Research Article: 2017 Vol: 21 Issue: 2

How Mandatory IFRS Adoption Changes Firms Opportunistic Behavior: Empirical Evidences From The Earnings Management Perspective

Fuad, Diponegoro University

Wahyu Tri Wijanarto, Diponegoro University

Keywords

IFRS, Real Earnings Management, Accrual Earnings Management, Panel Data Analysis.

Introduction

Managerial opportunistic behaviour in the scope of financial reporting has become one of the main concerns for years. Agency theory has long argued that when the ownership and management are separated, the accounting and operational functions are affected by agency conflicts (Jensen and Meckling, 1976) and increase the information asymmetry between principal and managers. As a consequence, managers may have the incentive to make decisions to fulfil their interest while to some extent, neglecting the interests of principal. Earnings management practice is one of those activities as a result of agency conflicts.

Numerous researches have tried to uncover the reasons (and consequences) of the earnings management practice. However, we emphasized the roles of accounting standards that may inhibit (or foster) managerial opportunistic behaviour through earnings management.

International Financial Reporting Standards was gradually implemented in Indonesia since 2012 in a hope to increase accounting and financial reporting quality. Researches however are stand divided about this. For example, more flexible accounting standard as in IFRS provides a greater scope for the discretion policy and involve a higher degree of subjectivity implied in the application of criteria (Jeanjean and Stolowy, 2008). These “flexible” rules encourage managers to have a broader space in applying their policies that can be used for their own interests if there is no effective control mechanism. Callao and Jarne (2010) maintained that firms regulated by the “loose” accounting standards tend to engage more earnings management (Callao and Jarne, 2010). Additional evidences showed that the principle-based accounting standards in IFRS provides more flexibility and hence looser as compared to the competing generally accepted accounting principles (GAAP) which is known to be “rules-based”. Capkun et al. (2012) also documented that earnings management increase can be observed among the companies in the countries that allow early IFRS adoption.

However, Pelucio-Grecco et al. (2014) found that IFRS have restricted effect on earnings management in Brazil after the full implementation of IFRS. Sellami and Fakhfakh (2014) on the other hand found that there is a decrease in the value of the absolute discretionary accruals during the six years after the mandatory adoption of IFRS in France. Doukakis et al. (2014) shows that mandatory IFRS does not significantly affect the level of accrual and real earnings management.

Our research on the other hand, does not attempt to test whether there is a blessing (or curse) after IFRS implementation. Rather, we try to uncover the earnings management practices on the accrual properties of accounting and manager’s tendencies to manage their reported earnings through real operational activities; which are also one of our contributions in the financial accounting literature. Healy (1999) maintained that accrual-based earnings management are usually conducted by using extensive judgment in preparing the financial reporting and modifying financial transactions to mislead the users of financial statements about the firms’ real performance. Roychowdury (2006) on the other hand, define real earnings management as management desire to mislead the users of financial reporting by manipulating the operational activities that are supposed to in normal fashion. Our contributions also stem from the fact that the impact of IFRS to real earnings management is categorized into their three main activities, namely: abnormal production costs, abnormal net cash flow from operations and abnormal discretionary expenses. We also test whether IFRS may inhibit or foster those activities.

The remainder of the paper is organized as follows. Section 2 provides a review of relevant literature and hypotheses development. Section 3 describes the sample selection, variable measurement and research design. Section 4 presents the result. Section 5 provides summary conclusions, limitation of this study and future research potentials.

Literature Review and Hypothesis Development

Earlier researches have documented that IFRS may change how management behaves in managing their earnings. For example, Christensen et al. (2008) found that income smoothing is significantly lower among the firms that voluntarily adopt IFRS prior to its effective date. They further found that mandatory adopters perceive that the cost of early adoption outweighs its benefits. However, Capkun et al. (2012) noted that earnings management increased can be observed among the firms that voluntarily adopt IFRS.

