Research Article: 2018 Vol: 22 Issue: 5

Impact of Compliance with IFRS Disclosure Requirements on ERC

Basheer Ahmad Khamees, The University of Jordan

Abstract

The aim of this study is to examine the effect of compliance with IFRS disclosure requirements on Earnings Response Coefficient (ERC). The rationale behind this goal is that great compliance will lead to an increase in the information available to users which in turn will increase the response of stock returns to the earnings news. Expected and unexpected earnings and stock returns are used to test the relationship between the earnings and the stock returns response. In addition, company size and company sector are used to control the relationship between stock returns and earnings. The study population includes all public shareholding companies listed in Amman Stock Exchange during the period 2010-2013. Accordingly, an index consists of (305) disclosure requirements, has been used to collect data and to calculate a compliance score of each company. Financial data was collected from the annual reports of the companies. In addition, the publications of Amman Stock Exchange were used to calculate stock returns. Data was analysed and processed by using descriptive statistical measures, correlation, along with multiple regression. The results show that compliance with IFRS disclosure requirements modifies the form of the relationship between earnings and stock returns whether it is expected or unexpected but in two different directions. It has a negative effect on expected earnings and returns relationship, but it has a positive effect on the relationship between unexpected earnings and return relationship. The results of the study suggest that high compliance with IFRS may enable the investors to relay on other factors, in addition to expected earnings, to evaluate the expected stock returns. Meanwhile, it increases the investor's reliance on unexpected earnings to evaluate unexpected stock returns. The main limitation of the study was to consider all variables that affect stock returns, which is a function consisting of many variables. Taking into consideration all these variables and the interaction terms among them is not possible. That is because they are not known or because they cannot be quantified.

Keywords

Compliance, International Financial Reporting Standards, Disclosure, ERC.

Introduction

Investor responsiveness to earnings, or Earnings Response Coefficient (ERC), is one of the earnings quality dimensions. Theoretically, investors are expected to response to information that has value implications. The higher correlation or explanatory power between earnings and value means that earnings reflect fundamental performance. Dechow et al. (2010) includes a review of studies that tests theories related to (ERC) determinants and consequences. One of the factors that can affect earnings quality in general is the regulatory body of accounting profession. In a situation where there is no regulations and standards that supervise the earnings information production process, it is expected that investors will be unable to react to that information because it is not understandable for them. There should be a framework upon which the accounting profession can guide companies to prepare their financial statements, and at the same time can help the users of these statements to understand the information there in, and in turn to react according to it. IFRS is one of these frameworks of standards.

IRFS are a set of standards issued by the International Accounting Standards Board (IASB) based in London. They are a principles-based standards compared to the U. S. GAAP, which sometimes referred to as rules-based standards. (IASB) is the successor of International Accounting Standards Committee (IASC), which was established in 1973. The objective of establishing the IASC was to develop accounting standards that would be acceptable around the world for improving financial reporting internationally (Ankarath et al., 2010). IFRS disclosure requirements are more comprehensive and more Capital market oriented than most national GAAP. However, applying IFRS does not guarantee the accounting quality because IFRS is one among other factors that affect it. DesCaPitale that, it is expected that IFRS would enhance earnings quality. Dichev et al. (2013) for example, demonstrate that chief financial officers "(CFOs) would like standard setters to issue fewer rules, and to converge U.S. GAAP with IFRS to improve earnings quality". It was also found that reporting under IFRS reduces the level of earnings management (El-Guindy and Keasey, 2010). This emphasizes the importance of profession regulations in enhancing the relationship between earnings information and the responses of investors to this information.

The adaption of International Accounting Standards (IAS/IFRS) began long ago in Jordan. In the late 1980's this adoption was voluntary. Then, since 1997, all public shareholding companies in Amman Stock Exchange (ASE) shall use the international accounting and auditing standards to prepare its financial reports (Companies Law No. 22, 1997). However, it seems that there is no complete compliance with these standards. This is obvious from the studies conducted on the Jordanian public shareholding companies, which reveal partial compliance (for example, Horani, 2016; Hutibat et al., 2011; and Shiab, 2003). This fact indicates that companies differ among themselves in the level of compliance with IAS/IFRS. This paper explores whether this differentiation in compliance with IAS/IFRS among Jordanian shareholding companies affects the market reaction to annual earnings. Strictly speaking, the current study aims to determine the effect of the Jordanian public shareholding companies' commitment with the disclosure requirements according to IFRS on ERC.

The importance of the study stemmed from that the knowledge, resulting from examining the impact of the companies' compliance with the disclosure requirements contained in the IFRS on ERC, helps parties that are interested in applying these standards. These parties may be local, international, governmental, private, or professional bodies, such as Jordan Securities Commission, Amman Stock Exchange, and associations interested in the profession of accounting and auditing. This knowledge also helps investors and lenders, academics and financial analysts to assess the extent of which the participants in the stock market evaluate the earnings declared by companies, taking into account the compliance of these companies with the disclosure requirements of the IFRS. This may in turn enhance the commitment of companies to comply with these disclosure requirements.

This paper contributes to the international literature in several ways. Firstly, it examines the extent of compliance with IFRS disclosure requirements in an emerging market. This, along with other evidence from other emerging economies will reveal to which extent IFRS is practically acceptable as a framework under which earnings is reported. This will in turn serve the comparison between emerging and well developed economies. In addition, it provides an evidence about the responses of investors to published earnings. Moreover, the study investigates whether the compliance with IFRS can improve these responses, which is a distinctive feature of it from the literature in the area, not only on the national but also on the international level. Most prior studies examined the effect of adapting, not complying with, IFRS on earnings quality, using earnings management as a proxy for earnings quality.

The remainder of the paper is organized as follows: In addition to the previous introduction, the next section presents the relevant previous literature. Section 3 states the hypotheses of the study. Section 4 describes the companies included in the study sample. Section 5 explains the study design, including data collection and statistical methods used. Results are reported in section 6. The last section includes the conclusions, limitations and suggestions for further research.

