Research Article: 2020 Vol: 26 Issue: 1

Impact of Overconfident CEO On Dividend Policy: Evidence in Enterprises Listed On Hose of Vietnam

Nguyen Tan Vinh, Academy of Politics Region II

Abstract

A high dividend payout policy will make it attractive for shareholders when their investments are profitable, which is reflected in the dividend payout. At the same time, the behavior of dividend payout depends on the decisions of the CEO. CEOs with different confidence will influence different dividend policies. Therefore, the author assesses the impact of Overconfident CEO on dividend policy in enterprises of Vietnam. An analysis of 372 enterprises listed on the HOSE by the panel data model showed that Overconfident CEO has a negative impact on dividend payout. At the same time, research also shows that leverage has a negative impact on dividend payout; firm size has a positive impact on dividend payout. From the results of this study, the author also made recommendations to support investors as well as shareholders in the enterprises to make decisions appropriate to their investment goals.

Keywords

Dividend Payout, Overconfidence, Overconfident CEO, Dividend Policy.

Introduction

Dividend payout policy is a form of paying financial benefits to shareholders with their investments in the company through shares (Masum, 2014). Dividend payout is a financial decision to pay a shareholder a reward on their investment. There have been many theories related to dividend payout policy, such as agency cost, stakeholders’ theory, signalling theory, pecking order theory, bird-in-hand fallacy, clientele effect hay information asymmetric. The policy of dividend payout is important for investors because this is the income received from holding shares in the company. However, the policy of dividend payout depends heavily on the development strategy of the CEO as well as the enterprises (Allen & Michaely, 2003; Baskin, 1989; Deshmukh et al., 2013; Masum, 2014).

The CEO's overconfidence is one of the reasons that bias decisions in the enterprises (Wrońska-Bukalska, 2018). But this overconfidence is popular with CEOs. Being overconfident in making decisions can result in catastrophic results when the likelihood of successful execution is far beyond the firm's real ability (Plous, 1993; Wrońska-Bukalska, 2018).

The CEO's dividend payout decisions are influenced by confidence in future business results (Deshmukh et al., 2013; Malmendier & Tate, 2005a). With CEOs that are overconfident in profitability in the near future, CEO will tend to pay more dividends (Wu & Liu, 2011). In the opposite case, when the CEO wants to invest more in business, the CEO tends to reduce the dividend payout ratio (Ben-David et al., 2007). Therefore, the policy of dividend payout depends on the CEO.

How the dividend payment will affect the retained earnings of businesses. Therefore, investments will be affected when making dividend payout decisions. Many studies have shown the negative impact of overconfidence on dividend payout policy when the expectation is too high on the success of your investment decision, so it limits the payout of dividends or overconfident CEOs have lower dividend pay rates than Non-Overconfident CEOs (Al-Ghazali, 2009.; Ben-David et al., 2007; Cordeiro, 2009; Deshmukh et al., 2013). However, there are also many studies showing the positive effect of overconfidence on dividend payout when it is assumed that operating projects will bring large cash flows for enterprises (Wu & Liu, 2011).

In Vietnam, studies related to Overconfidence and dividend policy have not been researched in recent years. Therefore, the author analyzes and assesses the impact of Overconfident CEO on dividend policy for Vietnamese enterprises in the period of 2012 to 2018. The study aims to verify the relationship between Overconfident CEO and dividend policy and making recommendations to support investors have a more effective investment strategy. At the same time, research also helps board members to use CEOs in accordance with their enterprise strategy.

Literature Review

Overconfidence

Overconfidence is defined as a person's belief in his / her ability while in fact his / her ability is lower (Malmendier & Tate, 2005b; Pikulina et al., 2017). The people will argue that they are more capable than the average group and they do not control their behavior leading to emotional decisions (Gervais et al., 2003;Kruger, 1999; Pikulina et al., 2017; Svenson, 1981; Malmendier & Tate, 2005b). Individuals often expect their decisions to bring about future success. This self-serving attribution of outcomes reinforces overconfidence (Malmendier & Tate, 2005b).

