Research Article: 2021 Vol: 25 Issue: 2

Impact of Liquidity and Profitability Ratios on the Stock Market Value of Jordan Insurance Companies

Abdullah Al Maani, Alhussein BinTala University

Akram Sh. Alawad, Alhussein BinTala University

Bassam S. Abu Karaki, Alhussein BinTala University

Abstract

This study aims to investigate the impact of liquidity and profitability ratios on the market value of stocks in Jordanian insurance companies by investigating a sample of five insurance companies during the period (2015-2019). Data were collected from the annual reports, while the study adopted Current trading ratios, net- operating capital (NOC), profitability ratios (PR), which are return on assets (ROA), return on equity (ROE) and operating profit margins (OPM). The study concluded that there was no impact of the current trading ratio (CTR), NOC, ROA, and OPM on the market value of the stock, while there was an impact of the ROE on the market value of the stock in Jordanian insurance companies.

Keywords

Liquidity Ratios, Profitability Ratios, Stock Market Value.

Introduction

Analysis of financial statements is a tool to interpret the statements and determine the meanings of their figures, and the relationship between them. Hence, the financial analysis provides information that helps to evaluate the company and performance of its various departments, while it contributes to rationalizing the economic decisions of many users of these statements. Even more than that, there are many financial analysis tools where the analyst can select the appropriate one according to the purpose of the analysis. The investigation of stock returns is "one of the tools" that are used to achieve many goals required, related to cash management. Strategically, it affects both the investors, and stockholders, and perhaps this event were one of the beginnings of the emergence of financial thought, and the financial ratios are considered one of the most important of the financial analysis, which users of financial statements rely on, where it helps them assess corporate performance.

Alhilali (2017) shows that applying ratios to financial analysis is characterized by easiness, it leads to show data not directly disclosed in the final financial statements, in addition to the possibility of annual comparisons. Matar (2016) emphasizes that the use of ratios is important in indicating and identifying weakness and strength points in corporate activity, and in forecasting cash flows. Many financial ratios that vary depending on the purpose of the analysis, which include liquidity ratios, profitability, and debt ratios. Note that profitability ratios show the ability of companies to generate profits from sales or money invested in other companies (Obeidat, 2006). Ziarko (2014) Confirms that profitability analysis is an important aspect for stock market investors, and through it, economic effectiveness can be measured, and Matar (2010), indicate that the liquidity ratio (LR) analysis focuses on the funding policy of the company and its reliance on debt to finance its assets, where it provides useful information about insurance. Kurihara (2006) Confirms that an important economic growth depends on the role of the financial markets and is based on the fact that economic resources, it should be directed to the most productive investment opportunities. Investors invest in many types of securities in capital markets. Stocks are one of these types (Gottwald, 1913).

The market value of stocks affected by many factors, of which the most important are investors’ expectations of profit per share (PPS), economic and political conditions, and good financial analysis, in addition to the prevailing market conditions (Al Nassar, 2002). As one of the basic pillars of all industries and service industries, insurance plays a fundamental role. It can protect property from potential dangers and contribute to stability and security, thereby promoting the development of the national economy (2016). Hence, insurance companies as a part of the financial institutions that play a significant role in the economic and social stability by raising the standard of living for individuals and try achieving an optimal environment for the encouraging investment and economic development (Mistawi, 2003). It also contributes to the provision of unique services that are represented by the insurance risks inherent to the economic entities and accomplish the longterm investments (Mwang, 2015). In Jordan, the penetration rate of insurance is the best in the Near East and the geographic region.

In this region, the total contribution of insurance premiums to (GDP) is (%2.06). Jaloudi (2019) confirmed that the relative importance of insurance increased between (2000) and (2016) at a rate of (12%) annually, and that the ratio of total insurance premiums to GDP increased from (1.7%) in the year (2000) to (2.1%) in The Year (2016). Thus, the concept of this study suddenly appeared to acknowledge the impact of financial ratios on the value of Jordanian insurance companies’ shares. The organization of the study is as follows: In the second section, the study presented the Related previous studies, the third related literature review, the fourth section explains the Methodology and data description of the study, the fifth section of this study presents an Empirical Data Analysis, and the sixth section includes the results, and conclusions.

Related Brevious Studies

Many studies have investigated the relationship between financial ratios and stock market value. Al-Amoudi & Khayal (2011) study identifies the impact of information derived from the cash flow statement in the market value of the stock, test cash indicators with the profitability index, and recognize the impact of change on the market value of the stock. The study founds a positive relationship between the change percentage of the stock market value, and both financing cash flow ratios to the total change of cash flows, and the ratio of cash flow to short-term and long-term liabilities, whereas there was a negative relationship with the ratio of operating cash flows to shareholders' equity. Al-Kubaisi & Al-Qudah (2015) study determined the effect of financial ratios on the financial performance of the industrial public shareholding companies, listed on Amman Stock Exchange, measured by return on assets, return on equity, and return on market value.