Further studies have also documented the impacts of IFRS adoption (or convergence) on accounting quality. Chen et al. (2010) for instance, found a convincing evidence of earnings management and absolute discretionary accruals and variations of unexplained accruals. Furthermore, they documented that IFRS encourages companies to engage in income smoothing practices. On the other hand, Aussenegg et al. (2008) using the sample from 17 European countries found that earnings management decrease can be observed among the firms following IFRS adoption as opposed to countries-specific (i.e., domestic) standards.

Firms also possess another alternative to manage their earnings through manipulating their real operational activities. Graham et al. (2005) conducted a survey indicating that managers prefer real earnings management instead of accrual-based earnings management. Empirical measures of Roychowdhury (2006) also showed that the avoidance of losses reporting by the managers can be used through manipulation of their real activities management. A study conducted by Zang (2012) found the trade-off and substitution between accrual-based and real earnings management. She also documented a negative correlation between accrual and real earnings management.

IFRS Adoption and Accrual Earnings Management

As previously mentioned, IFRS provides inherent flexibility in applying the assets estimation through, for example, fair values method. This flexibility is provided through various alternatives in depreciation methods, inventory and revenue recognition, among others. Therefore, IFRS may provide broader room for the managers to achieve and set particular earnings that is not provided by prior, GAAP-based standards.

Prior researches, to some extent also concur with the above lemma. For example, Jeanjean and Stolowy (2008) analysing the deviation of the income distribution as a proxy of earnings management examined the impact of IFRS on three countries (i.e., Australia, United Kingdom and France). They found that earnings management in those countries are not declining and even increasing in France. Callao and Jarne (2010) also showed that the earnings management increased since the adoption of IFRS in 11 countries in Europe. Using data in New Zealand from 2002-2009, Kabir et al. (2010) found that discretionary accruals are higher after the adoption of IFRS and shows a lower quality of earnings at the time of IFRS implementation as compared to the pre IFRS. Therefore, we state our first hypothesis as follows:

H1: Accrual earnings management practices are higher after IFRS convergence

IFRS Adoption and Real Earnings Management

Indeed, better accounting standards guarantee a better accounting quality, where they may increase the value relevance of financial reporting and earnings variability, among others. This will also yield that the firms’ financial reporting can be easily scrutinized by the auditors and regulators. As a consequence, firms may opt to engage in real earnings management as it is more difficult to detect when they try to manage their earnings rather than using accruals.

Earlier researches have also noted that IFRS may increase the real management activities. One of the notable researches include Lippens (2008) that tested both real and accrual-based earnings management for the firms in EU countries following mandatory IFRS adoption. He expected that the rate of accrual earnings management will increase in the period after mandatory adoption of IFRS and level of real earnings management will decline during the period. However, using the periods of 2000-2006 he showed that level of accrual and real earnings management increase significantly in the period after mandatory adoption of IFRS. In a survey study, Graham et al. (2005) found that managers prefer managing earnings through real activities than through accrual policy. This is in line with Zang (2012) stating that the manager doing the manipulation of earnings through real activities first and then adjust the level of target profit by the use of discretionary accrual policies. Hence, the following hypothesis is proposed:

H2: earnings management through real operational manipulation increases after firms adopt IFRS

Research Method

Sample Selection

The population in this study includes all manufacturing listed firm in Indonesian Stock Exchange from 2009-2014.The study excludes observations with negative book value of equity and missing values. Data was taken from audited financial statement and annual report of the firm that publish at Indonesian Stock Exchange website (http://www.idx.com). As a result, we found a balanced sample set consist of 438 observation.

