Research Article: 2018 Vol: 22 Issue: 2

Impact of Employee Ownership on an Organizational Productivity: A Mediating Role of Psychological Ownership

Tariq Javed, Sultan Idris Education University

Keywords

Psychological Ownership, Organizational Productivity, Employee Ownership, Firm Efficiency, Voting Rights, Alignment of Interest.

Introduction

Shared ownership with employees has significant and growing contribution in academia and corporate world of the developed countries. This form of ownership has also been adopted in the developing countries. The focal point of the policy makers and advocates of this scheme is alignment of interests of the managers with the share holders and its impact on organizational productivity. Yet, empirical literature does not provide any solid evidence that employee ownership is associated with higher productivity (Blasi et al., 1996). According to Weitzman and Kruse (1990) employee stock plans have a larger positive impact on productivity when operated in combination with policies which overcome free rider problem and involve employees in decision making process. Perotin and Robinson (2003) argue that observed effects of employee ownership on organizational productivity are usually positive, but albeit small.

There is another viewpoint, although it is less commonly emphasized in existing literature of employee ownership and organizational productivity. According to this view involving too many employees will have an adverse effect on productivity because of slow decision making process, ill-qualified participants. This will also introduce assorted and potentially contradictory interests into the management process. According to Hansmann (1996) and Pendleton (2001) combination of employee ownership and involving them in decision making process could be a “toxic combination” because employee owners may emphasize stronger rights to influence decision than is efficient.

The starting point of discussion is that none of the opposing arguments are unanimously correct and accepted. The effects of employee ownership plans and their involvement in an organizational setup will be influenced by the intensity of employee participation in the plan. There are very few studies that were carried out which investigated the role of employees’ ownership towards organizational performance in developing world. Nonetheless, in Pakistan, this is the foremost study on the impact of employees’ ownership on an organizational performance. Innovatively, this study provides empirical evidence that how employee ownership affects an organizational productivity and their participation in decision making process mediates their existing relationship.

The idea of shared ownership is preliminary launched in state owned entities of Pakistan, as an attempt to align employee’s interest with an organization. In order to accomplish this objective, the Government of Pakistan distributed twelve percent outstanding shares among employees of government holdings.

After the introduction next section demonstrates the relevant literature of the study which is followed by theoretical framework and variable measurements. In the next section there is hypothesis development, research methodology and their statistically representation. The fourth section is about statistical analysis and conclusion of the study.

Literature Review

The basic theoretical background between employee shared ownership and their involvement is rooted in principal agent perspectives. If their incentives are aligned with the desired outcomes of principals, then allowing employees to influence the work done is quite logical, specifically if employees hold production related expertise. If they are not involved in equity sharing they may ask for compensation against knowledge sharing with coworkers and managers (Ben-Ner and Jones, 1995).

Employee Ownership

The sole purpose of giving shares to employees is to support them with financial benefit with their consistent stake in the organization. Kaarsemaker et al. (2010) pointed out there two categories of employee ownership, in the first category employees own the majority of the shares, whereas in the second category employee do not own the majority of the shares rather they own share options. This interaction of organizational management and organizational ownership has been an area of interest at different platforms. This has been discussed in different contexts, i.e., at an organizational level, economic level and in business studies. This area is not beyond the scope of corporate governance, which addresses the effects of ownership structures. Different scholars tested this idea in different scenarios like impact of venture capital ownership of an organizational performance, stock listing vs. private ownership and companies wholly or partially owned by employees (Zhou, 2001). The basic argument being employee stock ownership, which covers a significant portion of total employees, is to create an economic benefit by working in the best interest of the organization. In the western countries, many companies have transformed from low tech organizations to knowledge intensive companies; a transformation process during which motivation of initiatives for employees became critical for competitive advantage was founded on the agency theory (Torp, 2011). He further argued that the effect of ESO is mediated by the creation of psychological ownership among employees and inclusion of employees in the decision making process. He further stressed that the sense of psychological ownership is enhanced when employees are allowed to participate in strategic decisions due to the importance of decisions. While all employees could be involved in strategic decisions, interest has increasingly focused on the importance of involving middle managers in strategy process.

