Research Article: 2022 Vol: 26 Issue: 3S

Impact of Infrastructure Development Index on Fdi: A Case of Pakistan

Syeda Amina Hasan, Institute of Business Management

Mirza Aqeel Baig, Institute of Business Management

Irfan Lal, Institute of Business Management

Citation Information: Hasan, S.A., Baig, M.A., & Lal, I. (2022). Impact of infrastructure development index on fdi: a case of pakistan. Academy of Accounting and Financial Studies Journal, 26(S3), 1-09.

Abstract

This paper investigates the impact of Infrastructure Development Index (IDI) on FDI using GFCF, INFL, TOPEN, EXR and INFL as the independent variables. The main contribution of this paper is to generate a comprehensive Infrastructure Development Index in Pakistan using 11 variables by applying the Principal Component Analysis. The main components used to generate the IDI include Transport, Telecommunication, Energy and Water and Sanitation. The time series technique of Johansen Cointegration in VAR and ECM is used for the analysis of the data and to derive empirical results for the year 1980 to 2018. After the analysis of our data the results of the Johansen Cointegration and ECM concludes that there exists a long and short run relationship between IDI and FDI in the case of Pakistan.

Keywords

Infrastructure Development Index, FDI, PCM.

JEL Classifications

C3, F21, C40.

Introduction

Infrastructure development is vital for a country in order to attract Foreign Direct Investment (FDI), boost exports and enhance economic growth. A country with poor infrastructure discourages foreign investors; therefore improving infrastructure development and expanding its services are significant for the economic development of a country. The Infrastructure of a country consists of more or less the same facilities like water and sanitation, transport system which includes roads, rail, air and seaport, electricity and gas, sewerage system and waste disposal, and telecommunication which comprises of landline, mobile and broadband internet subscribers. The development of infrastructure will lead to enlarging market, promoting innovations which eventually will lead to higher levels of productivity and lower cost. With high levels of productivity the industrialization increases, thereby boosting the exports of the country and thus increasing employment. This eventually leads to enhanced economic growth. World Bank in their World Development report (2006) emphasized the fact that infrastructure development is vital for better business environment, greater investment and therefore will result in growth and economic development of a country.

Pakistan infrastructure needs are rising while the resources are limited. Operating infrastructure is difficult due to the massive gaps in the public sector and the limited fiscal space available. For the economy of Pakistan it is important to improve the quality and availability for water supply, enhance the distribution of power and gas, provide better sewerage system and improve the transport and logistics of the country. Suneta et al. (2010) investigated whether infrastructure has an impact on the economic growth and FDI in Pakistan. Their results concluded that the FDI and GDP of Pakistan will increase as infrastructure development increases. In addition to this Rehman et al. (2011) and Zeb et al. (2014) also estimated the impact of infrastructure on FDI in case of Pakistan and came to the same conclusion that Infrastructure development will significantly affect the FDI.

As per international standards Pakistan infrastructure is relatively poor. Pakistan faces electricity shortages, doesn’t have proper water and sanitation facilities etc. In 1948, Pakistan took its first step towards establishing the Five-Year Plan which was inspired by the Soviet Union. This plan was brought into effect by the Ministry of Finance in order to enhance the industrialization of the economy and to expand the banking sector of Pakistan. Even though the First Five Year plan failed to meet its desired objectives, the next government in command revived and launched the Second Five Year plan in 1960, where priority was given to the industrial development and improvements of railways, communication and transport.

Similar versions of the Five-Year plan were adopted by different government regimes at different times. Later on the Medium Term Development Framework came into effect by the Ministry of Finance in 2005, where the aim was to strengthen the economy and enhance the infrastructure development of the country. This framework was designed to develop infrastructure facilities like electricity, transport and water resource to turn Pakistan into an industrialized nation and reduce poverty levels. The government also plans to develop the transport infrastructure with important projects like Karachi Lahore Motorway, Raikot-Havelian-Islamabad Section, construction of Breakwaters, and overcoming energy shortage by project like Diamer Basha Dam, Karachi Coastal Power Project and other CPEC Projects (Reform, 2017-18).

