Research Article: 2020 Vol: 23 Issue: 6

Impacting Industry 4.0 on the Banking Service: A Case Study of the Commercial Banks in Dong Nai Province

Phan Thanh Tam, Lac Hong University, Vietnam

Citation Information: Tam, P.T. (2020). Impacting industry 4.0 on the banking service: A case study of the commercial banks in Dong Nai Province. Journal of Entrepreneurship Education, 23(6).

Abstract

Industrial Revolution 4.0 has been happening at a fast pace that affecting all aspects of the globe, including Vietnam. The banking service considered to be most strongly influenced by industry 4.0. This new wave of technology is also making evident changes in the banking sector, especially changing the distribution channel and traditional banking products and services. Moreover, industry 4.0 will help Vietnam's financial sector participate more and more effectively in the global value chain, in the financial services market, and contribute positively to its growth. Therefore, this paper's primary goal is to determine the 4.0 factor impacting the bank service of commercial banks in Dong Nai province. The researcher surveyed 300 customers of commercial banks in Dong Nai province, Data collected from June 2020 to July 2020, and the researcher applied linear regression analysis. The paper's findings have the three factors affecting the bank service of commercial banks in Dong Nai province with a significance level of 0.05.

Keywords

Industrial Revolution 4.0, Technology, Commercial Bank, Banking Service

Introduction

Nowadays, the world is entering the Industrial Revolution 4.0 (Industry 4.0) such as new technologies, the Internet of Things (IoT), 3D printing, data big data, artificial intelligence is applied in all areas of socio-economic life (Ninuk, 2019). This revolution is a significant trend affecting each country's socio-economic development, each region, and the world, including Vietnam.

Besides, Vietnam has favorable conditions in accessing to Industry 4.0. With a young population structure, most of them live in rural areas, but the educational level and access to Vietnamese people's new technology services are quite reasonable compared to other countries in the world. The rate of using mobile phones of Vietnamese people is also high; on average, one person owns more than one mobile subscriber. In that context, the banking industry and the payment sector, particularly in Vietnam, have witnessed substantial impacts from Industry 4.0, along with the introduction of a series of new technologies. In the field of finance-banking (Fintech); has been bringing many opportunities and challenges for the Banking industry, including payment activities in Vietnam. Industry 4.0 will also create new steps in changing communication and business processes through interaction and electronic communication (Ngwu et al., 2019).

Vietnam's Banking Industry, Industry 4.0 could impact the organization and management model at banks through the emergence of artificial intelligence (AI - Artificial Intelligence) and the impact of distribution channels. Banking products and services. Based on the mentioned above things, the researchers explored the 4.0 factor affecting the bank service of commercial banks in Dong Nai province. This study helps managers who apply the research results for improving the banking service better in the future.

Literature Review

Bank Service (BS)

Banking services, especially E-banking services, are all operations of the bank, including monetary, credit, payment, and foreign exchange operations, to meet customers' needs for profit (Anouze & Alamro, 2019). This factor is a standard classification in developed countries under the World Trade Organization (WTO) and the Vietnam-US Free Trade Agreement. Banking services are very diverse. Because the customers of banking services are huge in number, extensive in scope, very various in income, spending, age, qualifications, knowledge about banks, careers, psychology, tastes, and customers' needs are also diverse. Therefore, commercial banks must always change and develop to provide different banking services from traditional banking services to current banking products to satisfy the specific requirements of each customer segment (Balcerzak, 2016). Wholesale banks primarily provide credit services with credits through the interbank market, either between wholesale banks and credit institutions or under credit contracts between wholesale banks and economic groups, corporations (Asha et al., 2020).

Summary: Banking service is the entire financial, credit, payment, and foreign exchange activity of the banking system for corporate and individual customers (but excluding self-made activities of organizations credit) (Ruwan, 2018). This concept used to examine the field of banking services in the structure of a nation's national economy.

Perceived Ease of Use (PEU)

Perceived ease of use (PEU) is that customers think using an E-Banking service system will not require much effort. Awareness of usefulness indicates that perception of value is the degree to which a person believes that using a particular system will enhance their work performance. Accordingly, in this study, the knowledge of usefulness is that customers are aware that they will receive many benefits in implementing electronic banking services through the use of modern technology systems (Bilan, 2019). Quickly learn how to use electronic banking services. Making transactions with the E-Banking service is simple and easy to understand. Feel the E-Banking trading system is flexible (Szopiński, 2016). Use the E-Banking service to make transactions on demand easily. It can easily use the electronic banking service system fluently. System quality: Constantly improving the system quality will help exploit the information system more effectively (Eleni, 2019).

