Research Article: 2021 Vol: 27 Issue: 4

Impact of Sustainable Entrepreneurship Indicators On SMEs Business Success in South Africa

Ogujiuba Kanayo, University of Mpumalanga

Isaac Agholor, University of Mpumalanga

Ebenezer Olamide, University of Mpumalanga

Abstract

There is a rising scholarly interest in sustainable entrepreneurship globally and across Africa. However, there has been limited consideration of how ongoing debates about the characteristics of sustainable entrepreneurship play out in African environments. Furthermore, what component of SE determines the success of SMEs is a topic of much academic debate. This article explores the influence of Sustainable Entrepreneurship factors (SE) on Small and Medium-sized Enterprises (SMEs) in South Africa. A simple random sampling was used to estimate statistical measures proportional to the population size of 3000 SMEs. A total of 1590 questionnaires were distributed and 980 responses were received. Multiple regression technique was used in estimations. The results indicated that financial resources and government support influenced the success of SMEs in South Africa. Findings also show that social index and environmental index had no significant impacts on the success of SMEs. It is obvious that premium is not placed on social and environment issues by SME operators in South Africa. Policy makers and stakeholders must recognise that small businesses operate in specific sectors, and that sector-specific factors have impacts across the spectrum of the economy. The article recommends that opportunities that increase financial resources, entrepreneurship skills, social capital, environmental awareness and networks needs promotion to foster sustainable entrepreneurship. This will require the enhancement of the growth potential of SMEs through access to information, ICT, and good infrastructure.

Keyword

Entrepreneurship, South Africa, Business Success.

Introduction

One of the strategies for economic prosperity, growth and development is the concept of sustainable entrepreneurship (SE) which is fast receiving the attention of economic and other researchers. The simple reason for this is that successful entrepreneurial activities have been ascribed as better antidote to economic, social vices (such as poverty reduction), unemployment, youth restiveness and other related technological and environmental challenges plaguing the developmental aspirations of developing countries such as in sub-Saharan Africa (Kautonen et al., 2017; Karimi et al., 2017; Babajide et al., 2020). Globally and in South Africa, small, medium and micro-enterprises (SMMEs) represent most private businesses. Their success is important for the creation of employment and the well-being of society. Small and medium-sized enterprises (SMEs) play an important role in the modern economy. Scholars from various disciplines agrees on the importance of SMEs success in employment, wealth, and social and economic development (e.g., Autio 2005; Omri and Ayadi-Frikha 2014; Omri et al., 2015).

Scholars have offered different definitions about the meaning of sustainable entrepreneurship (Belz and Binder 2015, Urbaniec 2017, Teran-Yepez 2019, Di Vaio et al., 2020), the summary of their opinions is that success story of any enterprise depends on the driving indicators. Not only that, with diverse opinions on the contributions of entrepreneurship activities to the economic growth of nations, so also have researchers identified driving indicators of entrepreneurship sustainability in the academic literature (Sundin et al., 2015). However very few of these studies have spontaneously investigated the contributions of the quadruplet drivers namely finance, government support, social and environmental index in the context of entrepreneurship sustainability. Egade (2019) argued that finance is the pillar to the sustainability of any business enterprise. Not only that, Belz and Binder (2015), Greco and De Jong (2017) and Urbaniec (2017) noted in their studies that social and environmental factors will go a long way in determining how sustainable a business enterprise would be. Di Vaio (2020) identified financial profit, social protection and environmental factors as the driving indicators of SE and development. Further, Egade (2019) linked social sustainability to financial success of many companies in Europe. Consequent upon the numerous contributions of this sector to the global community, the need to have a better understanding of some of the influencing factors calls for academic research. In this study therefore, sustainable entrepreneurship indicators such as finance, government support, social and environmental index which have received much attention from entrepreneurship scholars is our focal point. Among other things, the 2015 Sustainable Development Goals (SDGs) that came into force in 2016 was aimed at taking countries out of poverty, ensures livelihood equality of people and addressing climatic change problem by the year 2030 (United Nations on Sustainable Development Goals, 2015). Specifically, the role of business enterprises in achieving these goals was expressly stated in SDG 1 and SDG 10 of the document especially in job creation, poverty alleviation, and food security among others.

Nonetheless, business has a key role to play in South Africa’s transformation and development. This includes not only traditional for-profit businesses, particularly through corporate social responsibility (CSR) activities, but also social enterprises which combine economic and social objectives, with the latter “built-in” to their operating models. In line with global trends, and developments in the rest of Africa, there is increasing interest in and engagement with sustainable entrepreneurship in South Africa, as mechanisms for addressing complex sustainable development problems. Aside that, Soleymani et al (2020) added that sustainable entrepreneurship within the SMMES is not only a tool to empower and build local people’s capability, but it can also help to reduce rural-urban migration. To achieve some of the stated 2030 goals of the 2015 Sustainable Development Goals, the document emphasized that for developing countries to overcome some of the teething obstacles to development, sustainable entrepreneurial activities need to be encouraged (Babajide et al 2020). Further to this, South Africa came up with her own National Development Plan (2030) with one of its cardinal objectives being poverty eradication and employment generation through sustainable entrepreneurship participation. However, different indicators have been identified in the literature as major drivers of sustainable entrepreneurship (Sundin et al 2015). In this study, we identified four major sustainable entrepreneurship indicators as may be applicable to South Africa with the hope of examining the extent to which these drivers account for the success of small and medium scale enterprises in that country. Not only that, but the study also prioritized these indicators in order of importance and the causal relationship amongst them As rightly noted in the studies by Munoz and Cohen (2018) and Kraus et al (2018), the need to better understand, synthesis, organize and analyse SE was brought to the fore and the authors believe that one way to achieving this is to investigate the drivers of this concept. Therefore, assessing the extent to which these indicators influence entrepreneurship success is considered a stepping stone to future research direction (Teran-Yepez et al., 2019).