Foreign Direct Investment can be beneficial for the host country as it beings capital finance into the country, lead to technological transfers and create linkages with local firms, along with stimulating economic development, boosting the economy, increasing productivity and thereby creating employment. Therefore, many developing countries like Pakistan chose to liberalize their FDI policies to encourage FDI inflows in their economies and obtain these benefits (Soneta et al., 1994).

Since the independence, Pakistan has been trying to pursue foreign direct investments in the country. The then government took measures to boost the business environment of the country by changing policy and regulatory measures to encourage foreign investments in the country. To achieve this measure any restrictions in the inflow and outflow of capital was lifted. Until 1991 however, there was an insignificant flow of FDI in Pakistan as the investment policies implemented were inconsistent. Later on the government of Pakistan undertook the liberalization policies which resulted in the flow of FDI to gradually increase. After incorporating these changes, Pakistan has seen relatively higher amount of FDI in the country over the past 20 years.

FDI has a great impact on economic growth of a country and many empirical studies have been carried out to examine the relationship between FDI and economic growth. Attari et al. (2010), Gudaro et al. (2010), Ahmed et al. (2014) Gul & Naseem (2014), Ghazali (2010), and Falki (2009) analyzed the FDI – Growth Nexus in Pakistan, all showing mixed results of the impact of FDI on Economic growth, where some showed a positive impact of FDI on Economic growth while others showed a negative impact among the two variables.

Study Objectives

To enhance the GDP of a country the development of its infrastructure is quite crucial. As per the review of numerous literatures there have been only few studies conducted that developed an Infrastructure Development Index (IDI). The main objective of this study is to:

1. Construct the Infrastructure Development Index in the case of Pakistan.

2. Analyze the impact of Infrastructure Development Index on FDI in Pakistan.

This study will be helpful in making policy recommendation as to how improving infrastructure will improve FDI and thereby enhance economic growth.

Literature Review

Analyzing the impact of Infrastructure Development Index in FDI is beneficial as it will help us find out whether an increase in Infrastructure development will affect the FDI inflows. A transport Infrastructure Index was generated by Pradhan et al. (2013) and their results concluded a positive impact of transport infrastrcture on FDI and economic growth in the case of India. Therefore it can be stated that an economy with a well-developed infrastructure tends to attract higher FDI inflows by boosting the investors’ confidence. Furthermore, since Infrastructure development enhances FDI and creates employment opportunities it will thereby lead to a higher growth. An analysis by Ismail & Mahyideen (2015) using both transport and telecommunication infrastructure came to the conclusion that these infrastructures do have a positive impact on trade and economic growth of a country.

Nyaosi (2011) developed an infrastructure development index in Kenya using three dimensions namely transport, energy and telecommunication. The variables incorporated were air, rail, road, energy consumption, electric consumption, internet users, mobile subscribers and telephone lines. The author then generated an infrastructure index and estimated it impact on FDI. While, Jan et al. (2012) also used the same three sectors mentioned above (transport, energy and telecommunication) to generate an Infrastructure index in Pakistan. Both authors’ results stated that infrastructure positively impacts the FDI of the respective countries.

Another research conducted by Shah (2012) in which a panel estimation for 90 developing countries for the years 1980 till 2007 was implemented; the results concluded that infrastructure has a significant impact on FDI. The results showed that market size along with economic development has a positive impact FDI inflow. Khadaroo & Seetanah (2009) analyzed the role of transport infrastructure on FDI for 33 African countries covering the time from 1984 to 2002. Other variables that were included in their research was natural resource intensity, labor cost, trade openness, human capital, political instability, market size, length of roads as a proxy for transport infrastructure and telephones available as a proxy for communication infrastructure. Their results showed that transport and other infrastructure is vital to attract FDI to a country.

Donaubauer et al. (2016) in their assessment of aid, infrastructure and FDI used the 3SLS estimation for their analysis and came up with the same conclusion that Infrastructure index (which comprises of transport, telecommunication, energy and finance) has a strong effect on FDI. While Kaur et al. (2016) also concluded with similar results stating that Infrastructure significantly impacts FDI. The analysis was conducted using VAR methodology for the case of India for the time frame 1991 till 2010. The variables used for in their research included Official development assistance as a percentage of GDP, air, rail, road, energy, internet, education, and wage.

