Research Article: 2019 Vol: 23 Issue: 1

Impact of Accounting Information System on Reducing Liquidity Risk in Saudi Banks Comparative Study Between Islamic Banks and Commercial Banks

Ziad Abdulhaleem Althebeh, Zarka University

Abstract

This study aimed to identify the impact of accounting information system on reducing liquidity risks in Saudi Arabia between Islamic and Commercial Banks listed in the Saudi Stock Market, through a comparative study of the annual reports for these banks. The researcher used inductive deductive approach in this research. The study was carried on a population consists of (3) Commercial Banks and (3) Islamic Banks listed on Saudi Stock Market. The researcher used appropriate statistical methods through SPSS program. The most important findings of this study that the liquidity problem is one of the most serious problems facing Islamic Banks; because of the nature of the projects in which to invest the money, and not dealing with the interest of usury (RIBA), there was no statistically significant difference of the accounting information system on reducing liquidity risks between Islamic Banks and Commercial Banks, Islamic banks have been most successful in liquidity indicators compared to Commercial Banks and that some of the Commercial Banks established affiliated Islamic Banks, this emphasizes that Islamic Banks have a competitive strength, therefore they have the possibility of attracting depositors and investors. The study made a number of recommendations, the most importance of these: developing accounting information systems in order to contribute to future prospects of liquidity position, providing adequate internal control for each bank for a various investment management, and study recommended that there is a need to provide appropriate financial and administrative measure instruments in order to avoid liquidity risks so as not to face financial insolvency, which leads to bankruptcy.

Keywords

Accounting Information System, Liquidity Risks.

Introduction

Regulations and instructions are some of the components of the accounting information systems, where these regulations and instructions differ from one institution to another, whether similar or different, such as commercial and Islamic banks. Commercial banks depend on standards, regulations, instructions and principles in their daily functions and these depend on international accounting standards (International Financial Reporting Standards (IFRS). Islamic banks as well as have standards, regulations and instructions on which they base on, differ from those applicable to the commercial banks, and included in standards issued by the accounting and auditing organisation for Islamic financial institutions (Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI). given that every kind of the aforementioned banks has its own accounting information system, so risk treatment that these banks may expose banks will differ from one type to another.

Study Problem

In light of the exposure that faced public institutions, particularly private banks of risks and financial problems caused by global financial crisis and its ensuing fallout, many international institutions started searching for solutions, including accounting information system based Islamic standards banking system, which is applied by Islamic Banks, that differs from accounting information system depending on international accounting standards applied by commercial banks. Through the aforementioned, the study problem can be summarized as follows:

1. Does the accounting information system based on Islamic accounting standards issued by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) affect on reducing liquidity risks in Islamic banks in Saudi Arabia?

2. Does the accounting information system based on International Financial Reporting Standards (IFRS) affect on reducing liquidity risks in commercial banks in Saudi Arabia?

Significance of Study

This study is important because it highlights the accounting information systems based on standards issued by the International Accounting Standards Board, and standards issued by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), and its impact on reducing liquidity risks in banks operating in Saudi Arabia, by comparing data issued by these two bodies during the period 2009-2013.

Study Objectives

Depending on the significance of this study, the researcher set the following objectives:

1. Showing impact of accounting information system based on Islamic accounting standards in reducing liquidity risks that Islamic banks face.

2. Showing the impact of accounting information system based on international accounting standards in reducing liquidity risks that commercial banks face.

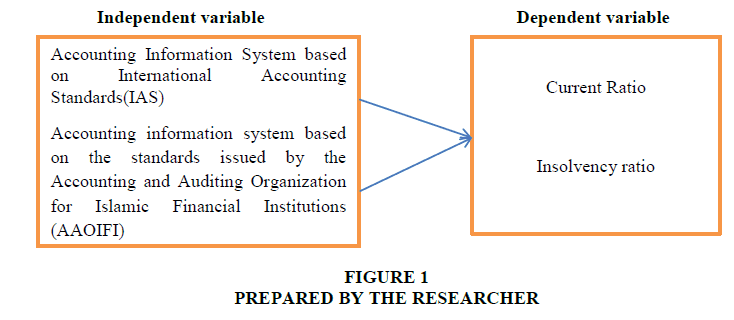

Study Model

Figure 1, which represents the variables that show the impact of the accounting information system on reducing liquidity risk in Islamic and commercial banks

Study Hypotheses

Depending on the study problem, this study proposes on the following hypotheses:

Major hypothesis

H0: There are no statistically significant differences of the impact of accounting information system in reducing liquidity risks between Islamic Banks and Commercial Banks at the significance level ≥ 0.05).

