Research Article: 2021 Vol: 25 Issue: 6

Impact of Block Chain Technology on the Process Efficiency with Reference to Financial Markets A Study

Parmeshwari Kalwani, Research Scholar, Koneru Lakshmaiah University

Dr. Vijay kumar Reddy, Associate Professor, Koneru Lakshmaiah University

Citation Information: Kalwani, P., & Reddy, K.V. (2021). Impact of Block Chain Technology on the Process Efficiency with Reference to Financial Markets – A Study. Academy of Accounting and Financial Studies Journal, 25(6), 1-11.

Abstract

The block chain technology is playing the vital role in various sector including financial sector across the globe. The present study has made an attempt in this direction to know the impact of block chain technology on the process efficiency in the financial markets. The study adopted the qualitative research methodology with the prime focus on the perception on the usage of block chain technology and impact on the adoption of technology for the efficiency improvement on financial markets. The study has framed the structured questionnaire and applied the statistical method of discriminant analysis and structure equation model. The study result found that Block chain technology will disrupt our industry. It means global transactions will influence the domestic market in capital market with the disruptive technology. The investors’ perception level observed to be higher on the Block chain technology is broadly scalable and will ultimately achieve mainstream adoption. The study made an attempt to examine the impact of block chain technology on the adoption of technology for the process efficiency in financial markets and observed that Reduction in settlement period followed by the Smart Contracts will significantly improve the process efficiency. Therefore, it has been stated that block chain technology will change the global scenario in all aspects in near future, with enhanced transparency and accountability.

Keywords

Adoption of Technology, Block-chain Technology, Financial Markets, Process Efficiency, Smart Contracts.

Introduction

Block chain technology (BC) is a novel approach to data storage. Transaction data is exchanged and modified in real-time using computer algorithms using the BC infrastructure, with no third-party interference. When combined with other technology such as big data and the Internet of Things (IoT), BC has the potential to change the way businesses exchange data and perform purchases. It also increases the traceability, validity, and credibility of the good or service. This technology has the potential to benefit various economic sectors, especially decentralized currencies such as cryptocurrencies, smart contracts, and smart land. The disintermediation triggered by BC is projected to exist in all sectors of the economy, with the financial sector being the most affected. BC may have an effect on financial management, assurance, and corporate governance. External audit block chain has the potential to enhance audit efficiency while still increasing the validity and reliability of financial statements. Advocates argue that BC has the power to radically alter the accounting and auditing industries by shifting the accountant's position "from collector and aggregator to translator and observer." As a result, auditors must consider how BC impacts the operational climate in order to assess the effect on a company's financial statements. The implementations of BC in auditing focuses on the technological strengths of the technology rather than how auditors could use it (Ahmad Jumah, 2020).

The potential of block chain to render data secure, permanent, open, and autonomous has piqued the interest of industry and academia. However, it is the social appeal of block chain more than its data processing capabilities that has piqued the interest of academics. Apart from data immutability and verifiability, the primary benefits of block chain in this context are the assurance of confidence in a trustless world and efficient peer-to-peer transactions without the requirement for a central controlling authority (“the third party”). These characteristics correspond to the logic of contemporary science: it is multinational, decentralized there is no administrative authority that determines everything and grows as a result of confidence networks within the academic community (peer review system and invisible colleges). The parallel was not lost on some early observers: “Scientific knowledge, at its core, is a massive, complex body of information and data that is collaboratively generated, changed, utilized, and exchanged, which lends itself perfectly to block chain technology.”

The appeal of block chain to industry and academia builds upon the promise to make data reliable, immutable, transparent, and decentralized. However, it is not the data handling, but the social appeal of block chain that has attracted the attention of academia. Principal advantages of block chain in this perspective, apart from the immutability and verifiability of data, is the guarantee of trust in the trustless environment and successful peer-to-peer interactions without the need for a central governing body (“the third party”). These features dovetail with the logic of modern science: it is international, decentralized there is no governing body that decides everything and develops thanks to networks of trust within the academic community (peer review system and invisible colleges). The analogy was not lost on a few early observers: “Scientific information in its essence is a large, dynamic body of information and data that is collaboratively created, altered, used and shared, which lends itself perfectly to the block chain technology”.

