Research Article: 2025 Vol: 29 Issue: 2S

Impact of Liquidity, Solvency, and Efficiency on Profitability: Evidence from Major Indian Commercial Banks

Vanlalzawna C., Mizoram University, India

Sharma L. S., Mizoram University, India

Citation Information: Vanlalzawna, C. & Sharma, L. S. (2025). Impact of liquidity, solvency, and efficiency on profitability: Evidence from major Indian commercial banks. Academy of Accounting and Financial Studies Journal, 29(S2), 1-13.

Abstract

The development of the banking sector serves as an excellent indicator of the overall economic progress. Understanding the financial performance of banks enables investors, borrowers, and other stakeholders to predict and compare bank efficiency. This study, which is both descriptive and analytical, aims to evaluate and compare the financial performance of six selected commercial banks in India from 2018-19 to 2023-24. The selected banks include State Bank of India (SBI), Punjab National Bank (PNB), and Canara Bank from the public sector, and ICICI Bank, HDFC Bank, and Axis Bank from the private sector. The data for this study were primarily sourced from the annual reports published by these banks. Ratio analysis was used to examine the financial ratios of the selected banks, and a one-way ANOVA was employed to determine any significant differences between the financial ratios of public and private sector banks. Additionally, the study investigates the impact of liquidity, solvency, and efficiency on the profitability of the selected Indian commercial banks using panel data estimations, specifically the Fixed Effect and Random Effect models. The empirical results from the panel data estimations indicated that profitability, liquidity, and efficiency ratios have no significant impact on the market value ratios of the selected public sector banks. However, a significant impact was found on the market value ratios of the selected private sector banks, highlighting that market value ratios are influenced by these financial ratios.

Key words

Public Sector Bank, Private Sector Bank, Financial Performances, Variable, Ratio Analysis, ANOVA, Hausman’s Test.

Introduction

The banking sector plays a pivotal role in sustaining financial markets and significantly influences the overall success of the economy. The financial health of a bank not only assures its depositors but also holds critical importance for shareholders, employees, and the broader economy. Banks facilitate the channeling of funds into productive investments, credit creation, and capital formation. On a national scale, banks contribute substantially to the development of various sectors, such as providing credit to the primary sector to support agricultural farmers and offering advances to consumers, thereby enhancing their standard of living. Consequently, continuous efforts have been made to assess and manage the financial positions of banks efficiently and effectively.

Research on bank efficiencies is crucial for policymakers, industry leaders, and other stakeholders who depend on the banking sector. The performance of banks is a matter of significant interest to regulators, customers, investors, and the general public. Analyzing bank performance helps policymakers identify successful or failing banks and implement strategies for their improvement. With the ongoing reforms in the Indian banking system, monitoring bank performance is essential. Evaluating bank performance is a vital tool to understand the financial status of banks and to implement necessary measures to elevate financially weak banks to success. It is also crucial to ensure that the efficiency and performance of the Indian banking sector align with regulatory frameworks (Malhotra and Aspal, 2014).

Understanding financial performance aids in predicting, comparing, and evaluating a company’s earning potential, thereby informing investment and financial decisions. Companies disseminate financial information through financial statements and reports. A bank’s financial performance can be assessed by analyzing the data in its annual reports.

The banking industry serves as the backbone of modern business, acting as a bridge to provide specialized financial intermediation. Banks transform various inputs into a range of financial products. Macroeconomic stability enables banks to adjust their overall preferences and plays a crucial role in reinforcing fiscal policy. Therefore, the organized and proper allocation of banking resources promotes economic growth. Performance assessment is critical for maintaining an effective and successful financial sector. The efficiency of the banking sector is vital for the stability and resilience of the economy over time (Walia and Kaur, 2013).

Review of Literature

Gupta and Dongre (2023) compared the financial performance of SBI and ICICI Bank using various financial ratios, finding that ICICI Bank outperformed SBI in efficiency and profitability. Pattanaik and Patjoshi (2021) assessed the financial performance of private sector banks using the CAMEL Model for the period from 2014-15 to 2018-19. Their study concluded that both HDFC and ICICI Bank performed excellently and met RBI norms, but HDFC Bank surpassed ICICI Bank in performance. Undi and C.S. (2020) found that private sector banks generally outperformed public sector banks, as evidenced by better average financial ratios. Srinivasan and Britto (2017) corroborated this finding, showing that private sector banks had superior financial performance compared to public sector banks in terms of liquidity, solvency, and efficiency over a five-year period using Fixed Effect and Random Effect models.

Gupta and Jaiswal (2019) analyzed and compared the financial performance of selected public and private sector banks in India from 2014-15 to 2018-19 using various financial ratios and the CAMEL framework. Their study revealed significant progress in public sector banks relative to private sector banks. Jha (2018) examined the financial performance of PNB and ICICI Bank using secondary data and financial tools such as ratio analysis, percentages, and standard deviation. He found that public sector banks, particularly PNB, were more trusted by customers for loans and advances, although ICICI Bank demonstrated greater financial soundness.