It shows the positive impact of the combination of independent variables on the company's financial performance, as well as the negative relationship between financial performance and institutional investors. Sweidan & Tashman (2008) study was conducted on commercial banks in Jordan and aimed at identifying the use of financial ratios in banks’ decision-making. It shows that lending and investment officers make extensive use of financial ratios to help them in the decision-making process related to investment and lending. Al-Ajlouni (2011) the study aimed to identify the relationship between profitability ratios and the market value of banks. It came up with several results, the most important of which is that those stock prices do not reflect the bank’s performance. Internationally, we also find many studies that explored the relationship of financial ratios to stock prices, such as the study of Inyiama & Ugah (2015), discovered the relationship between financial ratios and stock price changes in the oil sector at Nigeria Stock Exchange, and the study of Rajapaksha & Yapa (2016), which determined the relationship between the stock price and the financial ratios of companies listed on Columbia Stock Exchange.

Taani (2011) study applied five categories of financial ratios to determine the effect of accounting information on earnings per share. Arkan (2020) study indicated that some ratios indicate positive, important relationship, trends, and behavior of the stock. It concluded that we could rely on a set of ratios for financial forecasting of the stock price. Therefore, investors who make decisions can rely on the analysis of financial ratios in taking financial and operational decisions. Rouhani (2018) emphasized the critical role of the stock market in the expansion of companies, the transformation of economic growth and the importance that this type of market acquires for the risk-free operation process. The study concluded that there was an integrative joint relationship between the stock price and trading volume, and that the multipliers of the price and profits have a significant negative impact on the stock price. Amir (2015) study that considered those stock prices are a serious discussion, showed that current ratios, and the rate of return on assets have a significant impact on stock prices, profitability ratio and return on equity that is positively correlated with industrial exchanges.

Literature Review

Many researchers, who tried estimating and understanding the behavior of stocks, and introduced several theories to explain this phenomenon, which would predict changes in the prices in the future, especially the interconnection between many markets, as the currency market, commodities, and stocks with global markets added to the behavior of the stock price a new feature characterized by the capacity to quickly move across the market (Ruhani et al., 2018) Cho et al. (1984) shows that several theories that describe the performance of the financial securities market: classical theory, the theory of an efficient capital market and the behavioral theory.

These theories analyzed the market according to its own methodology, where classical theory assumes that we can analyze the market in terms of the intersection of supply and demand behavior, and the stability of this intersection at an equilibrium point, therefore it represents a series of equilibrium positions (Negishi, 1962). The effective capital market theory suggests that current stock prices fully reflect the available information about the value of the company, while the behavioral theory is based on an attempt to explain and anticipate making decisions that can be observed by (Clarkson, 1964(. It can be said that financial markets are a very important part of the infrastructure of any society, while the stock market is a part of the financial market that can lead to many achievements of the economy, such as increase capital for businesses, convert savings into investments, facilitate the growth of companies, create investment opportunities for small investors, as well as redistribution of income.

Ahmadi (2017) emphasizes that stock exchanges are institutions that contribute to the increase in companies’ capital, which reflects the preservation of liquidity, and the sustained economic growth for stock investors. In this context, we find that Admi et al. (2017) pointed out that one of the measures that investors care about is stock prices, which express, from their point of view, the extent of the company's success in managing its business. Prediction of the prices of companies' stocks has a big role for investors looking for investment opportunities, where Arkan (2016) suggests that one of the most important factors for an investor to make his investment decision is to pay great attention to the stock price. Kendall (1953) used accounting data and financial ratios to illustrate changes in the prices of stocks, and noticed random changes in stock prices to predict future prices. The emergence of financial ratios goes back to the mid of the 19th century when analysts and accountants used it, which still retains its classical strength in financial and analytical models, which is one of the financial analysis techniques are represented in calculating financial ratios, which have a pre-specified formula, then explaining the results to get an overview of the company's position and make a decision on a rational investment strategy (Al-ghalayini, 2015).

Importance of the Study

This study is important because it provides addition to previous studies on the topic of financial ratios and their impact on the stock price. The study is conducted in Jordan, where insurance companies deal with competitors, shareholders, and other users. It also provides results and recommendations that will enable decision-makers in insurance companies, which in turn will help shareholders, management, stakeholders, and researchers to determine useful information for them, to identify clear evidence on the impact of financial ratios on the market value of the stock.

Objectives of the Study

The study aimed at:

1. Identify the impact of financial ratios on the market value of stocks in insurance companies in Jordan.

2. Recognize the effect of liquidity ratios (trading ratio, net operating capital) on the market value of stocks in insurance companies in Jordan.

3. Identify the impact of profitability ratios (ROA, ROE, OPM) on the market value of stocks in insurance companies in Jordan.

