Research Article: 2022 Vol: 26 Issue: 4S

Impact of boko haram-led conflict on capital flows in Nigeria: Evidence from time series data

Erkan Demirbas, University of Lincoln

Nurettin Can, Vistula University & Nile University of Nigeria

Ahmet Arabaci, Nile University of Nigeria

Citation Information: Demirbas, E., Can, N., & Arabaci, A. (2022). Impact of Boko Haram-led conflict on capital flows in Nigeria: Evidence from time series data. Academy of Accounting and Financial Studies Journal, 26(S4), 1-13.

Keywords

FDI, Boko Haram, Internal Fatalities, National Insecurity, Nigeria, Economic Growth

Abstract

This paper demystifies empirical evidence on the relationship between Boko Haram-led insurgency and capital importation in Nigeria for the period of 2010-2016. This study focuses on capital inflows since it indicates the confidence of international investors in a particular state of the Federal Republic of Nigeria in cases of insecurity caused by Boko Haram. The findings of the study show that there is an adverse relationship between the statistics of fatalities carried out by Boko Haram and FDI in Nigeria between 2010-2016, whereas this relation is not found for portfolio investment and total capital importation.

Introduction

Many reasons might affect the decisions of firms' in order to attempt FDI. They can be categorized into the aspects like delivery, need, and political. Delivery aspects are influenced by a company's expenditures. A few much significant delivery aspects, which might have an influence on company's decisions to start FDI, are production expenditures, logistics, open access to the raw materials and main technology. Additionally, corporations may involve in FDI to broaden the market for their goods (need aspect). These aspects contain client access, selling advantages, and conservation of competing profits. The aspect of politics may also involve a company's choices to make FDI. Companies may make investments in other countries to bypass their business difficulties or to gain benefits of its economic advancement incentives (Can, 2010).

According to the Doing Business Report of the World Bank's in 2020, Nigeria was placed 131st globally, for the simplicity of conducting business. Thus, it represents a surge from 149th ranking in 2019. The government has boosted developments in many subgroups like commencing a work, handling with construction authorizations, obtaining electrical power, inscribing the estate, commerce beyond the boundaries, and carrying out the deals. Nigeria seems to be one of the top-10 developers twice (Doing Business, 2020). In the report of the UNCTAD 2019 World Investment, Nigeria after Egypt and Ethiopia is the third African economic hub for FDI. The state is amid the most favourable crossroads of development in Africa and allures many investors in the areas of oil, energy, constructions etc. Some of the major capitalizing states in Nigeria include the USA, China, the United Kingdom, the Netherlands and France (UNCTAD, 2019).

The impact of FDI on the country's development cannot be overstated (Okpaga et al., 2012). Availability of enormous Foreign Direct Investment shall not only generate employment however it will also carry out as an instrument for technology development, supply skilled labor and executive approaches, make it easy for indigenous organizations' link with global markets and diversify the produced goods (Adefeso & Agboola, 2012). In recognition of these facts, many technologically advanced and growing countries have provided funds to embolden FDI in their economies (Akinde & Yusuff, 2014).

Investment is a coward. It stays only where there is the security of life and property. Government over the years has continued to make efforts that will attract FDI into the country, but the main encumbrance is national insecurity in various parts of the country. Nigeria since 2009, according to Achumba, et al., (2013) had lost up to 1000 lives to the insurgence of the infamous Islamic Sect, 'Boko Haram' in the North East. The impact of the cruel massacre is the direct reduction in the efficient population important for the relevant improvement of the economy, primarily where the statistics are seen. The recent trend of bombings in many developing countries, particularly Nigeria puts forward the concern of inland terrorism (Oriakhi & Osemwengie, 2012). Inland terrorism and social upheavals do not only deliver ambiguity in the investment and economic environment but also surges security expenditures, bring a decline in productive power, reduce tourism, damage infrastructure and dislocation of foreign direct investment which has carry out the implication for economic advancement and development of developing economies (Oriakhi & Osemwengie, 2012).

Various theories showed that the issue of terrorism in Nigeria both in terms of individual causes of the radicals, the emphasizing reasons of terrorism, and the values of the groups that contain the terrorism and sustain it. The theories usually associated terrorism in Nigeria to cultural, socio-political, religious factors (Achumba et al., 2013). The advanced grow in national insecurity in Nigeria, if not surveyed, may bear huge investor indifference for the country and small inflow of FDI. It might force institutional investors to search in other stable economies to make investments (Afolabi, 2015).

