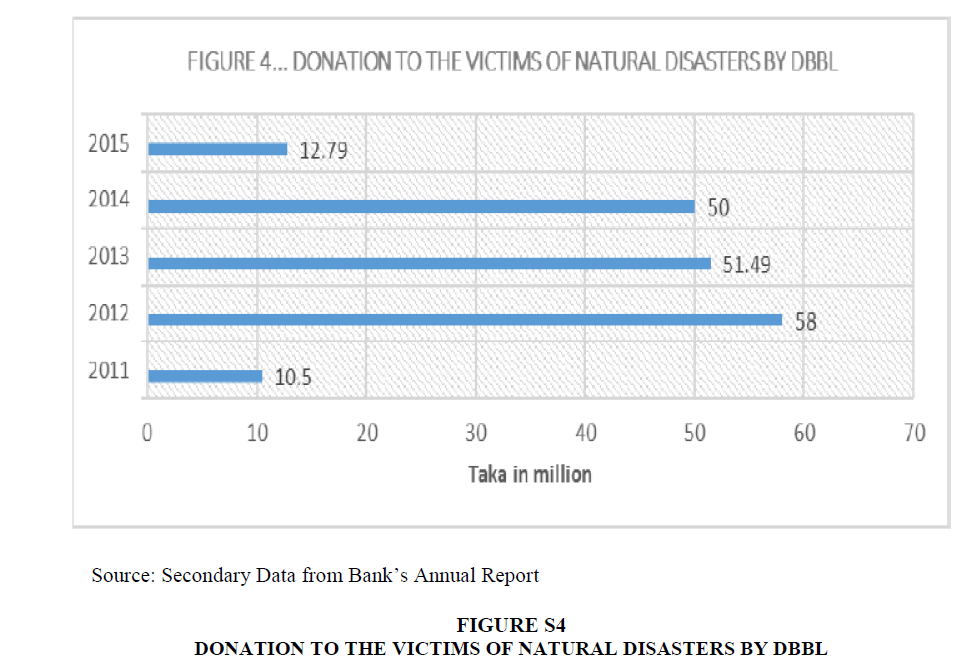

Donating to the Victims of Natural Disasters

DBBL has donated to the victims of natural disasters every year as a part of corporate social responsibility activity against climate change. Bangladesh is one of the most vulnerable countries and a huge number of people in the northern regions and in the southern coastal area is affected by flood, droughts, cyclone, aila, sidr, tsunami which are the consequences of climate change and environmental degradation. The Bank is committed to providing adequate financial and non-financial support to them for reintegration in the human chain.