A diverse range of research disciplines have investigated block chain technologies. Any scholars, for example, also investigated block chain's underlying technologies, such as distributed computing, peer-to-peer networking, cybersecurity, smart contracts, and consensus algorithms.

Review of Literature

Michael Crosb (2015): This paper was developed in an accessible classroom setting as part of a curriculum lead by Prof. Ikhlaq Sidhu at UC Berkeley's Sutardja Center for Entrepreneurship & Technology. The author have focused on the Block chain Technology beyond the Bitcoin. The opinions expressed are solely those of the writers and do not constitute those of the University of California, Berkeley. The findings state that there are number of investors increasing in the bitcoin market which results the usage of the Block Chain technology enabled to many industries. To conclude, Blockchain is the infrastructure that underpins Bitcoin. The distributed ledger capability of BlockChain, combined with its stability, allows it a very appealing technology for solving current financial and non-financial business problems.

Jesse Yli-Huumo (2016): The author explanation for the interest in Blockchain is due to its core characteristics, which include confidentiality, transparency, and data integrity without any third party entity in charge of the transactions, and hence it creates interesting research areas, especially in terms of technological challenges and limitations. The results show that focus in over 80% of the papers is on Bitcoin system and less than 20% deals with other Blockchain applications including e.g. smart contracts and licensing. The bulk of research is focused on exposing and enhancing Block chain’s shortcomings in terms of safety and protection, but several of the suggested solutions ignore concrete assessment of their efficacy. Many other Blockchain scalability issues, such as throughput and latency, have gone unexplored. Researchers are given suggestions for potential research directions based on the findings of this report.

Laura Jutil (2017): The aim of this study is to provide a thorough understanding of the potential applications and challenges of blockchain technology. The thesis investigates how technology will impact and support the financial industry, which is the thesis's subject. It investigates how financial institutions will minimise risks and costs by using blockchain technologies, as well as how competitiveness among institutions would change. Since blockchain technology is a relatively recent phenomenon, there has been no study into its implications in the financial industry. As a consequence, estimations of potential outcomes are 5 unknown, and several of the predictions of what blockchain technology could allow in the future financial sector are hypotheses produced in this study.

Soonduck Yoo (2017): This paper explores the current business movements in the finance industry and associated utilities using blockchain. First, an examination of domestic and international cases reveals that the sectors where blockchains are most widely used in the finance industry are extending into arbitration, remittance, securities, and smart contracts. Simultaneously, as the ability to infringe on individuals' personal details has grown, so has the need for blockchain technologies as a result of organisations' attempts to protect it. This paper leads to a better explanation of the developments occurring in the finance industry as a result of the use of blockchain technology.

Dusko Knezevic (2018): The purpose of this paper is to conduct research on the effect of blockchain technology platforms on the financial sector through cryptocurrency, as well as the impact on other industries. This technology, as well as its industrial use, is the focus of study. To comprehend the platform, the study begins with an examination of how the technology works. Then, the benefits for market and economic transactions are identified, and finally, the paper discusses the effect of digital technology on business, including financial operations. The research findings indicate that the technology under consideration has already had a substantial effect on the financial market, that it is in the early stages of transforming several sectors, and that it is likely to transform them dramatically in the next five to ten years. Businesses are gradually discovering the potential of this technology to capitalise on the gains of the Fourth Industrial Revolution.

Sheetal Sinha (2019): The paper's aim is to perform analysis on the impact of block-chain technologies on the finance sector. The Block-chain is an immutable archive that records information facts, or, to put it another way, it is a virtual ledger containing all purchases, contracts, or other events that must be separately registered. One of the most important features of Block-chain is that this virtual database is distributed through a large number of computers and is not always guaranteed to be processed in a centralised location. The block-chain chain has already begun to shake the financial services sector, and it is this infrastructure that underpins the virtual money- bitcoin transaction. Block-chain improves data storage and transformation security, provides a shared and open network architecture, and greatly lowers operational costs. These remarkable characteristics render block-chain a very exciting and in-demand solution, even in a highly regulated industry like banking.