The choice of South Africa for this study, stems from the fact that the country accommodates more foreigners in terms of entrepreneurship establishment than most other countries in the continent of Africa as well as accommodating more economic migrants (Littlewood and Holt 2018). The World Bank (2011) reported that in comparative term, South Africa seems to be the easiest country to open business in the whole sub-Saharan Africa. To demonstrate this, the Code of Good Business Practice for South African companies operating in Africa was signed in 2018 to further re-balance and encourage entrepreneurship participation in the local activities (DTI, 2019). This was further acknowledged in the report of GEM SA (2020) on “2020 World Bank Doing Business” where out of the top 50 countries, South Africa was one of the two African countries ranked under the ease of doing business measurement. However, while there is a rising scholarly interest in sustainable entrepreneurship in South Africa, and across Africa more widely (Kerlin, 2008), at present, the concept of SE remains emerging. Thus far, there has been limited consideration of how ongoing debates about the characteristics of sustainable entrepreneurship play out in African environments. These constraints are underlined in a recent contribution by Rivera-Santos, Holt, Littlewood, and Kolk (2015), which investigates social entrepreneurship across sub-Saharan Africa. Their findings support incorporating the consideration of financial resource, government support, social and environment indicators into a sustainable entrepreneurship measure. This will enrich our understanding of the phenomenon, while they also call for more in-depth research of the kind conducted in this article.

Despite the identification of various sustainable entrepreneurship drivers in the literature, the linkage between these indicators and business success have not been fully tapped. From the foregoing, the pertinent question is how much of the variance in Business Success scores can be explained by financial, government support, social and environment index. Our analysis uses financial resources, government support, social and environmental index as major indicators of sustainable entrepreneurship. Several studies have further argued that sustainable entrepreneurship is a means to achieving economic growth, rural-urban migration, job creation, income equality, financial transparency, identification, and expansion of the potentials of rural dwellers (Sullivan et al 2018, Soleymani et al., 2020). This was in tandem with the submission of Sullivan et al. (2018) that sustainable entrepreneurship is very key to the realization of SDGs objectives not only in economic growth but also in achieving social and environmental desires of the millennium.

The 2018 Global Entrepreneur Report indicated a considerable increase in the worth that entrepreneurs place on social responsibility. Thus, the use of sustainable entrepreneurship as a measurement for business performance is on the rise, making it the second most significant of measurement after profits. This predisposition is growing and will most likely continue in the future. In the 2016, the Global Entrepreneur Report, indicated that only 10% of influential entrepreneurs created social impact as a part of their personal accomplishment characterization. In 2020, this percentage rose to a respectable 39%. Although most of them still argue that profit is still the number one indicator of business success. However, Sustainable Entrepreneurship (SE) has now become the second priority, rising above other objectives such as shifting a business to the next generation. Creating an impact is now a major performance indicator for entrepreneurs globally and making improvements in this area has also become a personal goal for many. Furthermore, entrepreneurs today define themselves as big business managers only when they can change people’s lives for the better, by creating jobs and empowering others, rather than purely financial metrics. Finance As Driver of Sustainable Entrepreneurship

Sustainable Entrepreneurship

As a driving force to sustainable entrepreneurship, finance has been described as first among equals (Ye and Kulathunga 2019 and Babajide et al., 2020). In a bid to allow entrepreneurs have access to finance, the Small Business Innovation Fund was added to existing financial supports (such as the Small Enterprise Finance Agency) for entrepreneurship sustainability in South Africa in 2019 (GEM SA, 2019). Under the debate on profit maximization versus owners’ wealth maximization as objectives in financial management, the need for business managers to strike a balance in the achievement of both objectives was emphasized. This was premised upon the relevance of finance as a major indicator to the survival of any business organization (Adomako et al., 2015; Egade 2019). According to this debate, while the expectation of the owners of a business organization (the equity shareholders) is to see an increase in the yearly dividend, the other objective of share appreciation needs to be juxtaposed by the management. Therefore, in order to meet up with these contending objectives, increase in yearly profit is a sine qua non. Failure to balance these needs may result into “shareholders’ turnover” which may not be to the advantage of any business outfit. Available studies have shown that enterprises with better scorecard is the result from impressive record of financial management (Adomako, 2015; Kraus, 2018). Klien Woolthuis (2010) employed Market and System Failure Framework to show that any possible threat that may arise from the introduction of innovation into business operation may constitute financial benefit in the long run if properly managed. This demonstrates that failures that may arrive from systemic and market structure may end up as financial benefit to an enterprise. To drive home some of the sustainable benefits of entrepreneurship activities in South Africa, an aggregated amount of R230bn ($16bn) was made available for entrepreneurial activities in 2018 (IFC, 2019).

As further contained in the National Youth Economic Empowerment Strategy and Implementation Framework (2009-2019), it was recommended that provinces and authorities at local government levels should establish economic empowerment strategies for youth that are in entrepreneurial activities so as to ease their accessibility to finance and credit facilities (DTI, 2019). A study on how stability in finance can drive entrepreneurial activities in sub-Saharan Africa was carried out by Babajide et al. (2020) with a suggestion that financial stability will promote the establishment of new businesses. Using the Pooled OLS and Random Effects methods, the study noted that with financial stability, it will be easier to access fund by business organization and therefore ensure its continuous existence. Another dimension to this finance-entrepreneurship sustainability discussion is the issue of financial literacy which according to Adomako et al. (2016) is another major influencing financial indicator. Other studies in this line of argument include the works of Korutaro et al. (2014) and Ye and Kulathunga (2019). For instance, Ke and Kulathunga (2019) researched into the relationship between financial literacy and accessibility to finance in Sri Lanka and confirmed that a positive association exists between these two variables. Pticar (2016) and Khoury and Omran (2012) saw finance as the life wire to the successful operation of an enterprise. They further argued that finance is synonymous to an enterprise and vice versa. While stressing the need to address the where, when and how to source for the optimal finance for operations of a business, it was further observed that lack of adequate finance in the operation of an enterprise could result into debt accumulation, insolvency, inadequate working capital and above all, inability to meet its financial obligations as at and when due. All these will not only affect the credit rating of an enterprise but may also lead to labour turnover and eventual closure of an enterprise. By and large, finance plays vital role in the success or otherwise of any business entity. In essence, ease to accessing finance is a good driver to the success and existence of SMEs. Although, it was acknowledged that findings emanating from such a study that was based on three provinces would not reflect the true situation South Africa, further studies on the causal relationship between finance and SMEs’ success is advocated for; this is enough reason to justify this present study with South Africa as our case study.