Green Investment

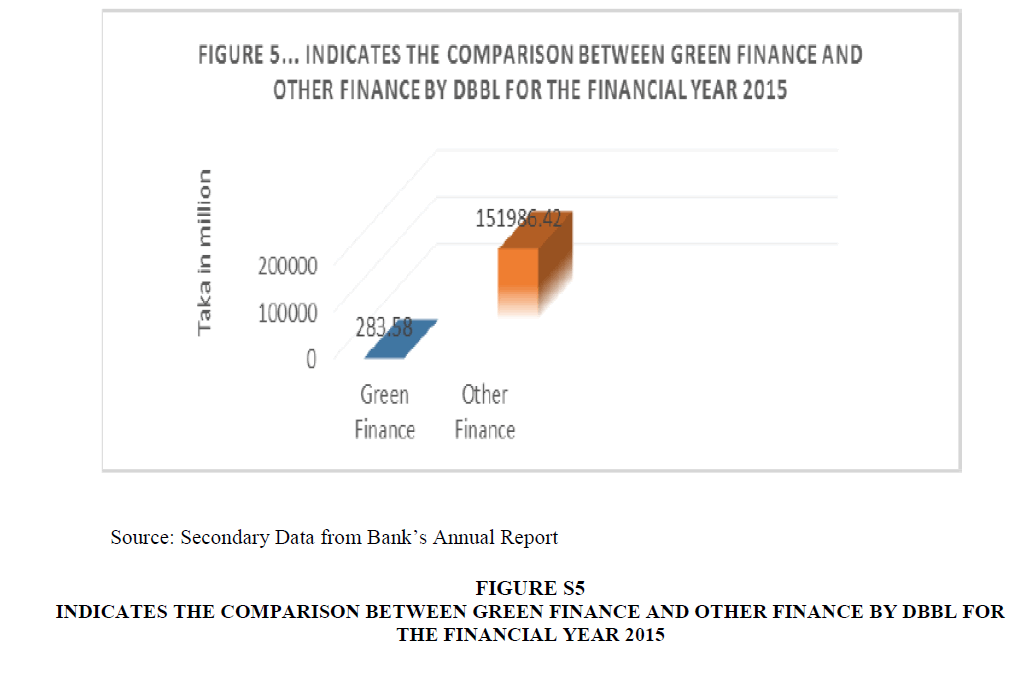

Green lending policy is the co-factoring tool that conveniently supports to reduce environmental pollution and bank may get rid of its external liability of environmental degradation. Green investment is the outcome of green lending policy that evaluates the credit proposal before approving it in the context of environmental and social risk and return. The Bank is offering a lucrative package in the fields of eco-friendly business, eco-friendly agribusiness and eco-supporting business ventures. It has provided taka 283.58 million as the green investment in the financial year 2015.

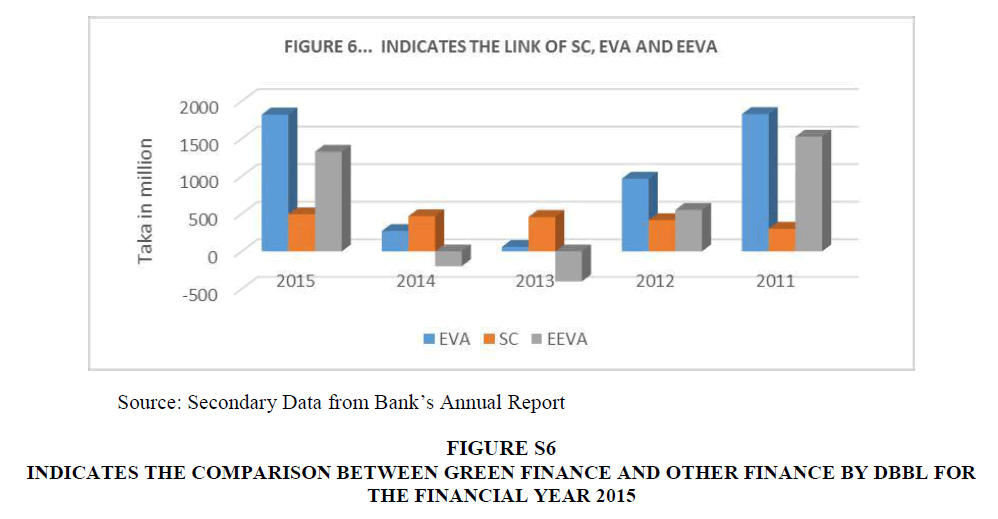

Interlink of Sacrificing Cost, Economic Value Added (EVA) and Environment-friendly Economic Value Added (EEVA)