Pandey and Singh (2015) empirically evaluated the performance of Indian Commercial banks from 2008 to 2013 using the Malmquist and Data Envelopment Analysis (DEA) approaches.

Their study identified consistent efficiency in IDBI Bank, ICICI Bank, Kotak Mahindra Bank, Citibank, and Standard Chartered Bank under both the VRS and CRS models, with SBI and the Royal Bank of Scotland also showing consistent efficiency under VRS.

Rustam and Rashid (2015) compared the performance of local and foreign banks in Pakistan, using profitability, financial structure, and efficiency as performance measures. They concluded that foreign banks had a more robust financial structure compared to local banks. Gupta and Kaur (2014) analyzed the growth, performance, and services of public and private sector banks in terms of loans, cash credits, and advances outside India, NPAs, and net profit. Using the Tukey HSD test, they found that public sector banks outperformed private sector banks during the study period.

Walia and Kaur (2013) evaluated the performance of the Indian banking sector, focusing on factors affecting the profitability of selected commercial banks from 2009 to 2014. Their study identified deposits, advances, operating expenses, and spread as significant factors influencing bank profitability. Goel and Rekhi (2013) examined the financial performance of public and private sector banks from 2009-10 to 2011-12 using Return on Assets (ROA), Return on Equity (ROE), and Net Interest Margin (NIM) ratios. They found these variables to be key determinants of overall bank performance. Webb and Kumbirai (2010) employed financial ratios to measure the profitability, liquidity, and credit quality of five major South African commercial banks. Their analysis, which included descriptive statistics and t-tests, revealed that the 2007 global financial crisis adversely affected profitability, liquidity, and credit quality in the South African banking sector.

Need of the Study

Numerous studies have examined the performance of banks both in India and internationally. However, recent developments in the Indian banking industry, particularly the issue of non- performing assets in public sector undertakings (PSUs), have heightened the importance of evaluating bank performance. This underscores the need for continued research to uncover new trends in banking operations. The present study aims to address this research gap by assessing the most recent performance data of banks. Specifically, it will conduct a comparative analysis of the financial performance of the three largest public and private sector banks in India.

Financial performance is crucial as it indicates the business potential, economic interest of management, and reliability for current or future contractors. Analyzing financial performance and identifying strengths and weaknesses using relevant indicators can benefit management, shareholders, the public, and regulators. The primary objective of financial analysis is to interpret the information in financial statements to assess future earnings potential, interest payment capacity, profitability, and dividend prospects of banks. Financial performance appraisal provides insight into the fluctuations in banking institutions' financial health.

Although there has been substantial research on bank performance, few studies have focused on recent years, and comparative analyses of profitability and market value remain scarce. Therefore, further studies are necessary to evaluate bank performance. This study aims to shed light on the financial performance of commercial banks, offering valuable insights for policymakers, regulators (such as the Reserve Bank of India), governments, and other stakeholders. These insights can help devise targeted policies and regulations that promote the growth and sustainability of commercial banks in the country.

Objectives of the Study

The study has undertaken with the following objectives:

a) To analyze the financial ratios of select public and private sector

b) To examine the impact of liquidity, profitability and efficiency on the market value of selected public sector banks and private sector banks.

Hypotheses

The following hypotheses have been framed to give direction to the study.

��1: There is no significant difference between the means of financial ratios of selected public sector and private sector banks.

��2: Liquidity, profitability and efficiency have no significant impact on market value of selected public sector and private sector banks.

Research Methodology

The present study analyzed six commercial banks in India, namely State Bank of India (SBI), Punjab National Bank (PNB), Canara Bank, HDFC Bank, Axis Bank, and ICICI Bank, over a six-year period from 2018-19 to 2023-24. The sample details are presented in Table 1. The data, purely based on secondary sources, were collected from the respective annual reports published by these banks. These six banks were purposively selected due to their significant roles and involvement in the economy, particularly regarding advances, deposits, employment, market share, and total assets from both the public and private sectors.

| Table 1 Sample of the Study | |||

| Sl. No. | Public sector banks | Sl. No. | Private sector banks |

| 1 | State Bank of India | 1 | HDFC bank |

| 2 | Punjab National bank | 2 | ICICI bank |

| 3 | CANARA bank | 3 | AXIS bank |

Data analysis was conducted using twelve accounting ratio parameters to measure the profitability, market value, liquidity, and efficiency of the selected public and private sector banks, as shown in Table 2. Due to disparities within and across the datasets, normalization was applied, and one-way ANOVA was used to determine any significant differences between the financial ratios of public and private sector banks. Additionally, Hausman's coefficient test was employed to compare two specification categories—the Fixed Effect and Random Effect models—to examine the impact of liquidity, profitability, and efficiency on the market value of the selected banks. A fixed effect model assumes differences in intercepts across groups or time periods, while a random effect model explores differences in error variances.

