Research Article: 2021 Vol: 24 Issue: 6

Impact of hidden tax preferential regimes on an optimal investment project model in Russia (on the example of a German automobile company)

Elena Sidorova, Financial University under the Government of the Russian Federation

Lyudmila Polezharova, Financial University under the Government of the Russian Federation

Polina Rezvantseva, JSC KPMG, Naberezhnaya

Citation Information: Sidorova, E., Polezharova, L., & Rezvantseva, P. (2021). Impact of “hidden” tax preferential regimes on an optimal investment project model in Russia (on the example of a German automobile company). Journal of Management Information and Decision Sciences, 24(6), 1-10.

Abstract

The object of the study is to analyze the impact of hidden preferential tax regimes in Russia on the choice of investment project models for foreign companies. The hypothesis is the need to improve tax mechanisms for attracting foreign investors to the development of existing Russian manufacturing enterprises, regardless of the region where they are located. Foreign and domestic views on methods and techniques of direct investment and “hidden” tax preferential regimes for investors were systematized and characterized with the system analysis and induction methods. Features of the Russian practice of tax support for corporate investments and special conditions of special economic zones, regional investment projects and special investment contracts were identified, summarized and disclosed. The dynamics of FDI inflows and outflows in Russia, as well as the dynamics of the number of organizations participating in preferential regimes over some years, were determined and graphically presented using economic and statistical methods. The models for the greenfield investments project and the acquisition of an existing enterprise in Russia with minimal tax expenses were proposed using the economic modeling method based on the data from a real German automobile company. The estimated indicators of the cost of sales, revenue from the sale of cars, profit before tax, profit tax, net profit from the project of the parent company and key indicators of the investment project were calculated using the methods of economic forecasting in the context of these two investment models. The method of comparative analysis was used to determine the optimal model of the investment project of a German company. As a result of the study, it was determined that Russian hidden preferential regimes provide a whole range of tax benefits if an investor meets a number of conditions. An access to the prevailing number of benefits is limited with the status of a Russian legal entity and is subject to registration in a certain territory of Russia. It was revealed that Russian regions have a significantly different list of investment tax benefits. It was also identified that the tax legislation of Russia encourages foreign investors to invest in the development and technical re-equipment of existing Russian manufacturing enterprises to a lesser extent. Tax benefits are mainly aimed at attracting foreign capital to create new enterprises in Russia on the territory of certain regions. It was concluded that the Greenfield project is optimal for reducing the investor's tax burden. For greater flexibility, in tax planning and sharing the economic risks of a foreign investor company, it is advisable to establish or to have a separate legal entity in Russia. The necessity of improving tax mechanisms for stimulating the inflow of foreign investments into the development of existing Russian manufacturing enterprises, regardless of their location, was substantiated. The research is practically significant for foreign companies as it provides systematic information and characteristics of the conditions of preferential tax regimes in Russia; it identifies the advantages and provides a methodology for determining the optimal investment technique in Russia.

Keywords

Foreign direct investment; Investment project; Investment strategy of the company; Investment tax benefits.

Introduction

In the era of the dominance of transnational companies (hereinafter TNCs), the world economy is under their direct influence. The main process by which TNCs are formed is direct investment. The investment decisions made determine the company's competitive advantages and, as a result, its success in the global market. The theory of OLI advantages, the most well-known theory about the implementation of FDI (Dunning, 1977), implies that one of the types of competitive advantages is the advantages of placement in a foreign country (Bird, 2008). Such advantages include a whole range of different variables, but we are interested in the impact of tax legislation in certain regions of countries on investment decisions of TNCs.

The main forms of FDI are mergers/acquisitions and “greenfield” investment. “Greenfield” investment is defined in economic theory as the creation of a new production enterprise or office by a company to expand its activities or the establishing of a completely new business from scratch (Ghoshal & Westney, 1993). Mergers and acquisitions are general terms that refer to the consolidation of companies or assets. Merger is a combination of two or more companies that creates a new business entity. Acquisition is a merger in which the acquiring company acquires the assets and liabilities of the acquired company, usually a smaller one (Merton & Bodie, 2005).

The most significant issues of a company that is expanding to other countries were noticed by Jorgenson notes. They are the tax risks associated with the acquisition of assets; taxation in the country of establishment of the enterprise for conducting operating activities; taxation of a subsidiary financing; taxation of reinvestment and divestment (Jorgenson, 1963). In the research of Hajkova et al. (2007), as well as in the study of Grubert (2003), it was revealed that the choice of an investment country is associated with the following factors: transparency of tax legislation, the level of tax burden and the tax policy of the host country.

Stimulation of investment activity in Russia is manifested through such tax policy instruments as tax incentives, i.e. benefits, including the possibility to avoid paying tax or pay it in a smaller amount. They include, first of all, “open” benefits that are available to both Russian and foreign companies: accelerated depreciation, bonus depreciation; investment tax deduction or credit; recognition of expenses for research and development (R&D) with an increasing coefficient, etc. (Goncharenko & Vishnevskaya, 2019).

It is highly important for a foreign investor to know the characteristics of the “hidden” preferential tax regime in countries with traditionally high or normal tax levels. These preferential regimes are usually available only for resident companies, that is why they are called hidden. It is difficult for foreign investors to find them, as it is necessary to research a huge number of regional laws. “Hidden” regimes are introduced for certain types of economic activity conducted on a given territory and they are used for the development of certain sectors of the economy or region. They provide investors with sustainable fiscal advantages allowing them to significantly reduce the effective tax rate (Gordon & Li, 2009).