Problem of the Study

As a result of the financial crisis that heavily affected all sectors of the Amman Stock Exchange (ASE), that led to stock prices fluctuation which also affected the decisions of investors. Ajlouni (2011) indicates that there are different changes in stock values in many stock exchanges, including (ASE) that are attributed to several factors related to the financial ratios associated with the ratios of company financial performance. There are changes that resulted from local and international political and other economic conditions. Based on the above-mentioned, this study will answer the following main question: Does the market value of stocks in insurance companies in Jordan affected by financial ratios, this question is branching into the following two sub questions: 1. Is there an impact of liquidity ratios (current ratio, net operating capital) on the market value of stocks in insurance companies in Jordan? 2. Is there an impact of profitability ratios (return on assets, return on equity, operating profit margin) on the market value of stocks in insurance companies in Jordan?

Hypotheses of the Study

H1: There is no statistically significant impact of financial ratios on the market value of stocks in insurance companies operating in Jordan.

The following sub-hypotheses are divided into:

H1.1: There is no statistically significant impact of the trading ratio on the market value of stocks in Jordan insurance companies.

H1.2: There is no statistically significant impact of net-operating capital on the market value of the stock in Jordan insurance companies.

H1.3: There is no statistically significant impact of operating the profit margin on the market value of stocks in Jordan insurance companies.

H1.4: There is no statistically significant impact of return on assets on the market value of stocks in the insurance companies of Jordan.

H1.5: There is no statistically significant impact of return on equity on the market value of the stock in Jordan insurance companies.

Data Description and Methodology

The study employs data from financial reports published by ASE during the (2015– 2019) period, financial reports issued by the insurance companies during the (2015–2019) period. And from books, periodicals, journals and previous studies that dealt with the issue of financial ratios and the market value of stocks. The study adopted the descriptive-analytical approach to investigate the relationship between both liquidity ratios and profitability ratios and its impact on the market value of stocks in Jordan insurance companies during the period (2015-2019) The study population represents (24) insurance company listed on Amman Stock Exchange, while the sample consisted of the first five ranked Insurance companies selected upon their paid up capital that represents (44.1%) of the total capital by a value of (119.6) million JD of the total capital of all companies, which equals (271.3) million JD. The sample consisted of Solidarity, First Insurance, Middle East Insurance, Jordan International Insurance and Arab Orient Insurance.

Empirical Data Analysis

The descriptive analysis of the variables

The dependent variable of the study is Jordan Insurance Companies, where independent Variables are: Current Ratio = Current Assets / Current Liabilities Net Operating Capital = Current Assets - Current Liabilities Return on assets = Net income / Average assets Return on Equity = Net Income / Average Equity of Shareholders. Operating Profit Margin = Gross Profit / Total Revenue The Table 1 shows that the mean market value of the stock for all companies included in the study was (1.27) JD. Jordan Insurance Company got the highest mean stock price (2.06 JD), while Jordan International Company got the lowest mean stock price (0.58 JD). The mean Return on Assets was (2.07%) For all companies included in the study, First Insurance Company scored the highest mean by (3.71%) while Arab East Insurance Company scored the lowest mean by (0.69%). The mean Return on Equity was (7.29%) For all companies included in the study, where "Arab East Insurance Company" scored the highest mean by (18.89%), while "Jordan Insurance Company" scored the lowest mean by (2.56%).