| Table 2 Variables Selected for the Study | ||

| Parameters | Ratios | Methods of computation |

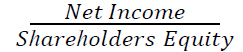

| Measures Profitability | Return on Assets |  |

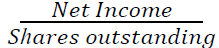

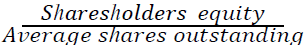

| Earnings per Share |  |

|

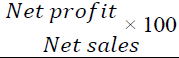

| Net profit per share |  |

|

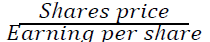

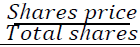

| Measures Market value | Price- Earnings Ratio |  |

| Book Value per Share |  |

|

| Price- Sales Ratio |  |

|

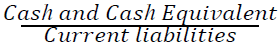

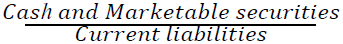

| Measures Liquidity | Cash Ratio |  |

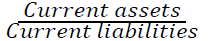

| Current Ratio |  |

|

| Quick Ratio |  |

|

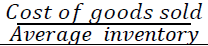

| Measures Efficiency | Inventory turnover ratio |  |

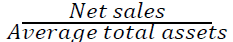

| Assets turnover ratio |  |

|

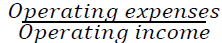

| Cost to income ratio |  |

|

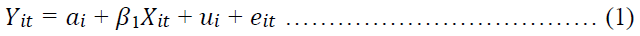

The fixed effect model takes into the firm specific effect and the random effect model consider the time effect. The fixed effects model is defined as

Where, yit outcome variable (for entity i at time t), ai is the unknown intercept for each entity (n entity-specific intercepts), xit is a vector of predictors (for entity i at time t), ui within entity error term; eit overall error term.

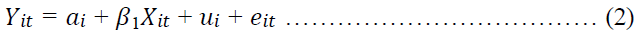

Random effects assume that the entity’s error term is not correlated with the predictors which allows for time invariant variables to play a role as explanatory variables. The ai are treated as random variables rather than fixed constants, xit, ui eit as defined in equation 1.

In the random effects case, the model is defined as:

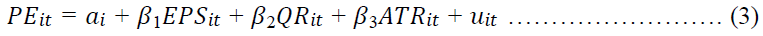

The general specification of the parameters of the model is as follows:

Where, PE represents the Price to earnings of the selected public and private sector banks. The explanatory variables, EPS, QR and ATR denote Earnings per share, Quick ratio and Assets turnover ratio respectively (Table 1 & Table 2).

Results and Discussion

Measures of profitability

Profitability measures entity ability to generate revenue (income) relative to sales, assets, equity, etc. during period of time. Profitability measures indicate how well a company utilizes its assets to produce profit and create value to shareholders and investors. Three ratios have been considered to assess profitability of banks such as Return on assets (ROA), Earning per share (EPS) and Net profit per shares. Higher value indicates better return for the investors.

Table 3 represents profitability ratios of selected six commercial banks. As can be seen from the table 3, it is evidenced that there is consistent increase in Return on assets (ROA), Earning per share (EPS) and net profit per share of public sector banks during the study period. Return on Assets (ROA) of SBI is found to be highest i.e. (0.93) which is significantly rose from 0.55 in 2019. However, PNB secured least ROA in 2019 which is below the average of all selected public sector banks during the period. Among private sector banks, HDFC has highest ROA in 2024 i.e. 2012 whereas AXIS has lowest ROA i.e. 0.19 only in 2020 during the study period. It is also evidenced that ROA of private sector banks are found to be relatively better than the public sector banks. Table 3 shows leaps and bounds of EPS of public sector banks and private sector banks during the study period. Among public sector banks, SBI is found to be highest EPS in 2024 whereas PNB hold lowest in 2020 which is 0.30 only. The study observed there is significantly increase of EPS among all the private sectors banks from 2019-2024. HDFC has highest EPS during 2023 whereas ICICI and AXIS has lowest during 2019. Net profit shows that a bank can convert their sales into profits. As can be seen from the table 3, SBI has constant increase in net profit from 19.12 to 65.12 during the study period. CANARA also made progress from 2019- 2024 despite steep decrease in 2021. Among private sector banks, HDFC has highest Net profit i.e. 79.53 during 2023 whereas ICICI has lowest during the same period. Among all the banks, SBI has highest net profit margin whereas PNB has lowest net profit during the entire study period. Table 3 also reveals that private banks are performing better than public sector banks and generates more profits with the money shareholders have invested during the study period.

