Research Article: 2020 Vol: 24 Issue: 3

Impact of Firm Size on The Relationship Between Inventory and The Business Results of Jordanian Public Shareholding Industrial Companies

Mohammad Ali Al Hayek, Al-Bayt University Jordan

Abstract

This study aimed to examine the impact of firm size on the relationship between inventory and the business results of Jordanian Public Shareholding Industrial Companies, and to achieve this goal the researcher conducted an analytical study which depended on the descriptive and analytical approach, by using the statistical methods to analyze the study data that represented in the actual data taken from the financial statements of Jordanian Public Shareholding Industrial Companies listed at the Amman Stock Exchange (ASE) for the study sample that consisted of (28) companies, for the period (2009-2018). The study results indicated the existence of statistically significant impact of firm size on the relationship between inventory and the business results of net profit or loss at the Jordanian Public Shareholding Industrial Companies, where as one of the study most significant recommendation is the necessity of those companies to have concern about the balance between firm size and inventory, due to its impact on the business results.

Keywords

Firm Size, Inventory Available for Sale, Beginning Inventory, Ending Inventory, Net Profit or Loss, Jordanian Public Shareholding Industrial Companies.

Introduction

The business results from profit or loss received a lot of attention and analysis from many parties of the economical process and the beneficiaries of financial statements to ensure the continuation of economical unit and the achievement of its objectives. The profit is the income that is earned after calculating all the expenses, where the profits gain always consider the main goal of each firm, and as a result the firm performance will be based on profit in its various forms. There are three main types of profits, which are gross profit, operating profit, and net profit where at the end it will be referred to the net income and will be inserted at the end of income statements, therefore the analysts are interested in the variables that may affect profits, such as inventory and firm size. The inventory is the goods and materials that firm keep and store in order to resell or use in the production process, and the commodity inventory is divided into the raw materials that used in the production processes, the commodities under operation, and ready goods for sale. Inventory also considers a major part of the industrial firm's current assets, and an important factor in the sustainability of production and the availability of goods and products in the market. It's evaluated by more than one accounting method, and through firm size the companies are classified into small, medium or large where there are several scales to measure the firm size, which include the total assets, total deposits, total sales, or the book value of assets.

Given the importance of net income, inventory, and firm size, this study aimed to examine the impact of firm size on the relationship between inventory and the business results from net profit or loss at the Jordanian Public Shareholding Industrial Companies, where this topic considers of great significance due to the importance of these variables for all internal and external financial data users.

Study Problems

The income increase through company’s business practice considers one of the core objectives of its existence, with the aim of satisfying the desire of owners by succeeding in their investments and its achievement of profits, by paying the obligations and developing the operations without the need for external financing, and by impacting the decisions and size of investment and its continuous operations which has created the motivation of many researchers to study and research the variables that have an impact on the net income, such as inventory and firm size. Despite the assortment of studies that addressed these variables, but the researcher noticed the lack of studies that connect between these variables due the importance of firm size to provide the resources for investing in inventory, and due to the importance of inventory for sustaining production and providing the goods for sale, and also bearing the cost of alternative opportunity related to holding the inventory. In addition, the researcher noticed a shortage in the studies that addressed the impact of these variables on net income at the Jordanian public shareholding companies; therefore the study problem represented its attempt to answer the following major question: "What is the impact of firm size on the relationship between inventory and the business results from net profit or loss at the Jordanian Public Shareholding Industrial Companies listed at the ASE?"

The researcher was motivated to implement this study on the industrial sector due to its active role in the Jordanian economy.

Study Importance

The importance of this study comes from its goal to study the impact of firm size on the relationship between inventory and the business results from net profit or loss at the Jordanian Public Shareholding Industrial Companies listed at the ASE, due to the importance of these variables and this topic to all the internal and external users of financial statements, where this topic acquires great importance and deserves a lot of independent studies to examine all of the aspects related to it, and to fill the gap by determining whether if there is an impact of the firm size; as an intervening variable on the relationship between inventory and the business results from net profit or loss at the Jordanian Public Shareholding Industrial Companies listed at the ASE.

Study Objectives

The study aimed to identify the relationship between each of firm size and inventory and the business results of the Jordanian Public Shareholding Industrial Companies listed at the ASE. This study aims to identify the existence of firm size impact on the relationship between inventory and the business results of these firms, where this study helps to increase the awareness of financial statements users to make the right decision related to specifying their strategies to deal with the company. The study results also help the company management and financial managers to control the optimum inventory investment compared to the firm size and its ability to provide the resources needed to invest in inventory, avoid the cost of alternative opportunity, and the cost of holding inventory in order to achieve one of the company's main objectives related to profitability.

Literature Review

Firm size is the identification and classification of companies to three different sizes, which are large, medium, and small, and there are several measurements that used to specify the firm size, such as the number of employees in the company, the market value, sales volume, book value, and the total assets (Telly & Ansori, 2019); (Do?an, 2013). The firm size has a significant impact on the operating environment inside and outside the company, and also the economies of size have an impact on the company's profitability due to the ability of large firm size to benefit from the economies of size and scope. Most of the studies found a positive impact between the firm size and profitability (Dahmash, 2015).

One of the advantages of firm's size is the amount of production capacity that meets the demand and the long-term competitive advantage of small-scale companies (Azhar & Ahmed, 2019), where the large companies enjoy a larger competitive capability and a direct impact on sales and profits compared with the small-scale companies, due to its ability to compete and work in areas that require high capital rates, and its ability to provide the required funds and obtain the loans (Kumar & Kaur, 2016).