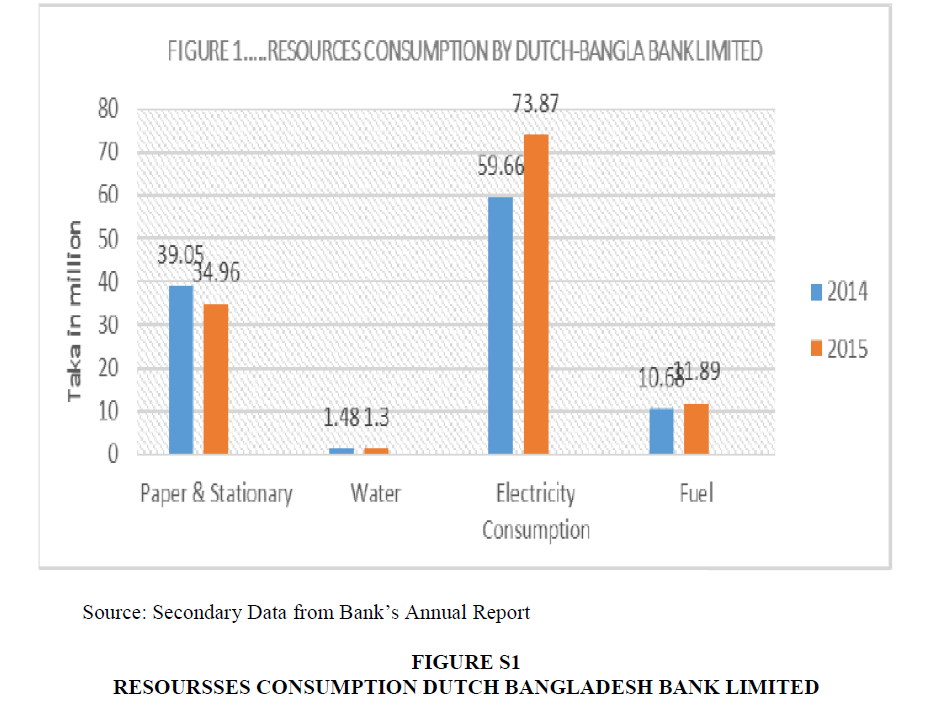

The study tries to determine interlink between sacrificing cost and economic value added in order to ascertain the environment friendly economic value added that actually make a contribution to the economy in respect of covering stakeholder interest to a greater extent. Sacrificing cost includes the cost which are directly or indirectly hit the environment. Electricity including power and light, water, paper and stationary and fuel is considered as sacrificing cost and their uses adversely affect the environment. The study delineates the following concept to determine the environment friendly economic value added.

Economic Value Added (EVA) - Sacrificing Cost (SC)=Environment friendly Economic Value Added (EEVA)

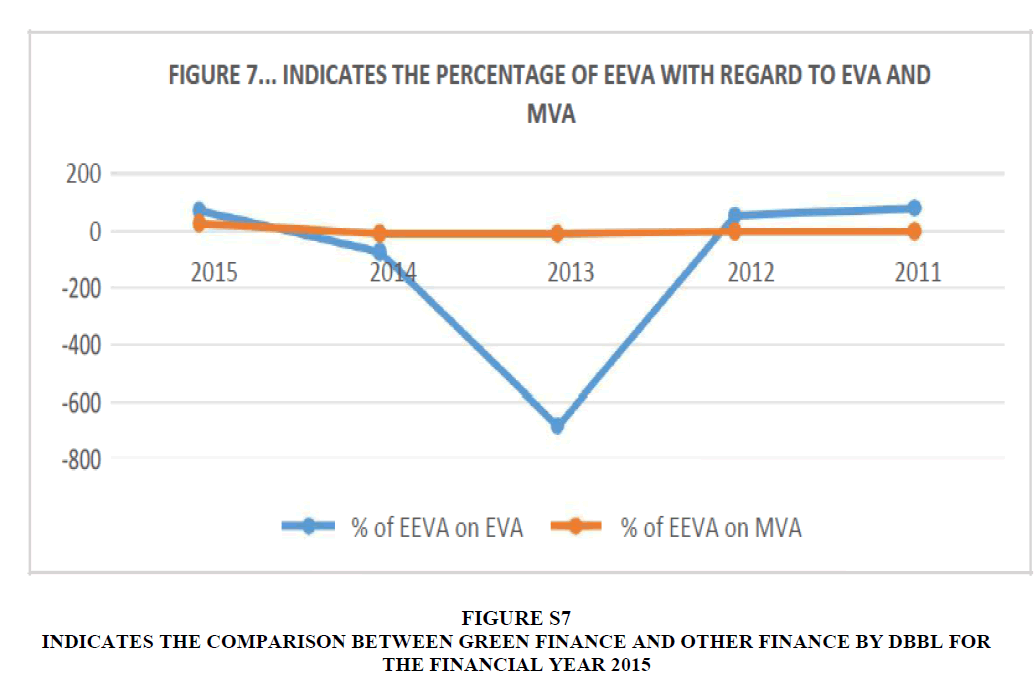

Contribution of Economic Value Added (EVA) and Market Value Added (MVA) regarding the Environment-friendly Economic Value Added (EEVA)