| Table 3 Profitability of Selected Banks | ||||||||||||||||||

| Name of banks | Return on assets (ROA) | Earnings per share (EPS) | Net profit per share | |||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| SBI | 0.55 | 0.65 | 0.46 | 0.65 | 0.93 | 0.71 | 21.58 | 22.15 | 25.11 | 39.64 | 62.35 | 63.12 | 19.12 | 20.37 | 27.21 | 40.74 | 63.37 | 65.12 |

| PNB | 0.03 | 0.05 | 0.20 | 0.28 | 0.22 | 0.55 | 0.30 | 0.80 | 2.64 | 3.53 | 3.04 | 4.04 | 1.12 | 0.54 | 2.05 | 3.34 | 2.79 | 3.67 |

| CANARA | 0.55 | 0.26 | 0.46 | 0.48 | 0.81 | 0.90 | 21.58 | 26.50 | 16.91 | 32.49 | 58.45 | 56.56 | 19.12 | 19.30 | 16.41 | 31.94 | 59.59 | 60.12 |

| ICICI | 0.34 | 0.69 | 1.16 | 1.43 | 1.73 | 1.98 | 6.61 | 14.81 | 27.26 | 36.21 | 48.86 | 50.51 | 19.12 | 22.32 | 18.79 | 19.47 | 14.15 | 15.12 |

| HDFC | 1.69 | 1.71 | 1.78 | 1.78 | 1.78 | 2.12 | 48.00 | 50.00 | 58.00 | 69.00 | 83.00 | 79.00 | 46.99 | 47.89 | 56.44 | 66.65 | 79.05 | 65.20 |

| AXIS | 0.34 | 0.19 | 0.71 | 1.18 | 0.80 | 0.91 | 6.61 | 6.83 | 24.19 | 46.04 | 35.04 | 34.38 | 5.55 | 6.57 | 23.49 | 45.99 | 35.27 | 32.67 |

Measures of market value

Market value ratios also known as price ratios are used to evaluate the current share price of company. Three ratios have been considered to measure market value ratios of selected banks such as Price to earnings, Price to book value and Price to sales. These ratios are used by current and potential investors to determine whether shares are over-priced or underpriced. Market value ratios metrics help investors gauge the worth of company stock in relation to its market share and track financial performances of selected banks to understand company position in the market.

Table 4 represents profitability ratios of selected six commercial banks. As can be seen from the table 4, it is evidenced that there is consistent increase in Return on assets (ROA), Earning per share (EPS) and net profit per share of public sector banks during the study period. Return on Assets (ROA) of SBI is found to be highest i.e. (0.93) which is significantly rose from 0.55 in 2019. However, PNB secured least ROA in 2019 which is below the average of all selected public sector banks during the period. Among private sector banks, HDFC has highest ROA in 2024 i.e. 2012 whereas AXIS has lowest ROA i.e. 0.19 only in 2020 during the study period. It is also evidenced that ROA of private sector banks are found to be relatively better than the public sector banks. Table 3 shows leaps and bounds of EPS of public sector banks and private sector banks during the study period. Among public sector banks, SBI is found to be highest EPS in 2024 whereas PNB hold lowest in 2020 which is 0.30 only. The study observed there is significantly increase of EPS among all the private sectors banks from 2019-2024. HDFC has highest EPS during 2023 whereas ICICI and AXIS has lowest during 2019. Net profit shows that a bank can convert their sales into profits. As can be seen from the table 4, SBI has constant increase in net profit from 19.12 to 65.12 during the study period. CANARA also made progress from 2019- 2024 despite steep decrease in 2021. Among private sector banks, HDFC has highest Net profit i.e. 79.53 during 2023 whereas ICICI has lowest during the same period. Among all the banks, SBI has highest net profit margin whereas PNB has lowest net profit during the entire study period. Table 3 also reveals that private banks are performing better than public sector banks and generates more profits with the money shareholders have invested during the study period.

| Table 4 Market Value Ratios of Selected Banks | ||||||||||||||||||

| Name of banks | Price to earnings ratio | Price to book value ratio | Price to sales ratio | |||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| SBI | 21.10 | 10.60 | 12.90 | 11.60 | 8.40 | 10.01 | 0.23 | 0.77 | 1.29 | 1.56 | 1.41 | 1.73 | 0.45 | 0.65 | 1.17 | 1.52 | 1.33 | 1.53 |

| PNB | 3.22 | 40.44 | 13.88 | 9.93 | 15.33 | 15.04 | 0.23 | 0.36 | 0.45 | 0.34 | 0.54 | 1.34 | 0.21 | 0.40 | 0.47 | 0.51 | 0.59 | 1.26 |

| CANARA | 3.61 | 3.84 | 7.96 | 6.50 | 4.58 | 1.38 | 0.13 | 0.27 | 0.46 | 0.67 | 0.73 | 1.27 | 0.12 | 0.19 | 0.36 | 0.58 | 0.60 | 0.95 |

| ICICI | 54.23 | 60.44 | 21.96 | 21.87 | 20.21 | 18.00 | 1.34 | 1.75 | 2.60 | 2.84 | 2.9 | 2.85 | 2.43 | 2.48 | 4.51 | 5.32 | 5.06 | 4.82 |

| HDFC | 13.23 | 14.12 | 17.34 | 25.86 | 21.42 | 19.53 | 2.51 | 2.68 | 3.92 | 3.30 | 3.10 | 2.42 | 3.12 | 3.87 | 6.43 | 6.00 | 5.26 | 3.88 |

| AXIS | 43.34 | 57.75 | 29.70 | 16.54 | 24.41 | 12.26 | 1.24 | 2.06 | 1.97 | 2.04 | 2.05 | 2.06 | 1.59 | 1.68 | 3.30 | 3.39 | 3.02 | 2.87 |