The paper aims to explore the effects of Boko Haram-led insurgency on the FDI in Nigeria. One of the novel features of this work is that the issue of Boko Haram-led conflict is empirically studied. Although there are numerous studies that analyze the effect of insurgency led by Boko Haram on economic indicators, to the best of our knowledge, none of them has moved beyond descriptive analyses. Moreover, this study decouples from previous studies by using a unique monthly data set of the number of deaths related to Boko Haram-led conflict. Furthermore, it separately studies the brunt of Boko Haram-led conflict on FDI, portfolio investment and a sum of both that is defined as capital importation. Therefore, this study significantly distinguishes from existing literature by providing an empirical analysis that demystifies the impact of Boko Haram-led conflict on capital inflows in Nigeria.

Furthermore, the structure of the paper adheres to Section 2 gives information on the history of Boko Haram in Nigeria, Section 3 review of the earlier literature. The current chapter, studies committing to literature is analyzed. Section 4 comprises the description of data, test results, and finally, the paper ends with conclusion and suggestions for future studies.

Boko Haram Insurgency and Fdi in Nigeria

Boko Haram is a militaristic terrorist group in Western Africa which is linked with Al Qaeda and Al Shabab1. Literally, the Boko Haram means that Western education is forbidden. ‘The origin of BH is questionable. The presence of this group could be traced to the mid-1990s’ (Aghedo & Osumah, 2012). The group is adopted anti-Western ideology2 and, it is struggling against the secularization of Nigeria.

Anyanwu (2014) relates the activities of this terrorist group with religious groupings which has a negative and critical influence on civil war occurrences in Nigeria and its neighbours. The sect is not only active with over 40 000 members in Nigeria but also operating in some of its neighbours, like Chad and Benin, and the Niger Republic, as well as in Somalia, Mauritania (Aghedo & Osumah, 2012); Mali (Onapajo et al., 2012). Although Boko Haram does not only attacks to Nigerian authorities, most of its deadly attacks are reported in Nigeria.

Boko Haram has become more violent after 2002. Its activities have become more violent and more frequent since 2009 (Omenma, 2020). The number of fatalities related to Boko Haram and other violent events between 2010 and 2016 is reported in Table 1. The number of causalities related to Boko Haram-led conflict reached its peak in 2014. The share of the number of deaths related to Boko Haram reached almost 60 % of total fatalities in Nigeria. The number of fatalities and its share fell dramatically after 2014.

| Table 1 Number of Deaths Related To Boko Haram and its Share in Nigeria |

|||

|---|---|---|---|

| Year | Boko Haram related death | Total fatalities in violent events | |

| Number of deaths | Share (%) | ||

| 2010 | 152 | 2.6 | 5,853 |

| 2011 | 717 | 10.7 | 6,698 |

| 2012 | 1,650 | 20.2 | 8,160 |

| 2013 | 4,859 | 37.8 | 12,848 |

| 2014 | 13,396 | 58.5 | 22,912 |

| 2015 | 9,750 | 51.9 | 18,769 |

| 2016 | 4,452 | 37.4 | 11,917 |

| Total | 34,976 | 40.1 | 87,157 |

Source: NigeriaWatch3, List of Events, Retrieved on 01.02.2020,

http://www.nigeriawatch.org/index.php?urlaction=evtListe&cherche=1

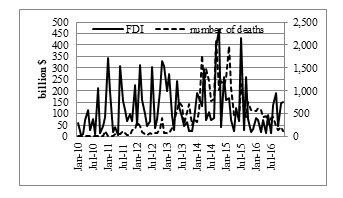

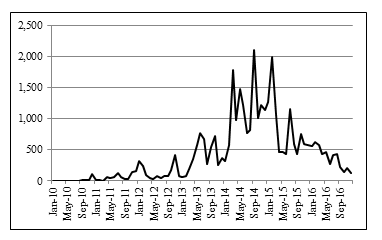

As the conflict has progressed, FDI in Nigeria fell from 469 billion USD in October 2014 to 40 billion USD in November 2014. After a concise period of recovery, it declined to 17 billion USD in November 2015 (Figure 1). This sharp decline indicates the adverse impact of the conflict on the FDI flows in Nigeria. Along with causing a decline in FDI in Nigeria, Boko Haram led tremendous economic damage in North-East of Nigeria. The annual impacts of the Boko Haram related clashes on output and inflation in the North-East were simulated between 2011 and 2015. Accumulated output loss is estimated as N1.66 trillion between 2011 and 2015, with a significant loss registered in 2012 and 2014, N464.32 billion and N447.13 billion respectively (North-East Nigeria 2016, 104).