Ariana Polyviou(2019): In this article, we outline five separate finance market usage cases that would be fundamentally changed by the use of block chain technologies. Block chain supporters claim that these usage cases would become commonplace in the finance industry over the next decade. Initially, block chain technology was used as a public transaction database for cryptocurrencies. Beyond cryptocurrencies, block chain technology has lately been considered for a variety of other applications due to its specific properties such as decentralisation, encryption, openness, and anti-tampering. Such assets are particularly beneficial for a number of notable problems encountered in the financial field. As a consequence, block chain technology has the ability to revolutionize the banking world by altering the way various financial services are handled.

Malik Al-Essa (2019): Financial institutions are attempting to adapt to these trends by implementing different types of technologies in order to compete with the high rise in financial services demand and the massive increase in global financial market rivalry. Financial Technology (FinTech) is a modern methodology that aims to substitute conventional financial approaches in the distribution of financial services. As a result, the finance sector must assess the possibilities and threats that Blockchain Technology could bring. Blockchain technology is seen as an incentive for financial organisations and must be regarded as strategic in order for certain institutions to embrace it. The primary goal of this study is to determine the effects of Blockchain Technology on Financial Technology (FinTech).

Min Xu (2019): As a result, this thesis examines existing empirical literature on blockchain, especially in the fields of business and economics. Author investigate the top-cited papers, most productive nations, and most popular keywords using a comprehensive analysis of the literature collected from the Web of Science service. Furthermore, we do a clustering study and describe five research themes: "economic gain," "blockchain technology," "initial coin offerings," "fintech boom," and "sharing economy." This paper also includes recommendations for prospective research directions and realistic implementations. This article works on reviewing and synthesising articles in industry and economics. We want to locate the primary nodes (e.g., the most influential publications and journals) of relevant study and the core blockchain research topics in our discipline. Furthermore, we plan to make some recommendations for potential studies as well as some recommendations for companies who want to put blockchain into effect.

Aino Nordgren (2019): With the introduction of Bitcoin in 2009, block chain technology became well popular, and it has also received a lot of hype as a technology that could shake the world of financial services. Block chain has also been proposed as a potential alternative to the UK's boundary problems after Brexit. While many applaud block chain's promise to improve transaction speed and security, some are sceptical of its real-world applicability. Is block chain the internet of the future, a transformative invention, or merely a fad? This paper examines block chain technology, its uses in finance and accounting, and block chain's transformative power in these areas. Author give an outline of the criticism and roadblocks that must be overcome in order for block chain to realize its full potential.

Petrov D (2019): Blockchain and distributed ledger are concepts that have just recently been coined. Their emergence and rising prominence was mainly linked to the rapid growth of Bitcoin and other cryptocurrencies. However, the features of blockchain technology, which is built on distributed ledger technology, greatly exceed the capabilities of cryptocurrencies. The latest technology is likely to cause seismic shifts in the financial services industry. The nature of anticipated developments is framed by a comparative profile of possible possibilities and shortcomings of blockchain application in the financial domain. Nonetheless, there are a host of unanswered technical, legal, and ethical challenges that must be addressed until blockchain technology can be widely adopted. The findings and guidelines include advice for effectively addressing objective obstacles to blockchain implementation while also summarising the prerequisites for a potential evolutionary leap in the growth of the financial services sector/

Altiyev Kahramon Saidovich (2020): It should be remembered that in today's information-technology environment, it is possible to digitise the partnership between economic institutions within the global financial system and transition to e-government. Furthermore, the mainstream use of blockchain technology in public and private sector services has the potential to address a variety of economic challenges in a timely, cost-effective, and timely manner. In Uzbekistan, a variety of steps are being taken in this direction as well. The essay examines the potential applications of blockchain systems in different socioeconomic domains of society. The focus is on doing a SWOT review of the method of applying blockchain technology to corporate financial management. Furthermore, the method of applying Blockchain technology to corporate financial management, as well as the benefits and challenges, was examined.

Victor Chang (2020): This article discusses the influence and revolution of FinTech and Block-chain in the financial market, as well as the key features of such technologies. Then, author raise three important problems as well as three legal concerns about the use of Block-chain technologies. Researcher discuss the actual reasons for banks to investigate Block-chain, as well as the challenges they face. To get a thorough understanding of the market, a holistic approach was used, and sixteen experts were consulted. The findings of the study revealed that intelligence hiding was caused by affective, physiological, and cognitive tests. The interviewees also presented some guidelines and success drivers for overcoming existing Block-chain implementation challenges. As a result, four key propositions have been created. Finally, this article suggests how financial institutions can adapt to this emerging technology and how to further handle information sharing. This essay adds to the body of knowledge about the emerging entrepreneurial finance ecosystem for Block-chain.

