Research Article: 2021 Vol: 24 Issue: 1S

How the Chief Executive Officer Characteristics Influence The Sustainable Development Report of Thai set 100 Listed Company?

Kulwadee Lim-U-Sanno, Prince of Songkla University

Abstract

Disclosure of Sustainable Development Report (SDR) of Thailand companies listed in SET 100, and relationship with characteristics of the Chief Executive Officer (CEO), performance and risk from 42 sample companies selected by proportional sampling between 2014-2019, and collected 252 sample company years obtained from reports of SET 100 company reports. Then, the data is analyzed using descriptive statistics and Multiple linear regression is used for factors like characteristics of CEO, organizational risk (Debt-to-Equity Ratio: DER) and Net Profit (NP). It is found that SDR has positive significance from characteristics of CEO if the latter has at least a Master’s degree and in advanced age. Negative relationship is found from tenure length, Organizational risk (DER) and Net Profit (NP). Relationship cannot be drawn from gender, and being both the CEO and chairperson, and disclosure of SDR in Thai public limited companies.

Keywords

CEO Characteristics, SET 100, Sustainable Development, Sustainable Development Report

Introduction

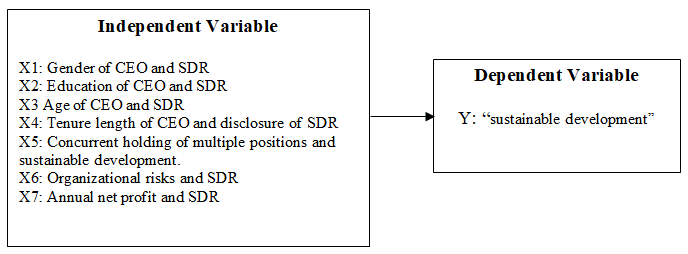

Sustainability Development (SD) is a concept in development of alternatives that becomes a world-level agenda. In connection with definition by World Commission on Environment and Development, SD means “a development route that can meet the needs of people today, while not diminishing ability to meet the needs of later generations” (Kasemcheunyot, 2020; Wang, 2017; & Pulatovich, 2019). SD focuses on creating balance through three paths of SD: 1) Economic concept that focuses on equilibrium and optimal resource consumption that generates maximum benefit for all parties, 2) Social concept that focuses on stability, equity and alleviating poverty, 3) Environment concept through conservation of natural and man-made environment (Bakanauskiene et al., 2020; Shi, Han, Yang & Gao, 2019; Melkonyan, Gottschalk & Kamath, 2017). SD work is voluntary, and there is an increasing number of studies on SDR that employ accounting methods (Al-Delawi & Ramo, 2020; Geert & Roy, 2018). However, participation in the organization’s SD and SDR under the concept of UN Global Impact is criticized about overall sustainable result and proving of SD in the company (Bakanauskiene et al., 2020). Running a business in the context of high competition and challenge, the management must be mindful of both benefits for the stakeholders and awareness of SD activities, despite the latter being strictly voluntary (Wang, 2017). It can be said that all three parts of sustainability are stakeholders other than the investor and shareholder, in connection with SDR that relies on standard-conforming accounting (Al-Delawi & Ramo, 2020) to make the stakeholders aware and acknowledged of the operation. Main issues are profitability ratio and affordability Ratio that can be assessed from Debt-to-Equity Ratio (DER) (Hapsoro & Husain, 2019). While SD activities are not yet compulsory, SDR as an annual report is still required to conform to the regulation and rules by the standard of Global Reporting Initiative (GRI) (Orazalin & Mahmood, 2019). Thus, SD and SDR are alternative activities of the organization, as the top management has effect on decision to disclose such report (Prachuabmoh et al., 2018; Kasemcheunyot, 2020). Thus, one research question is what characteristic of CEO would lead to SDR. This study examines sampled SET 100 companies as they are large public limited companies with enough resources and opportunities to build sustainability, in addition to them being driven to show responsibility to SD on the basis of current business operation (Na & Hong, 2017). So research objectives set to (1) Examine Sustainable Development Report (SDR) released by SET 100 companies. And (2) Test effects of chief executive officer characteristics on disclosure of sustainable development report of Thai SET 100 listed company.