The major hypothesis has the following sub- hypotheses:

HO1: There are no statistically significant differences of the impact of accounting information system in reducing liquidity risks (current ratio) between Islamic Banks and Commercial Banks at the significance level ≥ 0.05).

HO2: There are no statistically significant differences of the impact of accounting information system in reducing liquidity risks (financial insolvency ratio) between Islamic Banks and Commercial Banks at the significance level ≥ 0.05).

Definition of Accounting Information System (AIS)

concept of information systems is one of the scientific terms commonly used at present and has various scientific connotations, including a group of personnel, equipments, software, communications networks and data resources, which is responsible for collecting necessary information for decision making, running, storing and distributing it, as well as it is responsible for coordination and supervision within the organization (Al-Hadi, 2001).

Accounting information system can be defined as it is one of the components of an administrative regulation concerning appropriate financial information collection, processing, analysing, and delivering, and complying it to make decisions to external parties, and manage the facility. Accounting information system is an essential component of management information system, the difference between them is limited in that the first is specialized in accounting data and information, while the second is specialized in data and information that affect on the facility activity (Moskov, 2002).

Accounting Information System in Banks

The importance of information systems in banks is reflected in facilitating financial transactions and developing, processing banking operations and assisting in the decision making process. The development of banking services became a necessity rather than a luxury because the world has competitions in banking and financial sectors in the market under the application of the General Agreement on Trade in services. Objectives of Accounting System in Banks (Abdullah and Qattani, 2007)

1. Achieving accuracy and right accomplishment.

2. Rapid completion.

3. Economize on expenses by making the system extremely flexible, so that it can be applied easily to fit technological products which require their use a computer and other.

4. Achieving the principle of internal control.

5. Completion of statements and financial reports required for purposes of the Bank, as well as to the Central Bank.

Accounting Information System Used In Commercial Banks That Is Based On International Accounting Standards

Commercial banks abide by preparing their own financial statements depending on International Financial Reporting Standards (IFRS) and using an accounting system compatible with these standards leads to having complete financial and comprehensive reports that show financial position of institutions and banks accurately.

Commercial banks rely more on fixed deposits to attract fixed funds, giving them greater potential to invest their resources and to reconcile profitability and liquidity.

And guarantees the deposits without exception, making them obliged to refund them to their owners, whatever the circumstances they are going through, even if at the expense of bankruptcy, and the liquidation of their property (Chlef, 2011). Accounting Information System used in Islamic banks based on standards issued by Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

There was a need to a body deals with financial institutions due to the urgent need of its existence, then the accounting auditing for financial institutions body was created, Formerly, financial accounting body for banks and Islamic financial institutions under the Foundation Agreement signed by a number of Islamic financial institutions. The Commission (body) aims to develop accounting and auditing thought for Islamic financial institutions, publish that thought, and its applications through training, seminars, issuing periodic newsletters, researches and other means, such as preparing accounting and auditing standards for those institutions, and issuing, interpreting, reviewing and adjusting them, in accordance with the provisions of Islamic Sharia and its principles are comprehensive regulation of all walks of life, and what fits the environment in which those institutions are established, fosters the trust of users using financial statements with information issued by these institutions, encourages them to invest, deposit, in them and taking advantage of their services (www.aaoifi.com).

Deposits attracted by Islamic banks are the main source of funds, with deposits being divided into:

1. Investment deposit in the Islamic banks is a speculative contract between the bank and the depositing customer. Current deposits (on demand) which are secured by their capital value, although no proceeds have been paid (Belzoz, 2013).

2. Investment Deposits: The investment deposit in the Islamic banks is a speculative contract between the bank and the depositing customer.

The bank does not guarantee the investment deposit or its profits except in case of default and infringement. The results of profits are distributed according to the speculative ratio agreed upon in the contract (Rifai, 2004).

