Research Article: 2017 Vol: 21 Issue: 3

Impact of Credit Cards and Debit Cards on Currency Demand and Seigniorage: Evidence From India

Kalluru Reddy, Gokhale Institute of Politics & Economics

Keywords

Currency Demand, Seigniorage, Banks, Electronic Cards, ARDL, India.

JEL

E41; E42; G21

Introduction

In recent years, electronic payment instruments such as credit cards, debit cards and prepaid instruments in banking transactions have attracted attention of academicians as well as regulators. It is because of mainly two reasons: (i) there is a high potential that the electronic payment instruments can substitute cash and can affect the amount of currency that a central bank should keep in circulation. (ii) If so, that would affect independence of monetary authority since a decreasing amount of currency in circulation would lead to a reduction in seigniorage, the revenue that a central bank earns from having a complete control over issuing currency notes in the country. As a result, central banks may be forced to rely on financial support of governments for their operational needs and hence, that affects independence of their monetary policy decisions (Friedman, 1999; Freedman, 2000; Goodhart, 2000; Woodford, 2000; Kroszner, 2003). As to Humphrey et al. (2004) any considerable reduction in the quantity of currency in circulation due to its substitutes, as the currency is an interest-free loan to central bank, would lead to a large repayment of loan and thus reduce seigniorage revenue of the central bank.

The existing literature on currency demand analysis largely focuses on the opening of economies, internationalization of capital markets and changes in exchange rate regimes (Sriram, 2001; Knell and Stix, 2006). Recent innovations in banking and payment systems have changed the research focus from the traditional money demand theories to the modern empirical analysis. Akhand and Milbourne (1986) first included cards as an alternative payment media in money demand framework and found that cards motivate people to hold less in money balances and more in bonds than in the normal Baumol-Tobin model. In recent years, several studies such as Duca and Whitesell (1995); Groeneveld and Visser (1997); De Grauwe et al. (2000); Owen and Fogelstrom (2005); Amromin and Chakravorti (2007) and Yilmazkuday and Yazgan (2009) empirically focused on examining the impact of new payment instruments and currency substitutes such as credit cards, debit cards and prepaid instruments on currency demand and central bank’s independence.

Broadly, these studies focused on answering to two important questions: will increased use of credit and debit cards lead to wither of cash and what would be the impact of such a change on monetary policy? Markose and Loke (2003) and Stix (2004) answer these questions by finding that the interest rate sensitivity of these cards on cash demand can be magnified if the network coverage of these cards improves and the impact of cards on the seigniorage is substantial when the discounted sum of the loss of future seigniorage included in the analysis. In this regard, Boeschoten (1992) found that Automatic Teller Machines (ATMs), credit cards and debit cards negatively affect demand for cash in Netherlands. Duca and Whitesell (1995) also revealed that credit card ownership is associated with lower transactions deposits. Humphrey et al. (1996) for 14 advanced countries also observed similar findings. Further, Markose and Loke (2001) argued that due to usage of alternative payment modes in USA and UK, transaction cash balances declined. Analyzing welfare cost of inflation for card holders and non-holders in Italy, Attanasio et al. (2002) observed that cash balances with ATM users are much lower than non-holders. Stix (2004) also found that debit cards affects cash demand significantly. Further, De Grauwe et al. (2000) found that the average cost of card payment is 1.3 percent of transaction value, which is much lower than the cost of cash payment at 9 per cent of transaction value. However, Rinaldi (2001) observed weak effects of credit and debit cards on currency in circulation in Belgium. Further, using panel data, Snellman et al. (2001) and Drehmann et al. (2002) for European countries and OECD countries, respectively, found that the number of cards has an insignificant effect on cash demand while Point of Sales (POS) terminals and ATMs have significantly negative impact. On the other hand, Humphrey (2004) argued that even though the share of cash in consumer payments declined by a third, between 1974 and 2000 in US due to cards as such, cash is not expected to disappear anytime soon. Further, Anderson-Reid (2008) found that demand for currency is positively affected by the volume of ATM transactions in the previous two periods and negatively affected by Electronic Funds Transfer Point of Sale systems (EFTPOS) transactions in the prior period in Jamaica. However, Carbo-Valverde and Fransisco (2014) observed that ATM transactions and POS transactions are negatively related and have a large economic impact one on another in Spain and currency demand is positively associated with ATM transactions whereas it is negatively related to POS transactions and the negative effect of POS transactions offsets the positive impact of ATM transactions.

On the effects of cards usage on the economy, Zandi and Singh (2010) found that 1 per cent raise in card usage increased consumption by 0.039 percent and GDP by 0.024 percent. The increase was little high in developed countries compared to developing countries. For India, it was 0.05 percent and 0.004 percent, respectively. Studies such as Benjamin (2001); Berentsen (1997) and Misati et al. (2010) observed that electronic money complicates the implementation of monetary policy. Further, Abednego and Apriansah (2010) observed that electronic money can change the money demand function and reduce the average amount of cash held which would increase circulation of money in the economy, thereby positively affecting velocity of money. Similarly, Schoellner (2002) also observed that higher credit card usage reduces the cash in hand with consumers and increases the balances in their checking and savings accounts. It was also found that higher revolving consumer credit outstanding was associated with more transitory monetary policy shocks. On the other hand, Yang and King (2011) argued that credit card banks unlike commercial banks do not create money and therefore cannot affect either the aggregate demand for or the supply of money whereas Holly (1999) observed mixed effects of payment technologies on demand for and supply of money in US.

The above brief literature reveals the following gaps: (i) the effects of credit cards and debit cards usage on economy in general and on currency demand in particular is inconclusive; (ii) most of the studies have been conducted from the perspective of advanced economies; (iii) For India, Seth (2009) argued that use pf electronic payments help country achieving sustained economic development by making economic systems more efficient and cost effective and thus integrating it with the global economy. The study is of the opinion that electronic payments will induce larger financial transparency and help curb the unregulated economy.