Accrual Earnings Management Measure

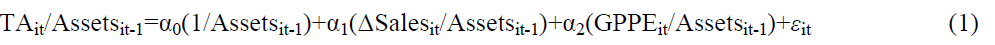

In this research, accrual earnings management is calculated using Modified Jones Models developed by Dechow et al. (1995). They showed that Modified Jones Model is way better in earnings management detection rather than the original Jones model. They further also further added the change in account receivable in order to control for the possibility to use revenue as a source of earnings management. Modified Jones Models based on Dechow et al. (1995) are as follows:

where TAit=total accruals, which is calculated as firm net income minus cash flows from operations; Assetsit-1=total assets for firm; ΔSalesit=change in sales; GPPEit=gross property, plant and equipment.

Estimated parameters from (1) are then used to estimate the firm-specific nondiscretionary accruals (NDAit):

Where NDAit=non-discretionary accruals; ΔARit=change in accounts receivable from year t-1 to year t, while all other variables are as previously defined.

Where DAit=discretionary accruals for firm i in year t.

Real Earnings Management Measure

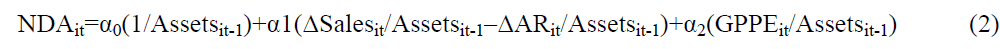

Roychowdury (2006) defined real earnings management as the difference in operating practices with normal operating practice, motivated by the desire of management to mislead stakeholders so that they believe that the purpose of a particular financial reporting have been achieved in the normal operation practice of the company. Some areas that can be exploited in real activities manipulation include overproduction, sales management and reduction of discretionary expense.

We use the following regression models for earnings management in three possible areas, including production (PROD), sales management (CFO) and discretionary expense reduction (DIEXP) is as follows:

where PRODit equals to production costs, which is the cost of goods sold plus inventories yearly change; CFOit is firms’ cash flows from operations; DISXit is discretionary expenses that is measured as selling, general and administrative expenses and Ait-1 is firms’ total assets; and ΔSit=yearly sales changes.

As with prior researches, this study used the residuals found in equations (4), (5) and (6) to measure abnormal production cost (ABN_PROD), abnormal net cash flow from operations (ABC_CFO) and abnormal value of discretionary expenses (ABN_DISEXP), respectively.

In line with Zang (2012) and Cohen and Zarowin (2010), among others, the value of ABN_CFO and ABN DISX are multiplied by -1 so that the higher value indicates the higher manipulation through price discounts and cutting discretionary expenses. To test the second hypothesis, we use the summated, composite score. We also run sensitivity tests, in which real earnings management proxies are separately regressed on IFRS.

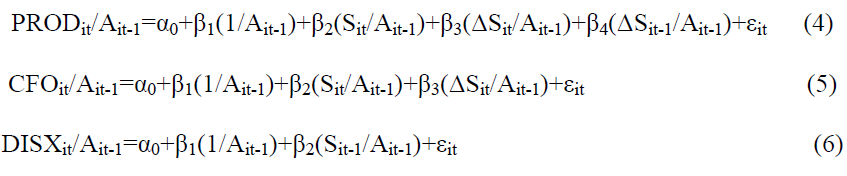

Panel Data Regression

Panel data regression was used to test our hypotheses, since our study employs cross sectional firms and multiple years. Using panel regression analysis for these multidimensional types of data gives more efficient estimate (Baltagi 2005). Furthermore, with the panel data analysis, the unobserved heterogeneity both in time as well companies can also be controlled. The panel regression models are tested based on the following models:

where ABS_DA=absolute value of accrual earnings management; REAL=total value of real earnings management; IFRS=dummy variable, 1 for 2012-2014 periods and 0 otherwise. We used several control variables including growth (GROWTH), audit size (BIG4) financial leverage (LEV), firm size (SIZE) and profitability (ROE). BIG4 is a dummy variable indicating that whether the firms hired a Big 4 auditor, GROWTH is measured as the sales change to control for the growth on earnings management. In order to control for the effect of firm size on earnings management, we measure SIZE as the natural logarithm of firm’s market value. LEV is the firm’s financial leverage which is the proportion of total liabilities to as the ratio of total liabilities to prior year’s total assets. Return on equity (ROE) is measured as the net income over last year’s shareholders equity. Researches (for example Doukakis 2014 and Zang 2012) have also concluded that real earnings management is conducted when firms do not have enough flexibility in earnings management through accrual discretions. Therefore, we also use accrual-based earnings management (ABS_DA) as one of the control variables for the real earnings management regression.

