Research Article: 2018 Vol: 22 Issue: 1

Growth Analysis of Islamic Banking in Pakistan: A Qualitative Approach

Asma Salman, American University in the Emirates

Huma Nawaz, Al-Madinah International University MEDIU

Syed Muhammad Hassan Bukhari, Virtual University Of Pakistan

Abou Baker, Islamia University Bahawalpur

Keywords

Islamic Banking, Banking growth, Banking, Pakistan, Academicians.

Introduction

Being one of the most developing Muslim nations in the world, State bank of Pakistan has been encouraging and getting the infrastructure for the development of Islamic Banking System. However, the Islamic banking is still relatively in the infancy stage as compared to the more established commercial banking sector in Pakistan. Upon reviewing some prior literature on the Islamic banking of Pakistan, researchers concludes that full-fledged Islamic banks are outperforming in the overall banking sector in Pakistan and earned approximately 8 billion in profit gain for the third quarter of 2011, 58% of growth showing due to the religious factors of the residents of Pakistan which are moved into their customers (Zaher & Kabir Hassan, 2001).

Many leading conventional banks in Pakistan have set up Islamic banking windows parallel to the commercial banking system to fulfil regulatory requirements of state bank of Pakistan(Akhtar, 2007b). In Islamic banking, there are a lot of other governance to be put in place to enhance the trust and confidence to strengthen the risk management through the Shariah rules and framework (Abdullah, Sidek & Adnan, 2012). Muslims, especially from rural areas, are now make up to more than half of some of the Pakistani Islamic banks’ customers (Akhtar, 2007a). Islamic banking products such as Murabaha and Mudarabah have drawn considerable interest from Pakistani religious citizens. Globally, Murabaha and Mudarabah products are among the fastest growing Islamic finance instruments, with study conclusion of many authors based on customer’s satisfaction and awareness towards the Islamic banking system. According Islamic Banking and Finance 2 1528-2635-22-SI-173

to the Global Islamic Finance Report, the assets of 1.34 trillion are being managed according to Islamic investment principles, while 20% of banking customers now moved towards Islamic financial products (Dar & Azmi, 2012).

Changes in the Pakistani financial system landscape and the promotion of Islamic banking have generated new dimension and prospects in the banking sector. Such premises had also led to the modification in the customer’s choice and demand for effective and highly efficient banking services. Since the development of more financial institutions from last few decades, both conventional and Islamic, customers, Muslims and non-Muslims of different income level group alike have been introduced with enormous prospective products and services to select from in term of their satisfaction and demand. Rather, before making any decision, customers are now spoilt for choices to choose the ones that meet their needs and wants (Thambiah, Eze, Santhapparaj & Arumugam, 2010). This situation applies to the products and services offered by the Islamic financial institutions same as of conventional banks. These products presented many challenges for products offered by the conventional banking but also among the products governed by the Islamic banking itself. Islamic banking growing and establishing deep roots with Muslims in Pakistan, but still not as much as it should be, where it was reported that 97% of the population in Pakistan are Muslims (Pakistan, 2010).

Is it because of less knowledge and awareness about the governing issues of Islamic products and services or strong concern for profit or any other reasons? We hypothesize that the effects of Islamic banking system are mediated by the degree of banking awareness and by the degree to which demographic aspects are causation.

More specifically, the study aimed to achieve the following specific research objective:

1. To determine, whether there are respondent background differences in developing positive attitudes towards Islamic banking in Pakistan.

2. To investigate and compare Pakistani residents' perceptions towards the Islamic banking system.

Literature Review

The effect of Islamic finance on Muslim world is well documented. Products and services offered by Islamic banks have the approaches of Islamic banks that are distinctly different from the ones of conventional banks (Chapra, 2000). The Development of Islamic finance in the global market has been very encouraging to meet the ethical and religious principles(Bukhari, Huma, Imam & Qadri, 2014). The premises of growth of Islamic banking depend on religious beliefs and many economic determinants. From the Islamic banking perspective, many authors attached the concept of justice with Islamic banks and emphasis on two fundamental factors of Islamic finance: The religion factor and the profitability factor (Haron, 1996b; Nawaz & Bardai, 2017). Islamic Banks as Islamic finance providers are one of the business organizations that offer a multitude of products and service for profit (Bukhari, Nawaz & Sair, 2014).