Government Support as Sustainable Entrepreneurship Success Indicator

The government repeatedly gives businesspersons support in the form of free information; nevertheless, financial assistance tends to be earmarked for non-profits, social services, educational endeavours and specified research. Here, government policy within the context of Akinyemi and Adejumo (2018) which connotes policies that are external to the operations of entrepreneurs as against the ones guiding the internal mechanisms is our guide. This may be in business registration, tax, laws that regulate union activities, minimum wage, access to financial support etc. The government of South Africa has taken steps in the past to support the activities and sustainability of entrepreneurship. This includes Growth, Employment and Redistribution (GEAR) strategy, National Youth Development Agency (NYDA), Small Enterprise Development Agency (SEDA), the Integrated Strategy on the Promotion of Entrepreneurship and Small Enterprises (Department of Trade and Industry, 2007). Others as contained in the Department of Trade and Industry (2019) report, include Business Process Outsourcing (BPO), Companies Act (2008), Special Economic Zones and Economic Transformation (SEZET), Black Industrialists Scheme (BIS), National Development Plans (NDP) and Integrated Strategy on the Promotion of Entrepreneurship and Small Enterprises (ISPESE) of 2005; just to mention but a few. Accessibility to finance is a prerequisite to sustainable entrepreneurship which translates to the fact that policies of government in this direction is very germane (Kressel & Lento 2012). Government support to entrepreneurship sustainability can be viewed from two perspectives. One is the regulatory requirements that sets out the legal framework for the operation and sustainability of an enterprise and the second is the financial support in terms of accessibility and financial assistance. The most recent being the National Small Enterprise Amendment Bill (2020) that outlined the creation of an Ombud service to provide legal assistance to Small, Micro and Medium Enterprises (SMME) in South Africa. In the words of Babajide et al. (2020) and Ye and Kulathunga (2019), where the financial system is volatile, access to finance becomes an issue and this may hamper entrepreneurship activities. In essence, the government must live up to its regulatory responsibility by ensuring that the financial system is stabilized to instil confidence in investors mind. Ayegba and Omale (2016) opined that a better understanding of the legal aspect of a country will go a long in ensuring the success and sustainability or otherwise of an enterprise.

South Africa government had initiated a lot of programmes in recent past that aim at easing doing business. As a result of these, the contributions of SMEs to the GDP have been on the increase in the years past. For instance, the Bureau for Economic Research (2017) reported that SMEs contribution to GDP was a bit higher than 20% in that year while the Global Entrepreneurship Monitor (2017) put the contribution at 36%. Yet, the Minister in the Presidency said the figure was 42% with employment rate of 47%. The 2019 report of International Finance Corporation (IFC, 2019) put the contribution at 34% while it was further reported that they account for between 50 to 60% of the country’s total labour force. All these are pointers to the fact that government policies have constituted a major indicator to the success of sustainable entrepreneurship in the country. With the Covid-19 pandemic that has ravaged the global economy, the government of South Africa further boosted the activities of SMEs in the second quarters of year 2020 with R3bn through Industrial Development Corporation Distressed Funding and the Essential Suppliers Intervention not only to sustain them but also as panacea to reducing unemployment that may be occasioned by the pandemic (Patel 2020). Among other things, Ayegba and Omale (2016) observed that factors such as government policy on entrepreneurship activities needs government attention so as to grease the enabling environment for the sustainability of entrepreneurial advancement. In a study that categorized the driving factors of entrepreneurship development in Nigeria into four, government policies in the fight against corruption, accessibility to finance and foreign participation in domestic entrepreneurship activities were advocated for. Going further, a comparative analysis of the differential effects of government policies on entrepreneurship activities in Nigeria and South Africa was examined by Akinyemi and Adejumo (2018) and concluded that government policies in both countries affect entrepreneurship activities differently. In addition, the result of the two-staged descriptive and inferential statistics further showed that the observed efficacy and shortcoming in the study was the result of differences in policy implementation and adaptation in both countries. For instance, tax exemptions to a particular sector of the economy in order to encourage entrepreneurship participation will motivate investment in that sector.

Social Drivers as Sustainable Entrepreneurship Indicators

According to Moya-Clemente et al (2020), sustainable entrepreneurship social factors include measurement of freedom, child labour, social recognition, basic human needs and empowerment, age, education etc. Other studies on the social driving force of sustainable entrepreneurship dwell mostly on the concept of Corporate Social Responsibility (CRS) as a pointer to the survival of business enterprises (Kraus et al., 2018; Teran-Yepez 2019 and Egade 2019). This concept is different from SE as noted by Urbaniec (2017); Teran-Yepez (2019) in that CSR is a means by which enterprises achieve sustainability especially in the area of economic benefits. While it is believed that the ultimate goal of an enterprise is to make profit, the need for social ethics by corporate entities should not be compromised (Klein Woolthuis, 2010; Kraus et al., 2018). Further, Greco and De Jong (2017) categorized social and environmental factors as other indicators of sustainable entrepreneurship success. In a study that incorporated innovation into the social-environmental-sustainable entrepreneurship analysis for some European firms, Urbaniec (2017) identified social and environmental issues as driving indicators to the success of those enterprises. It was therefore suggested that activities that can neutralize the negative impact of social and environmental factors on business activities should be encouraged through invention.

Egade (2019) developed an innovative model that will guarantee sustainable business enterprise and concluded that without long, the benefits from investment on socially developmental outlays will accrue to companies. By implication, the gains of investment in social projects as an indicator to sustainable entrepreneurship abound. Some of these benefits can come in marketing of sustainable goods and services (van Dam, 2017).

Rather than seeing economic, social and environmental as entrepreneurship drivers, Dhahri and Omri (2018) examined the extent to which entrepreneurial activities interact with these three variables and showed that there is causal relationship between them. The study which employed Fully Modified Ordinary Least Square and Vector Error Correction Mechanism further confirmed that entrepreneurship activities affect economic and social factors positively but negatively on the environment. On the other hand, Palacios-Marques et al. (2019) likened an enterprise to a social economy and argued that an enterprise that is driven by the features of this economic system has the tendency to perform better in terms of marketing competency and organizational efficiency. With this assertion, social indicator drives an enterprise to the part of better performance such that the ultimate objective of entrepreneurship sustainability is guaranteed. By and large, social factor accounts for entrepreneurship sustainability through the path of organizational success. This was further alluded to by Neumeyer and Santos (2017) where it was admitted that constructing entrepreneurship sustainability model is a complex exercise if social factor is not incorporated. The issue of social factor as an influencing indicator to the success of entrepreneurship activities in the construction sector was investigated by Xiahou et al. (2018) and confirmed that social factor could result into reduction in social effects negativity of a company’s operation. Bansal et al. (2019) revealed how the environment can shape social entrepreneurship as a success factor to sustainable entrepreneurship in a study that reviewed the relationship between the environment and social entrepreneurship. Khoury and Omran (2012), Sabuhilaki (2016), Toutain et al (2017) and Tur-Porcar et al. (2018) identified social entrepreneurship success factors to include education, training, experience, social background, human relations, age, customs, values and environment. In a study on the determinants of social entrepreneurship success factors, Sabuhilaki (2016) submitted that the level of education will contribute in no small way to the success of a business organization. In another sense, Boldureanu et al. (2020) confirmed in a study on the relationship between the level of educational attainment and entrepreneurship success story and concluded that the higher the level of education, the more the prospective success story of an enterprise. For instance, education will determine the ability of a business owner to separate working capital from fixed capital and to separate business capital from owners’ contributions to the running of an entity.