Psychological Ownership as Mediator

Psychological ownership is the feeling about an object that it is mine or ours. It is the psychological experienced phenomenon; employees develop possessive feelings for the target. According to Furby (1991) sense of possession is a core of psychological ownership. The feelings of possessiveness are omnipresent which can be called tangible as well as intangible objects (Beaglehole, 1932; James, 1890), Wilpert (1991) argue that this can be based either in the existence or nonexistence of legal ownership. Employees have feeling of psychological ownership which infused them towards organization (French, 1987).

According to Toscano, (1983a) there are diverse range of employee ownership which have different impact on the organization and organizational work force.

According to Klein and Hall (1988) there are different ownership characteristics which play very important role in influencing employee satisfaction. Different researchers like Klein & Hall (1988); Long (1978a) commented on the characteristics of the ownership structure, they argue that noncontributory systems will have lower worker participation. According to Klein and Hall (1988) employee centered ownership plans give more satisfaction to the employees. There are a lot of studies like Lawler (1977); Long (1978a); and Webb (1912) which discuss the common interests associated with the employees, commitment and integration of employees (Long, 1978a; Rhodes & Steers, 1981) psychological equity sharing (Hammer & Stern, 1980). Pierce, Rubenfel and Morga (1991) argued that employees get ownership experience when they have psychological ownership. Webb (1912) argues that ownership gives sense of responsibility; it works through common interest which increases careful working and zeal. Employee ownership is a system of joint payoff which makes the organization a participative organization (Whyte, 1978).

There are number of research studies on the involvement of management in the organizational strategic policy making and employee ownership. Torp (2011) argued that effect of employee ownership is mediated by their participation, which supports and encourage involvement by legitimizing and expecting the involvement of management. He further stressed that employee ownership has increased employee involvement and the effect is distinctively dependent on creation of psychological ownership. The creation of psychological ownership and its effect on organizational outcome is discussed and empirically tested in this paper.

Employee ownership scheme has certain inbuilt expectations; if the actual experiences do not congruent with expectations; psychological ownership will be weaker and will not create the desired effect on organizational performance. There may be number of reasons for non congruence between employee ownership and employee control (Blasi, 1987). Traditionally it is believed that “legitimate authority rest with property rights, which management either holds or represents” (Blasi, 1987). This concept of “legitimate authority” prevents the creation of sense of psychological ownership which affects the employee attitude, commitment and involvements.

The creation of legitimacy of employee involvement is highly dependent on the philosophy of management. Rosen et al. (1986, p. 64) argued that “the extent to which management sees employee ownership as a part of the company’s overall culture, human relations policy and/or commitment to employees”. The management’s attitude will affect the possibility for employees of 1) becoming owner, 2) accessing information 3) exercising influence. There may be four factors which lead to a higher level of employee participation in decision making process: Exercising the formal ownership rights, creating of psychological ownership, congruency of experience and expectations, philosophical commitment to employee.

Certain studies shows high employee participation in decision making in employee owned companies (Conyon & Freeman, 2001; Dube & Freeman, 2001). This involvement of employees in decision making is not very straight process; it requires the creation of culture, which ensures that employee opinion is taken, valued and acknowledged (Emery, 1995). Therefore, the environment can only be created if, employees feel save, top management is curious and exert their efforts to understand employees (Poon et al., 2001).

Employee Participation

Workers' participation in decision making process and profit sharing has received a growing attention since 1970 in business, academia and even in the politics of different countries. Companies can be divided into two major poles; Profit maximizing firms and labor managed firms, where workers are involved in decision making process in their different capacities.

Franklin (1983) declared that technical knowledge and competencies of lower level employees as an asset equivalent to cash, inventory or other fixed assets. He stressed on the utilization of this asset (employees) from all aspects to get the desired level of success. But this asset cannot be reflected on the balance sheet because human resource accounting has not been accepted uniformly. He further narrated that when the organizations follow participative approach from planning for production processes, it reduces defective rates and improves product quality; consequently organizations achieve economies of scales and an ultimate result is higher profitability.