The Committee on Payment and Settlement Systems (2012) also opined that innovations in retail payments cut processing costs and increase social welfare and create serious policy issues for central bank. In a recent RBI study by Nachane et al. (2013) examined the determinants of currency demand at the aggregate as well as at denominations level. It observed that growth in currency circulation is much higher than that of growth in nominal GDP. This study did not account for currency substitutes for payment (such as credit/debit cards) while determining currency demand. Slozko and Pelo (2014) in a cross country study found that the usage of cashless payment is closely related to the level of economic development and the higher GDP per capita. These studies are general in nature as per as the focus is concerned. To the best of our knowledge, not a single study is available for India to understand the effect of credit card and debit card on currency demand. Our study is very relevant because both the Government of India and the RBI aggressively pursuing for complete financial inclusion in the country, millions of financially excluded people are joining the formal banking system. To make their services affordable and reachable, banks have to increase their dependency on technology in banking services. That would further increase usage of alternatives for cash substitutes for making payments. On the other hand, the banks are the transmitters of monetary policy and facilitators of the nation’s payment system. Any change in payment system may affect the very basic objective of monetary policy and overall stability of financial markets. If the seigniorage is affected by the usage of electronic payment instruments, then the central bank may have to look for alternatives to stand on its own without depending on government for financial support in order to maintain the independence of monetary policy decisions from government interventions.

In this paper we examine whether the usage of credit and debit cards effect currency demand in India and what would be the impact of these cards on seigniorage? Auto Regressive Distributed Lag (ARDL) approach for monthly data has been employed. The rest of the paper is organised as follows. Section two briefs the trends in electronic payments and seigniorage; section three deals with methodology employed; section four discusses empirical results; and section five concludes.