Kohila Kanaga lakshmi (2020): A Block-chain technology is the foundation of Bitcoin, and has recently gained mainstream interest. It is also known as a distributed, irrefutable, and automated ledger since it records transactions in the same order in which they are made in near real-time. Transactions take place in a transparent way on the block-chain. Only with the consent of the network's members, defined as nodes, will additional transactions be added to the ledger. The resulting transfers may only be applied to the ledger with the consent of the network's members, defined as nodes. Block-chain implementations range from finance, digital currency and financial technology, risk control, social services, and the Internet of Things. This paper provides an overview of block-chain technologies in banking applications as well as recent advancements.

Ali (2020): New digitalization movements have totally disrupted and reshaped corporate processes, whole companies, and even whole sectors. Block chain technology is thought to be the most recent breakthrough in sectors such as finance, where confidence is critical. Block chain technology is a decentralized and coded encryption mechanism that allows for the creation of new digital services and networks using this evolving technology. A comprehensive overview of academic publications on block chain technologies in the financial industry is presented in this study. The author began by considering 227 papers and then narrowed this selection down to 87 articles. As a result, author propose a three-dimensional classification framework: block-chain enabled financial incentives, threats, and capabilities. This study explores consequences for potential block chain-related science and practice.

Kotishwar A (2020) examined the perception on the usage of blockchain technology implementation. The study used the primary data and the used the structure equation modelling. It was found that smart contract had a higher impact on the efficiency of financial transactions followed by digital currency.

Research Gap

There were many studies have focused on the block-chain technology and its importance in the various sectors

The above few mentioned reviews are in that direction. The existing extensive literature indicated that, there is a luke warm research took place in financial sector, where technology plays vital role for the seamless transactions. Few researches have focused as follows:

1. Many papers have focused on the Block chain Technology beyond the Bitcoin. The paper also stated that there are number of investors increasing in the bitcoin market which results the usage of the Block Chain technology enabled to many industries

2. Few papers were focused on the influence and revolution of FinTech and Block-chain in the financial market, as well as the key features of such technologies.

3. Few studies indicated that in today's information-technology environment, it is possible to digitise the partnership between economic institutions within the global financial system and transition to e-government.

The above mentioned reviews indicated that no research has been attempted to know the impact of Block chain technology on financial markets process efficiency. Thus, the present study is making an attempt to fill the research gap with title of “The Impact of Block Chain technology on the process Efficiency with reference to Financial Markets". The study focused on the perception on the usage of block chain technology.

Research Questions

Based on the research gap the following research questions were framed

1. Will investors have any perception on the usage of block chain technology in financial markets?

2. Does block chain technology will have any impact on the financial transactions process efficiency?

Objectives of Study

1. To examine the investors perception on the usage of block chain technology in financial markets.

2. To know the impact of block chain technology in the financial transactions process efficiency.

Hypothesis of the Study

H0: There is no impact of adoption of Block Chain on financial market process Efficiency

H1: There is an impact of adoption of Block Chain on financial market process Efficiency

Research Methodology

The study has adopted the qualitative research to examine the role of block chain technology in the financial markets transactions process efficiency. The study has considered the various papers, which were studied on the block chain technology in the capital markets aspects.

Source of Data: The study has considered the primary data for the examination of proposed objectives. The data was collected with the help of Questionnaire made by the researcher.

Sampling method: The study has taken primary data using Convenience Sampling method. Convenience sampling is a sampling method in which the first available primary data source is used without any additional study criteria. To put it another way, this sampling procedure entails locating participants wherever they can be found, which is usually wherever it is most convenient. In convenience sampling, no inclusion criteria were established prior to subject collection. Participation is open to all subjects.

Sample Units: The study has considered the equity market investment experiencing with technology knowledge. The study has considered the investors occupation is technology, who are working on the block chain technology. The study has considered the Infosys and Polaris software services companies employees, who are working on this technology and also understand the importance of block chain technology and future disruptive technologies.

Sample Size: The questionnaires were distributed to 140 and out of that 15 are partially and non-filled questionnaires have been received. Therefore, the study has considered the 125 completely filled questionnaires were considered.