The Concept of Sustainable Development Report (SDR)

Currently international agencies have drafted an understanding about making SDR in business sector, communicating impact of SDR on the business sector and guideline for SD management or Global Reporting Initiative (GRI). An SDR standard is also developed (Orazalin & Mahmood, 2019) as making standard SDR can generate value for the organization in terms of sustainability that can cover all stakeholders (Shi, et al., 2019). SDR is improved management data with more attention to GRI Standards (Pongpan, 2015) that aims to have listed companies disclosing SD activities to the investor and stakeholder through the Annual Report (56-2 report) and Sustainability Report (SR) or SDR (Thaemnanee & Rungruangwuttikrai, 2018).

Chief Executive Personal Characteristics with the Disclosure of the SDR

The CEO’s duty is to manage and develop sustainability for the organization according to its context (Rasche, 2020; Prachuabmoh et al., 2018). Personal characteristics of the CEO may vary and thus this study aims to understand the suitable personal characteristics in each aspect such as age, gender, education, experience and tenure length (Ma, Zhang, Yin & Wang, 2019), especially education that affects mindfulness and responsibility toward SD and disclosure of such report to the relevant parties (Yusliza et al., 2019) that becomes a topic for examination of chief executive personal characteristics’ effects on SD and disclosure of SDR.

Gender of CEO and SDR

Due to psychological differences, different gender of the CEO has different effect that can improve performance of the company. Both genders also have positive relationship with SDR-Disclosure (Na & Hong, 2017). Nevertheless, presentation of comparative studies between male and female CEOs show that male CEOs have better leadership, decision-making, risk-taking, efficiency, profitability, growth generation, performance and confidence from shareholders (Sitthipongpanich & Polsiri, 2015; Na & Hong, 2017). On the other hand, studies that showed perks of female CEOs discovered that female CEOs are usually more careful, attentive, analytic, communicative, transparent, honest, less likely to partake in corruption, strategic and voluntary interested in SDR-Disclosure (Na & Hong, 2017). Comparative studies show that female CEOs are more sensitive, risk-averse, and have less ability regarding decision-making, risk management, and generating growth. Female CEOs have negative relationship with voluntary disclosure and tenure length (Sitthipongpanich & Polsiri, 2015). Therefore, a hypothesis can be formed as follows:

H1 Male CEOs have effect on SDR-Disclosure.

Education of CEO and SDR

CEOs with at least a master’s degree is bolder and more proactive regarding decision-making and management, thus increasing performance and efficiency compared to those with bachelor’s degree or lower (Ma et al., 2019). Despite no difference in performance of CEOs with different education level, but CEOs with at least a master’s degree is more likely to get promoted due to better capability and performance prediction (Garces-Galdeano & Garcia-Olaverri, 2019). CEOs with at least a master’s degree also has positive relationship with SD and SDR-Disclosure (Ma et al., 2019). Despite this, CEOs with at least a master’s degree or higher usually is more conscious of cost, and as the SD is a voluntary concept, they might rank SD and SDR-Disclosure at the bottom of priority or ignore them altogether. CEOs with at least a master’s degree are more likely to disclose SDR if benefits from it is allowing the stakeholders to catch up with the company’s information and thus increasing their investment (Bamber, Jiang & Wang, 2010) Therefore, a hypothesis can be formed as follows:

H2 CEOs with at least a master’s degree affects SDR-Disclosure.

Age of CEO and SDR

Some studies show that older CEOs do not like change or high risk (Ya, Huawei & Song, 2019), but they are more careful, experienced, capable in business, confident, honest and motivated to achieve the goal, thus they are slower in making decisions compared to younger CEOs (Finkelstein et al., 2009). Conversely, younger CEOs would focus more on short-term profitability, thus higher risk, and view SD as an alternative (Ma et al., 2019; Ferrell, Fraedrich & Ferrell, 2017; Fabrizi, Mallin & Michelon, 2014). Being older usually lead to more aversion to incorrect actions, thus more credibility (Ya et al., 2019). Old CEOs usually look for stability and peace, while their physical conditions limit performance. On the other hand, some studies do not discover relationship between age of CEOs and SD disclosure (Glaeser et al., 2019) Therefore, a hypothesis can be formed as follows:

H3 Age of CEO affects SDR-Disclosure.

Tenure Length of CEO and Disclosure of SDR.