Hines and Park (2019) state that increasing point tax preferences for certain types of investments can reduce and distort investment processes.

Vavulin and Simonov (2014)] disclose certain tax regimes established for investors in Russia. Tikhonova (2019) notes the need for balanced fiscal incentives for investors. The complexity of administrative procedures, the ambiguity of the law and restrictions are the main problems for investors.

Gereev (2018) reveals the impossibility of access to investment benefits for medium and small Russian businesses.

Drobyshevsky et al. (2020) proves that regional preferences support Russian companies whose positions in the region are already strong. Scientists raise the question of the feasibility of such benefits and point out that aggressive tax competition for investors is wasteful for sub-federal budgets.

The current research provides a comparative description of hidden preferential tax regimes in Russia and their impact on the investment model of a foreign company.

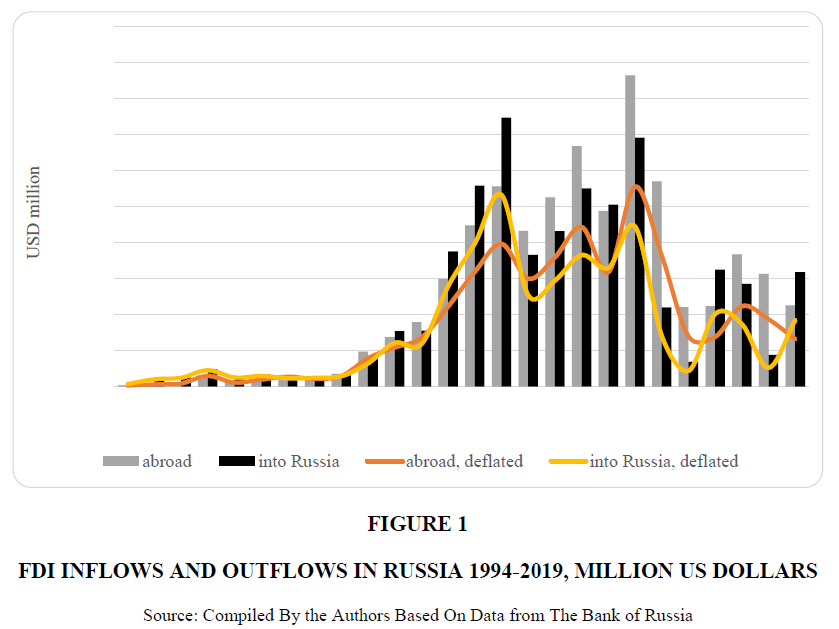

The analysis of the dynamics of foreign direct investment (FDI) inflows and outflows in Russia for 1994-2019 (Figure 1) shows that FDI inflows to Russia prevailed over outflows from 1994 to 2008. The economic crisis in 2009 sharply reduced FDI flows (by 40% on average), and Russia became a net exporter of capital until 2019.

In 2019, Russia received 3.5 times more investment than in 2018 and investment inflows began to prevail over outflows.

At the beginning of 2020, a small increase in the volume of FDI in the world and in Russia was also expected. However, the outbreak of COVID-19 had a negative impact on the dynamics of the FDI. This led to an increased need for FDI to develop the economy and overcome the consequences of the fight against COVID-19.

The Analysis of the Russian Practice of Tax Support for Investments

Foreign individuals can conduct business in Russia, make investments, buy land and have a 100% share in the capital of organizations. A number of federal laws and international treaties with Russian participation regulate the activities of organizations with foreign capital in Russia.

The Russian economy is attractive for foreign capital because of its market capacity, numerous natural and labor resources, qualified personnel and a gradual increase in effective demand. Improving the investment climate is a priority of modern Russian policy (Steshenko & Tikhonova, 2018).

Reducing the profit tax burden is considered the most effective investment incentive. The regions have the right to establish reduced tax rates in terms of the tax credited to the regional budget. Due to their fiscal capacity, only some regions with a strong investor-friendly position can afford to establish such benefits. Many regions reduce property tax rates for taxpayers who make capital investments.

Reduced tax rates are established, for example, for residents of special economic zones (SEZs) of technology innovative and industrial types (Table 1).

| Table 1 Profit Tax Benefits for SEZ Residents | |||

| Tax rate | Terms of benefits | Cause | |

| Technology innovative special economic zones | |||

| in terms of federal budget | 0% | Article 284 of the Tax Code of the Russian Federation (hereinafter the Code) | |

| in terms of the subject's budget | not more than 13.5% | Article 284 of the Code | |

| SEZ “Tomsk” | 5% 10% 13,5% (12,5% in 2017-2024 years. | - 5 years from the moment of receiving the first profit; - from the 6th to the 10th years; - after 10 years. |

Tomsk Region Law № 30-ОЗ of 13.03.2006. |

| SEZ “Zelenograd” | 0% 5% 12,5% | - from 01.01.2018; - from 01.01.2028; - from 01.01.2033. |

Moscow law № 37 of 23.11.2016 |

| SEZ “Dubna” | 0% 5% 12,5% | - from 01.01.2018; - from 01.01.2028; - from 01.01.2033. |

Moscow law № 37 of 23.11.2016 |

| SEZ “Saint Petersburg” | 13,5% (12,5% in 2017-2020 years) |

period of SEZ existence | Saint Petersburg Law № 81-11 of 14.07.1995 |

| SEZ “Innopolis” | 0 % 5% 13,5% | - 5 years from the moment of receiving the taxable profit; - from the 6th to the 10th years; - after 10 years. |

the Republic of Tatarstan Law № 5-ZRT of 10.02.2006 |

| R & D expenses in the amount of actual costs | period of a SEZ existence | Article 262 of the Code | |

| Industrial special economic zones | |||

| in terms of federal budget | 2% | Article 284 of the Code | |

| in terms of the subject's budget | no more than 13,5 % | Article 284 of the Code | |

| SEZ “Alabuga” | 0 % 5% 13,5% | - 5 years from the moment of receiving the taxable profit; - from the 6th to the 10th years; - after 10 years. |