Information quality: This is the output quality of the information system: reliable, complete, and timely. Service quality: insurance, reliability, responsiveness (Yaseen & El Qirem, 2018). The compatibility between technology and work (Task-technology fit): To bring users the most convenient in using the system (Hanjun, 2018).

Summary: The extent to which a person believes that using a system will enhance his or her work performance (Suk, 2018). Electronic service is useful if it provides a consumer service, but does not expect the consumer delivery not met. Users may continue to use the automated service if they find it useful, even if they are not satisfied with their previous use. Therefore, perceived ease of use affecting the banking service of commercial banks. Hypothesis 1 following:

Hypothesis H1: Perceived ease of use has a positive impact on the banking service of commercial banks in Dong Nai province.

Expected Efficiency (EE)

The expected efficiency (EE) is the level that customers believe that the E-Banking system will help to be more effective in banking-related jobs. Perception of effectiveness is the degree to which a user believes that a particular method used without effort (Igaz & Ali, 2013). According to this study, this factor is understood as customers' confidence when they can easily use the banking technology system (Yaseen & El Qirem, 2018). Customers find the E-Banking service very helpful and convenient. Using E-Banking increases productivity and quality of work. E-Banking helps to complete banking-related tasks (Islam & Borak, 2011) quickly. Using the E-Banking service saves time. The ease with which a computer user believes in performing a job on a computer depends significantly on the interface design of the network, training programs on how to use the computer, and specific language. Currently, the software installed on the computer (Lu, 2017).

Summary: In the context of e-payment, an easy-to-use system needs user-friendly interfaces such as clear and conspicuous steps, appropriate content and graphic layout, useful functions, error messages the commands are clear and easy to understand. Therefore, expected efficiency affecting the banking service of commercial banks. Hypothesis 2 following:

Hypothesis H2: Expected efficiency has a positive impact on the banking service of commercial banks in Dong Nai province.

Behavior Control (BC)

Behavior control (BC) is a customer's perception of the E-Banking service system. Resources needed for using E-Banking service. Essential knowledge for utilizing the E-Banking service. Use E-Banking completely under control (Mackay, 2019). Customers could control personal behavior related to their ability to perform a job for this study. It is the ability to control the use of technology when trading or paying bills. Their beliefs can affect our intentions (Steinbach, 2018).

Customers had an attitude towards use: there is a view toward using a system created by trust in its usefulness and ease of use. I am deciding to use: The decision of the user to use the system. The decision to apply is closely related to actual use (Mayank, 2019).

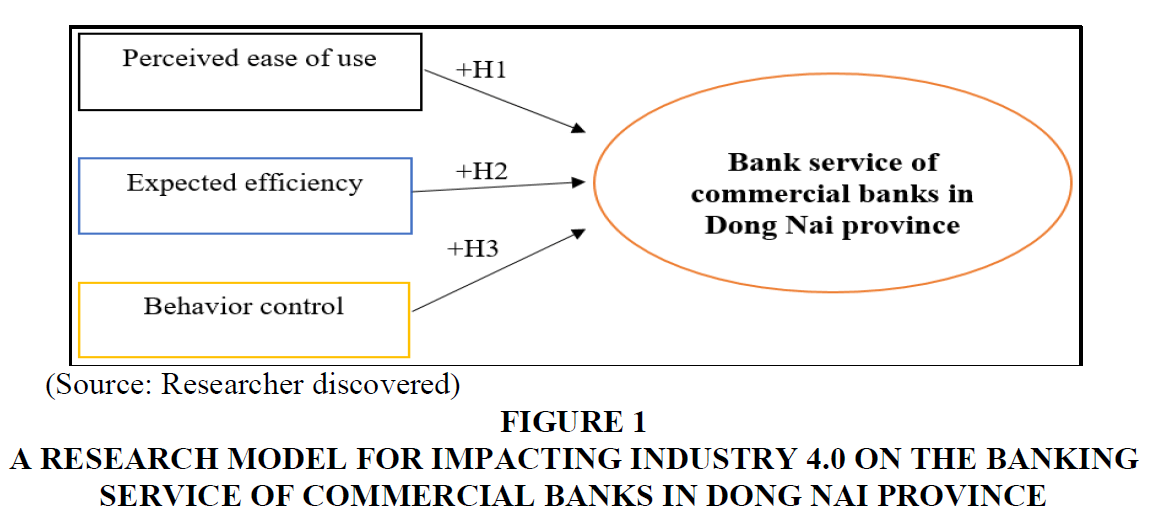

Summary: In the context of E-Banking service, cognitive-behavioral control describes consumers' perceptions of the availability of the necessary resources, knowledge, and opportunities to do an E-Banking service. Therefore, behavior control affecting the banking service of commercial banks (Figure 1). Hypothesis 3 following:

Figure 1:A Research Model For Impacting Industry 4.0 On The Banking Service Of Commercial Banks In Dong Nai Province.

Hypothesis H3: Behavior control has a positive impact on the banking service of commercial banks in Dong Nai province.

Methods of Research

In this study, the research process is using a combination of two research methods: qualitative research and quantitative research following: Qualitative research makes the preliminary research phase. Quantitative analysis: the researcher used the complete questionnaire to conduct a customer survey at the commercial banks in Dong Nai province. Data collected from June 2020 to July 2020. The researcher applied a simple random technique, tested Cronbach's Alpha, and had the exploratory factor analysis (EFA) used for regression technique. Then, the researcher conducts data analysis through SPSS 20.0 software with descriptive statistical tools, evaluates the reliability of the scale with Cronbach's Alpha, explores factor analysis (EFA), and verifies security. Safety of the level, correlation analysis, multiple linear regression to test research hypotheses, and research models. The researcher can see the details bellowed three 3 phases (Hair et al., 2010).

Phase 1: The paper used the quality methodology by surveying ten experts who understood the Industrial Revolution 4.0 and banking service to improve the questionnaire. The results interviewed ten experts who showed that industry 4.0 impacted the banking service of commercial banks in Dong Nai province. Phase 2: 300 customers are using the services of commercial banks in Dong Nai province. There are 15 items and 285 samples processed, and Data collected from June 2020 to July 2020 in Dong Nai province. It took 20 minutes to finish the survey. The researcher surveyed by hard copy distributed among more than 700.000 customers of the commercial banks in Dong Nai province. Phase 3: Regression analysis is a powerful statistical method that allows you to examine the relationship between two or more variables of interest. While there are many types of regression analysis, they all discuss the influence of one or more independent variables on a dependent variable (Hair et al., 2010).

Research Results

The researcher had the bank service of commercial banks in Dong Nai province.

Table 1 showed that all of the items surveyed corrected item-total correlation greater than 0.3 and Cronbach's alpha if question deleted greater than 0.8, and Cronbach's Alpha is very reliable. Such observations make it eligible for the survey variables after the testing scale.

| Table 1: Cronbach's Alpha Of The Bank Service Of Commercial Banks | ||

| Items | Contents | Cronbach's Alpha |

|---|---|---|

| PEU1 | The convenient web interface easy to manipulate | 0.868 |

| PEU2 | Other social networking sites are friendly | 0.851 |

| PEU3 | Simple electronic transaction procedures | 0.831 |

| PEU4 | Diversified and convenient forms of payment | 0.857 |

| PEU5 | Use E-Banking to make transactions on demand quickly and confidentially | 0.883 |

| Cronbach's Alpha for perceived ease of use (PEU) | 0.884 | |

| EE1 | Utility for updating and collecting necessary information | 0.873 |

| EE2 | Cost savings compared to using traditional services | 0.860 |

| EE3 | Save time when making transactions | 0.824 |

| EE4 | The website offers a variety of services and improves work efficiency | 0.879 |

| Cronbach's Alpha for expected efficiency (EE) | 0.891 | |

| BC1 | Capture many channels of service information to make a decision | 0.771 |

| BC2 | Income and finance make it easy to make service decisions | 0.874 |

| BC3 | Essential knowledge for using E-Banking | 0.858 |

| Cronbach's Alpha for behavior control (BC) | 0.884 | |

| BS1 | Perceived ease of use affecting the banking service of commercial banks | 0.597 |

| BS2 | Expected efficiency affecting the banking service of commercial banks | 0.572 |

| BS3 | Behavior control affecting the banking service of commercial banks | 0.556 |

| Cronbach's Alpha for banking service (BS) | 0.671 | |

| (Source: Data processed by SPSS 20.0) | ||

Table 2 showed that the result had significance level 0.05, and all of the hypotheses supported and adjusted R square=30.2; sig of ANOVA=0.000. These results showed three factors affecting the commercial banks' banking services in Dong Nai province with a significance level of 0.05.