A study revealed that the religion is the main factor for growth of Islamic banking in Pakistan as Islamic banking based on Islamic laws and principles (Manzoor, Aqeel & Sattar, 2010) and most of the Pakistani Islamic banking customers have adopted both banking system, as about 67% of the customers have account in conventional banking system (Khattak, 2010). This shows that Islamic banks are lacking many of the feature and the requirement that customer wants. Muslim wants their money security and growth without Riba (Rashid, Hassan & Ahmad, 2009). Due to stiff competition among products of Islamic banking, the Islamic banking therefore need to consider several procedures and methods such as bank’s image and performance, speed of transaction, channel of delivery system, banking convenience and product diversity to attract Muslims and non-Muslims customers to continuously do banking business (Abdullah et al., 2012). Erol & El-Bdour (1989) study are considered to be the premier study of individual consumers’ attitudes relation with banking governing practices. Bank customers attitudes, behaviour and patronage factors was ascertained by a self-administered questionnaire (both Islamic and conventional) with a study in Jordan (Naser, Jamal & Al-Khatib, 1999).

The paper based on background information of (Haron, Ahmad & Planisek, 1994; Metawa & Almossawi, 1998; Omer, 1992). Metwally (1996) conducted a study focused on perceptions and attitude of the customer towards Islamic banking. A majority of respondent’s survey reflected the importance of religion, Islamic finance operations confidentiality of the bank and economic determinants. Gerrard & Barton Cunningham (1997); Haron (1996a); Metawa & Almossawi (1998), reported economics of Islamic finance by a study based on Muslim and non-Muslim customers of Malaysia, Singapore and Bahrain respectively. They found that 53 percent of non-Muslim respondents perceived Islamic banking substantive according to the understanding of its operations. Kaynak, Küçükemiroglu & Odabasi (1991) reported many determinants of Islamic finance growth in Turkey based on bank selection criteria according to gender, age and educational background of bank customers.

It is stated that the first attempt to establish Islamic finance institutions was in Pakistan in the late 1950s (Zainol, Shaari & Ali, 2008), with the establishment of a local bank in a rural area, although this did not have a lasting impact (Wilson, 1983). The substantial growth in the Islamic finance industry indicates that a greater interpretation of the factors that influence different choices can only benefit the growth and development of appropriate strategies to address the growing appetite for products and services (Bley & Kuehn, 2004; Nawaz, 2015). This study attempts to add to this literature by more carefully exploring the characteristics and knowledge of Islamic financial concepts, preferences for Islamic financial services and certain individual preferences of the Pakistani raters as presented. The instruments of the research were retrieved from different previous studies. According to Ronald Rulindo et al. (2008), age, religion, income have no correlation with investor’s interest in the Islamic market of Malaysia (Rulindo, Mardhatillah & Hidayat, 2008). In addition, the research is delimited with sub-parts instruments of mediating variable i.e., customer’s perception and attitude for selection of Islamic mode of financing (Nawaz, 2017) because Islamic banking services are emerging in the global economy but are under-researched. According to Dusuki & Abdullah (2007a & 2007b) knowledge of consumer motivations for choosing Islamic banking versus conventional banking services is submissive and the limited research to date is reported.

Methodology

In previous studies as acknowledged in literature review section of this article, the Islamic financing concept was used to understand the perceptions and attitude of customers towards Islamic banking and value derived from services, resulted in a limited scope. In this study, we define academician’s respondents' perceptions towards Islamic banking in comparison with commercial banking.

Based on the aforementioned discussion and objective of the study, the purpose of this study is to investigate the following hypotheses:

H0: The effects of Islamic banking system are mediated by the degree of contextual banking awareness.

H1: The effects of Islamic banking system are not mediated by the degree of contextual factors and banking awareness.