Figure 1: Number of Deaths Related To Boko Haram And Fdi In Nigeria

Source: Central Bank of Nigeria and NigeriaWatch

Literature Review

The relationship between insecurity and investment has been studied by many researchers. There is almost a consensus that insecurity negatively correlated with investment. Some studies differentiate fatal conflicts such as terrorism and murder from other types of insecurities such as kidnapping, ethnic/religious tensions and corruption. Constantinou (2011) found out that among other crimes, only violence-related crimes significantly discourage foreign investors. Bussmann (2010) empirically demonstrates that the beginning of a critical argument unquestionably curtails the FDI fund in a country with a delay of three years. He summarizes the empirical findings as in the following: ‘A deadly attack cuts down FDI influxes, effluxes, and supply if we consider endogeneity’ (Bussmann, 2010)

An economy with various political obstacles is destined to curtail FDI funding of the market because political unpredictability jeopardizes the benefits of foreign investment, political violations, comprising terrorism, can harm foreign properties right away and reduce the production capability of a national economy in a distant future (Qian & Baek, 2011).

There is empirical evidence approving the positive correlation between terrorist attacks and FDI levels. Terrorist threats decrease expected returns to investments by putting greater impact on FDI flows (Abadier & Gardeazabal, 2008). Rasheed & Tahir (2012) also found that increasing level of terrorism decreases FDI and visa-versa. Abadie & Gardeazabal (2008) show that if the terrorist risks are high, it results in lower levels of net FDI. The following example gives detailed scientific data as further evidence. Enders & Sandler (1996) estimate that Greece and Spain experienced up to 13.5% net FDI decline due to terrorism-led insurgency.

Filer & Stanisic (2016) find a significant correlation between FDI and terrorism. According to their study, terrorism affects only FDI flows among other investment tools. The outcomes show indicates that a basic change rise up the number of terrorism-related occurrences decreases FDI inflow by 12 per cent (Filer & Stanisic, 2016).

In the African context, Ezeoha & Ugwu (2015) have also indicated similar findings. They presented the outcomes of an empirical study which includes 41 African countries. Their findings show a significant negative effect of conflicts on FDIs.

Political insecurity does reduce not only the FDI inflows but also increases the capital flight to the outside of a country. Efobi & Asongu (2016) suggest that domestic or international conflicts deteriorate the investment atmosphere by raising the insurance premium. These conflicts may also result in damaging or losing assets. Thus, investors can direct to other countries where the risks are lower. In the African case, terrorism causes greater instances of the outflowing of capital flight.

In the case of Nigeria, studies show parallel shreds of evidence. Although Nigeria benefits from its attractive location, the investment atmosphere for Nigeria is surrounded by large scale uncertainties which greatly discourage FDI (Koko et al., 2017). Koko, et al., (2017) analyzed the relationship between the FDI and several political tensions and crimes such as political violence, kidnapping, corruption, ethnic tension, religious tension and disputes with neighbouring countries. Among other criminal factors, their empirical results indicate a positive impact of political violence over FDI, significantly (Ibid, 176).

Terrorism-led insurgency destroyed the investment climate in Nigeria. Achumba, et al., (2013) explicitly argue that FDI has declined due to terrorism-related insurgency. Investors do not prefer building new companies instead of this; they intend to buy shares of quoted companies. This study assumes that this can be due to the increased Boko Haram terrorist activities.

According to the study of Ikpe (2017), on the influence of terrorism on economy national and regional economy, FDI clear inflows in Nigeria were at a diminishing tendency since 2009. Ikpe (Ibid, 392) finds a 5.8 billion USD deficit of FDI inflows from 2011 to 2015. In the same vein, the ratio of FDI inflow/GDP dramatically decreased from 5% in 2009 to 2% in 2010. This shows the severity of the negative impacts of the terrorism-led insurgency on FDI inflows.

Ikpe (Ibid, 399-400) focuses more on the development costs of the Boko Haram-led conflicts in North-East Nigeria. Terrorism created uncertainty and diverted FDI out of the region, resulting in trading sector vulnerable. Eme & Ibietan (2012) review the damage of Boko Haram-led conflict on the Nigerian economy. Their study cites the World Investment Report (WIR) of UNCTAD, which indicates $8.65 billion lost in FDI from 2009 to 2010 (Ibid, 23 quoted from Okereocha, 2012).