The study proposed should have the standard proportionate contribution of Economic Value added (EVA) and Market Value Added (MVA) on regarding the Environment-friendly Economic Value Added (EEVA). The researchers underlined that EEVA should be 75% of EVA and 25% of MVA. These proportionate rates should be the minimum required standard for every company in order to measure the contribution on environment-friendly economy. For the earth to be free from environmental pollution and climate change, it is high time to take a tight policy to control man-made wastages, out of which a major portion is delivered from different types of companies. From Tables 1 and 2, it is seen that percentage of EEVA on EVA is negative and 6.24% on MVA which is very poor does not cover study proposed requiring standard.

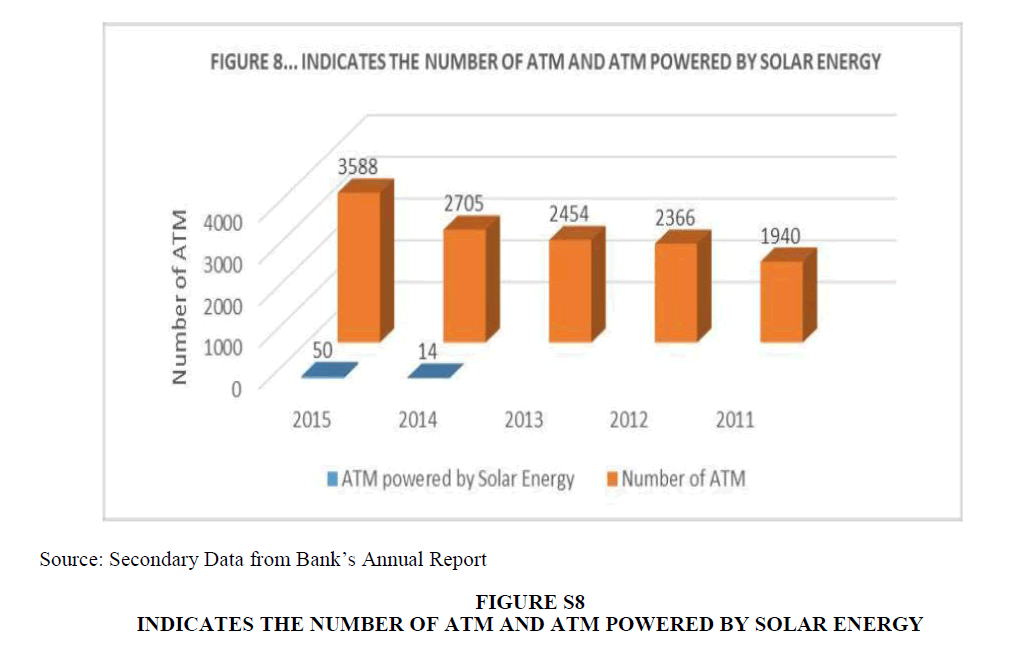

ATM Powered by Solar Energy

DBBL has been attempting to provide faster and doorstep service since its establishment. Automated Teller Machine is also a medium of paperless transaction between the bank and the customer. This is a process of drawing money from ATM booth without being physically present in the bank counter. It can be noted that it requires the consumption of lot of electric power, thereby, there should be a balanced between the benefit of paperless transaction and electricity consumption by an automated teller machine. The bank has taken initiatives to use solar energy instead of electricity power with a view to minimize the corresponding problem and protect the environmental elements constructive in nature.

