Research Article: 2022 Vol: 26 Issue: 2

Human Resource Accounting Disclosure and Firm Value: An Empirical Study in Vietnam

Pham Duc Hieu, Thuongmai University

Doan Van Anh, Thuongmai University

Nguyen Thi Minh Giang, Thuongmai University

Hoang Thi Bich Ngoc, Thuongmai University

Nguyen Thi Hong Lam, Thuongmai University

Citation Information: Hieu, P.D., Anh, D.V., Giang, N.T.M., Ngoc, H.T.B., & Lam, N.T.H. (2022). Human resource accounting disclosure and firm value: an empirical study in vietnam. Academy of Accounting and Financial Studies Journal, 26(2), 1-09.

Abstract

This study examines the effect of human resource accounting disclosure on firm value in Vietnam. Tobin’s Q is used as a firm value proxy while the human resource accounting disclosure is measured using unweighted human resource disclosure index by content analysis of the company’s annual report. The control variables considered in this study are firm profitability, firm size, financial leverage, foreign ownership, listing age, and auditor type. The population of the study comprises annual reports of nonfinancial listed firms in the Vietnam Stock Exchange between the periods of 2016-2018 out of which 81 are selected. Final sample of this study is 243 firm-year observations. The analysis technique used in this research is the multiple regression analysis models. The results show a positive association between human resource accounting disclosure and firm value. The findings provide new insight into the effect of the firms’ human resource accounting disclosure and firm value in the Vietnamese business context.

Keywords

Human Resource Accounting, Human Resource Disclosure, Firm’s Value, Vietnam.

JEL Classification

G32, M14, M41.

Introduction

In the recent global market, among three fundamental factors of production: land, labour and capital as defined by the classical economics, it is significant that the firm immensely depends on its manpower as a weapon in the competitive market. Labour is the internal assets of the firm because of the expertise and competency of the employees (Guthrie et al., 2004). As defined by Schultz (1961), human resource can be considered as abilities and skills of people or an individual person that have value which includes behavior, experience, knowledge, morale and attitude and altogether are expected to generate future economic value to the entity. Due to transformation of economy from industrial economy to knowledge-based economy, human resource is recognized as a vital asset and value creator to companies in gaining a key source of competitive advantage compared to its competitors. So, the focus of the organizations has changed from physical resources to human-related resources. With the onset of innovation and learning era, it is clear that human resource is the only capital which influences the success of the organizations.

Regardless of the huge importance of human assets in an enterprise, conventional accounting still treats investment associated with the selection, recruitment, training of personnel in an organization as an expense charged against the income statement, and which is used to reduce profit unlike any other physical assets such as plant and machinery, whose costs of acquisition are capitalized in the financial position and only a depreciable amount being charged against the profit or loss account every fiscal year. However, given the increasing awareness to shift attention from an economy characterized with physical based assets to knowledge-based assets as the crucial dynamic to corporate sustainable development, there is therefore an increasing need to determine measure and disclose company human resource (Guthrie et al., 2004).

The objective of this research is to find out the effect of human resource accounting disclosure on firm values in Vietnam. This research is being done empirically by observing nonfinancial companies that are listed in the Vietnam Stock Exchange from 2016-2018. The financial sector companies are excluded from the sample of this research because of firms’ value evaluation that differs from other sectors.

A lot of prior studies choose developed countries as research location. This study chooses Vietnam as a research location because of the potential for human resource development in developing countries. The study results will provide a new perspective on how the capital market in Vietnam realizes the importance of human resource in the entity. Our study contributes to the literature in two ways. First, we explore the human resource disclosure practice among the nonfinancial listed companies in Vietnam and then examine simultaneously its consequences on firm value. To best our knowledge, no other studies in Vietnam attempted this. Second, this study also examines the impact of other variables, which were found to be a significant determinant of firm value to understand more completely how these factors jointly impact the firm value. The findings from this study would generate incremental insights to managers who seek to enhance the human resource disclosure and value of companies.

This paper is organized as follows. Section 2 discusses the theoretical motivation for hypothesizing a link between human resource disclosure and firm value. Section 3 discusses the data and methodology, Section 4 presents the analysis of the results, and Section 5 presents the conclusions, discusses the limitations of this study and suggestions for future research.