The empirical study about Pakistan illustrates the impact of terrorism on both FDI and business investment. Since the terrorist incidences increase, foreign investors lost their confidence and ceased FDI and eventually resulted in the withdrawing of portfolio investment (Gul et al., 2010). Another study reveals the impacts of terrorism and peace periods over portfolio investments in the Basque region of Spain. When terrorism resumed in Basque, portfolio investment has been negatively affected, comparing to peace periods in the same region (Frey et al., 2004). Terrorism-related insurgency may negatively impact the prices, sales and purchase of assets in the stock market (Oriakhi & Osemwengie, 2012 quoted from Jackson et al., 2007).

Baek & Qian (2011 quoted from Enders et al., 2006); Gaibulloev & Sandler (2011) expose little to continuing effects of terrorist assaults on FDI flows. Enders, et al., (2006) examine how transnational terrorism impacted US FDI stocks abroad. The researchers find that terrorism had little impact. Particularly, 9/11 terrorist attacks had an ongoing negative impact on US FDI flows in 69 countries apart from Turkey.

The 2010 CBN Annual Report indicates 78.1% decline in FDI due to Boko Haram-led insurgency. Although Boko Haram terrorism has created a very hostile environment for investment, the report shows that Nigeria stock market enjoyed with a promising 87.2 % rise of portfolio investment. The increase was, partly, due to depression in the Nigerian economy (Oriakhi & Osemwengie, 2012). Foreign investors maintained their large share in the Nigerian Stock Exchange in 2012 despite increasing of insurgency (Nwangu & Ononogbu, 2014 quoted from Agomuo, 2013). On the other hand, Filer & Stanisic (2016) also find that terrorism does not affect bond issuance or portfolio investment.

Data and Methodology

Our data set includes observations of the number of deaths related to Boko Haram-led conflict, capital importation that consists of FDI inflows and portfolio investment in Nigeria, crude oil prices, and inflation rate. Monthly data set of mentioned variables ranging from January 2010 to December 2016 is analyzed by EViews 11. Data of FDI, portfolio investment, capital importation, crude oil prices and inflation rate are retrieved from the statistics database of Central Bank of Nigeria4. The number of deaths related to Boko Haram-led conflict is extracted from the database of NigeriWatch.

FDI is taken as a dependent variable in this study. The number of deaths is used to measure the Boko Haram-led conflict.

Zulfiqar, et al., (2014) suggest that terrorism can be measured by summing up of all injured people or the whole number of terrorist incidents. This paper estimates the terrorism by taking the statistics of the death toll caused by terroristic attacks.

The null and alternative hypothesis of this research study is:

H01: Boko Haram-led conflict has no adverse impact on foreign direct investment in Nigeria.

H11: Boko Haram-led conflict has an adverse impact on foreign direct investment in Nigeria.

H02: Boko Haram-led conflict has no adverse impact on portfolio investment in Nigeria.

H12: Boko Haram-led conflict has an adverse impact on portfolio investment in Nigeria.

H03: Boko Haram-led conflict has no adverse impact on capital importation (that consists of FDI and portfolio investment) in Nigeria.

H13: Boko Haram-led conflict has an adverse impact on capital importation in Nigeria.

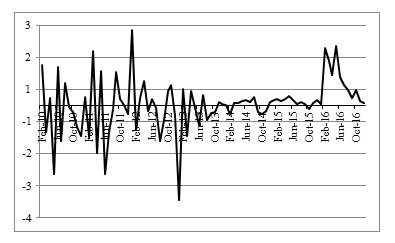

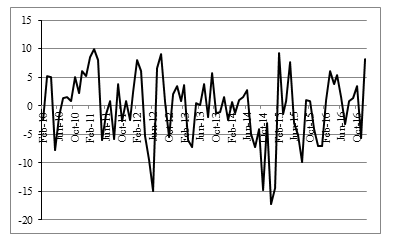

Analysis of Data

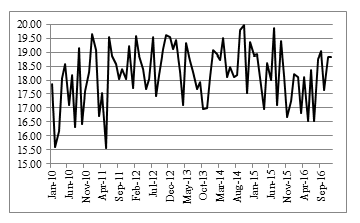

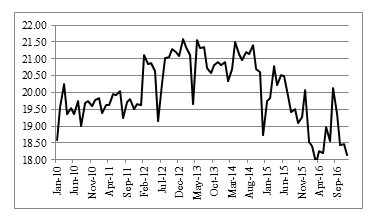

Source: Central Bank of Nigeria.

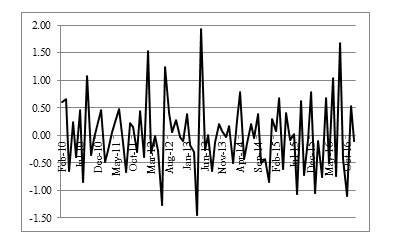

Figure 4: Logarithm of Total Capital Importation in Nigeria (Us$) (First Difference)

Source: Central Bank of Nigeria.