The inventory plays a very important role in the companies, since it considers one of the most important assets for many companies, especially at the industrial one where inventory often formulate a huge assets of the companies' financial statements and represents a source for revenues; in the near future through sales. The inventory in industrial companies consists of the quantity of raw materials, supplies, commodities under operation, and ready goods for sale where the inventory considers one of the traded and required assets for the effective operation at the industrial companies (Monisola, 2013). Holding the inventory involves carrying the cost of alternative opportunity; therefore, the management seeks to ensure keeping an appropriate inventory in its warehouses to avoid the excess investment in inventory (Sitienei & Memba, 2015). The inventory also considers a variable that has an impact on the decision during the stages of product manufacturing, distribution, and sale, therefore the company's focus on the availability of inventory at the lowest cost (Gokhale & Kaloji, 2018), and it represents a large part of the traded assets in industrial companies which may reach (40%) of the total capital (Kung'u, 2016). Inventory also formulates a key component of working capital, which forced the management to pay attention to controlling and seek to reduce the size of investment in it (Sitienei & Memba, 2015), where the inventory investment ratio vary depending on the size of firm , therefore the firm tries to provide inventory at the ideal time in order to avoid disrupting or stopping the production or marketing process (Anshur et al., 2018), due to the fact that process of controlling inventory affects the productivity and growth of the industrial companies (Kuncová et al., 2016).

The importance of keeping enough inventory returns to a number of reasons, the most important are insurance and protection against risks and price volatility, the continuous availability of raw materials for production and the finished products for sale, and the achievement of economical savings through the purchase or manufacture of large quantities (Sharma & Arya, 2016). Therefore, the objective and role of inventory management is based on the availability of ideal stock quantity that meets the purpose of production and sale (Sharma & Arya, 2016), and the inventory plays a key role in the firm's growth and its survival (George, 2019) where the process of obtaining inventory at the right and appropriate time, place, and quantity means that inventory management has a direct or indirect impact on profitability (Shardeo, 2015) & (Kolawole et al., 2019), therefore management must focus on the efficient and effective inventory planning to avoid the idle inventory and ensure the continuity of production (Monisola, 2013).

Profit is the amount of income a firm can make within its limited resources, and due to the fact that firm's main goal is to increase income, most management efforts go toward improving the profitability where the most profitable companies can easily expand the size of its operations through internal financing (Azhar & Ahmed, 2019) & ( Kumar & Kaur, 2016). The firm's profit rate differ significantly by the difference in firm size (small, medium, large), and the inventory management is strongly connected to the firm profitability where the effective management has a positive impact on profitability (Ammar et al., 2003). In addition, profit considers an indicator on the efficiency of firm's management policies, and the ability of this management to employ the capital and achieve the main goal related to generating profits by increasing the revenues on the account of costs or expenses (Shin et al, 2015).

Previous Studies

Several studies have addressed many variables that may affect the profitability of the company and its survival, where the success of any company depends mostly on the achievement of profits, and the inventory was one of these variables that addressed by the current study, where the inventory considers one of the main variables that may affect the definition of company's profitability, which include the following studies:

The study of (Capkun et al., 2009) aimed to examine the relationship between the inventory and the financial performance at the manufacturing companies in the USA, with a sample size of 2,000 companies for the period (1980-2005), where the study arrived to existence of a significant positive relationship between the performance of inventory and the financial performance measurements.

The study of (Kung'u, 2016) aimed to determine the impact of inventory control on the profitability of industrial and allied companies in Kenya, where a random categorical sample of (71) industrial and allied companies from (399) industrial and allied companies in Nairobi and its surrounding area, for the period (2009-2014). The results of analysis showed a positive and significant relationship between the practices of inventory control and the profitability of industrial companies.

The study of (Kipkemoi et al., 2018) aimed to analyze the impact of inventory and cash transfer cycles on the financial performance in Kenya, by the case study of commercial and service sector companies listed on the Nairobi Stock Exchange, where 12 companies from the commercial and service sectors were examined at the Nairobi Stock Exchange for the period (2007-2017), and the study found that stock conversion period had no relationship with the financial performance.

The study of (George, 2019) examined the impact of inventory management on the net profit, where it examined the financial statements of a sample that consists of (5) steel manufacture companies in India for the period (2011-2015), and the study showed that inventory transfer cycle is directly related to the company's net profit.

The study of (Kolawole et al., 2019) assessed the degree of relationship between the inventory management and the profitability of industrial companies in Nigeria, where it adopted one of the factories as a case study for the period (2002-2011). Study results indicate that effective inventory management significantly contributed to the profitability of industrial companies.

But in relation to the studies that dealt with the variable of firm size, mixed results were found where some studies found a positive relationship between the firm size and profitability. In addition, some studies found a negative relationship between the firm size and profitability, and some of it found that firm size doesn't affect the profitability, which include the following studies:

The Do?an (2013) study aimed to examine the impact of firm size on the profitability, where in this study the data of 200 companies listed on the Istanbul Stock Exchange (ISE) for the period (2008-2011) were used, but the analysis didn't include companies operating in the financial sector due to its different financial structures. It used the Return on Assets (ROA) as indicator of the company's profitability and used the Total Assets, Total Sales, and the number of employees as indicators for size, where the study found a positive relationship between the indicators of size and the profitability of companies.

John & Adebayo (2013) study examined the impact of firm size on the profitability of industrial companies listed on the Nigerian Stock Exchange, where the study sample consisted of 5 industrial companies for the period (2005-2012), where the ROA was used to measure the profitability while the Total Assets and Trading Volume were used to measure the firm size. The study found that firm size had a positive impact on the profitability of Nigerian industrial companies.

The study of (Niresh & Velnampy 2014) examined the impact of firm size on the profitability of industrial companies in Sri Lanka, by analyzing the data of (15) companies that were active on the Colombo Stock Exchange (CSE) during the period (2008-2012), where the ROA and Net Profit were used as indicators of the company's profitability, while the Total Assets and Total Sales were used as indicators of firm size. The results showed that firm size had no profound impact on the profitability of Sri Lanka's industrial companies.

The study of (Dahmash 2015) tested the impact of size on the company's profitability for a large sample that consists of (1538) companies listed on the ASE for the period (2005-2011). The analysis results indicated an impact of firm size on the profitability where the greatest impact was at the companies of industrial sector, followed by the companies of service sector, and finally at the companies of financial sector.

Kumar & Kaur (2016) studied the impact of firm size on the profitability at the Indian automaker companies, for the period (1998-2014) where the net profit ratio to the total sales and the net profit ratio to the net assets, in addition to the working capital as an indicators of profitability, and use the total sales and net assets as indicators of firm size. The study found no relationship between firm size and the profitability.