Cards, Seigniorage And Currency Demand

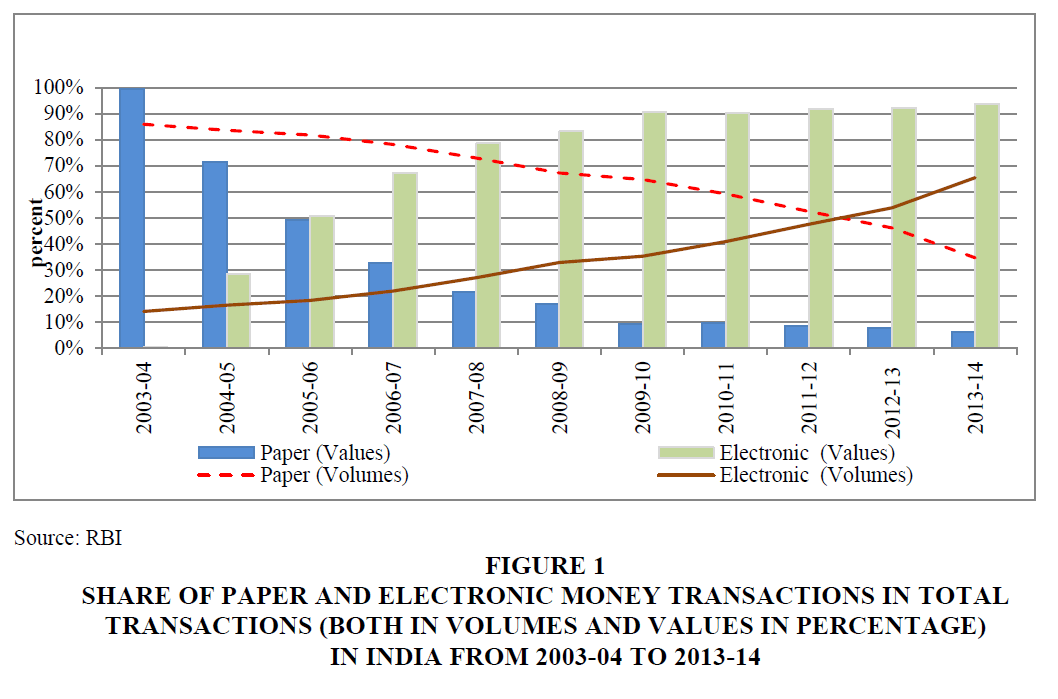

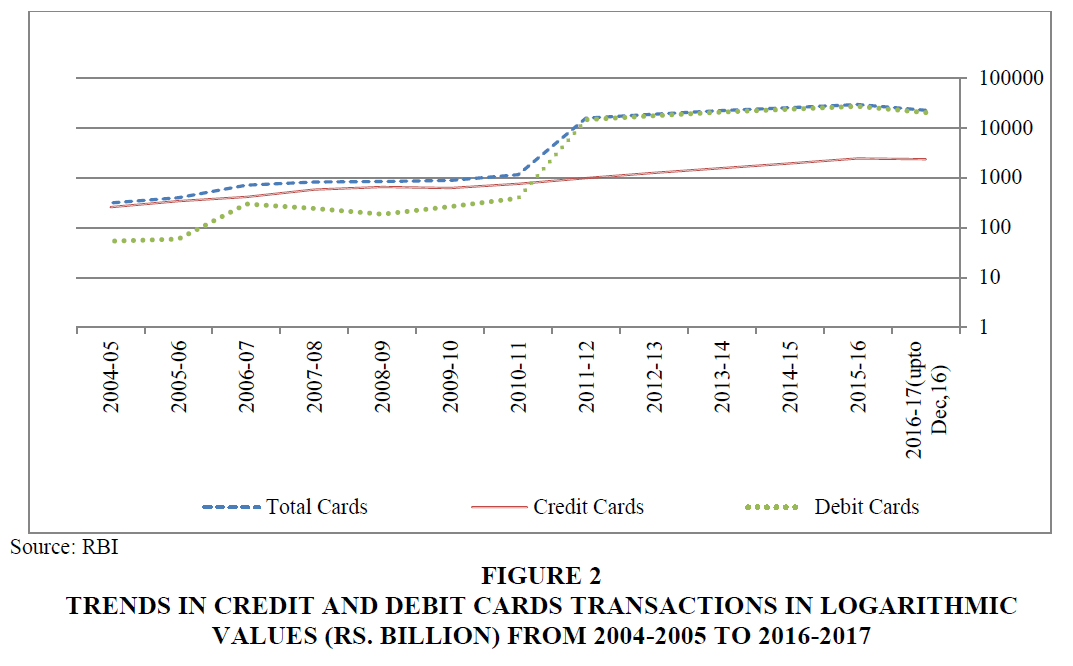

Electronic payments are, either in credit or debit form, made entirely electronically with the value transferring from one bank account to another bank account. The electronic based payment instruments provide faster, cost effective and very secure payment mechanism to the customers over paper based payment system. Among electronic payment instruments credit cards and debit cards are very popular. These are made important substitutes for cash transactions in many advanced economies. Credit cards perform primarily two functions: a medium for borrowing and an alternative mechanism for payment. The former relies on the number of ATMs and the latter depends on the extent of acceptance by firms for payments. If credit card service is popular and well developed in a country, the amount of money demanded in that country will be negatively affected by usage of the cards since people shift all kinds of their demand for money to credit cards. Debit cards in addition to functioning as an alternative medium of payment, they are also used as medium of liquidity and employed to withdraw the money from current and savings bank accounts. If the banking system is technically advanced and well developed with greater penetration of bank cards in a country, the amount of currency in circulation will be negatively affected by the debit card usage. Therefore, it is necessary to assess the policy impact of cards usage in a money demand relation frame work to understand movements in monetary aggregates (Stix, 2004; Knell and Stix, 2006; Yilmazkuday and Yazgan, 2009). Due to financial sector reforms since 1992, Indian commercial banks have been introducing new products and services and banks focus on retail products to cater to the needs of first generation bank customers. New generation private banks, like ICICI and HDFC banks, changed the way the Indian banking system, dominated by public sector banks, had been working was working and are aggressive in use of technology in banking services. As a result, electronic cards such as credit cards and debit cards emerged in the payment system and have fastened the monetary transactions in the country in a less paper manner. In India, the share of total electronic based payments has increased significantly over the period. By March 2014, electronic payments accounted for about 65.4 per cent in volume and 93.7 per cent in value (Figure 1). Usage of credit and debit cards is also continuously increasing. The raise is high particularly after 2007-08 across various channels (Figure 2). By the end of December 2016, Indian banks issued about 28 million credit cards, 751 million debit cards; there were 219866 ATMs and 1705423 Point of Sales (POS) terminals in the country. The number of ATMs per 100,000 adults in India was 18.07 in 2014. This is less than the global average of 43.9 ATMs.

Figure 1:Share Of Paper And Electronic Money Transactions In Total Transactions (Both In Volumes And Values In Percentage) In India From 2003-04 To 2013-14.

Figure 2:Trends in credit and debit cards transactions in logarithmic values (rs. Billion) From 2004-2005 to 2016-2017.

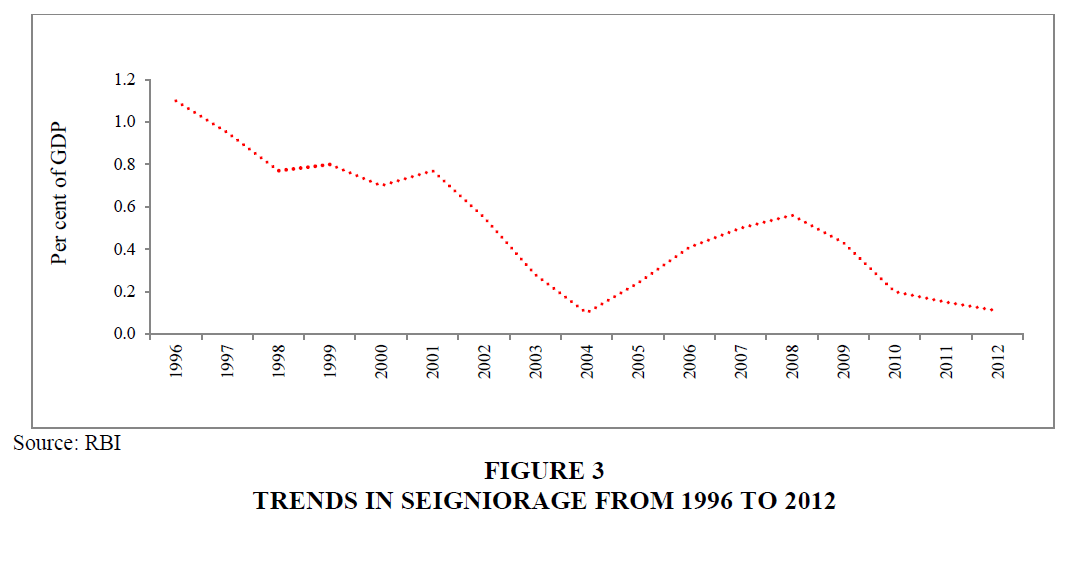

On the other hand, seigniorage is the difference between revenue earned from interest free debt that the central bank receives by creating base money and the cost of printing and distributing that base money. To Drazen (1985), it is the total revenues associated with money creation. This government has to pay this opportunity cost if it takes the base money as a loan from the central bank (Baltensperger and Jordan, 1998). Since 1996, seigniorage of RBI has been declining (Figure 3).

Yilmazkuday and Yazgan (2009) illustrated by presenting monetary exchange equation, to understand the impact of credit cards and debit cards on the currency demand.