Long (1978a) found that “although individual share ownership does have positive effects on some key job attitudes, worker participation in decision making has much stronger effects”. Franklin (1983) declares the involvement of employees as a respect for their expertise and knowledge. Hespe and Wall (1976) found that employees have different preferences regarding their interest in decision making, they express highest interest in decision making related to their job performance; their work unit is at number second and a weak interest in overall policy making. He further commented that in conventional organizations, there is no difference in worker owners and non owners for their desire of participation in decision making.

Long (1978b) commented that employee ownership actually increases participation in decision making. The findings of Long (1978b) are debatable on the grounds that half of the non-managers believe that participation in decision making at all the three levels, identified by Hespe and Walls (1976) has increased. He further commented that there is an increase in participation of decision making "despite a lack of formal mechanisms or pressures", may be due to the altered behaviour of supervisors.

The assumption that lower per unit cost of production will improve the profitability is an illusion because it is short-term in nature. Researchers are of the view that it will not strengthen the customers’ loyalty; improve the product quality or demand for the product. Jensen and Meckling (1976) explained how increasing cash flow rights of managers will increase corporate value of cutting down consumptions. The only enduring approach to improve profitability is to improve the productivity (Franklin, 1983). Jones and Pliskin (1988) argued in favour of Weitzman that employee participation in profit sharing will stabilize production level near full capacity. Long (1978b) found that with structural change of employee takeover brings a shift from large financial losses to financial gains and improve employee attitude towards their jobs and decreases turnover. Hence, there is a need to devise a system which will involve employees in organizational matters and improve performance of an organization. It is linked to the involvement of employees in the decision making which can be achieved by offering them ownership rights in the organization.

Firm Efficiency

Efficiency can be said as a relative productive performance, which is a maximization of productivity ratio. Organization for Economic Corporation and Development defines efficiency as “the degree to which a production process reflects best practices”. Another definition by Fried, et al. (2008) is that efficiency is the result of comparison between observed and optimal values of input and output in the firm’s production process. In the competitive environment firms produce at lowest possible average cost and the price is equal to marginal cost, there may be a situation that companies produce maximum output with a given level of inputs it can (X-efficiency or Pareto efficiency). It means productive without waste and in normal business life waste means money.

Theoretical Framework

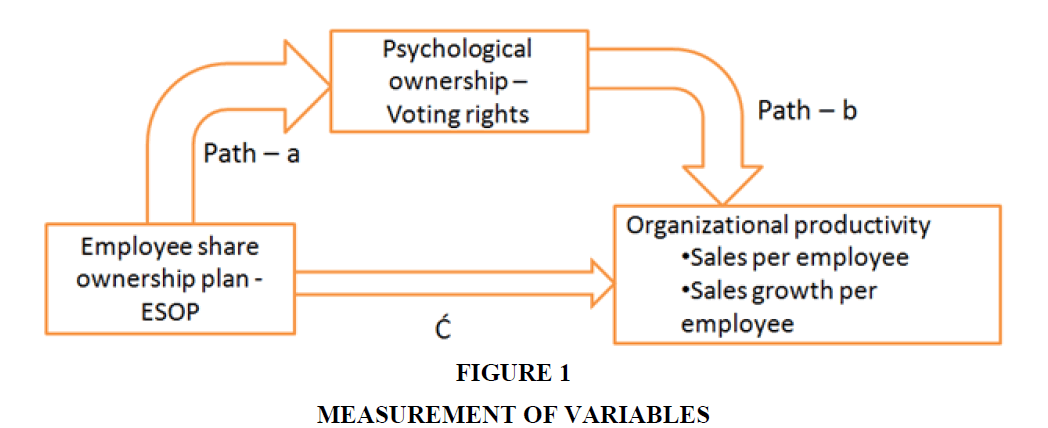

Variables

• Independent Variable → Employee Ownership (ESOP)

• Dependent Variable → Organizational Productivity

• Mediating Variable → Psychological ownership - Voting Rights

So, being efficient has a direct impact on the bottom line of financial statements. Top performing companies continuously improve their bottom line by customer retention through providing them a better quality of goods and services (dynamic efficiency), improved employee satisfaction and reduced administrative costs through employee feedback, better use of technology, improving customer service and minimizing staff.