Literature Review

Over the years stock returns-earnings relationship has been investigated from a number of different angels. Beisland (2009) reviewed the value relevance literature. He concluded that accounting information is relevant for equity investors. The most important variables he identified included book value of equity and earnings. Focusing on earnings, numerous studies of which he reviewed reveal that the value relevance of earnings is systematically under-estimated when using regression analysis. In addition, some studies argue that the relationship between earnings and stock returns is nonlinear, and this nonlinearity should be considered when applying regression analysis. Moreover, it was suggested that the value relevance of the earnings components differs from one component to another and decomposition of net income often leads to substantial increases in value relevance. The review also reveals that US studies show a declining trend in value relevance of earnings over the last decades, but non US studies do not report that. The conclusion that is of interest to the current study relates to the effects of accounting standards or methods on the value relevance of accounting information. Concerning this aspect, the review reveals that the value relevance of the balance sheet improves when fair values, rather than historical cost, are implemented. While other studies found that the value relevance of earnings decreased when historical cost is abandoned. Lim and Park (2011) argues that the increasing noise in both stock returns and earnings is responsible for the declining association between stock returns and earnings.

Actually, the relationship between earnings and stock returns has been extensively researched since the studies of (Beavers, 1968) and (Ball and Brown, 1968). Studies that searched in this relationship examined not only the effects of accounting methods on this relationship but also other factors that affect it. Beaver et al. (2015) found that the information content of earnings has increased since the release of the Sarbanes Oxley act. In addition, they found that this content positively associated with firm size, analyst coverage and profitability. Other examples of these factors are Bita risk, growth opportunities, Capital structure, and board composition. Pimentel (2015) reveals that the relationship between stock returns and earnings is positively affected by earnings persistence, but it is negatively affected by nonlinear effects of unexpected earnings and total risk. In addition, the results show that earnings-stock returns relationship is not affected by systematic risk. Hosseini et al. (2016) reveals that ERC is affected negatively by debit limit, but it is not affected by the plan executive compensation or the reduction of the executives' financial performance. Malek et al. (2016) Shows that the involvement of external auditors in the quarterly accounts has a positive effect on ERC. Cieslik (2016) demonstrates that earnings quality positively affect the returns-earnings relationship.

As a result of adopting the IAS/IFRS by the European Union in 2005, several studies have been conducted to examine the effects of that adoption. One of these studies is (Beisland and Knivsfla, 2015), which found that the change from Norwegian Generally Accepted Accounting Principles to IAS/IFRS decreases the earnings value relevance. Pimentel (2015) reveals that the full adoption of IFRS by the Brazilian companies in 2010 has no significant effect on the ERC. Another study is (Fasan et al., 2014), which found that the adoption of IAS/IFRS in 19 European countries increases the value relevance of Other Comprehensive Income. Wu et al. (2014) found that ERC is lower under Chinese GAAP than IFRS. Their results reveal that earnings reported under the Chines GAAP are less timely than those reported under IFRS before the convergence with the IFRS, and they became worse after the convergence. They concluded that the harmonization and convergence with IFRS in emerging markets may not lead to improve the quality of accounting information. Glaum et al. (2013) found that adopting IFRS by German companies improves the accuracy of analysts' forecasts. Also Cotter et al. (2012) found that the adoption of IFRS by Australian companies improves the accuracy of analysts' forecasts. In the study of (Andre et al., 2014), it was found that the mandatory adoption of IFRS in 2005 decreases the conditional conservatism in Europe. Negakis (2013) examined the effect of adopting IFRS by the Greek companies. The results show that stock returns-earnings relationship is negatively affected, in terms of earnings levels and earnings changes, by this adoption. The reduction in the value relevance of earnings in the Greek companies was attributed, mainly, to the introduction of the fair value principle. On the contrary, Landsman et al. (2012) found that adopting IFRS increased the information content of earnings in 16 countries compared to 11 countries that apply their national accounting standards. Their results also reveal that the legal enforcement by the adopting countries can strength this effect. This result enhances the idea of dealing with the adoption of IFRS in a way that examines the effect of auxiliaries on this adoption such as the legal enforcement in their study and the compliance with IFRS disclosure requirements as in the current study.

The literature of the IAS/IFRS adoption toke a farther step when it examined not only the adoption of the IAS/IFRS by all firms in a country, but also the effects of the compliance with these standards by the individual firms. For example, Demir and Bahadir (2014) examined the extent of compliance with (IFRS) by listed companies on Istanbul Stock Exchange for the year 2011. The average compliance was 79 percent. The study reveals that compliance with IFRS disclosures is positively related to companies being audited by Big 4 auditing firms, but negatively associated with the level of leverage. Finally, they found that size, age, and profitability do not explain, significantly, the level of disclosure compliance with IFRS.

The literature has also focused on identifying the impact of the introduction of the disclosure requirements according to IFRS. The results of previous studies indicate that there is conflicting evidence about the effect of these disclosures on corporate profitability, the appropriate timing for these profits, the quality of accounting, and on the financial analysts forecast accuracy. In the Philippines, for example, Ferrer and Ferrer (2011) did not find a significant relationship between the profitability measures and meeting the requirements of the financial disclosure for Philippine public shareholding companies in accordance with IFRS. The profitability ratios are return on assets, return on equity, return on sales, and the basic earnings per share. The study reached the above result desCaPitale that there is high commitment by the studied companies in the Philippines with the IFRS requirements. It was recommended that future studies would examine the impact of these disclosures on the financial performance of the company's value. Hodgdon et al. (2008) found that compliance with the disclosure requirements of IFRS reduces information asymmetry and improve the ability of financial analysts to provide more accurate forecasts. They also argue that the extent of compliance with accounting standards is as important as the standards themselves.

Hypotheses

Based on the literature reviewed previously, it is clear that - according to the researcher knowledge – the effect of the compliance with the disclosure requirements of IFRS on earningsreturn relationship is still uninvestigated. It is worth noting that the effect of IFRS compliance on the relationship between earnings and stock returns can be handled from two different aspects. One of these aspects is to examine the effect of compliance on the permanent components of earnings and stock returns, which is measured by the expected values of both of them. Under the second approach, the compliance of IFRS can be tested again to examine its effect on the transitory relationship between earnings and stock returns, which is measured by the unexpected values of both of them. Accordingly, the following two hypotheses are tested:

H1 Regressing expected stock returns on expected earnings, the level of compliance with IFRS disclosure requirements has no significant effect on earnings response coefficient.