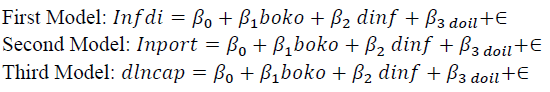

Models

We have developed three models to analyze the impact of the number of people killed by Boko Haram-led conflict on capital inflows in Nigeria. For this purpose, we have selected three dependents variables, i.e., FDI in Nigeria (first Model), portfolio investment in Nigeria (second Model), and the sum of both investments (FDI and portfolio investment) as capital importation in Nigeria (third Model).

For this purpose, we used the following multiple regression models to test these hypotheses:

Where:

lnfdi = Logarithm of foreign direct investment in Nigeria (current US$)

lnport = Logarithm of portfolio investment in Nigeria (current US$)

dlncap = First difference of logarithm of capital importation in Nigeria (current US$)

boko = number of deaths related to Boko Haram-led conflict

doil = First difference of crude oil prices

dinf = First difference of inflation

We have added the lag of dependent variables in the model to avoid serial correlation problem. Moreover, lag of independent variables is also included in each model to unveil their impact on related dependent variable. After making necessary adjustments, our models can be retyped as follows:

First Model:

Second Model:

Third Model:

Results and Interpretations

Unit Root Test

We checked the stationary of data to avoid any spurious results in our Ordinary Least Square-OLS estimation. Aiming this, Augmented Dickey Fuller-ADF unit root test is applied to check if the series have unit root or not.

lnfdi = Logarithm of foreign direct investment in Nigeria (current US$)

lnport = Logarithm of portfolio investment in Nigeria (current US$)

dlncap = First difference of logarithm of capital importation in Nigeria (current US$)

boko = number of deaths related to Boko Haram-led conflict

dinf = First difference of inflation

doil = First difference of crude oil prices

| Table 2 ADF Unit Root Test Results |

||

|---|---|---|

| Variables | t-Statistic | p-value |

| Lnfdi | -8.081203 | 0 |

| Lnport | -3.176573 | 0.025 |

| Lncap | -2.363956 (-14.14891) | 0.1551(0.0001)* |

| Boko | -3.940357 | 0.0145 |

| Inf | -0.640526(-4.933932) | 0.8548(0.0001)* |

| Oil | -1.071000 (-6.777951) | 0.7238(0.0000)* |

Owing to the fact that capital importation, inflation and crude oil prices have the p-value higher than 5% within the variables applied in the design as illustrated in Table-1, these three variables also became stationary after taking the first difference (the unit root test results for the first difference are illustrated in brackets). Remaining series i.e., logarithm of FDI, logarithm of portfolio investment and the number of deaths related to Boko Haram-led conflict are stationary at their levels.

We exhibit the estimation outcomes of the three models by OLS Method in Table 3.

| Table 3 OLS Estimation Results |

|||

|---|---|---|---|

| Independent Variable | Model 1 | Model 2 | Model 3 |

| LNFDI | LNPORT | DLNCAP | |

| lnfdi (-1) | 0.0034 (0.1087) | - | - |

| lnport(-1 | - | 0.5299*** (0.1167) | - |

| lnport(-2) | - | 0.3459*** (0.1216) | - |

| dlncap(-1) | - | - | -0.4787*** (0.1039) |

| boko | 0.0004 (0.0003) | 0.0001 (0.0002) | 0.0001 (0.0002) |

| boko(-1) | 0.0004 (0.0003) | 0.0003 (0.0002) | 0.0003 (0.0002) |

| boko(-2) | -0.0007** (0.0003) | -0.0002 (0.0002) | -0.0003 (0.0002) |

| dinf | -0.3592*** (0.1303) | -0.1451* (0.0887) | -0.1616** (0.0798) |

| dinf(-1) | 0.0439 (0.1301) | 0.0505 (0.0894) | 0.1205 (0.0756) |

| dinf(-2) | -0.1745 (0.1279) | -0.0295 (0.0888) | 0.0260 (0.0809) |

| doil | 0.0192 (0.0187) | 0.0421*** (0.0123) | 0.0353*** (0.0113) |

| doil(-1) | -0.0386* (0.0200) | 0.0056 (0.0134) | 0.0017 (0.0123) |

| doil(-2) | -0.0093 (0.0199) | 0.0091 (0.0128) | 0.0048 (0.0119) |

| C | 18.140*** (1.966) | 2.3656 (1.9057) | -0.0376 (0.0885) |

Note: Numbers in parentheses indicate the t-values. ***, **, ** denote significance at 1%, 5% and 10% respectively.