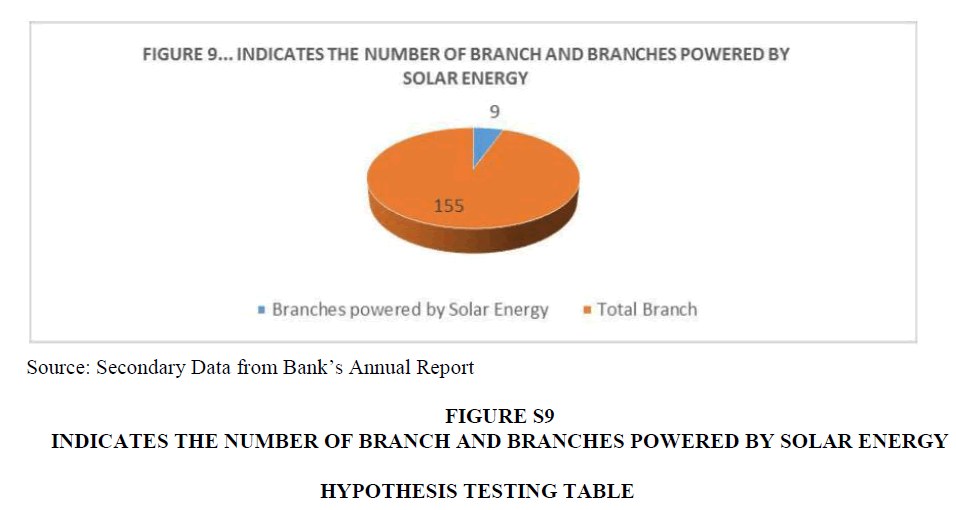

Branches Powered by Solar Energy

The Dutch Bangla Bank is the first electronic bank in Bangladesh. It was fully automated in 2003 and that introduced plastic money to the customer. The use of solar energy instead of electric power is a big challenge of the bank. Automation requires a lot of power that is mostly supplied from electric power. As a consequence of it, wastage from electric power Generation Company pollutes the elements of the environment and degrades the climate.

Hypothesis Testing

Multiple regression analysis supports to determine the relationship between dependent variable and independent variables. The study tries to determine the relationship between a fund for the victims of natural disasters and operating profit, total assets and cash flow of Dutch Bangla Bank Limited. The r=0.999 indicates the good level of prediction of dependent variables. The r square indicates the relationship between dependent variable and independent variables. The r square=0.998 indicates the almost perfect positive correlation between dependent variable and independent variables. It represents that our independent variables explain 99.8% of the variability of our dependent variable. The adjusted r square indicates that 99% of the data are reported accurately (Appendix).

The study sought to determine the association between the variables. The computed F value is 138.973 which are greater than the table value of F (1, 3) d.f and 5% level of significance is 10.13. The computed F value is 138.973 which has occurred by chance with a P<0.05. Underlying it is that the regression model is a good fit for the data. We can conclude that profit before provision; total assets and cash flow are statistically and significantly predict the fund for the victims of natural disasters.

Unstandardized coefficients indicate the contribution of independent variables to the dependent variable. The calculated t value is 12.051 is greater than the table value of 2.776 and p<0.05which indicates the contribution made by profit before provision, total assets and cash flow to the fund for the victims of natural disasters is significant and we may conclude that the null hypothesis is rejected and the alternative hypothesis is accepted.

Paired Samples t-Test determined the statistically significant differences of mean between dependent variable and independent variable and finally dictated to the selection of the hypothesis. The computed t value is 16.603 greater than the table value of 4 d.f is 2.776 and p<0.05which indicated that utility of profit before provision statistically predicts and make contribution to the climate risk fund. Paired sample t-Test revealed a statistically significant influence between profit before provision and climate risk fund. This is underlined that the alternative hypothesis is accepted.

The one-way ANOVA tries to determine the association between the variables. The computed F value is 24.535 which are greater than the table value of F (3, 15) d.f and 5% level of significance is 3.29. The computed F value is 24.535 which has occurred by chance with a P<0.05.We can conclude that Economic Value Added (EVA), Environment-friendly Economic Value Added (EEVA), Sacrificing Cost (SC) and Market Value Added (MVA) are statistically significantly associated with them and contribute to promoting green activities.