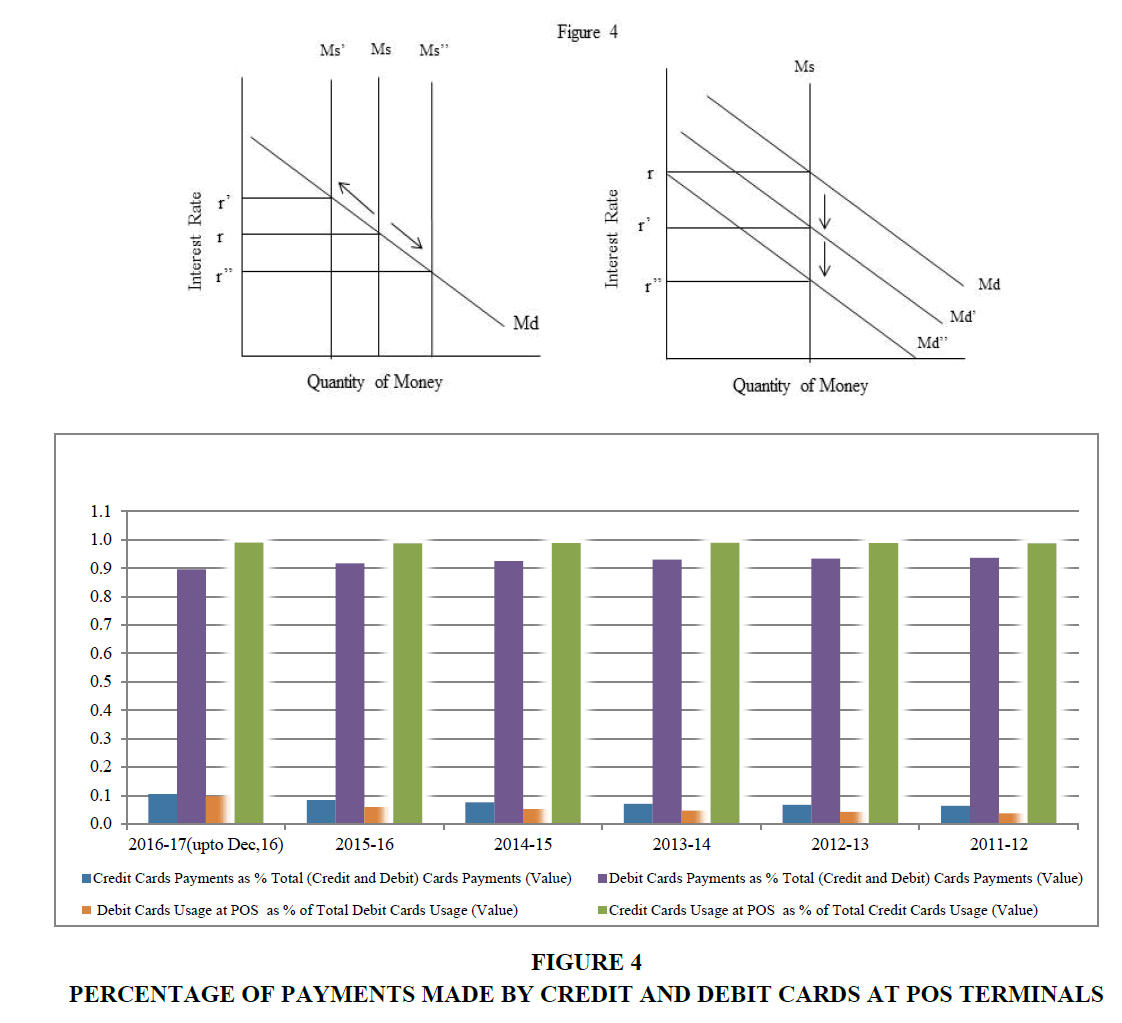

Where M is the equilibrium amount of money, V is velocity and GDP is gross domestic product. Assuming that the GDP is constant, V can move in relation to movements in M and M can move in two ways (Figure 4): (i) movement along the demand curve from Ms to Ms’ or Ms”, resulting in a change in money supply; (ii) a shift in money demand form Md to Md’ or Md”, holding money supply constant. Figure 4 illustrates that any alternative means of payments such as credit cards, debit cards act as a substitute for paper currency would lead to a shift in money demand and thus change in interest rates. This simple example draws an inference on to what extent electronic payments can have impact on monetary policy.

Methodology

Cards and Currency Demand

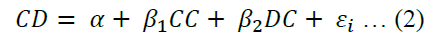

Following Yilmazkuday and Yazgan (2009), the currency demand equation is given as:

where, Currency Demand (CD) is measured as currency in circulation divided by price levels. CC is credit cards measured in value terms. Higher the usage of credit cards lower is the demand for currency since credit cards (CC) provide interest free loan from the bank for certain time due to which people do not prefer to hold cash in hand for making payments. Therefore, CC will have negative impact on currency demand. Further, people prefer to use alternative payment such as credit card instead of currency for making payments. This would reflect in decline in currency demand, which in turn reduce the amount of currency in circulation. Thus, the coefficient (β1) of CC is expected to be negative.

DC is debit card measured in value terms. In a well-developed banking system, people prefer to maintain liquidity in banks and use debit card for making payments and thus would reduce currency in circulation. On the other hand, in case of India, debit card is mostly used for withdrawing money from ATMs; this in turn would entertain the money in circulation. Therefore, sign of the coefficient (β2) of DC is not known.

We have also considered other factors that determine currency demand and it is given as.

Following studies such as Holly (1999), Nenovsky and Hristov (2000) and Attanasio et al. (2002) we use three macroeconomic variables as control variables. In the traditional IS-LM frame work national income and interest rates are the two primary determinants of money demand and supply. Growth in national income directly affects the activities of economic agents in the country. In a growing economy, per capita income and standard of living of people would raise that would increase the purchasing power of people and thus incentivising them to make more monetary transactions. Earlier studies used growth of Gross Domestic Product (GDP) to represent performance of the economy. Since monthly data on GDP is not available, we use index of industrial production (IIP) as a proxy for performance of the economy and its coefficient is expected to be positive. Higher interest rates will increase cost of funds. Yet, holding currency in hand in the regime of higher interest rates will increase opportunity cost of cash. Therefore, higher interest rates will reduce demand for currency. We take five major public sector banks’ average deposit rates as a rate of interest (INT). This coefficient is expected to be negative. We have also included wholesale price index inflation (INF) to account for price levels in the economy. Raising prices will increase demand for currency as people try to maintain same living standards as before. But if the opportunity cost of holding cash is then people prefer to maintain the same balances in checking accounts (CASA accounts) that reduce demand for cash. The coefficient of INF is expected to be uncertain. All the variables are in 2004-2005 prices, seasonally adjusted and are then converted into natural logarithm.

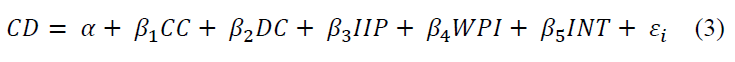

Impact of Cards on Seigniorage

From the above model, one would raise the question that if the cards affect the currency in circulation, then what would be the impact of electronic payment on seigniorage? To examine this issue we further a model for seigniorage. There are three seigniorage concepts in the literature: (i) the opportunity cost or fiscal seigniorage concept, which is the net interest income on the central bank’s reserves, (ii) monetary seigniorage, which is the change in the monetary base over a year after adjusting it for the costs of the creation of the monetary base, and (iii) the inflation tax concept, which is the product of the inflation rate and the monetary base. However, each one has its own limitations. The fiscal concept ignores the effects of changes in base velocity on seigniorage. The monetary approach ignores the effects of differences in the real rate of interest and the rate of growth of GDP. And the inflation tax approach ignores the both and it is the stock of monetary base, the assumed ‘tax rate’ differs in each case (RBI, 2013).

Choice of which concept of the seigniorage, i.e., Inflation tax or opportunity cost concept, one should adopt depends on the kind of the economy it is measured for. The inflation tax concept is more appropriate for economies where hyperinflationary trends exist and central bank majorly finances government deficits. Since both monetary seigniorage and the inflation tax approach neglect the role of real interest rates in the generation of seigniorage, it would be more useful to employ the opportunity cost concept in computing seigniorage for a country like India as this concept is similar to the accounting definition of seigniorage, viz., the net interest accrued to central bank reserves. Since data on cost of printing of currency is not available, we follow Groeneveld and Visser (1997) and measure seigniorage (SEIG) as the change in the amount of base money. Base money is sum of currency in circulation, bankers’ deposits and other deposits with RBI. In this case, the coefficients of credit cards and debits are expected to be negative since alternative means of payments to cash will reduce cash in circulation. Other three variables viz. IIP, INT and INF are included as control variables and are expected to be positive.