H2 Regressing unexpected stock returns on unexpected earnings, the level of compliance with IFRS disclosure requirements has no significant effect on earnings response coefficient.

Description Of The Companies Included In The Study

Jordanian shareholding companies started their business at the beginning of the thirties of the previous century. During that time, three companies were formed, and since that time the number of public shareholding companies has been increasing. The exchange of securities among investors was limited and was not supervised by any formal agency. It was until 1976, when Amman Financial Market was established. The law of Amman Financial Market was replaced in 1990 by another law, which in turn was amended in 1992. In 1997, the Interim Securities Law No. 23 was issued. That was the beginning of a restructuring process in the Jordanian Capital market, which sought to develop it. That includes developing the pillars of the Capital market involving strengthening the investor protection and liberalizing the financial market. The issuance of this law is one of the most important features of the developments in the Jordanian Capital market. It is considered a qualitative leap and an important turning point in the market. This law aimed to improve the market in accordance with the international standards of transparency and to increase the soundness of handling of securities. The issuance of the Law resulted in replacing the Amman Financial Market with three institutions, which are the Amman Stock Exchange (ASE); the Securities Depository Center; and the Jordan Securities Commission (JSC) (Amman Stock Exchange, 2018). Acording to the records of the Jordan Securities Commission, there are 240 listed corporations on Amman Stock Exchange. These corporations, which represent the population of this study, are classified into three sectors, including financial, services, and industry. However, 50 corporations were excluded from the study sample because they were suspended or their stock prices were unavailable. This leaves 190 corporations in the sample of the study.

Jordanian corporations also have their own economic characteristics. For example, according to the World Economic Forum's Global Competitive Index 2015-2016 Rankings, Jordan ranks 64th out of 140 economies with a score of 4.23 out of 7 points. The index indicates that the Jordanian economy performance is one of the best economies in the Middle East and North Africa. The rankings show that the financial market development in Jordan ranks 71st out of 140 economies with a score of 3.84 out of 7 points. Meanwhile, the strength of investor protection ranks 121st out of 140 with a score of 4.2 out of ten points. This law investor protection motivates the adoption of the IAS/IFRS because it improves the information quality (Houqe et al., 2014). The most problematic factor for doing business in Jordan according to the above index is access to financing.

Study Design

This section reveals how the relationship between earnings and stock returns is examined taking into consideration the effect of compliance with IFRS disclosure requirements. In addition, it shows how this relationship is controlled by the company's size and company's sector. It also explains how expected (unexpected) earnings and stock returns are calculated. Finally, it illustrates how the level of compliance with IFRS disclosure requirements is calculated for each company included in the study.

The Effect of Compliance on the Relationship between Earnings and Stock Returns

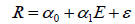

Earnings response coefficient describes the relationship between earnings and the change in a company's stock price as follows:

(1)

(1)

Where,

R: a company's stock returns.

E: a company's earnings.

α0: constant.

α1: the earnings response coefficient.

ε: random error.

This relationship can be examined in different ways. For example, the study can be conducted as an association study, in which the annual (interim) earnings are used to estimate the annual change in stock prices. Alternatively, it can be conducted as an event study, in which the annual (interim) earnings are used to estimate the change in stock prices around the earnings announcement event. Given that one of the above study types is used, still we need to determine which earnings and stock returns are going to be used. For example, are we going to use the actual earnings and stock returns, the expected earnings and stock returns, or the unexpected earnings and stock returns? In the case of using the expected (unexpected) values of earnings and stock returns, we need to determine how expected (unexpected) values are calculated, since these values can be calculated using cross-sectional or intertemporal data. In some cases when future forecasts are available to investors, expected earnings can be represented by earnings forecasts. DesCaPitale that Brown et al. (1987) argue that analysts' forecasts are better than univariate time series earnings, analysts' forecasts are not used in this study because of the unavailability of them in the Jordanian market. One of the mERits of analysts' forecasts is that it represents the expectations of the analysts about the future earnings based on the circumstances surrounding these expectations. It is like comparing the budgeted with actual numbers rather than comparing current actual numbers with previous actual numbers. Accordingly, unexpected values of earnings are computed as the differences between earnings forecasts of a given period and the actual earnings for that period.

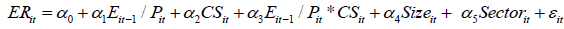

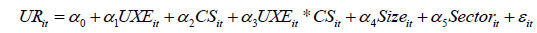

The current study is part of an on-going project supported by Deanship of Academic Research at The University of Jordan. It examines part of the story; it is not going to test all of the above alternatives. In addition, it does not aim to compare among the several alternatives of earnings, let alone the several alternatives of calculating stock returns. It aims to examine the effect of compliance with IFRS disclosure requirements on the ERC given that this coefficient is calculated in an acceptable approach. Therefore, the study is conducted as an association study, in which the annual earnings and stock returns are used. In order to take into account that effect, another variable (i.e IFRS Compliance) and its interaction effect are added. The following regression model is used to examine the relationship between stock returns and earnings along with the moderating effect of the compliance with IFRS disclosure requirements on the association between stock returns and earnings:

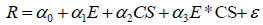

(2)

(2)

Where,

CS: compliance score for the company.

E*CS: interaction term between compliance with IFRS disclosure requirements and earnings.

α3: the incremental effect of compliance with IFRS disclosure requirements on the relationship between earnings and stock returns.

All other variables are defined above.

In the above equation, α3 is the coefficient of interest. It is magnitude will indicate how the compliance with IFRS disclosure requirements is interacted with earnings to affect stock returns. A positive and significant coefficient implies that compliance increases the responses of stock returns to earnings. The higher the coefficient, the higher the effect of compliance on responsiveness of stock returns. The sum of α1 and α3 is measuring the ERC after considering the effect of compliance with IFRS disclosure requirements.