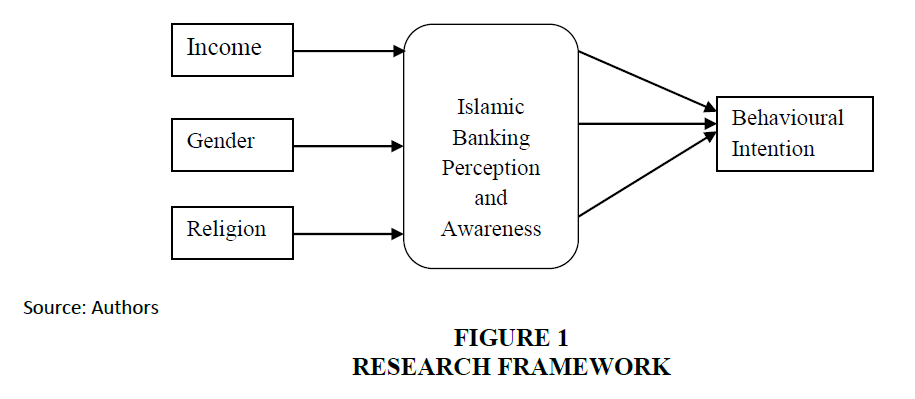

The research model in Figure 1 primarily trying to predict that the mediating variables i.e., First reaction to Islamic banking in Pakistan; Perception for Islamic banking; Governance of Islamic banking in Pakistan have an impact on the relationship between independent variables [age, religion and income] and the dependent variable of behaviour.

The target population of this study consisted of academic professionals of HEC recognized Universities of Pakistan who had taken or providing academic services to postgraduate level learners (Ameen, 2007). For sampling frame, a computer-generated random list of 200 academic professionals collected for research purpose by social websites that are considered as a major medium for social interaction i.e., LinkedIn, Facebook (Keenan & Shiri, 2009). An online questionnaire was sent to all 200 respondents on the sampling frame. The final realized sample representing a 75% response rate and found appropriate to fulfil the objective of this research (VanVoorhis & Morgan, 2007). The quantitative method of the close-structured questionnaire had been conducted for the study. There were some multiple-choice questions in a questionnaire to collect answers from the respondents. Besides, the researcher also applied the ‘psychometric” approach which is one of the most useful methods (Likert, 1932). Researchers used a five-point item, based on Likert items (Strongly agree-Code 1, Agree-Code 2, neutral-Code 3, Disagree-Code 4, strongly disagree-Code 5) for a respondent reaction towards Islamic banking in Pakistan.

Result Findings

The sample was dominated by young respondents (59%) and the majority (40%) of the respondents reported monthly household income between Rs.25,000 and Rs.49,999. From the descriptive statistics Table 1, it had been found that the highest similarity in opinions is associated with religion (Mean=1.00, Standard deviation=0.098) and the difference in our sample result found on governing the perception of Islamic banking in Pakistan (Mean=2.91, Standard deviation=1.27). The values of our all variables except age have only a minor difference with normal kurtosis i.e., 3 due to the minor difference from the mean. The results show that 35% of respondents consider a very positive step towards an Islamic banking system in Pakistan. However, 23% of respondents dislike Islamic banking of Pakistan at a moderate level. Moreover, 22% respondents consider Islamic banking in Pakistan, according to Shariah rules while 16% consider an extremely good condition of Shariah ruling in Islamic banks of Pakistan. Nearly, 31% of respondents using the services of commercial banks. Sixteen percent of respondents preferred Islamic banking, while 22% of respondents reported that they are using the services of both banking systems. Ninety percent respondents consider the importance of requirement and development of the true Islamic banking system in Pakistan.

| Table 1: Descriptive Statistics | |||||

| Determinants | Mean | Standard deviation | Variance | Skewness | Kurtosis |

|---|---|---|---|---|---|

| Age | 1.68 | 0.717 | 0.514 | 1.43 | 6.73 |

| Religion | 1.008 | 0.092 | 0.008 | 10.72 | 1.16 |

| Income | 2.26 | 1.211 | 1.46 | 3.1 | 0.9717 |

| Reaction to IB | 2.11 | 1.01 | 1.02 | 2.47 | 0.478 |

| Perception | 2.06 | 0.984 | 0.969 | 3.1 | 0.68 |

| Governance | 2.91 | 1.27 | 1.62 | 1.93 | 0.065 |

| Behavior | 2.31 | 1.14 | 1.30 | 2.67 | 0.515 |

Table 2 depicts the Correlation matrix of variables for this research. There is a strong evidence of a close correlation between behaviour and contextual factors of this study [including Reaction to IB, Perception and Governance] specific for this research. However, bivariate correlation failed to suggest the relationship between variables of social demographic characteristics (i.e., Age, religion and income) and outcome variable of ‘behaviour’.