Comparison with CEO’s tenure length shows that CEOs in different organizations usually have different tenure length (Dayuan et al., 2019). Being a CEO after a top-management position means more proficiency but slow decision-making process due to caution (Glaeser, Michels & Verrecchia, 2019). Nevertheless, the organization has better efficiency, sustainable development and strength than competitors. It is found that the CEO with long tenure has more frequency and likelihood to disclose SDR with greater accuracy (Grassa & Chakroun, 2016; Hussain, Quddus, Pham, Rafiq, & Pavelková, 2020). Some studies discover conflicting findings however, as newer CEOs are more interested and willing to learn new things, more compliant to new rules and determined to disclose SDR voluntarily (Huang, 2013; Ali & Zhang, 2015; Deng, Kang & Low, 2013). Study by Soheilyfar, Tamimi, Ahmadi & Takhtaei (2014) did not find relationship between tenure length of CEO and SDR-Disclosure. Therefore, a hypothesis can be formed as follows:

H4 Tenure length of CEO affects disclosure of SDR.

Concurrent Holding of Multiple Positions and Sustainable Development

The company’s board members should have knowledge, proficiency, skills, experience and power to make decision and manage according to the needs of the company and circumstances. It is found that there are merging of CEO and chairman of the board as a position to increase performance and efficiency in leadership (Guillet, Seo, Kucukusta & Lee, 2013; Hussain, Ahmad, Quddus, Rafiq, Pham & Popesko, 2021). Pimpare & Suksonghong (2019) found that there was no relationship between merger of CEO and board chairman, and company performance. Rutledge, Karim & Lu (2016) found negative relationship between merging of the two positions, and performance, especially regarding check and control. Work quality was reduced, there were shady benefits, and such position merging conflicted with the Agency Theory (Prachuabmoh et al., 2018; Hussain, Nguyen, Nguyen & Nguyen, 2021), resulting in more likelihood of corruption. Position merging also affected disclosure and quality of the report (Tang, 2016; Hussain & Hassan, A.A.G. 2020). Therefore, a hypothesis can be formed as follows:

H5 CEO that holds other positions at the same time affect disclosure of SDR.

Organizational Risks and SDR

Accounting operations in the line of SDR that is measured against GRI index. A factor in reaction to the SET 100 company’s investment and risk assessment by using data to create credibility and confidence toward the company is Debt-to-Equity Ratio (DER) (Hapsoro & Husain, 2019; Pulatovich, 2019). However, conclusion of some studies conflicted DER whether positively, negatively, or no effect towards the capital market and SDR (Safitri, Mertha, & Wirawati, 2020; Lucia & Panggabran, 2018). Thus, DER has been used as a factor to explain organizational risk and effect on SD and SDR, because DER is used for making decision on investment (Hapsoro & Husain, 2019). Therefore, a hypothesis can be formed as follows:

H6 Organizational risks affects SDR.

Annual Net Profit and SDR

Accounting information technology in the stock market that present performance and efficiency of the organization. Still, there are conflicts with result of study on effect of the organization (or SET 100 company)’s net profit on SDR (Lucia & Panggabran, 2018; Whetman, 2017; Maury, 2018; Sinaga & Fachrurrozie, 2017). There are studies that conclude annual net profit’s positive, negative or non-existent effect on disclosure of SDR, which might include genuine disclosure or token efforts to comply with the regulation (Sinaga & Fachrurrozie, 2017; Maury, 2018 and Karaman, Kilic & Uyar, 2018). Therefore, a hypothesis can be formed as follows:

H7 Net profit affects SDR.

Research Method

Population and Sample

The sample is selected from annual disclosure of SDR of SET 100 companies (www.set.or.th) which are the main company group for index calculation in the stock market and conditional proportional sampling (Lucia & Panggabran, 2018). The disclosed data between 2014 and 2019 from 42 companies is used, thus 252 company years of information is available for six years according to following conditions. 1) The company has the 56-1 form, 2) the company has the 56-2 report, 3) samples cover all industrial sectors, and 4) SDR (if any, voluntary), data acquisition, characteristics of CEO, organizational risk, net profit from the 56-1 report. Disclosure of SDR is from the 56-2 form.

Data Analysis

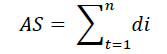

Data analysis is done by SPSS Panel data analysis in tracking survey recording for years (or any given time unit). Technical research, correlation analysis, descriptive statistical analysis and multiple regression analysis along with independent factors and influence of interesting factors (Jaquette & Parra, 2014). Regarding consideration of SDR (Y), indicators from GRI Version 4.0 of Thai SET 100 companies are used. After rating the SDR, the actual score received by the companies according to GRI Version 4.0 can be shown in the following formula (Pongpan, 2015).