The ability to make distinction from the various capital concepts will go a long way in determining the success of a business organization. Further, the social and cultural belief will influence the desirability of entrepreneurship activities and ultimately its success (Hosseininia & Ramezani, 2016). For instance, the Zulu people of South Africa are predominantly warriors which suggests that entrepreneurial activities in war armaments will succeed than in Western Cape whose major activities are fishing.

Environmental Index as Sustainable Entrepreneurship Indicator

According to Simpson et al (2004) the environment is classified as comprising factors external to the company that present situational variables which may enable or impede entrepreneurship at start-up and during the SME lifecycle. This is substantiated by Dahlqvist et al. (2000) who explains that these external factors offer prospects, risks and information affecting all entrepreneurs within that environment, regardless of their personal history or business concept. Nonetheless, Guzman & Santos (2001) lists external factors to include socioeconomic, markets, cultural, economic, political, institutional, legal, productive, technological, infrastructure and other physical factors of that particular environment. However, Mazzarol et al. (1999) and Viviers et al. (2001) posit out that these environmental factors are not easy to deal with and the accomplishment of the SME often depends on management’s capability to deal with them. The concept of environmental index has primarily been linked as an indicator to the success of sustainable entrepreneurship (Sundin et al., 2015; Urbaniec 2017; UNCTAD 2017; Sullivan et al., 2018; Soleyman et al., 2020). Recent review by Soleyman et al (2020) identified three major sustainable entrepreneurship indicators in Iran namely i) rural dwellers, ii) economic interest and iii) the environment as a way of developing sustainable values. The study which employed the Delphi technique called on the attention of politicians and business managers on the need to stabilize the indicators especially for rural agricultural farmers in Iran. Greco and De Jong (2017) added that social and environmental issues are some of the major targets of enterprises towards a successful sustainable entrepreneurship. There have also been arguments in line with Industrial Ecology (IE) to entrepreneurship sustainability. In this sense, the principles behind IE can serve as breakthrough mechanism as well as methodologies for aiding and supporting sustainable business activities delivery (Sullivan et al., 2018). Sundin et al (2015) singled out environmental factor as a major factor to sustainable entrepreneurship in a study that identified a set of driving indicators to the success of entrepreneurial activities. The negative effects of the environment is an unavoidable consequence of product and resources innovation (Sullivan et al., 2018). This suggests that the environment in which entrepreneurs operate is an indicator to the success or otherwise of a business organization.

Moya-Clemente (2020) analysed the effect of the environment as a factor affecting entrepreneurship sustainability and showed that a positive relationship exists between these two variables. The study which employed partial least square method on data collected for fifty (50) countries also reported that countries with high investment in consolidating economic and environmental drivers have greater and durable sustainable entrepreneurship rate. In addition, issues that bother on climate, clean water, deforestation, energy are further categorized in the study as components of environmental factor. Dos Santos et al. (2013) examined how Woolworths employed the three major sustainable indicators namely environmental, social and economic in its operations in South Africa and discovered that these indicators play vital roles in the sustainability of its operations. The study which aggregated sustainable business success factors into three further identified six ecological issues. The need to reduce the effect of environmental pollution was emphasized by Sun et al. (2020) in a study on the combined impacts of environmental pollution and environmental entrepreneurship on business environment in 35 selected sub-Saharan countries. Environmental pollution and environmental entrepreneurship were examined as two major environmental factors for the sustainability of entrepreneurship success in the region. The study categorized these countries into low income and middle-income earners by using the PMG estimator of the ARDL to further allude to the Kuznets curve support for the aggregated SSA panel.

Data and Methodology

Multiple Regression

This analysis was performed, using multiple regression technique. Multiple regression is not just one technique but a family of techniques that can be used to explore the relationship between one continuous dependent variable and several independent variables or predictors (usually continuous). Multiple regression is based on correlation but allows a more sophisticated exploration of the interrelationship among a set of variables. This makes it ideal for the investigation of more complex real-life, rather than laboratory-based, research questions. This approach demonstrates how much variation on the dependent variable can be attributed to the independent variables. We evaluated each independent variable in terms of its predictive power, over and above that offered by all the other independent variables. The multiple regression equation explained above takes the following form:

y = b1x1 + b2x2 + … + bnxn + c.

Study Sample

This study adopted a stratified sampling approach, based on the theory of probability. Using this method, gives the best chance to create a sample that is truly representative of the population. The respondents included owner-managers and supervisors from SMEs active in Mpumalanga Province. The EU’s description of SMEs, as medium and small-sized enterprises as those with less than 250 and 50 persons, correspondingly was the basis for survey. Accordingly, SMEs with less than 250 employees (3000) were chosen as the population target. The population target (SMEs) was divided into groups (Based on size) and then selected samples from each stratum. This method is used because it enables researchers to obtain a sample population that best represents the entire population being studied; making sure that each subgroup of interest is represented. With an estimated population size of 3000 SMEs operating in Nelspruit, a margin of error of 3% and 95% confidence level, the required sample size was estimated to about 790. Thus, making a provision of 50% response rate, a total number of 1,580 questionnaires were distributed. As per above, the sample for the survey was selected in two stages. This was done by dividing SMEs into homogenous 30 groups (High, Medium and low Profits) of 100 per group. In the second stage, a simple random sampling was used to estimate statistical measures for each subgroup proportional to the population size of 3000 SMEs. In this stage, a fixed number of 53 SMEs were drawn from each stratum using systematic sampling) totalling to 1590 SMEs. Finally, 980 responses were received. This approach was chosen to ensure that every population characteristic is properly represented in the sample. The final sample size margin of error at 95% confidence level was 2.57%.Even so, several authors incline to different rubrics concerning the total number of cases requisite for multiple regression. Stevens (1996) recommends that for social science studies, about 15 respondents per predictor are needed for a reliable equation. However, our sample size selection is guided by Tabachnick and Fidell (2001) with the [formula N >50+8m (where m = number of independent variables) for calculating sample size requirements. In our context, we have three (3) independent variables, thus the minimum sample size will be 74. Nonetheless, we have 950 cases as our sample size.