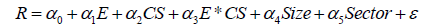

To control the relationship between earnings and stock returns, company's size and company's sector are used as control variables. It should be clarified that it is not intended here to control neither the relationship between the compliance with IFRS disclosure requirements and the response of stock returns to earnings nor the relationship between compliance and stock returns or earnings. To make it look easy, one can think about the compliance as a control variable to control for the level of firm's compliance on the relationship between stock returns and earnings. In other words, we need to know how the relationship between earnings and stock returns can be moderated by the compliance, which is a quantitative variable not categorical. Now using a control variable should serve the purpose of examining how the relationship between earnings and stock returns is affected by the moderate variable, the compliance, when controlling for the specified control variable. Using size as a control variable depends on the work of Collins and Kothari (1989). While using the company's sector depends on that prior research, generally, excludes financial institutions companies because they are subject to a whole lot of additional disclosures required by the Central Bank of Jordan and the Insurance Commission-Jordan. In addition, they have different Capital structure and ratios. After introducing the control variables, the regression model in equation (2) becomes:

(3)

(3)

Where,

Size: total assets of the company.

Sector = 1, if the company is financial and 0 otherwise.

All other variables are defined above.

Expected and Unexpected Earnings

In the process of examining the contemporaneous relationship between earnings and stock returns, it could be presumed that earnings as well as stock returns consists of two main components. One is permanent that can be expected and the other is temporary that is not expected. As a result, the relationship between earnings and stock returns can be dealt with in two ways. One could think about this relationship in a way that relates the expected earnings with the expected stock returns. Thinking in such a way leads us to examine how the permanent components of the two sides are related, but it does not reveal how the market reacts to the new information included in the earnings figures. The other way of dealing with this relationship is to link unexpected earnings with unexpected returns on the bases that abnormal react of the market is a result of the new information in earnings. Thus, abnormal stock returns are regressed on the unexpected earnings. Now this study seeks to examine how the compliance with IFRS disclosure requirements affects the market response to earnings in these two types of relationships.

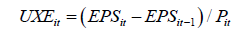

To calculate expected and unexpected earnings, earnings per share in previous period, scaled by share price at the beginning of the current period, represents the expected earnings for the current period. Subsequently, the change in earnings per share, scaled by share price at the beginning of the current period, is used as a proxy for unexpected earnings. This approach is a well-documented approach, which was developed by Collins and Kothari (1989). It assumes that earnings of previous period is the best unbiased expectation of the earnings of current period (Ariff et al., 2013). It is calculated as follows:

(4)

(4)

Where,

EPSit : earnings per share for firm (i) in the year (t).

EPSit-1: earnings per share for firm (i) in the year (t-1).

Pit: share price for firm (i) at the beginning of the 15-month return period.

The change in earnings per share could have been scaled by earnings per share in previous period. However, it was scaled by the price at the beginning of the 15-month return period to avoid having undefined values resulted from zero values of earnings per share in previous period, to avoid having very large values of unexpected earnings that result from having very small values of earnings per share in previous period, and to avoid having negative denominators.

Expected and Unexpected Returns

Expected returns can be calculated either statistically or economically. Examples of the statistical models are the Market Model and Market Adjusted Model, and examples of economic models are the Capital Assets Pricing Model (CAPM), Arbitrage Pricing Theory (APT) model and Fama and French a Three-Factor Model. Statistical models are stemmed from statistical assumptions which take into account the direction of the returns of the assets. While, the economic models depend upon assumptions that take into account the behaviour of the investors. Economic models are more preferable in practice and more comprehensive than the statistical models because of the accuracy of their results. In addition, they do not ignore statistical assumptions (Campbell et al., 1998; MacKinlay, 1997). Therefore, in this study the Capital Assets Pricing Model (CAPM) is used. It is worth knowing that a respected argument toward the CAPM is exist (for example: Keasey and Hudson, 2007; Dempsey, 2013; Moosa, 2013; and Cai et al, 2013). The researcher feels that the existence of such argument may help in interpreting the results of the study through the questionable rationality of the Capital market. The CAPM also assumes a number of simplifying assumptions. The most important assumptions are listed in (Pike and Neale, 1993). It is not intended to analyse these assumptions further in this study on the ground that such a discussion more properly belongs to the literature of economic models in general.

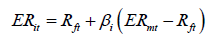

Based on the CAPM, the expected stock return for company (i) in year (t) is calculated according to the following equation:

(5)

(5)

Where,

Rft: The risk free rate in Jordan for the year (t).

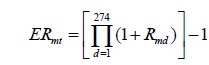

ERmt: Return for the market in the year (t); it is accumulation of the daily market return (Rmd) for (247) days, as shown in the following formula:

(6)

(6)

Where,

Rmd: The daily market return, which is calculated based on the daily general index prices, as shown in the following formula:

(7)

(7)

Where,

GIPd: the general index price on day (d), for the methodology of calculating the general index price in Amman Stock Exchange, visit their site at www.ase.com.jo/en/methodology.

GIPd-1: the general index price on day (d-1).

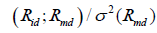

βi: the coefficient of the relationship between the security risk of company (i) to market risk.

(8)

(8)

Where:

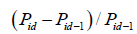

Rid : the daily stock return of firm (i) on day (d), which is calculated as follows:

(9)

(9)

Where,

Pid: the stock price of firm (i) on day (d).

Pid-1: the stock price of firm (i) on day (d-1).

(βi) is estimated for each company in the sample over three years using daily returns. Choosing the time period for beta is a controversial issue. In this study the three year period was chosen to guarantee to some extent that the beta of a company represents the current characteristics of that company. During the long periods, companies' characteristics may have changed.

Given that the expected return of company (i) was calculated for year (t), then unexpected return is found by subtracting the expected stock return from the actual return of a specific period as follows:

(10)

(10)

Where,

ARit: actual stock return for firm (i) in the year (t).

ERit: expected stock return for firm (i) in the year (t).

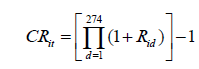

Actual stock return for firm (i) in the year (t) consists of dividends yield and Capital gains yield. Companies usually pay dividends annually, therefore, dividends yield is calculated on an annual base. But concerning the Capital gains, they are accumulated on a daily base as explained above. Then, it is assumed that these gains are reinvested. Implementing this assumption in our calculation results in compound returns. The accumulated daily stock return (CRit) is calculated as follows:

(11)

(11)

The clarification above leads us to calculate actual stock return (ARit) as follows:

(12)

(12)

Based on the Securities Law No. (76) for the year 2002, which requires that a company should provide Jordan Securities Commission with its annual report, including financial statements certified by an auditor, within 90 days of the end of its fiscal year, and because the sample companies all have December 31 year-ends, a 12-month stock return is accumulated from April 1 of year (t) to March 31 of the next year.