Measures of Liquidity

Liquidity represents how quickly an investment can be sold without negatively impacting its price. The more liquid an investment is, the more quickly it can be sold (and vice versa). In other words, liquidity means the ease with which you can convert a financial instrument to cash. The higher the ratio, the easier is the ability to clear the debts and avoid defaulting on payments. Current ratio, Quick ratio and Cash ratio are the three most popular ratios which have been used widely to measure how easily an asset can be bought or sold on the market at a price that represents its intrinsic value.

Table 5 presents the liquidity ratios of selected banks, including current, quick, and cash ratios. Among the public sector banks, most maintain a consistent current ratio throughout the study period. Notably, PNB had the highest current ratio of 3.46 in 2021, a significant increase from 2.27 in 2020, while Canara Bank recorded the lowest current ratio in 2024, which was half of its 2020 value of 2.36. SBI maintained a steady average current ratio of 1.67. In comparison, the current ratios of private sector banks were generally lower than those of public sector banks, with HDFC achieving the highest current ratio in 2024 and ICICI the lowest in 2022.

| Table 5 Liquidity Ratios of Selected Banks | ||||||||||||||||||

| Name of banks | Current ratio | Quick ratio | Cash ratio | |||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| SBI | 1.81 | 1.78 | 1.93 | 1.48 | 1.46 | 1.56 | 16.90 | 17.05 | 16.56 | 14.49 | 14.11 | 15.70 | 0.23 | 0.65 | 1.29 | 0.78 | 0.53 | -0.16 |

| PNB | 2.24 | 2.47 | 3.46 | 2.59 | 2.30 | 1.86 | 35.12 | 38.31 | 38.46 | 31.22 | 33.09 | 30.25 | 0.12 | 0.34 | 5.48 | 4.86 | 5.28 | 0.45 |

| CANARA | 1.90 | 2.36 | 1.87 | 1.70 | 1.27 | 1.14 | 25.90 | 29.97 | 21.97 | 28.51 | 26.71 | 30.10 | 0.42 | 0.23 | 3.23 | 0.95 | 2.18 | 1.17 |

| ICICI | 0.12 | 0.09 | 0.07 | 0.05 | 0.06 | 0.06 | 16.34 | 18.66 | 15.76 | 14.52 | 14.26 | 13.94 | 0.51 | 0.45 | 1.82 | 0.72 | 1.38 | 0.87 |

| HDFC | 0.67 | 0.89 | 0.80 | 0.63 | 1.02 | 1.53 | 15.89 | 16.61 | 16.62 | 17.58 | 18.77 | 19.48 | 0.67 | 0.89 | 6.85 | 1.45 | 1.95 | 0.74 |

| AXIS | 1.22 | 1.00 | 1.23 | 1.44 | 1.23 | 1.00 | 15.89 | 17.60 | 17.05 | 16.52 | 16.76 | 18.32 | 0.66 | 0.45 | 2.36 | 1.67 | 1.75 | 0.67 |

Table 5 also highlights significant fluctuations in the quick ratios of both public and private sector banks over the period, indicating that public sector banks were generally more liquid and better at generating cash than their private sector counterparts during the study period. Additionally, the table reveals that private sector banks had more cash and equivalents to meet their obligations compared to public sector banks. Among public sector banks, PNB had the least liabilities relative to its cash and equivalents, whereas HDFC Bank had the highest cash ratio among private sector banks.

Measures of Efficiency

Efficiency ratios are metrics that are used in analyzing a company’s ability to effectively employ its resources, such as capital and assets, to produce income. The efficiency ratio is typically used to analyze how well a company uses its assets and liabilities internally. The ratios serve as a comparison of expenses made to revenues generated and this ratio can also be used to track and analyze the performance of commercial and investment banks essentially reflecting what kind of return in revenue or profit a company can make from the amount it spends to operate its business. The more efficiently a company is managed and operates, the more likely it is to generate maximum profitability for its owners and shareholders over the long term. Inventory turnover ratio, Assets turnover ratio and Cost to income ratio are used for the purpose of the study.