| Table 4 Statistics and Diagnostics |

|||

|---|---|---|---|

| Model 1 | Model 2 | Model 3 | |

| Prob(F-statistic) | (0.006) | (0.00000) | (0.000087) |

| R-squared | 0.28 | 0.69 | 0.38 |

| Adjusted R-squared | 0.18 | 0.65 | 0.29 |

| Durbin-Watson | 1.8 | 2 | 2.19 |

| LM Test1 | (0.09) | (0.68) | (0.12) |

| B-P-G2 | (0.92) | (0.87) | (0.51) |

| Jarque-Bera | (0.35) | (0.99) | (0.81) |

Note: 1denotes Breusch-Godfrey Serial Correlation LM Test, 2denotes Breusch-Pagan-Godfrey Test that is applied to check the Heteroskedasticity; (*) denotes that Values in parentheses under these statistics are the p-values.

Statistics and diagnostics test results related to three Models are summarized in Table 4. The F-statistics of each equation shows that our models are important at the 1% significance level. The values of R-square show that independent variables explain 28%, 69% and 38% of changes in the Models respectively. The Durbin-Watson statistics measuring the serial correlation in the residuals are obtained to be 1.8, 2 and 2.19 in Model 1, 2 and 3 respectively, which indicate that residuals are not suffering from serial correlation in all Models. The Breusch–Godfrey serial correlation LM test results also provide the same evidence that there is no following order of correspondence in the remaining of each regression. To examine the homoskedasticity assumption, we used Breusch-Pagan-Godfrey Test. We acknowledge the null hypothesis of the presence of homoskedasticity as the p-values are greater than 5% in all Models.

Moreover, Jarque-Bera test has been applied to investigate whether the residuals of the fitted models are normally distributed. As the P-values are greater than 5%, we accept the null hypothesis of normality in each Model. In summary, all Models pass the diagnostic tests for serial correlation, heteroskedasticity, and normal distribution.

We have included enough lags of all variables to satisfy the serial correlation and homo-scedasticity assumptions for time-series regressions. Regarding our assessment outcomes, there is a negative relationship between the number of deaths related to Boko Haram-led conflict and FDI flows in Nigeria in the first Model. The coefficient of the two-period lag of boko variable reveals that one increase in the number of deaths related to Boko Haram-led insurgency causes 0.07% decrease in FDI in Nigeria. This inverse relation is just observed in period t-2 among all Models. In other words, Boko Haram-conflict has no impact on portfolio investment and total capital importation in Nigeria. Inflation is found negatively oriented with dependent variables in all models in the current period. According to the table, one per cent increase in inflation causes 35%, 14% and 16% decrease in related dependent variables, i.e., FDI, portfolio and total capital importation, respectively.

In contrast, crude oil prices negatively impact on FDI in the period t-1 in Model 1, whereas this relation is found to be positive for the Model 2 and 3 in the current period. Results indicate that one dollar increase in crude oil prices cause 3.8% decrease in FDI, but it causes 4.2% and 3.5% increase in portfolio investment and total capital importation in Model 2 and 3, respectively. The lagged FDI is found to be insignificant, whereas the first two lag periods of portfolio investment have a positive impact on portfolio investment in Model 2. The lagged capital formation is found to be significant, but it has a negative impact on the dependent variable in Model 3. The negative impact of the Boko Haram-led conflict on FDI is outlined in other studies like Eme & Ibietan (2012); Ikpe (2017). According to the results, we find a negative impact of numbers of deaths on FDI as empirically shown in previous studies: Enders & Sandler (1996); Abadie & Gardeazabal (2008); Bussmann (2010); Baek & Qian (2011); Rasheed & Tahir (2012); Filer & Stanisic (2016).

Conclusion

The study investigated the impact of Boko Haram-led conflict on three methods of capital flows, i.e., FDI, portfolio investment and total capital importation. For this purpose, we applied OLS Method to analyze the relations between the number of deaths related to Boko Haram-led conflict, inflation, crude oil prices and mentioned dependent variables above by using monthly data for the period of 2010-2016. Using the database of NigeriWatch, we obtained a unique dataset of the number of deaths related to Boko Haram-led conflict in Nigeria. The results are generally important and reliable with the various theoretical frameworks. According to results, one per cent increase in inflation causes a decrease in related dependent variables, i.e., FDI, portfolio and total capital importation, respectively. In other words, Inflation is found negatively oriented with dependent variables in all models in the current period. Besides, crude oil prices have a negative brunt on FDI in Model 1, whereas this relation is found to be positive for Model 2 and 3 in the current period. Based on our assessment outcomes, there is a negative relationship between the number of deaths related to Boko Haram-led conflict and FDI inflows in Nigeria in the first Model. Our study shows that Boko Haram-led conflict has no impact on portfolio investment; this result is, therefore in accordance with Filer and Stanisic (Ibid.). Studies to follow may examine the regional impact on Boko Haram-led conflict on FDI in Nigeria. Furthermore, future studies could be conducted to explore the spill-over effects of Boko Haram on FDI flows into neighbouring countries.