A comparison between the structure of financing commercial banks and structure of financing Islamic banks and the impact of this on liquidity management:

Traditional bank guarantees demand deposits, time deposits, savings deposits, so its assets mainly are serious debts and the loss of an asset if it is large or medium shall make the banks unable to meet their obligations based on the level of liabilities, while the opposite happens in the shadow of Islamic financial intermediation, as demand deposits are only guaranteed, while investment deposits are employed on the basis of sharing profits and losses because their owners contribute in taking risks (Fadil and Belhadeyat, 2010).

In addition, as a result the prospects of bankruptcy or exposure to banking run cases to withdraw bank deposits in Islamic bank relatively more stable than the commercial bank. But, although the nature of the deposits include provisions for fair risk-sharing between the depositors and the Islamic bank, there is someone who sees the possibility that Islamic banks to expose to banking run as a result of the following: (Islamic Financial Services Board, 2005)

1. Rate of return is less than expected or acceptable.

2. Non-compliance of those institutions with Sharia in their contracts or different activities.

3. Concern about financial position of that bank.

4. If withdrawal is collective, it may lead the Islamic bank to the exposure of bankruptcy, so this requires good management of liquidity and enough capital.

The investment deposits in the Islamic banks are a speculative contract between the bank and the depositing customer. The latter, under the terms of the agreement, The bank does not guarantee the investment deposit nor its profits, except in the case of default and infringement, or in case of violation of the terms of the contract, and distribute the results of profits according to the actual results and according to the proportion of speculative agreed upon in the contract (Rifai, 2004)

Liquidity Risks

Liquidity the ability of the bank to provide the money needed to finance the increase in assets and meeting its obligations in due dates without incurring any unacceptable losses.

Causes of liquidity risks

Researcher has various views on causes of liquidity risks reasons, most notably the following:

1- Difficulty of current assets monetization due to increased withdrawals; this forces the institution to liquidate some of its assets less than their book value in fulfilment of those immediate commitments, which effects on profitability.

2- The first side of budget (assets) such as letters of credit and guarantee services that are done outside the budget, once the customer gets credit under which, then it appears in the budget, leading liquidity risks to arise that monetize due to selling the institution to its assets of a value less than its due worth to provide Liquidity.

3- The second side of the budget (liabilities), they are the cases of depositors' requests to withdraw their money, which forces the institution to seek its needs for cash leading it to borrow with additional cost from Central Bank-other banks- to issue more securities.

4- Different due dates, where inadequate short term deposits due dates for credit collection dates for long term clients due to the institution.

5- Imbalance between (resources-uses) inflows and outflows.

Literature Review

1. Ahlasa Study (2013) entitled "The role of accounting and financial information in managing liquidity risks" applied study.

The study aimed to clarify the importance of the role of accounting and financial information in managing liquidity risks in commercial banks, identifying the most important tools used in measuring and assessing liquidity risks, the role of regulatory bodies in monitoring liquidity risks and shedding light on the performance and functions of commercial banks to address the risks that commercial banks may expose to and reducing these risks. One of the recommendations of this study is the need to pay attention to liquidity surplus and shortage that banks may face while doing their business.

2. Al-Habib (2010) entitled “Financial Stability and Islamic Banks: Experimental analysis.”

The study examines the financial stability of Islamic banks in light of the financial crisis as a prerequisite for the continuation of their financing activities. It is clear that the Islamic banking model is less affected by the negative effects of this crisis, which qualifies it to be a real alternative in the global financial arena today.

3. Sadka (2011) entitled “Liquidity Risk and Accounting Information.”

This study aimed to show that there is a relation between accounting information and liquidity risks, most importantly of this study, it concluded:

The importance of the role of accounting information during liquidity crises, increase of information quality could reduce corporate exposure to liquidity risks and transparency, objectivity can lead to reducing uncertainty of liquidity level in corporate.

4. Iqbal (2012) entitled “Liquidity Risk Management: Comparative Study between Conventional and Islamic Banks of Pakistan.”

The purpose of this study is to consider the liquidity risk associated with, inherent in the financial institution, to assess liquidity risks management by analyzing a comparison between traditional banks and Islamic banks in Pakistan, the main findings of the study:

a. There is a positive relationship between the size of the bank and net capital with risk liquidity in both models, in addition to there is a positive relationship between return on assets and capital adequacy ratio in conventional banks, Islamic banks, but in relative terms.

b. Superior performance in asset items and return confirmed that the Islamic banks have the best profitability, liquidity and risk management.