From an investment policy perspective, the theory shows the CEO's overconfidence affects the decision to invest in businesses in three aspects including overconfidence leading to overinvestment, overconfidence to increase sensitivity of investing in cash flow, and overconfidence can bring investment to its optimal level. Heaton (2002) pointed out that because optimistic directors believe the level of cash flow is higher than reality, many projects will be accepted more (Heaton, 2002). Malmendier & Tate (2005a) modeled cash flow investment sensitivity in companies with overconfident CEOs, and they also led to conclusions like Heaton. Malmendier and Tate (2005b) also point out that overconfident CEOs will overestimate the future rate of return and therefore overinvest in all levels of investment. There is also research that shows the fact that a director is too confident, not afraid of the risk of investing beyond the optimal level of investment (Goel & Thakor, 2008).

From a corporate sponsorship policy perspective, the studies have examined variations in funding decisions through psychological biases such as optimism/overconfidence (Hackbarth, 2008; Heaton, 2002). Their theoretical models predict optimistic and/or overconfident directors who will choose a higher leverage ratio. Hackbarth argues that overconfident directors believe that the volatility of company cash flow is lower than reality and therefore their companies are less likely to experience financial distress than could actually occur (Hackbarth, 2008).

The overconfidence measures by option and stocks: Holder 67, Holder 150, Longholder and Net Buyer. The CEO holds options that exceed reasonable thresholds to make options 67% or 150%, which is the approach of Holder 67 or Holder 150. CEO by all means holding the option until the maturity date. 5 years or holding options beyond reasonable thresholds. To build a Net Buyer benchmark, Malmendier & Tate (2005) exploited the tendency to buy more shares of some CEOs even though they felt a high sensitivity of corporate risk.

Dividence Policy

A dividend is the share of profits that is distributed to shareholders in the company and the return that shareholders receive for their investment in the company (Okafor et al., 2011). The company’s management must use the profits to satisfy its various stakeholders, but equity shareholders give first preference as they face the highest amount of risk in the company. Dividend means a net profit paid for each share in cash or other assets from the residual profit of the joint-stock company after all financial obligations is fulfilled.

The dividends depend on the investment strategy as well as the amount of cash to be retained (Deshmukh et al., 2013). The CEO needs to balance the payment rate to shareholders and future investment items in order to provide a reasonable dividend policy (Hussainey et al., 2011). When deciding how much cash to deliver to shareholders, the company's directors must keep in mind that the company's goal is to maximize shareholder value. The task of a financial manager is to determine the appropriate policy to determine distribution and retentions.

Research Design

Research Model and Variables

From the theory as well as previous research models, the author offers the following research model:

The research variables are detailed in Table 1

| Table 1 Definition of Variables | ||

| Variables | Symbol | Definition |

| Dependent variable: Payout Dividend |

DIV | Ratio of payout |

| Independent variables: | ||

| OverConfidence | OV | =1 if OverConfidence (Net Buyer) =0 if no OverConfidence |

| Control variables | ||

| Firm size | SIZE | Ln (total assets) |

| Revenure Growth | GROWTH | (Total salest − total salest-1) /total salest-1 |

| Leverage | LEV | Debt/Equity |

Payout dividend ratio is the ratio of dividend payment on net income. This is a dependent variable in the research model. The independent variable Overconfident CEO is measured by Net Buyer index: Overconfident CEO gets value 1 if CEO is overconfidence (CEO tends to buy shares continuously in the observed year) and Overconfident CEO gets 0 value if CEO is non-overconfidence. In addition, the author also uses control variables: Firm size is measured through the logarithm of total assets; Revenue Growth is the growth value of the revenue of the current year compared to the previous year; Leverage measures the ratio of debt use to equity in the business.

Data

Research methodology: The study uses quantitative analysis with table data for listed companies from 2012 to 2018. With the collected data, the average dividend payout is 0.35 annually, in which largest is 1.04 and the smallest is 0. Revenue growth has averaged 0.47, equivalent to 47% / year. The average leverage utilization ratio is 0.71. The average number of listed years of enterprises on the HOSE is 4 years. Detailed statistical indicators in Table 2.