Endnotes

- For more information about the identity and linkages of Boko Haram, please see: Onapajo, H., U. O. Uzodike and A. Whetho. 2012. “Boko Haram terrorism in Nigeria: The international dimension.” South African Journal of International Affairs 19 (3): 337-357. p.346; Onapajo, H. and A. A. Usman. 2015. “Fuelling the Flames: Boko Haram and Deteriorating Christian–Muslim Relations in Nigeria.” Journal of Muslim Minority Affairs 35 (1): 106-122. pp.118-119.

- About ideology of Boko Haram, please see: Oriola, T. B. and O. Akinola. 2018. “Ideational dimensions of the Boko Haram phenomenon,” Studies in Conflict & Terrorism 4 (18): 595-618.

- NigeriWatch is an organization collected data on insurgencies, such as the numbers of death, casualty or kindnappings based on particular timeframe.

- Oil prices are extracted from the official website of the Central Bank of Nigeria under the title of Crude Oil, retrieved on 27.01.2019, https://www.cbn.gov.ng/rates/crudeoil.asp

References

Abadie, A., & Gardeazabal, J. (2008). Terrorism and the world economy. European Economic Review, 52, 1–27.

Crossref , Google scholar , Indexed at

Achumba, I.C., Salome, I.O., & Akpor-Robaro. M.O.M. (2013). Security challenges in Nigeria and the implication for business activities and sustainable development. Journal of Economics and Sustainable Development, 4(2), 79-99.

Adefeso, H.A., & Agboola, A.A. (2012). Determinant of foreign direct investment in Nigeria: An empirical investigation. Journal of International Business Management, 6(1), 83-89.

Afolabi, A. (2015). The insurgence and socio-political economy in Nigeria. International Journal of Development and Economic Sustainability, 3(5), 61-74.

Crossref , Google scholar , Indexed at

Aghedo, I., & Osumah, O. (2012). The Boko Haram uprising: How should Nigeria respond? Third World Quarterly 33(5), 853-869.

Crossref , Google scholar , Indexed at

Akinde, M.A., & Yusuff, M.A. (2014). Ineffective national security administration: The implication on Foreign Direct Investment (FDI) in Nigeria. Research Journal of Finance and Accounting, 5(10), 1-9.

Crossref , Google scholar , Indexed at

Anyanwu, J.C. (2014). Oil wealth, ethno-religious-linguistic fractionalization and civil wars in Africa: Cross-country evidence. African Development Review, 26(2), 209–236.

Crossref , Google scholar , Indexed at

Bussmann, M. (2010). Foreign direct investment and militarized international conflict. Journal of Peace Research, 47(2),143–153.

Can, N. (2010). A short look at theories on international economics and growth scenario for Kazakhstan under modern theories. Alatoo Academic Studies, 5, 25-34.

Constantinou, E. (2011). Has foreign direct investment exhibited sensitiveness to crime across countries in the period 1999-2004? And if so, is this effect non-linear? Undergraduate Economic Review, 7(1), 1-31.

Enders, W., Sachsida, A., & Sandler, T. (2006). The impact of transnational terrorism on U.S. foreign direct investment. Political Research Quarterly, 59(4), 517-531.

Crossref , Google scholar , Indexed at

Efobi, U., & Asongu, S. (2016). “Terrorism and capital flight from Africa.” International Economics (148), 81-94.

Crossref , Google scholar , Indexed at

Eme, O.I., & Ibietan, J. (2012). The cost of Boko Haram activities in Nigeria. Arabian Journal of Business and Management Review (OMAN Chapter), 2(2), 10–32.

Crossref , Google scholar , Indexed at

Enders, W., & Sandler, T. (1996). Terrorism and foreign direct investment in Spain and Greece. Kyklos, 49(3), 331–352.

Crossref , Google scholar , Indexed at

Ezeoha, A.E., & Ugwu, J.O. (2015). Interactive impact of armed conflicts on foreign direct investments in Africa. African Development Review, 27 (4), 456–468.