Parameters Support: The present study has considered the block chain technology role in the financial markets transactions process efficiency. There were many studies have focused on the usage of block chain technology (San Frost, 2019). The study has considered the following Process efficiency of transactions related parameters such as, Faster Payments, Reduction in settlement period, Smart Contracts, Digital Record keeping, Digital Currency and Digital Assets

Questionnaire: The study has framed the questionnaire relating to two objectives. The responses were collected in likert scale structured 1 to 5 points.

Data Reliability: The study applied the Cronbach’s alpha for the primary data reliability for the questions. The calculated value observed to be 0.946, which greater than base value of 0.7. Therefore, the study can consider the primary data for the analysis.

Statistical Tools: The statistical tools used in the study were using SPSS Statistics software. The study applied the following statistical methods for the examination of framed objectives:

Discriminant Analysis: The study applied the discriminant analysis to know the investors perception on the usage of block chain technology in the financial markets transactions process efficiency. The discriminant coefficient values will depicts the level of perception of the investors fraternity.

Structure Equation Model: The study measured the impact of block chain technology on the process efficiency of the financial transactions. The study has considered the six variables based on the San Frost, 2019, which were studied on the capital markets in the US markets.

Tabulation of Data Analysis

Objective 1: To Examined the Investors Perception on The Usage of Block Chain Technology in Financial Markets

The study examined the investor’s perception of the usage of block chain technology in the financial markets. The study had applied the discriminant analysis to know the perception level based on the coefficient values. The study applied the wilks lambda test to know the fitness for the application of discriminant analysis and the result reveals that all the parameters values were fallen near to 1 i.e. strongly fit of primary data for the proposed questions. The following is the output of the discriminant analysis in Table 1.

| Table 1 Investors Perception Level on Usage of Block Chain | ||

| Parameters | Coefficients | TDS Weights |

| Executive team believes there is a compelling business case for use of block chain technology | 0.372 | 16.83 |

| Planning to replace current systems of record in block chain | 0.291 | 12.05 |

| Block chain technology is broadly scalable and will ultimately achieve mainstream adoption | 0.721 | 17.59 |

| Suppliers, customers, and/or competitors are discussing or working on block chain solutions | 0.296 | 26.82 |

| Block chain technology will disrupt our industry | 0.835 | 17.8 |

| Will lose a competitive advantage if we don't adoption of block chain technology | 0.683 | 8.91 |

The above table depicts the equity markets investors’ fraternity perception level on the usage of block chain technology. The coefficient values indicates that “Block chain technology will disrupt our industry” (0.835) followed by the parameter of “Block chain technology is broadly scalable and will ultimately achieve mainstream adoption” (0.721) are having the higher perception level among the investors on the block chain technology. The study observed that investors are having the lower perception level with the parameters such as “Planning to replace current systems of record in block chain” (0.291) followed by the “Suppliers, customers, and/or competitors are discussing or working on block chain solutions” (0.293). The study found that all the parameters coefficient values are observed to be differ with each other.

Objective – 2: To know the impact of block chain technology in the financial transactions process efficiency

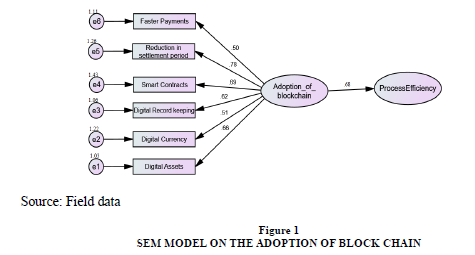

The current study have explained regarding the Block Chain Technology. The analysis considered six factors as the independent variables namely faster payments, reduction in settlement period, Smart contracts, Digital record keeping, Digital currency and Digital Assets. For this, first the model-estimated goodness of fitness index followed by model consistency, which indicates the model, is significant. Structure Equation modeling (SEM) is a set of statistical models that seeks to explain relationships between multiple variables. It helps to simultaneously analyze interrelationships between several dependent and independent variable. First of all, the reasons for choosing SEM for data analysis were, SEM has the ability to test causal relationships with multiple measuring objects between constructs. Secondly, to deal with complex systems, it provides efficient and robust statistical procedures. Finally, the hypothesized model (SEM model) have framed to test the results of the estimated and the results are presented as follows in detail.