Kartikasari & Merianti (2016) study aimed to analyze the impact of financial leverage and firm size on its profitability, where data were obtained from the financial statements of 100 qualified industrial companies listed on the Indonesian Stock Exchange for the period (2009- 2014). The firm size was measured by the total assets and total sales, and the profitability through ROA. Study found that firm size had a statistically negative and small impact on the companies' profitability.

The study of (Samosir, 2018) aimed to provide a experimental evidence on the impact of cash transfer cycle, firm size, and age of company on the profitability of industrial companies listed on the Indonesian Stock Exchange (BEI) for the period (2012-2014), for a study sample of (101) companies out of the (303) total industrial companies. The study results showed a positive impact of firm size on ROA.

Azhar & Ahmed (2019) examined in their study the relationship between the firm size and profitability in the textile companies listed on the Pakistan Stock Exchange by selecting a sample of 10 textile companies listed on the Pakistan Stock Exchange for the period (2012-2016). The total sales and total assets were used to measure the firm size variable while the net profit ratio and ROA were used to measure the variable of profitability. The study results showed a negative relationship between the company's profitability and the total assets.

The current study distinguished from the previous studies in its attempt to investigate the impact of firm size, as an intermediate variable in the relationship between inventory, as an independent variable and net profit, as a dependent variable in the Jordanian Public Shareholding Industrial Companies listed at the ASE.

Study Hypotheses

The researcher relied on the following main hypothesis to achieve the objectives of the study:

H0: "There is no statistically significant impact of firm size on the relationship between inventory and the business results of Jordanian Public Shareholding Industrial Companies listed at the ASE", and derives from it the following hypotheses:

H01: "There is no statistically significant relationship between commodity inventory and the business results of Jordanian Public Shareholding Industrial Companies listed at the ASE", and derives from it the following secondary hypotheses:

H011: "There is no significant relationship between the beginning inventory and the business results of Jordanian Public Shareholding Industrial Companies listed at the ASE".

H012: "There is no significant relationship between the inventory available for sale and the business results of Jordanian Public Shareholding Industrial Companies listed at the ASE".

H013: "There is no significant relationship between the ending inventory and the business results of Jordanian Public Shareholding Industrial Companies listed at the ASE".

H02: "There is no statistically significant relationship between firm size and the business results of Jordanian Public Shareholding Industrial Companies listed at the ASE".

Methodology

The study population consisted of the Jordanian Public Shareholding Industrial Companies listed at the ASE, where a sample of (50%) was taken from the (56) Jordanian Public Shareholding Industrial Companies listed at the ASE according to the latest update at the end of 2019, and (28) companies were selected according to the serial order of industrial companies at the securities depository center while excluded the companies that didn't issue financial statements during any period of the study (2009 -2018). The researcher relied on the actual data extracted from the annual financial reports of the companies under study for the years (2009-2018) to achieve the objectives of this study and test its hypotheses, where the research variables were classified and its nature were determined as follows:

1. Independent variables: stock first term, stocks available for sale, stock last period.

2. Dependent Variable: business results of net profit or loss.

3. Intermediate Variable: the firm size, where the logarithm of assets was used in this research assets as a scale for firm size, since the increase in firm assets considers equivalent to the increase in its size (Kartikasari & Merianti, 2016), (Telly & Ansori, 2019).

The study adopted the descriptive and analytical approach through the exposure to concept of firm size impact on the relationship between inventory and business results from net profit or loss at Jordanian Public Shareholding Industrial Companies listed at the ASE", by using the required scientific knowledge about the different aspects of study, and by returning to previous studies where it enabled the researcher to get acquainted with all the required cognitive aspects to accomplish the research. In addition, the statistical method was used to analyze study data based on the relevant corporate data for the period (2009-2018) by using the descriptive statistical analysis methods to analyze data and test the study hypotheses, and used the E-Views, as an advanced statistical program in analysis.

Empirical Results

This study seeks to identify the impact of firm size on the relationship between inventory and the business results of Jordanian Public Shareholding Industrial Companies listed at the ASE, by analyzing the time-based or panel data collected from the cross-section company data for a specified time series. The data included a set of indicators related to (28) industrial companies for the period (2009-2018), where the analysis process began by verifying the suitability of data for statistical analysis, then the descriptive analysis, and ended with testing the hypotheses.

Data Analysis Validity Tests

The study depended on the regression analysis tests, which require the identification of data properties and to ensure its appropriateness for testing the study hypotheses, and its validity for the analysis, to ensure the accuracy of results, and the following required tests have been conducted:

Normal-Distribution Test

The statistical studies have shown that samples with a size greater than (30) views will be closer to the normal distribution and there will not be any significant problem of distributing data on to the analysis results, and since the number of views in this study is (280), it means that data are close to the normal distribution. To increase the certainty the data was subject to the Jarque- Bera parameter test, which is one of the most common tests to identify the closeness of data to the normal distribution, where the decision-base will be to accept the nihilism hypothesis that data follow the normal distribution if probabilities of J-B test is greater than (5%) (Gujarati, 2013). Results of Table 1 showed that probabilities of J-B test for all the model variables were greater than the significant level (α ≤ 0.05), which means that data are close to the normal distribution.

| Table 1: Normal-Distribution Test | |||

| Variables | Normal Distribution | Result | |

|---|---|---|---|

| Jarque-Bera Test | |||

| J-B | Prob. | ||

| Beginning inventory | 1.75 | 0.387 | Normal Distribution |

| Inventory available for sale | 5.087 | 0.078 | Normal Distribution |

| Ending inventory | 0.763 | 0.682 | Normal Distribution |

| Company size | 1.682 | 0.402 | Normal Distribution |

| Net/Loss income | 0.468 | 0.781 | Normal Distribution |

Time Series Stationary/ Stability Test

The researches that use the Time Series assume the stability of those series, and to verify the stability of time series the Unit Root Parametric Test which included the Augmented Dicky- Fuller Test (ADF) and the Phillips-Person Test (PP). Its noticed from Table 2 that Time Series are stable where the Absolute Value of ADF Parametric Test and the Non-Parametric (PP) test was statistically significant at level (α ≤ 0.05), which indicates that Time Series (2009-2018) are stable at the desired level for all study variables, and also indicates the possibility of jointly integrating it at the level.