Abu Bakar et al. (2012), on the other hand, analyzed the impact of infrastructure on FDI using the Ordinary Least Square technique in the case of Malaysia from 1970 to 2010, to analyze the impact of infrastructure on FDI incorporating other independent variables which are human capital, trade openness and market size and the result concluded that infrastructure has a significant role on FDI. Another analysis for the case of Malaysia was done by Ahmad et al (2015) for the time period of 1980 till 2013 using the Auto Regressive Distributive Lag Model (ARDL). The variables incorporated were FDI, GDP, Exchange rate and Telecommunication infrastructure and the results indicated that infrastructure positively affects FDI.

Enriquez et al. (2014) used transport infrastructure index to analyze its impact on FDI for ASEAN countries for the annual data from 1999 to 2012 by applying the Fixed and Random Effect model. The result of this study confirmed that transport infrastructure plays a vital role in attracting FDI. It was further analyzed by the researchers that air transport has the most significant impact on FDI followed by rail and then road not having relatively significant impact. A transport Infrastructure Index generated by Pradhan et al (2013) using the ARDL methodology and VECM for the period 1970 till 2012 indicated that there exists a positive impact of transport infrastructure on FDI and economic growth in India.

An analysis of telecommunication infrastructure on FDI was conducted by Zeb et al (2014) in the case of Pakistan for the time frame 1990 till 2012. Mobile subscription was taken as a proxy for telecommunication infrastructure while other explanatory variables incorporated were labor force, market size and trade openness to estimate the impact on FDI. The Johansen Cointegration and OLS technique was used to estimate the long and short run relationship. The results of the analysis concluded that infrastructure plays a positive and significant role in attracting FDI in Pakistan.

Iqbal & Nadeem (2006) also developed an Infrastructure development index in Pakistan along with other composite indicators like real, monetary and social development and states that social development causes real development while there is no relationship between real development and monetary development. The annual data comprised of the period 1971 to 2003 where the authors used the Granger Causality test and VECM to derive the empirical results. The paper concluded that real development and monetary indicators can be used to develop social and physical infrastructure which will boost investments.

Research Methodology

Research Hypothesis

H0: Infrastructure development index does not have a significant impact on FDI

H1: Infrastructure development index does have a significant impact on FDI

Data & Methodology

The data for this research has been derived from the World Bank Database and Pakistan Economic Survey for the period of 1980-2018 that is 39 years of annual time series. To create the Index the main sectors incorporated are Transport, Telecommunication, Energy and Water and Sanitation. The subsector variables for Transport include air, rail and road. For Telecommunication the variables included are cellular, telephone and internet. For Energy the variables used are electric consumption, electric distribution and energy use. Furthermore, water and sanitation is also included in our infrastructure index. For analyzing the impact of IDI on FDI the variables used are FDI, inflation, exchange rate, trade openness and GFCF.

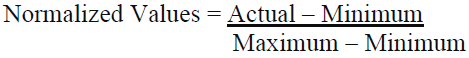

The Principal Component Analysis is applied to construct the infrastructure development index using sub indicators from energy, transport, telecommunication sector and water and sanitation. To construct the index through PCA the variables are first normalized to remove any unit biasness. This is done by applying the following:

This is the method of normalizing, after which the Functional Principal Component (FPC) is generated which is actually the weight assigned to each variable of the index. After generating the FPC the normalized values of each variable are multiplied with their respective FPC and then summed up to obtain the index as below:

Z= (Normalized value of first variable x FPC of first variable) + (Normalized value of second variable x FPC of second variable) + (Normalized value of third variable x FPC of third variable) + ……..