As di=”1” if there is “t” and “0” if I or SDR is not disclosed.

Research Result

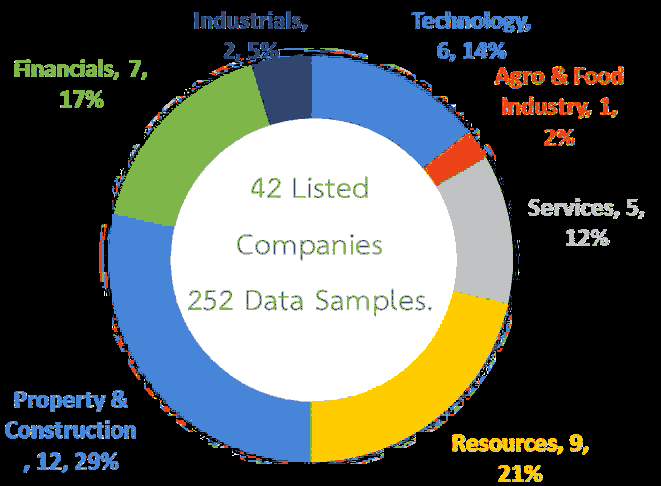

Company data used as example as shown in Figure 1, grouped by sector of SET 100, covers 42 companies and 252 company years. 29% is in property & construction, 21% is in resources, 17% is financials, 14% is technology, 12% is services, 5% is in industrials and 2% is Agro & food. industry.

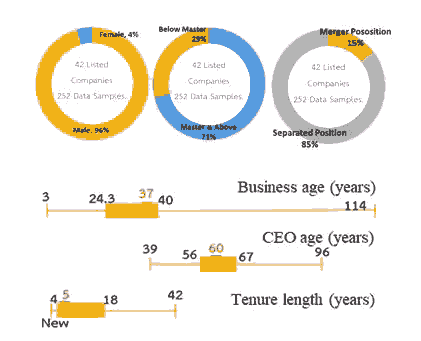

The data is analysed using descriptive statistics such as mean and standard deviation to explain characteristics of the CEO. The result can be summarized and shown in Figure 2. The age of the business ranges from 3 to 114 years, with average being 37 years.

It is found that from 252 samples, 96% are male and 4% are female. 71% have at least a master’s degree, and 29 have lower education. 85% of the companies separate the positions of chairman and CEO while 15% have mergers position.

CEOs age between 39–96 years with mode being 60 years. Tenure length ranges from 0 to 42 years and average being 5 years. The amount of SDR-Disclosure according to the economic indicators provided by GRI Version 4.0 can be shown as follows:

| Table 1 Amount of Sustainable Development Report Disclosure (Control Factors, N=252 Company-Year) |

||||

|---|---|---|---|---|

| SDR-Disclosure | Min | Max | Mean | SD |

| ECONOMICS | - | 7 | 3.65 | 1.185 |

| SOCIAL | - | 13 | 6.71 | 2.009 |

| ENVIRONMENTAL | - | 22 | 6.76 | 4.972 |

| Total average | 0.67 | 13 | 5.71 | 1.973 |

| Controlling factor | ||||

| Business Risk (Debt -to-equity ratio) | 0 | 12.14 | 2.436 | 2.644 |

| Net profit (Unit: million baht) | -31,590.49 | 184,610.02 | 114,765.55 | 22,901.97 |

Table 1 shows the amount of SDR-Disclosure. From the table, average economic disclosure is 3.65 topics (min=0, max=7, SD=1.185) average social is 6.71 topics (min=0, max=13, SD=2.009) average environmental is 6.76 topics (min=0, max=22, SD=4.972) for the total average of 5.710 topics (min=0.67, max=13.00, SD=1.973). Controlling factors such as business risk (Debt -to-equity ratio) is 2.436 times (min=0.00, max=12.140 SD=2.644) and average net profit is 11,476.55 million baht. (min=-31,590.49, max=184,610.02, SD=22,901.97).