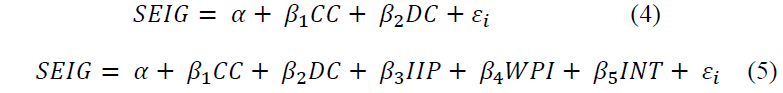

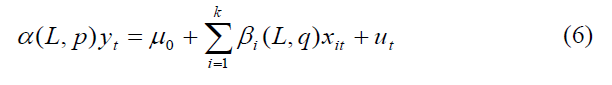

The ARDL co-integration approach developed by Pesaran and Shin (2001) has several advantages over other co-integration methods such as Engle and Granger (1987), Johansen (1991) and Johansen and Juselius (1990) procedures. The ARDL approach provides unbiased estimates of long-run model and valid t-statistics, even when some of the regressors are endogenous, (ii) a dynamic error correction model can be derived through a simple linear transformation in the ARDL model, (iii) it does not depend on pre-testing the order of integration of the variables, hence it is applicable irrespective of whether the underlying regressors are I(0), I(1) or mutually co-integrated. However, if the order of integration of any of the variables is greater than one, for example for an I (2) variable, then the critical bounds provided by Pesaran et al. (2001) and Narayan (2005) are not valid. They are computed on the basis that the variables are I(0) or I(1). For this purpose, we first carried out the unit root tests to see the degree of integration of the selected variables. Most variables were found to have a unit root at the levels but not in their first differences, i.e., (I(1)). But a few variables did not have any unit roots at, i.e., (I(0)) (Appendix 1). Given this mix of I(1) and I(0) variables and a relatively small sample size consisting of 114 monthly observations, the ARDL estimation procedure has been used for estimating the long-run relationships among the variables.

The ARDL procedure involves two stages. The first stage is to establish the existence of a longrun relationship. Once it is established, a two-step procedure is used for estimating the long-run and short run coefficients of the same equation in error correction framework. The augmented ARDL model can be written as follows:

Where  is a constant;

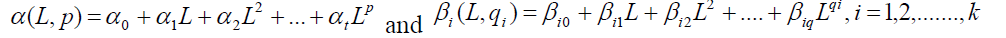

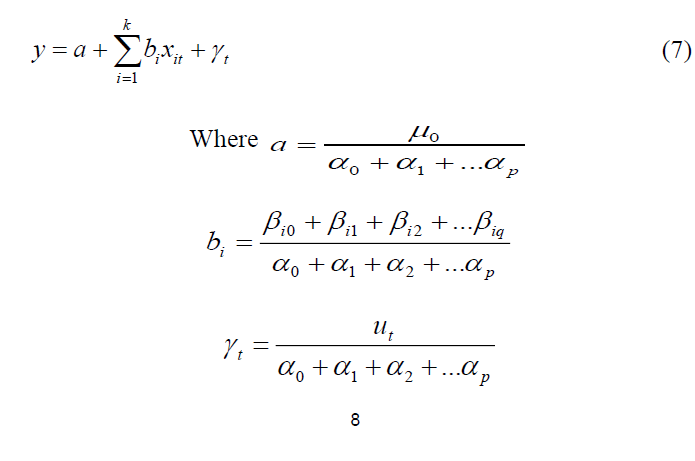

is a constant; is the dependent variable; xit, is the vector of explanatory variables and α(L, p) and β(L, q) are polynomials of order p and q of the lag operator L.

is the dependent variable; xit, is the vector of explanatory variables and α(L, p) and β(L, q) are polynomials of order p and q of the lag operator L.

In the long-run equilibrium  Using these equilibrium conditions and solving for y, we get the following long run relation:

Using these equilibrium conditions and solving for y, we get the following long run relation:

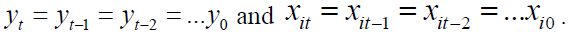

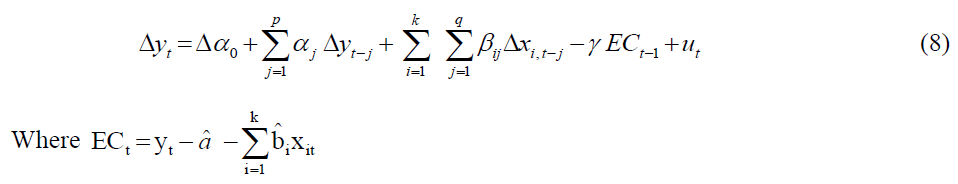

The existence of the long run relationship is confirmed with the help of an F-test that tests the coefficients of all explanatory variables are jointly different from zero. The null hypothesis of ‘no long-run relationship’ is tested with the aid of an F-test of the joint significance of the lagged level coefficients of equation (6). Pesaran et al. (2001) have proved that the distribution of this F-statistic is non-standard irrespective of whether the regressors are I(0) or I(1) and have tabulated the appropriate critical values. They compute two sets of critical values for a given significance level. One set assumes that all variables are I (0), while the other assumes they are all I (1). If the computed F-statistic exceeds the upper critical bounds value, then the H0 is rejected. On the other hand, if the F-statistic falls within the bounds, then the test becomes inconclusive, whereas, if the F-statistic is below the lower critical bounds value, it implies no co-integration. Narayan (2005) doubted the validity of existing critical values, because they are based on large sample sizes and cannot be used for small sample sizes. Therefore, Narayan (2005) regenerated the set of critical values for the limited data ranging from 30 to 80 observations by using the Pesaran et al.’s (2001) GAUSS code. Lastly, the error correction (EC) representation of the ARDL method can be written as follows:

where  is the first difference operator;

is the first difference operator;  and

and  are the short-run dynamic coefficients and γ measures the speed of adjustment. The study uses monthly time series data from April 2005 to September 2014. All the required data has been collected from the Database on Indian Economy, Reserve Bank of India.

are the short-run dynamic coefficients and γ measures the speed of adjustment. The study uses monthly time series data from April 2005 to September 2014. All the required data has been collected from the Database on Indian Economy, Reserve Bank of India.