The following table portrays the Goodness of Fit, which involves Fit statistics, Recommended and Obtained value, and the result is explained below in Table 2.

| Table 2 For Fit Index of Structural Equation Model | ||

| Fit statistic | Recommended Value | Obtained Value |

| Chi square | 6.884 | |

| Df | 5 | |

| Chi square significance | p < = 0.05 | 0.024 |

| Goodness Fit Index | >0.90 | .984 |

| Adj. Goodness Fit Index | >0.90 | .912 |

| Normed Fit indexes | >0.90 | .913 |

| Relative Fit Index | >0.90 | .863 |

| Comparative Fit Index | >0.90 | .941 |

| Tucker Lewis Index | >0.90 | .947 |

| RMSEA | <0.05 | .072 |

Goodness of fit index indicates the fitness of hypothesized model with respect to Adoption of Block chain. The result indicates that GFI (Goodness Fit Index) is 0.984 and Adjusted Goodness of fit Index is 0.912 that are observed to be above the recommended level. Normed fit Index seems to be greater than 0.913 and Relative fit index is 0.863. Goodness index like Comparative Fit index (0.941) and Tucker Lewis Index (0.947) are observe to be above the cut-off level. Root mean Square is 0.024, which implies that significant of the model. Hence, goodness of fit index concluded that the model is satisfactory in Figure 1.

Note: There are two basic requirements for the identification of any kind of SEM Model: (1) there must be at least as many observations as free model parameters (df ≥ 0), and (2) every unobserved (latent) variable must be assigned a scale (metric).

Table 3 illustrates the adoption of Block Chain on finance. The regression weights of each of the factor are explain in details as follows:

| Table 3 Regression Weights with Respect to Process Efficiency | ||||||

| Estimate | S.E | C.R | P-value | |||

| Faster payments | <--- | Adoption of Block chain | 0.5 | 0.132 | 3.787879 | *** |

| Reduction in settlement period | <--- | Adoption of Block chain | 0.781 | 0.101 | 7.732673 | *** |

| Smart Contracts | <--- | Adoption of Block chain | 0.693 | 0.117 | 5.923077 | *** |

| Digital Record keeping | <--- | Adoption of Block chain | 0.622 | 0.13 | 4.784615 | *** |

| Digital Currency | <--- | Adoption of Block chain | 0.514 | 0.162 | 3.217284 | *** |

| Digital Assets | <--- | Adoption of Block chain | 0.662 | 0.074 | 3.945946 | *** |

| Process Efficiency | <--- | Adoption of Block chain | 0.862 | 0.184 | 0.394721 | *** |

H0: There is no impact of adoption of Block Chain on financial market process Efficiency

H1: There is an impact of adoption of Block Chain on financial market process Efficiency

There are six factors considered in the Adoption of Block chain, they are faster payments, Reduction in settlement period, Smart contracts. Digital Record Keeping, Digital Currency and Digital assets. The results states the highest impact of estimate value signified to be in Reduction on Settlement period i.e. observed to be 0.781 meaning that through reducing the period of settlement there is chances of increasing the usage block chain technology, followed by Smart contracts 0.693 meaning that these are factors which effect upon the Block chain technology to improve the financial efficiency. The rest factors are Digital record keeping is 0.622 and Digital assets with 0.662 and Digital currency is tended to be 0.514 meaning that this factor through imposing currency digitally, will be useful for the growth of the economy and increase in the financial aspects. The end factor, which is obtained to be having the more influence on the adoption of the block chain is the Faster payments estimate value is tend to be 0.5 as the estimate value. The p-value is witnessed to be significant that is less than 0.05. Hence, there is a rejection of Null Hypothesis and acceptance of Alternative Hypothesis.

Findings of the Study

1. The study examined the investors’ perception on the usage of block chain technology with the discriminant analysis and the result reveals that Block chain technology will disrupt our industry (0.835). Therefore, it means global transactions will influence the domestic market in capital market with the disruptive technology.

2. The study observed that “Block chain technology is broadly scalable and will ultimately achieve mainstream adoption” (0.721) are having the higher perception level among the investors on the block chain technology.