IDI = [N(Air) x FPC(Air)] + [N(Road) x FPC(Road)] + [N(Rail) x FPC(Rail)] + [N(EC) x FPC(EC)] + [N(ENR) x FPC(ENR)] + [N(ED) x FPC(ED)] + [N(INT) x FPC(INT)] + [N(MOB) x FPC(MOB)] + [N(TEL) x FPC(TEL)] + [N(WAT) x FPC(WAT)] + [N(SANI) x FPC(SANI)]

Where N is the normalized value of the respective mentioned variables and FPC is the functional principal component of the mentioned variables. Air, Road and Rail are the variables incorporated for transport infrastructure. EC is Electric Consumption, ER is Energy Use and ED is Electric Distribution which are the sub indicators used for energy infrastructure. While for Telecommunication infrastructure INT refers to Internet, MOB refers to Cellular Mobile and TEL refers to Telephone. WAT refers to Water and SANI stands for Sanitation.

The time series technique of Johansen Cointegration in VAR and ECM is used to determine the long and short run relationship between IDI and FDI. Trade openness, inflation, gross fixed capital formation and exchange rate are used as the independent variables for the empirical analysis. The data has been obtained from World Bank Database and Economic Survey of Pakistan for the period of 1980 till 2018 that is at least 39 years of data.

FDI = f (IDI, trade openness, exchange rate, Inflation, gross fixed capital formation)

To analyze the long run relationship among the variables they need to be integrated at I(1) for testing of the Johansen Cointegration. The following model has been derived for our regression analysis:

LNFDIt = β0+β1LNIDIt+β2LNTOPENt+β3LNGFCFt+β4LNINFL+β5LNEXR+εt (3)

Where IDI is used as abbreviation for Infrastructure Development Index, FDI is the Foreign Direct Investment, GFCF means Gross Fixed Capital Formation, INFL refers to inflation, EXR means Exchange rate. While t refers to the Time period, β measures the elasticities, ε is the Error term and LN is the logarithm (Malik, 2015).

Empirical Analysis

To conduct an empirical analysis the data is first converted to its log form to limit the skeweness of data. Next the unit root test is applied to check the stationarity of the data to ensure the data is not misleading and does not cause a spurious regression. The Augmented Dickey Fuller (ADF) Test is conducted to check the stationarity of the variables. The result is shown below in Table 1.

| Table 1 ADF Unit Root Test | ||

| SIC at 7 lags | ||

| LNEXR | 0.2515 | 0.0004* |

| LNFDI | 0.5814 | 0.0001* |

| LNGFCF | 0.9673 | 0.0001* |

| LNIDI | 0.2617 | 0.0000* |

| LNINFL | 0.1151 | 0.0000* |

| LNTOPEN | 0.2668 | 0.0000* |

| Note *denotes 5% significance level | ||

The results from the above table show that the variables are non-stationary at level for 5% level of significance. The probabilities associated with each variable is greater than 0.05 therefore, the null hypothesis cannot be rejected. As the probability of all variables is less than 0.05 it means the variables are integrated at I(1).

When all the variables are integrated at I(1) the Johansen Cointegration technique in Vector Auto Regressive (VAR) model is applied for the empirical analysis. The following are the results obtained Table 2 and Table 3:

| Table 2 Johansen Cointegration in Var | ||

| At 1 Lags | ||

| Trace Tests | Max Eigen | |

| FDI | 2 cointegrating equation | 1 cointegrating equation |

| At 5% level of significance | ||

| Table 3 Johansen Cointegration in Var (FDI) | ||||

| Hypothesized | Trace Statistics | Prob. | Max Eigen | Prob. |

| None * | 119.8811 | 0.0004 | 46.12292 | 0.0093 |

| At most 1 | 73.75819 | 0.0234 | 28.55913 | 0.1889 |

| At most 2 | 45.19906 | 0.087 | 21.29376 | 0.2589 |

| At most 3 | 23.9053 | 0.2045 | 17.23689 | 0.1611 |

| At most 4 | 6.668408 | 0.6165 | 5.995196 | 0.6138 |

| At most 5 | 0.673211 | 0.4119 | 0.673211 | 0.4119 |

| Trace test indicates 2 cointegrating eqn(s) at the 0.05 level Max-eigenvalue test indicates 1 cointegrating eqn(s) at the 0.05 level |

||||

From the table 3 above the trace test shows that two cointegrating equation exists among the variables as the P value (0.0004) and (0.0234) is less than 5 % level of significance. This means that there exists long run relationship among the variables. The max Eigen value test also shows one cointegration as the P value shows (0.0093) and therefor long run cointegrating exists among the variable as we reject null hypothesis of no cointegration in both cases.