Results and Discussion

Model for Currency Demand

The results of ARDL for the long run currency demand function are given in Table 1. The Fstatistics in Model 1 and 2 confirm the co-integration relationship as its values are above the upper bound at the 1% significance level. However, diagnostic tests suggest that Model 1 reports the problem of functional form at one percent significance level, but when the model is augmented by including the log of WPI, IIP and INT, in Model 2, the diagnostic test satisfies all the cases. Therefore, our interpretation is based on estimates of the Model 2. The coefficient of credit cards is negative and it is significant at 1 percent level. It implies that if credit card usage is increased by INR one billion, if other things remain constant, the amount of currency held in circulation comes down by INR 0.10 billion. One possibility for this result is that with credit cards customers get interest free use of funds for purchases within outstanding limit provided by bank for 20 to 50 days. Due to this facility customers might not be interested to use cash for their purchases. Therefore, the demand for currency would fall.

| Table 1: Long Run Results Of Currency Demand | ||

| Dependent Variable | Model 1 | Model 2 |

|---|---|---|

| LRCD | LRCD | |

| LRCC | -0.14*** | -0.10*** |

| LRDC | 0.32*** | 0.33*** |

| LWPI | -0.29* | |

| LIIP | 0.16* | |

| LINT | -0.002 | |

| C | 8.26*** | 8.69*** |

| Bounds F-Tests | 9.36*** | 8.16*** |

| Diagnostic Tests | ||

| R-Square | 0.99 | 0.99 |

| Durbin Watson | 1.91 | 2.21 |

| Serial Correlation | 14.23 | 20.79* |

| Functional Form | 13.37*** | 0.01 |

| Normality | 2.42 | 1.75 |

| Heteroscedasticity | 1.14 | 0.57 |

Note: Figures in parentheses are t-statistics. *&*** indicates statistical significance at the 1 & 10% level, respectively.

The coefficient of debit cards is positive and it is significant at 1 percent level. It suggests that if debit card usage is increased by one billion INR, the amount of currency held in circulation increases by INR 0.33 billion. One possible reason for this is that debit cards increase marginal benefit of money and raise demand for currency (Bade and Parkin 2011). This may be also due to that debit cards are majorly used for cash withdrawals to make payments in cash since banking penetration is low in the country and POS terminals are also limited. Thus acceptability of debits cards for purchases by merchants is also limited. This is seen from the Figure 4 that usage of debit cards at point of sales (POS) terminals is less than one percent of total usage of debit cards (in value).Debit cards are primarily used for cash withdrawals at ATMs in India. The trend is consistently persistent for the few years.

As per Census data (2011), 58.7% households avail banking services in India. A very significant portion of population does not have bank accounts. Public is more dependent on cash as the reserve money to broad money ratio, an indicator of the scale of cash in circulation, is around 0.18 for India. That is very high when compared with developing country peers. If banking is available to all parts and sections of people of the country, acceptance of cards for making even for small transactions will increase that may reduce demand for cash in future.

The estimates of interest rate and price level are negative. But the coefficient is statistically significant for the price level. It implies that an increase in price level would reduce demand for currency. People maintain cash balances in current account and savings accounts (CASA) for all transactional, speculative and precautionary purposes as these accounts provides the customer higher liquidity as well as some return (from savings bank account in particular). Since the account pays the customer minimum 4 percent on their balances and allows the customer to withdraw the balance any time, the customers would assess the opportunity cost of holding cash in hand and maintaining cash balances with these accounts, keeping the price levels in mind. If the opportunity cost of holding cash in hand is high, people will maintain balances with banks. Thus, the demand for currency will be low. People demand for more currency till the opportunity cost of holding the cash in hand is low relative to bank balances.

The estimate of log of IIP is positive and it is statistically significant at 1 percent level. It suggests that one percentage point increase in IIP increases demand for currency by INR 0.16 billion. This is obvious fact that a raise in economic growth in a country would increase income of people in the country and thus raise purchasing power of the people and increase demand for goods and services. The coefficient of ECM in Model 2 of Table 2 is -0.44 which implies that 44 percent of short-term dis-equilibriums are corrected in each month in line with long term equilibrium values.

| Table 2: Short Run Results Of Currency Demand | ||

| Model 1 | Model 2 | |

|---|---|---|

| dLRCD1 | 0.31*** | 0.43*** |

| dLRCD2 | 0.28*** | 0.44*** |

| dLRCD3 | - | 0.17* |

| dLRCD4 | - | 0.13 |

| dLRCD5 | - | 0.06 |

| dLRCD6 | - | 0.23** |

| dLRCC | 0.06*** | 0.06** |

| dLRCC1 | - | 0.06** |

| dLRDC | 0.018 | 0.01 |

| dLRDC1 | -0.03* | -0.07*** |

| dLRDC2 | -0.07*** | -0.08*** |

| dLRDC3 | -0.07*** | -0.06*** |

| dLWPI | -0.09** | - |

| dLIIP | -0.04 | - |

| dLINT | -0.00 | - |

| dC | 2.95*** | 3.68*** |

| ECM (-1) | -0.33*** | -0.44*** |

Note: Figures in parentheses are t-statistics. *, ** &*** indicates statistical significance at the 1, 5 & 10% level, respectively.

Model for Seigniorage

From the above analysis, it is apparent that the cards do affect currency demand. This triggers the question on the impact of electronic payments on seigniorage. Does the penetration of electronic payments create loss of revenue through circulating paper money? Table 3 reports the long run estimation using ARDL technique. The F-statistics in Model 3 and 4 confirm the co-integration relationship as their values are above the upper bound at the 10 and 5 percent significance level. This implies that there is a co-integration relationship among the variables. The diagnostic tests also suggest that there is no functional form, serial correlation, heteroscedasticity problem in the analysis, but the test reports normality issue 5 per cent significance level.

| Table 3:Long Run Results Of Seigniorage | ||

| Dependent Variable | Model 3 | Model 4 |

|---|---|---|

| LRSEIG | LRSEIG | |

| LRCC | 0.09 | 0.09 |

| LRDC | 0.24* | -0.11 |

| LWPI | - | 0.72** |

| LIIP | - | 1.04*** |

| LINT | - | 0.42*** |

| C | 5.39*** | -3.25* |

| Bounds F-Tests | 3.23* | 4.47** |

| Diagnostic Tests | ||

| R-Square | 0.96 | 0.97 |

| Durban Watson | 1.93 | 1.90 |

| Serial Correlation | 10.39 | 20.28* |

| Functional Form | 1.34 | 2.20 |

| Normality | 36.37** | 12.63** |

| Heteroscedasticity | 0.37 | 0.007 |

Note: Figures in parentheses are t-statistics. *&*** indicates statistical significance at the 1 & 10% level, respectively