| Table 1 Theaverages and Atnndarddeviations of the Studyvariables | ||||||

| Var Type | Var Name | Mean | SD | Min Value | Max Value | Unit |

| Dependent Variable |

Stock Price(SP) | 1.27 | 0.63 | 0.37 | 2.73 | JD |

| Independent Variables | Return on Assets(ROA) |

2.07 | 3.2 | -10.46 | 5.35 | % |

| Return on Equity(ROE) |

7.29 | 9.72 | -2.31 | 48.76 | % | |

| Net Operating Capital(NOC) |

29.99 | 6.43 | 20.94 | 42.61 | Million JD | |

| Current Ratio(CR) |

1.47 | 0.81 | -0.03 | 2.67 | % | |

| Operating Profit Margin(OPM) |

0.77 | 1.5 | 0 | 4.3 | % | |

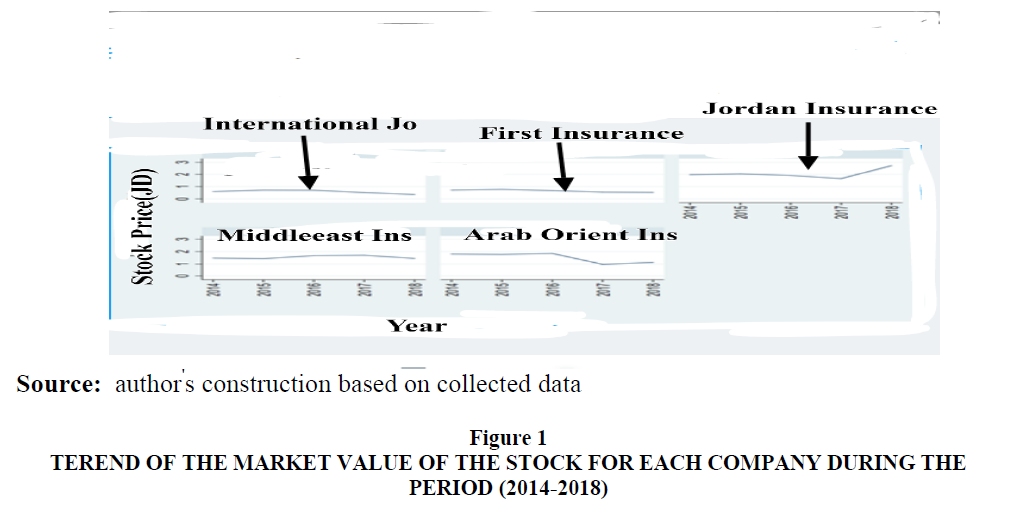

The mean net-operating capital of all companies included in the study was (29.99) million JD, where "Middle East Insurance Company" obtained the highest mean stock price by (39.59 JD), while "Jordan International Company" scored the lowest mean stock price, which was (23.56 JD). The mean Current Ratio was (1.47%), for all companies included in the study, where "First Insurance Company" scored the highest mean by (2.22%) while Jordan of the Study. Figure 1 shows the trend of market value of the stock for each company during the period (2014 – 2018). We note that the market value of the stock price fluctuates between high and low for all companies included in the study.

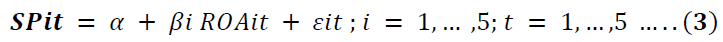

Multiple Linear Regression

In this model, the time of data is ignored, as this model is one of the simplest data models for the panel, which is used to increase the size of the sample, as the regression coefficients are fixed for all individuals and time periods. In other words, this model neglects the effect of time, where its regression function is as shown in equation (1), that is estimated using the Ordinary Least Square (OLS).

(1)

(1)

The following are the results of this model in Tables 2 and 3. Analysis of variance is used to test the significance of the model as a whole using F test by testing the following hypothesis:

| Table 2 Summary of Modle (1) | ||||

| Model | R | R2 | Adjusted R2 | Std Error of Estimate |

| 1 | 0.684 | 0.468 | 0.362 | 0.50424 |

| Table 3 Analysis of Variance Anova For Modl (1) | ||||||

| Model | Sum of Squares | DF | Mean Square | F | Sig | |

| 1 | Regression | 4.475 | 4 | 1.119 | 4.400 | ***0.01 |

| Residual | 5.085 | 20 | 0.254 | ***0.00 | ||

| Total | 9.560 | 24 | ||||

| Note: ***Significance at (0.01), **Significance at (0.05). | ||||||

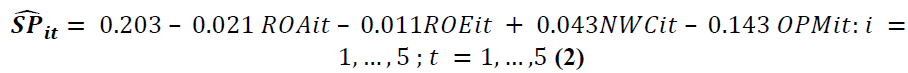

Since p-value = (0.010) it is less than the value of the recognized level of significance, therefore we cannot reject the alternative hypothesis, which means that the model as a whole is significant at the level of significance (α = 0.01), If the null hypothesis related to the F test is rejected, we test the significance of each parameter of the model separately, but if the null hypothesis is not rejected, there is no need to test the model parameters, which indicates that the model used is inappropriate. So the estimated regression function can be written as:

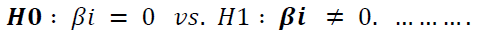

Where t test is used to test the significance of each variable separately, assuming that the rest of the variables included in the model remain unchanged, so the null hypothesis and the alternative hypothesis can be written as follows:

In the Table 4 we note that the p-value for all variables included in the model is greater than the value of normal significance (α = 0.05), except for the net- operating capital (NOC) and the constant, thus the stock price is affected by net-operating capital on average at a significance level (α = 0.05), while it is affected by the operating profit margin (OPM) at a significance level (α = 0.10).

| Table 4 Shows the Significant Coefficientsof Independent Variables Included In The Model | ||||||||

| Model | Unstandarized Coefficients | Standardized Coefficients | T | Sig | 95% Confidence Interval for B | |||

| B | Std Error | Lower limit |

Upper limit | |||||

| 1 | Constant | 0.203 | 0.648 | 0.313 | * *0.022 | -1.150 | 1.555 | |

| ROA | -0.021 | 0.037 | -0.107 | -0.566 | 0.587 | 0.099 | 0.057 | |

| ROE | -0.011 | 0.013 | -0.163 | -0.827 | **0.418 | -0.037 | 0.016 | |

| NOC | 0.043 | 0.019 | 0.441 | 2.299 | **0.032 | 0.004 | 0.083 | |

| OPM | -0.146 | 0.083 | -0.347 | -1.759 | 0.094 | -0.319 | 0.027 | |

| Note: ***Significance at (0.01), **Significance at (0.05). | ||||||||

Net Operating Capital (NOC)