Crossref , Google scholar , Indexed at

Filer, R.K., & Stanisic, D. (2016). The effect of terrorist incidents on capital flows. Review of Development Economics 20(2), 502–513.

Crossref , Google scholar , Indexed at

Frey, B., Luechinger, S., & Stutzer, A. (2004). Calculating tragedy: Assessing the costs of terrorism. Working Paper, No. 1341: 1-36.

Crossref , Google scholar , Indexed at

Gaibulloev, K., & Sandler, T. (2011). The adverse effect of transnational and domestic terrorism on growth in Africa. Journal of Peace Research, 48(3), 355–371.

Crossref , Google scholar , Indexed at

Gul, T.G., Hussain, A.H., Bangash, S.B., & Khattak, S.W.K. (2010). Impact of terrorism on financial markets of Pakistan. European Journal of Social Sciences, 18(1), 98-108.

Ikpe, E. (2017). Counting the development costs of the conflict in North-Eastern Nigeria: The economic impact of the Boko Haram-led insurgency. Conflict, Security &Development 5(17), 381-409.

Crossref , Google scholar , Indexed at

Jackson, B.A., Dixon, L., &. Greenfield, V.A. (2007). Economically targeted terrorism: A review of the literature and a framework for considering defensive approaches. RAND Report, 1-61.

Crossref , Google scholar , Indexed at

Koko, M.H., Aminurraasyid, Y., & Tapiwa, Z.K. (2017). Political risk and foreign direct investment in Nigeria: New empirical evidence. Accounting, 3,171–180.

Crossref , Google scholar , Indexed at

NigeriaWatch. List of Events, Retrieved on 01.02.2020.

Nwangwu, C., & Ononogbu, O. (2014). National security and sustainable economic development in Nigeria since 1999: Implication for the vision 20:2020. Journal of Educational and Social Research, 4(5), 129-142.

Crossref , Google scholar , Indexed at

Okpaga, A., Chijioke, U.S., & Innocent, O. (2012). Activities of Boko Haram and Insecurity Questions in Nigeria. Arabian Journal of Business Management Review, 1(9), 77-99.

Crossref , Google scholar , Indexed at

Okereocha, C. (2012). Heartache for the Economy. TELL, 14, 46 – 47.

Omenma, J.T., Onyishi, I.E., & Okolie, A.M. (2020). A decade of Boko Haram activities: The attacks, responses and challenges ahead. Security Journal, 33, 337–356.

Crossref , Google scholar , Indexed at

Onapajo, H., & Usman, A.A. (2015). Fuelling the flames: Boko Haram and deteriorating christian–muslim relations in Nigeria. Journal of Muslim Minority Affairs, 35(1), 106-122.

Crossref , Google scholar , Indexed at

Onapajo, H., Uzodike, U.O., & Whetho, A. (2012). Boko Haram terrorism in Nigeria: The international dimension. South African Journal of International Affairs, 19(3), 337-357.

Crossref , Google scholar , Indexed at

Oriakhi, D., & Osemwengie, P. (2012). The impact of national security on foreign direct investment in Nigeria: An empirical analysis. Journal of Economics and Sustainable Development, 3(13), 88-96.

Oriola, T.B., & Akinola, O. (2018). Ideational dimensions of the Boko Haram phenomenon. Studies in Conflict & Terrorism, 41(8), 595-618.

Crossref , Google scholar , Indexed at

Qian, X., & Baek, K. (2011). An analysis on political risks and the flow of foreign direct investment in developing and industrialized economies. Economics, Management, and Financial Markets, 6(4), 60–91.

Rasheed, H., & Tahir, M. (2012). FDI and Terrorism: Co-integration & Granger Causality. International Affairs and Global Strategy, 4, 1-5.

UNCTAD. (2020). UNCTAD 2019. World Investment Report, Geneva,

World Bank. (2016). North-East Nigeria, recovery and peace building assessment, Component Report Volume II, International Bank for Reconstruction and Development.

World Bank. (2020). Doing business.

Zulfiqar, B., Fareed, Z., Shehzad, U., Shahzad, F., & Nabi, S. (2014). The impact of terrorism on FDI inflow in Pakistan. European Journal of Economic Studies, 10(4), 279-284.

Crossref , Google scholar , Indexed at

Received: 23-Dec-2021, Manuscript No. AAFSJ-21-10593; Editor assigned: 25-Dec-2021, PreQC No. AAFSJ-21-10593(PQ); Reviewed: 07-Jan-2022, QC No. AAFSJ-21-10593; Revised: 16-Jan-2022, Manuscript No. AAFSJ-21-10593(R); Published: 23-Jan-2022