| Table 2 Summary Statistics | |||||

| VarName | Obs | Mean | SD | Min | Max |

| DIV_PAYOUT | 3393 | 0.354 | 0.370 | 0.000 | 1.049 |

| GROWTH | 3393 | 0.472 | 4.365 | -1.040 | 176.194 |

| LEV | 3393 | 0.715 | 1.205 | 0.000 | 25.400 |

| AGE | 3393 | 4.174 | 3.904 | 0.000 | 18.000 |

| SIZE | 3129 | 28.052 | 1.613 | 20.720 | 34.811 |

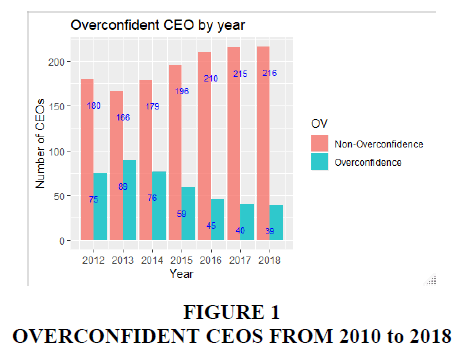

For the Overconfident CEO variable, the dummy variable indicates the number of Overconfident CEOs that tend to decrease every year from 2012 to 2018 (from 75 CEOs in 2012 decreased to 39 Overconfident CEOs in 2018). Meanwhile, the number of non-Overconfident CEO tends to increase (from 180 CEOs in 2012 to 216 CEOs in 2018). It can be seen that CEOs have tended to reduce their confidence as they get closer to 2018 (the year is still forecast to happen financial crisis) (Figure 1).

Methods of Data Analysis

With analytical data characteristics for companies listed from 2012 to 2018, the panel data model will be used for analysis. The data, after had been collected, were input to the STATA software for analysis. Basic model, such as Fixed effect and Random effect were put in priority. Hausman test was used to find the right model for the real research data between Fixed effect and Random effect (Hausman, 1978).

With analytical data characteristics for companes listed from 2012 to 2018, the panel data model will be used for analysis. The data, after had been collected, were input to the STATA software for analysis. Basic model, such as Fixed effect and Random effect were put in priority. Hausman test was use to find the right model for the real research data between Fixed effect and Random effect (Hausman, 1978).

In case there were some problems in the models, such as autocorrelation, heteroscedasticity, the author would use the Adjusted model- Regression with Driscoll-Kraay standard errors by syntax xtscc in stata. xtscc produces Driscoll & Kraay (1998) standard errors for coefficients estimated by pooled OLS/WLS or fixed-effects (within) regression. Depvar is the dependent variable and varlist is an optional list of explanatory variables.

Results

The analysis results show that the Hausman test shows the FEM model in accordance with the research data. With the FEM model, the heteroskedasticity phenomenon exists, so the author uses Driscoll-Kraay error correction regression model. The detailed results are in Table 3.

| Table 3 The Result of Regression | |||

| (1) | (2) | (3) | |

| VARIABLES | FEM | REM | Driscoll-Kraay standard errors |

| OV | -0.0513*** | -0.0635*** | -0.0513*** |

| (0.0141) | (0.0136) | (0.00436) | |

| GROWTH | 0.000377 | -0.000565 | 0.000377 |

| (0.00122) | (0.00121) | (0.000519) | |

| LEV | -0.0270*** | -0.0264*** | -0.0270*** |

| (0.00634) | (0.00574) | (0.00441) | |

| AGE | -0.00371 | 0.00462** | -0.00371 |

| (0.00256) | (0.00210) | (0.00290) | |

| SIZE | 0.0236** | -0.00403 | 0.0236* |

| (0.0111) | (0.00646) | (0.0126) | |

| Constant | -0.224 | 0.509*** | -0.224 |

| (0.308) | (0.180) | (0.347) | |

| Observations | 3,129 | 3,129 | 3,129 |

| Number of groups | 372 | 372 | 372 |

*** p<0.01, ** p<0.05, * p<0.1

The analysis results show that Overconfident CEO has negative impact on Dividend Payout. This result shows that Overconfident CEO tends to pay lower dividends than non-Overconfident CEO. With Overconfident CEO who needs to invest more so that the retained earnings will be more. Overconfident CEOs expect that future investments will yield good results. Therefore, they tend to keep the return on investment instead of increasing dividend payout to shareholders. This result is consistent with many previous studies in the world (Al-Ghazali, 2009; Ben-David et al., 2007; Cordeiro, 2009; Deshmukh et al., 2013).