Republic of Tatarstan Law № 5-ZRT of 10.02.2006 |

| SEZ “Lipetsk” | 0% 5% 13,5% | - 5 (7) years from the moment of receiving the first profit; - from the 6th to the 10th years; - after 10 years. |

Lipetsk region Law № 151-OZ of 29.05.2008 |

| SEZ “Togliatti” | 0% 5% 13,5% | - 5 years, beginning from the tax period in which profit was first received; - from the 6th to the 10th years; - after 10 years. |

Samara region Law № 187-GD of 7.11.2005 |

| SEZ “Titanium valley” | 0% 5% 13,5% | - 10 years from the moment of receiving the taxable profit; - from the 11th to the 15th years; - from the 16th year |

Sverdlovsk region Law № 42-OZ of 29.11.2002 |

| SEZ “Moglino” | 0 % 5% 13,5% | - 5 years, beginning from the tax period in which profit was first received; - from the 6th to the 10th years; - after 10 years. |

Pskov region Law № 473-OZ of 12.10.2005 |

| SEZ “Stupino Kvadrat” | 0 % 5% 13,5% | - 8 years, beginning from the first day of the quarter following the date of the entity recognition as a SEZ resident; - from the 9th to the 14th years; - after 14 years. |

Moscow region Law № 151/2004-OZ of 24.11.2004 |

| SEZ “Kaluga” | 0% 3% 5% 8% 10% 13,5% | - 5 years from the moment of obtaining the SEZ resident status; - from the 6th to the 9th years; - from the 9th to the 11th years; - from the 12th to the 13th years; - from the 14th to the 15th years; - from the 16th year. |

Kaluga region Law № 621-OZ of 29.12.2009 |

| SEZ “Uzlovaya” | 0% 5% 13,5% | - 5 years, beginning from the tax period in which profit was first received; - from the 6th to the 10th years; - after 10 years. |

Tula region Law № 56-ZTO of 15.07.2016 |

| R & D expenses in the amount of actual costs | period of a SEZ existence | Article 262 of the Code | |

| increasing factor to the basic depreciation rate, not higher than 2 in relation to own fixed assets | period of a SEZ existence | Article 259.3 of the Code | |

SEZ residents are exempt from property tax for 10 years if the property is created (acquired), actually located and used on the SEZ territory.

Regional authorities provide similar benefits to participants in regional investment projects (RIPs). They are investment companies that implement new technologies, carry out modernization and technical re-equipment of production and produce competitive products.

RIP members are provided with profit tax benefits:

— in terms of the federal budget: the tax rate is 0% for 10 years from the date of receiving the first profit;

— in terms of the subject's budget: the tax rate is not more than 10% for 5 years from the tax period in which the first profit from the project was received and it is not less than 10% for the next 5 years.

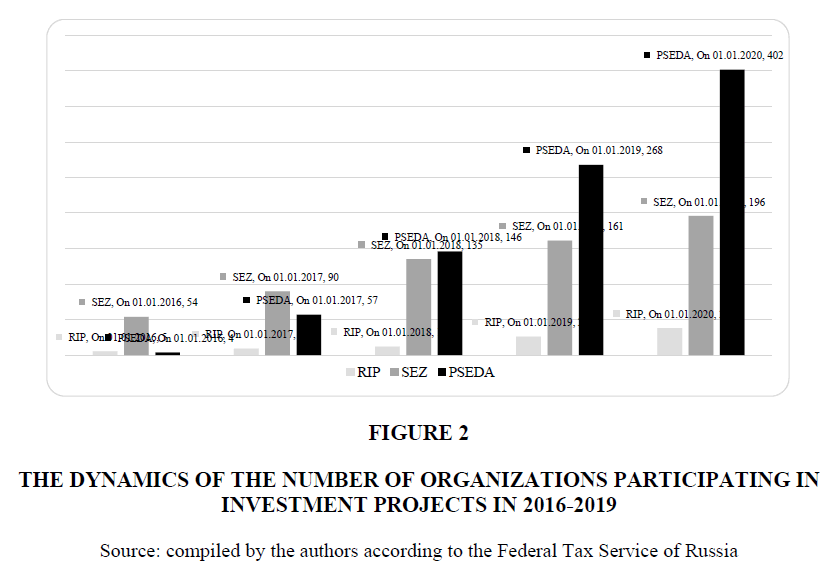

Figure 2 shows the dynamics of the number of RIP participants, residents of SEZs and priority social and economic development areas (PSEDAs). Their number is steadily growing, which indicates the attractiveness of preferential treatment.

Figure 2 The Dynamics of the Number of Organizations Participating in Investment Projects in 2016-2019

According to the Federal Tax Service of Russia, the amount of the provided profit tax benefits amounted to 316.9 billion rubles in 2018. In fact, this is the amount of funds left at the disposal of investors for their development.

In 2015, a special investment contract (SPIC) was introduced in addition to RIP. The subject of the SPIC is the development and (or) implementation of modern technology in order to develop a mass production of industrial products based on this technology in Russia. The parties of the SPIC, on the one hand, are federal, regional and municipal authorities and, on the other hand, an investor.

The SPIC is mainly applicable when making “greenfield” investments or establishing a joint venture. The problems here are complex administrative procedures, unclear legal framework and stipulated restrictions.