| Table 2 Result Of Pearson’s Correlation Between the CEO and SDR |

|||||||

|---|---|---|---|---|---|---|---|

| (Variable) | X Sex | X Edu | X Age | X Ser-Y | X Mer-Pos | XDE | XNP |

| SDRDisclosure | -0.096 | 0.146* | -0.04 | -0.127* | -0.014 | -0.249** | -0.229** |

| Gender of CEO (XSex) | 0.141* | 0.202** | 0.034 | 0.075 | 0.059 | 0.087 | |

| Education of CEO (XEdu) | . | . | -0.157* | -0.214** | -0.177** | 0.157* | 0.156* |

| Age of CEO (XAge) | . | 0.467** | 0.147* | 0.087 | 0.127* | ||

| Tenure of CEO (XSer-Y) | . | . | . | . | 0.168** | -0.12 | -0.113 |

| CEO-Chairman position merging (XMer-Pos) | . | . | . | . | -0.112 | 0.145* | |

| Debt-to-equity ratio (XDER) | . | . | . | . | . | . | 0.147* |

| VIF | 1.089 | 1.182 | 1.328 | 1.33 | 1.18 | 1.123 | 1.156 |

Result of Pearson’s Correlation test between characteristics of the CEO, business risk, net profit and SDR using Multi Correlation Analysis can be shown in Table 2. The result is summarized through Pearson’s Correlation and Variance Inflation Factors, and analyzed using Multiple Regression Analysis as shown in Table 3.

| Table 3 Result of Multiple Regression Analysis Between Characteristics of The CEO and SDR Disclosure |

|||||

|---|---|---|---|---|---|

| Variable | Unstandard. Coefs. | Stand. Coefs. | t | Sig | |

| B | Std. Error | Beta | |||

| (Constant) | 4.895 | 0.936 | 5.229 | 0 | |

| Gender of CEO (XSex) | -1.144 | 0.597 | -0.114 | -1.915 | 0.057 |

| Education of CEO (XEdu) | 0.938 | 0.267 | 0.215 | 3.514 | 0.001 |

| Age of CEO (XAge) | 0.044 | 0.015 | 0.201 | 2.936 | 0.004 |

| Tenure of CEO (XSer-Y) | -0.047 | 0.013 | -0.25 | -3.714 | 0 |

| CEO-chairman position merging (XMer-Pos) | -0.258 | 0.244 | -0.064 | -1.06 | 0.29 |

| Debt-to-equity ratio (XDER) | -0.219 | 0.044 | -0.294 | -4.954 | 0 |

| Net profit (XNP) | -2.19E-05 | 0 | -0.255 | -4.206 | 0 |

| R Square | 0.212 | ||||

| Adjusted R Square | 0.19 | ||||

| F-Value (Sig) | 9.635 (000) | ||||

From Table 3, it is found that dependent factors in relationship between characteristics of the CEO and SDR-Disclosure can be explained by 21.2% (R Square=0.212) and the multiple regression formula is:

From the formula, statistical significance that can conclude positive relationship of XEdu and XAge of the CEO, and negative relationship of XMer-pos, XDER and XNP with SDR-Disclosure. On the other hand, XSex and XMer-pos of the CEO cannot be concluded if they have relationship with SDR-Disclosure. Summary of hypothesis test under the research question can be shown in table 4.

| Table 4 Summary of Hypothesis Test |

||||

|---|---|---|---|---|

| Hypothesis test | Beta Coefficient | P-Value & Significant | Decision | Justification |

| H1: Male CEOs have effect on SDR-Disclosure. | -1.144 | 0.057 | Rejected | P-value is not significant. |

| H2: CEOs with at least a master’s degree affects SDR-Disclosure. | 0.938 | 0.001 | Accepted | P-value is significant and 0.938 positive impact on SDR. |

| H3: Age of CEO affects SDR-Disclosure. | 0.044 | 0.004 | Accepted | P-value is significant and 0.044 positive impact on SDR. |

| H4: Tenure length of CEO affects disclosure of SDR | -0.047 | 0 | Accepted | P-value is significant and -.047 negative impact on SDR. |

| H5: CEO that holds other positions at the same time affect disclosure of SDR | -0.258 | 0.29 | Rejected | P-value is not significant. |

| H6: Organizational risks affects SDR | -0.219 | 0 | Accepted | P-value is significant and -.219 negative impact on SDR. |

| H7: Net profit affects SDR | -2.19E-05 | 0 | Accepted | P-value is significant and -2.194E-5 negative impact on SDR. |