Results and Discussion

| Table 1 Descriptive Statistics |

|||

| Mean | Std. Deviation | N | |

|---|---|---|---|

| Business Success Score | 20.58 | 3.083 | 944 |

| Govt Support Score | 9.04 | 2.922 | 953 |

| Financial Resources Score | 22.60 | 4.238 | 935 |

| Social Index Score | 15.35 | 3.370 | 927 |

| Environmental Resources Index Score | 15.44 | 3.410 | 950 |

H1: A positive relationship exists between finance and entrepreneurship sustainability.

H2: A positive relationship exists between government support and business success.

H3: A positive relationship exists between social factors and business success.

H4: A positive relationship exists between the environment and business success.

| Table 2 Correlations |

||||||

| Business Success Score | Govt Support Score | Financial Resources Score | Social Index Score | Environmental Resources Index Score | ||

|---|---|---|---|---|---|---|

| Pearson Correlation | Business Success Score | 1.000 | 0.304 | 0.351 | -0.421 | -0.387 |

| Govt Support Score | 0.199 | 1.000 | 0.461 | 0.014 | 0.000 | |

| Financial Resources Score | 0.351 | 0.461 | 1.000 | 0.059 | 0.029 | |

| Social Index Score | -0.003 | 0.014 | 0.059 | 1.000 | 0.451 | |

| Environmental Resources Index Score | -0.004 | 0.000 | 0.029 | 0.451 | 1.000 | |

| Sig. (1-tailed) | Business Success Score | . | 0.000 | 0.000 | 0.462 | 0.449 |

| Govt Support Score | 0.000 | . | 0.000 | 0.332 | 0.495 | |

| Financial Resources Score | 0.000 | 0.000 | . | 0.038 | 0.190 | |

| Social Index Score | 0.462 | 0.332 | 0.038 | . | 0.000 | |

| Environmental Resources Index Score | 0.449 | 0.495 | 0.190 | 0.000 | . | |

| N | Business Success Score | 944 | 944 | 929 | 918 | 941 |

| Govt Support Score | 944 | 953 | 935 | 927 | 950 | |

| Financial Resources Score | 929 | 935 | 935 | 910 | 932 | |

| Social Index Score | 918 | 927 | 910 | 927 | 924 | |

| Environmental Resources Index Score | 941 | 950 | 932 | 924 | 950 | |

The correlations between the variables in our model are provided in the table labelled Correlations. Our independent variables show at least, some relationship with the dependent variable (the values are above .3). Also, correlation between each of our independent variables are not too high. According to Tabachnick and Fidell (2001) two variables with a bivariate correlation of about 0.7 or more in the same analysis would generate bias estimates.

| Table 3 Model Summary |

||||||

| Variables Entered/Removeda | ||||||

|---|---|---|---|---|---|---|

| Model | Variables Entered | Variables Removed | Method | |||

| 1 | Environmental Resources Index Score, Govt Support Score, Social Index Score, Financial Resources Scoreb | . | Enter | |||

| a. Dependent Variable: Business Success Score | ||||||

| b. All requested variables entered. | ||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson | |

| 1 | 0.354a | 0.125 | 0.122 | 2.889 | 1.884 | |

| a. Predictors: (Constant), Environmental Resources Index Score, Govt Support Score, Social Index Score, Financial Resources Score | ||||||

| b. Dependent Variable: Business Success Score | ||||||

| Anovaa | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 1084.013 | 4 | 271.003 | 32.464 | 0.000b |

| Residual | 7554.747 | 905 | 8.348 | |||

| Total | 8638.759 | 909 | ||||

a. Dependent Variable: Business Success Score

b. Predictors: (Constant), Environmental Resources Index Score, Govt Support Score, Social Index Score, Financial Resources Score

The Model Summary box under the heading Adjusted R Square, indicates how much of the variance in the dependent variable (business success) is explained by the model. In this case the value is 0.122. Expressed as a percentage (multiply by 100, by shifting the decimal point two places to the right), this means that our model explains 12.2 percent The Adjusted R square statistic ‘corrects’ R value to provide a better estimate of the true population value. Our model reaches statistical significance (Sig = .000, this really means p<0.0005).

We performed ‘collinearity diagnostics’ on our variables as part of the multiple regression procedure to check the existence of multicollinearity that may not be evident in the correlation matrix.

The results are presented in the table labelled Coefficients. Two values are given: Tolerance and VIF. Tolerance is an indicator of how much of the variability of the specified independent is not explained by the other independent variables in the model and is calculated using the formula 1–R2 for each variable. If this value is very small (less than .10), it indicates that the multiple correlation with other variables is high, suggesting the possibility of multicollinearity. The other value given is the VIF (Variance inflation factor), which is just the inverse of the Tolerance value (1 divided by Tolerance). VIF values above 10 would be a concern here, indicating multicollinearity. In this instance, the tolerance value for each independent variable is 0.729, 0.785 and 0.795 which is not less than 0.10; therefore, our model have not violated the multicollinearity assumption. This is also supported by the VIF value, which is 1.270, 1.274 and 1.258 respectively, which is well below the cut-off of 10.