| Table 2: Correlations | ||||||||

| Age | Religion | income | Reaction to IB | Perception | Governance | Behaviour | ||

|---|---|---|---|---|---|---|---|---|

| Age | Pearson Correlation | 1 | .a | 0.279** | 0.012 | 0.021 | 0.057 | 0.059 |

| Sig.(2-tailed) | 0 | 0.004 | 0.9 | 0.825 | 0.555 | 0.537 | ||

| Religion | Pearson Correlation | .a | 1 | -0.101 | -0.015 | -0.109 | 0.004 | 0.05 |

| Sig.(2-tailed) | 0 | 0.283 | 0.874 | 0.241 | 0.969 | 0.592 | ||

| Income | Pearson Correlation | 0.279** | -0.101 | 1 | 0.058 | 0.111 | 0.05 | -0.014 |

| Sig.(2-tailed) | 0.004 | 0.283 | 0.486 | 0.181 | 0.546 | 0.871 | ||

| Reaction to IB | Pearson Correlation | 0.012 | -0.015 | 0.058 | 1 | 0.612** | 0.476** | 0.240** |

| Sig.(2-tailed) | 0.9 | 0.874 | 0.486 | 0 | 0 | 0.003 | ||

| Perception | Pearson Correlation | 0.021 | -0.109 | 0.111 | 0.612** | 1 | 0.400** | 0.180* |

| Sig.(2-tailed) | 0.825 | 0.241 | 0.181 | 0 | 0 | 0.028 | ||

| Governance | Pearson Correlation | 0.057 | 0.004 | 0.05 | 0.476** | 0.400** | 1 | 0.199* |

| Sig.(2-tailed) | 0.555 | 0.969 | 0.546 | 0 | 0 | 0.015 | ||

| Behaviour | Pearson Correlation | 0.059 | 0.05 | -0.014 | 0.240** | 0.180* | 0.199* | 1 |

| Sig.(2-tailed) | 0.537 | 0.592 | 0.871 | 0.003 | 0.028 | 0.015 | ||

| ** Correlation is significant at the 0.01 level (2-tailed) | ||||||||

| * Correlation is significant at the 0.05 level (2-tailed) | ||||||||

| a: Cannot be computed because at least one of the variables is constant | ||||||||

Further, the research instrument was tested for composite reliability and internal Consistency using Cronbach’s coefficient alpha estimate (Tavakol & Dennick, 2011). Table 3 indicates reliability analysis by Cronbach's alpha reliability coefficient of all variables. The Cronbach’s alpha scale reliability coefficient (0.6), relative to the minimum alpha of 0.6 (Chen & Tsai, 2007), thus the constructs measures are deemed reliable.

| Table 3: Result Of Reliability Test (Cronbach's Alpha) | |

| Scale reliability coefficient | Average interitem covariance |

|---|---|

| 0.6 | 0.2 |

Regression analysis results of the study show that perception and awareness about Islamic banking have a mediating effect in strengthening the relationship between social demographic factors and respondents choice towards the selection of Islamic banking products and services Table 4. This suggests that awareness of Islamic banking can use the same general communication themes regarding services offered when communication with different age, religion and income level group.

| Table 4: Regression Results | |||

| Variables | Behaviour | ||

|---|---|---|---|

| Step 1 | Step 2 | Step 3 | |

| Socio-demographic characteristics | |||

| Age | -0.3944 | -0.219* | |

| Religion | 4.876** | - | |

| Income | -0.2521* | -0.272* | |

| Perception and awareness about Islamic banking | 1.54** | - | 0.171* |

| R2 | 0.07 | 0.111 | 0.178 |

| Note: Significance at: *p<0.05 and **p<0.001 | |||

Conclusion And Discussion

This study investigated the potential role of banking relationship efforts in influencing consumer awareness and behaviour intention. To our knowledge, it is the first study that demonstrates academician’s perception and the effect of preferential treatment efforts in Islamic banking of Pakistan. In all samples, the result indicates that Islamic banking mode in Pakistan can influence Pakistani market trust by a certain level of knowledge regardless of social demographic differences. These results are in line with previous studies (Rashid et al., 2009).