Conclusion and Discussion

Relationship between characteristics of the CEO and SDR-Disclosure in SET 100 companies can be concluded as follows. (1) Use of Debt-to-Equity ratio has negative effect on SDR-Disclosure with statistical significance. It can be discussed that high DER or risk affect decision to invest in the company, resulting in the company less willing to disclose SDR. This agrees with Prachuabmoh, et al., (2018); Hapsoro & Husain (2019). (2) Net profit has significant negative effect on SDR-Disclosure, in concurrence with Maury (2018); Sinaga & Fachrurrozie (2017) which found that SDR-Disclosure was due to pressure from stakeholders that wanted high profit, but showing environmental and social responsibility had expense and thus decrease profit. This finding conflicts with Pulatovich (2019); Whetman (2017) which stated that the more SDR-Disclosure, the more profit for the company. (3) Education of the CEOs (a master’s degree and over) has positive relationship with SDR-Disclosure due to higher education showing efficiency in management, working and thoughts involving sustainability. Thus, they see SDR-Disclosure as necessary, in concurrence with Finkelstein, et al., (2009). Attention to voluntary SDR-Disclosure can build good company reputation and long-term benefit, as it allows the stakeholders to know more about the company and decide to invest in the company. (4) Age of the CEO has positive effect on SDR-Disclosure. The study finds that the CEO’s median of 60 years, which is in the senior range, needs more stability and sustainability while being more cautious, averse to risk and experienced in avoiding bad things. This results in more credible and accurate SDR-Disclosure, concurring with Ya, et al., (2019); Ferrell, et al., (2017). (5) Tenure length of the CEO has negative relationship with SDR-Disclosure because the tenure length of the CEO is usually similar, limited by terms, and the CEOs’ advanced age which make the CEOs avoiding risk and less responsive to changes. This concurs with Soheilyfar, et al., (2014) and conflicts with Grassa & Chakroun (2016) which found that long-time CEOs would be more proficient have more opportunities and frequency to disclose SDR. (6) Gender and position merging of the CEO also have negative relationship with SDR-Disclosure but there is not enough data to definitively conclude the hypothesis. Being male means more decisiveness, but advanced age means more preference of sustainability on little change, and there is check and balance from few positions merging. If SDR is disclosed at all, it is usually done carefully, this can result in either positive, negative or no effect on SDR-Disclosure. This concurs with Sitthipongpanich & Polsiri (2015); Na & Hong (2017); Sitthipongpanich & Polsiri (2015); Tang (2016). And (7) Managerial application which found that 1) characteristics of the CEO such as age, gender, education, tenure length and position merging are desirable for business operation along with sustainable development consciousness and application to seek the manager, 2) reflection in terms of accounting data shows balanced risk factors such as debt-to-equity ratio, profitability or net profit, and use of financial data as a factor in creating a guideline to promote sustainable development and disclose SDR, allowing the stakeholders to know transparency and building sustainability at the same time, 3) this work can support agencies or institutions in improving their rules, laws, and suggestions to promote SD and SDR-Disclosure.

Recommendations

Creating sustainability has initiatives from organization's sustainability that are driven by a core medium of management. The key issue lies in good governance, transparency and accountability in operational management. The Sustainability report expectation to be a continuation of the internal sustainability and wider responsibility expanding.

Implications

The implications of this research can be found either in practical or theorical dimension as follow.

Practical Implication

1. Financial department can use results from this research as a financial analysis data and trend forecasting.

2. Investors can understand the current circumstance that research results disclosures do not correlate with financial performance whereas the development results disclosure do.

3. Shareholders and stakeholders can use the results from this research as the information to decide whether to invest or not in that business.

Theoretical Implication

As there is no research to test the relationship between disclosure of R&D expenditure and financial performance in Thailand and use it as a guideline for determination. So, this research did and presented the R&D Disclosure Criteria which is a comparative information to inform the change in the level of R&D disclosure for the benefit of future researchers. Moreover, this research found that the Transmission theory can clearly describe the nature and degree of R&D disclosure and financial performance. In term of the Representative theory, it can test the relationship between R&D disclosure and financial performance so well too.

Limitations

This research collects data only from the annual report of the MAI Stock Market during 2016 to 2018 because this is a trusted source which presenting on the approved lists. Therefore, the results from this research may limit within timeframe too.

References

- Al-Delawi, A.S., & Ramo, W.M. (2020). The impact of accounting information system on performance management. Polish Journal of Management studies, 21(2), 36-48.

- Ali, A., & Zhang, W. (2015). CEO tenure and earnings management. Journal of Accounting and Economic, 59(1), 60–79.