The SPIC provides an investor with the following benefits:

• 0% rate in terms of profit tax credited to the federal budget;

• Reduction of the profit tax rate to 0% in the part of the tax credited to the regional budget;

• Exemption (reduced rate) from property tax;

• Land tax benefits;

• Increasing depreciation factor 2 for equipment created under the SPIC.

Profit tax incentives are applied if the profit from the sale of goods produced under the SPIC is at least 90% of the organization's total profit.

Regional legislation on SPICs exists in the Perm Territory, in the Kostroma, Moscow, Novosibirsk regions and in the Republic of Tatarstan (Gereev, 2016).

Under the SPIC, a taxpayer is guaranteed stability of tax conditions, protection from increases in tax rates and changes in the conditions for granting benefits (Komleva, 2018).

This policy was continued in Russia with the introduction of a new instrument in 2020, this is the investment protection and promotion agreement (IPPA), which also guarantees the invariability of the conditions for implementation.

The IPPA allows stabilizing tax conditions (for profit tax, property tax, transport tax, payment terms and procedure for VAT refund, new taxes and fees) for up to 20 years.

The listed regimes provide investors with a whole range of benefits, but in order to receive them, investors must meet a number of parameters and comply with certain conditions. Will foreign investors be able to take advantage of these benefits? The systematization of the Russian rules (Table 2) shows that foreign companies cannot be residents of the SEZs, residents of the territory with a special taxation system, which is the Free port of Vladivostok residents of the PSEDAs and the participants of the RIPs. In order to use these preferential regimes, a foreign company must establish its own subsidiary in Russia. Moreover, these regimes require registration on the territory of a certain Russian region.

| Table 2 The Special Conditions for the Application of the SEZ, RIP and SPIC Regimes | |||

| Conditions: | SEZ | RIP | SPIC |

| Investments volume | at least 120 million rubles | at least 50 million rubles in the first 3 years, 500 million rubles in the first 5 years (article 25.8 of the Code) |

no |

| residency in a specific territory | yes, on the SEZ territory | yes, on the territory of the subject (Article 25.9 of the Code) | no |

| Is it possible for foreigners to participate? | no (Article 25.9 of the Code) |

no (Article 25.9 of the Code) |

yes |

| revenue from this project in total revenue | separate accounting (Article 284 of the Code) | a) 90% b) separate accounting (Article 284 of the Code) |

a) 90% b) separate accounting (Article 284 of the Code) |

A foreign company can directly enter into the SPICs in Russia and participate in the IPPA. For tax purposes, in this case, it will be recognized as having a separate division (branch) in Russia. The company may have difficulty meeting the condition that 90% of its revenue is generated from the sale of SPIC in Russia. Therefore, for greater flexibility and sharing of economic risks when entering a SPIC or IPPA, it is advisable for a foreign investor to establish a separate legal entity in Russia.

Further, economic modeling and comparison of two options for investment projects are considered - (1) the creation of new production facilities in Russia with the registration of a new subsidiary and (2) the acquisition of an existing Russian organization with its transformation into a subsidiary. The comparative analysis can identify the best investment option and tax preferences that allow achieving an optimal investment (Kostyukhin, 2016).

Creation of Production Facilities based on A New Legal Entity

The object of the study is a real German company (hereinafter “the Company”), a manufacturer of passenger cars. The company enters the Russian market with four models of passenger cars, which will be assembled in Russia. The Company will take advantage of the fact that labor is cheaper in Russia, customs duties on the import of automobile components are less than on finished cars and assembly will be carried out in close proximity to the consumer (Filatov et al, 2019). The choice of a settlement for registering a new legal entity is a highly important step, it may influence on obtaining certain benefits (Kruzhkova et al., 2018).

The most attractive region for the company is the region of Central Russia, in particular the Lipetsk region. There is a special economic zone “SEZ-Lipetsk”, and it is also possible to conclude a RIP. As a result of the comparative analysis, it was found that for residents of the “SEZ-Lipetsk”, tax conditions are more favorable than for RIPs. It was decided to build a new plant on the territory of the “SEZ-Lipetsk” (Kostuhin & Savon, 2020).

The project to create a plant on the territory of the “SEZ-Lipetsk” is designed for 10 years. It is supposed that the new enterprise will be financed from the Company's own funds and borrowed capital (Batashev et al., 2020). In the zero period, taking into account that the construction of the plant takes two years, it is necessary to invest 8 billion rubles in the first year and another 2 billion rubles in the second year. The investor's goal is to maximize the final profit, as well as to maximize the net present value (hereinafter NPV) of the investment project. For the purposes of calculating NPV, it is assumed that the only investment alternative is a bank deposit account.

Due to the limited scope of the article, we do not provide here calculated data on the itemized statements of management and commercial expenses, expenses as part of the cost of manufactured and sold products and the revenue from sales of products.

It should be noted that commercial expenses also include royalty for trademarks and software. The Russian company pays the Company royalty at a rate of 1.5% of the annual sales of cars and since the countries have a tax agreement, in Russia, the taxation at source is not withheld. Royalty profit tax is paid by the parent Company in Germany (Huizinga & Nielsen, 1997; Vikhrova, 2019; Agafonova et al., 2020).

The cost of sales includes wages of factory workers, raw materials, depreciation of workshops and production equipment and other expenses (Kostyukhin, 2019). The plant's capacity is designed to produce 25-30 thousand cars per year.