Friedman (1953) argues that when firm is ‘consistent with rational and informed maximization of returns, the business will prosper’. While talking about efficiency, law of increasing return pops up it means that selected choices should produce greater return with the increase in a given variable. According to Bradley and Estrain (1987) if profit sharing increases marginal and average production per worker, then profit sharing firms will employee more and more workers at a certain level of pay than a conventional fixed wage firm (Table 1).

| Table 1: Measurement Of Variables | |||

| Variables | Ratios | Measurements | References |

|---|---|---|---|

| Employee Ownership | ESOP | No. of shares with employees/total outstanding shares | (Torp, 2011) |

| Psychological Ownership | Voting Rights | No. of employees’ nominated directors/total number of directors | (Rosen, 1990) |

| Productivity | Sales per employee | Total Sales/No. of employees | (Blassi and Kruse, 1996) |

| Sales growth per employee | Change in sales/Base year sales | (Wagner and Rosen, 1985, p. 77) | |

Hypotheses Developments

Moving towards theoretical model, the mechanism identifies the effects of employee ownership on organizational productivity and attitudes which has not yet been explored specifically in the under-developed countries. Pierce et al. (1991) developed a model to explain the impact of organizational ownership towards individual and group outcomes through psychological ownership and integration. Similarly Logue and Yates (1999) model the effects of different elements like organizational structure, communication system, trainings and employee ownership on an organizational performance.

The study is designed to find out the role of employee ownership on an organizational productivity. The literature suggests that employee ownership enhance organizational productivity through certain intervening variables which mediate this relationship.

While all employees could be involved in strategic decisions, interest has increasingly focused on the importance of involving middle managers in the strategy process.

Hypothesis

Shared ownership with employees give them a sense of responsibility by giving them rights to participate in the organizational decision making process and ultimately enhance organizational productivity in the developing countries like Pakistan.

a. Employee share ownership improves organizational productivity.

b. Voting rights mediate the relationship between employee ownership and organizational productivity.

Research Methodology

The study is based on the primary as well as secondary data, primary data is collected by circulating a questionnaire among the employees of sate owned entities covered under the of employee ownership. Primary data is collected from already published financial statements of the companies for the period of 2010 to 2015. The values of the secondary data are averaged to analyse it with primary data. This research is based on the twenty seven state owned entities which have implemented the employee ownership scheme. Primary data is collected from 395 employee covered under the scheme by circulating a questionnaire. The questionnaire is circulated based on the convenience of the researcher.

Statistical Model

The dependent variable is an organizational productivity, which is measured through two ratios i.e., sales per employee and sales growth per employee. The independent variable is share of employee ownership in organizational equity measured. Mediating variable is employees’ involvement in decision making process.

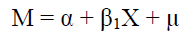

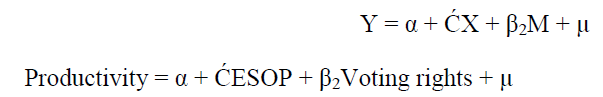

In statistical form this model is represented with two linear models, one with mediators as outcome variable and one with dependent variable as outcome and with mediation.

M = α + β1X + μ 01

Y = α + ?X + β2M + μ 02

Here; M is a mediator, X is an independent variable and Y is a dependent variable. As X’s effect on mediator is modeled in equation 01, then similarly is indirect effect of X on Y, because indirect effect is product of conditional effect of X on M and unconditional effect of M on Y.

In the above models both the effects of independent variable on mediation and direct effect of independent variable on dependent variable are estimated.

Data Analysis

The study examines above hypothesis and debates about the role of employee ownership on organizational productivity through a mediating role of employees’ participation in decision making process. The analysis is performed by using statistical tool PROCESS developed by Hayes.

The reliability and validity of the questionnaire is also tested, the computed value of KMO is 0.758 which is in the acceptable range and the Bartlett's test is significant. The reliability statistics shows a value of Cronbach’s Alpha as 0.924 which is as good as required.