One Sample t-Test determines the statistically significant differences of mean between dependent variable and independent variable and finally dictates the selection of the hypothesis. The computed t value is 3.769 less than the table value of 1d, f is12.71 and not p<0.05 that is p=0.165 which indicates that deposits do statistically not make a contribution to the expansion of green investment by the required proportion. This underlines that the null hypothesis is accepted.

Findings of the Study

The study objectives have been searched by the researchers in the ground frame of green banking practices by Dutch-Bangla Bank Limited. The information collected from the bank annual report is presented with the line of both descriptive and inferential statistics with a view to drawing a meaningful conclusion in respect of the setting objectives of the study. The study outlines the following quite significant findings.

a. The bank has developed its infrastructure to promote green banking activities. In-house green management, online banking, mobile banking, green banking cell, e-payment gateway facilities, development of environmental and social management system, structural reform to enhance green investment, train up its employees and finance in a waste management project are the good sign of paperless banking and post action activities of green banking.

b. Donation to the victims of natural disasters and budget for the climate risk fund are a crucial and praiseworthy step taken by the bank. It is emphasized on the ground of corporate social responsibility and to free the bank from its external liability of environmental pollution. This is likewise a post action activity under the frame of green banking of the bank supporting to those who are homeless, landless due to the climate change and environmental degradation.

c. Green investment has been given more importance by the researcher’s inception as the greatest way to be free from external liability of the bank. The study is degraded the bank due to its finance in green project that is only 283.58 million taka lower than 0.20% of total investment in the financial year 2015. One sample t-Test indicates that deposits do not statistically make a contribution to the proportionate rate for the expansion of green investment volume.

d. The bank has a total of 155 branches, out of these only 9 branches are powered by solar energy instead of electric power and in 2015; the number of ATM Booths is 3588, out of these only 50 booths are powered by solar energy. In addition, the percentage of EEVA on EVA is negative and 6.24% on MVA which is very poor does not cover study proposed requiring standard. The bank should take demanding steps regarding this issue to reduce the consumption of sacrificing cost and increase the volume of environment-friendly economic value added.

e. Multiple regression analysis underlines that have perfectly positive correlation among the donation to the victims of natural disasters and profit before provision, total assets and cash flow of DBBL and their association and contribution to promote this fund is statistically significant. Paired Sample t-Test indicates that climate risk fund and profit before provision are statistically significant. From the ANOVA table, it is seen that EVA, EEVA, SC and MVA are statistically significantly associated with them.

f. It may be argued that the bank has almost covered the standard of phase-I and phase-II except phase-III required by Bangladesh Bank. Phase-III emphasizes that all schedule banks will prepare internationally accepted standard environmental report and produce green products that offer utmost mission oriented and convenient green banking practices that will support the bank free from its internal and external liability of environmental degradation. Although the bank has included an environmental report in its annual report in 2015, it has not yet come under the internationally accepted required standard. Furthermore, green products are completely absent.

Concluding Remarks

The financial sector can play a vital role to uphold the environmental elements to be free from pollution by its lending policy that certainly ensures green investment and build a green future for the next generation. The study outlines liability as the context of internal activities and external liability that originate from the post action operation of the industries which are getting credit facilities from the financial institutions. The study on DBBL underlines that DBBL should give more emphasis on introducing green products which are offered to those industries have taken initiatives for in-house green management. In addition, Bank should take step regarding the reducing of sacrificing cost and introducing solar energy instead of electric power for the purpose of sustainability of value addition to the economy. It is noted that in-house green management of DBBL is praiseworthy as it ensures paperless banking. The study has not found out any green branch declared by DBBL that was the requirement of Bangladesh Bank.