If the net-operating capital of the company is increased by (1 million JD), will increase its stock price by an amount (0.043) JD on average, assuming that other factors are constant. Operating Profit Margin (OPM): If the company's operating profit margin is increased by (1%) will decrease the stock price by an amount of (0.146) JD on average if other factors/variables remain unchanged. Calculation of the coefficient R square and modified coefficient of adjusted R Square, as shown in Table 4, is used to referee how well the model fits. The table shows that the value of the determination coefficient does not exceed (50%) which indicates the independent variables included in the model, namely: ROA, ROE, NOC, OPM were able to explain (46.8%) in the changes that occurred to the company's stock price during the period from (2014–2018), The other remaining percentage of change, which equals (53.2%) was attributed to factors other than those included in the "residual" model. We also note that the modified coefficient of determination does not differ much from the value of the coefficient of determination as its value was (36.2%), but it is better to use the value of the modified coefficient of determination because it is affected only by the number of significant independent variables in Tables 5 to 10.

| Table 5 Summary of Model (2) | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 2 | 0.006 | 0.000 | -0.043 | 0.64472 |

| Table 6 Analysis of Variance Nova for Model (2) | ||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 2 | Regression | 0 | 1 | 0 | 0.001 | 0.977 |

| Residual | 9.56 | 23 | 0.416 | |||

| Total | 9.56 | 24 | ||||

| Table 7 Parameter of Model (2) | ||||||||

| Model | Un standardized Coefficients | Standardized Coefficients | T | Sig. | 95.0% Confidence Interval for B |

|||

| B | Std. Error | Beta | Lower Bound | Upper Bound | ||||

| 2 | Constant | 1.272 | 0.154 | 8.235 | ***0.000 | 0.953 | 1.592 | |

| ROA | -0.001 | 0.041 | -0.006 | -0.029 | 0.977 | -0.086 | 0.084 | |

| Note: ***Significance at (0.01), **Significance at (0.05). | ||||||||

| Table 8 Summary of Model (3) | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 3 | 0.066 | 0.004 | -0.039 | 0.64331 |

| Table 9 Analysis of Variance Nova for Model (3) | ||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 3 | Regression | 0.042 | 1 | 0.042 | 0.101 | 0.753 |

| Residual | 9.519 | 23 | 0.414 | |||

| Total | 9.560 | 24 | ||||

| Table 10 Parmete of Model (3) | |||||||||||

| Model | Un standardized Coefficients |

Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B | Correlations | |||||

| B | Std. Error | Beta | Lower Bound | Upper Bound | Zero- order | Partial | Part | ||||

| 3 | (Constant) | 1.301 | 0.162 | 8.026 | 0.000 *** | 0.966 | 1.636 | ||||

| ROE | - 0.004 |

0.014 | -0.066 | -0.318 | 0.753 | -0.032 | 0.024 | -0.066 | -0.066 | - 0.066 |

|

| Note: ***Significance at (0.01), **Significance at (0.05) | |||||||||||

Simple Linear Regression Models

It is a statistical model that estimates the relationship between one quantitative dependent variable, with another quantitative independent variable(s).

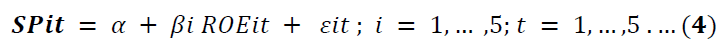

Model (2): illustrate the impact of (ROA) on the stock price

The statistical equation for this model can be formulated as follows:

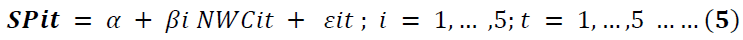

Results of This Model Table 9 shows that the value of P-value is larger than the value of the F, which indicates the non-significance of the model, i.e, accepting the null hypothesis at a significant level (0.05). So, no need to comment on the significant parameter Table 11 of model transactions. The statistical equation for this model can be formulated as follows:

| Table 11 Summary of Model (4) | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 4 | 0.617 | 0.381 | 0.354 | 0.50724 |

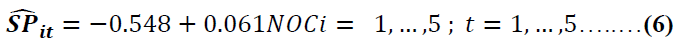

Table 12 shows that P-value is very small, i.e. (5%) less than the value of the level of significance accepted, and the value of the F is very small, which indicates the significance of the model, i.e. rejection of the null hypothesis at a significant level of (0.05). In terms of Table 13 if we increased net operating capital of the company by (1 One million JD), this will increase its stock price by an amount (0.061 JD) in average. The estimated regression function can be written as:

| Table 12 Shows the Impact NOC on the STOCH Price of Model (4) | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 4 | Regression | 3.643 | 1 | 3.643 | 14.158 | 0.001*** |

| Residual | 5.918 | 23 | 0.257 | |||

| Total | 9.56 | 24 | ||||

| Note: ***Significance at (0.01), **Significance at (0.05) | ||||||

| Table 13 Parameter of Model (4) | |||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B |