Results

Descriptive Statistics

The descriptive statistics of model are shown on the Table 1. The variable ABS_DA indicates an average of 0.108 which means that the average value of accruals that generated by management discretion compared to the previous year assets on manufacturing company in Indonesia. Our study also indicates that 40.6% of our sample was being audited by BIG4. The variable sales growth (GROWTH) have an average value of 0.097 which shows that the average sales increase against the previous year on manufacturing company in Indonesia is 9.6%. While 45.1% of assets are financed by debt, the average of return of equity was 12.4%.

| Table 1: Descriptive Statistics |

|||||

| N | Mean | Maximum | Minimum | Std. Dev. | |

|---|---|---|---|---|---|

| REAL | 438 | 1.113 | 2.783 | -0.152 | 0.499 |

| ABS_DA | 438 | 0.108 | 0.416 | 0.001 | 0.074 |

| SIZE | 438 | 21.131 | 25.17 | 18.060 | 1.482 |

| GROWTH | 438 | 0.097 | 0.800 | -0.499 | 0.183 |

| LEV | 438 | 0.451 | 0.914 | 0.0413 | 0.193 |

| ROE | 438 | 0.124 | 0.591 | -0.271 | 0.117 |

| IFRS | 438 | 0.500 | 1.000 | 0.000 | 0.500 |

| BIG4 | 438 | 0.406 | 1.000 | 0.000 | 0.491 |

The correlation statistics which are displayed in Table 2 showed that discretionary accrual has a positive relationship with real earnings management. On the other hand, the real earnings management is negatively correlated with the audit size (BIG4) and profitability (ROE) and positively correlated with leverage (LEV).

| Table 2: Correlation Results |

||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| 1 ABS_DA | 1 | |||||||

| 2 REAL | 0.143*** | 1 | ||||||

| 3 IFRS | 0.037 | 0.027 | 1 | |||||

| 4 BIG4 | -0.021 | -0.200*** | 0.028 | 1 | ||||

| 5 SIZE | 0.006 | -0.082 | 0.134*** | 0.344*** | 1 | |||

| 6 GROWTH | 0.076 | -0.054 | 0.073 | 0.008 | 0.082 | 1 | ||

| 7 LEV | 0.066 | 0.479*** | -0.015 | -0.180*** | 0.247*** | 0.038 | 1 | |

| 8 ROE | 0.027 | -0.109** | -0.140*** | 0.249*** | 0.060 | 0.235*** | -0.182*** | 1 |

Source: EVIEWS output, 2016

** significant at the 0.05 level

*** significant at the 0.01 level

Panel Regression

Table 3 presents the regression analysis results of regression model (7) and regression model (8). Our statistics indicate that the models satisfy all the classical assumptions. For example, as appeared in Table 3 the VIF scores are all less than 10, indicating no serious multicollinearity issue. We also corrected the standard errors for their possible biases due to heteroscedasticity using the White’s method. As been highlighted earlier, we also conducted the Hausman test to control for time and cross sectional heterogeneity. The tests indicate that fixed effect model is used for the discretionary accrual and random effect model is used for the real earnings management.