The results of Model 3 and 4 reveal that credit card is positive and statistically insignificant. The coefficient of debit cards is inconclusive. When the Model 4 includes WPI, IIP and interest rate, then the coefficient of debit card is negative and statistically insignificant. Therefore, the results suggest that the uses of electronic cards have no significant effect on seigniorage in the case of India. This may be due to the fact that that despite various initiatives taken by RBI to increase the usage of electronic channels such as cards in retail transactions cash is still preferred in India in retail payments and card usage is yet to penetrate in rural areas. Once the full financial inclusion is achieved, seigniorage may be affected. As per theoretical expectations WPI, INT and IIP have positive impact on seigniorage revenue of RBI. The coefficient of ECM in Model 2 in Table 4 is -0.43 which implies that 43 percent of short-term dis-equilibriums are corrected in each month in line with long term equilibrium values.

| Table 4: Short Run Results Of Seigniorage | ||

| Model 3 | Model 4 | |

|---|---|---|

| dLRSEIG1 | 0.11 | 0.05 |

| dLRSEIG2 | 0.33*** | 0.24*** |

| dLRSEIG3 | -0.18** | - |

| dLRCC | 0.11 | 0.02 |

| dLRCC1 | -0.23*** | - |

| dLRDC | -0.13** | -0.05 |

| dLRDC1 | 0.06 | - |

| dLRDC2 | -0.04 | - |

| dLRDC3 | 0.08* | - |

| dLWPI | - | 2.05*** |

| dLWPI1 | - | 1.65** |

| dLIIP | - | 0.45*** |

| dLINT | - | 0.18*** |

| dC | 0.72*** | -1.42** |

| ECM(-1) | -0.13*** | -0.43*** |

Note: Figures in parentheses are t-statistics. *&*** indicates statistical significance at the 1 & 10% level, respectively.

Concluding Remarks

The study examines the impact of credit cards and debit cards on currency demand and seigniorage in India. By employing auto-regressive distributed lag (ARDL) model for monthly data the study found that credit cards decrease currency demand. The fact is that credit cards always come with interest free credit for customers, while owning credit cards customers do less cash transactions and prefer less cash to be held in hand. Result on the impact of debit card is interesting as it is found debit cards usage is positively associated with currency demand. This is because of, as mentioned by Bade and Parkin (2011), that debit cards increases marginal utility of money and increase demand for currency. These cards are majorly used for cash withdrawals to make payments in cash since banking penetration is less in the country and thus acceptability of debits cards by merchants is also limited. Significant portion of population in India do not have bank accounts, do not have access to electronic cards as such and rely on cash for their economic transactions. Growth of IIP has positive effect on currency demand. On seigniorage specification, the study found inconclusive results as coefficients of credit and debit cards are statistically insignificant. Our results have few policy implications. If cash is replaced with cards in the future, credit cards in particular, will reduce currency usage. With the kind of changes expected to be in banking near future, for instance measures such as financial inclusion to provide banking services to all unbanked and marginal sections of population, would bring new payment channels and increase penetration in use of financial services which would lead to less use of cash and thus reduce demand for currency. However, wider usage of electronic cards may not a threat to the central bank autonomy in near future as seigniorage revenue is not affected by use of cards.

Appendix

| Table A1: Unit Root Test Results | ||||

| ADF test | PP test | |||

|---|---|---|---|---|

| Levels | First Difference | Levels | First Difference | |

| LRCD | -1.95 | -6.58*** | -1.97 | -9.08*** |

| LRCC | -0-13 | -12.18*** | -0.94 | -20.23*** |

| LRDC | -2.73* | -11.11*** | -0.23 | -32.57*** |

| LWPI | -0.32 | -8.51*** | -0.16 | -8.49*** |

| LIIP | -2.92** | -2.64* | -2.48 | -27.61*** |

| LINT | -2.15 | -10.54*** | -2.15 | -10.54*** |

| LSEIG | -1.66 | -6.74*** | -1.66 | -11.09*** |

Endnote

1. In economic theory, there are three motives for demand for currency. In addition to primarily carrying it for monetary transactions, people and firms prefer to hold currency for meeting unexpected eventualities in the future and for earning income from speculative activities in financial markets.

2. For instance, Jan Dhan Yojana, a flagship mission of financial of Government of India, launched on 28th August 2014 with an ambition to provide a bank account, insurance and pension to large section of the population. As on 20th July, 2016, there are about 24.49 crore accounts have been opened under this financial inclusion mission.

3. The two-step procedures are (i) the orders of the lags in the ARDL model are selected using an appropriate lag selection criterion based on any optimal lag information Criteria and (ii) the selected model is estimated by the Ordinary Least Square technique.

References

- Abednego, P. and Apriansah, G. (2010). Correlation between electronic money and the velocity of money. Global management conference, Bali, Indonesia. http://repository.gunadarma.ac.id/1180/1/correlation%20between%20electronic%20money%20and%20the%20velocity%20of%20money%20_UG.pdf

- Akhand, H. & Milbourne, R. (1986). Credit cards and aggregate money demand. Journal of Macroeconomics, 8, 471-478.

- Amromin, G. & Chakravorti, S. (2007) Debit card and cash usage: A cross-country analysis. FRB of Chicago working Paper No. 2007-04. http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.692.9244&rep=rep1&type=pdf

- Anderson-Reid, K. (2008). Estimating the impact of the alternative means of payment on currency demand in Jamaica, Bank of Jamaica. http://boj.org.jm/uploads/pdf/papers_pamphlets/papers_pamphlets_Estimating_the_Impact_of_the_Alternative_Means_of_Payment_on_Currency_Demand_in_Jamaica.pdf

- Attanasio, O., Jappelli, T. & Guiso, L. (2002). The demand for money, financial innovation and the welfare cost of inflation: An analysis with household data. Journal of Political Economy, 110, 317-351.

- Bade, R. & Parkin, M. (2011). Foundations of economics, 6/E, University of Western Ontario, Pearson Publications.

- Baltensperger, E. & Thomas J. J (1998). Seigniorage and the transfer of central bank profits to the government. Kyklos, 51, 73-88.