| Table 2: Time Series Stationary Test | |||

| Variables | Time Series Stationary | Result | |

|---|---|---|---|

| PP | ADF | ||

| Beginning inventory | -9.215 | -4.561 | stable |

| Inventory available for sale | -7.205 | -3.671 | stable |

| Ending inventory | -9.625 | -4.162 | stable |

| Company size | -8.015 | -3.114 | stable |

| Net/Loss income | -9.213 | -4.61 | stable |

Multicollinearity/ Linear Regression Test

To ensure there is no linear overlap or Non-Collinearity between the independent variables, which intensify the Interpretation Coefficient Value (R2) and makes it larger than its actual value, the Collinearity Diagnostics test was used by calculating the Tolerance Coefficient and then finds the Variance Inflation Factor (VIF). (Gujarati, 2013) has indicated that VIF factor should not exceed the value of (5), the Tolerance Coefficient Value must be greater than (0.05). Table 3 shows that VIF values for all variables were less than (5), and between (1.021-1.951), and that Tolerance values were greater than (0.05) and between (0.431-0.814), which means that study model doesn't suffer from any Collinearity problem between the independent variables and indicates the strength of study model in interpreting the relationship between the independent variable and the dependent variable.

| Table 3: Multicollinearity Test | |||

| Variables | Multicollinearity | Result | |

|---|---|---|---|

| Collinearity Statistics | |||

| VIF | Tolerance | ||

| Beginning inventory | 1.507 | 0.521 | Acceptable |

| Inventory available for sale | 1.294 | 0.614 | Acceptable |

| Ending inventory | 1.951 | 0.431 | Acceptable |

| Company size | 1.021 | 0.814 | Acceptable |

Hetroskedasticity Test

The Hetroskedasticity Test or Random Error Variations Constancy considers one of the important assumptions of linear regression, where the average Variations must be equal to zero, and in case of non-variation random error variability, some statistical methods will be used to overcome this problem, such as the White test, which detects and treats the instability at the same time (AL-Shwiyat, 2013). The results showed that statistical probability (White) is equal to (0.030), which is less than (5%) and indicate that study model doesn't suffer from the problem of Hetroskedasticity or Random Error Variations Constancy.

Correlation Matrix Test between Study Variables

To ensure that there are no high correlations between the independent variables in the study model that result in distortion of relationship between one of the independent variable and the dependent variable, the Pearson Correlation Matrix between the independent study variables was prepared where (Anderson et al., 1993) indicated that Collinearity problem between the independent variables created when the value of correlations between independent variables exceeds (70%), and Table 4 shows the results of this test.

| Table 4: Correlation Matrix | |||||

| independent Variables | Net/Loss income | Ending inventory | Inventory available for sale | Beginning inventory | |

|---|---|---|---|---|---|

| Beginning inventory | 0.641** -0.055 |

0.629** 0.000 |

0.597** 0.000 |

Pearson Correlation Sig. |

1 |

| Inventory available for sale | 0.630** 0.000 |

0.602** 0.000 |

1.000 | Pearson Correlation Sig. |

0.597** 0.000 |

| Ending inventory | 0.655** 0.000 |

1.000 | 0.602** 0.000 |

Pearson Correlation Sig. |

0.629** 0.000 |

| Company size | 1.000 | 0.655** 0.000 |

0.630** 0.000 |

Pearson Correlation Sig. |

0.641** 0.000 |

**. Correlation is significant at the 0.01 level (2-tailed)

The previous table shows the non-existence of high correlations between independent study variables to the extent it can affect the regression analysis results, where the Correlation Coefficient Values between the independent variables were statistically acceptable (> 0.70), and shows the accuracy and validity of regression analysis results.

Descriptive Analysis of Study Variables

Table 5 shows the development of study independent and dependent variables' values during the period (2009-2018) by dividing the total variable values for all companies in the same year on the total number of companies of (28), and below are the development results of study independent, dependent, and intermediate variables' values during the study period.

| Table 5: Descriptive statistics of the variables (2009-2018) (Millions) | |||||

| Variables Year | Beginning inventory | Inventory available for sale | Ending inventory | Company size | Net/Loss income |

|---|---|---|---|---|---|

| 2009 | 8.932 | 44.937 | 9.616 | 89.277 | 10.755 |

| 2010 | 9.616 | 53.141 | 9.034 | 95.891 | 9.708 |

| 2011 | 9.034 | 56.586 | 16.293 | 111.451 | 14.869 |

| 2012 | 16.293 | 59.545 | 15.083 | 109.572 | 11.123 |

| 2013 | 15.083 | 66.061 | 18.133 | 111.199 | 4.509 |

| 2014 | 18.133 | 69.407 | 15.528 | 112.391 | 4.997 |

| 2015 | 15.528 | 61.735 | 14.150 | 112.051 | 6.185 |

| 2016 | 14.150 | 58.478 | 13.329 | 106.826 | -1.430 |

| 2017 | 13.329 | 55.265 | 11.522 | 105.612 | 3.090 |

| 2018 | 11.522 | 58.148 | 12.958 | 109.131 | 4.131 |

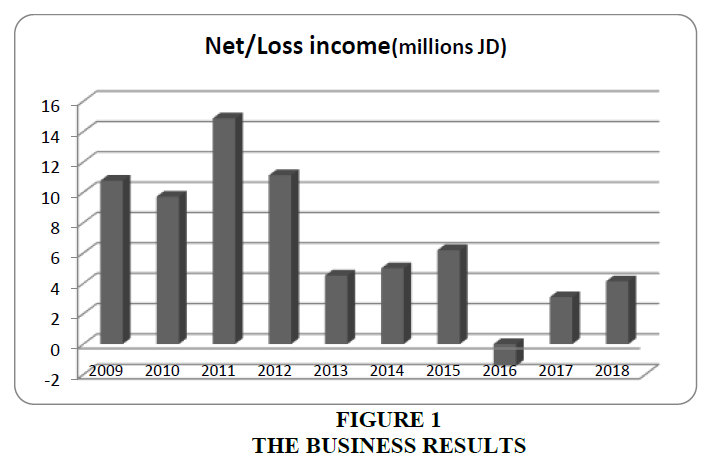

It noticed from the data in Table 5 above a fluctuation or variation in the study variables during the period (2009-2018), where it shows a continuous increase in the values of beginning inventory, the inventory available for sale, the last period, and the firm size from (2009-2014), and then the values began to decline significantly until 2017, accompanied by fluctuation of Net profit/loss values, while in 2018 there was a noticed improvement where the values started to increase compared with 2017, and the corporate earnings rose from (3.090) millions in 2017 to (4,131) in 2018, and the following Figure 1 shows the business results during the study period.