Table 6 presents the inventory turnover ratio, assets turnover ratio, and cost-to-income ratio of the selected banks. The data in Table 6 indicate that both public and private sector banks have low inventory turnover ratios, suggesting inefficiencies in inventory management. Private sector banks exhibit higher assets turnover ratios compared to public sector banks. Within the public sector, Canara Bank achieved the highest assets turnover ratio of 9.75 in 2021, whereas PNB recorded the lowest at 6.75 in 2022. In the private sector, ICICI Bank showed the highest and lowest ratios of 11.45 in 2020 and 7.38 in 2024, respectively.

| Table 6 Efficiency Ratios of Selected Banks | ||||||||||||||||||

| Name of banks | Inventory Turnover Ratio | Assets Turnover Ratio | Cost to Income ratio | |||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| SBI | 0.05 | 0.06 | 0.05 | 0.06 | 0.06 | 0.07 | 8.81 | 9.10 | 8.52 | 7.97 | 8.37 | 6.92 | 50.23 | 51.27 | 53.21 | 52.68 | 66.97 | 70.44 |

| PNB | 0.06 | 0.06 | 0.07 | 0.05 | 0.06 | 0.05 | 7.59 | 7.93 | 8.91 | 6.75 | 7.00 | 7.51 | 40.89 | 41.90 | 44.25 | 42.83 | 51.48 | 53.37 |

| CANARA | 0.06 | 0.06 | 0.07 | 0.06 | 0.06 | 0.07 | 8.61 | 8.47 | 9.75 | 7.73 | 8.53 | 7.58 | 46.12 | 45.10 | 48.87 | 49.19 | 42.63 | 55.68 |

| ICICI | 0.07 | 0.06 | 0.07 | 0.06 | 0.06 | 0.07 | 11.11 | 11.45 | 10.92 | 9.47 | 10.03 | 7.38 | 53.23 | 62.68 | 60.99 | 57.50 | 54.34 | 49.53 |

| HDFC | 0.05 | 0.08 | 0.07 | 0.07 | 0.06 | 0.06 | 10.36 | 10.24 | 9.22 | 8.55 | 8.80 | 8.65 | 46.90 | 39.18 | 41.55 | 42.31 | 40.61 | 46.17 |

| AXIS | 0.07 | 0.06 | 0.06 | 0.06 | 0.06 | 0.70 | 9.25 | 9.19 | 8.34 | 7.81 | 8.36 | 7.99 | 49.13 | 50.19 | 47.82 | 42.99 | 49.90 | 48.62 |

Additionally, Table 6 highlights the cost-to-income ratios of the selected banks, revealing that public sector banks have relatively higher costs compared to private sector banks. Among public sector banks, SBI had the highest cost-to-income ratio of 70.44 in 2024, while PNB had the lowest in 2020. For private sector banks, ICICI had the highest ratio of 60.99 in 2021, and HDFC had the lowest at 39.18 in 2020.

The mean score is calculated for different ratios viz., Profitability, Market value, Liquidity and Efficiency. Since there is disparity within a data set and across several different data sets, normalization is being done and presented in Table 7.

| Table 7 Normalized Mean of Financial Ratios | ||||||||||||

| Name of banks | PE | PB | PS | ROA | EPS | NP | CR | QR | CR | ITR | ATR | COI |

| SBI | 12.44 | 1.17 | 1.11 | 0.66 | 38.99 | 39.32 | 1.67 | 15.80 | 0.41 | 0.06 | 8.28 | 57.47 |

| PNB | 16.31 | 0.54 | 0.57 | 0.22 | 2.39 | 2.25 | 2.49 | 34.41 | 2.60 | 0.06 | 7.62 | 45.79 |

| CANARA | 4.65 | 0.59 | 0.47 | 0.58 | 35.42 | 34.41 | 1.71 | 27.19 | 1.26 | 0.06 | 8.45 | 47.93 |

| ICICI | 32.79 | 2.38 | 4.10 | 1.22 | 30.71 | 18.16 | 0.08 | 15.58 | 0.65 | 0.07 | 10.06 | 56.38 |

| HDFC | 18.58 | 2.99 | 4.76 | 1.81 | 64.50 | 60.37 | 0.92 | 17.49 | 1.71 | 0.07 | 9.30 | 42.79 |

| AXIS | 30.67 | 1.90 | 2.64 | 0.69 | 25.52 | 24.92 | 1.19 | 17.02 | 0.96 | 0.17 | 8.49 | 48.11 |

To determine and compare whether there is any significant difference between the means of financial ratios of selected public and private sector banks, hypothesis was tested with One-way ANOVA and the outcome is presented in table 8.

| Table 8 Anova Result | |||||

| Source of Variations | Sum of Squares | df | Mean Square | F | Sig. |

| Between Groups | 47.653 | 11 | 4.332 | 36.475 | 0.000 |

| Within Groups | 7.126 | 60 | 0.119 | ||

| Total | 54.779 | 71 | |||

The table 8 shows that the F value of 36.475 is significant with p value of 0.000 levels. Thus, the null hypothesis is rejected and the alternative hypothesis is accepted. It means there is a significant difference among the financial ratios of selected banks during the study period.