Literature Review

Stakeholders Theory

The stakeholder’s theory is the theory of organizational management and business ethics that discusses the capital and values in managing organization. Freeman (1984, 2001) identifies and models the groups of stakeholders from companies. The traditional view of a company believes that the shareholders are the only important thing for the company. The company has binding fiduciary obligation to fulfill their need that is increasing the value for the shareholders. However, the stakeholder’s theory opines that there are the other parties that have to be considered, including the employees, customers, supplier, financier, society, and government. The existence of a company is not only to maximize the wealth of the shareholders, but also the stakeholders.

Signaling Theory

The discussion of the signaling theory in financial management was initiated by Spence (1973) who examines the signal in the labor market related to the economic indicator. Generally, a signal means a cue given by the company to the external party. The information given by the company is the signal about the company condition. Signaling theory is useful for describing behavior when two parties have access to different information. Signaling theory in accounting for one of its functions is to assess any private information that will be issued by the management to shareholders. The manager seeks to communicate private information which tends to contain good news is to increase shareholder wealth. The information released by management as good news can help investors to make upward revisions to earnings and performance of the company in the coming and decide to buy the company’s stock. Conversely, if the prediction is higher than actual, which means bad news, investors will revise down and immediately sell the shares of the company because the company’s performance does not match their expectation (Ambarwati, 2008).

Human Resource Accounting Disclosure

Human resource accounting, according to the American Accounting Association (1974) ; Ullah and Karim (2015) ; Sarkar et al. (2016) , is the process of establishing and estimating data about human resources and communicating this information to interested users. Human resource accounting disclosure is an important process by which companies communicate information about employees who possess knowledge and skills that give future economic benefits to the organization (Ullah & Karim, 2015).

In Vietnam, the disclosure on human resource began to surface since 2016, but prior to 2016, this disclosure has surfaced many companies but very few are disclosed in a report. This was probably because Vietnam does not have any means of support such as: accounting guidelines and reporting regulations for preparation of this kind of report. So that human resource disclosure is not considered important to report in detail because no one requires reporting on human resource. But the situation has been changed. With the growing awareness of the importance of human resource, many companies attempt to disclose the human resource of their companies on a voluntary basis to reduce the information asymmetry and improve the transparency between them and various stakeholders (Petty & Guthrie, 2000; Schneider & Samkin, 2008) and also show their social responsibility compliance (Dominguez, 2011). Company has recognized that it no longer faced with the responsibility that rests on a single bottom line: the financial results only. But corporate responsibility should be based on the triple bottom lines (Elkington, 1994). Here, others than the financial bottom line are also social and environmental because financial conditions are not enough to guarantee the value of the company to grow in a sustainable manner. Sustainability will only be guaranteed when the company shows interest to the social and environmental dimensions. As a consequence, there is raising the need for a different type of information such as disclosure of human resource information which brings considerable value to a firm (Abeysekera & Guthrie, 2005; Guthrie et al., 2004). The main objective of human resource disclosure is to satisfy the information needs of users in a manner that enables both decision making and accountability and finally inform the stakeholders about the quality and value of the firm (Firer & Williams, 2003; Petty & Guthrie, 2000).

Firm Value

The firm value represents the firm's past, present and future performance, which is the perception of the investor to the success of a company. The share price is often associated with the firm's value because the stock price reflects the willingness of investors to buy the firm's shares (Tobin, 1969; Damodaran, 2012). The market price of the company’s shares that is formed between the buyer and the seller in the transaction is called the market value of the company, because the market price of the stock is considered as a reflection of the true value of the company’s assets. The increase of the share price shows the trust of the investors to the company, so they are willing to pay more with aiming for higher return. The value of a company is the total assets owned. It consists of the market value of share and liabilities. The measurement of a company value can be done through many indicators, such as Tobin’s Q, Price Earning Ratio (PER), Price to Book Value (PBV), et cetera (Damodaran, 2012).

Hypothesis Development

Stakeholders and Signaling theories indicate that a company with better human resource intended to disclosure more information about their operations in order to keep its image up. It is more likely that the management of a socially responsible enterprise will voluntarily disclose more to the market to enhance the value of the company, as well as the value of their human capital in a competitive labor market (Barako, 2007). According to McGuire et al. (1988) a firm has an investment in reputation, including its reputation for being socially responsible. The authors argued that the disclosure of human resource significant effect on firm value. This is because more and more disclosure of human resource then it shows the company’s value, the better. Dowell et al. (2000) measure firm value and find that multinational enterprise adoption of strict global social and environmental norms is positively related to higher firm value. Various studies have been conducted to prove the positive relationship between human resource disclosure and firm value (Garcia-Zambrano et al., 2018; Putra & Ratnadi, 2021; Adewumi et al., 2021; Harymawan et al., 2020; Machmuddah et al., 2020). The results of that research prove that human resource as one of the intangible assets owned by the company has a value that is valued by the market. The value of these intangible assets can be increased through human resource investment and disclosure so that it will increase the overall value of the company. Therefore, the following hypothesis is formulated:

H1: Human resource disclosure positively influences firm value.