Table 6 also shows the descriptive analysis results of independent variables and dependent variable at the Jordanian Public Shareholding Industrial Companies during the period (2009-2018), where the results indicated that Skewness Coefficients Values of study variables fall within the normal acceptable range of Skewness Coefficients, where the values were limited to (±1), and ranged from (0.276) for the beginning inventory and (0.869) for the business results from profit or loss, and all variables were skewed toward the right, and that Kurtosis behavior for the study variables was greater than the normal distribution (Kurtosis = 3).

| Table 6: Descriptive Statistics of the Variables (2009-2018) (Millions) | |||||

| Net/Loss income | Company size | Ending inventory | Inventory available for sale | Beginning inventory | |

|---|---|---|---|---|---|

| Mean | 6.794 | 106.34 | 13.564 | 58.33 | 13.162 |

| Median | 0.15 | 21.185 | 3.905 | 15.175 | 3.905 |

| Maximum | 299.69 | 1223.27 | 272.82 | 812.74 | 272.82 |

| Minimum | -90.14 | 0.32 | 0.11 | 0.2 | 0.12 |

| Std. Dev. | 33.191 | 255.659 | 35.17 | 135.101 | 33.622 |

| Skewness | 0.869 | 0.323 | 0.046 | 0.838 | 0.276 |

| Kurtosis | 6.058 | 8.642 | 5.206 | 8.052 | 9.513 |

| Sum | 1902.23 | 29775.2 | 3798.03 | 16332.5 | 3685.32 |

| Observations | 280 | 280 | 280 | 280 | 280 |

Source: Researcher calculations depend on E-Views out put

It noticed from the table above that average net business results of corporate profits or losses during the study period (2009-2018) was (6.794) million JDs as a net profit, which shows the efficiency and effectiveness of corporate management policy in generating profits from its core operations, where the standard deviation amounted to (33,191) with a discrepancy between companies in the result of this variable, and the companies' results of profit or loss ranged from net profit of (299,690) million JDs to net loss of (-90.140) million JDs.

Hypotheses Test

After ensuring that data are appropriate for the statistical analysis, and describing the study variables, it comes the phase of testing hypotheses and since the relationship is between a set of independent variables and the dependent variable, the Pooled Data Regression Model will be the appropriate model, the study data is Cross Sectional Data, and for a specified extended time series for the period (2009-2018). To estimate the relationship between variables, the E-Views software was used, and the following in the results of study hypotheses test:

First Main Hypothesis Test: this hypothesis states that "there is no statistically significant relationship between commodity inventory and the business results of Jordanian Public Shareholding Industrial Companies listed at the ASE" and to test this hypothesis, the Pooled Data Regression Analysis was used and the following are the results of hypothesis test:

The previous Table 7 shows that regression model is highly significant, where the F-Value amounted to (151.501) which is statistically significant at the level (α ≤ 0.05), and this shows the significance of model as a whole and the statistical interpretive strength, where it shows the existence of statistically significant relationship between the commodity inventory as a whole and the business results of profit or loss. The overall correlation value between the dimensions of inventory variable and business results amounted to (0.789), which is a high and positive relationship, and shows the importance of commodity inventory in the impact on business results of profit or loss at the industrial companies.

| Table 7: Pooled Data Regression for the effect the Inventories on Net/Loss Income | ||||

| Independent Variable | Coefficient | Std. Error | T-Statistic | Prob. |

|---|---|---|---|---|

| (Constant) | 0.549 | 1.336 | 2.411 | 0.021 |

| Beginning inventory | 1.038- | 0.107 | -9.745 | 0 |

| Inventory available for sale | 0.451- | 0.023 | -19.94 | 0 |

| Ending inventory | 0.393 | 0.104 | 3.783 | 0 |

| R | 0.789 | |||

| R-squared | 0.622 | |||

| Adjusted R Square | 0.619 | |||

| F-statistic | 151.501 | |||

| Prob (F-statistic) | 0 | |||

Dependent variable: Net/Loss income

In regard to the ability of independent variable dimensions on explaining the variation in dependent variable, Adjusted R Square indicated that (61.9%) from the variation in dependent variable can be explained through the independent variable, which means that (61.9%) from the changes that happen in business results of companies are due to the changes in commodity inventory.

By reviewing the results of regression coefficients, we find that coefficient values for all variables at the different levels of T-Statistic are at the significant level (α ≤ 0.05), and all of it are less than (5%), which confirms the significance of regression coefficients; and indicates that relationship between independent variables and the dependent variable is statistically significant. From the above, it's possible to predict the business results of company through the commodity inventory and according to the following regression formula:

Y= β0 + β1 X1 + β2 X2 + β3 X3+ Eit

Net/Loss Income = 0.549 - 1.038 (Beginning Inventory) + 0.451 (Inventory Available for Sale) - 0.393 (Ending Inventory) + 1.336

It derives from the first hypothesis three sub hypotheses to measure the relationship between the commodity inventory elements and the business results of profit or loss at the Jordanian industrial public shareholding companies during the period (2009-2018), and the secondary hypotheses were tested as follows:

Testing the first sub hypothesis: this hypothesis states that “There is no significant Relationship between beginning inventory and Net/Loss income".