Mediation Analysis

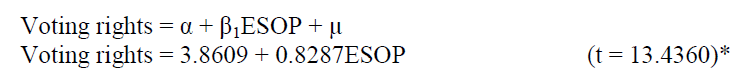

The intervening variables model exhibits the following regression coefficient

The above regression analysis indicates first constituent path of mediation analysis, this exhibits that employee ownership has a positive impact on psychological ownership measured through employees voting rights. The coefficient value is statistically significant at 99% confidence interval. The positive value indicates that a unit change in employee ownership will have an impact of 0.8287 on psychological ownership. It means that increase in employee ownership will have a positive impact on psychological ownership.

In above regression analysis organizational productivity is measured through two ratios i.e., sales per employee and sales growth per employee. The coefficient values of β2 indicate that a unit change in voting right will have positive change of 0.2415 on average sales and by 0.1873 on average sales growth. Both the values are positive and statistically significant at 95% confidence interval. The values exhibits that if employees are psychologically satisfied and considers themselves as owner of the company which is only possible by giving them voting rights, it will positively affect organizational productivity.

These significant positive values indicate that higher employees’ involvement in decision making process will give them a sense of responsibility and strong sense of psychologically ownership.

The direct effect is represented as ?, which indicates impact of employee ownership on organizational productivity by controlling the impact of mediating variable. The coefficient values 0.2109 and 0.2250 for sales per employee and sales growth per employee respectively, the values are positive but statistically insignificant.

The above discussion describes how the effect of X on Y in a simple mediation model can be divided into direct and indirect components. The effects estimated by using OLS regression will always give true results in any given data set and total effect can be calculated by adding direct effect and indirect effects. These results define the association between variables rather generalizability (Table 2).

| Table 2: Direct Effect And Second Constituent Path | |||

| Dependent Variable | Intercepts | (C) ESOP | (ß2) Voting Rights |

|---|---|---|---|

| Sales per Employee | 3.0969 | 0.2109 (t = 1.1151) |

0.2415 (t = 2.9534)* |

| Sales growth per employee | 3.2173 | 0.2250 (t = 1.5103) |

0.1873 (t = 2.2128)* |

* Significant at 95% confidence interval, t -values in parenthesis.

Indirect Effect Inference

Indirect effect is the product of two constituent paths of regression analysis (Table 3). The below results indicate that the indirect impact of employee ownership on organizational productivity through sense of psychological ownership is positive. The indirect effect exhibits how employee ownership affects employees’ psychological ownership which in turn affects organizational productivity. This indirect relationship is called causal chain of events (Hayes, 2012).

| Table 4: Total Effect | |||

| Dependent Variable | Direct Effect (C) | Indirect Effect (ß1X ß2) | Total Effect |

|---|---|---|---|

| Sales per employee | 0.2109 | 0.2001 | 0.411 |

| Sales growth per employee | 0.2250 | 0.1552 | 0.3802 |

Total Effect Inference

Total effect is the sum of direct effect and indirect effect of X on Y through M. It can simply be calculated by regressing Y on X.

The total effect of employee ownership on organizational is very straight forward and simple (Table 4). It calculates regression coefficients by simply regressing independent variable on dependent variable. The calculated values are positive which demonstrates that employee ownership has a positive impact on organizational productivity through sense of psychological ownership. It is simply the sum of direct and indirect effects.

Normal Theory Approach

The normal theory approach is also referred to as the product of coefficients approach (Table 5). This theory is distinctively based on the theory used for direct effect in the social sciences. Basic assumption of the theory is that sample distribution of “ab” paths is normal and the argument is made on the basis of P-value. The results of normal theory are presented in the below table.

| Table 5: Normal Theory Approach | |||

| Dependent Variable | Coefficients (ßs) | Z-Value | P-value |

|---|---|---|---|

| Sales per employee | 0.0794 | 2.5773 | 0.0100*** |

| Sales growth per employee | 0.0616 | 2.0286 | 0.0425** |

*** Significant at 1% level of significance; ** Significant at 5% level of significance.

The results reject the null hypothesis of no indirect effect at the 95% level of confidence. The results indicate the significance of the indirect effect of employee ownership on organizational productivity. This test is simple enough and can be conducted by using any software which can simply run the regression analysis and can calculate their standard error.