Construction and Scoring of Compliance Index

To examine the effect of IFRS disclosure requirements on ERC, a measure of the level of compliance with IFRS must be first established. To do so, some researchers used a selfconstructed indices, whereas some used indices developed by others. To serve the purpose of this study an index consists of (305) disclosure requirement items developed in Horani (2016) is used. The two different approaches that can be used to score the compliance index are the weighted and the un-weighted compliance indices. The first approach usually reflects the importance of each item as determined by investors through a discussion with a group of users to specify how important they regard each item according to a given scoring scale. Meanwhile under the second approach, each disclosure item is assigned a value of (1) if it is disclosed and (0) if it is not disclosed. If an item in the index is not applicable to a firm it is scored as (not applicable). This approach is commonly known as the “dichotomous” (Cooke, 1992) and it has been employed in many previous studies (i.e. Shiab, 2003; and Tsalavoutas et al., 2010).

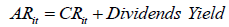

In this study the un-weighted 'dichotomous' approach is used because it is preferable when each item of IFRS mandatory disclosure is equally important among different users of financial statement (Cooke, 1992), which is the case of this study. It is not directed to a specific user group. The compliance score of each company is computed in two steps. In the first step the total number of disclosure is calculated as follows:

(13)

(13)

Where,

TDi: Total number of disclosures for firm (i).

dj: (1) if the item is disclosed; (0) if the item is not disclosed; and not applicable (N/A) is assigned if an item is not applicable to firm (i).

n: the disclosure items specified in the index, which is 305.

the second step, the company’s relative disclosure level is measured. This level is the ratio of a company’s total number of disclosures (TDi) made in the company’s annual financial statements divided by the maximum score that the company could achieve by fully complying with IFRS mandatory requirements.

(14)

(14)

Where,

CSi : Compliance score for firm (i).

CDi : Amount computed using equation 13.

nj : number of items expected to be disclosed.

The company has a high level of compliance with the IFRS disclosure requirements when the value of the index approaches (1). One important issue in scoring the index is to decide whether a certain item is applicable to a given company. To deal with this problem, a precious reading of the whole contents of the annual financial reports should be done first to make a judgment as whether a particular item is relevant. This methodology was used by prior disclosure studies (e.g. Hossain, 2008). This procedure prevents the researcher from penalizing the company under investigation because it does not disclose an irrelevant item to its activities.

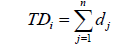

Building on the above equations, the two hypotheses of the study will be tested according to the following two equations, respectively:

(15)

(15)

(16)

(16)

Study Results

This section reveals the results of the study, which encompassed all of the Jordanian corporations listed in Amman Stock Exchange. The sample varied in the size and sector. Companies ranged in size from small (Total Assets=JOD 807,163) to large (Total Assets=JOD 24,538,372,000), with most companies being of intermediate size (Mean=JOD 319,358,782 & Median=JOD 23,091,449). More than 50% of the companies (103 companies) were nonfinancial companies, and the rest of the samples were financial companies (87 companies). The descriptive statistics of the study variables are presented in Table 1. It can be seen from Table 1 that earnings, whether expected or unexpected, has a higher standard deviation than expected stock returns. Concerning unexpected stock returns, it has the highest standard deviation. The mean of the compliance score is 78.63%.

| Table 1 Descriptive Statistics Of The Study Variables |

|||||

| Minimum | Maximum | Mean | Median | Std. Deviation | |

| ERit | 0.22% | 5.71% | 2.88% | 3.03% | 0.0083 |

| Eit-1/Pit | -145.80% | 224.76% | -0.57% | 3.12% | 0.2635 |

| URit | -65.27% | 370.27% | 6.55% | -1.94% | 0.4954 |

| UXEit | -223.86% | 159.56% | 1.07% | 0.54% | 0.2540 |

| CSit | 45.74% | 96.99% | 78.63% | 80.18% | 0.0996 |

| Eit-1/Pit*CSit | -1.1406 | 1.5113 | -0.0052 | 0.0226 | 0.1975 |

| UXEit*CSit | -1.5053 | 1.2482 | 0.0098 | 0.0033 | 0.1901 |

To test the hypotheses of this study two hierarchal regression models were run. In the first model, expected earnings are regressed on expected stock returns. In the second model, unexpected earnings are regressed on unexpected stock returns. The usage of hierarchal regression resulted from the interest of this study, which aims to determine whether the compliance with IFRS affects the relationship between earnings and stock returns. In each regression model control variables were interred first, then earnings and the compliance score, and finally the interaction term. The proportion of explained variance in stock returns(R2) is calculated three times. The critical (R2) is that of the third regression in each model, which includes the interaction term of compliance score. It should have a statistical significant change comparing with regression 2. This approach is used to show the incremental explanation of the moderating effect (if it exists). It is worth retrieving that the statistical significance of α3 in Equation 3 determines the moderating effect of compliance with IFRS.