Correlations | |||||

| B | Std. Error |

Beta | Lower Bound |

Upper Bound |

Zero-order | Partial | Part | ||||

| 4 | Constant | -0.548 | 0.494 | -1.110 | 0.278 ** |

-1.569 | 0.473 | ||||

| NWC | 0.061 | 0.016 | 0.617 | 3.763 | 0.001 *** |

0.027 | 0.094 | 0.617 | 0.617 | 0.617 | |

| Note: ***Significance at (0.01), **Significance at (0.05). | |||||||||||

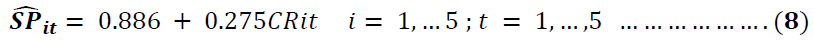

Model 5: illustrates the effect of the current ratio CR on the stock price: The statistical equation for this model can be formulated as follows:

Tables 14 and 15 shows that P-value was (0.084), while the value of F is large, which indicates the significance of the model, but at a significant level (0.10), The following Tables 16 and 17, can be argued in that when increasing the trading percentage of the company by (1%), this will increase the stock price by an amount of (0.275 JD) in average. So the estimated regression function can be written as:

| Table 14 Summary of Model (5) | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 5 | 0.353 | 0.124 | 0.086 | 0.60326 |

| Table 15 Analysis of Variance Anova for Model (5) | ||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 5 | Regression | 1.190 | 1 | 1.190 | 3.270 | 0.084 |

| Residual | 8.370 | 23 | 0.364 | |||

| Total | 9.560 | 24 | ||||

| Table 16 Patameter of Model (5) | |||||||||||

| Model | Un standardized Coefficients | Standardized Coefficients | T | Sig. | 95.0% Confidence Interval for B | Correlations | |||||

| B | Std. Error |

Beta | Lower Bound |

Upper Bound |

Zero- order |

Partial | Part | ||||

| 5 | (Constant) | 0.866 | 0.254 | 3.415 | **0.002 | 0.341 | 1.391 | ||||

| CR | 0.275 | 0.152 | 0.353 | 1.808 | 0.084 | -0.040 | 0.589 | 0.353 | 0.353 | 0.353 | |

| Note: ***Significance at (0.01), **Significance at (0.05) | |||||||||||

| Table 17 Summary of Model (6) | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 6 | 0.531 | 0.282 | 0.251 | 0.54636 |

Model 6: Shows the impact of (OPM) on the stock price: The statistical equation for this model can be formulated as follows:

Table 18 shows that P-value is less than the significance value of the moral level of (0.05), while F value is very small, which indicates the significance of the model, i.e, rejection of the null hypothesis at a significant level (0.05). The following Table 19 shows that when increasing the operating profit margin of a company by (1%), this will lead to a reduction in the stock price by (0.224JD) in average. Therefore the estimated regression function can be written as:

| Table 18 Analysis of Variance Anova for Model (6) | ||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 6 | Regression | 2.695 | 1 | 2.695 | 9.028 | 0.006*** |

| Residual | 6.866 | 23 | 0.299 | |||

| Total | 9.56 | 24 | ||||

| Note: ***Significance at (0.01), **Significance at (0.05) | ||||||

| Table 19 Parameter of Model (6) | ||||||||||||

| Model | Un standardized Coefficients |

Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B |

Correlations | ||||||

| B | Std. Error | Beta | Lower Bound | Upper Bound | Zero- order | Partial | Part | |||||

| 6 | Constant | 1.441 | 0.123 | 11.69 | 0.000*** | 1.186 | 1.696 | |||||

| OPM | -0.224 | 0.074 | -0.531 | -3.005 | 0.006*** | -0.377 | -0.07 | -0.531 | -0.53 | -0.53 | ||

| Note: ***Significance at (0.01), **Significance at (0.05). | ||||||||||||

Findings and Conclusions

Investors and traders are looking to know the direction of stock prices, and this trend depends on basic conditions Musyoki 2012, including what is related to internal factors and others related to external factors. Usman (1990) and Igbinosa (2012) point to many of these factors for instance: establishing a governance system, and changes in government policy. The models used in the study focused on the impact of five independent variables (trading ratio, ratio of operating capital, operating profit margin, return on assets and return on equity) on the dependent variable (stock market value) of insurance companies in Jordan. The test results show that (ROE) is correlated with the statistically significant market value of Jordanian insurance company stocks.