Since long run cointegration exists, the VECM is applied to determine the short run relationship among the variables, the ECM results can be seen below Table 4:

| Table 4 ECM for FDI | ||||||

| Error Correction: | D(LNFDI) | D(LNINDEX) | D(LNGFCF) | D(LNEXR) | D(LNINFL) | D(LNTOPEN) |

| CointEq1 | -0.22509 | -0.02057 | -0.01749 | -0.02443 | -0.17231 | 0.031428 |

| -0.08423 | -0.02162 | -0.01918 | -0.00969 | -0.07133 | -0.01228 | |

| T statistics | [-2.67251] | [-0.95133] | [-0.91180] | [-2.52051] | [-2.41574] | [ 2.55970] |

The above table shows us the T statistics of [-2.67251] which means that the ECM is significant, while the coefficient of (-0.22509) there is convergence towards the equilibrium by 22.5%. Therefore from our results of Johansen Co integration and Error Correction Model it can be confirmed that infrastructure development index significantly impacts the FDI in both the long and short run in the case of Pakistan.

Conclusion

This research explores the relationship between Infrastructure Development Index with Foreign Direct Investment in the case of Pakistan. In this research the main objective was to construct an Infrastructure Development Index (IDI) for Pakistan using the Principal Component Analysis. Transport, Telecommunication, Energy and Water and Sanitation were used to develop the Index and the Infrastructure Index is then used to estimate its impact on Foreign Direct Investment. From the Unit Root Test it was depicted that all the variables are incorporated at I(1) and therefore, the Johansen Co-integration was applied in this research to obtain the long run relation between the variables. Developing the Index proved to be beneficial for this study as the combined impact of Infrastructure Development i.e. including all sub sectors namely transport, telecommunication, energy and water and sanitation on FDI was estimated.

The results derived from this research concluded that a long run relationship exists between IDI and FDI. The results of this study are in line with Zeb et al. (2014), Shah (2012) and Donaubauer et al. (2016) along with numerous other researchers who all stated that Infrastructure Development has a positive impact on FDI. The results of the Error Correction Model confirms about a short run relationship between IDI and FDI meaning that Infrastructure Development will start having a positive impact on FDI in the short run as well.

Pakistan has great opportunities to emerge as a global leader however, inconsistent growth rates, poor education, low levels of infrastructure development, lack of health facilities, deficit in balance of payment and high levels of inflation hinders Pakistans growth. If the government of Pakistan tackles these issues Pakistan can reach to great heights.

Investments need to be made in infrastructure developmental projects with key priority to be given to projects that are near completion stage. As per the Planning Commission (2011) the private sector should be brought in to invest in key infrastructure projects like transport, energy and water & sanitation as these sectors are underperforming under monopoly. One of the greatest examples of infrastructure development in Pakistan which has positively impact the economy not only in terms of development but also in terms of good relationship with our neighboring country is the China Pakistan Economic Corridor (CPEC). Pakistan needs more development projects like these to attract tourism as well which will enhance the economic growth of our country.

Most of the infrastructure in Pakistan is provided by the public sector, the government should ensure that any decision made must be analyzed as per the cost and benefits rather than on political grounds while the interest of public should be taken into account rather than personal interest of the government. Since Pakistan is an agricultural economy infrastructure development in rural or agricultural sector is vital for the development of Pakistan. All three sectors of the economy agriculture, industrial and services need to be build up simultaneously as these three sectors are linked with the three infrastructure sectors namely energy, transportation and telecommunication.

References

Ahmad, N.A., Ismail, N.W., & Nordin, N. (2015). The impact of infrastructure on foreign direct investment in Malaysia. International Journal of Management Excellence, 5(1), 584-590.

Indexed at, Google Scholar, Cross Ref

Attari, M.I.J., Kamal, Y., & Attaria, S.N. (2011). The causal link between foreign direct investment (FDI) and economic growth in Pakistan economy. The Journal of Commerce, 3(4), 61.