| Table 3: Regression Results From The Pooled Sample |

||||

| Estimate (t-value) | Variance Inflation Factors (VIF) | |||

|---|---|---|---|---|

| ABS_DA | REAL | ABS_DA | REAL | |

| Constant | -1.572*** (-4.646) | 2.400*** (4.009) | ||

| IFRS | -0.021*** (-2.714) | 0.052** (2.522) | 1.068 | 1.062 |

| BIG4 | -0.020 (-0.858) | -0.070 (-0.997) | 1.298 | 1.296 |

| SIZE | 0.070*** (4.422) | -0.076*** (-2.844) | 1.370 | 1.311 |

| GROWTH | 0.005 (0.297) | -0.219*** (-3.549) | 1.093 | 1.090 |

| LEV | 0.035 (0.815) | 0.476*** (4.031) | 1.596 | 1.205 |

| ROE | 0.145*** (2.673) | -0.213 (-1.323) | 1.202 | 1.201 |

| REAL | 0.150*** (7.650) | 1.396 | ||

| ABS_DA | 1.484*** (8.833) | 1.012 | ||

| Adjusted R² | 0.489 | 0.259 | ||

| F-statistic | 6.292*** | 22.827*** | ||

| Hausman Prob | 0.00 | 1.00 | ||

Source: EVIEWS output, 2016

Notes: ABS_DA: Accrual Earnings Management; REAL: Total Real Earnings Management; IFRS: IFRS Adoption, a dummy variable in which 1 is after IFRS adoption from year 2012-2014, 0 prior IFRS adoption from year 2009-2011; BIG4: Auditor Type, a dummy variable in which 1 is audited by BIG4 and 0 otherwise; GROWTH: Sales Growth; SIZE: Firm Size; LEV: Leverage; ROE: Return on Equity

** significant at the 0.05 level

*** significant at the 0.01 level

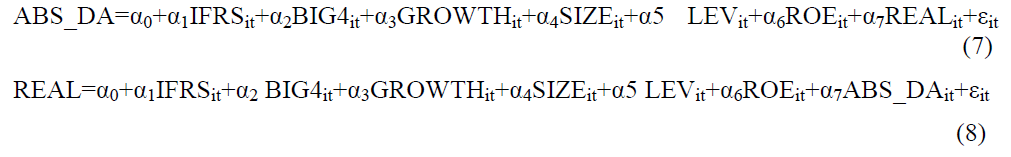

On the first model where the dependent variable is the accrual earnings management the adjusted R-squared value is 0.489. This indicates that the discretionary accrual is explained by the variation of IFRS and all the control variables (BIG4, SIZE, GROWTH, LEV, ROE and REAL) by 48.9%. F-statistics (6.292) for this is also significant at 1% indicating that all the variables significantly affect discretionary accrual.

The first hypothesis (H1) is regarding the adoption of IFRS that may have a positive association with the change in accrual earnings management practices. Our regression results showed that IFRS adoption has a lower discretionary accrual by 2.1% as compared to the firms that have yet to implement IFRS (t-value=-2.713). Surprisingly, our finding cannot confirm our hypothesis that earnings management is increased after IFRS convergence. Rather we found that inverse association in which earnings management is reduced following IFRS convergence.

We also test whether real earnings management is increased after the infusion of IFRS. The Adjusted R-squared of this particular model is 0.259. In this regards, we found that real earnings management is higher in the post IFRS implementation by 5.2% as compared to the prior IFRS implementation (t-value=2.522; p=0.0120).

However, as sensitivity tests, when we decompose the real earnings management intro its three known activities, we found that Earnings management is lowered in the post IFRS implementation only from sales management activities (i.e., abnormal cash flow from operations, ABN CFO, t=-1.962) and reduction of discretionary expenses (AB_DISEXP, t=-3.135). Nevertheless, we cannot find that real earnings management through over production (ABN_PROD) is different in the post, vis a vis, pre IFRS implementation (t=0.348) (Table 4).