This study showed that Islamic banks have evolved considerably in recent times and became a good alternative for traditional banks, after using Islamic tools such as Murabaha, Mushraka, Mudaraba, Salam and Istisna'a. The researcher used a descriptive analysis, where he studied all Islamic banks in Malaysia, South Africa, Jordan, Sudan, Indonesia, Qatar, Yemen, Iran, Saudi Arabia, Mauritania, Tunisia, Egypt and Bahrain. The purpose of this study is to measure the performance of Islamic banks in those countries.

Study Methodology

The researcher adopted in this study the inductive and analytical method through the following steps:

1. Identifying the problem through studying literature review, laws and resolutions regulating Islamic and commercial banking and the standards relating to them.

2. Identifying study hypotheses that represent proposed solutions to the elements study problem.

2. Identifying study hypotheses that represent proposed solutions to the elements study problem.

4. Collecting required data to test hypotheses through annual reports issued from Islamic banks and commercial banks operating in Saudi Arabia for years (2009-2013).

5. Analyzing data.

6. Testing hypotheses to reach to conclusions and recommendations.

Study Population

Study population consists of Saudi banking system, which includes Islamic banks and commercial banks operating in the Kingdom of Saudi Arabia and listed on Saudi Arabia Stock Market amounted to (12) banks, according to the Saudi financial market. (www.tadawul.com.sa, 2014 increase date: 10/11/2014).

Study Sample

Study sample included Islamic banks operating in Saudi Arabia and they are three: (Alinma Bank, Bank Albilad, Bank AlJazira) and three commercial banks: (Saudi British Bank and Riyad Bank, National Commercial Bank).

Financial ratios used in Analysis

To achieve the goal of comparing the performance of Islamic banks with commercial banks through financial ratios, the following liquidity ratios were used:

1. Current ratio.

2. Proportion of financial insolvency.

Results And Discussion

Current Ratio

This ratio refers to the ability of existing cash balances in the Fund in the Saudi Arabian Monetary Agency (Central Bank) and other banks, and any other balances, as foreign currencies in the bank to meet financial obligations of the bank, the payment due on time. This can be expressed by the following equation (Aqel, 2006):

Other liquid stocks+central bank's monetary+cash on hand=Current ratio.

Deposits and the like: The above equation shows that the higher the current ratio, the higher the bank's ability to discharge its financial obligations on time is that is there is a direct relation between the proportion of current ratio and liquidity.

Table 1 shows the current ratio of Saudi Islamic banks and commercial banks for the years under study (2009-2013), and that there is a variation in these ratios in growth and decline from year to year, this percentage in the Islamic banks in the first year is (300.6%), while in the year 2010 it decreased to reach (57%), and then it began to rise gradually as it reached (70%) in the year 2011, then it dropped in the year 2012 to reach (67%) and (64%) in the year 2013.

| Table 1 Current Ratio Of Islamic And Commercial Banks In Saudi Arabia |

||||

| Islamic Banks | Commercial Banks | |||

| Year | Arithmetic Mean | Standard Deviation | Arithmetic Mean | Standard Deviation |

| 2009 | 3.06 | 3.84 | 0.77 | 0.08 |

| 2010 | 0.57 | 0.28 | 0.66 | 0.25 |

| 2011 | 0.7 | 0.1 | 1.08 | 0.38 |

| 2012 | 0.67 | 0.12 | 1.37 | 0.73 |

| 2013 | 0.64 | 0.11 | 0.79 | 0.51 |

| Average percentage | 1.13 | 0.66 | 0.93 | 0.26 |

In addition, it is noted that current ratio of Saudi commercial banks for the years under study (2009-2013), and that there is a variation in these ratios in growth and decline from year to year, where it reached in the commercial banks in the first year (77%), while in the year 2010 it decreased to reach (66%), and then it began to rise gradually as it reached (108%) in the year 2011 and (137%) in 2012, then it dropped to reach (794%) in the year 2013.

It is noted from the results shown in Table 1, that the average percentage of current ratio for Islamic banks for the five-year period is 1.13, which is larger than the average for commercial banks, 0.93. Thus, this means that Islamic banks have higher ability to meet their obligations in circumstances without having to break their forward deposits than the ability of commercial banks. It is also noted from standard deviation that the risk of the decline in current ratio from the mean as measured by standard deviation of Islamic banks which is 0.66, that is more serious than its risk in decline for commercial banks which is 0.26. It is also noted that the highest percentage of current ratio for Islamic banks in 2009 amounting to 3.06, while the highest percentage for commercial banks in 2012 amounted to 1.37. The lowest percentage in Islamic banks in 2010 amounted to 0.57 and it amounted to 0.66 for commercial banks for the same year.