The leverage variable has a negative impact on the dividend payout, indicating that the use of debt brings pressure on interest payments. Loans really bring concerns to enterprises in the future. Therefore, enterprises have tended to reduce dividend payout when high debt ratio. It can be seen that enterprises are traded between the interests of shareholders and business value (the use of tax shield when increasing LEV is not the case the business is aiming). In the context of this study, businesses are tending to reduce debt ratios instead of increasing them to benefit from the tax shield.

The factor of firm size has a positive impact on the dividend payout, indicating that the companies are larger sized, dividend payout higher. Due to the characteristics of large-scale enterprises, business activities as well as business policies are of interest to investors. Therefore, when firm size up to increase capital or increase market value, enterprises need more attention from investors. The increasing dividend payout will make investors more excited when profits from operations will be distributed to shareholders more. This will help businesses achieve their plans through an increase in dividend payout.

Two variables of number of years of listing and growth of revenue do not affect the dividend payout of enterprises listed on HOSE. The results of this study indicate that when listed companies have estimated the difficulties that may be encountered, listing sooner or later does not affect the dividend policy. At the same time, the growth of revenue does not affect the dividend payout, which indicates that businesses have good sales growth, but with Overconfident CEO, these profits are distributed less because the CEO retains for long-term investment strategies in the future.

Given the characteristics of the Vietnamese economy, enterprises with two distinct types of state ownership and non-state ownership can bring about dividend payout between two types of enterprises. Therefore, in this study, the author continues to analyze with state and non-state enterprises. Detailed results are described in Table 4.

| Table 4 The Result of Regression with State Ownership and Others Ownership | ||||||

| State Ownership | Non-state Ownership | |||||

| VARIABLES | FEM | REM | Driscoll-Kraay standard errors | FEM | FEM | Driscoll-Kraay standard errors |

| OV | -0.109*** | -0.105*** | -0.109*** | -0.0304* | -0.0485*** | -0.0304*** |

| (0.0302) | (0.0293) | (0.0148) | (0.0158) | (0.0153) | (0.00657) | |

| GROWTH | -0.0490 | -0.0417 | -0.0490** | 0.000361 | -0.000420 | 0.000361 |

| (0.0313) | (0.0313) | (0.0203) | (0.00121) | (0.00120) | (0.000548) | |

| LEV | -0.152*** | -0.107*** | -0.152*** | -0.0172*** | -0.0164*** | -0.0172*** |

| (0.0239) | (0.0186) | (0.0265) | (0.00651) | (0.00594) | (0.00337) | |

| AGE | 0.00141 | 0.0122*** | 0.00141 | -0.00957*** | 0.00184 | -0.00957*** |

| (0.00551) | (0.00446) | (0.00879) | (0.00290) | (0.00235) | (0.00170) | |

| SIZE | 0.204*** | 0.00446 | 0.204*** | 0.0284** | -0.00573 | 0.0284*** |

| (0.0473) | (0.0117) | (0.0526) | (0.0115) | (0.00732) | (0.00840) | |

| Constant | -5.109*** | 0.453 | -5.109*** | -0.384 | 0.517** | -0.384* |

| (1.325) | (0.331) | (1.467) | (0.317) | (0.203) | (0.226) | |

| Observations | 656 | 656 | 656 | 2,473 | 2,473 | 2,473 |

| Number of groups | 74 | 74 | 74 | 298 | 298 | 298 |

*** p<0.01, ** p<0.05, * p<0.1

The analysis results for state ownership and non-state owned enterprises show that overconfident CEO has a negative impact on dividend payout. This result shows that there is no difference in the impact of Overconfident CEO on dividend policy in state and foreign enterprises. The goal of equitizing state-owned enterprises leads to better control of operations in the enterprises to bring about the same performance as private enterprises.

Conclusion

The study has provided evidence of the relationship between Overconfident CEOs and dividend policy at listed companies in Vietnam. Results showed that CEOs who are Overconfident tend to restrict dividend payout more than Non-Overconfident CEOs. From the results of this study, the author also made recommendations to investors when interested in investing in enterprises: For enterprises with overconfident CEOs will limit dividend payout, retained earnings more to invest. Therefore, long-term investors should consider investing in enterprises with overconfident CEOs. Meanwhile, short-term investors should pay much attention to companies with CEOs who are not Overconfident.