To implement the project, it is necessary to invest 10 billion rubles in a lump. The company can allocate its owned capital in the amount of 6 billion rubles. It is planned to borrow 2 billion rubles from the parent company in the first year of the plant construction at 7% per annum and 2 billion rubles from the bank in the second year of the plant construction at 7% per annum. The payment schedule is structured in such a way that during the construction of the plant, the debt on the principal is not paid, interest is also not paid and it is capitalized in the principal. At the same time, the organization will pay 1082 million rubles for the main loan and for the repayment of the second debt, the total amount of interest payments will be 848 million rubles. Like other car manufacturers, the Company receives subsidies from the Ministry of Industry and Trade of the Russian Federation to reimburse part of the costs of producing Euro-4 and Euro-5 cars, using energy resources and maintaining jobs. The subsidies are included in profit for tax purposes (Samarina et al., 2020). A simplified type of cash flow equal to profit before tax is calculated in Table 3.

| Table 3 The profit formation before taxation, RUB MLN. | ||||||||

| Indicator \ Period | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Revenue minus dealers fees | 27 671 | 36 736 | 37 302 | 38 056 | 38 948 | 39 967 | 41 104 | 42 352 |

| Production cost | 28 607 | 35 768 | 36 191 | 36 728 | 37 368 | 38 101 | 38 920 | 39 818 |

| Administrative costs | 332 | 358 | 356 | 354 | 353 | 353 | 353 | 354 |

| Selling costs | 1 762 | 1 715 | 1 748 | 1 764 | 1 783 | 1 800 | 1 819 | 1 839 |

| Profit (loss) from sales | - 3 030 | - 1 104 | - 992 | - 790 | - 555 | - 287 | 12 | 341 |

| Other profit (subsidies) | 3 044 | 3 210 | 4 103 | 4 186 | 4 284 | 4 396 | 4 521 | 4 659 |

| Other expenses (% to be paid) | 810 | 775 | 740 | 705 | 670 | 635 | 600 | 565 |

| Cash flow 1 | - 796 | 1 331 | 2 371 | 2 691 | 3 059 | 3 474 | 3 933 | 4 434 |

Table 4 shows that due to the preferential profit tax rates applied by residents of the “SEZ-Lipetsk”, more than 3.6 billion rubles were released during the project implementation. The company may offset the loss incurred in the first period against the gains in the second and the third periods. This shifts the time when the first profit is received and, accordingly, the beginning of the period when the profit tax benefit is applied. Only during this period, the company pays 5% profit tax in the amount of 418 million rubles.

| Table 4 The Calculation of Profit Tax and Net Profit of the Plant, RUB MLN | |||||||||

| Period | Cash flow 1 | Offset of losses in the SEZ | Standard offset of losses | Tax base of the SEZ | Standard tax base |

Preferential tax rate | Released funds | Profit tax | Cash flow 2 |

| 1 | - 796 | - | - | - | - | - | - | - | - 796 |

| 2 | 1 331 | 796 | 665 | 534 | 665 | 0% | 133 | - | 1 331 |

| 3 | 2 371 | - | 131 | 2 371 | 2 239 | 0% | 448 | - | 2 371 |

| 4 | 2 691 | - | - | 2 691 | 2 691 | 0% | 538 | - | 2 691 |

| 5 | 3 059 | - | - | 3 059 | 3 059 | 0% | 612 | - | 3 059 |

| 6 | 3 474 | - | - | 3 474 | 3 474 | 0% | 695 | - | 3 474 |

| 7 | 3 933 | - | - | 3 933 | 3 933 | 5% | 590 | 197 | 3 737 |

| 8 | 4 434 | - | - | 4 434 | 4 434 | 5% | 665 | 222 | 4 213 |

| Totals | 20 497 | 796 | 796 | 20 497 | 20 497 | - | 3 681 | 418 | 20 078 |

From the moment when the new plant in Russia becomes steadily profitable, the German company is going to withdraw its net profit in the form of dividends. According to German law, dividends are exempt from 95% profit tax and foreign profit that has already been taxed is subject to a tax credit. Based on the Russian-German agreement, the withholding tax rate in Russia is 5%, which exceeds the amount of tax on dividends in Germany. Therefore, no additional tax is charged. Profit in the form of royalties and interest on the loan will not be taxed at source, but will be subject to profit tax in Germany (33%). The amount of all types of profit received in connection with the creation of a subsidiary in Russia, net of taxes, will amount to RUB 23,525 million (excluding euro conversion) (Table 5).

| Table 5 The Calculation of the net Profit from the Project of the Parent Company, RUB MLN | ||||||||

| Period | Profit in Russia | Tax at source (5%) | Sum in Germany | Royalties | Interest | Royalties and interest | Royalties and interest after taxation | Total |

| 1 | - | - | - | 422 | 410 | 832 | 558 | 558 |

| 2 | - | - | - | 560 | 393 | 953 | 638 | 638 |

| 3 | 2 371 | 119 | 2 252 | 569 | 375 | 944 | 632 | 2 885 |

| 4 | 2 691 | 135 | 2 556 | 580 | 358 | 938 | 629 | 3 185 |

| 5 | 3 059 | 153 | 2 906 | 594 | 340 | 934 | 626 | 3 532 |

| 6 | 3 474 | 174 | 3 301 | 610 | 323 | 933 | 625 | 3 925 |

| 7 | 3 737 | 187 | 3 550 | 627 | 305 | 932 | 625 | 4 174 |

| 8 | 4 213 | 211 | 4 002 | 646 | 288 | 934 | 626 | 4 628 |

| Total | 19 544 | 977 | 18 567 | 4 608 | 2 792 | 7 401 | 4 958 | 23 525 |

The choice of the method for determining the calculated interest rate is justified by economic appropriateness. For our project, we determine the calculated interest rate using the cumulative method: the interest on deposits in Germany is 0.15%, the exchange rate risk is 1% and the political risk is 1%. NPV, return index PI and payback period are calculated at the settlement interest rate, since it must be less than the interest rate on the loan.