The previous table shows that Coefficient Value related to the variable of beginning inventory equals to (-1.038), which is a negative value and indicates a negative relationship between the beginning inventory and company's business results, and means that any increase in the balance of beginning inventory leads to reduce the company's net profit. In other words, an increase by (1%) in the beginning inventory leads to a decrease in the company's net profit by (1.038), and this agree with the accounting theory that calls for the existence of reverse relationship between the beginning inventory and the company's business results, where an increase in the value of beginning inventory by 1 JD will also leads to an increase in the cost of sold goods by 1 JD, and as a result it will be a reduction at the same value in the total profit and net profit of the company. This results is confirmed by the calculated T-Statistic value of (-9.745), which is statistically significant at the confidence level of (95%), and also the probability was less than (5%) and achieved (0.000), which means to reject the nihilistic hypothesis and to accept the alternative hypothesis that stated "there is a statistically significant relationship between the beginning inventory and the business results of net profit or loss in the Jordanian public shareholding industrial companies listed on the ASE".

Testing the second sub hypothesis: this hypothesis states that “there is no significant relationship between inventory available for sale and Net/Loss income".

The previous table shows that Coefficient Value related to the variable of inventory available for sale equals to (-0.451), which is a negative value and indicates a negative relationship between the inventory available for sale and company's business results, and means that any increase in the balance of inventory available for sale leads to reduce the company's net profit. In other words, an increase by (1%) in the inventory available for sale leads to a decrease in the company's net profit by (0.451), and this agree with the accounting theory that calls for the existence of reverse relationship between the inventory available for sale and the company's business results, where an increase in the value of inventory available for sale by 1 JD will also leads to an increase in the cost of sold goods by 1 JD, and as a result it will be a reduction of the same value in the total profit and net profit of the company. This results is confirmed by the calculated T-Statistic value of (-19.940), which is statistically significant at the confidence level of (95%), and also the probability was less than (5%) and achieved (0.000), which means to reject the nihilistic hypothesis and to accept the alternative hypothesis that stated "there is a statistically significant relationship between the inventory available for sale and the business results of net profit or loss in the Jordanian public shareholding industrial companies listed on the ASE".

Testing the third sub hypothesis: this hypothesis states that “there is no significant relationship between ending inventory and Net/Loss income".

The previous table shows that Coefficient Value related to the variable of ending inventory equals to (0.393), which is a positive value and indicates a positive relationship between the ending inventory and company's business results, and means that any increase in the balance of ending inventory leads to increase the company's net profit. In other words, an increase by (1%) in the ending inventory leads to an increase in the company's net profit by (0.393), and this agree with the accounting theory that calls for the existence of positive relationship between ending inventory and the company's business results, where an increase in the ending inventory value by 1 JD will also leads to an decrease in the cost of sold goods by 1 JD, and as a result it also will be an increase in the total and net profit of the company by 1 JD. This results is confirmed by the calculated TStatistic value of (3.783), and its statistically significant at the confidence level of (95%), and also the probability was less than (5%) and achieved (0.000), which means to reject the nihilistic hypothesis and to accept the alternative hypothesis that stated "there is a statistically significant relationship between the ending inventory and the business results of net profit or loss in the Jordanian public shareholding industrial companies listed on the ASE".

From the above, it's clear to accept the three alternative sub-hypotheses of commodity inventory elements, and will accept the main hypothesis of the study which stated the existence of statistically significant relationship between the commodity inventory and the business results of net profit or loss in the Jordanian public shareholding industrial companies listed on the ASE.

Second Main Hypothesis Test: This hypothesis states that "there is no statistically significant relationship between firm size and the business results of net profit or loss in the Jordanian Public Shareholding Industrial Companies listed at the ASE" and to test this hypothesis, the Simple Data Regression Analysis was used and the following are the results of hypothesis test:

The previous Table 8 shows that regression model is highly significant, where the F-Value amounted to (317.818) which is statistically significant at the level (α ≤ 0.05), and this shows the significance of model and the statistical interpretive strength, where the value of Correlation Coefficient amounted to (0.730) which is a positive and strong relationship and shows the importance of firm size on influencing the business results of industrial companies from profit or loss. It means that an increase of (1%) in firm size (total assets) leads to improvement of company's business results by (73%). This explains that any increase in firm size opens the way for company to expand in its investments and increase its competitiveness, which helps to improve its profits and agrees with the accounting theory that calls for a positive relationship between the firm size and the business results, and this is confirmed by the T-Statistic value of (17.827), which is a statistically significant at the confidence level of (95%), and also probability came less than (5%) by achieving (0.000).

| Table 8: Simple Regression for the effect the Firm Size on Net/Loss Income | ||||

| Independent Variable | Coefficient | Std. Error | T-Statistic | Prob. |

|---|---|---|---|---|

| (Constant) | 3.289 | 1.47 | 2.237 | 0.026 |

| Company size | 0.73 | 0.005 | 17.827 | 0 |

| R | 0.73 | |||

| R-squared | 0.533 | |||

| Adjusted R Square | 0.532 | |||

| F-statistic | 317.818 | |||

| Prob (F-statistic) | 0 | |||

Dependent variable: Net/Loss income

In regard to the ability of independent variable; firm size on explaining the variation in dependent variable, Adjusted R Square indicated that (53.2%) from the variation in dependent variable can be explained through the independent variable, which means that (53.2%) from the changes that happen in business results of companies are due to the changes in firm size. Accordingly, the nihilistic hypothesis will be rejected and will accept the alternative hypothesis "there is a statistically significant relationship between the firm size and the business results of net profit or loss in the Jordanian Public Shareholding Industrial Companies listed at the ASE ". From the above, it's possible to predict the level of company's business results through firm size, according to the following regression formula:

Y= β0 + β1 X1 + Eit

Net/Loss income = 3.289 + 0.730 (Company size) + 1.470

Primary Hypothesis Test: this hypothesis states that "there is no statistically significant impact of firm size on the relationship between inventory and the business results of Jordanian Public Shareholding Industrial Companies listed at the ASE", and to test this hypothesis the multiple hierarchical regression analysis was used, and hypothesis test results show in the following Table 9:

| Table 9: Multiple Hierarchical Regression Analysis Results for the Impact of Firm on the Relationship Between Inventory and Business Results of Net Profit or Loss | ||||

| Independent Variable | Coefficient | T-Statistic | Prob. | |

|---|---|---|---|---|

| Model 1 | (Constant) | 0.549 | 2.411 | 0.021 |

| Beginning inventory | -1.038 | -9.745 | 0 | |

| Inventory available for sale | -0.451 | -19.94 | 0 | |

| Ending inventory | 0.393 | 3.0783 | 0 | |

| (R ) | 0.789 | |||

| (R2 ) | 0.622 | |||

| Statistic (F) | 151.501 | |||

| Prob | 0 | |||

| Model 2 | (Constant) | 2.196 | 2.196 | 0.033 |

| Beginning inventory | -5.591 | -6.732 | 0 | |

| Inventory available for sale | 0.028 | -0.72 | 0.472 | |

| Ending inventory | -0.096 | -1.16 | 0.247 | |

| Company size | 0.176 | 13.938 | 0 | |

| (R ) | 0.882 | |||

| (R2 ) | 0.779 | |||

| R Squa Change | 0.157 | |||

| Statistic (F) | 241.753 | |||

| Change (F) | 149.259 | |||

| Prob | 0 | |||

Predictors: (Constant), Ending inv., available inv., Begging inv.