Bootstrap Confidence Intervals Approach

Bootstrap confidence interval approach removes the assumption of normality of distribution. Bootstrapping technique is being implemented and used with increasing frequency; this can be applied to many problems encountered by researchers. This technique constructs the confidence interval for assessing mediation effect. The results of bootstrap confidence intervals for voting rights as a mediation are presented in the below (Table 6).

| Table 6: Bootstrap Confidence Intervals | |||

| Dependent Variable | Coefficients (ß) | BootLLCI | BootULCI |

|---|---|---|---|

| Sales per employee | 0.0794 | 0.0189 | 0.1614 |

| Sales growth per employee | 0.0616 | 0.0009 | 0.1272 |

There is clear evidence that the indirect effect is positive to a “statistically significant” degree. As these confidence intervals do not contain and are entirely above zero, this supports the conclusion that the indirect effect is positive.

Conclusion

The role of organizational ownership, management and organizational performance has not been explored in developing economies, specifically the role of employees’ participation in ownership structure and their role in the decision making process. There are conflicting interests of the managers and shareholders which negatively affect the organizational performance. Therefore, to reduce these divergences of interests and control the associated agency cost, adopted strategy is the involvement of employees in ownership structure. This employee ownership is supported by giving them rights in the decision making process which give them sense of psychological ownership.

The study identifies the mediating role of employee participation in decision making towards enhancing corporate productivity. This mediator variable function as the conduit through which causal effects operates. When a causal variable transmits an effect on the dependent variable through mediator this is called indirect effect. The statistical inferences indicate that participative ownership structure with employees will have significant positive effects on organizational productivity, if they have been involved in an organizational decision making process. This indirect effect is estimated by using OLS regression, the normal theory approach and bootstrap confidence intervals approach. This study provides an empirical support to the policy makers that employee ownership along with participation in the decision making will align their objectives with the organization. This shared ownership along with voting rights will enhance organizational productivity. The results are consistent with the studies of (Weitzman and Kruse, 1990; Perotin and Robinson, 2003); and Long (1978a) who argue that non contributory system will have lower participation of workers.

References

- Baron, R.M. & Kenny, D.A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173-1182.

- Beaglehole, E. (1932). Property: A study in social psychology. New York: Macmillan.

- Blasi, J.R. (1987). Employee ownership through ESOPs: Implications for the public corporation. New York: Pergamon press.

- Blasi, J.R., Conte, D. & Kruse, D.L. (1996). Employee stock ownership and corporate performance among public companies. Industrial and Labor Relations Review, 50, 60-79.

- Bradley, K. & Estrain, S. (1987). Profit sharing in the retail trade sector: The relative performance of the john lewis partnership. London School of Economics, Center for labor Economics, Discussion paper No. 279.

- Dube, A. & Freeman, R. (2001). Shared compensation systems and decision-making in the US job market. Incomes and productivity in North America. Secretariat of the Commission for labor Cooperation. Washington DC.

- Emery, F. (1995). Participative design: Effective, flexible and successful, now! Journal for Quality & Participation, 18, 6-9.

- Franklin, M.C. (1983). Improved productivity means increased profitability. American Journal of Small Business, 7(4), OSTI Identifier, 622-643.

- French, J.L. (1987). Employee perspectives on stock ownership: Financial investment or mechanism of control? Academy of Management Review, 12, 427-435.

- Fried, H.O., Lovell, C.A. & Schmidt, S.S. (2008). Efficiency and productivity, the measurement of productive efficiency and productivity change. New York: Oxford University Press.

- Friedman, M. (1953). Essays in positive economics. Chicago: University of the Chicago Press.

- Furby, L. (1991). Understanding the psychology of possession and ownership: A personal memoir and appraisal of our progress. Journal of Social Behaviour and Personality, 6(6), 457-463.

- Hammer, T.H. & Stern, R.N. (1980). Employee ownership: Implications for the organizational distribution of power. Academy of Management Journal, 23, 78-100.

- Hansmann, H. (1996). The ownership of enterprise. Cambridge, MA: Belknap.

- Hayes, A.F. (2012). A versatile computational tool for observed variable mediation, moderation and conditional process modeling. Retrieved from http://www.afhayes.com/public/process2012.pdf

- Hespe, G. & Wall, T. (1976). The demand for participation among employees. Human Relations, 29, 411-428.