The results in Table 2 reveal that the difference of (R2) between regression 2 and 3 is statistically significant at 0.05 levels, which means that the interaction term of the compliance with IFRS in regression 3 explains the expected stock returns above and beyond the control variables, expected earnings and compliance score in regression 2. The added variable in regression 3 explains an additional 2.3% of the variation of the variance in expected stock returns. The results also show that the Durbin-Watson statistic is 1.526, which indicates that the autocorrelation in the sample is positive, but it does not raise an alarm that there is an autocorrelation in the data because the value is above 1.5. The critical value for the Durbin-Watson static in this study sample is 1.66 at level of significance equals 0.05. To reduce autocorrelation, variables were transformed. This transformation increased the Durbin-Watson value to 1.62.

| Table 2 Expected Earnings & Stock Returns Model Summaryd |

||||||||||

| Model | R | R Square |

Adjusted R Square |

Std. Error of the Estimate |

R Square Change |

Change Statistics | Sig. F Change |

Durbin- Watson |

||

| F Change | df1 | df2 | ||||||||

| 1 | 0.160a | 0.025 | 0.015 | 0.0082698 | 0.025 | 2.441 | 2 | 187 | 0.090 | |

| 2 | 0.295b | 0.087 | 0.067 | 0.0080466 | 0.062 | 6.259 | 2 | 185 | 0.002 | |

| 3 | 0.331c | 0.110 | 0.085 | 0.0079687 | 0.022 | 4.636 | 1 | 184 | 0.033 | 1.526 |

a. Predictors: (Constant), Sector, Size

b. Predictors: (Constant), Sector, Size, Eit-1/Pit, CS

c. Predictors: (Constant), Sector, Size, Eit-1/ Pit, CSit, Eit-1/Pit*CSit

d. Dependent Variable: ERit

As for multicollinearity, one of its common causes is the interaction term included in a regression model. It is well documented in the literature that high correlation is likely to occur between it and the other independent variables in the model (Afshartous and Preston, 2011). In this study the results show that the correlation between the interaction term and the expected earnings is very high (0.995). In addition, the results reveal that the Variance Inflation Factor (VIF) for the interaction term and the expected earnings is 115.492 and 115.629, respectively. This may indicate that multicollinearity is a serious problem in the study. This problem was solved by centering both of the expected earnings variable and the compliance score variable. This solution resulted in reducing the correlation between the interaction term and expected earnings to -0.488 and reducing the VIF of the interaction term and the expected earnings to 1.387 and 1.329, respectively. Table 3 shows that Variance Inflation Factor (VIF) does not exceed 5 for all of the study variables, which indicates that multicollinearity is no longer a problem in the study sample. A related point to consider is that centring did not affect the unstandardized coefficient of the interaction term nor its statistical significance.

| Table 3 Results Of Regressions Between Expected Earnings & Stock Returnsa |

||||||||

| Model | Unstandardized | Standardized | t | Sig. | Collinearity Statistics | |||

| Coefficients | Coefficients | |||||||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| (Constant) | 0.030 | 0.001 | 36.580 | 0.000 | ||||

| 1 | Sector | -0.002 | 0.001 | -0.124 | -1.705 | 0.090 | 0.982 | 1.018 |

| Size | -3.748E-13 | 0.000 | -0.085 | -1.167 | 0.245 | 0.982 | 1.018 | |

| (Constant) | 0.030 | 0.001 | 37.424 | 0.000 | ||||

| Sector | -0.002 | 0.001 | -0.106 | -1.490 | 0.138 | 0.977 | 1.024 | |

| 2 | Size | -4.690E-13 | 0.000 | -0.106 | -1.469 | 0.144 | 0.942 | 1.062 |

| EPSit-1/Pit | 0.008 | 0.002 | 0.248 | 3.520 | 0.001 | 0.991 | 1.009 | |

| CSit | 0.003 | 0.006 | 0.035 | 0.493 | 0.622 | 0.961 | 1.041 | |

| (Constant) | 0.030 | 0.001 | 37.221 | 0.000 | ||||

| Sector | -0.001 | 0.001 | -0.087 | -1.220 | 0.224 | 0.961 | 1.040 | |

| 3 | Size | -4.186E-13 | 0.000 | -0.095 | -1.320 | 0.188 | 0.936 | 1.068 |

| EPSit-1/Pit | 0.005 | 0.003 | 0.164 | 2.041 | 0.043 | 0.753 | 1.329 | |

| CSit | 0.005 | 0.006 | 0.060 | 0.833 | 0.406 | 0.937 | 1.068 | |

| EPSit-1/Pit*CSit | -0.068 | 0.032 | -0.176 | -2.153 | 0.033 | 0.721 | 1.387 | |

a. Dependent Variable: ERit

In addition, extreme values were deleted and variables were transformed to approach normality. It should be emphasized here that deleting extreme values is not a blindly process, because the existence of these values within the data may distort the distribution of study variables if they are due to an error in data entry or calculation of variables, or if they result from a heterogeneous classification of some companies within sectors or from unusual or unanticipated values of certain items in the financial statements. On the other hand, the exclusion of these values is likely to distort the distribution of study variables if these values are nature and are expected to occur. Therefore, these values were investigated with caution before deciding to exclude them. Data was also transformed using square values, cubic roots, shifted locations along with logarithm. These methods were applied with due consideration to positive and negative values of data.

The results in Table 3 also reveal that the compliance with IFRS has an effect on ERC. The unstandardized coefficient of the interaction term is negative and significant at 0.05 level. This means that compliance with IFRS decreases the effect of expected earnings on the expected stock returns. This result leads to reject hypothesis 1. It can be inferred from this result that the level of compliance with IFRS disclosure requirements has a significant incremental effect on ERC, which means it moderates the relationship between expected earnings and expected returns. But, is it a pure moderating? According to Sharma et al. (1981), yes it is because it is not a predictor variable in the regression, meanwhile, expected earnings per share variable is a significant predictor variable. If compliance level was a predictor variable it would cause a problem in determining if it moderates the relationship between earnings and returns or that earnings is the variable that moderates the relationship between compliance level and stock returns. But can earnings, theoretically at least, be a moderator to the relationship between compliance with IFRS and stock returns? The answer would be yes, it can. One could argue that stock returns would be more positively affected by compliance when a company has higher earnings because high earnings would boost the credibility of this compliance, meanwhile, it would be more negatively affected by compliance in low earnings companies because compliance with IFRS would show how severe the low earnings is. This argument emphasizes the need for the compliance level to not be a predictor variable.