- Bakanauskiene, I., Bendaraviciene, R., Juodelyte, N., & Vveinhardt, J. (2020). Sustainability of NASDAQ-Listed companies: The effects of Participation in the UNGC. Polish Journal of Management studies, 21(1), 87-103.

- Bamber, L.S, Jiang, J.X., & Wang, I.Y. (2010). What’s my style? The influence of top Managers on voluntary corporate financial disclosure. The Accounting Review, 85(4), 1131–1162.

- Dayuan, L.I. (2019). Relationship between CEO characteristics and corporate environmental disclosure in Thailand. Frontiers of Engineering Management, 6(4), 564–574.

- Deng, X., Kang, J., & Low, B. (2013). Corporate social responsibility and stakeholder value maximization: Evidence from mergers. Journal of Financial Economics, 110(1), 87–109.

- Fabrizi, M., Mallin, C., & Michelon, G. (2014). The role of CEO’s personal incentives in driving corporate social responsibility. Journal of Business Ethics, 124, 311-326.

- Ferrell, O.C., Fraedrich, J., & Ferrell, L. (2017). Business ethics: Ethical decision making and cases, (11th edition). USA: Cengage Learning: Boston.

- Finkelstein, S., Hambrick, D.C., & Cannella, A.A. (2009). Strategic leadership: Theory and research on executives, top management teams, and boards. Oxford University Press: New York.

- Garces-Galdeano, L., & Garcia-Olaverri, C. (2019). The hidden value of intangibles: Do CEO characteristics matter? International Journal of Manpower, 40(6), 1075-1091.

- Geert, B., & Roy, P. (2018). Corporate sustainability performance and assurance on sustainability reports: Diffusion of accounting practices in the realm of sustainable development. Corporate Social Responsibility and Environmental Management, 25(20), 164–181.

- Glaeser, S., Michels, J., & Verrecchia, R.E. (2019). Discretionary disclosure and manager horizon: Evidence from patenting. Review of Accounting Studies, Forthcoming, 1-60.

- Grassa, R., & Chakroun, R. (2016). Ownership structure, board’s characteristics and corporate governance disclosure in GCC Banks: what about IBs? International Journal of Accounting, Auditing and Performance Evaluation, 12(4), 360-395.

- Guillet, D.B., Seo, K., Kucukusta, D., & Lee, S. (2013). CEO duality and firm performance in the U.S. restaurant industry: Moderating role of restaurant type. International Journal of Hospitality Management, 33(1), 339-346.

- Hapsoro, D., & Husain, Z.F. (2019). Does sustainability report moderate the effect of financial performance on investor reaction? Evidence of listed firms. International Journal of Business, 24(3), 208-328.

- Huang, S.K. (2013). The impact of CEO characteristics on corporate sustainable development. Corporate Social Responsibility and Environmental Management, 20, 234-244.

- Hussain, S., & Hassan, A. A.G. (2020). The reflection of exchange rate exposure and working capital management on manufacturing firms of Pakistan. Journal of Talent Development and Excellence, 12(2s), 684-698.

- Hussain, S., Ahmad, N., Quddus, A., Rafiq, M., Pham, T.P., & Popesko, B. (2021). Online education adopted by the students of business science. Academy of Strategic Management Journal, 20, 1-14.

- Hussain, S., Nguyen, Q.M., Nguyen, H.T., & Nguyen, T.T. (2021). Macroeconomic factors, working capital management, and firm performance—A static and dynamic panel analysis. Humanities and Social Sciences Communications, 8(1), 1-14.

- Hussain, S., Quddus, A., Pham, P.T., Rafiq, M., & Pavelková, D. (2020). The moderating role of firm size and interest rate in capital structure of the firms: Selected sample from sugar sector of Pakistan. Investment Management and Financial Innovations.

- Jaquette, O., & Parra E.E. (2014). Using IPEDS for panel analyses: Core concepts, data challenges, and empirical applications. Higher Education: Handbook of Theory and Research 29, 467-533. Springer, Dordrecht.

- Karaman, A.S., Kilic, M., & Uyar, A. (2018). Sustainability reporting in the aviation industry: worldwide evidence. Sustainability Accounting, Management and Policy Journal, 9(4), 362-391.

- Kasemcheunyot, K. (2020). Thailand’s development on sustainable development goals. Journal of Chandrakasemsarn, 26(1), 16-30.

- Lucia, L., & Panggabean, R.R. (2018). The effect of firm’s characteristic and corporate governance to sustainability report disclosure. Social Economics and Ecology International Journal, 2(1), 18-28.