In general, the results explained the mediating effect of perception and awareness about Islamic banking services for the development of Islamic banking in Pakistan. This makes clear that, apart from specific consumer age, income group and religious factors, level of awareness additionally contribute to consumers trust.

Our study indicates that outreach and governing efforts of Islamic banking system are important drivers of banking growth. Consequently, managers should direct more of their attention at developing and implementing efforts for quality services. Our study suggests that services governing strategies can be built around consumer’s beliefs and perceptions.

In general, several scholars, warn that consumers understanding of service quality is strongly dependent on values and beliefs that vary from one consumer to another (Bell, Auh & Smalley, 2005). This study provides strong empirical support for the growth of Islamic banking in Pakistan resulting from the quality services based on consumers perception and outreach of banking services.

Some limitation might be related to collecting and interpreting results. A first limitation might be lack of study of respondent’s perception on a longitudinal manner as questionnaire distributed on a one-time.Another limitation is small sample size and common method bias as only one single questionnaire used to construct measurement variables. A large sample size would have allowed more authenticated results.

References

- Abdullah, A.A., Sidek, R. & Adnan, A.A. (2012). Perception of non-Muslims customers towards Islamic banks in Malaysia. International Journal of Business and Social Science, 3(11), 151-163.

- Akhtar, S. (2007a). Building an effective Islamic financial system. BIS Review, 38.

- Akhtar, S. (2007b). Pakistan banking sector reforms: Performance and challenges. Speech delivered by Dr. Shamshad Akhtar Governor State Bank of Pakistan, Geneva, 1.

- Ameen, K. (2007). Issues of quality assurance (QA) in LIS higher education in Pakistan. Citeseer.

- Bell, S.J., Auh, S. & Smalley, K. (2005). Customer relationship dynamics: Service quality and customer loyalty in the context of varying levels of customer expertise and switching costs. Journal of the Academy of Marketing Science, 33(2), 169-183.

- Bley, J. & Kuehn, K. (2004). Conventional versus Islamic finance: Student knowledge and perception in the United Arab Emirates. International Journal of Islamic Financial Services, 5(4), 17-30.

- Bukhari, N., Huma, Imam, A. & Qadri, M.M. (2014). Religious aspects of finance promises: Evidence from Pakistan. Sci.Int.(Lahore), 26(5)(CODEN: SINTE 8), 2471-2475.

- Bukhari, S.M.H., Nawaz, H. & Sair, A. (2014). Compliance of investment sukuk with shariah. Sci.Int.(Lahore), 26(5) (CODEN: SINTE 8), 2471-2475.

- Chapra, M.U. (2002). The future of economics: An Islamic persepective. Middle East Quarterly Fall, 14(1).

- Chen, C.F. & Tsai, D. (2007). How destination image and evaluative factors affect behavioral intentions? Tourism Management, 28(4), 1115-1122.

- Dar, H. & Azmi, T. (2012). Global Islamic Finance Report GIFR. In: London, United Kingdom: Rexiter.

- Dusuki, A.W. & Abdullah, N.I. (2007a). Maqasid al-shari'ah, Maslahah and corporate social responsibility. The American Journal of Islamic Social Sciences, 24(1), 25-45.

- Dusuki, A.W. & Abdullah, N.I. (2007b). Why do Malaysian customers patronise Islamic banks? International Journal of Bank Marketing, 25(3), 142-160.

- Erol, C. & El-Bdour, R. (1989). Attitudes, behaviour and patronage factors of bank customers towards Islamic banks. International Journal of Bank Marketing, 7(6), 31-37.

- Gerrard, P. & Cunningham, J.B. (1997). Islamic banking: A study in Singapore. International Journal of Bank Marketing, 15(6), 204-216.

- Haron, S. (1996a). Competition and other external determinants of the profitability of Islamic banks. Islamic Economic Studies, 4(1), 49-66.

- Haron, S. (1996b). Prinsip dan operasi perbankan Islam. Berita Pub.