- Benjamin, J.C. (2001). Electronic money: New day or false dawn. Review of International Political Economy, 8(2), 197-225.

- Berentsen, A. (1997).Monetary policy implications of digital money. MPRA Paper 37392, University Library of Munich, Germany. https://mpra.ub.uni-muenchen.de/37392/1/Monetary_Policy_Implications_of_Digital_Money.pdf

- Boeschoten, W.C. (1992). Currency use and payment patterns, academic publishers, Dordrecht/ Boston.

- Carbo-Valverde, S. & Fransisco, R.F. (2014) ATM withdrawals, debit card transactions at the point of sale and the demand for currency. SERIEs, 5, 399-417.

- De Grauwe, P., Buyst, E. & Rinaldi, L. (2000). The costs of cash and cards compared: The cases of Iceland and Belgium, mimeo.

- Drazen A. (1985). A general measure of inflation tax revenues. Economics Letters, 17, 327-330.

- Drehmann, M., Goodhart, C. & Krueger, M. (2002). The challenges facing currency usage: Will the traditional transaction medium be able to resist competition form the new technologies? Economic Policy, 34, 195-227.

- Duca, J.V. & Whitesell, W.C. (1995). Credit cards and money demand: a cross-sectional study. Journal of Money, Credit and Banking, 27, 604-263.

- Engle, R.F. & Granger, C.W.J. (1987). Co-integration and error-correction: Representation, estimation and testing. Econometrica, 55, 251-276.

- Freedman, C. (2000). Monetary policy implementation: Past present and future. Will the advent of electronic money lead to the demise of central banking? International Finance, 3, 211-227.

- Friedman, B.M. (1999). The future of monetary policy: The central bank as an army with only a signal corps? International Finance, 2, 321-338.

- Goodhart, C.A.E. (2000). Can central banking survive the IT revolution? International Finance, 3, 189-209.

- Groeneveld, H. & Visser, A. (1997). Seigniorage, electronic money and financial independence of central banks, BancaNazionale del Lavoro Quarterly Review, BancaNazionale del Lavoro. 200, 69-88.

- Patrick, H. Jr. (1999). The effect of technology growth on money supply and demand: A co-integration approach. The Park Place Economist, 7(5), 63-75.

- Humphrey, D.B. (2004). Replacement of cash by card in U.S. consumer payments. Journal of Economics and Business, 56, 211-225.

- Humphrey, D.B., Lawrence B.P. & Jukka M.V. (1996). Cash, paper and electronic payments: A cross-country analysis. Journal of Money, Credit and Banking, 28(2), 914-939.

- Johansen, S. (1991). Estimation and hypothesis testing of co-integration vectors in Gaussian vector autoregressive models. Econometrica, 59, 1551-1580.

- Johansen, S. & Juselius, K. (1990). Maximum likelihood estimation and inference on co-integration with application to the demand for money. Oxford Bulletin of Economics and Statistics, 52, 169-210.

- Knell, M. & Stix, H. (2006). Three decades of money demand studies: Differences and similarities. Applied Economics, 38, 805-818.

- Kroszner, R.S. (2003). Currency competition in the digital age. In Evolution and Procedures in Central Banking, (Ed.), Dave Altig & Bruce D. Smith, pp. 275-299. New York: Cambridge University Press.

- Markose, S. & Loke, Y.J. (2003). The microstructure of recent trends in cash less ness: UK and USA compared, mimeo.

- Misati, N.R., Njoroge, L., Kamau, A. & Ouma, S. (2010). Financial innovation and monetary policy transmission in Kenya. International Research Journal of Finance and Economics, 50, 123-136.

- Nachane, D.M, Chakraborty, A.B, Mitra, A.K & Bordoloi, S (2013). Modelling currency demand in India: An empirical study. DRG Study (No. 39), Reserve Bank of India. https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/39DRGS180213.pdf

- Narayan, P.K. (2005). The saving and investment nexus for China: evidence from co-integration tests. Applied Economics, 37, 1979-1990.

- Nenovsky, N. & Hristov, K. (2000). Currency circulation after currency board introduction in Bulgaria (Transactions Demand, Hoarding, Shadow Economy), Bulgarian National Bank Discussion Papers DP/13/2000, October. http://www.bnb.bg/bnbweb/groups/public/documents/bnb_publication/discussion_200013_en.pdf

- Owen, A.L. & Fogelstrom, C. (2005). Monetary policy implications of electronic currency: An empirical analysis, Applied Economics Letters, 12, 419-423.

- Pesaran, M.H., Shin, Y. & Smith, R.J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16, 289-326.

- Pesaran, M.H., Shin, Y. & Smith, R.J. (1996). Testing for the existence of a long-run relationship, DAE Working Paper, No. 9622.

- RBI (2013). Report on currency and finance 2009-2012: Fiscal-Monetary Co-ordination.

- Rinaldi, L. (2001). Payment cards and money demand in Belgium, CES Discussion Paper DPS 01.16, KU Leuven.

- Schoellner, T. (2002). The effects of credit cards on money demand. Unpublished Ph.D. Dissertation. Ohio State University. https://etd.ohiolink.edu/

- Seth, S. (2009). Junoon-building india with passion, creativity & simplicity. Tech Barrack Solutions Pvt. Ltd.

- Slozko, O. & Pelo, A. (2014) The electronic payments as a major factor for further economic development. Economics and Sociology, 7(3), 130-140.

- Snellman, J., Vesala, J. & Humphrey, D. (2001). Substitution of noncash payment instruments for cash in Europe, Journal of Financial Services Research, 19, 131-145.

- Sriram, S.S. (2001). A survey of recent empirical money demand studies, IMF Staff Papers, 47, 334-365.

- Stix, H. (2004). How do debit cards affect cash demand? Survey data evidence, Empirica, 31, 93-115.

- The Committee on Payment and Settlement Systems (2012). Bank for International Systems. http://www.bis.org/cpmi/publ/d105.pdf

- Woodford, M. (2000). Monetary policy in a world without money. International Finance, 3, 229-260.

- Yang, B.Z. & King, A.S. (2011) Do credit cards really reduce aggregate money holdings? Atlantic Economic Journal, 39(1), 85-95.

- Yilmazkuday, H. & Yazgan, M.E. (2009). Effects of credit and debit cards on the currency demand. Applied Economics. 41, 2115-2123.

- Zandi, M. & Singh, V. (2010). The impact of electronic payments on economic growth. Moody?s Analytics. http://www.economy.com