| Table 4: Regression Results For Individual Proxies Real Earnings Management |

|||

| ABN_CFO | ABN_PROD | ABN_DISEXP | |

|---|---|---|---|

| Constant | 0.023(0.251) | -1.412***(-3.507) | -5.806***(-6.549) |

| IFRS | -0.011*(-1.962) | 0.003(0.348) | -0.068***(-3.135) |

| BIG4 | 0.036***(2.754) | 0.006(0.165) | 0.090(1.099) |

| SIZE | 0.003(0.646) | 0.060***(3.157) | 0.222***(5.263) |

| GROWTH | -0.070***(-4.449) | 0.041**(1.986) | 0.318***(6.885) |

| LEV | -0.150***(-5.518) | 0.250***(4.987) | 0.137(1.245) |

| ROE | 0.403***(11.237) | -0.374***(-6.648) | -0.443***(-3.581) |

| REAL | |||

| ABS_DA | -0.756***(-17.618) | 0.269***(4.472) | -0.519***(-3.922) |

| Adjusted R² | 0.540 | 0.893 | 0.857 |

| F-statistic | 74.383*** | 47.084*** | 34.280*** |

Source: EVIEWS output, 2016

Notes: ABN_CFO: Abnormal Value of Cash Flow from Operation; ABN_PROD: Abnormal Value of Production; ABN_DISEXP: Abnormal Value of Discretional Expenses; ABS_DA: Accrual Earnings Management; REAL: Total Riil Earnings Management; IFRS: IFRS Adoption, dummy 1 after IFRS adoption from year 2012-2014, 0 before IFRS adoption from year 2009-2011; BIG4: Type of Auditor, dummy 1 audited by BIG4, 0 audited by non BIG4; GROWTH: Sales Growth; SIZE: Firm Size; LEV: Leverage; ROE: Return on Equity

* significant at the 0.10 level

** significant at the 0.05 level

*** significant at the 0.01 level

Discussion and Conclusion

This study tests the impacts of mandatory IFRS adoption on earnings management from Indonesian manufacturing firms. Although prior researches have put serious attention on how IFRS may affect the earnings management behaviour, but they tend to focus more on accrual-based earnings management. This study however tries to focus both on accounting (i.e., discretionary accrual) and operational aspects of earnings management, namely real earnings management.

Based on a sample of 438 observations from Indonesian Stock Exchange (IDX) for fiscal years of 2009 to 2014, we found several interesting findings. First, adoption of IFRS has a negative association with accrual earnings management. It means therefore, there is a decrease in the level of discretionary accruals on manufacturing companies in Indonesia after a period of implementation of IFRS. In line with Doukakis (2014), the implementation of IFRS may increase the firm’s transparency and improve the overall quality of financial reporting. In this case, analysts, investors, capital market authority are at better position to evaluate and monitor firms’ accounting quality and may make informed decision based on firms’ accounting options and basic assumptions. As a consequence, managers may not be at ease to falsify or manipulate its performance in their financial reports. Zeghal (2012) also mentioned that the adoption of IFRS improves the quality of earnings by limiting the selection of management decision by eliminating allowed accounting alternative and provide a more consistent approach to accounting measurements. The results of this study are also consistent with a research conducted by Sellami and Fakhfakh (2014) and Brad et al. (2006) that found the adoption of IFRS tend to decrease the earnings management practice based on discretionary accruals.

In contrary, we found that real earnings management tend to be higher in the post IFRS period. A trade-off explanation is provided by Cohen et al. (2008) maintain that a decline in one type of earnings management may be because of the substitution of another method of earnings management had already occurred. A survey conducted by Graham (2005) also indicate that managers prefer engaging in real earnings management practice rather than accrual earnings management, as real activities directly affect the cash flow (Cohen and Zarowin 2010). Cohen and Zarowin (2010) also provide further justifications the reasons real earnings management is preferred. As previously mentioned, aggressive accrual earnings management may lead to higher risk of surveillance by the auditor and perhaps, regulators. Second, less flexibility is available when the firms engage in accrual earnings management (i.e., less slack in discretionary accrual for the following periods). This finding also in-line with Zang (2012) that examined the effect of trade-offs between accrual earnings management and real earnings management and generate a negative relationship between both earnings management.