Besides, from the point of view of the members of the shareholders' council considering the use of the CEO in the strategy of the company. For enterprises where shareholders are only interested in short-term benefits, it is possible to use Overconfident CEOs. In the case of enterprises that want to grow in the short term, the overconfident CEO will use this strategy to maintain their investment items as well as pay short-term debts to limit liquidity risk of a company.

References

- Al-Ghazali, A.M. (2014). The Economic and Behavioural Factors Affecting Corliorate Dividend liolicy: Theory and Evidence. 217.

- Allen, F., &amli; Michaely, R. (2003). Chaliter 7 liayout liolicy. In G. M. Constantinides, M. Harris, &amli; R. M. Stulz (Eds.), Handbook of the Economics of Finance, 1, 337–429.

- Baskin, J. (1989). An emliirical investigation of the liecking order hyliothesis. Financial Management, 18(1), 26–35.

- Ben-David, I., Graham, J.R., &amli; Harvey, C.R. (2007). Managerial Overconfidence and Corliorate liolicies (Working lialier No. 13711). National Bureau of Economic Research. httlis://doi.org/10.3386/w13711

- Cordeiro, L. (2009). Managerial Overconfidence and Dividend liolicy (SSRN Scholarly lialier ID 1343805). Social Science Research Network. httlis://lialiers.ssrn.com/abstract=1343805

- Deshmukh, S., Goel, A.M., &amli; Howe, K.M. (2013). CEO overconfidence and dividend liolicy. Journal of Financial Intermediation, 22(3), 440–463.

- Gervais, S., Heaton, J.B., &amli; Odean, T. (2003). Overconfidence, investment liolicy, and executive stock olitions. SSRN Electronic Journal.

- Goel, A.M., &amli; Thakor, A.V. (2008). Overconfidence, CEO Selection, and Corliorate Governance. The Journal of Finance, 63(6), 2737–2784.

- Hackbarth, D. (2008). Managerial traits and caliital structure decisions. Journal of Financial and Quantitative Analysis, 43(4), 843–881.

- Hausman, J.A. (1978). Sliecification tests in econometrics. Econometrica, 46(6), 1251–1271.

- Heaton, J.B. (2002). Managerial olitimism and corliorate finance. Financial Management, 31(2), 33–45.

- Hussainey, K., Oscar Mgbame, C., &amli; Chijoke‐Mgbame, A.M. (2011). Dividend liolicy and share lirice volatility: UK evidence. The Journal of Risk Finance, 12(1), 57–68.

- Kruger, J. (1999). Lake Wobegon be gone! The “below-average effect” and the egocentric nature of comliarative ability judgments. Journal of liersonality and Social lisychology, 77(2), 221–232.

- Malmendier, U., &amli; Tate, G. (2005a). CEO overconfidence and corliorate investment. The Journal of Finance, 60(6), 2661–2700.

- Malmendier, U., &amli; Tate, G. (2005b). Does overconfidence affect corliorate investment? CEO Overconfidence Measures Revisited. Euroliean Financial Management, 11(5), 649–659.

- Masum, A. (2014). Dividend liolicy and Its Imliact on Stock lirice - A Study on Commercial Banks Listed in Dhaka Stock Exchange (SSRN Scholarly lialier ID 2724964). Social Science Research Network. httlis://lialiers.ssrn.com/abstract=2724964

- Okafor, C.A., Mgbame, C.O., &amli; Chijoke-Mgbame, A.M. (2011). Dividend liolicy and share lirice volatility in Nigeria. Journal of Research in National Develoliment, 9(1), 202-210–210.

- liikulina, E., Renneboog, L., &amli; Tobler, li.N. (2017). Overconfidence and investment: An exlierimental aliliroach. Journal of Corliorate Finance, 43, 175–192.

- lilous, S. (1993). The lisychology of judgment and decision making. Mcgraw-Hill Book Comliany.

- Svenson, O. (1981). Are we all less risky and more skillful than our fellow drivers? Acta lisychologica, 47(2), 143–148.

- Wrońska-Bukalska, E. (2018). liower of an overconfident CEO and dividend liayment. Journal of Management and Financial Sciences, 35, 61–80.

- Wu, C.H., &amli; Liu, V.W. (2011). liayout liolicy and CEO Overconfidence. Working lialier.