Methodology

Given the large number of publicly listed companies in Vietnam, it was further decided to limit the sample population to those firms continuously listed on the Vietnam Stock Exchange between December 31, 2016 and December 31, 2018, and disclosed their human resource information on the annual report. The sample size consisted of eighty one (81) listed firms randomly drawn from all non-financial sectors in Vietnam.

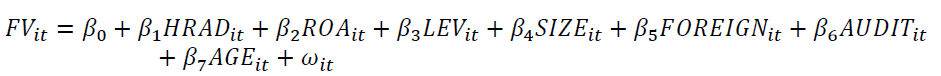

This research uses a quantitative approach to identify the relationship between human resource accounting disclosure and firm’s value. Human resource disclosure index (HRAD) is used as an independent variable. Besides, this study uses 6 (six) control variables, namely: (1) return on asset (ROA), (2) leverage (LEV), (3) firm size (SIZE), (4) foreign ownership (FOREIGN), (5) Auditor type (AUDIT), and (6) firm’s listing age (AGE). Multiple linear regression is used to determine the effect of the dependent variables on the independent variable. The model of analysis is represented by the following equation:

Where, FV: Value of firm “i” in year “t” (measure by Tobin’s Q); β_0: Intercept; HRAD: Level of human resource accounting disclosure of firm “i” in year “t” (measure by human resource disclosure index); ROA: Profitability of firm “i” in year “t” (measured by ratio of net profit to total assets); LEV: Debt ratio of firm “i” in year “t” (measured by ratio of total debt to total assets); SIZE: Size of firm “i” in year “t” (measured by natural logarithm of total assets); FOREIGN: Foreign ownership of firm “i” in year “t” (measured by proportion of shared held by foreign investors); AUDIT: Auditor type, dummy variable whose value is 1 if the auditor is one of the Big4 and 0 if otherwise; AGE: Listing age (measured by the number of years since listed on the Vietnam Stock Exchange); ω: residual errors; i: companies, from 1 to 81; t: year or period, from 2016 to 2018.

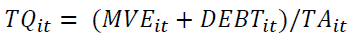

In this study, Tobin’s Q is used as a measure of firm value. Tobin Q is defined as the ratio of market value to the replacement value of a firm’s assets. If the firm has a high Tobin’s Q value, it can be interpreted that the firm’s growth will be better because investors will make more sacrifices for companies that have a market value of assets that is greater than the book value. Because debt market value and replacement costs required very detailed information that is difficult to obtain, so this study follows modified Tobin’s Q’s calculations as (Damodaran, 2012):

Where, TQ: Tobin’s Q of firm “i” in year “t”; MVE: Market value of equity of firm “i” in year “t”; DEBT: Book value of total debt of firm “i” in year “t”; TA: Total assets of firm “i” in year “t”.

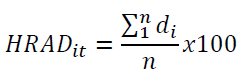

In this study, human resource accounting disclosure (HRAD) was measured by constructing an index comprising 32 items of discretionary human resource disclosure in line with the methodology used by Barako (2007) ; Sarkar et al. (2016) . A dichotomous approach to scoring the items was adopted, in which an item scores one if disclosed and zero if otherwise. This procedure is conventionally termed the unweighted approach, and it was adopted for the study as other researchers have used it successfully (Hossain & Hammami, 2009; Pham et al., 2021; Sarkar et al., 2016; Adejuwon et al., 2020). An HRAD was then computed by using the following formula:

Where, HRAD: Human resource accounting disclosure index of firm “i” in year “t”; di: 1 if the item is disclosed and 0 if otherwise; n: number of items that might be disclosed ( n≤32 items).

Descriptive statistics in the form of tables were used to present demographic and other data relating to the study. Multiple regression was used to analyze the possible relationship between human resource accounting disclosure and firm’s value in Vietnam. The strength of the relationship between the independent and dependent variables were ascertained by using Pearson correlation coefficient.