These results indicate that Islamic banks have more relative ability to meet their financial obligations and payment due on time, compared with commercial banks in study sample; this may not mean that the current ratio is low to reach insolvency.

Insolvency Percentage

It is lack of sufficient cash balances and cash equivalent balances to meet the needs of the bank, resulting in that bank is unable to meet its financial obligations on the due date, its inability to move its operational cycle or to meet contingencies requiring ready cash. This can be expressed mathematically in the following equation (Aqel, 2006):

Percentage of Insolvency=Cash and cash equivalents/Long term liabilities

Table 2 shows that the percentage of insolvency of Saudi Islamic banks and commercial banks for the years under study (2009-2013), and that there is a variation in these ratios in growth and decline from year to year, this percentage in the Islamic banks in the first year is (34%), while in the year 2010 it increased to reach (85%), and then it began to drop gradually as it reached (12%) in the year 2011, then it increased in the year 2012 to reach (17%) and then it dropped to (7%) in the year 2013.

| Table 2 Insolvency Percentage Of Islamic And Commercial Banks In Saudi Arabia |

||||

| Year | Islamic Banks | Commercial Banks | ||

| Arithmetic Mean | Standard Deviation | Arithmetic Mean | Standard Deviation | |

| 2009 | 0.34 | 0.5 | 0.1 | 0.14 |

| 2010 | 0.85 | 1.4 | 0.05 | 0.06 |

| 2011 | 0.12 | 0.1 | 0.05 | 0.05 |

| 2012 | 0.17 | 0.01 | 0.09 | 0.05 |

| 2013 | 0.07 | 0.06 | 0.03 | 0.02 |

| Gross | 0.31 | 0.35 | 0.06 | 0.06 |

It is noted that the percentage of insolvency of Saudi Islamic banks and commercial banks for the years under study (2009-2013), and that there is a variation in these ratios in growth and decline from year to year, this percentage in the Islamic banks in the first year is (10%), while in the year 2010 it dropped to reach (4%), and then it began to rise gradually as it reached (5%) in the year 2011, then it dropped in the year 2013 to reach (2%).

It is noted from the results in Table 2 that the average percentage of insolvency for Islamic banks for the five-year period is (0.31), which is larger than the average for commercial banks amounted to (0.06). Thus, this means that Islamic banks’ exposure to insolvency is lower commercial banks. It is also noted from standard deviation that the risk of the decline in insolvency from the mean as measured by standard deviation of Islamic banks which is (0.35), that is more serious than its risk in decline for commercial banks which is (0.06). It is also noted that the highest percentage of insolvency for Islamic banks in 2010 amounting to (0.85), while the highest percentage for commercial banks in (2009) amounted to (0.10). The lowest percentage in Islamic banks in (2013) amounted to (0.07) and it amounted to 0.03 for commercial banks for the same year.

These results indicate that Islamic banks have more relative ability to meet their financial obligations, payment due on time to meet the needs of the bank and its ability to move its operational cycle or to meet contingencies requiring ready cash more than commercial banks.

Testing Major Hypothesis

HO: There are no statistically significant differences of accounting information system in reducing liquidity risks between Islamic Banks and Commercial Banks at the significance level ≥ 0.05).

Results of Paired Samples t-test of accounting information system in reducing liquidity risks between Islamic Banks and Commercial Banks

The data contained in the Table 3 above show that calculated t-value is 0.074, with a tabulated value amounted to 4.303, by comparing the values obtained in testing this hypothesis, it is found that calculated value is less than tabulated value, and this is confirmed by the value of significance level of (α=0.948), which is greater than significance level (α ≥ 0.05), so alternative hypothesis is rejected and null hypothesis is accepted.

| Table 3 Testing Major Hypothesis |

||||||

| Accounting information System in Reducing Liquidity Risks | Islamic Banks | Commercial Banks | t-value | Significance Level | ||

| Arithmetic Mean | Standard Deviation | Arithmetic Mean | Standard Deviation | |||

| 0.58 | 0.26 | 0.56 | 0.21 | 0.074 | 0.948 | |

Note: t: tabulated at the significance level ≥ 0.05=4.303.