Perhaps, because this variable is an indicator of the profitability of the company and shows the efficiency of the insurance companies to invest stockholder's funds and achieve profits, which is evidence of the efficient performance of management (Kujewska, 2016). This indicates the efficiency of Jordanian insurance companies in investing funds of shareholders and their ability to achieve earnings. Al-Issa et al. (2017), emphasizes this result, where he indicated the impact of the rate of return on equity in the market value of the stocks. Al-Nimr (2015) agrees with that, where he indicated there is an effect of the (ROE) on the market value of companies operating in the insurance sector listed on the Amman Stock Exchange. In addition, many people may find that they represent a good investment opportunity, especially in the future, and it may be that Ihsan's study (2012) provides a logical explanation for this issue, as it indicated that the return on equity generates excess returns positive. Alternatively, the study showed there was no impact for the percentage of stock trading of insurance companies on the value of a market stock, perhaps that explains many other factors that have an obvious impact on the stock prices of insurance companies, for example, the reputation of the company or dividend policy. Perhaps the reason for that can be explained by the findings of Chandrapala (2011) who stated: the error in the investor’s determination of future earnings and low-liquidity stocks is the reason for the negative relationship between the proportion of trading and the value of shares.

The study results indicate there is no significance of net-operating capital on the market value of the stocks of insurance companies in Jordan, attributed to nature of the variable related to the financial short term activities, that do not affect the market value of the stock, as well as the case for return on assets which showed there is no statistically significant impact of (ROA) on the market value of the stock in Jordanian insurance companies which might be attributed to the fact that returns were not converted to cash assigned by the insurance company. Additionally, based on this result, we can reach an important conclusion, which is that return on assets has no role in attracting investors. This conclusion supported by "Utami's" 2019 findings, where he indicated that the increase or decrease in the return on assets for the company does not necessarily mean that its stock prices are high or Low and that the good return on assets does not contribute to attracting investors. The results of the impact of the margin of operating profit on the market value of a stock in the Jordanian insurance companies showed that it was consistent with the results of Puspitaningtyas (2017) study, which showed no impact of the profit on the stock prices, and that the stock price reflects the market valuation of the company's stocks.

References

- Al-Ajlouni, T. (2011). The Effect of Profitability on the Market Value of Stocks: An Applied study on a Sample of Jordanian Commercial Banks, Al-Balqa Journal for Research and Studies, 14(2), 215-238.

- Al- Ahliyya Amman University, Jordan. Admi, Pelita, A., & Erlina, T. (2017). The effect of liquidity, leverage ratio, activities and profitability on stock price with dividend policy as intervening variables in manufacturing companies in Indonesia and Malaysia 2015-2017, ]core.ac.uk/download/pdf/229764623.pdf.

- Al-ghalayini, S. (2015). The Change in the Stock Price Based on the Information Resulting from the Financial Ratios: Evidence from Palestine Stock Exchange. GRIN Verlag.

- Ahmadi, A. (2017). The stock price valuation of earnings per stock and book value: evidence from Tunisia, Journal of Internet Banking and Commerce: An open access Internet journal (http://www.icommercecentral.com Journal of Internet Banking and Commerce, April 2017, 22(1).

- Al-Nimer, M., & Alslihat, N. (2015). The effect of profitability ratios on market capitalization in Jordanian insurance companies listed in Amman Stock Exchange. Journal of Economics and Sustainable Development, 6(6), 140-146.

- Al Nassar, W.I. (2002). Effect of dividends and the Rate of distribution at Stock prices, M.A, thesis, University of Baghdad, Faculty of Administration and Economy.

- Alnef, L., & Hanaa, M. (2016). Determinants of Profitability in Islamic insurance companies, Field study on Islamic Insurance Companies in Jordan, Mu'ta Journal for research and studies, social and humanity Sciences, 31(3).

- Al-Kubaisi, A., & Alquthah, M. (2015). The impact of financial ratios on the performance of the financial public stockholding companies of Jordan. Almanarah Journal for Research and Studies, 21(1), 105-134. Al al-Bayt University, Jordan.

- Al-Khaiyal, T., & Al-Amodi, A. (2011). Studying the Relationship between Cash Flow Ratios and Market Share Value (An Analytical Study on Saudi Corporations). Journal of King Abdulaziz University-Economics and Administration, 25(2), 135-181.

- Al-Khalayleh, M. (2013). Financial Analysis, Wael Publishing and Distribution co, Amman, Jordan

- Al-Issa, M.S., Alaishat, M., & Alquthah, L.A. (2017). Factors affecting the stock market: a survey applied study on the sectors listed on Amman Stock Exchange. Journal of Economics and Development, 17, Algeria.

- Arkan, T. (2016). The importance of financial ratios in predicting stock price trends: A case study in emerging markets. Finanse, Rynki Finansowe, Ubezpieczenia, (79), 13-26.

- Cho, D.C., Elton, E.J., Gruber, M.J. (1984). On the robustness of the Roll and Ross arbitrage pricing theory. Journal of Financial and Quantitative Analysis, 1-10.