Appendix

Figure S5 : Indicates The Comparison Between Green Finance And Other Finance By Dbbl For The Financial Year 2015.

| Table 1: Represents The Eva, Sc And Calculated Value Of Eeva |

|||

| Years | EVA | SC | EEVA |

|---|---|---|---|

| 2015 | 1821 | 493.64 | 1327.36 |

| 2014 | 271 | 468.05 | (197.05) |

| 2013 | 59 | 458.54 | (399.54) |

| 2012 | 968 | 415.04 | 552.96 |

| 2011 | 1828 | 301 | 1527 |

Figure S6 : Indicates The Comparison Between Green Finance And Other Finance By Dbbl For The Financial Year 2015.

| Table 2: Represents The Percentage Of Eeva With Regard To Eva And Mva |

|||||

| Years | EEVA | EVA | MVA | % of EEVA on EVA | % of EEVA on MVA |

|---|---|---|---|---|---|

| 2015 | 1327.36 | 1821 | 4766 | 72.89% | 27.85% |

| 2014 | (197.05) | 271 | 6643 | (72.71%) | (2.97%) |

| 2013 | (399.54) | 59 | 8298 | (677.18%) | (4.81%) |

| 2012 | 522.96 | 968 | 11996 | 57.12% | 4.61% |

| 2011 | 1527 | 1828 | 23320 | 83.53% | 6.54% |

| Mean | 562.14 | 989.4 | 11004.60 | (107.27%) | 6.24% |

Source: Secondary Data from Bank’s Annual Report

Figure S7 : Indicates The Comparison Between Green Finance And Other Finance By Dbbl For The Financial Year 2015.

Figure S9 : Indicates The Number Of Branch And Branches Powered By Solar Energy Hypothesis Testing Table.

One Sample t-Test between Green Investment (GI) and Total Deposits of Dutch-Bangla Bank Limited.

| Table 1S: One-Sample Statistics |

||||

| N | Mean | Std. Deviation | Std. Error Mean | |

|---|---|---|---|---|

| GI | 2 | 96.2300 | 35.73718 | 25.27000 |

| Table 2S: One-Sample Test |

||||||

| Test Value=1 | ||||||

|---|---|---|---|---|---|---|

| t | df | Sig. (2-tailed) | Mean Difference | 95% Confidence Interval of the Difference | ||

| Lower | Upper | |||||

| GI | 3.769 | 1 | 0.165 | 95.23000 | -225.8558 | 416.3158 |

Multiple regression analysis between a fund for the victims of natural disasters and the stimulating indicators such as profit before provision, total assets and cash flow of Dutch Bangla Bank Limited.

| Table 3S: Model Summary |

||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

|---|---|---|---|---|

| 1 | 0.999a | 0.998 | 0.990 | 2.24555 |

a. Predictors: (Constant), Profit Before Provision, Total Assets, Cash Flow

| ANOVA a | |||||

|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F | Sig. |

| 1 Regression | 2102.306 | 3 | 700.769 | 138.973 | 0.042a |

| Residual | 5.042 | 1 | 5.042 | ||

| Total | 2107.349 | 4 | |||

a. Predictors: (Constant), Profit Before Provision, Total Assets, Cash Flow

| Table 3S: Coefficients |

|||||||

| Unstandardized Coefficients | Standardized Coefficients | 95% Confidence Interval for B | |||||

|---|---|---|---|---|---|---|---|

| Model | B | Std. Error | Beta | t | Sig. | Lower Bound | Upper Bound |

| 1 (Constant) | 107.540 | 8.923 | 12.051 | 0.043 | -5.843 | 220.923 | |

| Profit Before Provision | 0.012 | 0.003 | 0.366 | 3.520 | 0.176 | -0.031 | 0.055 |

| Total Assets | -0.003 | 0.000 | -5.851 | -14.737 | 0.043 | -0.005 | 0.000 |

| Cash Flow | 0.009 | 0.001 | 5.700 | 16.645 | 0.038 | 0.002 | 0.016 |

Dependent Variable: Fund for the victims of natural disasters.