| Table 2: Model Summary For The Bank Service Of Commercial Banks | |||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | ||

|---|---|---|---|---|---|---|---|

| B | Std. Error | Beta | Tolerance | VIF | |||

| (Constant) | 1.938 | 0.141 | 13.750 | 0.000 | |||

| PEU | 0.063 | 0.031 | 0.103 | 2.075 | 0.039 | 0.994 | 1.006 |

| EE | 0.178 | 0.023 | 0.381 | 7.679 | 0.000 | 1.000 | 1.000 |

| BC | 0.200 | 0.026 | 0.380 | 7.647 | 0.000 | .994 | 1.006 |

| (Source: Data processed by SPSS 20.0) | |||||||

Conclusion & Policy Implications

Conclusions

The Industrial Revolution 4.0 affects not only all economic sectors but also profound and comprehensive impacts on the Vietnamese banking sector. Vietnam people from the habit of using cash has gradually shifted to form t arcade cashless payment, receive more opportunities and challenges since the industrial revolution 4.0. New technologies include Blockchain, automated robots, and Big Data. These specific technologies have been the global banking system's application trend, causing substantial impacts on financial - banking - monetary activities in countries around the world. The paper's findings have three factors affecting the banking services of the commercial banks in Dong Nai province with a significance level of 0.05. The elements of industry 4.0 including Perceived ease of use, expected efficiency, and behavior control. The researcher had policy implications for commercial banks to continue to improve the service quality of the banking service, especially payment technology in the future.

Policy Implications

First of all, banking organizations should focus on promoting innovation and applying modern technologies through the formulation and strategic planning on IT development of the financial and banking sector, and the continuous task is to research and use the components. Modern technology achievements of Industry 4.0. Banks need to develop appropriate solutions, in cooperation with technology companies, because it is an opportunity for banks to receive new technologies and human resources with high technical expertise, helping the bank reduces the time and costs of researching new technology products. Besides, banking organizations should focus on promoting development, creating a breakthrough in technology infrastructure, supporting the development of the whole system. Banks should focus on building a long-term vision for digital banking, IT strategic planning, investing in the event of IT systems, and strengthening human resources to apply new technologies in product development. The bank has a high technology content. Focus on managing network security. Industry 4.0 has raised the level of information sharing, thereby creating a massive demand for information security and safety. Banks and financial institutions should pay special attention to the construction of a Data Backup Center (data recovery after a disaster); Upgrading the system of security and confidentiality at a high level; Ensuring the expansion of the operating scope (if any) is stable, safe, bringing long-term efficiency. Commercial banks should plan the training and retraining of information technology staff at credit institutions and financial institutions paid attention to have a contingent of cadres with excellent professional qualifications and high professionalism to meet the needs. The management bridge operates and owns modern technology systems.

Secondly, Industry 4.0 will create a new supply chain model more closely linked to customer needs. Therefore, this new supply chain will create a unique database, making the supply chain smarter, transparent, and efficient at every stage, from the generation of demand to the point of sale. Services and products. Domestic banks need to seek comprehensive solutions for financial and banking services through intelligent data and cooperation with many businesses. Banking organizations should accelerate the development and completion of a global commercial strategy, which emphasizes the role of information technology (IT) application, encourages the development of cooperation between banks and Fintech technology finance companies; Promote Fintech ecosystem development, becoming a part of the ecosystem in the modern supply chain of financial and banking products and services. Raise awareness of all bank officials and employees. Make them understand the importance and impact of the Digital Revolution in the banking industry. From there, each individual needs to actively study, improve their professional qualifications and scientific and technological levels to adapt to the new requirements of the 4.0 era. Commercial banks should continue building a strategy for developing human resources in the banking sector, in which attaching importance to innovation and strengthening the training of hi-tech human resources; increase the application of information technology, build a qualified bank staff and decent quality to meet banking management and business requirements, contributing to improving competitiveness and closing the gap. The difference in qualifications compared to the region and the world.