- Clarkson, G.P. (1964). Empirical foundations of economic analysis., Working Paper, 83, MIT. Chandrapala, P. (2011). The relationship between trading volume and stock returns. Journal of Competitiveness.

- Dadrasmoghadam, A., & Akbari, S.M.R. (2015). Relationship between financial ratios in the stock prices of agriculture-related companies accepted on the stock exchange for Iran. Research Journal of Fisheries and Hydrobiology, 10(9), 586-591.

- Gottwald, R. (1913). The Dependence Between Stock Price and Intrinsic Value of a Stock. Change, 1871, 1914- 1944. Hilali, M. (2017). Financial Accounting, 2ndEd, Dar Al-Minhaj for Publishing and Distribution, Amman, Jordan.

- Inyiama, O.I., & Ugah, H. (2015). Evaluation of the relationships between financial ratios and share price movements in Nigeria oil and gas (2002-2014). International Journal of Technical Research and Applications, 3(4), 367-375.

- Ihsan, A.F.M. (2012). Mainul, can ROE be used to predict portfolio performance? Economics, Management, and Financial Markets, 7(2), 132-148.

- Igbinosa, S.O. (2012). Investments: Analysis and management. Benin City: Ambik Press Limited.

- Jaloudi, M.M. (2019). The efficiency of Jordan insurance companies and its determinants using DEA, slacks, and logit models. Journal of Asian Business and Economic Studies.

- Kendall, M.G. (1953). The Analysis of Economic Time?Series Part I: Prices. Journal of the Royal Statistical Society: Series A (General), 116(1), 11-25.

- Kurihara, U. (2006). The relation between exchange rate and stock prices during the quantitative easing policy in Japan. International Journal of Business, 11(4), 375-386.

- Kijewska, A. (2016). Determinants of the return on equity ratio (ROE) on the example of companies from metallurgy and mining sector in Poland. Metalurgija, 55(2), 285-288.

- Matar, M. (2010). Recent Trends in Financial and Credit Analysis, Middle East University for Graduate Studies, Wael Publishing House, 3rd ed, Amman, Jordan.

- Matar, M. (2016). Recent trends in the financial and credit analysis: methods, tools and practical application, 4 th edition, Dar Wael Publishing, Amman, Jordan.

- Mistawi, M.S. (2003). Assessment the performance of Insurance Companies in the Egyptian, Paper presented for the 17th International Conference, Faculty of Commerce. Almansoura University.

- Musyoki, D. (2012). Changes in share prices as a predictor of accounting earnings for financial firms listed in Nairobi Securities Exchange. International Journal of Business and Public Management, 2(2), 1-11.

- Mwangi, M.D., & Jane W.M. (2015). The Determinants of Financial Performance In General Insurance Companies In Kenya. European Scientific Journal January, 11(1). ISSN: 1857 – 7881 (Print) e - ISSN 1857- 7431.

- Negishi, T. (1962). The Stability of Competitive Economy: A Survey Article.

- Econometrica, 30, 324-71. Nawwaf, O.A. (2006). Building a model to assess the capacity of industrial Jordanian public stockholding companies to sustain using information of cash flows, Unpublished PhD thesis, Amman University for Graduate Studies, Amman, Jordan

- Puspitaningtyas, Z. (2017). Is Financial Performance Reflected in Stock Prices?. 2nd International Conference on Accounting, Management, and Economics 2017 (ICAME 2017) (17-28). Atlantis Press.

- Rajapaksha, R.M.D.S., & Yapa, R.D. (2016). The Relationship Between Financial Ratios & Stock Prices, and Prediction Of Financial Failure: Evidence From Sri Lanka, International Journal of Scientific & Technology Research, 21(5), 16-17.

- Ruhani, F., Islam, M.A., Ahmad, T.S.T., & Quddus, M.R. (2018). Effects of Financial Market Variables on Stock Prices: A Review of the Literature. Journal of Modern Accounting and Auditing, 14(11), 597- 610.

- Sweidan, M.S., & Tashman, D. (2008). The extent of using financial ratios in lending and investment decisions: a field study on Jordanian commercial banks and insurance companies. Trade and Finance Journal, 24(3), 313-343, Tanta University.

- Taani, K. (2011). The effect of financial ratios, firm size and cash flows from operating activities on earnings per share: (an applied study: on Jordanian industrial sector). International Journal of Social Sciences and Humanity Studies, 3(1), 197-205.

- Usman, M. (1990). ABC Pasar Modal Indonesia. LPPI/IBI dan ISEI: Jakarta.

- Ziarko, A.R. (2014). The Influence of Profitability Ratiosand Company Size on Profitability and Investment Risk in the Capital Market. Folia Oeconomica Stetinensia, 152-161.

- Utami M.R. (2019). Effect of DER, ROA, ROE, EPS and MVA on Stock Prices in Sharia Indonesian Stock Index, (2019), Journal of Applied Accounting and Taxation, 4(1), 15-22.