According to the calculations (table 6), NPV of the project is 10920 million rubles and PI=2.09. The profitability of the project is very high. The project is profitable for the company, since the internal IRR rate of return is higher than the settlement rate.

| Table 6 Key Indicators of the Investment Project, RUB MLN | |||

| Period | Cash flow | Indicator | Value |

| -1, 0 | -8000 | NPV | 10 920 |

| 1 | 558 | ||

| 2 | 638 | ||

| 3 | 2 885 | PI | 2,09 |

| 4 | 3 185 | ||

| 5 | 3 532 | ||

| 6 | 3 925 | IRR | 18% |

| 7 | 4 174 | ||

| 8 | 4 628 | ||

Taking into account tax payments, the project pays off in the sixth year of its implementation (if not taking into account the two years of the plant construction). Profit tax benefits allow saving more than 3.6 billion rubles.

Development Project of a German Company as A Result of the Acquisition of a Russian Company

The project plan for the development of a German company as a result of the acquisition of a Russian company with production facilities in the Moscow region and its spin-off into a subsidiary is described below. The project is designed for 10 years and involves a one-off investment of 15 billion rubles at the initial stage, due to which the company is purchased, one building is completed and the production process is set up. In the second half of the year, the plant starts producing cars. The plant's capacity is designed to produce 25-30 thousand cars per year. The list of profit and expenses recognized as profit and expenses from the organization's ordinary activities is similar to those in the Greenfield model analyzed above.

Subsidies from the Ministry of Industry and Trade of the Russian Federation to car manufacturers are included in profit for tax purposes (Table 7).

| Table 7 The Profit Formation Before Taxation, RUB MLN | ||||||||||

| Period | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Revenue minus dealers fees | 18 447 | 27 671 | 36 736 | 37 302 | 38 056 | 38 948 | 39 967 | 41 104 | 42 352 | 43 707 |

| Production cost | 19 072 | 28 607 | 35 768 | 36 362 | 37 124 | 38 064 | 38 101 | 38 920 | 39 818 | 40 791 |

| Administrative costs | 255 | 332 | 358 | 356 | 354 | 353 | 353 | 353 | 354 | 355 |

| Selling costs | 1 175 | 1 762 | 1 715 | 1 748 | 1 764 | 1 783 | 1 800 | 1 819 | 1 839 | 1 861 |

| Profit (loss) from sales | -2 054 | -3 030 | -1 104 | -1 146 | -1 147 | -1 182 | -1 269 | -1 436 | -1 717 | -2 154 |

| Other profit (subsidies) | 2 029 | 3 044 | 3 210 | 4 103 | 4 186 | 4 284 | 4 396 | 4 521 | 4 659 | 4 808 |

| Cash flow 1 | - 25 | 14 | 2 106 | 2 904 | 3 000 | 3 033 | 4 109 | 4 533 | 4 999 | 5 507 |

The profit tax is further calculated (Table 8). In the first period, the company made significant investments (500 million rubles) in the construction of a production and warehouse building. According to the Moscow region law (Government of the Moscow Region, 2004), in the second period, the company began to apply the benefit (i) for profit tax in the form of a reduced rate of 15.5% and (ii) for the exemption of the new building from property tax. The property tax benefit is applied from the month following the month when the item of fixed assets is registered for four consecutive tax periods. The period of validity of the profit tax benefit ends with the tax period in which the amount of funds released from the tax benefit reaches the cost of the capital construction facility. Therefore, the sixth period of the project implementation is the last period of applying the profit tax benefit, since at the end of this period the amount of funds released from the tax benefit reaches 498 million rubles (the cost of the facility is 500 million rubles). In total, over the ten-year period of its existence, the company will pay about 5.5 billion rubles of profit tax to the budget.

| Table 8 The Calculation of Profit Tax and Net Profit, RUB MLN | |||||||

| Period | Cash flow 1 | Possibility to record losses | Tax base | Reduced rate | Accumulated funds released | Profit tax | Cash flow 2 |

| 1 | - 25 | - | - | 0 | - | 0 | - 25 |

| 2 | 14 | 7 | 7 | 15,5% | 0,31 | 1 | 13 |

| 3 | 2 106 | 18 | 2 088 | 15,5% | 94 | 324 | 1 782 |

| 4 | 2 940 | - | 2 940 | 15,5% | 227 | 456 | 2 485 |

| 5 | 3 000 | - | 3 000 | 15,5% | 362 | 465 | 2 535 |

| 6 | 3 033 | - | 3 033 | 15,5% | 498 | 470 | 2 563 |

| 7 | 4 109 | - | 3 020 | 20% | - | 822 | 3 288 |

| 8 | 4 533 | - | 2 926 | 20% | - | 907 | 3 627 |

| 9 | 4 999 | - | 2 716 | 20% | - | 1 000 | 3 999 |

| 10 | 5 507 | - | 2 340 | 20% | - | 1 101 | 4 406 |

| Итого | 30 216 | 25 | 22 070 | - | - | 5 545 | 24 671 |

From the moment when production in Russia becomes steadily profitable, the German company is going to withdraw net profit from the project (table 9) in the form of dividends.