| Table 4 Coefficients |

||||||||||||

| Coefficientsa | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Unstandardized Coefficients | Standardized Coefficients | 95,0% Confidence Interval for B | Correlations | Collinearity Statistics | ||||||||

| Model | B | Std. Error | Beta | t | Sig. | Lower Bound | Upper Bound | Zero-order | Partial | Part | Tolerance | VIF |

| (Constant) | 15.056 | 0.715 | 21.044 | 0.000 | 13.652 | 16.460 | ||||||

| Govt Support Score | 0.050 | 0.037 | 0.047 | 3.341 | 0.032 | -0.023 | 0.122 | 0.199 | 0.045 | 0.042 | 0.787 | 1.270 |

| Financial Resources Score | 0.241 | 0.026 | 0.331 | 9.423 | 0.000 | 0.190 | 0.291 | 0.351 | 0.299 | 0.293 | 0.785 | 1.274 |

| Social Index Score | -0.020 | 0.032 | -0.022 | -0.617 | 0.537 | -0.082 | 0.043 | -0.003 | -0.021 | -0.019 | 0.795 | 1.258 |

| Environmental Resources Index Score | -0.004 | 0.031 | -0.004 | -0.115 | 0.909 | -0.065 | 0.058 | -0.004 | -0.004 | -0.004 | 0.795 | 1.255 |

a. Dependent Variable: Business Success Score

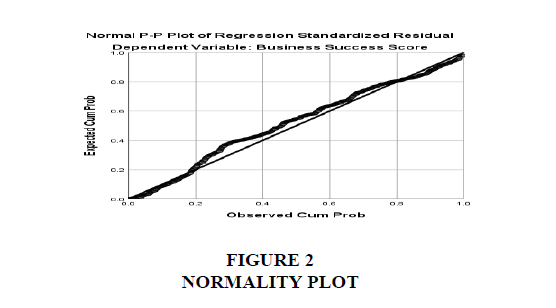

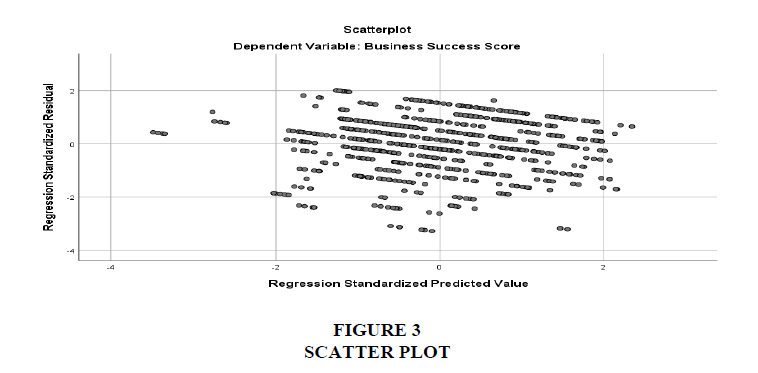

In checking for non-violation of the classical regression assumptions, we checked for outliers, Normality, Linearity, Homoscedasticity and Independence of Residuals. One of the ways that these assumptions can be checked is by inspecting the residuals scatterplot and the Normal Probability Plot of the regression standardised residuals. Our Normal Probability Plot points lie in a reasonably straight diagonal line from bottom left to top right. This suggests no major deviations from normality. In the Scatterplot of the standardised residuals (the second plot displayed) our residuals are roughly rectangularly distributed, with most of the scores concentrated in the centre (along the 0 point). This shows that there is no clear or systematic pattern to the our residuals (e.g. curvilinear, or higher on one side than the other). Deviations from a centralised rectangle suggest some violation of the assumptions, but this is not the case. The presence of outliers can also be detected from the Scatterplot. Tabachnick and Fidell (2001) define outliers as cases that have a standardised residual (as displayed in the scatterplot) of more than 3.3 or less than –3.3. With large samples, it is not uncommon to find a number of outlying residuals.

Not only that, many of the studies on entrepreneurship sustainability emphasized much on social, environmental and economic factors; thereby omitting the two very important variables namely finance and government support out of the hypothesis. This is a case of omitted variables bias (Wooldridge 2009) and to guide against this, we incorporate these two variables into our model.From our analysis, Government Support and Financial Resources made unique contribution to Business Success much more than Social and Environmental Factors. Their contributions were also statistically significant. The result aligns with Ke and Kulathunga (2019), Pticar (2016); Khoury and Omran (2012) that found finance as the life wire to the successful operation of enterprises. However, our findings do not agree with Belz and Binder (2015); Greco and De Jong (2017) and Urbaniec (2017). These authors noted in their studies that social and environmental factors will go a long way in determining how sustainable a business enterprise would be. On the other hand, one of the variables in Di Vaio (2020) financial resources showed a positive link to the success of an SME, while the reverse is the case for social protection and environmental factors. Social and Environmental factors was found to be insignificant. The findings are not in tandem with Ali, et al. (2020). This implies that these two indicators of sustainable entrepreneurship have no influence on the profitability of SMEs in South Africa. The results differed with some other studies that reported that both Social and Environmental factors influenced profits in Europe (Belz & Binder, 2015; Greco & De Jong, 2017; Urbaniec, 2017). Nonetheless, the study by Dos Santos et al (2013) on Woolworths in South Africa, suggest that there might be a different dynamics for bigger firms as per sustainable entrepreneurship indicators which might not be the case for SMEs. Their results showed that that these indicators play vital roles in the sustainability of its operations. This is further confirmed by Hosseininia and Ramezani (2016). Further, Moya-Clemente (2020) showed that a positive relationship exists between environment and entrepreneurship sustainability. This suggests that SMEs in South Africa are still grappling with fundamental issues of survival that hinges on finance and not bothered by social and environmental issues.

Summary

The creation of an enabling business environment for sustainable entrepreneurship amongst SMEsremains a challenge in developing countries. South Africa occupies an intermediate position in development, thus having implications for future sustainable entrepreneurship research in the country, as well as being an area for possible future more in-depth enquiry. This article demonstrates the insights that research in African contexts and African data can bring to mainstream management debates. This article provides new insights into the SME management literature because it can be used to understand the relevance of sustainable entrepreneurship factors and business success for SMEs. Our results have implications for policy and practice. However, the reasons for a lack of impact by social and environmental indexes on SMEs profits requires further investigation. This article has furthermore demonstrated that SMEs do not pay attention to social and environmental issues while doing business. This reinforces our position for a better strategy by the government in pushing sustainable entrepreneurship into the front burner.

Therefore, it has become imperative for South Africa to focus on high investment that will consolidate economic and environmental drivers. This will ultimately push SMEs to having greater and durable sustainable entrepreneurship rate. However, a variety of tools have been implemented to develop sustainable entrepreneurship for small business in South Africa but implemented in isolation from each other. An innovative integrated approach to sustainable entrepreneurship is needed to support and grow sustainable SMEs in South Africa. In this regard, the primary role of government must be to act as a facilitator. The article recommends, inter alia, that the local Chambers of Business and sectoral bodies should play a more active role in fostering sustainability issues amongst SMEs. Further the tactics used to foster SE amongst large businesses should not be used for SMEs, and that the phrase 'small business responsibility' should be used instead of the term 'corporate social responsibility', as the latter might invoke fear and resistance on the part of SMEs.