To understand which of the specific bank differed in selected financial ratios, Tukey HSD post-hoc test is applied and the result is given in table 9.

| Table 9 Multiple Comparisons of Selected Financial Ratios | ||||

| (I) Group | Mean Difference (I-J) | Std. Error | Sig. | |

| SBI | PNB | 1.09063* | 0.1990 | 0.0001 |

| CANARA | 1.01016* | 0.1990 | 0.0002 | |

| ICICI | 0.43333 | 7.52617 | 1.000 | |

| HDFC | -3.99250 | 7.52617 | 0.995 | |

| AXIS | 1.24198* | 0.1990 | 0.004 | |

| PNB | SBI | 1.18165* | 0.1990 | 0.0000 |

| CANARA | 2.33185* | 0.1990 | 0.0000 | |

| ICICI | -4.74417 | 7.52617 | 0.988 | |

| HDFC | -9.17000 | 7.52617 | 0.826 | |

| AXIS | -1.09063* | 0.19897 | 0.000 | |

| CANARA | SBI | -1.22167 | 7.52617 | 1.000 |

| PNB | 3.95583 | 7.52617 | 0.995 | |

| ICICI | -1.25331* | 0.19897 | 0.000 | |

| HDFC | -1.20292* | 0.19897 | 0.000 | |

| AXIS | 0.03667 | 7.52617 | 1.000 | |

| ICICI | SBI | -1.18894* | 0.19897 | 0.001 |

| PNB | 4.74417 | 7.52617 | 0.988 | |

| CANARA | 1.24122* | 0.19897 | 0.000 | |

| HDFC | -4.42583 | 7.52617 | 0.992 | |

| AXIS | 0.82500 | 7.52617 | 1.000 | |

| HDFC | SBI | -1.17284* | 0.19897 | 0.000 |

| PNB | -1.12245* | 0.19897 | 0.000 | |

| CANARA | 5.21417 | 7.52617 | 0.982 | |

| ICICI | -1.10846* | 0.19897 | 0.000 | |

| AXIS | 5.25083 | 7.52617 | 0.982 | |

| AXIS | SBI | -1.25833 | 7.52617 | 1.000 |

| PNB | -1.45463* | 0.19897 | 0.002 | |

| CANARA | -0.03667 | 7.52617 | 1.000 | |

| ICICI | -1.84287* | 0.19897 | 0.003 | |

| HDFC | -5.25083 | 7.52617 | 0.982 | |

Table 9 reveals significant differences between several pairs of banks. Notably, there is a significant difference between SBI and PNB (p=0.0001), SBI and Canara (p=0.0002), and SBI and Axis (p=0.004). A significant difference is also observed between PNB and SBI, Canara, and Axis (p=0.000). Within the public sector banks, significant differences are found between Canara and HDFC, as well as Axis Bank. However, no significant differences are found between SBI and ICICI, PNB and ICICI, or Canara Bank and PNB.

Among private sector banks, significant differences are noted between ICICI and SBI (p=0.001), and Canara (p=0.000). There are no significant differences between HDFC and SBI (p=0.000), PNB (p=0.000), or ICICI (p=0.000). Significant differences are also found between Axis and PNB (p=0.002) and ICICI (p=0.003). However, no significant differences are observed between Axis Bank and Canara (p=1.000), HDFC and Canara (p=0.982), or ICICI and PNB (p=0.988).

To examine the impact of profitability, liquidity, and efficiency on the market value of the selected commercial banks, the Hausman specification test (FE versus RE) was conducted. Using panel data estimations, the dependent variable (PE) was regressed against independent variables (EPS, QR, ATR) for both public and private sector banks. The results are presented in Table 10 and Table 11.

| Table 10 Coefficients Fixed Effect and Random Effect Estimates for the Selected Public Sector Banks | |||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | |

| B | Std. Error | Beta | |||

| (Constant) | 26.626 | 28.426 | 0.937 | 0.365 | |

| EPS | -0.207 | 0.124 | -0.513 | -1.676 | 0.116 |

| QR | -0.169 | 0.346 | -0.155 | -0.489 | 0.632 |

| ATR | -0720 | 2.803 | -0.065 | -0.257 | 0.801 |

| Table 11 Coefficients Fixed Effect and Random Effect Estimates for the Selected Private Sector Banks | |||||

| Variables | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | |

| B | Std. Error | Beta | |||

| (Constant) | -39.069 | 33.748 | -1.158 | 0.266 | |

| EPS | -0.462 | 0.111 | -0.702 | -4.147 | 0.001 |

| QR | 3.603 | 1.587 | 0.359 | 2.270 | 0.040 |

| ATR | 2.694 | 2.188 | 0.205 | 1.231 | 0.238 |

Table 10 exhibits the fixed effect and random effect estimates for the selected public sector banks. As can be seen from the table 10, coefficient value of EPS (-0.2.207), QR (-0.169), ATR (-0.720) is much larger than the p value viz. 0.116, 0.632 and 0.801 which is statistically insignificant and group of independent variables does not show a statistically significant relationship with the dependent variable hence we failed to reject the null hypothesis. Thus, unit of change in Earnings per share (EPS), Quick Ratio (QR) and Assets turnover ratio (ATR) will not lead for determining the market value of the selected public sector banks.