Predictors: (Constant Ending inv., available inv., Begging inv., size

Dependent Variable: Net income/ loss

The results of previous table show a statistically significant impact at level (α ≤ 0.05) of the firm size on the relationship between commodity inventory and the company's business results of net profit or loss at the Jordanian Public Shareholding Industrial Companies listed at the ASE, where the Correlation Coefficient Value between the commodity inventory and business results in the industrial companies increased from (78.9%) to (88.2%), at an increase rate of (9.3%) as a result of introducing the firm size variable into the regression model, which means that the variable firm size has affected the relationship between commodity inventory and the business results. The R-square value has also increased from (62.2%) to (77.9%) after entering the firm size variable, at R2 change rate of (15.7%), and this shows that firm size result has contributed to the improvement of relationship between the commodity inventory and business results at the Jordanian industrial companies, where the changes interpretation degree that happen in the company's business results of net profit or loss have increased by (15.7%), and as a result the overall degree of interpretation raised to (77.9%).

With regard to the ability of firm size variable; total assets to fully or partially represent the dimensions of independent variable; the commodity inventory in influencing the company's business results, the results indicated that firm size has fully represented both of available inventory for sale and ending inventory on influencing the company's business results, where Tvalue for the two variables was statistically significant prior to the introduction of firm size variable, while it became statistically insignificant after entering the firm size variable to the model. The beginning inventory variable was partially represented by the firm size, where the Tvalue was statistically significant before and after the introduction of firm size variable and its impact decreased from (-1.038) in the first model to (-0.591) in the second model after the introduction of firm size variable, and this shows the need of companies to pay attention to firm size due to its role in influencing the relationship between inventory and business results in the Public Shareholding Industrial Companies.

In addition, F-Change Value was statistically significant at level (α ≤ 0.05) and reached (149.259), where the F-value in the first model was (151.501) at a significant level of (0.000) to increase to (241.753) in the second model at a significant level of (0.000). This confirmed the significant regression of both models at level (5%), and shows the existence of statistically significant impact of firm size on influencing the relationship between inventory and business results of net profit or loss at the Jordanian Public Shareholding Industrial Companies listed at the ASE, and based on the above the nihilistic hypothesis will be rejected and will accept the proven hypothesis "there is a statistically significant impact of firm size on the relationship between inventory and business results of Jordanian public shareholding industrial companies listed on the ASE."

Conclusion & Recommendations

Conclusion

The results of statistical analysis for study variables showed a statistically significant impact at the level (α ≤ 0.05) of firm size on the relationship between the commodity inventory and business results of net profit or loss at the Jordanian public shareholding industrial companies listed on the ASE, where the Correlation Coefficient Value between commodity inventory and business results in the industrial companies increased from (78.9%) To (88.2%) at a rate of increase (9.3%) as a result of the introduction of firm size variable to the regression model, which means that the firm size variable has affected the relationship between the commodity inventory and the business results. The R-square has also increased from (62.2%) to (77.9%) after the introduction of firm size variable, at a R2 Change rate of (15.7%) and this shows that firm size result has contributed to the improvement of relationship between the commodity inventory and the business results at the Jordanian industrial companies, where the changes interpretation degree that happened in the company's business result of net profit or loss has increased by (15.7%), and as a result the overall degree of interpretation raised to (77.9%).

In addition, F-Change value shows a statistically significant change at level (α ≤ 0.05) and amounted to (149,259), where the F-value at the first model was (151.501) at the significant level (0.000) to increase in the second model to (241.753) at a significant level of (0.000), and this confirms the significant of regression in both models at the level (5%), and it shows a statistically significant impact of firm size on influencing the relationship between inventory and business results of net profit or loss at the Jordanian public shareholding industrial companies listed in ASE.

Recommendations

The study made following recommendations: “where as one of the study most significant recommendation is the necessity of those companies to have concern about the balance between firm size and inventory, due to its impact on the business results.”

The needs to conduct other studies related to the impact of firm size on the relationship between other variables at the public shareholding industrial companies.

The need to conduct further studies and researches about the impact and relationship of study variables at public shareholding companies in other sectors and comparing it with the results of this study.

References

- AL-Shwiyat, Z.M., ALRjoub, A.M., & Bshayreh, M. (2013). The impact of social responsibility on the financial performance for Jordanian companies. European Journal of Business and Management, 5(30), 123-132.

- Ammar, A., Hanna, A.S., Nordheim, E.V., & Russell, J.S. (2003). Indicator variables model of firm’s size-profitability relationship of electrical contractors using financial and economic data. Journal of Construction Engineering and Management, 129(2), 192-197.

- Anderson, D.R., Sweeney, D.R., & Williams, T.A. (1993). Statistics for Business and Economics, (Fifth Edition). West Publishing Company, St. Paul, MN.

- Anshur, A.S., Ahmed, M. M., & Dhodi, M.H. (2018). The role of inventory management on financial performance in some selected manufacturing companies in Mogadishu. International Journal of Accounting Research, 6(2).

- Azhar, K.A., & Ahmed, N. (2019). Relationship between firm size and profitability: investigation from textile sector of Pakistan. International Journal of Information, Business and Management, 11(2), 62-73.