| Table 4S: Paired Samples T-Test |

||||||||

| Paired Differences | t | df | Sig. (2-tailed) | |||||

|---|---|---|---|---|---|---|---|---|

| Mean | Std. Deviation | Std. Error Mean | 95% Confidence Interval of the Difference | |||||

| Lower | Upper | |||||||

| Pair 1 Fund - Profit | -5.25444E3 | 707.67464 | 316.48172 | -6133.13812 | -4375.74988 | -16.603 | 4 | 0.000 |

One-way ANOVA is used to determine the association between Economic Value Added (EVA), Environment-friendly Economic Value Added (EEVA), Sacrificing Cost (SC) and Market Value Added (MVA).

| ANOVA b | |||||

| Attributes | Sum of Squares | df | Mean Square | F | Sig. |

|---|---|---|---|---|---|

| Between Groups | 1.676E8 | 3 | 5.586E7 | 24.535 | 0.000 |

References

- Ahuja, N. (2015). Green banking in India: A review of literature. International Journal for Research in Management, 4(1), 11-16.

- Agrawal, S. (2014). Green banking in India: An empirical study of commercial banks. Voice of Research, 2(4), 58-60.

- Ahmad, F., Zayed, N.M. & Harun, M.A. (2013), Factors behind the adoption of green banking by Bangladeshi commercial banks. ASA University Review, 7(2), 241-254.

- Ademola, F. & Anyankora, M.I. (2012). The challenges of improving informal sector activities conditions in Lagos Island, Nigeria. British Journal of Arts and Social Sciences, 6(2), 218-232.

- Afroz, N.N. (2017). Green banking initiatives of Islamic bank Bangladesh limited. Global Journal of Management and Business Research: C Finance, 17(1).

- Bahl, S. (2012). The role of green banking in sustainable growth. International Journal of marketing, Financial Services & Management Research, 1(2), 27-35.

- Choudhury, T.T, Salim, M., Bashir, M.M. & Saha, P. (2013). Influence of stakeholders in developing green banking products in Bangladesh. Research Journal of Finance and Accounting, 4(7), 67-77.

- Jha, N. & Bhome, S. (2013). A study of green banking trends in India. International Monthly Refereed Journal of Research in Management & Technology, 2, 127-131.

- Krishna, K.B. & Srinivas, G. (2014). Green banking - An impetus in banking sector, Acme Intellects International Journal of Research in Management, 7(7), 1-7.

- Mihaela, D., Liliana, F. & Niculae, F. Green banking in Romania. Accounting Department, Faculty of Accounting and Management Informatics System, Bucharest University of Economic Studies, Bucharest, Romania, 617-624.

- Masukujjaman, M., Siwar, C., Mahmud, M.R. & Alam, S.S. (2016). Bankers perception on green banking - An empirical study on Islamic banks in Bangladesh. The National University of Malaysia, Selangor, Malaysia, 295-310.

- Mehedi, S., Kuddus, M.A. & Maniruzzaman, M. (2017). The identification of banker s perception toward indicators for the adoption of green banking in Bangladeshi scheduled commercial banks. Journal of Internet Banking and Commerce, 22(2).

- Narag, D. (2015). Green banking - A study of select Banks in India. International Journal of Management and Commerce Innovations, 3(1), 5-12.

- Rao, Y.G.P., Menezes, S.J. & Dhanush, R. (2015). Contemplating customers and bankers outlook on green banking. International Journal of Science Research and Technology, 1(1), 75-82.

- Rao, Y.G.P. (2015). An empirical study on green banking in India. Proceedings of International Conference on Management Finance Economics, ISBN: 9788193137307, 125-129.

- Rahman, M., Saha, N.K. & Sarker M.N.I (2017). Problems and prospects of electronic banking in Bangladesh: A case study on Dutch-Bangla Bank Limited. American journal of Operations Management and Information Systems, 2(1).

- Sudhalakshmi, K. & Chinnadorai, K.M. (2014). A study on customer’s awareness on green banking initiatives in selected private sector banks with special reference to Coimbatore city. The International Journal of Business & Management, 2(4), 160-163.