3. The study examined the impact of block chain technology on the process efficiency with the SEM and the result states that “Reduction in settlement period” (0.781) followed by the “Smart Contracts” (0.693) are having the stronger influence on the adoption of block chain technology.

4. The adoption of block chain technology significantly influenced the process efficiency of the financial markets, as the coefficient values (0.862) indicates the higher influence has been observed.

Conclusion of the Study

The study focused on the usage of block chain technology in the financial markets in the Indian context. The study has considered the investors who are working in disruptive technology since three years and how this plays the vital role in changing the present financial markets process. The study has adopted the qualitative research and with the convenient sampling method for the collection of the primary data. The study framed the two objectives based on the research gap, which has been emerged with the literature survey. The study examined the investors perception on the usage of block chain technology in the financial markets and the applied the discriminant statistical method. The study result stated that Block chain technology will disrupt our industry. It means global transactions will influence the domestic market in capital market with the disruptive technology. The investors’ perception level observed to be higher on the Block chain technology is broadly scalable and will ultimately achieve mainstream adoption. The study made an attempt to examine the impact of block chain technology on the adoption of technology for the process efficiency in financial markets with the statistical method of structure equation model and the observed that Reduction in settlement period followed by the Smart Contracts will significantly improve the process efficiency.

Further Research Scope

There is need to do further research on the block chain technology, which is acting as a substitute to international currency dollar. Does the crypto will replace the global currencies in future with the support of block chain technology.

References

- Ali. (2020). The state of play of blockchain technology in the financial services sector: A systematic literature review, 54, Elsevier Journal, https://espace.library.uq.edu.au/ view/ UQ:232f51b

- Chang, V., Baudier, P., Zha services–The overview, challenges and recommendations from expert interviewees. Technological Forecasting and Social Change, 158, 120166.

- Crosby, M., Nachiappan, P.P., Verma, S., & Kalyanaraman, V. (2015). Blockchain technology. Sutardja Center for Entrepreneurship & Technology, 1, 2-5.

- Knezevic, D. (2018). Impact of blockchain technology platform in changing the financial sector and other industries. Montenegrin Journal of Economics, 14(1), 109-120.

- Kotishwar, A. (2020). Impact of Blockchain Technology on Efficiency of Financial Transactions. Indian Journal of Finance, 14(3), 36.

- Laura, J. (2017). The blockchain technology and its applications in the financial sector, thesis.

- Lavita, M., & Biradar, S. (2020). A Conceptual Study of Blockchain to Financial Sector. International Research Journal on Advanced Science Hub, 2(8), 112-117.

- Malik Al-Essa. (2019). The Impact of Blockchain Technology on Financial Technology. FinTech 11(5),15-29.

- Nordgren, A.I.N.O., Weckström, E.L.L.E.N., Martikainen, M.I.N.N.A., & Lehner, O.M. (2019). Blockchain in the fields of finance and accounting: a disruptive technology or an overhyped phenomenon. ACRN Oxford Journal of Finance and Risk Perspectives, 8(1), 47-58.

- Petrov, D. (2019). The impact of blockchain and distributed ledger technology on financial services. Industry 4.0, 4(2), 88-91.

- Polyviou, A., Velanas, P., & Soldatos, J. (2019). Blockchain Technology: Financial Sector Applications beyond Cryptocurrencies. In Multidisciplinary Digital Publishing Institute Proceedings, 28(1), 7.

- Saidovich, A.K. (2020). Swot Analysis of Introducing Blockchain Technology to Corporate Financial Management. Solid State Technology, 63(4), 141-149.

- Sinha, S., & Bathla, R. (2019, November). Implementation of Blockchain in Financial Sector to Improve Scalability. In 2019 4th International Conference on Information Systems and Computer Networks (ISCON) (pp. 144-148). IEEE.

- Xu, M., Chen, X., & Kou, G. (2019). A systematic review of blockchain. Financial Innovation, 5(1), 1-14.

- Yli-Huumo, J., Ko, D., Choi, S., Park, S., & Smolander, K. (2016). Where is current research on blockchain technology? a systematic review. PloS one, 11(10), e0163477.

- Yoo, S. (2017). Blockchain based financial case analysis and its implications. Asia Pacific Journal of Innovation and Entrepreneurship.

- ng, H., Xu, Q., Zhang, J., & Arami, M. (2020). How Blockchain can impact financial