- Bin Syed, S.J.A.N., Mohamad, N.N.S., Rahman, N.A.A., & Suhaimi, R.D.S.R. (2016). A study on relationship between inventory management and company performance: A case study of textile chain store. Journal of Advanced Management Science, 4(4).

- Capkun, V., Hameri, A.P., & Weiss, L.A. (2009). On the relationship between inventory and financial performance in manufacturing companies. International Journal of Operations & Production Management.

- Dahmash, F.N. (2015). Size effect on company profitability: Evidence from Jordan. International Journal of Business and Management, 10(2), 58.

- Dogan, M. (2013). Does firm size affect the firm profitability? Evidence from Turkey. Research Journal of Finance and Accounting, 4(4), 53-59.

- Etale, L.M., & Bingilar, P.F. (2016). The effect of inventory cost management on profitability: A study of listed brewery companies in Nigeria. International Journal of Economics, Commerce and Management United Kingdom, 4(6). ??

- Farooq, U. (2019). Impact of inventory turnover on the profitability of non-financial sector firms in Pakistan. Journal of Finance and Accounting Research, 1(1), 34-51.

- Ferencíková, D. (2014). Inventory management in small and medium-sized manufacturing companies and its main Dilemmas. In International Conference on Industrial Engineering and Operations Management (pp. 756-763).

- Ganas, I., & Hyz, A. (2015). Inventory management and its impact on firms’ performance: An empirical study in the region of Epirus, Greece. In ICQQMEAS2015.

- George, E.A. (2019). study on the impact of inventory management on profitability of firms with special reference to steel industry. ISSN 2249-3352 (P) 2278-0505 (E).

- Gokhale, P.P., & Kaloji, M.B.A (2018). Study on inventory management and its impact on profitability in foundry industry at Belgravia, Karnataka. International Journal of Latest Technology in Engineering, Management & Applied Science, 8(9).

- Gujarati, D.N. (2013). Basic Econometrics, (Seventh Edition), McGraw-Hill.

- John, A.O., & Adebayo, O. (2013). Effect of firm size on profitability: Evidence from Nigerian manufacturing sector. Prime Journal of Business Administration and Management (BAM), 3(9), 1171-1175.

- Kareem, T.S. (2018). Impact of Inventory Management Practices on Small and Medium Enterprises Manufacturing Subsector in Oyo State, Nigeria. South Asian Journal of Social Studies and Economics, 1-8.

- Kartikasari, D., & Merianti, M. (2016). The effect of leverage and firm size to profitability of public manufacturing companies in Indonesia. International Journal of Economics and Financial Issues, 6(2), 409-413.

- Kipkemoi, P., Kiru, K., & Koima, J.K. (2018). Effect of inventory and cash conversion cycles on financial performance of listed commercial and service firms in Nairobi securities exchange Kenya. Scholars Journal of Economics Business and Management (SJEBM),1(1).1.

- Kolawole, A.D., Akomolafe, A.B., & Olusipe, B.J. (2019). Inventory management: An impetus for increased profitability in manufacturing firms. International Journal of Accounting, Finance and Risk Management, 4(4).

- Koumanakos, D.P. (2008). The effect of inventory management on firm performance. International journal of productivity and performance management, 57(5), 355-369.

- Kumar, N., & Kaur, K. (2016). Firm size and profitability in Indian automobile industry: An analysis. Pacific Business Review International, 8(7), 69-78.

- Kuncová, M., Hedija, V., & Fiala, R. (2016). Firm size as a determinant of firm performance: The case of swine raising. Agris on-line Papers in Economics and Informatics, 8(665-2016-45098), 77-89.

- Kung’u, J.N. (2016). Effects of inventory control on profitabi3lity of industrial and allied firms in Kenya. IOSR Journal of Economics and Finance, 7(1), 9-15.

- Lwiki, T., Ojera, P.B., Mugenda, N.G., &Wachira, V.K. (2013). The impact of inventory management practices on financial performance of sugar manufacturing firms in Kenya. International Journal of Business, Humanities and Technology, 3(5), 75-85.

- Monisola, O. (2013). An assessment of inventory management in small and medium scale industrial enterprises in Nigeria. European Journal of Business and Management, 5(28), 150-158.

- Niresh, A., & Velnampy, T. (2014). Firm size and profitability: A study of listed manufacturing firms in Sri Lanka. International Journal of Business and Management, 9(4).

- Nwakaego, D.A., Dorathy, O.C., &Ikechukwu, O. (2014). Inventory management on the profitability of building materials and chemical and paint companies in Nigeria. International Journal of Economics, Commerce and Management, 4.

- Panigrahi, C.M.A. (2013). Relationship between inventory management and profitability: An empirical analysis of Indian cement companies. Asia Pacific Journal of Marketing & Management Review, 2(7).

- Samosir, F.C. (2018). Effect of cash conversion cycle, firm size, and firm age to profitability. Journal of Applied Accounting and Taxation, 3(1), 50-57.

- Shardeo, V. (2015). Impact of inventory management on the financial performance of the firm. IOSR Journal of Business and Management, 17(4), 1-12.

- Sharma, A., & Arya, V. (2016). Study of inventory management in manufacturing industry. International Journal of Advanced Engineering and Global Technology, 4(03), 2012-2021.

- Shin, S., Ennis, K.L., & Spurlin, W.P. (2015). Effect of inventory management efficiency on profitability: Current evidence from the US manufacturing industry. Journal of Economics and Economic Education Research, 16(1), 98.

- Sitienei, E., & Memba, F. (2015). The effect of inventory management on profitability of cement manufacturing companies in Kenya: A case study of listed cement manufacturing companies in Kenya. International Journal of Management and Commerce Innovations, 3(2), 111-119.

- Telly, B.R., & Ansori, M. (2019). Effect of size and cash conversion cycle on company profitability. Journal of Applied Managerial Accounting, 3(1), 155-165.

- Velmathi, N., & Ganesan, R. (2012). Inventory management of commercial vehicle industry in India. International Journal of Engineering and Management Research, 2(1), 34-45.

- Velnampy, T., & Nimalathasan, B. (2010). Firm size on profitability: A comparative study of Bank of Ceylon and Commercial Bank of Ceylon Ltd in Srilanka. Global Journal of Management and Business Research, 10(2). ?