The results in Table 4 reveal that the difference of (R2) between regression 2 and 3 is statistically significant at 0.01 level, which means that the interaction term of the compliance with IFRS in regression 3 explains the unexpected stock returns above and beyond the control variables, unexpected earnings and compliance score in regression 2. The added variable in regression 3 explains an additional 4.2% of the variation of the variance in unexpected stock returns. The results also show that the Durbin-Watson statistic is 2.041, which indicates that there is no autocorrelation in the sample. As far as hypothesis 2 is concerned, the unstandardized coefficient of the interaction term is positive and significant at 0.01 level. This means that compliance with IFRS increases the effect of unexpected earnings on the unexpected stock returns. This result leads to reject hypothesis 2.

| Table 4 Unexpected Earnings & Stock Returns Model Summaryd |

||||||||||

| Model | R | R Square | Adjusted R Square |

Std. Error of the Estimate |

R Square Change | Change Statistics | Sig. F Change |

Durbin- Watson |

||

| F Change | df1 | df2 | ||||||||

| 1 | 0.156a | 0.024 | 0.014 | 2.0585 | 0.024 | 2.314 | 2 | 185 | 0.102 | |

| 2 | 0.207b | 0.043 | 0.022 | 2.0500 | 0.019 | 1.770 | 2 | 183 | 0.173 | |

| 3 | 0.299c | 0.089 | 0.064 | 2.0052 | 0.046 | 9.252 | 1 | 182 | 0.003 | 2.041 |

a. Predictors: (Constant), Sector, Size

b. Predictors: (Constant), Sector, Size, UXEit, CSit

c. Predictors: (Constant), Sector, Size, UXEit, CSit, UXEit*CSit

d. Dependent Variable: URit

It can be inferred from this result that the level of compliance with IFRS disclosure requirements has a significant incremental effect on ERC in terms of unexpected earnings and unexpected stock returns. In all cases, it seems that earnings response to stock returns. This is consistent with (Farooq et al., 2018; Park, 2018; & Herwaty, 2018).

Summary And Conclusions

The empirical results of this study show that earnings-returns relationship is affected by the compliance with IFRS disclosure requirements, whether this relationship is expressed in terms of expected earnings and expected returns or by unexpected earnings and abnormal returns. In addition, the results show that compliance affects the above relationship in two different ways. High compliance weakens the effect of the permanent component of earnings on the permanent component of stock returns. It seems that when more disclosure is available this allows the investors to relay on other indicators rather than earnings to evaluate the expected or the permanent component of the company's value. Concerning the transitory components of both earnings and returns, the results show that more compliance with the disclosure requirements will amplify the response of the market to the new information reflected by earnings. This indicates that compliance helps the investors in valuing the change in earnings.

The main limitation of the study was to consider all variables that affect stock returns, which is a function consisting of many variables. Taking into consideration all these variables and the interaction terms among them is not possible. That is because they are not known or because they cannot be quantified.

Behind the scenes, one can think about the factors that can reinforce the effect of compliance like the financial regulations and the characteristics of the organisations and the market. These factors include, but not limited to, the corporate governance, investor protection, and the efficiency of the Capital market. Thus, to maximize the benefits of IFRS, in terms of improving the market response to earnings, the institutional features of Jordanian market that are presented in section 3 could enhance the quality of accounting information arising from the proper compliance with the disclosure requirements of IFRS.

Recently, the Jordanian market has witnessed the issuance of the Securities Law No. 18 of 2017 effective on May the 16th 2017. Based on this law, Jordan Securities Commission has been working on issuing the regulations stipulated in it, such as: rules of governance of public shareholding companies and companies subject to the control of the Commission including financial services companies, investor protection schemes, public funds, mutual funds companies, the solvency criteria of financial services companies, the licensing of financial services companies and the accreditation of authorized persons, a system for the transfer of regulatory powers provided for in the Companies Act, and the conditions and requirements for the self-listing of the financial market and the amendment of the disclosure instructions. This law and its instructions aim to adopt new methods in dealing with securities, protecting investors, diversifying investment tools, and encouraging openness to international financial markets. Future research could be directed to examine the effect of such factors that could affect earnings quality.

Acknowledgement

This research paper is part of a project funded by the Deanship of Academic Research at the University of Jordan.

References

- Afshartous, D., & Preston, R.A. (2011). Key results of interaction models with centering. Journal of Statistics Education, 19(3), 1-24.

- Amman Stock Exchange (2018). Capital markets profile. Retrieved from www.ase.com.jo/en/Capital-markets-profile.

- André, P., Filip, A., & Paugam, L. (2014). Impact of mandatory IFRS adoption on conditional conservatism in Europe.Working paper.

- Ankarath, N., Mehta, K.J., Ghosh, T.P., & Alkafaji, Y.A. (2010). Understanding IFRS fundamentals: International financial reporting standards. John Wiley & Sons.

- Ariff, M., Fah, C.F., & Ni, S.W. (2013). Earnings response coefficients of OECD banks: Tests extended to include bank risk factors. Advances in Accounting, 29(1), 97-107.

- Ball, R., & Brown, P. (1968). An empirical evaluation of accounting income numbers. Journal of Accounting Research, 6(2), 159-178.

- Beaver, W.H. (1968). The information content of annual earnings announcements. Journal of Accounting Research, 6(3), 67-92.

- Beaver, W.H., McNichols, M.F., & Wang, Z.Z. (2015). The information content of earnings announcements: new insights on intertemporal and cross-sectional behavior. Working Paper.

- Beisland, L.A. (2009). A review of the value relevance literature. The Open Business Journal, 2(1), 7-27.

- Beisland, L.A., & Knivsflå, K.H. (2015). Have IFRS changed how stock prices are associated with earnings and book values? Evidence from Norway. Review of Accounting and Finance, 14(1), 41-63.

- Brown, L.D., Hagerman, R.L., Griffin, P.A., & Zmijewski, M.E. (1987). Security analyst superiority relative to univariate time-series models in forecasting quarterly earnings. Journal of Accounting and Economics, 9(1), 61-87.

- Cai, C.X., Clacher, I., & Keasey, K. (2013). Consequences of the Capital asset pricing model (CAPM)-a critical and broad perspective. Abacus, 49(S1), 51-61.

- Campbell, J.Y., Lo, A.W., MacKinlay, A.C., & Whitelaw, R.F. (1998). The econometrics of financial markets. Macroeconomic Dynamics, 2(4), 559-562.

- Cieslik, R. (2016). Effect of earnings quality on the returns-earnings relationship: evidence from the warsaw stock exchange. University of Warsaw, Faculty of Management Research Reports, 2(22), 60-77.