Analysis and Discussion

Descriptive Analysis

Table 1 presents the descriptive statistics of the main variables and control variables of this study. A total of 243 firms-years are investigated. The maximum FV is 5.61 and the minimum FV is 0.35. The average FV is 1.567 with the standard deviation of 0.924. The maximum HRAD is 81.25 while the minimum HRAD is 9.38. The average HRAD is 36.90 with very high standard deviation of 12.5. The average ROA is 8.396 with the maximum ROA of 41.63 and the minimum ROA of -3.76. The average LEV is 0.436 with the maximum LEV and minimum LEV of 0.87 and 0.03 respectively. The average SIZE is 13.337 with the standard deviation of 1.472. The mean of FOREIGN is 0.161 with the standard deviation of 0.169. The average AUDIT value is 0.395 with the deviation standard of 0.49.

| Table 1 Descriptive Statistics | ||||||

| N | Range | Min | Max | Mean | Std. Deviation | |

| FV | 243 | 5.26 | 0.35 | 5.61 | 1.567 | 0.924 |

| HRAD | 243 | 71.88 | 9.38 | 81.25 | 36.90 | 12.461 |

| ROA | 243 | 45.39 | -3.76 | 41.63 | 8.396 | 8.20 |

| LEV | 243 | 0.84 | 0.03 | 0.87 | 0.436 | 0.218 |

| SIZE | 243 | 6.36 | 11.82 | 18.18 | 13.337 | 1.472 |

| FOREIGN | 243 | 0.77 | 0.00 | 0.77 | 0.161 | 0.169 |

| AUDIT | 243 | 1.00 | 0.00 | 1.00 | 0.395 | 0.490 |

| AGE | 243 | 15.00 | 2.00 | 17.00 | 8.877 | 2.875 |

Correlation Analysis

Table 2 shows the results of a Pearson correlation for the main variables to investigate the relationship among firm value (FV), human resource disclosure (HRAD), return on assets (ROA), leverage (LEV), size (SIZE), foreign ownership (FOREIGN), auditor type (AUDIT), and listing age (AGE). The results show that firm value (FV) is positively correlated with HRAD (0.329), ROA (0.303), SIZE (0.142), and FOREIGN (0.347), but negatively correlated with LEV (-0.292).

| Table 2 Pearson Correlations | ||||||||

| FV | HRAD | ROA | LEV | SIZE | FOREIGN | AUDIT | AGE | |

| FV | 1 | |||||||

| HRAD | 0.329** | 1 | ||||||

| ROA | 0.303** | 0.173* | 1 | |||||

| LEV | -0.292** | 0.037 | -0.516** | 1 | ||||

| SIZE | 0.142* | 0.357 | -0.118 | 415* | 1 | |||

| FOREIGN | 0.347** | 0.293 | 0.240** | -0.232** | 0.379 | 1 | ||

| AUDIT | 0.055 | 0.230* | -0.073 | 0.010 | 0.460 | 0.279 | 1 | |

| AGE | -0.105 | 0.002 | -0.027 | -0.102 | 0.180 | 0.384 | 0.008 | 1 |

Multiple Regression

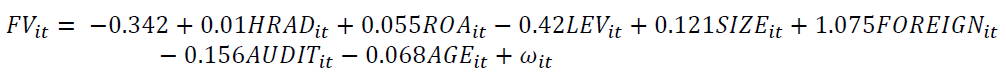

To find out the association of HRAD with corporate characteristics, a multiple regression model is executed. Table 3 summarizes the results of multiple regression analysis. It is apparent that the F-value is 31.564 (p=0.000) which statistically supports the significance of the model. The multiple correlation coefficient (R) is 0.696; the R-square and adjusted R-square are 0.485 and 0.469 respectively, indicating that 48.5% of the variation in firm value can be predicted from the selected independent variables (Table 3). Based on the results of the linear regression analysis, the regression equation for this study is as follows:

| Table 3 Multiple Regression Results | |||||

| Variables | Predicted sign | FV | |||

| Coefficient | t | p-value | VIF | ||

| HRAD | + | 0.010 | 2.669 | 0.008** | 1.253 |

| ROA | + | 0.055 | 8.462 | 0.000** | 1.538 |

| LEV | + | -0.420 | -1.465 | 0.144 | 2.086 |

| SIZE | + | 0.121 | 2.745 | 0.007** | 2.258 |

| FOREIGN | + | 1.075 | 3.199 | 0.002** | 1.715 |

| AUDIT | + | -0.156 | -1.478 | 0.141 | 1.428 |

| AGE | + | -0.068 | -4.025 | 0.000*** | 1.266 |

| Constant | -0.342 | -0.652 | 0.515 | ||

| R square = 0.485; F = 31.564; Sig. = 0.000; Durbin-Watson = 0.996 | |||||

Table 3 shows that human resource accounting information (HRAD) disclosed by Vietnamese listed firms between 2016 and 2018 significantly impacts firm value (p-value =0.008), and therefore the hypothesis H1 is supported. HRAD coefficient value of 0.10 shows that HRAD has a positive (+) impact on firm value, but it is relatively low compare to the other control variables coefficient. Moreover, ROA, SIZE, and FOREIGN show a positive (+) coefficient (0.055, 0.121, and 1.075 respectively) and significant impact (p-value of 0.000, 0.007, and 0.002) on firm value, while LEV and AUDIT show a negative (-) coefficient (-0.42 and -0.156) and not significant impact (p-value of 0.144 and 0.141) on firm value. However, AGE shows a negative (-) coefficient (-0.068) and significant impact (p-value of 0.000) on firm value.

This study provides new findings related to the relationship between human resource accounting disclosure and firm value. Prior studies found evidence that companies try to increase their value by increasing the human resource quality and disclosure (Garcia-Zambrano et al., 2018; Putra & Ratnadi, 2021; Adewumi et al., 2021; Harymawan et al., 2020; Machmuddah et al., 2020). According to Becker (1975) , high quality human resource will increase a firm’s productivity that leads to an increase in a firm’s performance. The capital market will value more the company with high performance. The results of this study support the prior studies indicating that human resource accounting disclosure does have a strong and positive influence on firm value.

Conclusion

This research aims to test whether human resource disclosure affects the firms’ value listed on the Vietnam Stock Exchange between 2016 and 2018. The independent variable used in this research is human resource disclosure. The result of test shows that firm value proxied by the Tobin’s Q is influenced significantly by human resource disclosure. Besides this, other variables namely profit of the firm, firm size, foreign ownership, and firm listing age also jointly impact significantly the firm value. The results of the study support prior research (Garcia-Zambrano et al., 2018; Han et al., 2020) that shows the significant and positive influence of human resource disclosure on firm value with the new research context, Vietnam.

However, this study cannot avoid some limitations that could be addressed in future work. First, the sample used in this study is only limited to companies that voluntarily disclose human resource information on their annual report. Voluntary disclosure in Vietnam plays an important role in gaining such research data. Second, the study relies on the same year data to show the short-term impact of human resource disclosure on firm value. Therefore, future studies can use time gaps between human resource disclosure and firm value data to investigate the long-term impact.

The results of this study may fill the research gap in which there is no prior research examined the influence of human resource disclosure on the firm value in Vietnam. The research findings motivate Vietnamese companies to disclose human resource information to enhance value for the company. In addition, Vietnamese regulators are expected to be able to set regulations and guidelines on human resource disclosure in order to encourage companies to disclosure more broadly and deeply.

Endnotes

Corresponding author: Pham Duc Hieu, Thuongmai University, Hanoi, Vietnam.

References

Ambarwati, S. (2008). Earnings response coefficient. Accountability, 7(2), 128-134.

Becker, G. (1975). Human capital: A theoretical and empirical analysis, with special reference to education, 2nd edition. National Bureau of Economic Research, Inc.

Damodaran, A. (2012). Investment valuation. New York: John Wiley & Sons, Inc.

Dowell, G., Hart, S., & Yeung, B. (2000). Do corporate global environmental standards create or destroy market value? Management Science, 46(8), 1059-1074.

Freeman, R.E. (2001). Stakeholder theory of the modern corporation. Business Ethics, 3, 38-48.

Freeman, R.E. (1984). Strategic management: A stakeholder approach. Boston: Pitman.

Sarkar, S.H., Alam, A., & Ali, I. (2016). Human resource accounting dislosure practices in Bangladesh. Australian Journal of Accounting Economics and Finance, 2(2), 100-113.

Schultz, T.W. (1961). Investment in human capital. The American Economic Review, 51(1), 1-17.

Spence, M. (1973). Job market signaling . The Quarterly Journal of Economics, 87(3), 355-374.

Ullah, H., & Karim, T. (2015). Human resource disclosure in annual report of listed banking companies in Bangladesh. Global Journal of Quantitative Science, 2(1), 7-19.