Like any other research, this study has also some limitations which is necessary to be mentioned. First, observation on this research is the manufacturing sector. Thus, this research has yet to represent the overall corporate sector in Indonesia Stock Exchange. Second, we do not properly (and comprehensively) test the presence of the trade-off between real earnings management and accrual based earnings management and whether the trade-offs prevails following IFRS adoption. We leave this interesting area for further research. Third, due to data availability, we do not differentiate mandatory vs. voluntary adopters of IFRS and thus their respective outcomes to the earnings management are left unexplored. Fourth, it is also interesting to examine the real earnings management using alternative proxies such as long-term asset sales, stock options, stock repurchases and structuring investment transactions and corporate fundings.

References

- Aussenegg, W., Inwinkl, P. & Schneider, G. (2008). Earnings management and local vs international accounting standards of European firms. Working paper.

- Baltagi, B.H. (2005). Econometric Analysis of Panel Data (Third edition). John Wiley and Sons.

- Brad, L., Dobre, F., Turlea, C. & Bravoseanu, I.V. (2014). The impact of IFRS adoption on Romania upon the earnings management of Bucharest stock exchanges entity. Procedia Economics and Finance, 15, 871-876

- Callao, S. & Jarne, J.I. (2010). Have IFRS affected earnings management in the European Union? Accounting in Europe, 7(2), 159-189.

- Capkun, V., Collins, D. & Jeanjean, T. (2012). Does adoption of IAS/IFRS deter earnings management? Working paper, University of Iowa, HEC Paris and ESSEC Business School.

- Chen, H.F., Tang, Q.L., Jiang, Y.H. & Lin, Z.J. (2010). The role of international financial reporting standards in accounting quality: Evidence from the European Union. Journal of International Financial Management and Accounting, 21(3), 220-278.

- Christensen, H., Lee, E. & Walker, M. (2008). Incentives or standards: What determines accounting quality changes around IFRS adoption? Working paper.

- Cohen, D.A. & Zarowin, P. (2010). Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics, 50(1), 2-19.

- Dechow, P.M., Sloan, R.G. & Sweeney, A.P. (1995). Detecting earnings management. Accounting Review. 70, 193-226.

- Doukakis, L.C. (2014). The effect of mandatory IFRS adoption on real and accrual-based earnings management activities. Journal of Accounting and Public Policy, 33, 551-572

- Graham, J., Harvey, C. & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics, 30, 3-73

- Healy, P. & Wahlen, J.M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13, 365-384.

- Jeanjean, T. & Stolowy, H. (2008). Do accounting standards matter? An exploratory analysis of earnings management before and after IFRS adoption. Journal of Accounting and Public Policy, 27, 480-494.

- Jensen, M. & Meckling, W. (1976). Theory of the firm: managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Kabir, M.H., Laswad, F. & Islam, M.A. 2010. Impact of IFRS in New Zealand on accounts and earnings quality. Australian Accounting Review, 20(4), 343-357.

- Lippens, M. (2008). The mandatory introduction of IFRS as a single accounting standard in the European Union and the effect on earnings management. Rotterdam: Erasmus University Rotterdam.

- Pelucio-Grecco, M.C., Geron, C.M.S., Grecco, G.B. & Lima., J.P.C. (2014). The effect of IFRS on earnings management in Brazilian non-financial public companies. Emerging Markets Review, 21, 42-66.

- Roychowdhury, S. (2006). Earnings management through real activities manipulation. Journal of Accounting and Economics, 42.

- Sellami, M. & Fakhfakh, H. (2014). Effect of the mandatory adoption of IFRS on real and accruals based earnings management: Empirical evidence from France. International Journal of Accounting and Economics Studies, 2(1), 22-33.

- Zang, A.Y. (2012). Evidence on the trade-off between real activities manipulation and accrual based earnings management. The Accounting Review, 87, 675-703.

- Zeghal, D., Chtourou, S. & Fourati, Y.M. (2012). The effect of mandatory adoption of IFRS on earnings quality: Evidence from the European Union. Journal of International Accounting Research, 11(2), 1-25.