- Collins, D.W., & Kothari, S.P. (1989). An analysis of intertemporal and cross-sectional determinants of earnings response coefficients. Journal of Accounting and Economics, 11(2-3), 143-181.

- Cooke, T.E. (1992). The impact of size, stock market listing and industry type on disclosure in the annual reports of Japanese listed corporations. Accounting and Business Research, 22(87), 229-237.

- Cotter, J., Tarca, A., & Wee, M. (2012). IFRS adoption and analysts’ earnings forecasts: Australian evidence. Accounting & Finance, 52(2), 395-419.

- Dechow, P., Ge, W., & Schrand, C. (2010). Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics, 50(2), 344-401.

- Demir, V., & Bahadir, O. (2014). An investigation of compliance with international financial reporting standards by listed companies in Turkey. Accounting and Management Information Systems, 13(1), 4.

- Dempsey, M. (2013). The Capital asset pricing model (CAPM): The history of a failed revolutionary idea in finance? Abacus, 49(S1), 7-23.

- Dichev, I.D., Graham, J.R., Harvey, C.R., & Rajgopal, S. (2013). Earnings quality: Evidence from the field. Journal of Accounting and Economics, 56(2), 1-33.

- El-Guindy, M., & Keasey, K. (2010). IFRS reporting, audit quality and earnings management: UK evidence. Working paper, University of Leeds.

- Farooq, O., Shehata, N.F., & Nathan, S. (2018). Earnings response coefficient in the MENA region. Applied Economics Letters, 25(16), 1147-1152.

- Fasan, M., Fiori, G., & Tiscini, R. (2014). OCI value relevance in continental Europe: An examination of the adoption of IAS 1 revised. Academy of Accounting and Financial Studies Journal, 18(4), 17.

- Ferrer, R.C., & Ferrer, G.J. (2011). The relationship between profitability and the level of compliance to the international financial reporting standards (IFRS): An empirical investigation on publicly listed corporations in the Philippines. Academy of Accounting and Financial Studies Journal, 15(4), 61.

- Glaum, M., Baetge, J., Grothe, A., & Oberdörster, T. (2013). Introduction of international accounting standards, disclosure quality and accuracy of analysts' earnings forecasts. European Accounting Review, 22(1), 79-116.

- Herawaty, V. (2018). The effect of environmental performance and accounting characteristics to earnings informativeness. Conference Series: Earth and Environmental Science, 106(1).

- Hodgdon, C., Tondkar, R.H., Harless, D.W., & Adhikari, A. (2008). Compliance with IFRS disclosure requirements and individual analysts’ forecast errors. Journal of International Accounting, Auditing and Taxation, 17(1), 1-13.

- Horani, A. (2016). The effect of compliance with IFRS on value relevance of accounting information: Evidence from Jordan. UnpublishedMaster’s Thesis, University of Jordan.

- Hossain, M. (2008). The extent of disclosure in annual reports of banking companies: The case of India. European Journal of Scientific Research, 4(23), 660-681.

- Hosseini, M., Chalestori, K.N., Hi, S.R., & Ebrahimi, E. (2016). A study on the relationship between earnings management incentives and earnings response coefficient. Procedia Economics and Finance, (36), 232-243.

- Houqe, M.N., Easton, S. & van Zijl, T. (2014). Does mandatory IFRS adoption improve information quality in low investor protection countries?. Journal of International Accounting, Auditing and Taxation, 23(2), 87-97.

- Hutaibat, K., Alberti, L.V., & Hutaibat, K. (2011). The extent of listed manufacturing companies' compliance with mandatory requirements: Evidence of IAS-List from Jordan. Jordan Journal of Business Administration, 7(4), 709-736.

- Keasey, K., & Hudson, R. (2007). Finance theory: A house without windows. Critical Perspectives on Accounting, 18(8), 932-951.

- Landsman, W.R., Maydew, E.L., & Thornock, J.R. (2012). The information content of annual earnings announcements and mandatory adoption of IFRS. Journal of Accounting and Economics, 53(1), 34-54.

- Lim, S.C., & Park, T. (2011). The declining association between earnings and returns: Diminishing value relevance of earnings or noisier markets? Management Research Review, 34(8), 947-960.

- MacKinlay, A.C. (1997). Event studies in economics and finance. Journal of Economic Literature, 35(1), 13-39.

- Malek, M., Saidin, S.F., Osman, H., & Noor, M. (2016). Audited quarterly accounts and earnings response coefficients. DLSU Business & Economics Review, 25(2), 53-62.

- Moosa, I.A. (2013). The Capital asset pricing model (CAPM): The history of a failed revolutionary idea in finance? Comments and extensions. Abacus, 49(S1), 62-68.

- Negakis, C.I. (2013). The explanatory power of earnings for stock returns in the pre-and post-IFRS era: Some evidence from Greece. Managerial Finance, 39(9), 814-824.

- Park, H. (2018). Market reaction to other comprehensive income. Sustainability (Switzerland), 10(6).

- Pike, R., & Neale, B. (1993). Corporate finance and investment, decisions and strategies. New York, Prentice Hall.

- Pimentel, R.C. (2015). Unexpected earnings, stock returns, and risk in the brazilian Capital market. Revista Contabilidade & Finanças, 26(69), 290-303.

- Sharma, S., Durand, R.M., & Gur-Arie, O. (1981). Identification and analysis of moderator variables. Journal of Marketing Research, 18(3), 291-300.

- Shiab, M. (2003). Financial consequences of IAS adoption: The case of Jordan. Unpublished Ph.D. thesis, University of Newcastle Upon-Tyne, UK.

- Tsalavoutas, I., Evans, L., & Smith, M. (2010). Comparison of two methods for measuring compliance with IFRS mandatory disclosure requirements. Journal of Applied Accounting Research, 11(3), 213-228.

- World Economic Forum (2015). The global competitiveness report 2015-2016. Retrieved from www3. weforum.org/docs/gcr/2015-2016/Global Competitiveness Report 2015- 2016.

- Wu, G.S.H., Li, S.H., & Lin, S. (2014). The effects of harmonization and convergence with IFRS on the timeliness of earnings reported under Chinese GAAP. Journal of Contemporary Accounting & Economics, 10(2), 148-159.