Indexed at, Google Scholar, Cross Ref

Donaubauer, J., Meyer, B., & Nunnenkamp, P. (2016). Aid, infrastructure, and FDI: Assessing the transmission channel with a new index of infrastructure. World Development, 78, 230-245.

Indexed at, Google Scholar, Cross Ref

Enriquez, J.M., Tiu, K., Lee, M., & Ng, R. (2014). The Role of Transport Infrastructure in Foreign Direct Investment Attractiveness Across ASEAN. School of Economics, De La Salle University.

Falki, N. (2009). Impact of foreign direct investment on economic growth in Pakistan. International Review of Business Research Papers, 5(5), 110-120.

Ghazali, A. (2010). Analyzing the relationship between foreign direct investment domestic investment and economic growth for Pakistan. International Research Journal of Finance and Economics, 47(1), 123-131.

Gudaro, A.M., Chhapra, I.U., & Shaikh, S.A. (2010). Impact of foreign direct investment on economic growth: A case study of Pakistan. IBT Journal of Business Studies (JBS), 6(2).

Malik, K. (2015). Impact of foreign direct investment on economic growth of Pakistan. American Journal of Business and Management, 4(4), 190-202.

Iqbal, J., & Nadeem, K. (2006). Exploring the causal relationship among social, real, monetary and infrastructure development in Pakistan. Pakistan Economic and Social Review, 39-56.

Ismail, N.W., & Mahyideen, J.M. (2015). The Impact of infrastructure on trade and economic growth in selected economies in Asia.

Indexed at, Google Scholar, Cross Ref

Jan, S.A., Chani, M.I., Pervaiz, Z., & Chaudhary, A.R. (2012). Physical infrastructure and economic development in Pakistan.

Kaur, M., Khatua, A., & Yadav, S.S. (2016). Infrastructure development and FDI inflow to developing economies: Evidence from India. Thunderbird International Business Review, 58(6), 555-563.

Indexed at, Google Scholar, Cross Ref

Khadaroo, J., & Seetanah, B. (2009). The role of transport infrastructure in FDI: evidence from Africa using GMM estimates. Journal of Transport Economics and Policy (JTEP), 43(3), 365-384.

Mat, S.H.C., & Harun, M. (2012). The impact of infrastructure on foreign direct investment: The case of Malaysia. Procedia-Social and Behavioral Sciences, 65, 205-211.

Indexed at, Google Scholar, Cross Ref

Nyaosi, E.N. (2011). The Effect of Infrastructure on Foreign Direct Investment in Kenya. Infrastructure and Economic Services Division, Kenya Institute for Public Policy Research and Analysis.

Pradhan, R.P., Norman, N.R., Badir, Y., & Samadhan, B. (2013). Transport infrastructure, foreign direct investment and economic growth interactions in India: the ARDL bounds testing approach. Procedia-social and Behavioral Sciences, 104, 914-921.

Indexed at, Google Scholar, Cross Ref

Reform, M.O. (2017-18). 11th Five Year Plans Information Management. PSDP.

Rehman, C.A., Ilyas, M., Alam, H.M., & Akram, M. (2011). The impact of infrastructure on foreign direct investment: The case of Pakistan. International Journal of Business and Management, 6(5), 268-276.

Indexed at, Google Scholar, Cross Ref

Shah, M. H. (2012). The significance of infrastructure for FDI inflow in developing countries. International Network for Economic Research. In 14th INFER Annual Conference , 10-13.

Indexed at, Google Scholar, Cross Ref

Soneta, K., Bhutto, N.A., Butt, F., Mahar, N., & Sheikh, S. A. (1994). Impact of infrastructure on manufacturing sector of Pakistan.

Zeb, N., Qiang, F., & Shabbir, M. (2014). Telecommunication infrastructure and foreign direct investment in Pakistan: An empirical study. Global Journal of Management and Business Research.

Received: 19-Jan-2022, Manuscript No. AAFSJ-22-10913; Editor assigned: 20-Jan-2022, PreQC No. AAFSJ-22-10913(PQ); Reviewed: 27-Jan-2022, QC No. AAFSJ-22-10913; Published: 31-Jan-2022