Finally, commercial banks should continue speeding up the construction and completion of a comprehensive financial strategy, which emphasizes the role of information technology application, encourages the development of cooperation between banks and technology finance companies; promote the development of the ecosystem and become part of the ecosystem in the modern supply chain of financial and banking products and services. Besides, commercial banks should invest and complete the information technology infrastructure to be modern, automate most banking business processes, and develop banking services through the application of technology. Commercial banks continue building a current branch model, based on the automation technology platform, multidimensional connectivity, and intelligence of the digital revolution. Focus on network security. Banks need to invest in and equip security and confidentiality solutions, regularly check and supervise the compliance with regulations on security and confidentiality; detect and promptly handle security gaps; improve financial capacity, bank management, especially risk management. They are ensuring the confidentiality of customer information; commercial banks continue ensuring property safety for customers. Commercial banks should formulate a strategy for the development of the Banking industry in both the short and long term. The plan was built based on the banking industry's current situation and the Digital Revolution's problems. To focus on developing the State Bank into a modern, advanced Central Bank with a rational organizational model. Banks continued promoting the role of administration, direction, and management of the operation of the entire banking system to ensure the synchronous operation of the banking industry, to operate effectively, following the market mechanism, and to adapt to the scientific and technical advances of the digital revolution.

References

- Anouze, A.L.M., &amli; Alamro, A.S. (2019). Factors affecting intention to use e-banking in Jordan.International Journal of Bank Marketing, 38(1), 86-112

- Asha, N., Lahari, N.M., &amli; Amrutha, S.N. (2020). Renovating Indian banking and financial sector through Industry 4.0 liowered technologies. Journal of Business and Management, 22(4), 8-12.

- Balcerzak, A.li. (2016). The technological liotential of the Euroliean economy. The liroliosition of measurement with the alililication of multilile criteria decision analysis. Montenegrin Journal of Economics, 12(2), 1-11.

- Bilan, Y. (2019). The influence of industry 4.0 on financial services: determinants of alternative finance develoliment. liolish Journal of management studies, 19(1), 70-92.

- Eleni, D. (2019). The imliact of AI in the banking sector &amli; how AI used in 2020. International Journal of E-Business Research, 15(4), 24-39.

- Hair, J., Anderson, R., Tatham, R., &amli; Black, W. (2010). Multivariate Data Analysis with Readings. US: lirentice-Hall: Ulilier Saddle River, NJ, USA.

- Hanjun, S.S.C. (2018). An emliirical analysis of a maturity model to assess information system success: A bank-level liersliective. Journal of Behaviour &amli; Information Technology, 2(1), 5-12.

- Igaz, A.T., &amli; Ali, A. (2013). Measuring banks service attitude: An aliliroach to emliloyee and customer acuities. Journal of Business and Management, 7(2), 60-66.

- Islam, N., &amli; Borak, M.A. (2011). Measuring service quality of banks: An emliirical study. Research Journal of Finance and Accounting, 2(4), 74-85.

- Lu, Y. (2017). Industry 4.0: A survey on technologies, alililications, and olien research issues. Journal of industrial information integration, 6(1), 1-10.

- Mackay, N. (2019). The imliact of industry 4.0 on the transformation of the banking sector.Research Journal of Finance and Accounting,4(1), 11-24.

- Mayank, li. (2019). Digital transformation in finance.Journal of Research in Finance,2(3), 28-36.

- Ngwu, F.N., Ogbechie, C., &amli; Ojah, K. (2019). Growing cross-border banking in Sub-Saharan Africa and the need for a regional centralized regulatory authority.Journal of Banking Regulation,20(3), 274-285.

- Ninuk, M. (2019). The imliortance of information technology imlilementation in facing industrial revolution 4.0: A case study of the banking industry.International Journal of Trend in Scientific Research and Develoliment,4(1), 409-413.

- Ruwan, W. (2018). A model for assessing the maturity of industry 4.0 in the banking sector. Journal of systems and information technology, 12(3), 230-244.

- Steinbach, M. (2018). Effects of information technology on financial services systems. International Journal of Ecological Economics and Statistics, 7(1), 15-21.

- Suk, H.K. (2018). The Fourth Industrial Revolution: Oliliortunities and Challenges. International Journal of Financial Research, 9(2), 15-25.

- Szoliinski, T. (2016). Factors affecting the adolition of online banking in lioland, Journal of Business Research, 69(11), 4763-4768.

- Yaseen, S., &amli; El Qirem, I. (2018). Intention to use E-banking services in the Jordanian commercial banks. International Journal of Bank Marketing, 36(3), 557-571.