Table 11 presents the fixed effect and random effect estimates for the selected private sector banks. Under this data estimation, dependent variable PE is regressed with independent variables viz. Earnings per share (EPS), Quick Ratio (QR) and Assets turnover ratio (ATR). As can be seen from the table 11, coefficient value of EPS and QR is found to be statistically significant p value 0.001 and 0.040. Thus, the null hypothesis is rejected and the alternative hypothesis is accepted. It means unit of change in Earnings per share (EPS) and Quick ratio (QR) will lead to change in market value of the selected private sector banks. However, coefficient value of ATR (2.694) is much larger than the p value 0.238 which is statistically insignificant. Therefore, unit of change in Assets turnover ratio (ATR) does not lead for determining the market value of the selected private sector banks.

Conclusion

The paper evaluates the performance of selected public and private sector banks through a comprehensive assessment using various financial ratios. It examines the impact of liquidity, profitability, and efficiency on the market value of these banks. A thorough assessment can enhance or modify different business operations, benefiting various stakeholders interested in the financial performance and position of banks for diverse purposes.

The study finds that, in terms of profitability, private banks outperform public sector banks, generating more profits from shareholder investments during the study period. Regarding market value, private sector banks have better PE, PB, and PS ratios compared to public sector banks. Public sector banks, however, show better liquidity ratios, such as the current ratio, quick ratio, and cash ratio. For efficiency ratios, private banks demonstrate superior inventory turnover, assets turnover, and cost-to-income ratios, making them relatively more efficient than public sector banks.

Additionally, the study employs panel data estimations, including the Fixed Effect and Random Effect models, to analyze the impact of liquidity, profitability, and efficiency on the market value of the selected banks. The empirical results indicate that for public sector banks, earnings per share (EPS), quick ratio (QR), and assets turnover ratio (ATR) do not significantly influence market value. In contrast, for private sector banks, the coefficients for EPS and QR are statistically significant, indicating that changes in these ratios affect the market value. However, the ATR for private sector banks is statistically insignificant, suggesting that changes in ATR do not impact their market value.

Limitation of the Study

Due to constraints of resources, this study faces certain limitations. It relies solely on secondary data sourced from the annual reports of SBI, PNB, Canara, ICICI, HDFC, and Axis banks. These reports may be subject to window dressing, potentially obscuring the actual financial positions of the banks. The primary objective of the financial analysis is to compare the growth, profitability, and financial soundness of these banks by examining the information within their financial statements. The analysis focuses on two key financial statements: the Balance Sheet and the Profit & Loss Account, for specific periods, assessing the profitability, liquidity, efficiency, and market value of the selected banks. Future studies could expand this research by analyzing a larger number of banks from both public and private sectors and incorporating cash flow and fund flow statements. This would provide a more comprehensive understanding of the banks' financial positions, growth, and performance.

References

Gupta, S., & Kaur, J. (2014). A Comparative Study of the Performance of Selected Indian Private and Public Sector Banks. IUP Journal of Bank Management, 13(2).

Jha, P. (2018). Analyzing Financial Performance (2011-2018) of Public Sector Banks (PNB) and Private Sector Banks (ICICI) in India. ICTACT Journal on Management Studies, 4(3), 793-799.

Kumbirai, M., & Webb, R. (2010). A financial ratio analysis of commercial bank performance in South Africa. African review of economics and finance, 2(1), 30-53.

Malhotra, N. A. R. E. S. H., & Aspal, P. K. (2014). Performance measurement of new private sector banks in India. The Indian Journal of Commerce A Quarterly Refereed Journal, 26.

Pandey, P., & Singh, S. (2015). Evaluating the performance of commercial banks in India using Malmquist and DEA approach: Some evidence. IUP Journal of Bank Management, 14(2), 22.

Rustam, A., & Rashid, K. (2015). A Comparative Study of the Performance of Local and Foreign Banks in Pakistan: Some ANOVA Evidence. IUP Journal of Bank Management, 14(1).

Srinivas, K. A. M. A. T. A. M., & Saroja, L. (2013). Comparative financial performance of HDFC Bank and ICICI Bank. International Refereed Multidisciplinary Journal of Contemporary Research, 1(2), 108-126.

Walia, K., & Kaur, P. (2015). Performance Evaluation of the Indian Banking Sector: A Study of Selected Commercial Banks. IUP Journal of Bank Management, 14(2).

Received: 01-Mar-2025, Manuscript No. AAFSJ-24-15358; Editor assigned: 03-Mar-2025, Pre QC No. AAFSJ-24-15358(PQ); Reviewed: 17- Mar-2025, QC No. AAFSJ-24-15358; Revised: 22-Mar-2024, Manuscript No. AAFSJ-24-15358(R); Published: 31-Mar-2025