First sub-hypothesis

There are no statistically significant differences of accounting information system in reducing liquidity risks (current ratio) between Islamic Banks and Commercial Banks at the significance level ≥ 0.05).

Results of Paired Samples t-test of Accounting Information System in Reducing Liquidity Risks (current ratio) between Islamic Banks and Commercial Banks

The data contained in the Table 4 above show that calculated t-value is 0.372, with a tabulated value amounted to 4.303, by comparing the values obtained in testing this hypothesis, it is found that calculated value is less than tabulated value, and this is confirmed by the value of significance level of (α=0.745), which is greater than significance level (α ≥ 0.05), so alternative hypothesis is rejected and null hypothesis is accepted.

| Table 4 First Sub-Hypothesis |

||||||

| Accounting information System in Reducing Liquidity Risks | Islamic Banks | Commercial Banks | ||||

| Arithmetic Mean | Standard Deviation | Arithmetic Mean | Standard Deviation | t- value | Significance Level | |

| 1.13 | 0.66 | 0.93 | 0.26 | 0.372 | 0.745 | |

Note: t: tabulated at the significance level ≥ 0.05=4.303.

Second sub-hypothesis

There are no statistically significant differences of accounting information system in reducing liquidity risks (insolvency ratio) between Islamic Banks and Commercial Banks at the significance level ≥ 0.05).

Results of Paired Samples t-test of Accounting Information System in Reducing Liquidity Risks (insolvency ratio) between Islamic Banks and Commercial Banks

The data contained in the Table 5 above show that calculated t-value is 1.0942, with a tabulated value amounted to 4.303, by comparing the values obtained in testing this hypothesis, it is found that calculated value is less than tabulated value, and this is confirmed by the value of significance level of (α=0.388), which is greater than significance level (α ≥ 0.05), so alternative hypothesis is rejected and null hypothesis is accepted.

| Table 5 Second Sub-Hypothesis |

||||||

| Accounting information System in Reducing Liquidity Risks | Islamic Banks | Commercial Banks | t-value | Significance Level | ||

| Arithmetic Mean | Standard Deviation | Arithmetic Mean | Standard Deviation | |||

| 0.31 | 0.35 | 0.06 | 0.06 | 1.094 | 0.388 | |

Note: t: tabulated at the significance level ≥ 0.05=4.303.

Zuwayid (2017) on Sudanese banks, which apply the Islamic banking system, showed that accounting information systems have a role in influencing the liquidity risk, predicting potential risks and thus controlling these risks, especially if technology is used. The Kheyata's study (2013), on the Syrian banks, which apply the traditional banking system, confirmed that accounting information systems affect the effectiveness of liquidity risk management. This is confirmed by Al-Khadra (2013) and Sadka (2011) that accounting information systems are important in resolving liquidity crises and that increasing the quality of information can reduce the exposure of companies to liquidity risks.

But Brown's study (2003) and the study of Aktar et al. (2011) showed that Islamic banks have developed significantly in recent times and have become a good alternative to traditional banks, using special Islamic tools, giving them preference in profitability, Risk, compared to conventional banks.

After this discussion, we can conclude that the accounting information system has a role in reducing risks in banks, including liquidity risks, in Islamic and conventional banks. This will be confirmed or denied by this study.

Conclusion

Based on statistical analysis results and testing hypotheses, the study found a set of results that can be summarized in the following points:

1. Liquidity problem is considered one of the most serious problems facing Islamic banks because of the nature of the projects that the money is invested in them, and not dealing in interest as commercial banks do, this requires giving attention to this problem and creating alternative legitimacy solutions to it.

2. Lack of return on investment in Islamic banks resulting from cash-flow problem, makes managements of those banks seek to approach the actual cash balance to cash balance that should be and making a balance between safety and profitability.

3. There are no statistically significant differences of accounting information system in reducing.

4. There is a difference between the system of commercial banks and the Islamic banking system regarding deposit insurance. The first guarantees if the result is a loss, but the Islamic system ensures only if there is infringement.

Recommendations

According to the study findings, the most important recommendations can be summarized as follows:

1. Commercial banks have to reconsider the issue of interest, and replace it with actual investment tools, which can be reflected on society and the economy as Islamic banks do.