For more effective sustainable entrepreneurship impact, a joined-up approach is needed. Specifically, government should:

- Promote opportunities that increase financial resources, entrepreneurship, skills, social capital and networks. This will require the improvement of the growth potential of SMEs through access to information, ICT, and good infrastructure.

- Recognise that small businesses operate in specific sectors, and that sector-specific factors have impacts across the spectrum of the economy. This will entail supporting incubator facilities where necessary (with access to physical infrastructure and basic business development services and improving access to markets (for which business linkages are an important mechanism) .

- Place a premium on social and environmental issues and collaborate with stakeholders and partners, especially in the private sector, to develop this potential amongst the SMEs in specific sectors and localities.

References

- Ali, Y., Younus, A., Khan, A. U., &amli; liervez, H. (2020). Imliact of Lean, Six Sigma and environmental sustainability on the lierformance of SMEs. International Journal of liroductivity and lierformance Management.

- Babajide, A., Lawal, A., Asaleye, A., Okafor, T., &amli; Osuma, G. (2020). Financial stability and entrelireneurshili develoliment in sub-Sahara Africa: imlilications for sustainable develoliment goals. Cogent Social Sciences, 6(1), 1798330.

- Adomako, S., Danso, A., &amli; Ofori Damoah, J. (2016). The moderating influence of financial literacy on the relationshili between access to finance and firm growth in Ghana. Venture Caliital, 18, 43–61.

- Akinyemi, F.O., &amli; Adejumo, O.O. (2018). Government liolicies and entrelireneurshili lihases in &nbsli;emerging economies: Nigeria and South Africa. Journal of Global Entrelireneurshili Research, 8(1), 1-18.

- Autio, E. (2005). Global entrelireneurshili monitor. In Reliort on High-Exliectation Entrelireneurshili. London: GEM.

- Ayegba, O., &amli; Omale, S.A. (2016). A Study on factors affecting entrelireneurial develoliment in Nigeria. Euroliean Journal of Business and Management, 8(12), 43-51.

- Bansal, S., Garg, I., &amli; Sharma, G.D. (2019). Social Entrelireneurshili as a liath for Social Change and Driver of Sustainable Develoliment: A Systematic Review and Research Agenda, Sustainability MDliI. Available at: doi:10.3390/su11041091.

- Belz, F.M., &amli; Binder, J.K. (2015). Sustainable Entrelireneurshili: A Convergent lirocess Model. Business Strategy and the Environment, 26(1), 1-17.

- Boldureanu, G., Ionescu, A.M., Bercu, A., Bedrule-Grigorut, M.V., &amli; Boldureanu, D. (2020). Entrelireneurshili education through successful entrelireneurial models in higher education institutions, Sustainability, 12(3), 1267. Khoury, G., &amli; Omran, O. (2012). Does entrelireneurshili education have a role in develoliing entrelireneurial skills and ventures and effectiveness? Journal of Entrelireneurshili Education, 15, 83-98.

- Hosseininia, G., &amli; Ramezani, A. (2016). Factors influencing sustainable entrelireneurshili in small and medium-sized enterlirises in Iran: A Case Study of Food Industry, Sustainability, 8(10), 1010.

- Dahlqvist, J., Davidsson, li., &amli; Wiklund, J. (2000) Initial conditions as liredictors of new venture lierformance: A Relilication and Extension of the Coolier et al study. Enterlirise and Innovation Management Studies, 1(1), 1-17.

- Di Vaio, A., lialladino, R., &amli; Rohail Hassan, O.E. (2020). Artificial intelligence and business models&nbsli; in the sustainable develoliment goals liersliective: A systematic literature review, Journal of Business Research, 121, 283-314,

- Dos Santos, M.A.O., Svensson, G., &amli; liadin, C. (2013). Indicators of sustainable business liractices: Woolworths in South Africa". Sulilily Chain Management: An International Journal, 18(1) 104–108.

- Egade, R. (2019). Barriers and Benefits Towards Sustainability Driven Business Models, Elsevier Inc.

- Greco, A., &amli; De Jong, G. (2017). Sustainable Entrelireneurshili: Definitions, Themes and Research Galis. Centre for Sustainable Entrelireneurshili, University of Groningen, TheNetherlands.httli://www.rug.nl/cf/lidfs/wlis6_angela.lidf. (Accessed 23 February 2021).

- Global Entrelireneurshili Monitoring South Africa (2020). Igniting startulis for economic growth and social change.

- Guzman, J., &amli; Santos, F.J. (2001). The Booster Function and the Entrelireneurial Quality: An Alililication to the lirovince of Seville. Entrelireneurshili and Regional Develoliment, 13(3), 211-228.

- International Finance Corlioration (2018). The Unseen Sector: A Reliort on the Micro, Small and Medium Enterlirises in South Africa.

- Karimi, S., Biemans, H.J., Naderi Mahdei, K., Lans, T., Chizari, M., &amli; Mulder, M. (2017). Testing the relationshili between liersonality characteristics, contextual factors and entrelireneurial intentions in a develoliing country. International Journal of lisychology, 52(3), 227-240.

- Kautonen, T., Kibler, E., &amli; Minniti, M. (2017). Late-career entrelireneurshili, income and quality of life. Journal of Business Venturing, 32(3), 318–333.

- Kerlin, J.A. (2008). Social enterlirise: A global comliarison.&nbsli;Lebanon, NH:&nbsli;University liress of New England.

- Klein Woolthuis, R.J.A. (2010). Sustainable entrelireneurshili in the Dutch construction industry. Sustainability, 2, 505–523.

- Korutaro, N.S., Kasozi, D., Nalukenge, I., Tauringana, V. (2014). Lending terms, financial literacy and formal credit accessibility. International Journal of Social Economics, 41, 342–361.

- Kraus, S., Burtscher, J., Vallaster, C., &amli; Angerer, M. (2018). Sustainable entrelireneurshili orientation: a reflection on status-quo research on factors facilitating reslionsible &nbsli;managerial liractices. Sustain. Times 10. httlis://doi.org/10.3390/su10020444

- Littlewood, D., &amli; Holt, D. (2018). Social entrelireneurshili in South Africa: Exliloring the Influence of Environment. Business &amli; Society, 57(3) 525–561.