| Table 9 The Calculation of the Net Profit from the Project, RUB MLN | ||||||

| Period | Profit in Russia | Tax at source (5%) | Sum in Germany | Royalties | Royalties after taxation | Totals |

| 1 | - | - | - | 281 | 188 | 188 |

| 2 | - | - | - | 422 | 283 | 283 |

| 3 | 1 782 | 89 | 1 693 | 560 | 375 | 2 068 |

| 4 | 2 484 | 124 | 2 360 | 569 | 381 | 2 741 |

| 5 | 2 535 | 127 | 2 408 | 580 | 389 | 2 797 |

| 6 | 2 563 | 128 | 2 435 | 594 | 398 | 2 833 |

| 7 | 3 288 | 164 | 3 123 | 610 | 409 | 3 532 |

| 8 | 3 627 | 181 | 3 445 | 627 | 420 | 3 865 |

| 9 | 3 999 | 200 | 3 800 | 646 | 433 | 4 233 |

| 10 | 4 406 | 220 | 4 185 | 667 | 447 | 4 632 |

| Totals | 24 683 | 1 234 | 23 449 | 5 557 | 2 843 | 18 307 |

The amount of all types of profit received in connection with the acquisition of a Russian enterprise, net of taxes, will amount to RUB 18,307 million rubles (excluding euro conversion).

The NPV, PI and payback period for a cash flow equal to the parent company's net profit are further calculated. According to the calculations, NPV = 8465 million rubles, PI=1,56 (Table 10). The project's profitability (56%) is quite high. The profitability of this project is confirmed by the fact that the IRR is higher than the settlement rate.

| Table 10 Key Indicators of the Investment Project, RUB MLN | |||

| Period | Cash flow | Indicator | Value |

| 0 | -15 000 | NPV | 8 465 |

| 1 | 188 | ||

| 2 | 283 | ||

| 3 | 2 068 | PI | 1,56 |

| 4 | 2 741 | ||

| 5 | 2 797 | ||

| 6 | 2 833 | ||

| 7 | 3 532 | IRR | 9,3% |

| 8 | 3 865 | ||

| 9 | 4 233 | ||

| 10 | 4 632 | ||

Taking into account tax payments and leaving a part of the profit to the subsidiary, the project pays off in the eighth year of its implementation.

Results

In Russia, tax incentives for priority economic activities, including investment, are provided through tax preferences. Their wide range is stipulated with federal and regional legislation. An access to the prevailing range of benefits is limited with the status of a Russian legal entity and, in many cases, depends on registration in a specific territory of Russia. Russian regions are significantly different from each other with a list of investment tax incentives. For greater flexibility, in tax planning and sharing the economic risks of a foreign investor company, it is advisable to establish or to have a separate legal entity in Russia. The results of statistical analysis showed an increase in the number of companies using preferential tax regimes in Russia, which indicates their effectiveness. Russia has a steady need for FDI to develop its economy and overcome the consequences of the coronavirus pandemic. Consequently, it is necessary to further improve the tax incentives for foreign capital inflows.

The unavailability of most preferential tax regimes for foreign companies makes it necessary to substantiate the most optimal model of direct investment in Russia.

As a result of modeling the investment project of a German company by creating a new legal entity in Russia, it was found that this project can be considered as a very profitable one. Taking into account the savings on tax payments, it pays off during its implementation period in the sixth year and has a very high rate of return. The profit tax benefits available to German investors in the “Lipetsk SEZ” allow them to save more than 3.6 billion rubles.

The modeling of the investment project through the acquisition of an existing Russian company showed that it can pay off in the eighth year of its implementation. The sixth period of the project implementation is the last period when the profit tax benefit is applied. By the end of this period, the amount of funds released from the tax benefit reaches 498 million rubles, which is equal to the amount of investments.

The main advantage of investing in the creation of a new subsidiary legal entity is a large selection of investment benefits and special regimes that can be used by an investor. This makes the implementation of the project more profitable. The company must be a separate Russian legal entity in order to enjoy tax preferences more fully and on a wider scale. The main advantage of the acquisition strategy of an existing Russian company is the faster entry of a foreign company into the Russian market.

Discussion

There are no researches in the scientific literature devoted to the effectiveness of the impact of hidden preferential tax regimes in Russia on the choice of investment project models for foreign companies.

For example, Gereev (2018) examined the possibility of access to investment incentives for medium and small Russian businesses. Drobyshevsky et al. (2020) conducted a study on the depth and breadth of coverage of investment benefits for taxpayers located in the Russian region that provides these benefits. Other research papers analyzed the impact of investment benefits on the financial stability of the region's budget.

In contrast to these studies, our research showed that Russian tax legislation is less likely to encourage foreign investors to invest in the development and technical re-equipment of existing Russian manufacturing enterprises outside of special economic territories. Tax incentives are mainly focused on attracting FDI to create new businesses in specific regions of Russia. In our opinion, Russian tax legislation needs to be improved to create incentives for attracting FDI to the development of existing Russian manufacturing enterprises, regardless of their location.

Conclusion

Russian hidden preferential regimes provide a whole range of tax benefits if the investor meets a number of conditions. An access to the prevailing number of benefits is limited with the status of a Russian legal entity and is subject to registration in a certain territory of Russia. Tax incentives encourage foreign investors to invest in the development and technical re-equipment of existing Russian manufacturing enterprises to a lesser extent. Tax benefits are mainly aimed at attracting foreign capital to create new enterprises in Russia on the territory of certain regions. The Greenfield project is optimal for reducing the investor's tax burden, as it provides access to a wide range of preferential regimes. It is necessary to improve tax mechanisms for stimulating the flow of FDI to the development of existing Russian manufacturing enterprises, regardless of their location. The current study is useful for further scientific research of such tax mechanisms. The research is practically significant for foreign companies as it provides systematic information and characteristics of the conditions of preferential tax regimes in Russia; it identifies the advantages and provides a methodology for determining the optimal investment technique in Russia.