- Ma, Y., Zhang, Q., Yin, Q., & Wang, B. (2019). The influence of top managers on environmental information disclosure: The moderating effect of company’s environmental performance. International Journal of Environmental Research and Public Health, 16(20), 1-15.

- Maury, B. (2018). Sustainable competitive advantage and profitability persistence: Sources vs. outcomes for assessing advantage. Journal of Business Research, 84(2017), 100-113.

- Melkonyan, A., Gottschalk, D., & Kamath, V.P. (2017). Sustainability assessments and their implementation possibilities within the business models of companies. Sustainable Production and Consumption, 12, 1-15.

- Na, K., & Hong, J. (2017). CEO gender and earnings management. Journal of Applied Business Research, 33(2), 297.

- Orazalin, N., & Mahmood, M. (2019). Determinants of GRI-based sustainability reporting: evidence from an emerging economy. Journal of Accounting in Emerging Economies, 10(1), 140-164.

- Pimpare, W., & Suksonghong, K. (2019). The relationship between board demographic diversity and firm performance. Journal of Liberal Arts and Management Science, 2(6), 9-26.

- Pongpan, T. (2015). Relationship between environmental responsibility disclosure levels. Society and corporate governance and financial performance of the company address in the SET 50 index. Bangkok: Dhurakij Pundit University press.

- Prachuabmoh, A., Meejaisue, P., Sakulitsariyaporn, P., & Jarupathirun, S. (2018). The relationship between structure of the board of directors and the performance of companies listed on the stock exchange of Thailand. Kasem Bundit Journal, 19, 124-141.

- Pulatovich, E.M. (2019). Impact of financial sustainability on enterprise value expansion. International Journal of Engineering and Advanced Technology, 9(1), 4640-4645.

- Rasche, A. (2020). The united nations global compact and the sustainable development goals. In Laasch, O., Jamali, D., Freeman, R.E. & Suddaby, E. Cheltenham: Edward Elgar.

- Rutledge, W.R., Karim, E.K., & Lu, S. (2016). The effects of board independence and CEO duality on firm performance: Evidence from the NASDAQ-100 index with controls for endogeneity. Journal of Applied Business and Economics, 18(2), 49-71.

- Safitri, K.Y.D., Mertha, I.M., & Wirawati, N.G.P. 2020. The impact of Debt-to-Equity ratio, price earnings ratio, earnings per share to the Stock price in banking sectors listed in infobank 15 index 2014-2018. American Journal of Humanities and Social Sciences Research (AJHSSR), 4(5), 49-56.

- Shi, L., Han, L., Yang, F., & Gao, L. (2019). The evolution of sustainable development theory: Types, goals, and research prospects. Sustainability, 11, 7158.

- Sinaga, J.K., & Fachrurrozie. (2017). The Effect of profitability, activity analysis, industrial type and good corporate governance mechanism on the disclosure of sustainability report. Accounting Analysis Journal, 6(3), 347-358.

- Sitthipongpanich, T., & Polsiri, P. (2015). Do CEO and board characteristics matter? A study of Thai family firm. Journal of Family Business Strategy, 6(2), 119-129.

- Soheilyfar, F., Tamimi, M., Ahmadi, M.R., & Takhtaei, N. (2014). Disclosure quality and corporate governance: Evidence from Iran. Asian Journal of Finance & Accounting, 6(2), 75-85.

- Tang, J. (2016). CEO duality and firm performance: The moderating roles of other executives and block holding outside directors. European Management Journal, 35, 362-372.

- Thaemnanee, W., & Rungruangwuttikrai, N. (2019). The level of sustainability reporting for listed companies in stock exchange of Thailand: A case study of property development business sector. Social Science Journal of Prachachuen Research Network, 1(1), 53-64.

- Wang, M.C. (2017). The relationship between firm characteristics and the disclosure of sustainability reporting. Sustainability, 9(4), 624.

- Whetman, L.L. (2017). The impact of sustainability reporting on firm profitability. Undergraduate Economic Review, 14(1), 1-19.

- Ya, C., Huawei, L., & Song, Z. (2019). Impact of CEO background characteristics on accounting information quality. Finance and Social Sciences Research, 237-247.

- Yusliza, M.Y. (2019). Top management commitment, corporate social responsibility and green human resource management: A Malaysian study. Benchmarking: An International Journal, 26(6), 2051-2078.