- Haron, S., Ahmad, N. & Planisek, S.L. (1994). Bank patronage factors of Muslim and non-Muslim customers. International Journal of Bank Marketing, 12(1), 32-40.

- Kaynak, E., Küçükemiroglu, O. & Odabasi, Y. (1991). Commercial bank selection in Turkey. International Journal of Bank Marketing, 9(4), 30-39.

- Keenan, A. & Shiri, A. (2009). Sociability and social interaction on social networking websites. Library Review, 58(6), 438-450.

- Khattak, N.A. & Kashif, U.R. (2010). Customer satisfaction and awareness of Islamic banking system in Pakistan. African Journal of Business Management, 4(5), 662-671.

- Khattak, N.A. (2010). Customer satisfaction and awareness of Islamic banking system in Pakistan. African Journal of Business Management, 4(5), 662.

- Likert, R. (1932). A technique for the measurement of attitudes. Archives of psychology.

- Manzoor, M.M., Aqeel, M. & Sattar, A. (2010). Factors paving the way towards islamic banking in pakistan. World Academy of Science, Engineering and Technology, 66, 1677-1683.

- Metawa, S.A. & Almossawi, M. (1998). Banking behaviour of Islamic bank customers: Perspectives and implications. International Journal of Bank Marketing, 16(7), 299-313.

- Metwally, M. (1996). Attitudes of Muslims towards Islamic banks in a dual-banking system. American Journal of Islamic Finance, 6(1), 11-17.

- Naser, K., Jamal, A. & Al-Khatib, K. (1999). Islamic banking: A study of customer satisfaction and preferences in Jordan. International Journal of Bank Marketing, 17(3), 135-151.

- Nawaz, H. (2015). Customer behavioural approach for using micro-credit: Analysis of rural community of pakistan. KASBIT Journal of Management & Social Science, 8(1), 60-76.

- Nawaz, H. & Bardai, B. (2017). Profitability of islamic banks: Case of Malaysia. In The Name of Allah, The most Beneficent, The most Merciful, 90.

- Nawaz, H.N. (2017). Perceptions and acceptance of Islamic banking in Pakistan. International Sciences of Management Journal, 2(2), 1-14.

- Omer, H. (1992). The implication of Islamic beliefs and practice on Islamic financial institutions in the UK. unpublished PhD dissertation, Loughborough University, Loughborough.

- Pakistan, Islam in. (2010). Oxford Centre for Islamic Studies, Oxford University Press. Approximately 97 percent of Pakistanis are Muslim. The majority are Sunnis following the Hanafi school of Islamic law. Between 10-15 percent are Shiis, mostly Twelvers.

- Rashid, M., Hassan, M.K. & Ahmad, A.U.F. (2009). Quality perception of the customers towards domestic Islamic banks in Bangladesh. Journal of Islamic Economics, Banking and Finance, 5(1), 109-131.

- Rulindo, R., Mardhatillah, A. & Hidayat, S.E. (2008). Analysis of Risk Attitudes, Spirituality and Shari [ah Consciousness of Current and Prospective Investors]. An Empirical Survey in Malaysia. Islamic Capital Markets, 307.

- Tavakol, M. & Dennick, R. (2011). Making sense of Cronbach’s alpha. International Journal of Medical Education, 2, 53-55.

- Thambiah, S., Eze, U.C., Santhapparaj, A.J. & Arumugam, K. (2010). Customers’ perception on Islamic retail banking: A comparative analysis between the urban and rural regions of Malaysia. International Journal of Business and Management, 6(1), 187.

- VanVoorhis, C.W. & Morgan, B.L. (2007). Understanding power and rules of thumb for determining sample sizes. Tutorials in Quantitative Methods for Psychology, 3(2), 43-50.

- Wilson, R. (1983). Banking and finance in the Arab Middle East. Macmillan London: Springer.

- Zaher, T.S. & Kabir, H.M. (2001). A comparative literature survey of Islamic finance and banking. Financial Markets, Institutions & Instruments, 10(4), 155-199.

- Zainol, Z., Shaari, R. & Ali, H.M. (2008). A comparative analysis on bankers’ perceptions on Islamic banking. International Journal of Business and Management, 3(4), 157.