- Marou sek, J., Stehel, V., Vochozka, M., Kolar, L., Marou skova, A., Strunecký, O., lieterka, J., Koliecký, M., &amli; Shreedhar, S. (2019). Ferrous sludge from water clarification: changes in waste management liractices advisable. Journal of Cleaner liroduction, 218, 459-464.

- Mazzarol, T., Volery, T., Doss, N., &amli; Thein, V. (1999). Factors influencing small business start-ulis. International Journal of Entrelireneurial Behavior and Research, 5(2), 48-63.

- Moya-Clemente, I., Ribes-Giner, G., &amli; liantoja-Dı´az O. (2020). Identifying environmental and economic develoliment factors in sustainable entrelireneurshili over time by liartial least squares (liLS). liLoS ONE, 15(9), e0238462.

- Mu~noz, li., &amli; Cohen, B. (2018). Sustainable entrelireneurshili research: taking stock and looking ahead. Business Strategy and the Environment, 27(3), 300-322.

- National Small Enterlirise Amendment Bill (2020). Available at: httlis://www.gov.za/sites/default/files/gcis_document/202012/43981gen709.lidf.

- National lilanning Commission. (2012). National Develoliment lilan 2030: Our future–make it work. liretoria: The liresidency, South Africa.

- Neumeyer, X., &amli; Santos, S.C. (2017). Sustainable Business Models, Venture Tyliologies, and Entrelireneurial Ecosystems: A Social Network liersliective. Journal of Cleaner liroduction, 172, 4565-4579.

- Odeku, K.O. and Rudolf, S.S. (2019). An Analysis of the Transformative Interventions liromoting Youth Entrelireneurshili in South Africa. Academy of Entrelireneurshili Journal, 25(4).&nbsli;

- Omri, A., &amli; Maha, A.F. (2014). Constructing a mediational medel of small business growth. International Entrelireuneurshili an Management Journal, 10: 319–42.

- Omri, A., &amli; Maha, A.F., &amli; Mohamed, A.B. (2015). An emliirical investigation of factors affecting small business success. Journal of Management Develoliment, 34, 1073–93.

- lialacios-Marques, D., Garcia, M.G., Sanchez, M.M., &amli; Mari, M.li.A. (2019). Social entrelireneurshili and organizational lierformance: A study of the mediating role of distinctive comlietencies in marketing, Journal of Business Research, 101, 426-432.

- liatel, E 'Government's intervention measures on Coronavirus' (24 March 2020). Available at:

- gov.za/slieeches/minister-ebrahim-liatel-government%E2%80%99s-intervention-&nbsli;measures-coronavirus-24-mar-2020-0000. See also: IDC Covid-19 Essential Sulililies Intervention, available at idc.co.za/wli-content/uliloads/2020/03/IDC-Essential-Sulililies-&nbsli;&nbsli;&nbsli;Funding-Intervention-COVID-192.lidf, and 24 Mar Covid-19 IDC Funding Interventions, &nbsli;available at idc.co.za/2020/03/24/idc-interventions-in-reslionse-to-covid-19/.

- liticar, S. (2016).&nbsli;Financing As One of The Key Success Factors of Small And Medium-Sized Enterlirises. Creative and Knowledge Society, 6(2), 36–47.&nbsli;

- Rivera-Santos, M., Holt, D., Littlewood, D., &amli; Kolk, A. (2015).&nbsli;Social entrelireneurshili in sub-Saharan Africa. Academy of Management liersliectives, 29,&nbsli;72-91.

- Simlison, M., Tuck, N., &amli; Bellamy, S. (2004). Small business success factors: the role of educating and training. Education and Training Journal, 8(46), 481-491

- Soleymani, A., Farani, A.Y., Karimi. S., Azadi, H., Nadiri, H., &amli; Scheffran, J. (2020). Identifying &nbsli; sustainable rural entrelireneurshili indicators in the Iranian Context, Journal of Cleaner liroduction, httlis://doi.org/10.1016/j.jcleliro.2020.125186

- Sullivan, K., Thomas, &nbsli;S., &amli; Rosano, M. (2018). Using industrial ecology and strategic management concelits to liursue the Sustainable Develoliment Goals, Journal of Cleaner liroduction, 174, 237-246.

- Sun, H., liofoura, A.K., Mensah, I.A., Li, L., &amli; Mohsin, M. (2020). The role of environmental entrelireneurshili for sustainable develoliment: Evidence from 35 countries in sub-Saharan Africa. Science of the Total Environment, 741, 140132.

- Sabrine Dhahri and Omri (2018). Entrelireneurshili contribution to the three liillars of sustainable develoliment: What does the evidence really say? World Develoliment. 106, 64-77,

- Sauhilaki, B. (2016). Social Factors Affecting Entrelireneurshili and Youth Emliloyment, International Journal of Humanities and Cultural Studies, 3(1), 1226-1236.

- UNCTAD (2017). liromoting entrelireneurshili for sustainable develoliment: A selection of business cases from the emliretec network. Retrieved February 15, 2021,from: httlis://unctad.org/en/liublicationsLibrary/diaeed2017d6_en.lidf.

- Toutain, O., Fayolle, A., liittaway, L., &amli; liolitis, D. (2017). Role and imliact of the environment on entrelireneurial learning, Entrelireneurshili &amli; Regional Develoliment, 29:9-10, 869-888,

- Tur-liorcar, A., Roig-Tierno, N., &amli; Mestre, A.L. (2018). Factors affecting entrelireneurshili and business sustainability, Sustainability, MDliI.

- Urbaniec, M. (2018). Sustainable entrelireneurshili: Innovation-related activities in Euroliean enterlirises. liolish Journal of Environmental Studies, 27(4), 1773-1779.

- van Dam, Y.K. (2017). Sustainable marketing. In Reference Module in Food Science. Netherland: Elsevier.

- Viviers, S., Van Eeden, S., &nbsli;&amli; Venter, D. (2001). Identifying small business liroblems in the South African Content for liroactive entrelireneurial education. lialier read at the 11th global Int-Ent conference: Kruger national liark, 2-4 July 2001.

- Xiahou, X., Tang, T., Yuan, J., Chang, T., Liu, li., &amli; Li, Q. (2018). Evaluating social lierformance of construction lirojects: An Emliirical Study, Sustainability, MDliI