References

- Agafonova, I. I., Sidorova, E. Y., Polezharova, L. V., Ryakhovsky, D. I., & Kostina, O. V. (2020). Certain measures for tax regulation of industrial development and digital trade in Russia (National and international aspects). Journal of Advanced Research in Dynamical and Control Systems, 12(3), 1214-1222.

- Batashev, R. V., Nikonovich, S. L., Kalafatov, E. A., Polezharova, L. V., Mironova, E. A., Kovalevskaia, N. V. (2020). Indicators of tax evasion: Dynamics and transformation. Journal of Advanced Research in Dynamical and Control Systems, 12(3 Special Issue), 597-607.

- Bird, R. M. (2008). Tax Challenges Facing Developing Countries. Institute for International Business Working Paper, 9.

- Drobyshevsky, S. M., Kostrykina, N. S., & Korytin, A. V. (2020). Tax competition and the activity of the regional tax policy. Voprosy Ekonomiki, (10), 5-27.

- Dunning, J. H. (1977). Trade, Location of Economic Activity and the MNE: A Search for an Eclectic Approach. In: Ohlin B., Hesselborn PO., Wijkman P.M. (eds) The International Allocation of Economic Activity. Palgrave Macmillan.

- Filatov, V. V., Zaitseva, N. A., Larionova, A. A., Maykova, S. E., Kozlovskikh, L. A., Avtonova, V. Y., & Vikhrova, N. O. (2019). Assessment of the socio-economic impact of the implementation of regional environmental programs for waste management. Ekoloji, 28(107), e107080, 267-273.

- Gereev, R. A. (2016). Special investment contract and its importance for the industrial development of the Russian Federation. Innovative Development of the Economy, 34, 39-43.

- Gereev, R. A. (2018). Features of tax incentives for industrial production. Taxes and taxation, (3), 1-10.

- Ghoshal, S., & Westney, E. (1993). Organizational Theory and the Multinational Corporation. New York: St. Martin Press.

- Goncharenko, L. I., & Vishnevskaya, N. G. (2019). Tax incentives for the innovative development of industrial production based on the analysis of advanced foreign experience. Taxes and Taxation, 4, 121-131.

- Gordon, R., & Li, W. (2009). Tax Structures in Developing Countries: Many Puzzles and a Possible Explanation. Journal of Public Economics, 93(7-8), 855-866.

- Government of the Moscow Region (2004). Law of the Moscow Region of November 24, 2004 No. 151/2004-OZ "On preferential taxation in the Moscow Region".

- Grubert, H. (2003). The Tax Burden on Cross-Border Investment: Company Strategies and Country Responses. Cesifo Working Paper, 964, 1-35.

- Hajkova, D., Nicoletti G., Vartia, L., & Yoo, K.-Y. (2007). Taxation and Business Environment as Drivers of Foreign Direct Investment in OECD Countries. OECD Economic Studies, 2006(2), 7-78.

- Hines J. R., & Park J. (2019). Investment ramifications of distortionary tax subsidies. Journal of Public Economics, 172, 36-51.

- Huizinga, H., & Nielsen, S. B. (1997). Capital Income and Profit Taxation with Foreign Ownership of Firms. Journal of International Economics, 42(1-2), 149-165.

- Jorgenson, D. (1963) Capital Theory and Investment Behavior. American Economic Review, 53, 247-259.

- Komleva, M. I. (2018). Advantages and disadvantages of special investment contracts, their comparison with other special modes. Economy and entrepreneurship, 91, 641-643.

- Kostuhin, Y., & Savon, D. (2020) Improving steel market performance indicators in the fact of increased competition. Chernyemetally, 4, 68-72.

- Kostyukhin, Y. (2019). Conceptual provisions of sustainable development of socio-economic systems (on the example of an industrial enterprise19th International Multidisciplinary Scientific GeoConference SGEM 2019, 5.3, 131-138.

- Kostyukhin, Y. Y. (2016). Enhancement of labor efficiency in coal mining industry. Economy, Organization And Management, 10, 08.

- Kruzhkova, G. V., Kostyukhin, Y. Y., & Rozhkov, I. M. (2018). Choice procedure for expedient composition of electronic waste. Mining Informational and Analytical Bulletin, 9, 47-57.

- Merton, R. C., & Bodie, Z. (2005). The Design of Financial Systems: Towards a Synthesis of Function and Structure. Journal of Investment Management,3(1), 1-23.

- Samarina, V. P., Skufina, T. P., Kostyukhin, Y. Y., & Savon, D. Y. (2020). Relationship between iron ore deposits and spread of heavy metals in shallow water rivers: Natural and man-caused factors. CIS Iron and Steel Review, 19, 75-80.

- Steshenko J. A., & Tikhonova A. V. (2018). An integral approach to evaluating the effectiveness of tax incentives. Journal of Tax Reform, 4(2), 157-173.

- Tikhonova, A. V. (2019). Application of a special investment contract in the context of the import substitution policy. Economics, Taxes Law, (6), 144-153.

- Vavulin, D. A., & Simonov, S. V. (2014). On the issue of tax benefits provided to investors at the regional level. Finance and Credit, 577, 30-37.

- Vikhrova, N. (2019). Recycling aluminium waste within the «circular» economy paradigm. 19th International Multidisciplinary Scientific GeoConference SGEM 2019, 5.3, 605-612.