2. Developing accounting information systems to contribute to future predictions about banks’ liquidity position to enable management to identify potential liquidity pressure.

3. The need to pay attention to the excess liquidity in banks to use it in a variety of investment projects in order to increase bank profitability, maintaining time value of money and creating new services from time to time, and this requires to pay attention to researcher and specialists and urging them to provide new, and evolving ideas.

4. Providing adequate financial and management measurement tools in order to avoid liquidity risks for not falling into insolvency, which in turn leads to bankruptcy. Maintaining certain ratio of liquidity in the bank and keeping some semi-liquid financial investment to ensure no exposure to any liquidity crisis.

References

- Ahlaseh, N.R. (2013). Role of accounting and financial information in liquidity risk management. Applied study. Gaza, Palestine.

- Akhtar, M.F., Ali, K., & Sadaqat, S. (2011).Factors influencing the profitability of Islamic banks of Pakistan. International Research Journal of Finance and Economics, 66, 125-132

- Alhabib, Z. (2009). Financial stability and Islamic banks: Experimental analysis. Algeria

- Al-Rifai, F.M. (2004). Islamic banks, (First Edition). Halabi Rights Publications, Beirut, Lebanon.

- Annual Financial Statements of Albilad Bank (2009-2013). Retrieved from http://www.bankalbilad.com/sites/en/Reports/Pages/fstatement.aspx

- Annual Financial Statements of Alinma Bank (2009-2013). Retrieved from https://www.alinma.com/wps/portal/alinma/Alinma/MenuPages/FinancialReports/AnnualReports/!ut/p/z0/04_Sj9CPykssy0xPLMnMz0vMAfIjo8ziff0tTTy8TQy93c2cXAwcPf0MDEz9_Awt_Mz0g1Pz9AuyHRUB3FLzew!!/

- Annual Financial Statements of AlJazira Bank (2009-2013). Retrieved from http://www.baj.com.sa/about-us.aspx?page=financial-report&id=142&AspxAutoDetectCookieSupport=1

- Annual Financial Statements of National Commercial Bank (2009-2013). Retrieved from https://www.jncb.com/About-Us/Reports/Annual-Reports

- Annual Financial Statements of Riyad Bank (2009-2013). https://www.riyadbank.com/en/about-us/investor-relations/financial-results

- Annual Financial Statements of Saudi British Bank (2009-2013). Retrieved from https://www.sabb.com/en/about-sabb/investor-relations/annual-reports/

- Aqel, M.M. (2006). Banking perspective, (First Edition). Amman: Arab Society Library for Publishing and Distribution, Jordan

- Belzooz, B.A., Kunduz, A.K., & Habbar, A.R. (2013). Risk management, (First Edition). Al-Warraq Publishing and Distribution, Amman, Jordan

- Brown, K. (2003). Islamic banking comparative analysis. Arab Bank Review, 5(2), 43-50.

- Chlef, H.B.A. (2011). Sukuk and its role in managing liquidity in Islamic banks. Master Thesis.

- El Hadi, M. (2001). Information systems in contemporary organizations. Dar El Shorouq, Cairo, Egypt

- Fadil, A.Q., & Belhadiyya, A. (2010). The Islamic financial system: A tragedy or inherent trauma-The role of self-discipline discipline. 4th International Conference on Islamic Banking and Islamic Finance: Risk Management, Organization and Supervision, Sudan.

- Iqbal, A. (2012). Liquidity risk management: A comparative study between conventional and Islamic banks of Pakistan. Global Journal of Management and Business Research, 12(5), 55-64.

- Islamic Financial Services Board, (2013). Revised capital adequacy standard (IFSB 15).

- Moskov, S. (2002). Accounting information systems for decision making. Dar Al-Marikh Publishing, Riyadh.

- Sadka, (2011). Liquidity risk and accounting information. Unpublished Research, University of Jerusalem.

- Sheikh Ali, H.S.A.H., Sewing, M.K.M., & Suleiman, M.S.M. (2013). Effect of accounting information systems on the effectiveness of liquidity risk management in Syrian banks. Journal of the Development of Rafidain, 35(114), 113-134.

- Zuwayid, A. (2017). The role of accounting information systems in the management of bank credit risk. Unpublished Letter, University of Sudan.