- James, W. (1890). Principles of psychology. New York: Macmillan.

- Jensen, M. & Meckling, W. (1976). Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3, 305-360.

- Jones, C. & Pliskin, D.J. (1988). The effects of worker participation, employee ownership and profit sharing on economics performance: A partial review. Bard College, Annandale-On-Hudson. The Jerome Levy Economics Institute.

- Kaarsemaker, E., Pendleton, A. & Poutsma, E. (2010). Employee share ownership schemes: A tentative opening of the black box. Personnel Review, 46(7),1280-1296.

- Klein, K.J. & Hall, R.J. (1988). Correlates of employee satisfaction with stock ownership: Who likes an ESOP most? Journal of Applied Psychology, 73, 630-638.

- Kruse, D. (2002). Research evidence on prevalence and effect of employee ownership. Rutgers University: US House of representatives.

- Lawler, E.E. (1977). Reward systems. In J.R. Hackman & J.L. Suttle (Eds.), Improving life at work. Santa Monica, CA: Goodyear.

- Logue, J. & Yates, J.S. (1999). Worker ownership American style: Pluralism, participation and performance. Economic and Industrial Democracy, 20, 225-252.

- Long, R.J. (1978a). The effects of employee ownership on organizational identification, job attitudes and organizational performance: A tentative framework and empirical findings. Human Relations, 31, 29-48.

- Long, R.J. (1978b). The relative effects of share ownership versus control on job attitudes in an employee owned company. Human Relations, 31, 753-763.

- MacKinnon, D.P., Fairchild, A.J. & Fritz, M.S. (2007). Mediation analysis. Annual Review of Psychology, 58, 593-614.

- Pendleton, A. (2001). Employee ownership, participation and governance: A study of ESOPs in the UK. London: Routledge.

- Perotin, V. & Robinson, A. (2003). Employee participation in profit and ownership: A review of the issues and evidence. Directorate General for Research. Leeds: European Parliament Working Paper No. SOCI109EN.

- Pierce, L.J., Rubenfeld, A.S. & Morgan, S. (1991). Employee ownership: A conceptual model of process and effects. The Academy of Management Review, 16, 121-144.

- Poon, M., Pike, R. & Tjosvold, D. (2001). Budget participation, goal interdependence and controversy: A study of a Chinese public utility. Management Accounting Research, 12, 101-118.

- Preacher, K.J. & Hayes, A.F. (2004). SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behaviour Research Methods, Instruments and Computers, 36, 717-731.

- Wilkinson, A., Marchington, M., Gollan, P. & Lewin, D. (Eds.). Oxford handbook of participation in organizations (pp. 315-338). Oxford, UK: Oxford University Press.

- Rhodes, S.R. & Steers, R.M. (1981). Conventional versus worker-owned organizations. Human Relations, 34, 1013-1035.

- Rosen, C.M., Klein, K.J. & Young, K.M. (1986). Employee ownership in America. Lexington, MA: Lexington Books.

- Torp, S.S. (2011). Employee stock ownership: Effect on strategic management and performance. Institute of Business and Technology (AU-IBT), PhD Thesis. Birk Centerpark 15, DK-7400 Herning: Aarhus University.

- Toscano, D.J. (1983b). Property and participation: Employee ownership and workplace democracy in three New England firms. New York: Irvington.

- Webb, C. (1912). Industrial cooperation: The story of a peaceful revolution. Manchester. England: Cooperative Union.

- Weitzman, M. & Kruse, D. (1990). Profit sharing and productivity. In: A. Blinder (Ed.), Paying for Productivity: A Look at the Evidence. Washington, DC: Brookings Institution.

- Whyte, W.F. (1978). In support of voluntary employee ownership. Society, 15(6), 73-82.

- Wilpert, B. (1991). Property, ownership and participation: On the growing contradictions between legal and psychological concepts. In Russell, R. & Rus, V. (Eds.), International handbook of participation in organizations: For the study of organizational democracy, co-operation (Vol. 2). New York: Oxford University Press.

- Zhou, X. (2001). Understanding the determination of managerial ownership and its relationship to firm performance: Comment. Journal of Financial Economics, 62, 559-571.